Is it possible to work without a work book?

Taking into account the legislation, there are only two possibilities for hiring an employee without a work permit (Labor Code of the Russian Federation of December 30, 2001). In this case, an agreement must be concluded with him. This can be done in the following cases:

- The employee performs his official duties part-time (Section 12, Chapter 44 of the Labor Code of the Russian Federation).

- The boss is an individual , but not an individual entrepreneur (section 12, chapter 48 of the Labor Code of the Russian Federation).

It is not possible to hire and register an employee in any other way without registering with the labor manager.

In the case of one-time work , limited in duration and volume, the employer accepts the employee without being registered in the employment record, but concludes a different form of contract.

Read all about getting a job under an employment contract in our article.

Differences between an employment contract and a civil law one

If the conditions provided for by the Labor Code of the Russian Federation are not met, then an employment contract cannot be drawn up. But there is a way out: work without labor can also be carried out when drawing up a civil contract (). It has differences from the usual contract: the parties here are not the manager and the employee, but the customer and the performer. The former will not have to spend extra money, which is inevitable when drawing up an employment contract as required by law. The second one does not have to comply with the regime and follow the rules that the employer assigns to his subordinates locally.

The deadlines for such a document are limited to completing the task, so you can’t count on long-term cooperation. Experience does not count in this case. The responsibilities of the parties must be clearly stated, otherwise the contract may be recognized as a labor contract in court proceedings with all the ensuing consequences.

IMPORTANT! In the described case, wages are calculated according to a pre-agreed plan, and not according to the law, when at least two monthly payments are due at intervals of no more than fifteen days, which are called advance and calculation. Here we are talking about a fee for a completed task.

How to apply?

An employee can get a job without a work permit; to do this, together with the head of the organization, you need to choose the form of the contract:

- Contract agreement (civil law).

- Copyright agreement.

- Agency contract.

This document is usually drawn up when performing one-time work.

This document is drawn up if you need a person for short-term creative work.

One of the parties undertakes, for a fee, to perform any actions on behalf of the other party, the customer.

When an employee gets a job without a salary, his manager must make payments to the Pension Fund . The management may not give any guarantees, because this agreement exempts you from this.

For this reason, a minority agrees to work under such conditions, since even the correct amount of salary will not be easy to achieve in the event of dismissal.

Employment using a GPC agreement

Unlike an employment agreement, which is regulated by the provisions of the Labor Code of the Russian Federation, a civil contract is subject to the articles of the Civil Code of the Russian Federation. For this reason, there is no need to enter a record of the conclusion/termination of a civil law contract (CLA) in the work book.

The subject of a civil law agreement (GPC) is remuneration for specific work or service, the result of which will be recorded in the closing accounting act. This form of arrangement without a work book requires weighing all the pros and cons, taking into account the interests of both parties:

- Remunerations under the GPC agreement are not included in the tax base for VNiM insurance. Payments are subject to “unfortunate” contributions only if the agreement between the parties obliges to mention this. For the employee, this will mean no sick pay in case of injury.

- Extension of the GPC contract is not permitted, and work under it is not carried out on a regular basis.

- Compliance with social guarantees in the form of vacation pay, compensation upon dismissal, etc. with mercenaries is not provided for in the GPC agreement.

If the audit reveals the slightest signs of labor relations under the GPA, including regular payments based on monthly acts, the contract will be qualified as an employment contract. Then the employer will pay to the budget all due amounts of insurance premiums and penalties on them.

Advantages and disadvantages

Many workers believe that there are many advantages , including:

- There is no fixed schedule. Thanks to this, it is possible to go to work when the employee deems it necessary.

- The subordinate chooses his own convenient working time.

- There is no need to follow orders from higher management.

few disadvantages to working under a contract:

- In most cases, when applying for a job, people expect that the employment relationship will last a long time. But, work under a rental agreement often has a certain period.

- It is possible to stop working under such an agreement only if the employer decides so. At the same time, he has the right not to warn the subordinate in advance.

- The employment contract does not provide for the required vacation, because the subordinate receives a salary for a specific amount of work.

- Under a rental agreement, there is no possibility to receive additional accruals, such as bonuses.

- Maternity leave and sick leave are not subject to payment.

- When accruing for sick leave, the period of work under such an agreement will not be taken into account.

- The term of work under the contract will be included in the insurance period only at the time of retirement age. If a citizen goes to work in another place, then this length of service is not taken into account.

- The manager is relieved of responsibility to the worker.

Is it possible to save on taxes when contracting a contract with an individual? Any manager will be interested to know:

How to determine the code of the function being executed

The code consists of five digits in the format XXXX.X:

- where 1–4 characters are the occupation group code from the All-Russian Classifier of Occupations;

- The 5th character is the control number indicated next to the group code from the same classifier.

The occupation classifier does not record positions, but the actual job responsibilities of the employee. This makes it difficult to find the code.

Experienced HR professionals advise the following:

1) Search by position

Some functions performed in the classifier sound the same as the job title. For example, for the position “accountant” there is a code of the same name “2411.6 Accountants”, for a secretary there is a code “4120.1 Secretaries (general profile)”.

If your search for a position does not produce results, proceed to step 2.

2) Search by classifier comments

For most, the position and function do not coincide in name, but in the comments to the classifier for each code there are examples of positions.

Follow the link, press F3 and enter the required position.

We have collected the most typical positions in a table to save your time.

| Job title | Function code | Occupation |

| Director | 1120.9 | Heads of institutions, organizations and enterprises |

| Commercial Director | 1221.4 | Sales and Marketing Managers |

| Chief Accountant | 1211.1 | Financial managers |

| Sales Manager | 2433.9 | Product sales specialists (excluding information and communication technologies) |

| HR Specialist | 4416.6 | Personnel records clerks |

| Storekeeper | 4321.9 | Employees involved in accounting, receiving and issuing goods in a warehouse |

| Sales Representative | 2433.9 | Product sales specialists |

| Courier | 9621.9 | Bellboys, baggage and package delivery workers and similar workers |

3) Select a code according to the description of the duties performed

To select a code, be guided by the description of the group and subgroup. For example, for the position of HR manager, select the code “2423.6 Specialists in the field of recruitment and use of personnel.” At the same time, it is guided by the description “...provide services to businesses related to personnel policy, hiring of employees, their development, employment analysis and career guidance.”

Hiring an employee without a work book

Under contract

Let's consider the option when the customer is a citizen without registering as an individual entrepreneur. This person can hire a person who will be a housekeeper: a cook, a cleaner, etc. Here it is believed that the worker does not aim for commercial income, and all the fruits in the garden will be used personally.

In this case, the customer cannot leave notes in the employee’s employment record, but must enter into a written contract. For this reason, the contract must be drawn up especially carefully, or use the help of special offices that draw up the document correctly.

In this case, the customer is obliged to notify the self-government authorities that he has hired such and such a citizen.

By agreement

When registering an employee with an organization, the boss must understand for himself why he needs a specific employee. Sometimes, it is needed to complete work for a couple of days . For such cases, there are contracts that are limited by strict deadlines for the work period.

If the deadline has expired and the employee’s services are still needed, the contract can be re-signed.

Requirements for the employee under the contract must comply with this legislation (length of the working week, rest, etc.). The customer needs to make payments to the Pension Fund for his employee. If the worker has begun his duties for the first time, then the customer must make a SNILS for him.

An employment agreement with an individual is called a civil contract , also known as a contract or employment agreement. Disadvantages of such labor relations:

- there is no guarantee of receiving the promised remuneration for work;

- the employee is not protected from illegal dismissal;

- the employer may demand compensation for alleged damage.

Download a sample contract agreement with an individual here for free.

The difference between an employment contract and an agreement is quite large and is as follows:

It is necessary to take into account all the rules for drawing up an agreement, since tax authorities have the power to change the qualifications of the document and have the right to adjust taxes. The same applies to insurance funds.

If there are controversial issues and the worker wants to receive certain payments, he can go to court. In turn, a well-drafted document will be important for the court, and even the smallest inaccuracy will play a big role.

At the same time

Part-time work without work is possible if the contract is drawn up part-time. The employer will be required to make insurance payments, but vacation, sick leave and other norms will not be paid. This agreement simply indicates the beginning and end of the relationship between a superior and a subordinate.

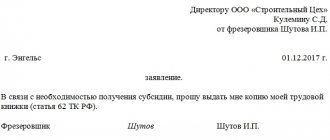

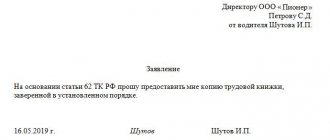

In the case of part-time work, the employee, at his own discretion, enters such length of service into the work book or does not enter it . This entry is made by the company where he works on a permanent basis. In this case, you just need to request a copy of the employment document, certified by the personnel department at the main place of work.

You can find the part-time agreement here.

An employment contract without an entry in the work book when working with a part-time worker

In accordance with Art. 282 of the Labor Code of the Russian Federation, part-time work is additional work performed either at the place of primary employment or with another employer in free time from the main job.

The main feature of this form of employment is that a part-time worker’s work shift cannot exceed 4 hours a day (Article 284 of the Labor Code of the Russian Federation). This restriction does not apply to days on which the employee is released from performing duties at his main place (including weekends and holidays). But even taking into account this possibility, a part-time worker cannot work more than half the monthly standard hours established for employees in similar positions.

It is possible to exceed the 50 percent standard working time limit only if the employee has suspended work at his main place of work due to a delay in salary or is temporarily suspended from work due to a refusal to transfer to another position for medical reasons (or the absence of one at the enterprise).

The contract must indicate that the person is accepted part-time. Then the employee can maneuver between the decision to enter information about the length of service in his documents and employment without a work book under a part-time agreement.

How does dismissal happen?

The dismissal procedure may be subject to the employee’s part-time employment.

In other cases, if an employment agreement or employment contract is concluded, the contractual relationship ends with the completion of the required amount of work or the expiration of the contract.

During the dismissal procedure, the rights of the worker must be fully taken into account. Basics of termination of a contract (Chapter 13 of the Labor Code of the Russian Federation) :

- consent on both sides;

- completion of the period specified in the employment contract;

- initiative coming from the worker;

- at the request of the manager (Article 81 of the Labor Code of the Russian Federation);

- the employee’s desire not to continue working due to changes in the terms of the contract;

- due to circumstances beyond our control.

The manager draws up an Order to terminate the employment contract , which is provided to the employee for signature. In all circumstances, the moment of termination of the employment contract is the employee’s last day of work. The settlement must be paid to him on the same day.

Registration of an employment contract without a work book for remote workers

An obvious achievement of the legislation is the introduction into the Labor Code of the Russian Federation since 2013 of provisions regulating the specifics of the work of remote workers who are not representatives of outsourcing companies.

Draw up a remote work contract correctly using the article “Sample employment contract with a remote worker 2017-2018.”

According to Art. 312.1 a remote employee is a person who works outside the territory under the control of the employer using telecommunication networks, including the Internet.

With such employees, all exchange of documents can occur electronically through the use of enhanced qualified digital signatures. At the same time, the employer is obliged to send the original contract and additional agreements to it to the distance worker by registered mail, as well as other working documents at the employee’s request.

Before the law, permanent and remote employees are equal in their rights and responsibilities. But the main “highlight” of remote work is the opportunity (by agreement with the employee) not to fill out or register a work book (Article 312.2 of the Labor Code of the Russian Federation).

What can you do to quit your job profitably?

It is especially important to fight for your rights in the case where the work was permanent and basic, that is, the person did not just work for two weeks and quit, but had a five-day schedule, salary and a long contract with the company.

The Labor Code of the Russian Federation states that after dismissal, an employee can count on compensation after dismissal. After all, losing a job in a country like Russia often leads to a long-term deterioration in financial well-being.

Options for terminating an employment contract

The Labor Code of the Russian Federation specifies the following options for terminating an employment agreement:

- Dismissal at your own request . The worker is required to notify the employer 2 weeks before cessation of activity.

- By staff reduction or initiative of the employer, who must notify of termination 2 months in advance.

- Dismissal by agreement of the parties eliminates the need to explain the reason for the decision and may be the most beneficial option for the employee.

- Due to unforeseen circumstances , which have developed in such a way that it is impossible to continue work regardless of the wishes of the parties. This includes conscription into the army, dismissal due to layoffs, revocation of a license, or a court decision.

- Due to the expiration of the contract. No additional agreements are required.

In order not to miss the opportunity to remain profitable even in the event of dismissal, you need to know your rights as an employee. The reason for dismissal is of great importance here.

Let's consider frequently encountered options in detail.