From January 1, 2021, a new taxation system for residential real estate , this includes an apartment, house, cottage, and land plot. If previously the tax was calculated according to the BTI method, then from this year the tax is calculated based on the market, cadastral value based on the address .

Now ordinary citizens will have to give ten times more personal money to the state. If there is no money to pay the tax, the authorities suggest selling the apartment and looking for a more affordable option or renting housing. Of course, the adoption of this law caused excitement among ordinary citizens, because how should pensioners and low-income citizens of the Russian Federation pay the cadastral tax?

What is property tax

You can learn everything about property tax in legislative language from the Tax Code (Chapter 32). This language is not familiar to all citizens of the Russian Federation, so we traditionally translate the article.

Property tax is the amount that the taxpayer pays to the regional budget for each property that he owns.

Taxpayers are individuals who own apartments, rooms, houses and other real estate. The more objects the owner owns, the greater the amount he will pay. The number of registered residents per square meter does not in any way affect the amount of contributions to the budget. It is not the one who lives who pays, but the one who owns.

The mechanism for calculating property taxes has undergone major changes in recent years. Until 2014, the basis, i.e., the starting point in determining the amount to be paid, was the inventory value of the object. It was determined by BTI workers. And it was far from real prices on the market. For example, an apartment worth more than 2 million rubles. could have an inventory value of only 100–200 thousand rubles.

It turns out that the owner paid property tax not on 2 million rubles, but only on 200 thousand rubles. What kind of state would tolerate this? It did not suffer. Since 2015, the order has changed. Now the amount payable to the budget is calculated not from the inventory value, but from the cadastral value, which ideally should be close to the market value.

But it was not possible to immediately switch to the new methodology, because there was not complete information on the cadastral value of all real estate objects in the regions of the Russian Federation. We created a transition period so that everyone could prepare, including taxpayers, whose property taxes were objectively expected to increase.

In 2021, adaptation ended. From this year, the tax is calculated only from the cadastral value. An exception was made for the city of Sevastopol, for them - from 2021.

To prevent the transition from being abrupt and people not looking at their pay slips in horror, they came up with transition coefficients - from 0.2 to 0.6 for the first three years of paying taxes in a new way. Next I will talk about them in more detail.

How to find out tax accruals

You can find out the property tax by knowing the cadastral number or the exact address of the property. To find out your tax debt, you need to go to the official website of the tax service and select your region in the upper left corner. Next, in the “electronic services” tab, you need to go to “all services”, find “Calculator for land tax and property tax for individuals, calculated based on the cadastral value.” Further actions will be as follows:

- If there is a cadastral number for the property, enter it and click “Next”. If only the address is known, then you can find out the cadastral number using the Rosreestr service.

- If you were unable to find out the cadastral number, you can enter the characteristics of the property manually. To do this, click “Next” without filling out the “Cadastral number”.

- The next step is to enter the area of the property, which is indicated in the passport, as well as the certificate of ownership.

- The period of ownership of the property is indicated, and the amount of the property tax deduction is entered, based on the type of property: 50 for a house, 20 for an apartment, 10 for a room. There is no deduction for land plots.

- The tax rate is indicated: 0.1% for apartments, houses, garages, 0.5% for other objects and 2% for VIP real estate, shopping centers with a cadastral value of 300 million rubles. For those who own plots that are used for agriculture or subsidiary farming, gardening, the rate is 0.3%, for other plots - 1.5%. Regional authorities can change these rates, if such plots exist; the exact rates for them and the inventory value can be checked on the portal.

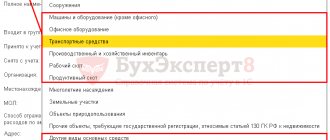

Objects of taxation

An exhaustive list of real estate objects on which the owner must pay property tax is given in Article 401 of the Tax Code of the Russian Federation:

- residential building, including buildings that are located on the land of personal subsidiary plots, individual housing construction, vegetable gardening and horticulture (dachas, garden houses);

- apartment, room;

- garage, parking place;

- single real estate complex;

- unfinished construction project;

- other objects.

There is no need to pay anything for objects that are not subject to state registration, as well as for the property of an apartment building that is classified as a common building (elevators, staircases, etc.).

After reading, you will understand how to stop working for pennies at a job you don’t like and start LIVING truly freely and with pleasure!

If the object belongs to several owners, then each pays in proportion to their share. And parents, guardians and other legal representatives pay for children, property owners.

How to determine the tax base

From January 1, 2020, the tax base is the cadastral value of the property. It is calculated in all regions of the Russian Federation.

Let's look at ways to find out the cadastral value of your property.

- Rosreestr website

Simply fill out the online application and receive all the necessary information.

- Taxpayer’s personal account on the Federal Tax Service website

The “My Property” section contains all the objects that you own. You can immediately see the cadastral number on the card. For example, if you want to make a request on the Rosreestr website, you will need it. And if you click on the property with the mouse, you will be taken to the description, where the cadastral value is located.

- Calculator on the Federal Tax Service website

The information is filled in sequentially. After entering the cadastral number, the value of the object is displayed. In my case, it’s still the same 1,816,986.38 rubles.

- Public cadastral map

There are no apartments on the map, only land plots and residential buildings.

- Tax receipt

If you do not have a personal account on the Federal Tax Service website or you have written a statement about your desire to receive notifications in paper form by mail, then the receipt sent in previous years contains the cadastral value.

The final value of the tax base is influenced by benefits: federal and local. There will be a separate section about them in the article.

Calculation based on inventory value

Now there is a transition period for taxpayers: property taxes are not taken in full, but are multiplied by reduction factors. But first we will show how the full amount is calculated.

When calculating property tax based on the cadastral value, it is reduced by a deduction and multiplied by the tax rate. The tenure period is also important: if it is less than a year, the amount of property tax is proportionally reduced. If you own only part of the property, tax liabilities are divided proportionally between all owners.

N = B × S × KPV × D

Here N is the amount of property tax, B is the tax base, or the cadastral value of the object after deduction, C is the property tax rate in the region for this object, KPV is the coefficient of the ownership period, D is the size of the ownership share in the object.

The taxpayer bought the apartment on June 20 and sold it on December 20. Then June is not taken into account in the period, but December is. Ownership period: 6 months. CPV is 6/12, that is, 0.5.

You can also see the calculation formula in your personal account on the Federal Tax Service website. It will not necessarily coincide with ours, because we gave an example without taking into account reduction factors. To apply them, the organization first calculates property tax at inventory value. We will tell you how to do this further, but first we will calculate the full property tax according to the cadastre using a real example.

Some regions still charge property taxes based on inventory value. In other regions, it is calculated in order to then be substituted into the formula for reducing property taxes based on cadastral value.

We invite you to read: Step-by-step instructions for buying an apartment through a realtor

The tax office also calculates the amount based on the inventory value, but for clarity, we will describe how the total amount is obtained. The calculation formula is similar. Only the tax base is taken not from the cadastral value, but from the inventory value, multiplied by a deflator coefficient. The deflator coefficient is set by the government.

Tax deductions do not apply.

N = I × KD × S × KPV × D

Here N is the amount of property tax, I is the inventory value of the object, CD is the deflator coefficient, C is the property tax rate in the region for this object, KPV is the coefficient of the ownership period, D is the size of the ownership share in the object.

Most owners do not yet pay the full amount of property tax at the cadastral value. To ensure a smooth transition to the new tax burden, reducing coefficients were introduced. 2021 is the deadline for the transition period to end for regions that began counting in a new way in 2015.

Н = (Н1 − Н2) × К Н2

Here N is the final amount of property tax for the current year.

N1 - the full amount of property tax according to the cadastre. We described above how it is considered.

N2 - tax liabilities based on inventory value for the last period when they were calculated. For example, in Moscow it is 2014, in the Omsk region - 2015.

K - reduction factor. In the first year after the transition to the cadastre, it is 0.2, in the second year - 0.4, in the third year - 0.6.

From the fourth year, the tax office compares the full amount of property tax at the cadastral value with the amount for the previous year. If the total amount has increased by more than 10%, the organization increases the amount of tax liabilities in the current period by 10%. If not more, from now on they take the full amount.

N = ((B x C - H2) x K H2) x KPV x D - L

where L is a tax benefit.

When the amount according to the cadastral value is less than the property tax according to the inventory value, reducing factors do not apply.

Tax rates

The Tax Code of the Russian Federation provides basic rates. Their final sizes are determined by regional authorities.

| Object type | Bid, % |

| A residential building and its part, an apartment and its part, a room, an object of unfinished construction, a single real estate complex and a residential building as part of it, a garage and a parking space, outbuildings. buildings and structures with an area of up to 50 square meters. m | 0,1 The rate can be reduced to 0 or increased, but not more than 0.3% |

| Objects worth more than 300 million rubles, real estate from clause 7 and para. 2 clause 10 art. 378.2 Tax Code of the Russian Federation | 2 |

| Other real estate | 0,5 |

All information about rates and benefits can be obtained from the link. I give an example for the city of Ivanovo, where I live. You just need to change the subject to see the latest information for your region.

As you go through each tab, you'll learn rates, deductions, local and federal benefits. For example, in the city of Ivanovo there are no local benefits. And the rate for the category of objects, which includes apartments, houses, rooms, etc., varies from 0.1 to 0.3 depending on the value of the property.

Tax on cadastral value

Property tax is calculated on the basis of cadastral property in the entities that have adopted the relevant regulatory legal act. Information about the cost is contained in the state real estate cadastre.

The cadastral value is also approved by an act of the municipality or subject according to data obtained during the mass state cadastral valuation, which is carried out in each subject at least once every five years.

The basis for calculating tax taking into account various categories of real estate is the cadastral value of a specific property minus the cadastral value:

- 20 m2 (apartments);

- 10 m2 (rooms);

- 50 m2 (individual houses).

All types of housing, garages and other related buildings are taxed at a rate of 0.1%.

For owners of luxury real estate (valued at an amount exceeding 300 million rubles), buildings included in a special list (shopping, office complexes) the rate is increased to 2%. Owners of other types of property must pay 0.5%.

By regional legislation, these tariffs can be increased by no more than 3 times, or reduced to zero.

If real estate was acquired or the rights to it were lost during the tax period, then a coefficient is applied to the calculated tax amount, calculated as the ratio of the number of full months of ownership of real estate to 12 (the number of months in a year).

Tax benefits

There are deductions for property taxes. The tax base is reduced by the cadastral value:

- 20 sq. m of apartment or part of a house;

- 10 sq. m of room or part of the apartment;

- 50 sq. m of residential building.

Example. Let's determine the tax base for a residential building with an area of 140 square meters. m and cost 3 million rubles:

- Cost of 1 sq. m = 3,000,000 / 140 sq. m = 21,428.57 rub.

- Tax deduction = 50 sq. m * 21,428.57 = 1,071,428.5 rub.

- Tax base = 3,000,000 – 1,071,428.5 = 1,928,571.5 rubles.

If a single real estate complex includes a residential building, then the tax base is reduced by 1 million rubles.

For large families (3 or more children), in addition to the deductions discussed above, the tax base is reduced by the cost of:

- 5 sq. m of apartment or part thereof, rooms for each child;

- 7 sq. m of residential building or part thereof for each child.

The Tax Code of the Russian Federation establishes federal benefits for various categories of citizens. They are mandatory for use throughout the Russian Federation. Local authorities can supplement them with their own. Some regions are limited to federal benefits only.

The list of citizens who have the right not to pay property tax at all or to pay it in a smaller amount is impressive. You can view it in Article 407 of the Tax Code of the Russian Federation. Among the beneficiaries are heroes of the Soviet Union and the Russian Federation, disabled people, pensioners, people who own premises for carrying out creative activities or owners of outbuildings with an area of less than 50 square meters. m.

Rules for receiving benefits:

- Permissible only for objects that are not used for business activities.

- All objects are divided into 5 categories. A taxpayer can select only one property from each category to receive the benefit.

- Benefits are of a declarative nature, i.e. the taxpayer must submit an application to the Federal Tax Service. If there are several properties owned, then the owner must choose the one for which he wants to reduce taxation. The decision can be changed every year until December 31 of the reporting period.

- If the beneficiary has not chosen an object for preferential taxation, the tax office will exempt the one with the highest cadastral value from paying tax.

- There is no need to attach documents confirming your right to benefits with your application. From January 1, 2018, the Federal Tax Service itself requests and verifies the necessary information from the relevant authorities.

- Real estate worth more than 300 million rubles. is not exempt from paying property tax.

Example . The pensioner owns two apartments and a garage. He is entitled to a 100% property tax exemption. The properties belong to different categories of real estate, so a pensioner may not pay for one of the apartments and a garage. He chooses an apartment for preferential taxation himself, or the Federal Tax Service does it for him.

Calculation example

We will calculate the full amount of property tax according to the cadastral value for our apartment in Omsk for 2021. Its cadastral value is RUB 810,000. Area is 60 m².

First, let's apply the tax deduction. To do this, let’s calculate the cadastral value of one square meter: 810,000 / 60 = 13,500 RUR.

The area after deduction is 40 m², so the cost after deduction will be 13,500 × 40 = 540,000 RUR.

The tax rate for apartments in Omsk is 0.1%

If the taxpayer owned such an apartment for a full year, the CPV is equal to one. If he is the only owner, D is also a unit.

Full amount of property tax: 540,000 × 0.1% = 540 RUR.

If the taxpayer owned the apartment for only six months, the CPV will be 0.5.

Full amount of property tax: 540 × 0.5 = 270 RUR.

And if the taxpayer owns only a quarter of the apartment, D - 0.25.

Full amount of property tax: 540 x 0.25 = 135 RUR.

Let's calculate the property tax based on the inventory value for our Omsk apartment. The Omsk region switched to cadastre registration in 2016, so the last period for calculating the inventory value is 2015. Inventory cost - 230,000 RUR. Deflator coefficient in 2015 - 1.147.

On the Federal Tax Service website we find out the tax rate in Omsk for 2015. For apartments costing up to 300,000 RUR this is 0.1%.

Property tax based on inventory value: 230,000 × 1.147 × 0.1% = 264 RUR.

If the period of ownership of the apartment is six months, the specified amount will be halved and amount to 132 RUR.

If the taxpayer owns only a quarter of this apartment, he will pay 66 RUR.

The property tax at the inventory value turned out to be two times less than at the cadastral value. Therefore, when switching to a new calculation method, reducing factors apply.

Let's calculate how the property tax for our apartment in Omsk is growing. In 2015, it was taken according to inventory, and we paid 264 RUR. The full amount according to the cadastre is 540 RUR. Let’s assume that the cadastral value will not change.

Terms and methods of payment

The deadline for paying property tax is December 1 of the year following the reporting year. For example, until December 1, 2021, property owners pay for 2021. And for 2021 – until December 1, 2021.

Every year, the tax authority sends out a notice to each taxpayer with all the necessary information on the object, amount and timing of payment. If you have a personal account on the Federal Tax Service website, the document will go there. If not, then by Russian post.

Payment methods:

- Online on the website of the Federal Tax Service of Russia through the “Payment of taxes and duties” service.

- Online through your personal account immediately after receiving the notification.

- At the bank with a receipt. The notification already contains a receipt; you just need to take it to the bank and pay the required amount in cash or by card.

- Through the State Services portal (Payment tab).

What taxes can you check?

What taxes does a person have? All real estate and the amounts accrued on it can be found on the official portal of the Federal Tax Service. All types of payments are available for verification, including taxes for heirs. All registered property using the TIN allows you to see in a timely manner up-to-date information on payments, debts, accrued penalties and fines, and the timing of their payment. But we must take into account that information on fines can only be obtained if paperwork on the debt has already been opened.

Using the official portal, you can find out the inventory, cadastral value, and the full amount of property that is registered with a specific person. But additional functions, for example, paying taxes, are only possible through authorization in your Personal Account.