The procedure for maintaining cash accounting is strictly regulated by law. Every entry is important. But no one is immune from mistakes.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Is it possible to correct errors found in the cash book? Current legislative norms establish a certain procedure for maintaining cash accounting.

Compliance with the standards is monitored by tax authorities, the State Control Committee, internal supervisory structures and banking institutions.

If an error is discovered in the cash book, the organization is charged with violating the rules for conducting cash transactions.

This threatens tax audits and penalties. How to make corrections in the cash book, is this possible?

Are changes allowed?

As of June 1, 2014, the generally binding rules governing the procedure for performing and recording cash transactions by business entities have significantly changed.

One of these innovations is the ability to correct entries in the cash book. A similar option is provided by Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014.

Thus, according to paragraph 4.7 of this regulatory act, it is allowed to make amendments to documents drawn up on paper, but not related to cash documents.

However, such adjustments must be made in strict accordance with established requirements.

The above-mentioned Directive of the Central Bank of the Russian Federation No. 3210-U classifies as cash documents only an incoming cash order (abbreviated as PKO) and an outgoing cash order (abbreviated as RKO).

This conclusion can be drawn from the first paragraph of clause 4.1 of this regulatory act, the provisions of which clearly establish what documents should be used to document cash transactions in the organization.

Of course, cash documents are not subject to any adjustments - this requirement is regulated by the content of clause 4.7, as mentioned earlier.

If errors are made in the documentation, such papers should simply be rejected and drawn up again.

Can I make mistakes on paperwork?

Guided by the content of Directive of the Central Bank of the Russian Federation No. 3210-U, it can be argued that the cash book is mentioned in this regulatory act, but does not refer to cash documents.

A cash book is a consolidated register that takes into account information about cash transactions according to cash register and cash register accounts.

Accordingly, a cash book on paper may be subject to adjustments (corrections), if the changes made are made according to generally accepted rules - accompanied by the date of correction, as well as indicating the full name and signature of the subject who issued the corrected document.

In electronic format

The cash book, which is maintained (filled out) in electronic format, is not subject to correction after it is signed.

This norm is established by the third paragraph of paragraph 4.7 of the above-mentioned Directive of the Central Bank of the Russian Federation No. 3210-U.

If inaccuracies are allowed, a new document that no longer contains errors should be created and signed.

How are adjustments made?

How to correctly correct a paper cash book if inaccuracies/errors are found in it?

The procedure for making such edits is carried out according to the following algorithm:

- Erroneous, incorrect information (text, numbers) is crossed out with one line. The corrected data must be visible after such a crossing out.

- In the immediate vicinity of the erroneous (crossed out) data, new, correct information is entered. An important requirement is the legibility of new information and its accessibility for reading.

- Next to the correction performed, the date of change (correction) of the data is indicated.

- The subject who directly carried out this correction signs the correction made. His signature is properly deciphered here.

If an error or inaccuracy is revealed in the book, made some time ago, but affecting the cash balance, and information about such balances is transferred to subsequent pages of this register, then proper adjustment of all its sheets that need correction will be required.

Whose signature is the amendments made?

If errors/inaccuracies are identified in the organization’s cash book, its proper adjustment is carried out by the very entity – the organization’s employee – who originally compiled (filled out) this document.

The book, as you know, is filled out by a cashier or, alternatively, an accountant.

This responsibility is assigned to the cashier/accountant by the relevant administrative act - a special order from management.

Therefore, it is the cashier/accountant who must make the necessary adjustments to this cash transaction register if errors are identified that need to be corrected.

It turns out that the cashier/accountant certifies the corrected inaccuracies with their signatures. The chief accountant or manager controls the maintenance of this register.

conclusions

The cash book must be filled out by an organization that regularly carries out cash transactions.

However, this register does not officially relate to cash documents, the adjustment of which, as is known, is strictly prohibited.

Erroneous information in the paper cash book is allowed to be corrected, but such corrections must be carried out in accordance with the law.

The electronic format of the cash book does not allow any changes to be made to it. All these points are regulated by the regulations of the Central Bank of the Russian Federation.

Highlights ↑

Previously, all business entities were required to maintain a cash book. The new Directive of the Central Bank of the Russian Federation No. 3211-U allowed individual entrepreneurs not to maintain cash books.

Individual entrepreneurs and small businesses are only required to generate payroll and payroll statements when paying wages and other remunerations in cash to individuals.

For legal entities, maintaining a cash book is still mandatory. At the same time, there is no prohibition on the use of cash documents by individual entrepreneurs.

Legislative amendments mean that inspection authorities do not have the right to check the availability of this documentation and punish for its absence. If it is convenient for an individual entrepreneur to use a cash book, then he can use it to keep cash records.

According to the new Directive, the procedure for maintaining cash documentation now differs between regular and simplified. Individual entrepreneurs and small businesses should maintain documentation in a simple manner.

As for legal entities, except for banking organizations, they are required to apply the usual cash accounting procedure. The forms of standard cash documents have not changed since the entry into force of the new Central Bank Decree.

What it is

When analyzing the term “cash book”, it is worth paying attention to such concepts as cash register and cash register. These definitions are often confused with each other. This makes it difficult to understand what exactly a cash book is.

A cash register or cash register is a device required when accepting cash. That is, when something is sold for cash, an economic entity is required to use a cash register.

In some cases, it is possible to use strict reporting forms instead of cash receipts. The cash register is the totality of absolutely all cash transactions of an entrepreneur.

The cash register displays cash income and expenses. All cash revenue received, including through a cash register or cash register, must be reflected at the cash desk.

Maintaining a cash book is in no way connected with the calculation of tax payments. Even in the absence of cash transactions and cash registers, it is still necessary to maintain a cash register.

For example, expenses do not affect the calculation of tax when applying the simplified tax system or UTII.

A cash book is a document that reflects all income and expense transactions with an entrepreneur's cash.

This document contains information about all deposits from clients, suppliers, funds issued to creditors, contractors, etc.

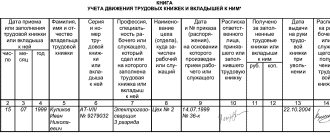

The Goskomstat resolution approves a unified form for the cash book, which is called KO-4. The book is kept on an accrual basis from the beginning of the year.

At the end of the calendar year, a new cash book is opened. If the book ends before the deadline, it is allowed to start another one and continue keeping records in chronological order.

For a sample of manually filling out a cash book, see the article: How to properly maintain a cash book.

The procedure for maintaining a cash book in electronic form.

As a rule, a ready-made book form, produced by printing, is used. It already has the required columns and columns lined up. It is also not prohibited to maintain a cash book in electronic format.

Recommendations for filling

The standard appearance of the cash book makes it easier to fill out. But you still need to comply with some requirements regarding the procedure for drawing up this document.

The main recommendations for filling out are as follows:

| Book title page | Must contain full details of the legal entity or individual entrepreneur. The time interval over which records will be kept is also indicated. |

| One book can be used for no longer than one year | It is strictly forbidden to keep one cash book for several years. |

| All pages of the document must be numbered and bound | The number of sheets must be indicated on the back of the book. |

Maintaining a cash book includes strict execution of this procedure based on six documents:

| Books of accounting of issued/received funds | Which is required to account for cash flow during the day |

| Incoming and outgoing cash orders | How is cash received and issued from the cash register formalized? |

| Cash book | Necessary for collecting information about cash transactions |

| Payroll | Used to record paid wages |

| Payroll | Necessary for recording working hours, deductions and salary payments |

In light of the new adjustments to the procedure for maintaining cash accounting, the following nuances that have arisen can be noted:

| Cash documentation can be maintained in electronic format | Documents are confirmed by electronic signature |

| Second sheet of the cash book (cashier's report) | No need to fill out |

| A general cash receipt order can be created | Both on the basis of the KKM control tape for the day, and on the basis of BSO |

| The recipient no longer has to enter the amount | Cash received in the cash settlement order |

| When issuing cash to an employee, report | It is necessary to draw up an application in any form. This is drawn up indicating the amount, period of use of the issued funds, date and signature of the manager |

| Statement of payment of wages | As before, it assumes that there is a “deposited” entry opposite the employee’s last name. Maintaining a register of deposited funds has become optional |

Normative base

The procedure for conducting cash transactions in the Russian Federation was approved by the Board of Directors of the Central Bank of the Russian Federation in 1993. In accordance with it, the organization's cash book must be numbered, laced and certified with a seal.

When filling out the cash book, each entry in it must be certified by the signatures of the chief accountant and the manager. According to the approved Procedure, the cash book is the main document confirming the receipt and expenditure of cash.

It consists of a list of incoming and outgoing orders for the cash register, having a prescribed form. The book also contains information about the cash balance at the beginning and end of the day.

Warrants are filed with the cashier's report in form KO-3. The totality of the cash book and cashier's reports are the main accounting documents when maintaining an account 50.

Resolution of the State Statistics Committee of the Russian Federation No. 88 dated August 18, 1998 approved special forms of primary documentation.

Here are also examples of forms PKO 0310001, RKO 0310002 and cash book 0310004. The same Resolution determines the maintenance of a book in a single copy.

If a company has structural divisions operating on a separate balance sheet, each one maintains a separate book. Copies of the cash books are sent to the main office.

From June 1, 2014, in accordance with Directive of the Central Bank of the Russian Federation No. 3210-U, the procedure for conducting cash transactions has been changed. The form of the book has been preserved. The changes were reflected in the optionality of maintaining this document for individual entrepreneurs.

Cash balance limit in the cash register

Legal entities independently determine the cash balance limit based on the nature of the activity, taking into account the volume of receipts or volumes of cash disbursement (Appendix to Directive No. 3210-U).

Small businesses, as well as individual entrepreneurs, are allowed to conduct cash transactions according to a simplified scheme. For example, individual entrepreneurs and small businesses may not set a cash limit (paragraph 10, paragraph 2 of Directive No. 3210-U). Especially many questions arise when conducting cash transactions of separate divisions. Let's look at several practical situations and give recommendations on how best to act.

Example 1. At the end of the working day, in a separate division of the organization, cash remains within the established limit. All cash proceeds of a separate division are transferred to the cash desk of the parent organization. The next morning, money from the cash register is given out for exchange.

If the obligation to hand over all cash proceeds of a separate division to the cash desk of the parent organization is not established, but only the right is secured, then everything is legal. It is legal to leave cash in a separate division of the organization (regardless of where it is located) at the end of the working day within the established limits.

Separate divisions that transfer proceeds to the bank into the account of a legal entity independently determine the cash balance limit (clause 2 of Directive No. 3210-U). The question is who should approve this limit by order: the division itself or the parent organization.

Example 2. Based on the results of the audit, the tax authority established that the director of the organization’s branch by order approved a new limit for the balance in the branch’s cash register. According to the inspector, the limit should be approved by order of the head of the organization. Therefore, the tax authority came to the conclusion that there was no limit on the balance in the branch’s cash register. The organization was brought to administrative responsibility under Art. 15.1 of the Code of Administrative Offenses of the Russian Federation (fined).

The actions of the tax authority are legal. The head of a branch of an organization does not have the right to approve the limit of the cash balance in the cash register by his own order. Such an order must be signed by the head of the legal entity.

Is it possible to make corrections in the cash book ↑

One of the innovations for 2021 was the ability to make corrections to the cash book. In clause 4.7 of the Directive of the Central Bank of the Russian Federation No. 3210-U, it is now stated that corrections in the cash book are possible.

Previously, the current rules established that it was impossible to correct cash documents, in particular cash orders. Nothing was said specifically about the cash book.

For this reason, the tax authorities prohibited the correction of inaccuracies and errors in the cash book. There were no grounds for such a position, since the cash book is a register, not a document.

However, the presence of corrections was subject to a fine. But only paper versions of documents can be edited.

The electronic cash book still cannot be corrected. To remove an error from an e-book, you need to create a new error-free version and re-sign it.

The need to make changes arises

Errors in the cash book can be of various types. There are errors that do not affect the final amount of the cash balance. That is, the presence of such does not change the correctness of accounting.

Such errors may include the date, surname, name of the organization and similar points if spelled incorrectly.

Other errors affect the reliable reflection of amounts. In this case, the situation is more serious, since such errors distort the entire accounting process.

For example, an incoming or outgoing amount may be written incorrectly. Correcting such errors is especially important. Depending on the nature of the inaccuracy, the method of correction differs.

How are they produced (methods)

There are two options for making corrections to the cash book. If the presence of an error does not affect the final result, then correcting the mistake is not so difficult.

You need to cross out the incorrect meaning with one line. The correct information is written above. Corrections in the cash book must be certified by the signatures of responsible persons.

When a mistake is made that distorts the accounting results, that is, the numerical value of the amount is indicated incorrectly, just crossing it out is not enough.

A complete revocation of the page containing the inaccuracy is required. Then a new cash sheet is drawn up, but with the correct data. An erroneous sheet is crossed out with two lines diagonally (a cross).

In addition, it is important to follow the procedure for correcting a significant error in the cash book. If the cashier wrote the amount incorrectly and noticed his mistake, he must submit a report to the chief accountant or director.

After this, a special commission is created to control the making of corrections in the cash book. After the correction, the cashier draws up a proper certificate indicating the errors and corrections made.

Corrections must be made by the same employee who originally compiled the document. That is, this is the person who, by order of management, is entrusted with the responsibility for maintaining the cash book - a cashier or accountant.

If you discover an error that is several days old, you need to correct all the sheets with incorrect data. This is due to the influence of inaccuracy on cash register balances, since the numerical data of one sheet is transferred to the next page.

Whose signatures are used to certify the corrections made?

A correction made to the cash book requires proper registration. The date of editing, full name must be indicated. the person who identified the inaccuracy and his signature.

According to clause 4.7 of Directive No. 3210-U, any correction in the cash book must be certified by the cashier and the chief accountant. That is, both signatures are placed.

The same correction procedure is established based on the provisions of Part 7, Article 9, Part 8, Article 10 of Federal Law No. 402 of December 6, 20011.

It is considered a grave violation if there are erasures and unspecified edits in the book. Under no circumstances should you tear out damaged sheets, use a corrector, or clean up the error with a blade.

Correction of the electronic cash book is possible only by creating a new document (page). In this case, the created document is certified in the usual manner.

What documents can be corrected?

When making changes to a document, the period of its preparation does not matter. Simply put, you can correct both a document drawn up on the current day and on previous days. The exception is a document on which information has already been sent to the tax authority or its existence has already affected the financial result of the institution and is taken into account in the final financial statements.

At the same time, there will be significant differences between making changes to a document drawn up on paper and a document drawn up and approved via an electronic digital signature.

Amount of fines ↑

The Tax Service checks the correctness of cash discipline by organizations. However, there are no specific deadlines or frequency of inspections.

During the year, the number of inspections is determined exclusively by regulatory authorities. Violation of keeping score 50 provides for punishment under the Administrative Code of the Russian Federation (Article 15, paragraph 1).

The fine for the organization reaches fifty thousand rubles. The statute of limitations for this offense is two months. Corrections in the cash book must be carried out in accordance with established requirements.

Find out whether an individual entrepreneur should keep a cash book from the article: individual entrepreneur cash book.

What is a cash book?

Sample of filling out a cash receipt order.

If the tax authority discovers non-compliance with the established procedure, the company will be fined. But you need to take into account that a fine can only be imposed if an error is discovered that was committed no earlier than two months at the time of the inspection.

Changes in legislation have significantly simplified the procedure for conducting transactions on account 50. The ability to maintain an electronic book has also become a significant advantage. Thus, accounting becomes more perfect.

But in any case, whether the cash book is kept in paper or electronic form, it is better to avoid mistakes. Although these can be corrected from now on, they take up a lot of working time.

Previous article: How to properly maintain a cash book Next article: How to properly sew a cash book

Procedure

It is necessary to maintain a cash book from the beginning of each calendar year, where its validity period must be indicated on the title page. If one book is not enough for a certain period (calendar year), you need to create or download another sample. You can use Excel form, where you can continue to record all income and expenses in chronological order.

Special attention must be paid! On the second copy of the book you also need to write the start and end dates of its maintenance. Thanks to this, neither the individual entrepreneur himself nor the inspector will be able to get confused in the sequence of filling out cash register data.

Nowadays, individual entrepreneurs buy ready-made printed cash books of a sample excel form, which do not need to be drawn on special columns - that is, a ready-made form. In addition, a sample of books can be downloaded for free on our website and, in the future, maintained based on established rules.

Corrections in the cash book: possible or not?

The rules covering the procedure for carrying out cash transactions have undergone significant changes since June 2014. One of these innovations is the ability to make changes to the cash book. It would be more accurate to say that now clause 4.7 of the instructions of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U states that it is possible to correct data in the cash book.

Read about new changes in the cash register from 08/19/2017:

- “Changes in the procedure for conducting cash transactions”;

- "New rules for working with accountables."

Previously, the current rules established that cash documents cannot be corrected (here we mean receipts and debit orders), but there was no specific information about the cash book. Inspecting authorities often took advantage of this circumstance, extending the ban to corrections in the cash book. This position had no basis, since a cash book is not a document, but a register.

Important: only paper cash books can be corrected. The electronic cash book cannot be edited.

Since corrections in the electronic cash book are unacceptable, you need to generate a new document, without errors, and sign it again.

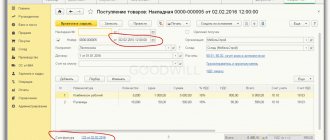

How to fill out RKO correctly

Important! Today, in cash settlement services, the recipient does not necessarily have to fill out the amount received by hand. It can also be printed on a computer (instructions of the Bank of Russia No. 3210-U dated March 11, 2014).

RKO (expenditure cash order) can be issued either by hand or using special technical means. When filling out the cash register by hand, you can use any color of ink; there are no restrictions in this case. In the “Base” line, the content of the business transaction is indicated, for example, like this: “Reimbursement of overexpenditure according to the advance report dated August 31, 2018 No. 123.” The “Appendix” line should contain a list of attached primary documents (invoices, applications, etc.), indicating their numbers and dates of preparation.

RKO numbering can be done at will, as is convenient for the organization. As a rule, numbering is used in ascending order or using a combination of letters and numbers. Numbering can be continuous or non- continuous. The procedure for maintaining cash documents does not oblige companies to maintain their continuous numbering. There is no liability for violation of order numbering. However, if omissions or duplicate numbers are found, the regulatory authorities may conclude that there may have been unaccounted funds in the cash register. And this in turn will lead to a more thorough check (

How to correct an error in the cash book

The question of the possibility of edits has been resolved, now let’s reproduce the algorithm for making corrections:

Step 1.

You need to cross out the erroneously entered data.

Step 2.

Next to the crossed out erroneous data, enter the correct data. It is very important that they are readable and legible.

Step 3.

We indicate the date the corrections were made.

Step 4.

The signature of the person by whom the corrections were made is affixed, with a transcript.

Corrections must be made by the same employee who originally compiled the document. Since the cash book is maintained by a cashier or accountant (this responsibility is assigned to them by order), it is they who will have to make corrections when errors are detected.

Important: if an error is discovered that was made several days ago, and it affects the cash balances, the data of which is transferred to subsequent sheets of the cash book, then all sheets that require such corrections are subject to correction.

The material “Cash Discipline and Responsibility for Violating It” will help you check whether you are making mistakes in cash discipline.

The cashier went on vacation

The cashier, with whom an agreement on full financial responsibility has been concluded, may go on vacation. During this time, cashier duties are usually assigned to another employee. Companies often forget that in the event of a change in financially responsible persons, an inventory is required (clause 22 of the “Methodological guidelines for accounting of inventories”, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, clause 27 of the “Regulations on accounting and accounting statements in the Russian Federation", approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

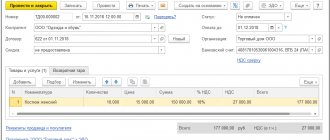

Corrections in the cash book: sample

Now let's move on from theory to practice, and, following the instructions we previously presented, we will make changes to the cash book.

Let’s imagine that in the cash book the corresponding account was incorrectly indicated for the amount issued for the account for the consumables. This is what the cash book sheet looked like before the correction:

| Document Number | From whom it was received or to whom it was issued | Corresponding account number, subaccount | Income, rub. cop. | Expense, rub. cop. |

| Balance at the beginning of the day | 10 000 | X | ||

| Orlov K. A. | 3 000 | |||

| Total for the day: | 3 000 | |||

| Finally the rest of the day: | 7 000 | X | ||

Cashier Kulikova D.I.

I checked the entries in the cash book and received documents in the amount of ____-____ receipts and __one__ expenses.

Accountant Tarasova N. G.

And this is what the cash book sheet will look like after correction:

| Document Number | From whom it was received or to whom it was issued | Corresponding account number, subaccount | Income, rub. cop. | Expense, rub. cop. |

| Balance at the beginning of the day | 10 000 | X | ||

| Orlov K. A. | 51 71 | 3 000 | ||

| Total for the day: | 3 000 | |||

| Finally the rest of the day: | 7 000 | X | ||

Cashier Kulikova D.I.

I checked the entries in the cash book and received documents in the amount of ____-____ receipts and __one__ expenses.

Accountant Tarasova N. G.

Corrected believe Cashier Kulikova D.I. 08/23/17

Now you know exactly how to correct the error made in the cash book correctly.

> Results

It is possible to correct errors in the cash book. But this must be done according to strict regulations, which are described above in this article.