Documents confirming the acquisition of inventory items by the accountant

An accountable person is an employee who has received funds for business, administrative and other expenses.

To account for the money received for the purchase of goods and materials, the accountable person fills out an advance report, which indicates exactly what valuables, in what quantities and in what amounts were purchased.

ATTENTION! With effect from November 30, 2020, by the Bank of Russia’s instruction No. 5587-U dated October 5, 2020, the Central Bank introduced a number of changes to the procedure for conducting cash transactions. For example, an organization has the right to independently set the period for which funds are issued for reporting purposes.

You can see an example of filling out an advance report (AO), as well as a completed AO, in the material “Sample of filling out an advance report in 2021 - 2021”.

Supporting documents are attached to the advance report, i.e. documents confirming these expenses. Let's look at what documents these might be. An employee of an organization, having received money on account, can purchase goods and materials anywhere: in a retail chain, in a small organization, having received a sales receipt and, if available, a cash receipt as documents confirming the purchase. In this case, a sales receipt confirms the fact of purchase of goods and materials, and a cash receipt confirms their payment.

What should an accountant do if the accountant did not bring a cash receipt, see the material “Features of an advance report without a cash receipt.”

An important point is the acceptance of correctly completed documents.

For what exactly should be indicated in the documents submitted by the accountable person, see the material “Check the details in the accountable person’s documents so as not to be subject to personal income tax.”

If inventory items were purchased from an organization that is not a VAT payer, these documents are quite sufficient to accept an advance report and capitalize inventory items for it.

In order for the accountable person, when purchasing goods and materials, to act before the selling organization not as an individual, but as a representative of his enterprise, it is necessary to issue a power of attorney for this employee. The power of attorney must contain the date of issue and expiration date. The written power of attorney is registered in a special journal and handed over to the employee. By presenting a power of attorney to the seller, the employee acts on behalf of his organization. All documents provided to him by other enterprises will be issued in the name of his employer. By purchasing goods and materials in this way, he will receive both a delivery note and an invoice indicating the details of his organization, which will allow him to accept “input” VAT for deduction.

ConsultantPlus experts explained how to issue a power of attorney to receive goods and materials. Get trial access to the K+ system and upgrade to the Ready Solution for free.

Compensation for overspending on a salary card

Situation: is it possible to reimburse an employee for overspending of accountable amounts to the same bank card to which his salary is transferred?

The legislation does not contain a clear answer to this question.

The advance report form provides for only one form of compensation for overspent accountable amounts - cash. The same opinion was expressed by the Bank of Russia in letter dated December 18, 2006 No. 36-3/2408.

At the same time, in letter dated December 24, 2008 No. 14-27/513, when commenting on settlements for business trips, the Bank of Russia indicated that the issue of the possibility of using bank cards for settlements on accountable amounts does not fall within its competence. The previously issued letter was not canceled. Therefore, the organization must independently decide whether to be guided by this letter or not.

Some arbitration courts do not deny the possibility of reimbursement of overspending to an employee’s bank card. For example, in resolution dated February 11, 2008 No. A52-174/2007, the Federal Antimonopoly Service of the North-Western District indicated that the organization lawfully transferred accountable funds to the employee’s “salary” account. And the employee, in turn, subsequently lawfully returned the unused accountable amounts from his bank account. These transactions were confirmed by the manager’s order (it recorded the possibility of issuing accountable amounts to employees by transferring them to bank cards), an employee’s advance report, a cash receipt order (on the basis of which the balance of the unused advance was returned to the organization), invoices, cash register checks , receipts.

To avoid unnecessary disputes with regulatory agencies, whenever possible, make all payments for accountable amounts through the cash desk. However, in any case, there is no responsibility for reimbursing the employee for overspending of accountable amounts to the same bank card to which his salary is transferred. The number of cash violations (violations of the procedure for working with cash and conducting cash transactions) does not include compensation for overspending of accountable amounts on a salary card (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

Account 71 “Settlements with accountable persons”

Synthetic accounting of settlements with accountable persons who are employees of the organization is maintained on the same account 71 “Settlements with accountable persons” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). Accounting account 71 is an active-passive account.

This account summarizes information on settlements with employees for the amounts that were issued to them on account for administrative, business and other expenses.

At the same time, a situation is possible when, for example, an employee went on a business trip without receiving the funds under the report. In this case, reimbursement of expenses incurred will also be reflected using account 71. This means that synthetic account 71 is used not only to account for amounts issued for reporting, but also to account for reimbursement of expenses incurred by employees at their own expense, but in the interests of the organization.

Analytical accounting on account 71 is maintained for each accountable person and the amount issued for reporting.

Postings for accounting of inventory items in accounting

Methods for acquiring inventory items in an organization can be different, for example:

- Purchase of goods and materials from a counterparty for non-cash payments (discussed in example 1);

- The organization issues cash to the employee for the purchase of goods and materials (studied in example 2 and example 3).

For tax accounting purposes, the cost of written-off materials is determined in accordance with clauses 2 and 4 of Art. 254 Tax Code of the Russian Federation.

Materials can be written off:

- For main production (account 20) (example 4);

- For auxiliary production (account 23);

- For general production expenses (account 25);

- For general business expenses (account 26) (example 5).

The acquisition of inventories (MPI) by bank transfer is regulated by clauses 5-11 of PBU 5/01, clause 1 of Article 254 of the Tax Code of the Russian Federation.

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 10.01 | 60.01 | 50 000 | Receipt of supplies | Consignment note (TORG-12) |

| 19.03 | 60.01 | 9 000 | VAT on purchased inventories included | Invoice received |

| 60 | 51 | 59 000 | Payment to the supplier for inventories | Bank statement |

| 68.02 | 19.03 | 9 000 | VAT is accepted for deduction | Book of purchases |

| Debit account | Credit account | Transaction amount, rub. | Wiring Description | A document base |

| 71.01 | 50.01 | 15 000,00 | Issuance of funds to an employee on account for the purchase of goods and materials | Manager's order, Expense cash order (KO-2) |

| 10.09 | 71.01 | 12 711,86 | Employee's advance report on purchased inventory items | Advance report, Consignment note (TORG-12) |

| 19.03 | 71.01 | 2 288,14 | VAT on purchased inventory items has been taken into account | Invoice received |

| 68.02 | 19.03 | 2 288,14 | VAT is accepted for deduction | Book of purchases |

| Debit account | Credit account | Transaction amount, rub. | Wiring Description | A document base |

| 71.01 | 50.01 | 20 000,00 | Issuance of funds to an employee on account for the purchase of goods and materials | Manager's order, Expense cash order (KO-2) |

| 10.09 | 71.01 | 22 500,00 | Employee's advance report on purchased inventory items | Advance report, Sales receipt |

| 71.01 | 50.01 | 2 500,00 | Issuance of funds to an employee (amount of overexpenditure according to the advance report) | Advance report, Expense cash order (KO-2) |

According to the “4x4 Boards” nomenclature, the organization had a balance of 150 pieces for a total amount of 40,500.00 rubles:

- Let's calculate the average cost: 40,500.00 / 150 = 270.00 rubles;

- Let's calculate the cost of the material transferred to production: 70 * 270.00 = 18,900.00 rubles.

| Debit account | Credit account | Transaction amount, rub. | Wiring Description | A document base |

| 20.01 | 10.01 | 18 900,00 | Transfer of materials to production | Requirement-invoice for release of materials according to form No. M-11 |

The organization had balances in the range of Notebooks in the amount of 400 pieces for a total amount of 10,280.00 rubles, in the range of Pens in the amount of 550 pieces for a total amount of 8,525.00 rubles.

Let's calculate the average cost:

- notebooks 10,280.00 / 400 = 25.70 rubles;

- pens 8,525.00 / 550 = 15.50 rub.

Let's calculate the cost of written-off material for general business expenses:

- notebooks 50 * 25.70 = 1,285.00 rub.;

- pens 100 * 15.50 = 1,550.00 rub.

| Debit account | Credit account | Transaction amount, rub. | Wiring Description | A document base |

| 26.01 | 10.01 | 1 285,00 | Write-off of office supplies (notebooks) to the Accounting department | Requirement-invoice for release of materials according to form No. M-11 |

| 26.01 | 10.01 | 1 550,00 | Write-off of office supplies (pens) to the Accounting department |

OSNO, simplified tax system and UTII

Money paid to an employee in order to reimburse overexpended accountable amounts will be included in expenses when calculating income tax and single tax when simplifying the difference between income and expenses. To do this, it is necessary to confirm their economic feasibility (clause 1 of article 252, clause 2 of article 346.16 of the Tax Code of the Russian Federation). The procedure for accounting for these expenses depends on what the employee paid. For example, entertainment expenses incurred during a business trip can be taken into account within the normal limits. Expenses when purchasing materials and fixed assets are taken into account in a special manner.

The calculation of the single tax under simplified income and the calculation of UTII does not affect the reimbursement of overspent accountable amounts to the employee, since organizations using these special regimes do not take into account any expenses at all (clause 1 of Article 346.14, clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account when calculating income tax the cost of goods (work, services) purchased through an employee before the organization compensated him for the overexpenditure of the amounts issued for reporting for this operation?

The answer to this question depends on what accounting method the organization uses when calculating income taxes.

If an organization calculates income tax using the accrual method, then the moment of compensation to an employee for overexpenditure to recognize costs for purchased goods (work, services) is not important. Recognize expenses during the period in which they are incurred. This is directly stated in paragraph 1 of Article 272 of the Tax Code of the Russian Federation.

If an organization calculates income tax using the cash method, then expenses are considered incurred only after they are actually paid. Payment for goods (work, services) is recognized as the termination of a counter-obligation by the purchaser to the seller, which is directly related to the delivery of goods (work, services). This is stated in paragraph 3 of Article 273 of the Tax Code of the Russian Federation. Article 273 of the Tax Code of the Russian Federation does not establish any specifics in the case of purchasing goods (work, services) through an employee (representative) of an organization. When the accountable pays for goods (work, services), the debt to the seller is repaid. However, as employees of the Ministry of Finance of Russia explain, until the overexpenditure is reimbursed to the accountant, it cannot be assumed that these expenses were paid by the acquiring organization (clause 1 of Article 252 of the Tax Code of the Russian Federation). The organization will have actual expenses only after compensation for overexpenditures. Therefore, in order to recognize expenses in tax accounting, it is necessary that the organization fully reimburse the employee for the overexpenditure.

An example of compensation to an employee for expenses in excess of the amounts issued to him on account. The organization applies a general taxation system. Income tax is calculated using the cash method

Secretary of Alpha LLC E.V. Ivanova purchased stationery for the organization. On March 24, she was given 2,800 rubles for these purposes, but she spent more. Ivanova submitted to the accounting department an invoice, a cash receipt, a receipt slip and an invoice for the amount of 3,000 rubles. (including VAT - 458 rubles).

On March 26, the head of Alpha approved Ivanova’s advance report. On the same day, the purchased stationery was transferred to household needs. On March 31, the organization’s cashier gave Ivanova 200 rubles. (3000 rubles - 2800 rubles), which the employee spent in excess of the money received on the report.

The Alpha accountant reflected these transactions as follows.

March 24:

Debit 71 Credit 50 – 2800 rub. – money was issued against Ivanova’s report.

26 March:

Debit 10 Credit 71 – 2542 rub. (3000 rubles – 458 rubles) – stationery purchased by the employee was received;

Debit 19 Credit 71 – 458 rub. – VAT on purchased stationery is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 458 rub. – VAT paid to suppliers is claimed for deduction.

March 31:

Debit 71 Credit 50 – 200 rub. – the employee was compensated for expenses in excess of the amounts given to him on account.

Expenses for the purchase of stationery when calculating income tax in the amount of 2542 rubles. Alpha's accountant took into account in March.

Situation: is it possible for an organization to take into account in expenses the cost of goods (work, services) purchased through an employee in a simplified manner, before he was compensated for the overexpenditure of the amounts issued for reporting for this operation?

No you can not.

When calculating a single tax under simplification, an organization has the right to recognize expenses only after they are actually paid. Payment for goods (work, services) is recognized as the termination of a counter-obligation by the purchaser to the seller, which is directly related to the delivery of goods (work, services). This is stated in paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation. Article 346.17 of the Tax Code of the Russian Federation does not establish any specifics in the case of purchasing goods (work, services) through an employee (representative) of an organization. When the accountable pays for goods (work, services), the debt to the seller is repaid. However, until the overexpenditure is reimbursed to the accountable, it cannot be assumed that these expenses were paid by the acquiring organization (clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation). The organization will have actual expenses only after compensation for overexpenditures. Therefore, when calculating a single tax under simplification, in order to recognize expenses, it is necessary that the organization fully reimburse the employee for the overexpenditure. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated January 17, 2012 No. 03-11-11/4.

An example of compensation to an employee for expenses in excess of the amounts issued to him on account. The organization applies simplification. The organization pays a single tax on the difference between income and expenses

Alpha LLC applies a simplified tax system; it pays a single tax on the difference between income and expenses.

Secretary E.V. Ivanova purchased stationery for the organization (paper, staplers, pens, etc.). She was given 2,000 rubles for these purposes, but she spent 3,000 rubles. (including VAT - 458 rubles).

On February 11, the head of Alpha approved Ivanova’s advance report in the amount of 3,000 rubles.

On February 13, Ivanova was compensated in the amount of 1,000 rubles. (3000 rubles - 2000 rubles), which she spent in excess of the money given to her on account.

When calculating the single tax (on the difference between income and expenses) for the first quarter, the Alpha accountant included 3,000 rubles in expenses.

Accounting entries for account 71

If funds are issued for reporting purposes, the posting will depend on the form of funds issued: cash or non-cash.

So, if money is issued from the cash register to the account, the posting will be like this:

Debit account 71 – Credit account 50 “Cash”

If accountable funds are transferred to an employee’s card, the posting will be different:

Debit account 71 – Credit account 51 “Current accounts”

Accordingly, if the balance of accountable amounts is deposited at the cash desk, the following posting should be reflected:

Debit account 50 – Credit account 71

Expenses incurred by the accountant are written off from the credit of account 71 to the debit of various accounts depending on the type of expenses:

| Operation | Account debit | Account credit |

| Materials purchased by accountable person | 10 "Materials" | 71 |

| Goods purchased by the accountant are capitalized | 41 "Products" | 71 |

| Travel expenses reflected | 26 “General business expenses”, 44 “Sales expenses”, etc. | 71 |

| The debt to the supplier was repaid through an accountable person | 60 “Settlements with suppliers and contractors” | 71 |

You can find more complete information on the topic in ConsultantPlus.

Free access to the system for 2 days.

Refund of unspent amounts

If the employee returned the unspent balance of the accountable amount to the cashier, make the following entry:

DEBIT 50 CREDIT 71

– unused money was returned.

EXAMPLE An employee of Aktiv JSC received 1000 rubles for a report. to buy stationery. He bought stationery in the store for the amount of 980 rubles, handed them over to the warehouse, and returned the rest of the funds (20 rubles) to the cash register. The Aktiva accountant made the entries: DEBIT 71 CREDIT 50

- 1000 rubles.

– funds were issued on account; DEBIT 10 CREDIT 71

– 980 rub.

– stationery was capitalized on the basis of the employee’s advance report; DEBIT 50 CREDIT 71

– 20 rub. – the unspent balance of accountable funds is accepted into the cash register. After all operations are completed, the employee has no debt, therefore the balance in account 71 for this employee is zero.

If an employee purchased material assets in a retail store, during an audit the tax office may require not only a sales receipt, but also a cash receipt as proof of expenses incurred.

This requirement does not apply to goods whose retail sale is permitted without the use of a cash register.

The ruling of the Supreme Court of the Russian Federation dated March 9, 2021 No. 302-KG16-450 made a conclusion that should convince tax payers of the need to be more attentive to such widespread documents confirming expenses and expenses as sales receipts.

Carelessly executed sales receipts can cause the expense not to be recognized as production; the money will be included in the employee’s income and personal income tax will be withheld from him.

What mistakes happen in practice? There is no information to determine who signed the checks. Often they do not indicate the date of drawing up the check, and do not fill in the columns “product price”, “quantity”, “seller’s signature”. Moreover, it is not necessary that all these shortcomings be admitted in one document.

Postings for settlements with accountable persons: table

Let us summarize the transactions discussed above in the summary table:

| Debit | Credit | Contents of operation |

| 50 "Cashier" | 52 “Currency accounts” | Money in foreign currency received at the cash register |

| 71 “Settlements with accountable persons” | 50 "Cashier" | The employee was given money from the cash register (in rubles, in foreign currency) |

| 71 “Settlements with accountable persons” | 51 “Current accounts” 55 “Special accounts in banks” | Non-cash accountable funds were transferred to the employee |

| 71 “Settlements with accountable persons” | 50.3 “Cash desk” (cash documents) | The employee was issued a train, plane ticket (or other financial document) |

| 07 “Equipment for installation” 08 “Investments in non-current assets” 10 "Materials" 11 “Animals in cultivation and fattening” 15 “Procurement and acquisition of valuables” 41 "Products" | 71 “Settlements with accountable persons” | Expenses are recognized on the advance report for the acquisition of non-current assets, inventory items |

| 20 "Main production" 23 “Auxiliary production” 25 “General production expenses” 26 “General business expenses” 44 “Sales expenses” | 71 “Settlements with accountable persons” | Expenses are recognized on the advance report of a production nature |

| 91 “Other income and expenses” | 71 “Settlements with accountable persons” | Non-production related expenses are recognized in the advance report |

| 60 “Settlements with suppliers and contractors” | 71 “Settlements with accountable persons” | The employee paid the supplier with accountable money for previously delivered goods (or as an advance against a future delivery) |

| 50 "Cashier" | 71 “Settlements with accountable persons” | The employee returned the balance of the accountable amounts to the organization's cash desk |

| 51 “Current accounts” | 71 “Settlements with accountable persons” | The employee returned the balance of the report by non-cash method |

| 71 “Settlements with accountable persons” | 50 “Cash desk” 51 “Current accounts” | Overexpenditure was compensated to the employee (in cash, to a bank account) |

| 94 “Shortages and losses from damage to valuables” | 71 “Settlements with accountable persons” | The employee did not return to the employer on time the difference between the accountable amount and confirmed expenses |

| 70 “Settlements with personnel for wages” | 94 “Shortages and losses from damage to valuables” | The employer withheld the unrefunded difference from the employee's salary |

| 73 “Settlements with personnel for other operations” | 94 “Shortages and losses from damage to valuables” | The unreturned amount was transferred to the account of other settlements with personnel (if the employee does not agree to repay the debt) |

| 76 “Settlements with various debtors and creditors” | 73 “Settlements with personnel for other operations” | The amount not returned by the former employee was transferred to the account of settlements with various debtors |

| 91 “Other income and expenses” | 76 “Settlements with various debtors and creditors” | Uncollected receivables are written off (included in other expenses) |

| 71 “Settlements with accountable persons” | 91 “Other income and expenses” | The organization's debt to the employee is included in other income after the expiration of the statute of limitations for its collection |

Amount of amounts issued

The legislation does not establish any restrictions on the amounts given to employees on account.

However, by paying expenses, the accountable person acts on behalf of the company. Consequently, the employee who received the money on account must comply with the maximum amount of cash payments (100,000 rubles under one agreement). This was established by Bank of Russia Directive No. 3073-U dated October 7, 2013.

If an employee violates the established settlement limit, your organization may be fined. The amount of the fine is from 40,000 to 50,000 rubles.

For the same violation, the head of your organization may be subject to a fine of 4,000 to 5,000 rubles (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

EXAMPLE If an employee paid 100,001 rubles from accountable money to another organization in cash under one agreement. (with a settlement limit of 100,000 rubles), your company may be fined in the amount of 40,000 to 50,000 rubles, and the manager - in the amount of 4,000 to 5,000 rubles. If the amount exceeds 100,000 rubles, your employee will pay cash register of another organization not under one, but under different agreements (for example, under a contract for the sale and purchase of goods - 50,000 rubles, and under a supply agreement - 51,000 rubles), there will be no violation. Thus, the accountable person cannot pay under one agreement more than 100,000 rubles, but may have more than 100,000 rubles under the report.

Terminology

| Designation | Term |

| Value added tax | VAT |

| Inventory | Inventory |

| Debit | D |

| Credit | TO |

| Outgoing payment order | PP outgoing |

| Incoming payment order | PP incoming |

| A document journal that reflects the receipt of materials | Receipt from supplier |

| A document journal that reflects the movement of materials from one warehouse to another | Internal movement |

| A document journal that reflects the write-off of materials for production | Write-off for production |

| A document journal that reflects the sale of materials | Implementation |

What to show on account 71

Order of the Ministry of Finance of the Russian Federation No. 94n approved that account 71 “Settlements with accountable persons” is intended to reflect transactions for the issuance and return of accountable amounts.

What is a subreport? This is a certain amount of money from the organization that is transferred to the employee for specific purposes. Moreover, the purpose of expenses and the reporting period are strictly limited. After the allotted time has passed, the subordinate must provide a report on the expenses incurred. In simple words, money is given in advance, but with the condition that the employee provides a report - this is the essence of reporting.

For example, the company secretary was given 100 rubles from the cash register to buy an envelope and send a letter. When the reporting employee sends the letter, he will be given a receipt or check at the post office. It is these payment documents that the secretary will attach to the report, which will confirm the fact that the funds were spent on purpose.

For what purposes can a report be issued:

- Advance on travel expenses. This is relevant when an employee is sent on a business trip. Travel allowances include payment for accommodation and travel, daily allowances and other expenses en route.

- Expenses for the business needs of the company. Money can be issued for any purpose, from buying a light bulb for a utility room to building materials for major repairs.

- Settlements with counterparties. For example, the issuance of money is subject to payment for the services of third-party organizations. The operation is used less and less often, since non-cash payments are much more convenient.

- Other goals fixed by the decision of the company management. The director has the right to order the issuance of a report for any purpose. For example, for the purchase of equipment, exclusive rights, software products, etc.

IMPORTANT! Loans and advances to employees cannot be reflected in account 71. For this purpose, a separate account is provided in accounting - 73. Some companies, wanting to simplify accounting and evade taxes, issue short-term loans to employees through 71 accounts. This is a violation.

Rules for issuing money report

The organization is obliged to independently develop and approve the procedure for settlements with accountable persons. For example, by identifying uniform provisions in the annex to the accounting policies. The company calculates limits and standards on an individual basis.

Key requirements for conducting settlements with accountable persons:

- Money can only be given to an employee of the company. That is, accountable persons (account 71 is used only in this case) must be determined by a separate order of the manager.

- Funds can be transferred in cash from the cash register or by bank transfer. Which method will be used in settlements with accountable persons should be specified in the accounting policy.

- The maximum amount to be issued for reporting can be fixed by a separate order of management.

- It is recommended to approve the limits on travel expenses in the subsistence report separately.

- The deadline for submitting a report on accountable money is also fixed in the regulations or in the accounting policy.

- All settlements with accountable persons (account 71) must be documented. To do this, checks, invoices, tickets, receipts and other documentation are attached to the report.

Money is issued based on a written application from the employee or by order of management. The recipient is required to sign the cash receipt order if funds are issued in cash from the cash register. When making purchases or while on a business trip, the reporting employee must keep all receipts and checks in order to account for the advance received. Upon returning from a trip or upon completion of the purchase, the subordinate draws up an advance report. Supporting documents are attached to the report. The deadline for drawing up a report on accountable money is 3 days.

Warehouse accounting of materials

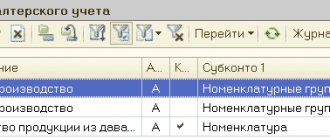

Inventories are accounted for in account 10 Materials at the actual cost of their acquisition (average purchased). For accounting in monetary and quantitative terms, warehouse accounting is being established, the essence of which is to formulate a range of materials in the program and reflect it in receipts and expenses. The arrival of material at the warehouse is documented by an invoice from the supplier, and consumption (write-off for production, internal movement from warehouse to warehouse or sale) is documented by an invoice.

To simplify accounting in small enterprises, we recommend using a single subaccount 10-01, as specified in the standard service configuration. In order to use other subaccounts in accounting, additional configuration of the service is required, which can be done independently or with the help of a remote administrator.

Journals of primary documents for material accounting are located in the Production section of AUBI Internet accounting.

Reflection of materials in accounting

- Pay the materials to the supplier from the PP settlement account outgoing. Carry out wiring D6000 K5100.

- Register the receipt of materials at the warehouse with a receipt from the supplier. Wiring D1001 K6000 will be performed automatically.

- Document the transfer of material from one warehouse to another with a transfer certificate. Posting D1001 K1001 will be performed automatically.

- Write off the material as an act for production. Posting D2000 K0101 will be performed automatically.

- Sell the consumable invoice material. Posting D9101 K0101 will be performed automatically.

Use bills of materials to track the status of account 10 and its subaccounts as a whole, as well as by warehouse and item.

Simplified taxation system

| № | Document | Debit | Credit | the name of the operation |

| 1 | PP outgoing | 60-00 | 51-00 | Paid to supplier |

| 2 | Purchase Invoice | 10-01 | 60-00 | Received materials from supplier |

| 3 | Transfer certificate | 10-01 | 10-01 | Moving material from one warehouse to another |

| 4 | Write-off act | 20-00 | 10-01 | Write-off of material for production |

| 5 | Sales Invoice | 91-01 | 10-01 | Sales of material to third parties |

General taxation system (VAT accounting)

| № | Document | Debit | Credit | the name of the operation |

| 1 | PP outgoing | 60-00 | 51-00 | Paid to supplier |

| 2 | Receipt invoice, incoming SF | 10-01 | 60-00 | Materials received from supplier to warehouse |

| 19-04 | 60-00 | VAT is reflected on purchased materials | ||

| 68-02 | 19-04 | VAT credited on purchased materials | ||

| 3 | Transfer certificate | 10-01 | 10-01 | Moving material from one warehouse to another |

| 4 | Write-off act | 20-00 | 10-01 | Write-off of material for production |

| 5 | Sales Invoice | 91-01 | 10-01 | Sales of other materials on the side |

| 91-02 | 68-02 | VAT accrued on other sales |

Purchasing materials through an accountable person

The reporting entity purchases inventory items for cash. In order to take into account purchased inventory items and report to the organization for the cash issued for the report, the accountable person draws up an advance report in which he indicates the inventory items purchased for cash. Cash receipts and sales receipts are attached to the advance report as supporting documents. A fiscal cash receipt confirms the fact of cash expenditure, and a sales receipt confirms the fact of acquisition of goods and materials. Typically, goods and materials are purchased for cash either in a retail chain or from small entrepreneurs. As a rule, such sellers carry out their activities without VAT, i.e. do not accompany the purchase with an invoice.

- Issue cash to the accountable person from the RKO cash desk. Carry out wiring D7100 K5100.

- Document the receipt of material from the accountable person with an advance report with a delivery note and a cash receipt from the supplier. Wiring D1004 K7100 will be performed automatically. If an invoice is attached to the advance report in addition to the delivery note or sales receipt, then additional entries are made related to the recording of VAT for offset.

- …