An organization can pay employees not only under an employment contract, but also under a civil law contract. A civil contract is concluded in accordance with the requirements of civil, not labor legislation.

Civil contracts include:

- construction contracts (Chapter 37 of the Civil Code of the Russian Federation);

- contracts for paid services (Chapter 39 of the Civil Code of the Russian Federation);

- contracts of agency (Chapter 49 of the Civil Code of the Russian Federation);

- agency agreements (Chapter 52 of the Civil Code of the Russian Federation);

- copyright agreements (Chapter 70 of the Civil Code of the Russian Federation).

Who can work under a civil contract

A civil contract can be concluded:

- with an employee of the organization;

- with a person who is not in an employment relationship with the organization.

If a civil contract is concluded with an employee of an organization, then work under this contract must be performed during non-working hours.

Otherwise, such work will be considered part-time work. At the same time, according to employment and civil law contracts, the employee must perform various types of work. EXAMPLE.

HOW TO CONCLUSION A CONTRACT AGREEMENT AT Passiv LLC A.N. Ivanov works as a watchman under an employment contract. “Passive” entered into a contract agreement with Ivanov. According to the agreement, Ivanov must clean the organization’s warehouses. In this case, the employment contract with Ivanov is not terminated.

Read also “Mixed contract agreement”

In what account should personal income tax be reflected on payments to the contractor?

When paying remuneration, the source of payments is obliged to withhold personal income tax from the amount accrued to the individual (subclause 6, clause 1, article 208 of the Tax Code of the Russian Federation). The customer does not have to perform the duties of a tax agent for personal income tax only if the GPC agreement is concluded with an individual entrepreneur, a private notary or a lawyer. These categories of performers pay the tax themselves (clause 2 of Article 227 of the Tax Code of the Russian Federation).

Operations for calculating tax and transferring it to the budget are carried out according to the following scheme:

The responsibilities of the tax agent when making payments under the GPC agreement are not limited to withholding tax, transferring it and reflecting payments in Form 6-NDFL. At the end of the year, you need to issue a 2-NDFL certificate or inform the tax authorities and the recipient of the income about the impossibility of withholding tax if the remuneration is issued in kind (clause 5 of Article 226 of the Tax Code of the Russian Federation).

What to consider in the contract

As a rule, civil law contracts with third parties are concluded if the organization does not have the necessary specialists on staff or the organization cannot perform certain work on its own.

The organization itself decides whether to hire a person under an employment contract or conclude a civil contract with him.

A person working under a civil contract is not subject to the internal regulations of the organization, and he is not subject to labor legislation (working hours, payment procedures for work on holidays and weekends, minimum wage, etc.).

A civil contract does not provide for vacation. If such an agreement stipulates that you need to work on holidays and weekends, then this condition must be met.

Under a civil contract, only the result of the work is paid. The contract states:

- work (services) to be performed;

- procedure for payment for work results;

- start and end dates of work;

- procedure for delivery and acceptance of work;

- requirements for the quality of work;

- liability of the parties for violation of the terms of the contract.

note

From the point of view of accounting and taxation, a lease agreement (Chapter 34 of the Civil Code of the Russian Federation) occupies a special place among civil law contracts. As you know, you can rent a vehicle from an individual either without a crew or with a crew. Taxation depends on this. Therefore, the cost of rent and the cost of driving services should be specified separately in the rental agreement for a vehicle with a crew.

Posting in accounting for payment of accrued remuneration

Each of the entries indicated in the previous section forms in the accounting the customer’s obligation to the contractor to pay remuneration for work performed under the GPC agreement (services provided). It arises after the customer accepts the work (service) from the contractor and signs the acceptance certificate. The act will serve as the basis for accounting entries. Then the customer needs to pay the contractor and also reflect this operation in accounting.

To reflect settlements under GPC agreements, the following posting is used:

The basis for such an entry in accounting (in addition to the agreement and act) will be a bank statement if the money is transferred in non-cash form, or a cash order when paying the contractor money from the cash register.

This material will introduce you to the postings for accounting cash transactions.

You can find out how a customer can calculate income tax, pay personal income tax and insurance premiums when paying for services to an individual in ConsultantPlus by getting trial access to the system for free.

How to accept a job

The fact of completion of work (provision of services) is confirmed by the act of acceptance and delivery.

The form of the act of acceptance and delivery of work (services) under a civil contract is not established by law.

However, you can draw up such an act in the form provided for the acceptance and delivery of work under an employment contract (form No. T-73, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1).

Sample of filling out the act

Accounting

The procedure for accounting for expenses under a construction contract depends on the duration of the concluded contract.

On this basis, construction contracts are divided into:

- short-term (if the work is performed within one reporting year);

- long-term (if the period of work takes more than 12 months or if the start and completion of work occur in different reporting years).

This conclusion follows from paragraph 1 of PBU 2/2008.

In this case, regardless of the duration of the work, the contractor’s expenses are included in expenses for ordinary activities (clause 5 of PBU 10/99, clause 10 of PBU 2/2008).

If contract work is short-term in nature, reflect the costs in the contractor’s accounting in the general manner (as costs of work) (clause 5 of PBU 10/99).

If construction work is long-term in nature, when reflecting operations under a construction contract in accounting, follow the rules of PBU 2/2008. According to this document, accounting for income, expenses and financial results is carried out separately for each executed contract (accounting object) in the context of analytical accounting. At the same time, with regard to cost accounting under some contracts, a number of features are provided.

Firstly, if one contract for a single project provides for the construction of a complex of facilities for one or several customers, then for accounting purposes the construction of each facility should be considered as the execution of a separate contract if the following conditions are simultaneously met:

- there is technical documentation for the construction of each facility;

- For each object, income and expenses can be reliably determined.

Secondly, two or more contracts concluded with one or more customers should be treated as one contract for accounting purposes if:

- individual contracts actually relate to a single project with a rate of profit determined as a whole for all contracts;

- contracts are executed simultaneously or sequentially (continuously, one after another).

Thirdly, if during the execution of a contract an additional construction object (additional work) is included in the technical documentation, then for accounting purposes the construction of this object (performance of work) should be considered as the execution of a separate contract. To do this, it is sufficient to fulfill at least one of the following conditions:

- the additional facility differs significantly in structural, technological or functional characteristics from the facilities provided for in the contract;

- the price of construction of an additional facility is determined on the basis of an additional estimate agreed upon by the parties.

Such rules are provided for in section II of PBU 2/2008.

Poor quality work

If certain work is performed poorly, then, at its choice, the organization may require:

- free elimination of all deficiencies;

- reducing the contract price;

- reimbursement of their expenses for eliminating deficiencies (if, under the contract, the customer has the right to eliminate deficiencies in the contractor’s work).

A person working under a civil contract who causes damage to the organization is obliged to compensate it in full.

Compensation is subject to both direct damage (the cost of missing or damaged valuables) and lost profits not received by the organization.

Please note: lost profits can only be compensated through legal proceedings.

Read also “Collection of material damage from an employee”

EXAMPLE.

HOW TO COMPENSATE DAMAGES UNDER A CONTRACT AGREEMENT The administration of the concert hall, under a contract agreement, hired workers to install chairs in the hall. The remuneration for the work was set in the contract in the amount of 75,000 rubles. During the work, 7 chairs were damaged. The cost of one chair is 1,150 rubles. In accordance with the contract, workers are obliged to reimburse the cost of damaged chairs. In this case, the contract price will be reduced by the cost of damaged chairs and will be: 75,000 rubles. − (1150 rubles × 7 pieces) = 66,950 rubles. Also, in accordance with the terms of the contract, the workers must compensate the amount of income of the concert hall that it lost as a result of the fact that it could not provide seats for all spectators (lost profits). So, if the cost of an entrance ticket to a concert hall is 400 rubles, then the amount of lost profits will be: 400 rubles. × 7 pcs. = 2800 rubles. To recover lost profits, the organization must go to court.

Settlements with an individual for the performance of work under a contract

During the execution of a construction contract, the contractor incurs expenses, which, along with the remuneration due to him, form the price of the contract (clause 2 of Article 709 of the Civil Code of the Russian Federation).

As a general rule, the price of work under a construction contract is determined based on the estimate (clause 3 of Article 709, clause 1 of Article 743 of the Civil Code of the Russian Federation). The estimate drawn up by the contractor becomes valid and becomes part of the contract from the moment it is confirmed by the customer (paragraph 2, paragraph 3, article 709 of the Civil Code of the Russian Federation). The price of the work (including that indicated in the estimate) can be approximate or fixed. Moreover, if the price is approximate, the condition for this must be directly stated in the contract (clause 4 of article 709 of the Civil Code of the Russian Federation).

https://www.youtube.com/watch?v=HfbbHplOCw0

If it follows from the terms of the contract that the price is fixed, the contractor has the right to demand an increase only in the event of a significant increase in the price of materials, equipment and services provided by contractors. Provided that such a rise in price could not have been foreseen when concluding the contract (clause 6 of Article 709 of the Civil Code of the Russian Federation).

The opposite situation may also arise when the contractor's actual expenses turned out to be less than those taken into account when determining the contract price (contractor savings). In such a situation, the contractor has the right to demand payment at the contract price, provided that the reduction in costs did not affect the quality of the work (clause 1 of Article 710 of the Civil Code of the Russian Federation).

Situation: is it possible not to prepare an estimate when concluding a construction contract?

The answer to this question depends on how the contractor is paid for construction and installation work.

It is mandatory that estimates be drawn up for capital construction projects financed from budget funds (subclause 11, clause 12, article 48 of the Town Planning Code of the Russian Federation).

If the object is being built through private investment and a fixed price is established in the contract, then it is not necessary to draw up an estimate to determine the contract price.

Situation: how to prepare a cost estimate for a construction contract?

The cost estimate is a document justifying the contractor's expenses under a construction contract (clauses 2, 3 of Article 709, clause 1 of Article 743 of the Civil Code of the Russian Federation). If the work is carried out in accordance with the estimate, then the estimate drawn up by the contractor becomes valid and becomes part of the contract from the moment it is confirmed by the customer (paragraph 2, paragraph 3, article 709 of the Civil Code of the Russian Federation).

The basic document in the field of estimate regulation in construction is the Methodology approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1. In accordance with it, estimated standards are divided into:

- state estimate standards (GSN);

- industry estimate standards (OSN);

- territorial estimate standards (TSN);

- branded estimate standards (FSN);

- individual estimate standards (ISN).

This is stated in paragraph 2.3 of the Methodology, approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1.

Recommended samples of estimate documentation are given in Appendix 2 to the Methodology, approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1. Among them are typical forms:

- estimates for design and survey work;

- summary estimate.

The procedure for drawing up estimate documentation is prescribed in Section IV of the Methodology, approved by Decree of the State Construction Committee of Russia dated March 5, 2004 No. 15/1.

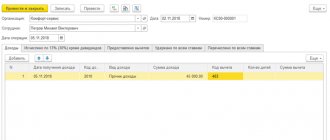

How to reflect in the accounting records of the customer organization the settlements with the contractor - an individual (not registered as an individual entrepreneur) for the performance of work under a contract? The organization entered into a contract agreement with an individual (not registered as an individual entrepreneur) to carry out cosmetic repairs in the office premises.

In accordance with the contract, the cost of work is 70,000 rubles. Payment for work performed is made after the parties sign the acceptance certificate for the work performed in cash from the organization’s cash desk. For the purposes of tax accounting of income and expenses, the organization uses the accrual method.

Civil relations

In accordance with paragraph 1 of Art. 702 of the Civil Code of the Russian Federation, under a contract, one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver its result to the customer, and the customer undertakes to accept the result of the work and pay for it. A contract is concluded for the manufacture or processing (processing) of a thing or for the performance of other work with the transfer of its result to the customer (Clause 1 of Article 703 of the Civil Code of the Russian Federation).

If the contract does not provide for advance payment for the work performed or its individual stages, the customer is obliged to pay the contractor the agreed price after the final delivery of the work results, provided that the work is completed properly and on time, or with the customer’s consent ahead of schedule (clause 1 of Article 711 Civil Code of the Russian Federation).

Insurance premiums

Organizations are policyholders and payers of insurance premiums (clause “a”, paragraph 1, part 1, article 5 of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Fund compulsory health insurance").

The amount of payments under a contract to an individual who is not an entrepreneur is subject to insurance contributions to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund. The amount of remuneration is included in the base for calculating these insurance premiums in full on the date of its accrual (Part 1, Article 7, Part 1, Article 8, Clause 1, Article 11 of Federal Law N 212-FZ).

The base for calculating insurance premiums is determined separately for each individual from the beginning of the billing period at the end of each calendar month on an accrual basis (Part 3, Article 8 of Federal Law No. 212-FZ).

Attention! For current premium rates and all changes for the current year, see the reference material “Insurance Premiums” on our portal.

In 2013, the following insurance premium rates are applied: to the Pension Fund of the Russian Federation - 22%, to the Federal Compulsory Medical Insurance Fund - 5.1% (Part 1, Article 58.2 of Federal Law No. 212-FZ).

Remuneration paid to an individual under a contract is not subject to contributions for compulsory social insurance in case of temporary disability and in connection with maternity, payable to the Social Insurance Fund of the Russian Federation (Clause 2, Part 3, Article 9 of Federal Law N 212-FZ ).

Also, this payment does not include contributions for compulsory social insurance against industrial accidents and occupational diseases (unless otherwise established in the contract for paid services) (paragraph 4, paragraph 1, article 5, paragraph 1, article 20.1 of the Federal Law of July 24, 1998 N 125-FZ).

We invite you to read: VHI policy: what it is, how much it costs and how to apply for it

Accounting

The cost of work performed is recognized in the organization’s accounting as an expense for ordinary activities on the date the parties sign the acceptance certificate for the work performed (clauses 5, 6, 6.1, 7, 16, 18 of the Accounting Regulations “Organization Expenses” PBU 10/99 , approved by Order of the Ministry of Finance of Russia dated 06.05.1999 N 33n).

The costs of repairing office premises are reflected in the debit of account 26 “General business expenses” (44 “Sales expenses” - for trade organizations) in correspondence with the credit of the account for accounting for settlements with the contractor (60 “Settlements with suppliers and contractors” or 76 “Settlements with various debtors and creditors") (Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

Insurance premiums accrued on the amount of remuneration paid to the contractor also relate to expenses for ordinary activities of the organization on the date of their accrual (clauses 5, 6, 18 PBU 10/99). In this case, an entry is made in the accounting to the debit of account 26 (44) and the credit of account 69 “Calculations for social insurance and security” (Instructions for using the Chart of Accounts).

Corporate income tax

The organization's expenses associated with the payment of remuneration to an individual who is not on the organization's staff for performing work under a contract are taken into account as part of labor costs on the basis of clause 21 of Art. 255.

Under the accrual method, labor costs are recognized monthly based on the accrued amount (clause 4 of Article 272 of the Tax Code of the Russian Federation).

Insurance premiums accrued by the organization for the specified payment to the contractor are recognized as other expenses associated with production and sales on the date of their accrual (clauses 1, 45, clause 1, article 264, subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation).

Personal income tax (NDFL)

An organization, as a result of relations with which an individual receives income, is recognized as a tax agent for personal income tax. In this case, the organization is obliged to calculate, withhold and transfer to the budget the corresponding amount of tax directly from the income of an individual upon their actual payment (clauses 1, 4 of Art.

226 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated April 25, 2011 N 03-04-05/3-292). The date of actual receipt of income is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties - when receiving income in cash (clause 1 of Article 223 of the Tax Code of the Russian Federation) {amp}lt; *{amp}gt;.

The amount of tax is determined based on the amount of remuneration received by an individual using a rate of 13% (clause 6, clause 1, article 208, clause 1, article 210, clause 2, article 226, clause 1, article 224 of the Tax Code of the Russian Federation).

Analytical account symbols used in the posting table

69-2 “Calculations for pension provision”;

69-3 “Calculations for compulsory health insurance.”

Such an agreement attracts the attention of tax authorities. Tax officials may recognize it as a work activity and then the organization may be fined (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). Article 15 of the Labor Code of the Russian Federation does not allow the conclusion of civil contracts that actually regulate labor relations between an employee and an employer.

Article 15 of the Labor Code of the Russian Federation states that the conclusion of civil contracts that actually regulate labor relations between an employee and an employer is not allowed. The minimum fine will be 5,000 rubles. In addition, you will have to pay some amounts to the employee, for example, compensation for vacation.

Choosing accounting accounts

The amount of remuneration accrued under a civil contract may:

- included in expenses for ordinary activities;

- be included in investments in non-current assets;

- increase the cost of acquired inventories;

- included in other expenses;

- be paid from the valuation reserve (for example, the reserve for warranty repairs of finished products).

If remuneration is accrued to an employee of your organization, then its amount is reflected on the credit of account 70, and if to a citizen who is not on the staff of the organization, then on the credit of account 76.

Select a corresponding account based on the unit for which and what work the citizen performs under the contract. When calculating remuneration under a contract that provides for the performance of work for the needs of the main (auxiliary, servicing) production, make the following entry:

DEBIT 20 (23, 29) CREDIT 70 (76)

— remuneration has been accrued to an employee (third party) performing work for the needs of the main (auxiliary, service) production.

If the contract provides for the performance of work related to the management of the organization (for example, financial analysis of the organization’s activities), then make an entry:

DEBIT 26 CREDIT 70 (76)

— remuneration has been accrued to an employee (third party) performing work related to the management of the organization.

When calculating remuneration under a contract that provides for the performance of work related to the sale of finished products or goods, make the following entry:

DEBIT 44 CREDIT 70 (76)

— remuneration has been accrued to an employee (third party) performing work related to the sale of finished products or goods.

Remuneration under civil law contracts is reflected as part of investments in non-current assets if the work (services) is related to:

- with the creation or purchase of fixed assets (intangible assets);

- with bringing fixed assets (intangible assets) to a state suitable for use;

- with modernization or reconstruction of fixed assets.

Reflect the accrual of remuneration for the specified work by posting:

DEBIT 08 CREDIT 70 (76)

— remuneration has been accrued to an employee (third party) performing work related to the creation of non-current assets.

If certain works (services) are associated with the acquisition of inventories, then the amount of remuneration increases their cost.

When calculating the reward, make a note:

DEBIT 10 (41) CREDIT 70 (76)

— remuneration has been accrued to the employee (third party) for work related to the acquisition of inventories.

Remuneration under a civil contract is included in other expenses if it is accrued for work not related to the production and sale of finished products or goods (charitable activities, holding sporting events, organizing recreation and entertainment, etc.).

If the performance of work is related to the organization’s receipt of other income (for example, repairs of leased fixed assets), then their amount is taken into account as part of other expenses.

In these cases, when calculating remuneration, make an entry in your accounting:

DEBIT 91-2 CREDIT 70 (76)

— the employee (third party) is accrued remuneration, which is included in other expenses.

Other expenses also include remuneration to employees liquidating the consequences of emergency events (natural disaster, fire, flood, etc.).

When calculating remuneration for such employees, make an entry:

DEBIT 91-2 CREDIT 70 (76)

— remuneration has been accrued to the employee (third party) performing work to eliminate the consequences of emergency circumstances.

If your company cannot avoid some future costs, it must create a provision. Warranty repairs are one of these cases.

If the organization has formed a reserve for warranty repairs of finished products, then reflect the amount of remuneration under the contract related to their implementation by recording:

DEBIT 96 CREDIT 70 (76)

— remuneration has been accrued to the employee (third party) at the expense of the previously created reserve.

When renting a vehicle with a crew from an individual, the following entries are made for the amount of remuneration for the provision of management services:

DEBIT 20 (26, 44) CREDIT 69-2

— contributions for compulsory pension insurance have been accrued;

DEBIT 20 (26, 44) CREDIT 69-3

— contributions for compulsory health insurance have been calculated.

When renting a vehicle without a crew from an individual for the amount of remuneration monthly during the term of the lease agreement, the following entry is made:

DEBIT 20 (26, 44) CREDIT 70 (76)

— monthly rental payments are included in expenses.

note

To account for leased property, use off-balance sheet account 001 “Leased fixed assets” in the amount specified in the lease agreements. An inventory card is opened for the rented property. The lessee does not charge depreciation on the leased fixed asset.

Results

Postings under a GPC agreement with an individual affect different accounting accounts.

The accrual of remuneration is reflected in account 76 “Settlements with various debtors and creditors”. The customer makes the payment by debiting account 76 in correspondence with the cash accounts. Insurance premiums are charged on the amount of remuneration and reflected in account 69 “Calculations for social insurance and security”. The deduction and transfer of personal income tax from the remuneration received is carried out using account 68 “Calculations for taxes and fees”. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Initial settings

Let's look at the process using the example of operations in 1C: Accounting 8.

To make it possible to register a civil law agreement in the program, configure the functionality (“Main” / “Administration” - block “Settings” - “Functionality” - “Employees” - checkbox “Contractor agreements”).

The “Contracts” checkbox will give you access to the following options:

- the ability to hire someone in the employee’s card in the “Contracts” section and via the “Contracts” link;

- viewing all GPC agreements issued for an employee (follow the “Contractor Agreements” link in the employee’s card);

- section “Contracts” in “Salaries and Personnel”.

Insurance premium rates

Knowledge of the nuances regarding the imposition of taxes and fees on a civil partnership agreement will allow the company to calculate its benefits and decide which agreement with an individual is better to conclude.

It became clear whether to punch a check when making payments under GPC agreements

What is a GPC agreement

The essence of a civil contract (CLA) with an individual is that it is concluded when it is necessary to perform certain work. The customer pays the physicist’s income only after the performer has delivered the results of the work and the customer has accepted them (Clause 1, Article 702 of the Civil Code of the Russian Federation). The parties may also provide for an advance payment under the contract, but the final payment occurs upon completion.

As soon as the work under the contract is completed, the legal relationship between the customer and the contractor ceases. This is a one-time job, and the contractor under such an agreement is involved in performing such work once. An employee working under a civil contract is not a full-time employee.

A civil contract with an individual is regulated by the Civil Code of the Russian Federation, not the Labor Code.

Taxation of GPC agreements in 2021

The features of a civil law contract also result in its differences from an employment contract in terms of taxation and payment of insurance premiums. According to the GPC agreement, the company must pay taxes and fees, since the individual receives income. But she doesn’t pay all the dues.

But it's not that simple. Firstly, personal income tax and contributions in 2021 are paid only under agreements concluded with an individual living in the Russian Federation. Agreements with individual entrepreneurs are not subject to taxation (Article 226 of the Tax Code of the Russian Federation). Secondly, there are exceptions among individuals, which we will discuss further.

Below you can see a sample of a typical civil law contract for 2021.

Let's now take a closer look at which funds the company pays insurance premiums to under a civil contract with an individual. Not every GPC agreement provides for the payment of contributions in 2021. To make it easier to understand, see the table, which contains all the cases of concluding this type of agreement.

| Reason for signing the GPA by the parties | Are fees paid? |

| Agreement on any work or services | Paid, and the tax base is reduced by the amount of expenses incurred by the contractor (if there is documentary evidence) |

| Transfer of rights to literary, musical, artistic or scientific works | |

| licensing-publishing | |

| Agreement for the transfer of property rights or ownership | Not paid |

| Student contracts | |

| Agreement with participants and organizers of the 2018 FIFA World Cup |

When paying insurance premiums under civil contracts in 2018, it is important to consider who the individual with whom you are signing the agreement is. Not every physicist’s income makes payments to the budget.

A GPC agreement is a civil law agreement, i.e. a civil law agreement (CLA). A party to this agreement may be one or more individuals and/or legal entities. GPA is any agreement concluded in accordance with the Civil Code of the Russian Federation and does not contradict the current civil legislation.

Civil contracts are conventionally divided:

- related to the transfer of property (donation, exchange, purchase and sale, etc.);

- contracts for the performance of work (contract, R&D, etc.) in accordance with Ch. 37 Civil Code of the Russian Federation;

- contracts for the provision of services (transportation, storage, commission, etc.) in accordance with Ch. 39, 51 Civil Code of the Russian Federation.

The difference between an employment contract and a GPC is primarily that an employment contract is regulated by the norms of the Labor Code of the Russian Federation, and the GPC is governed by civil law. The GPA cannot use terms and wording of labor legislation.

Many questions arise in a situation when a service invention (sample or model) is created. If, according to the labor functions enshrined in the employment contract or job description, the creation of this invention is prescribed, then this case is considered in the area of labor legislation.

It should be taken into account that Part 2 of Art. 15 of the Labor Code of the Russian Federation directly prohibits the conclusion of civil contracts, which in their meaning regulate labor relations.

The Supreme Court of the Russian Federation came to the conclusion that in a number of cases, GPAs concluded with individual entrepreneurs, which provide for monthly remuneration, compliance with labor regulations, etc., should be reclassified as employment contracts, since they are illegal and infringe on the rights of employees (definition Sun dated 02.27.17 No. 302-KG17-382). This means that companies take a very big risk when they enter into GPAs, which are very similar to employment contracts.

| Signs | GPC agreement | Employment contract |

| Parties to the agreement | Customer and performer | Employer and employee |

| Subject of the agreement | Specific task | According to job description |

| Payment under the contract | Reward | Salary |

| Execution of the contract | Personally or with the involvement of third parties | Personally |

| Deadline | Defined, which ends upon completion of the contract | Indefinite. Urgent only in special cases |

| Time and end of the working day | Not regulated | Internal labor regulations |

| Working conditions | The contractor independently equips his workplace | The employer is obliged to equip the workplace, provide tools and, if necessary, provide special clothing and footwear. |

| Documenting | GPC agreement | Reception order. Entry in the work book. Employment contract |

| Business trip | The performer's trip is not considered a business trip and is paid for by the performer himself. The customer cannot send on a business trip | When sent on a business trip, the employer pays daily allowance, travel and accommodation expenses |

In order to understand in which cases insurance premiums are paid and in which they are not paid, let’s look at the table.

| Subject of the agreement | Is insurance premiums included in the tax base? |

| Work agreement | Turns on |

| Royalties | Included minus documented expenses |

| Alienation of rights to the results of intellectual activity | Included minus documented expenses |

| Contract of sale | Doesn't turn on |

| Contract for paid services | Turns on |

| License agreement | Included minus documented expenses |

| Lease contract | Doesn't turn on |

| Loan agreement | Doesn't turn on |

| International Football Association events | Doesn't turn on |

| Volunteering | Doesn't turn on |

Moreover, undocumented expenses are accepted for deduction as a percentage of the amount of accrued income established by clause 9 of Art. 421 Tax Code of the Russian Federation. For example, for the creation of databases and computer programs - 20%.

The question often arises: is it possible not to pay premiums if the GPC agreement stipulates that the insurance premiums are paid by the executor or contractor himself? The answer is clear: no. The condition that the contractor pays his insurance premiums will be considered void, since it contradicts current legislation.

The contractor under the GPA for the provision of services or performance of work can count on receiving compensation for his costs (clause 2 of Article 709, Article 783 of the Civil Code of the Russian Federation). You can compensate, for example, for the contractor’s documented expenses for materials, work, and services directly used to fulfill this GPC agreement.

All expenses subject to compensation must be documented. Otherwise, the taxpayer may have problems with the Federal Tax Service. This position is also shared by the regulatory authorities (subclause 2 of clause 1 of Article 422 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated August 21, 2017 No. 03-15-06/53442).

But if a decision is made to compensate an individual for the costs of purchasing equipment, then if insurance premiums for such payments are not calculated, a dispute with the tax authorities is possible. Since compensation for the purchase of equipment or tools can be regarded as a payment option under the GPA, since the contractor will use this equipment to perform work under other contracts or for personal purposes.

Often, the GPA includes a condition for the payment of an advance. Moreover, the advance can be paid in a certain percentage or amount both for the completed stage of work and for the execution of the contract as a whole. In this case, when should contributions be calculated from GPC agreements - 2021? According to Art. 424 of the Tax Code of the Russian Federation, the date of payment and remuneration to an individual is the date of accrual of such payment. That is

under GPC agreements - the date of signing the acceptance certificate for work or services provided under the terms of the agreement. Therefore, the date of accrual of insurance premiums for GPC remuneration will be the date of accrual of such payment: for a separate stage or for the contract as a whole. A similar point of view is reflected in the letter of the Ministry of Finance of the Russian Federation dated July 21, 2017 No. 03-04-06/46733.

According to Art. 426 of the Tax Code of the Russian Federation for 2017–2020, the following rates of insurance contributions are established, which are applied to both wages and benefits under the GPA:

- for compulsory pension insurance - 22% within the limit and 10% on income exceeding this amount;

- Compulsory medical insurance - 5.1%.

The limit in 2021 for calculating insurance contributions for pension insurance is set at RUB 1,021,000. (Resolution of the Government of the Russian Federation dated November 15, 2017 No. 1378).

Cost accounting using your own materials

It happens that to carry out construction work, the customer provides materials on a toll basis. However, by default, the contract is drawn up as dependent on the contractor. That is, construction is carried out from the materials of the contractor, with his forces and means. This is provided for in paragraph 1 of Article 704 of the Civil Code of the Russian Federation.

Such material costs are taken into account as direct costs. Often the amount of such costs is clear in advance based on the estimate. Therefore, they are included in the expected direct costs.

The purchase of materials is reflected in the general order.

Next, the property is transferred to production. Why draw up one of the documents:

- limit-fence card, for example, in form No. M-8. This document is used when there are approved standards and plans for the consumption of materials;

- requirement-invoice (form M-11) or warehouse registration card (form M-17). They are used when there are no standards and plans and there is no need to transfer materials to a remote unit;

- an invoice for the release of materials to the third party (form M-15) is drawn up when materials are transferred to a geographically remote unit.

This is established by paragraphs 100, 109 and 126 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Debit 20 Credit 10 (16) – materials written off for production (construction).

This procedure is provided for in the Instructions for the chart of accounts (accounts 10, 16, 20).

If expenses are expected, they can be written off against a special reserve.

In this case, the cost of materials is written off as the cost of work in accordance with the cost estimation methodology approved in the accounting policy.

If this is expressly provided for in the contract, then for construction work the customer can provide the contractor with materials on a toll basis.

Debit 003 – materials received for construction work.

Organize internal movements of the customer's materials on subaccounts of off-balance sheet account 003. When transferring materials to production, their cost does not affect the cost of your work.

Debit 20 Credit 02, 10, 23, 25, 26, 60, 68, 69, 70, 76… – the expenses of the performing organization for processing materials are taken into account.

Credit 003 – materials transferred to production are written off.

Credit 003 – unused materials were transferred to the customer.

This order follows from the Instructions for the chart of accounts (accounts 02, 10, 20, 23, 26, 60, 68, 69, 70, 76... 003).

The basis for such an entry will be a report on the consumption of materials and an invoice in form No. M-15.

Indirect costs include the part of the organization's general business expenses that falls on a specific contract. Set the procedure for distributing indirect costs between contracts yourself in your accounting policy for accounting purposes. For example, you can distribute indirect costs in proportion to the revenue for each of the contracts or in proportion to direct costs.

Debit 20 Credit 26 (25, 23) – indirect expenses are taken into account.

This procedure is provided for in paragraph 13 of PBU 2/2008.

Direct and indirect costs

All costs incurred by the contractor are divided into direct, indirect and other. This is provided for in paragraph 11 of PBU 2/2008.

Direct expenses include expenses that are directly related to the execution of a construction contract. They can be of two types:

- actual costs of executing the contract. For example, wages, depreciation, rent, cost of accepted subcontract work;

- Foreseen expenses are expected unavoidable expenses that are reimbursed by the customer under the terms of the contract. These, in particular, include the costs of eliminating deficiencies in projects and construction and installation works, dismantling equipment due to defects in anti-corrosion protection, etc.

We invite you to read: Agreement of donation of a house and land to two people

Debit 20 Credit 10 (68, 69, 70, 76, 60...) – direct costs under the construction contract are taken into account.

Anticipated direct costs can be recognized in one of two ways:

- forming a special reserve.

Debit 20 Credit 10 (68, 69, 70, 76, 60...) – anticipated direct costs under the construction contract are taken into account.

A reserve to cover anticipated expenses is created provided that such expenses can be reliably determined. The amount of the provision is an estimated liability. The procedure for forming the reserve shall be established in the accounting policy for accounting purposes. This is provided for in paragraph 7 of PBU 1/2008 and paragraph 12 of PBU 2/2008, the procedure for determining estimated liabilities is enshrined in PBU 8/2010.

In accounting, reflect the reserve for covering expenses in account 96 “Reserves for future expenses.” Analytical accounting for this account is carried out by type of reserves. Therefore, to account 96, open a subaccount “Reserve for covering anticipated expenses under a construction contract.” Additionally, in this sub-account, divide the amounts under different agreements (Instructions for the chart of accounts).

Debit 20 Credit 96 subaccount “Reserve for covering unforeseen expenses under a construction contract” – deductions were made to the reserve for covering unforeseen expenses.

Debit 96 subaccount “Reserve for covering anticipated expenses under a construction contract” Credit 10 (23, 25, 26, 60, 70, 76, 97...) – current expenses are written off from the reserve.

Costs directly related to the preparation and signing of the contract that the organization incurred before signing it are included in direct costs if it is probable that the contract will be signed. Such costs, in particular, include the costs of developing a feasibility study and preparing an insurance contract for the risks of construction work.

other expenses

Other construction contract costs may include:

- certain types of costs for managing an organization;

- other costs, the reimbursement of which by the customer is specifically provided for in the contract.

Debit 20 Credit 26 (60, 76, 70, 69...) – other expenses reimbursed by the customer are reflected as expenses under the construction contract.

This procedure is provided for in paragraph 14 of PBU 2/2008.

In this case, it is necessary to distinguish between other expenses under a construction contract, which are reflected in production accounts (clause 14 of PBU 2/2008), and other expenses that are immediately written off to financial results (clause 11 of PBU 10/99). In particular, other expenses that are accounted for in account 91 include costs associated with the preparation of a construction contract if the organization does not have sufficient confidence that the contract will be signed (clause 15 PBU 2/2008, clause 11 PBU 10 /99).

Expenses under a construction contract are taken into account in the reporting period to which they relate. In this case, expenses for completed work are taken into account as production costs, and expenses associated with upcoming work are taken into account as deferred expenses (in the debit of account 97). This is stated in paragraph 16 of PBU 2/2008.

Debit 97 Credit (25, 26, 23, 60, 70, 69...) – reflects deferred expenses under the construction contract.

Debit 20 Credit 97 – included in production expenses are costs previously recorded as deferred expenses.

Debit 90-2 Credit 20 – expenses under a construction contract are recognized.

This procedure for recognizing expenses is provided for in paragraph 16 of PBU 2/2008.

Some information about the costs of construction contracts must be disclosed in the contractor's financial statements. For more information about this, see How to record a contractor's income under a construction contract.

The procedure for calculating taxes depends on the tax system that the organization uses.