First of all, we note that only those taxpayers who have already established a “two-way communication channel” will be able to receive an electronic request for payment of taxes, fees, penalties and fines. First of all, these are the largest taxpayers; they must report declarations and calculations strictly in electronic form. Then this category includes organizations (it is possible that entrepreneurs) whose average number of employees for the previous year exceeds 100 people, and therefore they have an obligation to submit tax reports only via telecommunication channels.

The requirement is no longer just a paper requirement...

Until 2011, the requirement was a paper document. Therefore, I only had to worry if such a piece of paper appeared. Now, in the definition of a tax payment requirement, the expression “written notice” has been corrected, and the requirement has become simply a notice without specifying its form. However, we are not talking about oral notification. The requirement must be confirmed by some document confirming the fact of its receipt. Otherwise, tax authorities have no reason to carry out further procedures.

The paper document is delivered in person against signature or sent by registered mail. If the request is sent by mail, it is considered received after six (working) days from the date of sending the registered letter. And in this case, the law does not establish the obligation to have taxpayers’ signatures proving the receipt of the request.

In the electronic version, the requirement is transmitted in the form of a file via telecommunication channels (TCC) in a specific format. Naturally, in encrypted form and using security measures, including an electronic digital signature (EDS). The form of the electronic demand does not differ from the paper document. It was introduced by order of the Federal Tax Service of Russia dated December 1, 2006 No. SAE-3-19/ [email protected]

A special procedure has been developed for electronic exchange. It was approved by order of the Federal Tax Service of Russia dated December 9, 2010 No. ММВ-7-8/ [email protected]

Let us analyze this procedure and tell you how the electronic requirement differs.

Request for payment of fees and charges

Regional contributions

Sample document

Local fees

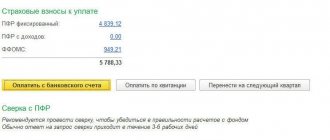

Payment on the Federal Tax Service website

Significant disadvantages of filing and submitting a request for payment of tax, penalties and fines include:

- lack of information informing the taxpayer about the existence of a debt; on the commencement of a procedure for enforcing the obligation to pay tax in relation to him and measures to collect and ensure the fulfillment of the obligation to pay tax;

- failure to provide the taxpayer with the minimum established period for voluntary compliance with the requirement;

- violation of the procedure for serving a demand.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

The above violations of the rules for preparing and submitting a request for payment of tax, penalties and fines are grounds for appealing this document, and the significance of these shortcomings guarantees the taxpayer that his complaint will be satisfied.

General scheme of electronic document management

There are, as always, three participants in electronic document management: the taxpayer (tax agent, fee payer), the tax inspectorate and the special communications operator. But it may be more if the file is transferred from the sender to the final recipient in several stages through other (intermediate) tax authorities.

Let us recall what technological electronic documents are generated when working in this mode:

1) confirmation of dispatch date;

2) acceptance receipt;

3) notification of refusal of admission;

4) notification of receipt of an electronic document.

In this case, a notification of receipt of an electronic document via telecommunication channels is generated for each requirement and each technological electronic document listed above.

Initially, the requirement is generated on paper. No later than the next working day, it is duplicated in electronic form, signed with an electronic digital signature (EDS) of a tax authority official and sent via TCS channels to the taxpayer. The tax authority records the date of its dispatch.

Within the next (third) business day, tax officials must receive confirmation of the dispatch date, an acceptance receipt or a notice of refusal of acceptance, signed with the taxpayer’s digital signature.

Having received a notification of refusal, the inspectorate eliminates the errors indicated in this notification and repeats the procedure for sending a request.

Important:

An organization (entrepreneur, individual), in turn, upon receiving a request from the tax authority in electronic form and there are no grounds for refusal of admission, within one business day from the date of receipt, must generate a receipt of acceptance and send it to the tax authority.

Special rules

Failure to comply with the requirement does not actually lead to any fines, but the taxpayer himself is interested in reporting to the tax office as soon as possible. If the tax authorities do not receive a receipt from the organization for accepting the request, they will send it the request again, this time on paper.

Failure to comply with this requirement does not actually lead to any fines, but the taxpayer himself is interested in reporting to the tax office as soon as possible. If the tax authorities do not receive a receipt from the organization for accepting the request, they will send it the request again, this time on paper. Ignoring such a document as a requirement to pay tax can lead to such consequences as tax authorities collecting arrears from funds in the taxpayer’s bank accounts, seizing property, etc.

Can't accept...

In the journal “Practical Accounting” No. 8, 2009, we published an article by an expert, “The demand for payment is illegal.” It sets out situations when the requirement to pay taxes and fees loses its legal force.

This will happen if:

1. The tax authority missed the deadline for sending a demand for payment of taxes. Let us recall that Article 70 of the Tax Code establishes the following deadlines: no later than three months from the date of detection of arrears or within 10 days from the date of entry into force of the decision based on the results of a tax audit.

2. The submitted request does not indicate the period of arrears; it is impossible to understand in respect of which arrears the amount of penalties was accrued, or the start date for the accrual of penalties. The requirements for document execution are set out in paragraph 4 of Article 69 of the Tax Code and provide for the mandatory indication of information about the amount of tax debt, the amount of penalties accrued at the time of sending the demand, the deadline for paying the tax, the deadline for fulfilling the demand, measures to collect the tax and ensure execution obligations to pay tax, which apply in the event of non-fulfillment of the requirement by the taxpayer, and must also provide detailed information on the grounds for levying the tax and references to the provisions of the legislation on taxes and fees that establish the taxpayer’s obligation to pay the tax.

3. The request was sent in the wrong form. For example, a request is sent to an individual in a form intended for legal entities. As emphasized in the article, if the tax office sent the taxpayer an inappropriate demand form, it turns out that it did not explain the legal consequences of its non-fulfillment.

4. The requirement contains general references to tax payment deadlines. It is mandatory to indicate a specific deadline for payment of the declared shortfall for a specific tax.

All of the above applies to those circumstances when the requirement to pay tax becomes legally invalid.

Electronic document management has supplemented this list. The special procedure for sending a claim electronically suggests that the taxpayer may have grounds for refusing to accept the claim. In this case, the organization must generate and send a notice of refusal to the tax authority. This procedure provides for only three cases when the claim is not considered accepted by the taxpayer:

1. The request was sent to the taxpayer in error. That is, it was received by one taxpayer instead of another who actually had the specified arrears.

2. The document does not comply with the approved format. As you can see, in addition to the form of the requirement, its format also matters. The version number of this format is 5.01.

3. The electronic request does not contain (does not correspond to) the digital signature of the authorized tax authority official. As you know, all correspondence is sent through a special operator using an electronic digital signature. One of the options for protecting it is to check the compliance of the digital signature.

But what if, before the tax authorities sent this demand, the organization paid the debt indicated in it on its own? There are no grounds to invalidate the claim. But in fact, the company does not have to fulfill the requirement to pay the arrears by transferring the money again.

We have already written that if the tax authority does not receive a receipt from the taxpayer for accepting the request, it will send the same request on paper. Probably, this rule is based on the fact that the requirement is considered accepted by the taxpayer if the tax authority has received an acceptance receipt signed with the taxpayer’s digital signature. However, this provision can be safely extended not only to the acceptance receipt, but also to the notification of refusal to accept the claim. Since any of these two documents can equally serve as confirmation of the taxpayer’s response to an electronic demand.

Therefore, having received a request for payment of the amount of tax that the taxpayer has already paid before the moment of sending, you can try to send the tax authorities a notice of refusal to accept the request, while reporting the fact of payment in the reasons for the refusal.

Example

KND code 1167003

Notice of refusal of admission

Recipient of the document:

Limited Liability Company "Project", INN/KPP 7606012000/760601001

(name of organization, TIN/KPP; full name of individual entrepreneur

(individual), TIN (if available), name and code

tax authority)

Notifies that the sender of the document:

Inspectorate of the Federal Tax Service for the Leninsky district of Yaroslavl, 7606___ ______________________________,

(name of organization, TIN/KPP; full name of individual entrepreneur

(individual), TIN (if available), name and code

tax authority)

04/04/2011 at 11.25.56 sent document(s)

name of the file(s) _T R 7606012000/760601001_7606015992_20110404_1,

through ____________________________________________________________________,

(name and code of the tax authority)

For

Limited Liability Company "Project", INN/KPP 7606012000/760601001,

(name of organization, TIN/KPP; full name of individual entrepreneur

(individual), TIN (if available))

which arrived on 04/04/2011

This document has not been accepted.

Reasons for refusal: Full payment of debt. P.p. No. 145 dated March 30, 2011 in the amount of 10,242.00 rubles, pp. No. 146 dated March 30, 2011 in the amount of 153.46 rubles.

Head of the organization (individual entrepreneur, individual, authorized representative, tax authority official) ______ Petrov

____/___Petrov I.A.___/

Signature Full name

Of course, if such an opportunity really presents itself. Since electronic document management primarily involves the use of directories, the possibility of entering a text message can be eliminated. In addition, as stated above, the order contains only three reasons for refusal, and the fact of absence of debt is not included in this list. Then the taxpayer will have to generate a receipt for the receipt of the demand, and send disagreements by an additional letter.

Structure and operation of the tax system in Russia

The taxation system of the Russian Federation is represented by three main levels: federal, regional and municipal (local). Federal law is the highest level of legislative power, and regulations adopted at the regional and local levels must comply with it.

The taxpayer's liability may be administrative and even criminal.

Federal fees

Taxes and fees that relate to the federal level are obligatory for payment throughout the Russian Federation; the amount and terms of payment do not depend on the location and registration of the citizen. The legal basis in this case is the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), the Constitution of the Russian Federation, presidential decrees and decrees of the government of the Russian Federation.

Federal fees include:

- Personal income tax (personal income tax);

- VAT (value added tax);

- unified social tax;

- excise taxes;

- state duty;

- income tax (for enterprises);

- water tax;

- tax on the use of natural resources;

- mineral extraction tax.

The amount of these contributions is fixed and the payment terms are the same throughout the Russian Federation.

Regional contributions

Fees and duties established in certain regions of the Russian Federation are regulated by the laws of the constituent entities, but do not contradict the regulatory legal acts of the Federal Law. The amounts of regional contributions and payment terms depend on regional or regional legislation.

Sample document

Such fees include:

- property tax on the property of enterprises and organizations;

- gambling tax;

- transport fee.

Please note! The amounts of duties and repayment conditions are relevant in the territory of a certain region or subject of the Russian Federation.

Local fees

Municipal tax legislation includes regulations that are in force in the territory of a certain region, city, town, municipality and do not contradict Federal Law.

Municipal fees:

- land tax;

- property tax for individuals.

Local fees apply on the territory of the municipality; their size and payment terms are regulated by the municipal legal framework.

Payment on the Federal Tax Service website

The Russian tax system provides taxpayers with the choice of a special tax regime:

- single agricultural tax (USAT);

- simplified taxation system (STS);

- unified tax on imputed income (UTII - the amount of payments depends on the type of activity);

- patent tax system (PTS).

Structure of the tax system of the Russian Federation