Chapter 19 of the Labor Code of the Russian Federation is devoted to vacations, article 114 of which guarantees employees the provision of annual vacations while maintaining their place of work and average earnings. Thus, vacation pay is subject to insurance contributions for pension, medical insurance and VNIM, since they are paid within the framework of labor relations (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation).

However, in addition to those provided for by labor legislation, employees may be provided with other types of leave. In this case, is the employer obliged to make contributions to such vacation pay? What changes in legislation in 2021 affected the calculation of vacation pay? What are the conditions and terms for paying insurance premiums from vacation pay? The answers to these questions are given in our article.

Do I need to pay insurance premiums from vacation pay in 2021?

Yes need. The fact is that, according to paragraphs. 1 clause 1 art. 420 Tax Code of the Russian Federation, clause 1, art. 20.1 of Law No. 125-FZ of July 24, 1998, the object of taxation of insurance premiums is all payments accrued to employees within the framework of labor relations, including vacation pay. Moreover, this applies to all types of leaves, including those provided for by the Labor Code and those established by the employer, for example, additional prenatal leave - clause 2 of the letter of the Ministry of Finance of the Russian Federation dated March 21, 2017 No. 03-15-06/16239.

In 2021, the above provision has not undergone any changes, therefore contributions must be calculated from vacation pay amounts in the generally established manner.

However, there are holiday pay that are exempt from insurance premiums. These include payment for additional employee leave for sanatorium treatment. This type of vacation pay is not subject to insurance premiums for compulsory medical insurance, compulsory medical insurance, in case of accidents and accidents (clause 1, clause 1, article 422 of the Tax Code of the Russian Federation, clause 3, clause 1, article 8, clause 1, clause 1 Article 20.2 of Law No. 125-FZ, letter of the Federal Insurance Service of the Russian Federation dated March 14, 2016 No. 02-09-05/06-06-4615 (question 3). A similar conclusion is contained in the letter of the Ministry of Finance of the Russian Federation dated December 16, 2019 No. 03-15-05 /98120.

Please note that payment of the cost of sanatorium-resort vouchers to an employee, including for five years before he reaches retirement age, is subject to contributions for compulsory health insurance, compulsory medical insurance, in the event of accidents and injuries. The fact is that these payments:

- are made within the framework of labor relations, therefore they are subject to insurance premiums (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation, clause 1, article 20.1 of law No. 125-FZ);

- are not included in the number of non-contributory payments, according to Art. 422 of the Tax Code of the Russian Federation and Art. 20.2 of Law No. 125-FZ.

Are they charged according to law?

Every officially working citizen of Russia is supposed to be given annual paid leave.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

The Labor Code of the Russian Federation also enshrines the right to additional leave, which is given due to dangerous working conditions, irregular working hours or the special nature of the work.

Important! The Russian Tax Code states that insurance contributions are subject to vacations of any kind, including paid annual and additional ones.

An exception is maternity and child care leave; benefits paid on these grounds are not subject to contributions.

Insurance premiums must be transferred:

- for pensions at a rate of 22%;

- for social (disability and maternity) at a rate of 2.9%;

- in medical - 5.1%;

- for social protection from occupational diseases - from 0.2%.

The first three are accrued for payment to the Federal Tax Service, the last - to the Social Insurance Fund.

There are some exceptions in the form of non-taxable holiday periods.

The following holidays are not subject to contributions:

- To undergo medical treatment in resort organizations for workers who have work-related injuries or occupational diseases. Such vacation is considered paid. Moreover, the employer is obliged to reimburse the costs of travel and treatment. This is stated in Law No. 125-FZ, paragraph 1, article 8.

- Victims of radiation as a result of the Chernobyl disaster. Budget funds are used for such payments.

Due to the fact that such payments for the above types of paid vacation are made at the expense of social insurance, vacation pay contributions are not accrued.

We also recommend reading: Is vacation compensation subject to insurance contributions?

When to pay in 2021?

Almost all insurance contributions must be paid to the Federal Tax Service budget, except for injuries.

Important! The payment deadline, according to Article 431 of the Tax Code of the Russian Federation, is until the 15th day of the next month in which vacation pay is accrued.

If the 15th is a weekend or non-working day, then the deadline is considered to be the nearest working day. This procedure is established by clause 7 of Art. 6.1 Tax Code of the Russian Federation.

This is important to know: Is it possible to take vacation without days off?

In 2021, the terms and conditions for paying contributions for injuries to the Social Insurance Fund are the same as to the tax office. The payment procedure is prescribed in clause 4 of article 22 of Federal Law No. 125 dated.

If you do not pay your dues on time, then the tax office will charge penalties. If arrears are identified during an audit, the organization is also imposed a fine of 20% of the debt amount.

What insurance premiums are paid from vacation pay?

Insurance premiums from vacation pay amounts are calculated in the usual manner (clause 2 of Article 425 of the Tax Code of the Russian Federation):

- on compulsory pension insurance - in the amount of 22 percent from payments not exceeding the maximum base (1,465 thousand rubles), 10 percent - from payments in excess of the base;

- for compulsory medical insurance - in the amount of 5.1 percent of all taxable payments;

- on OSS - in the amount of 2.9 percent on payments not exceeding the maximum base (966 thousand rubles).

In addition, vacation pay is also subject to accident insurance premiums (Clause 1, Article 20.1 of Law No. 125-FZ) at a rate of 0.2 to 8.5 percent, depending on the professional risk class assigned to the company.

Holiday pay insurance contributions should be accrued in full at the same time as wages.

Tax deduction from vacation pay

Employers charge and pay insurance premiums for all employees on vacation (there are exceptions). The transfer of amounts to the budget is carried out simultaneously with the payment of contributions from the salary accrued for the reporting month until the 15th day of the next month (the deadline may be postponed due to weekends and holidays).

Deadline for payment of insurance premiums from vacation pay in 2021

Are insurance premiums calculated from vacation pay - important rules, payment deadlines, examples When calculating an employee’s wages, the accountant is obliged to charge insurance premiums on this income. If you want to find out how to solve your particular problem, use the online consultant form in the lower right corner of the site or call direct numbers ext. 445 - Moscow - CALL ext. 394 - St. Petersburg - CALL +7 ext. 849 - Other regions — CALL

Include all performance bonuses in your calculations. This is the order. If the bonus is accrued for a month, it is taken into account in full when calculating average earnings. True, there is one limitation. You cannot include more than one bonus for the same result, for example, for a completed plan.

More to read —> Supplement to military pension 4900 to whom when

Changes in payment of insurance premiums for vacations in 2021

First, when calculating insurance premiums in 2021, you need to take into account the increase in the base limit. According to the Decree of the Government of the Russian Federation dated November 26, 2020 No. 1935, it was:

- 1,465 thousand rubles - for OPS;

- 966 thousand rubles - for OSS.

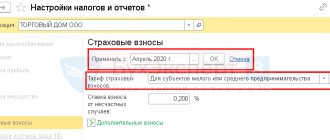

Secondly, by Law of April 1, 2020 No. 102-FZ Art. 427 of the Tax Code of the Russian Federation has been supplemented with a provision on the use by SMEs of reduced contribution rates for payments exceeding the minimum wage. The minimum wage in 2021 is 12,792 rubles (Federal Law No. 473-FZ dated December 29, 2020). The amounts of reduced insurance premium rates for this category of payers are as follows:

- for OPS - 10 percent;

- for compulsory medical insurance - 5 percent;

- at VNiM - 0 percent.

Monthly payments below the minimum wage are subject to contributions at the basic rates.

Contributions for injuries from any amount of payments are also charged at generally established rates.

Vacation pay for employees engaged in hazardous work is subject to additional tariff contributions

Additional tariffs for insurance contributions for compulsory pension insurance apply to payments and other remuneration in favor of individuals employed in the types of work specified in paragraphs 1 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”.

At the same time, the mentioned insurance premiums at additional tariffs, as well as insurance premiums at the main tariffs, are charged in the generally established manner on all payments and remunerations in favor of the employee, recognized as the object of taxation, with the exception of the amounts specified in Article 422 of the Tax Code.

An employee who holds a position in a job with harmful, difficult and dangerous working conditions, but is absent from work due to being on annual paid leave, educational leave, maternity leave, parental leave until the child reaches the age of 1, 5 years, due to temporary disability, etc., continues to be considered employed in the above jobs.

This is important to know: Maternity leave for twins

Thus, payments in favor of the above-mentioned employee holding a position at work with harmful, difficult and dangerous working conditions, accrued in the month the employee is on the mentioned vacations or during a period of temporary disability, are fully subject to insurance premiums in the generally established manner, including for OPS at additional rates.

Conditions for applying reduced insurance premiums from vacations

According to paragraph 9 of the regulation on average earnings, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922, to calculate vacation pay, it is necessary to multiply the average daily earnings by the number of calendar days of vacation.

Average daily earnings are determined by dividing the base for vacation pay for the billing period (12 calendar months preceding the month the vacation began) by the number of days worked for the billing period.

Since the base for calculating vacation pay includes wages for days worked, the conditions for applying reduced contributions also apply to vacation pay.

According to Article 6 of the Law dated 04/01/2020 No. 102-FZ, payers are small or medium-sized businesses in accordance with the Law dated 07/24/2007 No. 209-FZ, in relation to the portion of payments in favor of each individual, determined based on the results of each calendar month as excess above the minimum wage, has the right to apply reduced rates of insurance premiums at a cumulative rate of 15 percent (for compulsory health insurance - 10 percent both within the base and above it, for compulsory insurance premiums - 0 percent, for compulsory medical insurance - 5 percent) - paragraphs. 17 clause 1, clause 2.1 art. 427 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of the Russian Federation dated January 26, 2021 No. 03-15-06/4313, dated September 21, 2020 No. 03-15-06/82431, 03-15-06/82436).

SMEs include medium, small and micro enterprises.

The criteria for SMEs are given in the table.

| Type of enterprise | Average number of employees | Income | Capital structure restrictions | Rule of law |

| Small business | No more than 100 people | No more than 800 million rubles | A minimum of 51 percent of the authorized capital must belong to individuals or organizations - SMEs. The share of organizations not related to SMEs should not exceed 49 percent, the share of the state, regions or NGOs - 25 percent | Clause 1 part 1.1 art. 4 of Law No. 209-FZ |

| Microenterprise | No more than 15 people | No more than 120 million rubles | ||

| Medium enterprise | No more than 250 people | No more than 2 billion rubles |

You can check whether you belong to an SMSP in a special register on the Federal Tax Service website.

The law does not provide any additional conditions regarding the conditions for applying the minimum wage to specific types of payments, therefore we believe that insurance premiums at a reduced rate are calculated as the sum of wages and vacation payments minus the minimum wage (12,792 rubles), multiplied by 15 percent of the total tariff.\

What holidays are covered by insurance premiums?

According to paragraph 1 of Art. 420 of the Tax Code of the Russian Federation, vacation payments are considered the main income of an employee, and therefore they are included in the taxable base when calculating insurance premiums. Accordingly, such contributions must be calculated based on the results of the month in which vacation pay was accrued.

What holidays are not subject to insurance premiums?

In accordance with paragraph 1 of Art. 420 of the Tax Code of the Russian Federation and paragraph 1 of Art. 20.1 of Federal Law No. 125-FZ of July 24, 1998, insurance contributions must be charged for vacations granted to employees. At the same time, labor legislation identifies several types of vacation pay included in the taxable base:

More to read —> Sanatoriums of the Ministry of Internal Affairs arrival dates 2021

The organization, as a result of relations with which an individual receives income, is recognized as a tax agent for personal income tax and is obliged to calculate, withhold and transfer to the budget the appropriate amount of personal income tax directly from the income of the individual upon their actual payment.

Average daily earnings for payment of vacations provided in calendar days and payment of compensation for unused vacations are calculated by dividing the amount of wages actually accrued for the billing period by 12 and the average monthly number of calendar days (29.3)

Vacation pay deadline

In this case, the employee can divide the vacation into several parts in agreement with the employer. In this case, one of the parts of the vacation must be at least 14 calendar days. And the employee can use the remaining days as he pleases.

The first is that if the vacation period extends over two reporting periods, then the amount of accrued vacation pay is included in expenses in proportion to the vacation days falling on each of the reporting periods.

In clarifications, the Ministry of Finance of Russia (letters dated No. /27129, dated No. /27643, dated No. /1/42) has repeatedly explained that when determining the tax base for income tax, the amount of accrued vacation pay for annual paid leave is included in expenses in proportion to the days of vacation, falling on each reporting period. They substantiated their position with the following provisions of Chapter 25 of the Tax Code of the Russian Federation.

General procedure for calculating vacation pay

If this difference is positive, then it must be taken into account as part of non-operating income of the current tax period, but if it is less than zero, the amount not covered by the reserve is included in labor costs for the current year.

Taxes on vacation pay are calculated at the rates established by tax legislation. The personal income tax rate on income received by citizens in 2021 as wages (including vacation pay) is 13%. Tax is withheld from all amounts paid to the employee, with the exception of those specified in the legislation. Income tax amounts are also reduced through tax deductions. The standard tax deduction when calculating vacation pay is applied depending on the employee's eligibility to receive it. The list of tax deductions by which the tax base is reduced is established by Article 218 of the Tax Code of the Russian Federation. Depending on the status of the taxpayer, it can range from 500 to 3000 rubles. Employees with children, disabled people, war veterans, participants in the liquidation of the consequences of the Chernobyl Nuclear Power Plant, etc. have the right to tax deductions.

- in the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund (for insurance in case of temporary disability and in connection with maternity) - no later than the 15th day of the month following the month in which vacation pay was accrued (Part 5 of Article 15 of Law No. 212-FZ);

- in the Social Insurance Fund (for insurance against industrial accidents) - simultaneously with the payment of wages for the month in which vacation pay was accrued (clause 4 of Article 22 of Law No. 125-FZ).

12/29/2021 Attention! The document is out of date! The new version of this document is free in ConsultantPlus

Is income tax charged on holiday pay? Usually this question is not asked, since this issue is clearly regulated by tax legislation. Taxation of vacation pay amounts is carried out in a manner similar to taxation of wages.

Since a standard or social deduction is applied on a monthly basis, the fixed amount of such a deduction reduces the tax base only in the period in which the payment to the employee occurred. Here's an example:

In May 2021, the storekeeper of Prioritet LLC, P.V. Volodin, was accrued vacation pay from 05/16/2021 to 06/14/2021 in the amount of RUB 20,950.00. Moreover, for the period from 05/01/2021 to 05/15/2021, the employee’s earnings amounted to 10,400.00 rubles. The child tax deduction used by Volodin P.V. is equal to 1,400 rubles. Let's calculate the personal income tax payable:

Tax deduction from vacation pay

In addition to the right to annual paid leave of standard duration, labor and social security legislation provides for other types of paid leave. Depending on the classification (purpose) of leave, the rules for assessing payments due to the employee with taxes and contributions also change:

More to read -> How long does it take to pay out Flood Insurance from Sberbank

Insurance contributions are paid at the rates established by law for the current year, taking into account all income transferred to the employee. These payments are deducted from the employer’s own funds and are not deducted from the employee’s salary.

Insurance premiums from rolling holidays

In practice, an employee’s vacation days may fall in different months, and it happens that they fall in different reporting (tax) periods.

In this case, regardless of whether the organization divides vacation pay between vacation months in tax accounting, insurance premiums in accordance with paragraphs. 1 clause 1 art. 264 of the Tax Code of the Russian Federation relate to other expenses associated with production and sales and are taken into account in the period of their accrual. That is, the date of incurring such expenses is the date of their accrual (clause 1, clause 7, article 272 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated June 1, 2010 No. 03-03-06/1/362).

Thus, if an employee’s vacation falls in March and April 2021, the organization recognizes insurance premiums from them in tax accounting in March 2021.

Methodology for filling out a tax payment form

Mistake #1. Failure to pay taxes by a company certainly leads to a violation of the main requirement of the legislator: tax withholding and transfer of funds from vacation payments to the treasury as a tax agent by the employer. The deadline for this is the last day of the month of payment of vacation pay itself.

Working with vacation pay for the purposes of calculating income tax and the simplified tax system

You probably should know that you are obliged to pay your subordinate money for vacation three days before it starts (Article 136 of the Labor Code of the Russian Federation). Otherwise, the inspection body will impose a considerable fine on your company and they are set out below in the table (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). Taxes on holiday pay in 2021 must be paid on time.

Contributions for compulsory social insurance against industrial accidents and occupational diseases must also be paid by organizations and individual entrepreneurs (employing persons subject to insurance against industrial injuries) no later than the 15th day of the month following the month in which contributions are calculated. Moreover, if the payment deadline falls on a weekend or non-working holiday, the end of the period is considered to be the next working day following it (Clause 4, Article 22 of the Federal Law of July 24, 1998 No. 125-FZ).

More to read —> Material damage amount of state duty

Deadlines for payment of insurance premiums

If there was a gross error when calculating insurance premiums, then the court will hold the director and chief accountant administratively liable and issue them a fine of 5,000 to 10,000 rubles. When a crime is committed, those responsible may be subject to criminal penalties.

Are insurance premiums calculated from vacation pay - important rules, payment deadlines, examples

Are holiday pay subject to insurance contributions in 2021 or not? This question arises for most employers. There are several types of vacation payments that require a certain procedure for calculating contributions. Let's look at them in more detail in this article.

A separate issue is contributions for injuries. The chief accountant transfers payments for insurance from NS and PZ to the territorial departments of the Social Insurance Fund (clause 1 of Article 201.1 125-FZ). Contributions for injuries cover wages, bonuses, additional payments and allowances, compensation and incentive payments. Insurance premiums against accidents are not calculated from the amounts of dividends, financial assistance to employees in the amount of up to 4,000 rubles, lump sum payment at the birth of a child, etc. A complete list of payments for which contributions from NS and PP are not charged is given in Art. 20.2 125-FZ.

Daily allowances (allocated for business trips), sick leave benefits, all compensation established by law are not subject to contributions, that is, none of the four types of deductions are made from them. The full list of exceptions is presented in Article 422 of the Tax Code of the Russian Federation.

When should insurance premiums be transferred in 2021?

- pension (insurance and savings);

- medical;

- for compulsory social insurance in case of temporary disability and in connection with maternity, industrial accidents and occupational diseases.

› · September 17, 2021 For more information on this, see the answer to the question. Accordingly, before vacation pay is paid, it must be calculated and accrued. And this can be done on any day of the month starting from the date of issuance of the order in which vacation pay is paid to the employee, but no later than the payment deadline 3.

We did it using the example of payment of vacation pay for the period from 07/01/2021 to 07/28/2021 and salaries for July. And you can supplement it with other types of income and adjust the dates. Indicators Type of employee income Vacation pay from 07/01/2021 to 07/28/2021 Salary for July 2021

Personal income tax on vacation pay when to pay in 2021

The employer calculates mandatory contributions payments based on the results of each calendar month based on the amounts accrued in favor of the employee (). And he pays them to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund no later than the 15th day of the month following the month of accrual ().

28 Apr 2021 uristgd 120

Share this post

- Related Posts

- Living Standards for 2021 in an Apartment in the Republic of Bashkortostan

- Repair work in an apartment according to the law in the Krasnoyarsk Territory

- Does a Pediatric Stomatology Nurse Receive a Surcharge for Harmfulness?

- Payment for Schoolchildren's Travel on the Train 2021 St. Petersburg