Current calculation form

Fill out and submit the calculation of insurance premiums on the 2018 form, which is fixed by order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551 (Appendix No. 1):

By the way, the same order sets out the procedure and rules for filling out a unified calculation of insurance premiums (ERSV).

As you can see, the official name of this form is “Calculation of Insurance Premiums”. And the prefix “single” appeared by itself. It is usually used by accountants.

Let us remind you that this type of reporting on insurance premiums has been introduced since 2021 for all individual entrepreneurs and companies acting as policyholders. It is submitted to the tax office, and not to the Pension Fund, as before. This is due to the transfer of the administration function of most of the contributions to the tax authorities. The only exception is contributions for injuries. They remained under the control of the Social Insurance Fund.

From our website you can freely calculate insurance premiums for 2021 using the direct link here.

Personalized information – section 3 of the ERSV for 2021

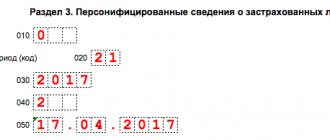

Complete section 3 separately for each employee. Please specify:

- in field 040 – a serial number that you define yourself. This can be either the number of personalized information in order (1, 2, 3, etc.) or the employee’s personnel number (Letter of the Federal Tax Service dated January 10, 2017 N BS-4-11/);

- in field 050 – the date of payment;

- in line 120 - for a Russian employee the code is “643”, for a foreigner - the code of his country from OKSM;

- in line 140 - code of the type of document identifying the employee. If it is a Russian passport, write “21”.

The category code of the insured person (column 200) for citizens of the Russian Federation is “NR”. Codes for foreigners: temporarily staying - VPNR, temporarily residing - VZHNR. If you pay contributions at reduced rates on the simplified tax system, the codes will be different: citizens of the Russian Federation - PNEED, temporarily staying foreigners - VPED, temporarily residing foreigners - VZhED.

In columns 210 - 250, show payments to the employee and accrued contributions to compulsory pension insurance from a base not exceeding the limit for the 4th quarter of 2018 - monthly and in total.

If payments were not accrued to the employee in the 4th quarter of 2021, then do not fill out subsection 3.2 (Letter of the Ministry of Finance dated September 21, 2017 No. 03-15-06/61030).

Example:

Payments to Potapov, a citizen of the Russian Federation, and contributions accrued from them to the compulsory pension insurance for the 4th quarter of 2021.

| Index | October | november | December | 4th quarter |

| All payments, rub. | 28 000 | 28 181,45 | 28 000 | 84 181,45 |

| Non-taxable payments, rub. | – | 4 602,90 | – | 4 602,90 |

| Contribution base, rub. | 28 000 | 23 578,55 | 28 000 | 79 578,55 |

| Contributions to community pension insurance, rub. | 6 160 | 5 187,28 | 6 160 | 17 507,28 |

A sample of section 3 as part of the DAM for the 4th quarter of 2021 will look like this:

What does the calculation form consist of?

The form under consideration for a single calculation of insurance premiums for 2018 consists of:

- from the title page;

- a sheet with information about an individual who does not have the status of an individual entrepreneur;

- Section 1 (summary data on the obligations of the contribution payer) + 10 appendices to it;

- Section 2 (summary data on obligations for insurance contributions of heads of peasant farms) + 1 appendix;

- Section 3 (information about insured persons).

Let us say right away that you do not need to include absolutely all sheets and applications in the generated report. So, in most cases, employers who paid income to individuals should only fill out:

- title page;

- Section 1 (subsections 1.1 and 1.2) + Appendices No. 1 and 2 thereto;

- Section 3.

Title page

The main fields of the title include “standard” information about the policyholder:

- Name.

- INN/KPP.

Separate divisions that independently pay income to employees indicate their checkpoint.

- Correction number (001, 002, etc.). For the initial calculation, enter 000 in this field.

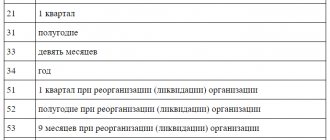

- The reporting period code is 33 for a 9-month report.

- Federal Tax Service code where the calculation is submitted.

- In the “location” field, enter the code corresponding to where the payment is being submitted. Our table will help with this:

- OKVED code.

- Full name of the person signing the report and date of signing.

- Leave the field “to be filled in by a tax authority employee” blank.

There were no changes

Let us immediately note that a new form of calculation for insurance premiums has not been introduced since 2018. Therefore, the previous form applies.

Although initially the Federal Tax Service of Russia planned to adjust it. Moreover, the changes introduced were mostly not related to changes in tax legislation. Officials simply wanted to finalize some sheets and details of the ERSV from 2021, as well as clarify its electronic version. However, this did not happen.

We wrote about this in detail here: “Review of changes in insurance premiums from 2021.”

Thus, there is no need to wait for a new form for calculating insurance premiums in 2018.

ATTENTION

The control ratios of its indicators that need to be taken into account will help you correctly fill out the form for calculating insurance premiums for 2021. They are given in the letter of the Federal Tax Service dated December 29, 2017 No. GD-4-11/27043.

What affects the deadline for submitting the RSV?

Despite the above, a report in the DAM form is often submitted a little later than the designated date on completely legal grounds. We are talking about the so-called postponements of deadlines for submitting information due to the officially approved deadline falling on state holidays or weekends. The legislative regulations for calculating the deadlines for submitting reports are regulated according to the norms of paragraph 7 of Art. 6.1 NK. It is defined here that if the last date coincides with an official weekend or holiday, the next working date is recognized as the deadline.

Additionally, in order to understand exactly when you need to take the DAM, you should take into account the vacation rules for citizens adopted annually by the Government of the Russian Federation. Holiday dates are approved by the Government - for 2021, Resolution No. 1250 of October 14, 2017 is in force. For reference, you can use the information presented in production calendars, which detail when workers work and when they can rest.

Submission of the DAM in 2021 - deadlines taking into account postponements

To increase the efficiency of working hours, several weekend transfers have been approved for 2021. The relevant norms are regulated by the Government in Decree No. 1250 of October 14, 2017. Within the framework of the topic under consideration, the following transfers are significant:

- From 01/07/18 (Sunday) to 05/02/18 (Wednesday).

- From 04/28/18 (Saturday) to 04/30/18 (Monday).

Current deadlines for submitting reports in 2021:

- RSV for the 1st quarter of 2021 - the due date according to the general rules is 04/30/18, but due to the official postponement of the holiday from April 28 to April 30, as well as taking into account the May holidays (1st and May 2nd) the deadline for submitting the form will be 05/03/18.

- DAM for the 2nd quarter of 2021 (half-year) - data must be submitted by 07/30/18.

- RSV for the 3rd quarter of 2021 (9 months) - SV payers should report no later than 10/30/18.

- DAM for the 4th quarter of 2021 (year) – the deadline for submitting the DAM for the 4th quarter of 2018, that is, based on the results of the calendar year 2021, falls on 01/30/19.

As you can see, the deadline for submitting the DAM for 2021 does not differ from the rules for submitting reports for interim periods. The provision of annual data is also given 30 days after the end of the calendar period. This procedure operates by analogy with how previously, when submitting the previous DAM form, the settlement period in the Pension Fund of the Russian Federation was determined - this is a year (clause 1 of Article 10 of the repealed Law No. 212-FZ of July 24, 2009). And according to the norms of Art. 423 of the Tax Code of the Russian Federation also preserves the duration of the reporting and settlement periods.

Electronic calculation format in 2018

For sending calculations of contributions to the tax office electronically, the requirements have also not changed. They are established by Appendix No. 3 to the mentioned order of the Federal Tax Service No. ММВ-7-11/551.

The developer of the software with which the policyholder generates the calculation always takes into account the format of the file with the report regulated by the Federal Tax Service of Russia and the ensuing issues.

Also see “How to fill out the calculation of insurance premiums for the 1st quarter of 2021: sample.”

Expenses for payment of benefits – Appendix 3 to Section 1

In Appendix 3, reflect only benefits from the Social Insurance Fund accrued in 2021. The date of payment of the benefit and the period for which it was accrued do not matter. For example, reflect a benefit accrued at the end of December and paid in January 2021 in the calculation for 2021. Reflect the sick leave benefit, which is open in December and closed in January, only in the calculation for the 1st quarter of 2021 (Letter Federal Tax Service dated June 14, 2018 N BS-4-11/11512).

Do not indicate benefits at the expense of the employer for the first three days of the employee’s illness in Appendix 3.

Enter all data on a cumulative basis from the beginning of 2021 to December 31 (clauses 12.2 – 12.4 of the Procedure for filling out the calculation).

In column 1, indicate on lines 010 – 031, 090 the number of cases for which benefits were accrued. For example, in line 010 - the number of sick days, and in line 030 - maternity leave. On lines 060 – 062, indicate the number of employees to whom benefits were accrued (clause 12.2 of the Procedure for filling out the calculation).

In column 2, reflect (clause 12.3 of the Procedure for filling out the calculation):

- in lines 010 – 031 and 070 – the number of days for which benefits were accrued at the expense of the Social Insurance Fund;

- in lines 060 – 062 – the number of monthly child care benefits. For example, if you paid benefits to two employees throughout the year, enter 24 in line 060;

- in lines 040, 050 and 090 - the number of benefits.

Example:

For 2021 the organization:

- paid for 3 sick days. At the expense of the Social Insurance Fund, 15 days were paid, the amount was 22,902.90 rubles;

- awarded one employee an allowance for caring for her first child for October, November, December, 7,179 rubles each. The amount of benefits for 3 months amounted to 21,537.00 rubles.

The total amount of benefits accrued is RUB 44,439.90. (RUB 22,902.90 + RUB 21,537.00).

What is the RSV-2 form

Form RSV-2 is a calculation of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and insurance contributions for compulsory medical insurance to the Federal Compulsory Health Insurance Fund by the heads of peasant farms (peasant farms). Its form was approved for reporting starting in 2014, by Order of the Ministry of Labor of Russia dated May 7, 2014 No. 294n “On approval of the form of calculation for accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and insurance contributions for compulsory medical insurance to the Federal compulsory health insurance fund by heads of peasant (farm) households.” The report has a narrow specific focus and is not used by any other business entities.

Calculation of contributions to VNiM - Appendix 2 to section. 1

In the “Payment attribute” field, put “2” (offset system), if you calculate and pay employee benefits yourself. If employees receive benefits directly from the Social Insurance Fund, put “1” (direct payments).

In line 070, indicate accrued benefits at the expense of the Social Insurance Fund. The date of payment of the benefit and the period for which it was accrued do not matter. For example, child care benefits for December were accrued on December 29 and paid on January 9. It must be shown in column 5 of line 070.

The amount in column 1 of line 070 of Appendix 2 must be equal to the amount in column 3 of line 100 of Appendix 3 to section. 1.

The indicator for column 2 of line 090 is calculated using the formula (Letter of the Federal Tax Service dated November 20, 2017 No. GD-4-11/):

If the result comes with a “+” sign, that is, contributions to VNiM exceeded benefits from the Social Insurance Fund, in column 1 of line 090, put the sign “1”. If the value of the indicator turns out to have a “-“ sign, put the sign “2” (Letter of the Federal Tax Service dated 04/09/2018 No. BS-4-11/).

In the same order, calculate and fill out columns 4, 6, 8, 10 of line 090.

Example:

There are 10 people in the organization; the organization calculates and pays benefits to them itself. The amounts of payments, contributions to VNiM and benefits accrued from the Social Insurance Fund for all employees for 2021 are shown in the table.

| Index | 9 months | October | november | December | year |

| Payments | 1 153 000 | 303 837 | 304 018,45 | 328 696 | 2 089 551,45 |

| Non-taxable payments | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

| Contribution base | 1 134 700 | 296 658 | 292 236,55 | 321 517 | 2 045 111,55 |

| Contributions to VNiM | 32 906,30 | 8 603,08 | 8 474,86 | 9 323,99 | 59 308,23 |

| Benefits from the Social Insurance Fund | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

Line indicator 090 of Appendix 2 to section. 1 is equal to:

- in column 2 – 14,868.33 rubles. (RUB 59,308.23 – RUB 44,439.90);

- in column 4 – 262.03 rubles. (RUB 26,401.93 – RUB 26,139.90);

- in column 6 – 1,424.08 rubles. (RUB 8,603.08 – RUB 7,179);

- in column 8 – -3,307.04 rub. (RUB 8,474.86 – RUB 11,781.90);

- in column 10 – RUB 2,144.99. (RUB 9,323.99 – RUB 7,179).