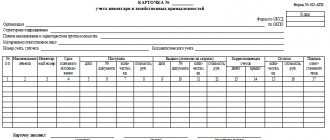

Form 0504041 CARD OF QUANTITATIVE-TUMAL ACCOUNTING OF MATERIAL VALUES

"___" _____________ 200_

Download ORDER of the Ministry of Finance of the Russian Federation dated 09/23/2005 123n ON APPROVAL OF BUDGET ACCOUNTING REGISTER FORMS (2019) Relevant in 2021

Read more:

- Categories

- Federal legislation

- Regional legislation

- Tax accounting

- Accounting

- HR records management

- Production calendar 2017

- Sample donation agreement

- Services

- Document forms

- Legal dictionary

- Agreement on division of property of spouses

- Chart of accounts

- Rates, rates, index

- Accounting rules accounting

- How to apply for a passport

- Navigation and features

- Help

- Search

- Entry into inheritance under a will

- How to get maternity capital

- How to get a passport for an apartment

- How to file a divorce

- Sample of a new compulsory medical insurance policy

- About the site

- About the system

- Terms of use of the site

- Technical requirements

- Articles and reviews

- Documents for opening an individual entrepreneur

- Registration of citizens

The site uses cookies. By continuing to browse the site, you agree to the use of cookies. from 2010-2019. Legal reference system.

General information about the materials accounting card

The form of the document was approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a. A separate card is drawn up for each item number, and the financially responsible person is responsible for its maintenance. Entries in the card are made on the basis of primary documents.

Since 2013, maintaining this form is not mandatory. Organizations are given the right to develop their own forms, which must contain a list of details approved by law.

Form M-17 “Material Accounting Card” is also used to release materials to production from the warehouse in which they are stored. An appropriate entry about the movement is made in the document, certified by the signature of the responsible person.

Your account has been created!

Accounting for the movement of material assets in the warehouse (receipt, expense and balance) is carried out by the financially responsible person (warehouse manager). If there is permission from the chief accountant and the consent of the financially responsible person, this responsibility can be assigned to the operator.

After the card is completely filled out, the second and subsequent sheets are added. All sheets are numbered and stapled. Subsequent sheets must be endorsed by an accountant during the next check of the card. Entries in cards are made on the basis of properly executed and executed:

- receipt orders;

- requirements;

- invoices;

- waybills, etc.

The warehouse manager indicates on the card:

- date of transaction;

- document details - the basis for the transaction;

- brief description of the operation.

Each operation is recorded separately.

How to fill out the M-17 card?

At the top of the document indicate the name of the organization and structural unit. Below is a table consisting of 16 columns:

- in the 1st column indicate detailed information about the structural unit in which inventory items are stored;

- in the 2nd - the type of activity carried out by the division;

- in the 3rd – warehouse number;

- in the 4th and 5th - a specific storage location for the material;

- in the following columns indicate the brand, grade, profile and size of the goods and materials, respectively;

- Next, you need to indicate the item number of the product, unit of measurement, price, stock rate, expiration date and the full name of the supplier.

If any information is missing, you can put a dash. After the table there is a field “Name of material”. The full name of the goods and materials is written here.

Next is another table. It is filled out if precious metals or stones are present in the inventory. The table contains the following information:

- name of the precious metal (stone);

- view;

- item number;

- unit of measurement;

- quantity (or mass);

- passport ID.

The third table contains information about the movement of materials:

- in the “Record date” column, enter the dates when the inventory was moved;

- in the “Document number” column indicate the number of the primary document that became the basis for the operation;

- in the column “Sequential number” indicate the serial number of the record;

- in the column “From whom it was received or to whom it was issued” the name of the organization or structural unit is written down;

- in the next column indicate the accounting unit of production;

- in the columns “Receipt”, “Expense” and “Balance”, indicate how many inventory items were received, issued and are available in the balance after the completion of each operation;

- in the last column put the signature of the responsible person and the date of the operation.

The last part of the card indicates the position of the financially responsible employee, his full name and the date of filling out the document (see a sample of filling out the card here).

Features of filling out the card

- All necessary invoices must be attached to the card.

- You can fill out the document either by hand or on a computer.

- There is no need to put a stamp on the card, since it relates to the internal document flow of the enterprise.

- No blots or inaccuracies are allowed in the document form. If a mistake was made, it is better to issue a new form. You can also carefully cross out false information and write the correct information above, confirming the correction with the signature of the person in charge.

- You cannot make notes with a pencil, only with a pen.

- Cards are issued for 1 year. At the end of the calendar year, balances from old cards are transferred to new ones (as of January 1). After the end of the reporting period, the completed cards are transferred to the accounting department, and then to the organization’s archive. Shelf life - at least 5 years.

Card for recording material assets in the budget

The card for recording material assets (OKUD 0504043), used in the public sector, was approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 N 52n. It is intended for accounting of inventory items available in the warehouse. The form contains information about the type and location of inventory items, their price, and supplier.

This form is used in government agencies that have a small amount of material assets. The document may consist of several sheets, since each individual asset must be allocated a separate sheet. Entries in the document are made by the employee responsible for storing valuables. The card should be certified with the individual signature of the responsible person with a transcript. You can download the card form below.

Form N 8 (OKUD 6002203) HANDOUT (DELIVERY) LIST OF MATERIAL VALUABLES

2. The statement is issued in one copy separately for the issuance and acceptance of material assets.

The statement is transferred to the financially responsible person against a receipt in the book of registration of primary accounting documents for the movement of non-financial assets (form according to OKUD 6002213). The statement is maintained by the financially responsible person.

When compiling a statement, its title should contain only those words that express the essence of the transaction being processed, related to the accounting of material assets (distribution or delivery statement). The unnecessary word is crossed out. 3. Upon completion of the issuance (reception) of material assets, the financially responsible person sums it up and confirms with his signature the issuance (reception) of material assets.

Checking the correctness of the issuance (reception) of material assets is carried out by the head of the logistics service, who makes the appropriate entry in the distribution (delivery) sheet.

Appendix No. 1. Forms of documents (using class 60 of the All-Russian Classifier of Management Documentation) used in the financial and economic activities of the Armed Forces of the Russian Federation, for which unified forms of documents are not provided, and unified forms of primary accounting documents and budget accounting registers in which are included additional details

Financial planning documents 1 - 3 Lost force on January 1, 2014.

— Order of the Minister of Defense of the Russian Federation dated September 20, 2013 N 670436001003 Estimate of income and expenses for income-generating activities5 - 7Repealed from January 1, 2014. — Order of the Minister of Defense of the Russian Federation dated September 20, 2013 N 670II. Fixed assets, intangible and non-produced assets 8OS-40306003 Act on the write-off of fixed assets (except for motor vehicles) 9OS-4a0306004 Act on the write-off of motor vehicles 10OS-4b0306033 Act on the write-off of groups of fixed assets (except for motor vehicles) 11-0504031 Inventory card for accounting of fixed assets 12-05040 32Group inventory card accounting of fixed assets 1366002101 Act on disassembly (cutting, dismantling) of an object of fixed assets (vehicles, groups of fixed assets) 1476002102 Book of total accounting of the library collection 15116002103 Inventory book of accounting of the library

OS inventory cards

Inventory cards of fixed assets are accounting registers of the standard form OS-6, intended for object-by-object accounting of fixed assets. They are filled out for each object at the time of its receipt and the completion of the commissioning certificate. The number of the inventory card of fixed assets is assigned in accordance with the numbering of the warehouse card file.

We talked in detail about filling out OS inventory cards here.

An inventory of inventory cards for accounting of fixed assets must be continuously maintained. It is compiled for the purpose of registering opened cards and monitoring their safety. The inventory is compiled in the accounting department in one copy. When a note is made in the inventory about the write-off of objects according to the last inventory card, it is handed over to the archive.

Commission

An important nuance: the inventory commission will not be enough to make a final decision.

Even if the composition of the employees in them is identical, a separate appointment order will still be required. Members of the commission must have sufficient knowledge to decide whether an item of non-financial assets should be written off or not. Sometimes outside experts are brought in for this purpose.

Persons financially responsible for the property cannot be members of the commission.

In any case, the act of writing off non-financial assets is the final and fundamentally important procedure in the entire write-off algorithm.

Card for quantitative and total accounting of material assets (f. 0504041)

An article on the purpose and procedure for generating cards for quantitative and total accounting of material assets 050441. They are formed in each institution and take into account the movement of all non-financial assets, with the exception of food and fattening animals, for which special forms have been developed.

In Order of the Ministry of Finance No. 52n dated May 30, 2015. The accounting registers of public sector organizations include a card for quantitative and total accounting of material assets 0504041. In it, you can trace the movement of non-financial assets recorded on balance sheet and off-balance sheet accounts.

Printing cards

3.1 Launch the Accounting module.

3.2 Select the menu item Functions – Turnover statements – By material assets.

3.3 The statement is generated for the required period and for a specific account.

3.4 To print the Wealth Accounting Card (f. 0504043), you need to mark one line of the statement and, through the Reports context menu, select the report “CCT KAISSA. Card for recording material assets (Form 0504043). Version 04.01". A card will be generated

3.5 To print the Card of quantitative and total accounting of material assets (f. 0504041), sort the records of the statement by MOL. Mark the lines of the statement (you can do it out of order) according to which you want to generate cards and, through the Reports context menu, select the report “CCT KAISSA. Card of quantitative and total accounting (Form 0504041). Version 04.01". The specified number of cards will be generated.

3.1 Launch the Accounting module.

3.2 Select the menu item Functions – Turnover statements – By material assets.

3.3 The statement is generated for the required period and for a specific account.

3.4 To print the Wealth Accounting Card (f. 0504043), you need to mark one line of the statement and, through the Reports context menu, select the report “CCT KAISSA. Card for recording material assets (Form 0504043). Version 04.01". A card will be generated

3.5 To print the Card of quantitative and total accounting of material assets (f. 0504041), sort the records of the statement by MOL. Mark the lines of the statement (you can do it out of order) according to which you want to generate cards and, through the Reports context menu, select the report “CCT KAISSA. Card of quantitative and total accounting (Form 0504041). Version 04.01". The specified number of cards will be generated.

Categories: Budget Accounting | Additional functions

Who fills out form 0504041

Based on Order of the Ministry of Finance dated May 30, 2015 No. 52n, the OKUD form 0504041 is mandatory for accounting departments of all government agencies, including:

State or municipal unitary enterprises are required to fill out the card if they keep budgetary records of the facts of economic life that arise when they perform the functions of customers when concluding government contracts on behalf of government authorities. The order applies to extra-budgetary funds and two state corporations: Roscosmos and Rosatom, also in terms of maintaining budgetary accounting.

Connecting an additional report

— ar_0504041.app – additional function;

— Form 0504041.xlt – card template;

— FORM 0504043.xlt — card template;

— Instructions for cards.doc — instructions for the additional report.

Let's assume that the software "PARUS-Budget 7" is installed in the C:Program FilesParusB directory. To connect an additional report, you need to copy the file ar_0504041.app to the C:Program FilesParusВAccountFox directory on the local station where the system is installed, and the Form 0504041.xlt, FORM 0504043.xlt templates to the C:Program FilesParusВAccountTemplate directory

— ar_0504041.app – additional function;

— Form 0504041.xlt – card template;

— FORM 0504043.xlt — card template;

— Instructions for cards.doc — instructions for the additional report.

Let's assume that the software "PARUS-Budget 7" is installed in the C:Program FilesParusB directory. To connect an additional report, you need to copy the file ar_0504041.app to the C:Program FilesParusВAccountFox directory on the local station where the system is installed, and the Form 0504041.xlt, FORM 0504043.xlt templates to the C:Program FilesParusВAccountTemplate directory

Deadline

Currently, no one fills out such voluminous documents for each item of material assets manually. Accounting is carried out in accounting programs 1C or similar. In them, card entries are generated automatically when you download or fill out primary documentation.

Based on clause 19 of Instruction 157n, when automating accounting in an institution, it is allowed to store information in the form of an electronic register signed with an electronic signature. In the event that this is not possible (for example, signatures have not been made), output on paper is required.

The period for which cards are printed is determined by the accounting policy, but should not be longer than the reporting period. The best option is once a year.

What are forms KS-2 and KS-3

If you are often one of the parties to legal relations in which the subject of the contract is construction and installation work, you already know that all settlements between the parties and the settlement of disputes are carried out on the basis of certain documents. But among the participants in the construction services market, who order them once every 5-10 years or less, there are those who do not even know what the KS-2 and KS-3 forms are.

Unified forms are not always, of course, required to be used.

Procedure for filling out form 0504041

First of all, you need to decide which values are subject to accounting in form 0504041. The complete closed list is given in 52n, the table below shows the corresponding synthetic accounts from Instruction 157n:

A card is created for each item of value taken into account. The procedure for filling out the Card for quantitative and total accounting of material assets:

- Columns 1-2 indicate the date and number of the journal in which the incoming or outgoing transaction is reflected;

- In column 3 - the name of the transaction, fill in briefly: purchase, write-off, gratuitous transfer, etc.;

- In columns 4 and 5 - the standard service life and the approximate date of write-off;

- In column 6 – price in rubles;

- In column 7 - units of measurement in accordance with the classifier, according to which values are accepted for accounting;

- In columns 8 and 9 – receipt, purchase, acceptance for accounting, the amount of the receipt document is entered;

- In columns 10 and 11 - write-off, there can be two options. If the institution's accounting policy provides for write-off at the actual price, each inventory item that differs only in acquisition cost will be considered new and a separate card will be needed. If the write-off is made at the average price, inventory items of the same name can be taken into account in one card. Column 11 will show the average price at the time of write-off.

- In columns 12-13, the first line indicates the balance at the beginning of the reporting period.

There are additional requirements:

- Leased property retains the lessors' inventory numbers;

- Inventory items in transit are taken into account by supplier;

- Inventory and materials accepted for storage - by owner;

- Inventory and materials accepted for processing - by customer, type and grade of materials.

The card is intended for maintaining analytical accounting of material accounts. In the 1C program, you should carefully fill out the analytical subcontos when reflecting transactions with non-financial assets, then correctly completed forms will be created automatically.

New forms of primary documents

Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n (hereinafter referred to as Order No. 52n) approved new forms of primary documents and accounting registers used by state (municipal) institutions, as well as Guidelines for their application (hereinafter referred to as Guidelines). These documents and registers should be used when developing accounting policies for 2015. With the entry into force of Order No. 52n, the previously existing Order No. 173n[1] becomes invalid. In the article we will conduct a comparative analysis of new and old forms of primary documents.

First of all, let us recall that the direct order of the Ministry of Finance, as before, approves only those forms of primary documents that belong to class 05 “Unified system of accounting, financial, accounting and reporting documentation for the public management sector” OKUD[2]. Now the list of such documents has expanded, primarily due to the inclusion of those documents that were previously approved by various resolutions of the State Statistics Committee of the Russian Federation and belonged to class 03 “Unified system of primary accounting documentation” OKUD.

Let's look at how much the codes and names of the forms of primary documents have changed in the table:

| In accordance with Order No. 52n | In accordance with Order No. 173n | ||

| Primary document form number | Name of the primary document form | Primary document form number | Name of the primary document form |

| 0504101 | Certificate of acceptance and transfer of non-financial assets | 0306030 | Certificate of acceptance and transfer of a building (structure) |

| 0306031 | Act on acceptance and transfer of groups of fixed assets (except buildings, structures) | ||

| 0306001 | Certificate of acceptance and transfer of fixed assets (except for buildings, structures) | ||

| 0504102 | Invoice for internal movement of non-financial assets | 0306032 | Invoice for internal movement of fixed assets |

| 0504103 | Certificate of acceptance and delivery of repaired, reconstructed and modernized fixed assets | 0306002 | Certificate of acceptance and delivery of repaired, reconstructed, modernized fixed assets |

| 0504104 | Act on write-off of non-financial assets (except for vehicles) | 0306003 | Act on write-off of fixed assets (except for vehicles) |

| 0306033 | Act on the write-off of groups of fixed assets (except for vehicles) | ||

| 0504105 | Certificate of write-off of a vehicle | 0306004 | Act on write-off of motor vehicles |

| 0504143 | Act on write-off of soft and household equipment | 0504143 | Act on write-off of soft and household equipment |

| 0504144 | Act on the write-off of excluded objects of the library collection | 0504144 | Act on the write-off of excluded objects of the library collection |

| 0504202 | Menu-requirement for issuing food products | 0504202 | Menu-requirement for issuing food products |

| 0504203 | Statement for the issuance of feed and fodder | 0504203 | Statement for the issuance of feed and fodder |

| 0504204 | Request-invoice | 0315006 | Request-invoice |

| 0504205 | Invoice for the release of materials (material assets) to the side | 0315007 | Invoice for issue of materials to the side |

| 0504206 | Card (book) for recording the issuance of property for use | – | |

| 0504207 | Receipt order for acceptance of material assets (non-financial assets) | – | |

| 0504210 | List of issuance of material assets for the needs of the institution | 0504210 | List of issuance of material assets for the needs of the institution |

| 0504220 | Certificate of acceptance of materials (material assets) | 0315004 | Certificate of acceptance of materials |

| 0504230 | Act on write-off of inventories | 0504230 | Act on write-off of inventories |

| 0504401 | Payroll | 0504401 | Payroll |

| 0504402 | Payslip | 0301010 | Payslip |

| 0504403 | Payment statement | 0504403 | Payment statement |

| 0504417 | Help card | 0504417 | Help card |

| 0504421 | Time sheet | 0504421 | Time sheet and payroll calculation |

| 0504425 | Note-calculation on the calculation of average earnings when granting leave, dismissal and other cases | 0504425 | Note-calculation on the calculation of average earnings when granting leave, dismissal and other cases |

| 0504501 | Statement for issuing money from the cash register to accountable persons | 0504501 | Statement for issuing money from the cash register to accountable persons |

| 0504505 | Advance report | 0504049 | Advance report |

| 0504510 | Receipt | 0504510 | Receipt |

| 0504514 | Cash book | 0504514 | Cash book |

| 0504608 | Children's attendance sheet | 0504608 | Children's attendance sheet |

| 0504805 | Notice | 0504805 | Notice |

| 0504816 | Act on writing off strict reporting forms | 0504816 | Act on writing off strict reporting forms |

| 0504817 | Notification on settlements between budgets | 0504817 | Notification on settlements between budgets |

| 0504822 | Notice of budget commitment limits (budget allocations) | 0504822 | Notice of budget commitment limits (budget allocations) |

| 0504833 | Accounting information | 0504833 | Reference |

| 0504835 | Inventory results report | 0504835 | Inventory results report |

| – | 0531728 | Certificate of acceptance and transfer of cash payments and receipts during the reorganization of participants in the budget process | |

| – | 0531811 | Certificate of financing and cash payments | |

Next, we will consider the procedure for filling out new forms of primary documents (they are highlighted in the table) in accordance with the Guidelines given in Appendix 5 to Order No. 52n .

Recommendations for filling out new forms

Act on acceptance and transfer of non-financial assets (form 0504101). This document immediately replaced three forms previously used by institutions, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7 (hereinafter referred to as Resolution No. 7):

- act of acceptance and transfer of fixed assets (except for buildings, structures) (f. 0306001);

- act of acceptance and transfer of a building (structure) (f. 0306030);

- act on the acceptance and transfer of groups of fixed assets (except for buildings, structures) (f. 0306031).

In this regard, an act in form 0504101 is now drawn up when registering transactions for the acceptance (transfer) of property related to non-financial assets, including investments in real estate (buildings, structures, etc.).

In addition, this act is used when registering the acceptance and transfer of both one and several objects of non-financial assets (that is, groups of objects). According to the methodological instructions, the act in form 0504101 is used to formalize the following operations:

- transfer of non-financial assets between institutions, institutions and organizations (other right holders), including when securing the right of operational management (economic management);

- transfer of property to the state (municipal) treasury, including when the body exercising the powers of the owner of state (municipal) property withdraws non-financial assets from operational management (economic management);

- transfer of property as a contribution to the authorized capital (property contribution);

- changing the legal holder of state (municipal) property on other grounds, with the exception of the acquisition of property for state (municipal) needs (needs of budgetary (autonomous) institutions), the sale of state (municipal) property. In this case, the institution is given the right, as part of the formation of accounting policies, to establish the procedure for applying the act in form 0504101 when acquiring, gratuitously transferring, or selling non-financial assets.

Invoice for internal movement of non-financial assets (form 0504102). The structure and purpose of this form largely repeats the form 0306032 “Invoice for internal movement of fixed assets” previously used by institutions, approved by Resolution No. 7, with the only difference that the new form is used more widely.

The new form of the invoice, in comparison with the previously used form, is used to register and record the movement within the institution of not only fixed assets, but also other objects of non-financial assets, in particular:

- intangible assets;

- finished products produced by the institution.

The invoice (f. 0504102) is issued by the transferring party (structural unit - sender) in triplicate, signed by the responsible persons of the structural units of the receiving and transferring parties.

The first copy is transferred to the accounting department, the second remains with the financially responsible person transferring the object, the third copy is transferred to the financially responsible person accepting the object. Certificate of acceptance and delivery of repaired, reconstructed and modernized fixed assets (f. 0504103). This act is used by institutions instead of form 0306002 approved by Resolution No. 7 with the same name and almost completely coincides with it. However, in the new form, unlike the previously used form, it is additionally necessary to indicate the details of contracts for work and the deadlines for their completion.

It has been established that an institution has the right to use an act in form 0504103 when modernizing intangible assets, if this is recorded in the accounting policy.

Act on the write-off of non-financial assets (except for vehicles) (f. 0504104). This act combines information previously indicated separately in the following forms approved by Resolution No. 7:

- in the act of writing off fixed assets (except for vehicles) (f. 0306003);

- in the act on the write-off of groups of fixed assets (except for vehicles) (f. 0306033).

Thus, now an act in form 0504104 is drawn up for one or more objects of non-financial assets for one group of state (municipal) property (real estate, especially valuable movable, other).

For real estate objects, an act is drawn up indicating the information contained in the cadastral passport of the real estate object. In accordance with the Methodological Instructions, an act in form 0504104 is drawn up by the commission for the receipt and disposal of assets based on its decision on the need to write off fixed assets, intangible assets, and other tangible assets (except for raw materials, supplies, as well as finished products produced by the institution) and serves as the basis to reflect in the accounting records of the institution the disposal of non-financial assets.

Certificate of write-off of a vehicle (form 0504105). This act replaced the form 0306004 “Act on the write-off of motor vehicles” previously used by institutions, approved by Resolution No. 7. Both forms are used to reflect transactions on the write-off of a motor vehicle.

It is worth noting that the structure and procedure for filling out these documents is almost the same, with the only difference being that the new form of the act is more adapted for use by public sector institutions.

Request-invoice (f. 0504204). This form is more compact compared to the previously used form of the same name 0315006, approved by Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a (hereinafter referred to as Resolution No. 71a).

Despite this, the purpose of these forms and the rules for filling out are the same. As before, the invoice requirement is used to record the movement of material assets within the organization between structural divisions or materially responsible persons, as well as to formalize operations for the delivery of leftover materials to the warehouse resulting from disassembly and disposal of fixed assets.

The claim-invoice is drawn up by the materially responsible person of the sending structural unit, transferring material assets to the receiving unit (for example, from a warehouse to a warehouse; from a warehouse to a structural unit, etc.) or to another materially responsible person, in two copies, one of which serves as the basis for the transfer of values, and the second – for their acceptance.

Invoice for the release of materials (material assets) to the third party (f. 0504205). Institutions are required to draw up such a document instead of the previously used form 0315007 “Invoice for the release of materials to the third party,” approved by Resolution No. 71a.

The invoice in the form 0504205 is used to record the release of material assets by the sending institution to third-party institutions (organizations) - recipients, organizations, including with the involvement of organizations carrying out transportation, on the basis of agreements (contracts) and other documents.

The invoice in form 0504205 is issued in two copies by the sending institution on the basis of agreements (contracts), orders and other relevant documents when presented by a representative of the recipient institution (organization); the organization carrying out the transportation, on the basis of a power of attorney to receive material assets, filled out in the manner prescribed by law. One copy is the basis for the release of materials, the second is transferred to the representative of the institution (organization) - the recipient of material assets.

Card (book) for recording the issuance of property for use (f. 0504206). This form was introduced for the first time and had no analogues before. According to the Methodological Instructions, the card (book) (f. 0504206) is used to record property that is issued for personal use to an employee (employee) during the performance of his official duties.

The card records the property issued for use by name reflected in column 1, indicating the rate of issue, the standard period of use (if any), and the number of material assets issued.

When returning property, the quantity of property handed over is recorded by name, indicating the quantity of property returned (surrendered), the date of return and the signature of the person who accepted the property handed over by the employee (employee).

When creating a card (book) (f. 0504206) for the purpose of accounting for the property of an institution issued to employees (employees), details reflecting the individual characteristics of the person who received the property (sizes of headgear, clothes, shoes, etc.) may not be filled in .

Receipt order for acceptance of material assets (non-financial assets) (f. 0504207). This is a completely new form. Institutions will have to compile it upon receipt of material assets (including fixed assets, inventories), including from third-party organizations (institutions). The receipt order serves as the basis for accepting incoming material assets for accounting and reflecting on the balance sheet of the institution. It contains information about the name of the product, its quantity, and cost.

The accounting department of the institution reflects the correspondence of accounts in the receipt order and issues a note on the acceptance for accounting and posting of material reserves (material assets).

If there is a quantitative and (or) qualitative discrepancy, as well as a discrepancy between the range of accepted material assets and the accompanying documents of the sender (supplier), the institution’s commission for the receipt and disposal of assets draws up an acceptance certificate for materials (f. 0504220), which is the legal basis for filing a claim with the sender (supplier) ).

Certificate of acceptance of materials (material assets) (f. 0504220). Now such an act is drawn up instead of the previously used form 0315004 “Act on acceptance of materials”, approved by Resolution No. 71a.

Comparing these forms, we note that the information indicated in them is almost the same. Therefore, it will not be difficult for institutions to switch to a new form.

Payroll (f. 0504402). The structure of such a statement largely repeats the form of the same name 0301010, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 . At the same time, the new form is more adapted for use by institutions in the public sector.

In accordance with the Methodological Instructions, the payroll (f. 0504402) is used to reflect accruals on employees' wages, scholarships, benefits, and other payments made on the basis of agreements (contracts) with individuals, as well as to reflect deductions from the amounts of accruals (taxes, insurance contributions, deductions under writs of execution and other deductions).

Advance report (f. 0504505). According to Order No. 52n, the advance report was transferred from the accounting registers to the primary documents. Due to this, the form code has changed. Previously, the code 0504049 was used.

As before, the advance report is used to record settlements with accountable persons. At the same time, the instructions for filling it out have been slightly adjusted.

According to the new version of such instructions, the accountable person, when drawing up an advance report, provides information about himself on the front side of the advance report and fills out columns 1 - 6 on the back side about the amounts actually spent by him, indicating the documents confirming the expenses incurred. The documents attached to the advance report are numbered by the accountable person in the order in which they are recorded in the report.

The advance report is approved by the head of the institution or a person authorized by him.

On the reverse side of such a report, columns 7–10, containing information about expenses accepted by the institution for accounting, and accounting correspondence are filled out by the person entrusted with accounting.

Amounts paid in foreign currency are recorded both in foreign currency and in ruble equivalent. Advances received by an accountable person are reflected indicating the date of their receipt.

In addition to the introduction of new forms of primary documents, it should be noted that there has been a change in the procedure for filling out existing forms, in particular:

- the rules for filling out the work time sheet are described in more detail (f. 0504421). A table is provided with the symbols that are used to draw up such a report card;

- notice (f. 0504805) is now used when processing settlements arising from transactions of acceptance and transfer of property, obligations not only between the institution and the separate structural divisions (branches) created by it, but also between other accounting entities, including in interdepartmental and interbudgetary settlements ;

- the basis for drawing up an act on the results of the inventory (f. 0504835) is now the inventory lists (matching sheets), and not the statement of discrepancies based on the results of the inventory (f. 0504092);

- The procedure for applying and filling out notifications for settlements between budgets has been significantly adjusted (f. 0504817).

* * *

Having analyzed the new forms of primary documents approved by Order No. 52n, which supplemented the list of existing forms of accounting documentation for the public sector, we note that most of them repeat the structure and procedure for filling out similar unified forms established by the relevant orders of the State Statistics Committee. Thus, taking single unified forms as a basis, the Ministry of Finance adapted them for use by public sector institutions. Some forms (0504206, 0504207) were introduced for the first time and had no analogues before.

Please also note that the adoption of Order No. 52n will entail significant changes to the accounting instructions established separately for state, budget and autonomous institutions. Let us remind you that draft amendments to these instructions are posted on the Ministry of Finance website, but they did not take into account the new forms of primary documentation. Perhaps, with the publication of Order No. 52n, these projects will be finally edited and adopted soon.

In the next issue of the magazine, read about new forms of accounting registers and the procedure for their application.

[1] Order of the Ministry of Finance of the Russian Federation dated December 15, 2010 No. 173n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal ) institutions, and guidelines for their use."

[2] All-Russian classifier of management documentation. OK 011‑93, approved. Resolution of the State Standard of the Russian Federation dated December 30, 1993 No. 299.

Source: Magazine “Institutions of Culture and Art: Accounting and Taxation”

Card of quantitative and total accounting of material assets according to form 0504041

The quantitative and total accounting card, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n, is used in government agencies to provide analytical accounting of the following assets:

- fixed assets;

- materials used in the manufacture of experimental devices;

- spare parts and components installed on vehicles to replace those that have failed;

- transferable badges of merit (awards, prizes, cups);

- inventory items in safekeeping;

- OS, MPZ on the way;

- materials;

- materials as customer-supplied raw materials;

- leased assets;

- assets for free use and storage.

Thus, f. 0504041 is used both for own assets and for those that are taken into account off the balance sheet.

This document is filled out by an accountant. First of all, you need to carry forward the balance to the beginning of the year. Then, during the period, data on the movement of the asset is entered into the card based on primary documents, and at the end of the period the balance is displayed. Receipts are indicated in the “Debit” column, disposals - in the “Credit” column. Information is filled in in rubles and in units of measurement. Information about the useful life of the asset and the expected write-off date is also provided.

A separate card is drawn up for each name. In addition, a separate card must also be filled out for each financially responsible person, even if the names of the assets under their control are identical. Also, for certain types of material assets, the following analytics are provided, listed in the table, that is, separate cards are compiled for each characteristic.

Types of material assets

Basic provisions

Accounting in the warehouse (in storage areas), materially responsible persons are kept in the Book of Accounting for Material Assets (f. 0504042) by name, grade and quantity of materials, finished products, soft equipment, dishes, objects of library collections using separate pages for each item accounting object.

If the volume of items of material assets is limited, financially responsible persons have the right to keep records of the availability of material assets and operations on their receipt and disposal in the Card of Accounting for Material Assets (f. 0504043).

Appropriate entries must be made about the results of checks on the page provided for this at the end of the Book (card).

The institution must systematically monitor the receipt and expenditure of material assets located in the warehouse (storage locations), and also reconcile the data on the inventory accounts with the records maintained by materially responsible persons at the storage locations of material assets.

The card for quantitative and total accounting of material assets (f. 0504041) (hereinafter referred to as the Card (f. 0504041)) is used for analytical accounting of fixed assets, material assets used in the manufacture of experimental devices; material assets issued for vehicles to replace worn-out ones;

rolling awards, prizes, cups; inventory items accepted for safekeeping, including special equipment purchased to carry out research work; non-financial assets in transit; material reserves (except for food products, young animals and fattening animals), as well as material assets accepted for processing; received for rent, free use, for storage.

— by name, quantity, cost;

— for each leased property — according to the lessor’s inventory numbers (if numbers are available);

— for non-financial assets in transit — for individual suppliers;

- for inventory items accepted for safekeeping - by owner(s);

- by raw materials and materials accepted for processing - by customers, types, grades of materials and their location.

Filling out the Card (f.

Accounting in the warehouse (in storage areas), materially responsible persons are kept in the Book of Accounting for Material Assets (f. 0504042) by name, grade and quantity of materials, finished products, soft equipment, dishes, objects of library collections using separate pages for each item accounting object.

Appropriate entries must be made about the results of checks on the page provided for this at the end of the Book (card).

The institution must systematically monitor the receipt and expenditure of material assets located in the warehouse (storage locations), and also reconcile the data on the inventory accounts with the records maintained by materially responsible persons at the storage locations of material assets.

The card for quantitative and total accounting of material assets (f. 0504041) (hereinafter referred to as the Card (f. 0504041)) is used for analytical accounting of fixed assets, material assets used in the manufacture of experimental devices; material assets issued for vehicles to replace worn-out ones;

rolling awards, prizes, cups; inventory items accepted for safekeeping, including special equipment purchased to carry out research work; non-financial assets in transit; material reserves (except for food products, young animals and fattening animals), as well as material assets accepted for processing; received for rent, free use, for storage.

— by name, quantity, cost;

— for each leased property — according to the lessor’s inventory numbers (if numbers are available);

— for non-financial assets in transit — for individual suppliers;

- for inventory items accepted for safekeeping - by owner(s);

- by raw materials and materials accepted for processing - by customers, types, grades of materials and their location.

Filling out the Card (f. 0504041) begins with transferring balances to the beginning of the year. Entries in the Card (f. 0504041) are kept on the basis of primary (consolidated) accounting documents attached to the Transaction Logs (f. 0504071), in quantitative and monetary terms, with balances displayed at the end of the period and compiled for each materially responsible person separately.

The additional report “Material Assets Accounting Cards” is designed for printing from the turnover sheet for material assets, the Quantitative and Total Assets Accounting Card (f. 0504041) and the Wealth Assets Accounting Card (f. 0504043).

Both cards are printed according to the marked entries on the turnover sheet.