Concept and types of advertising expenses

The main task of advertising is to attract and maintain the attention of potential buyers to goods, works and services.

However, in order for the expenses incurred to be called advertising, they must satisfy the conditions of paragraph 1 of Art. 3 of the Law “On Advertising” dated March 13, 2006 No. 38-FZ, namely: to attract and maintain attention to the object of advertising among an indefinite circle of people in order to promote it in the market. According to para. 2 p. 2 art. 346.16 of the Tax Code of the Russian Federation, simplifications take into account advertising expenses in the same manner as income tax payers (according to the rules of Article 264 of the Tax Code of the Russian Federation). And in paragraph 4 of Art. 264 of the Tax Code of the Russian Federation provides that advertising costs are classified as non-standardized and standardized (clause 4 of Article 264 of the Tax Code of the Russian Federation).

Note! Advertising costs can only be taken into account by single tax payers with the object of taxation “income minus expenses” (clause 20, clause 1, article 346.16 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 20, 2010 No. 03-11-06/2/63).

Non-standardized expenses are fully taken into account for single tax purposes. Normalized items are taken into account in an amount not exceeding 1% of sales revenue, calculated in accordance with Art. 249 of the Tax Code of the Russian Federation.

USN. Costs for making a sign

The entrepreneur applies the simplified tax system (income minus expenses). I ordered a sign and a security sign for the store from an advertising agency.

Can these expenses be attributed to clause 20 of Art. 346.16 of the Tax Code of the Russian Federation and reduce the tax base by the amount of these expenses?

According to clause 4 of PBU 6/01 “Accounting for fixed assets”

, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n, when accepting assets for accounting as fixed assets,

the following conditions must be simultaneously met

:

a) use in the production of products when performing work or providing services or for the management needs of the organization;

b) use for a long time, that is, a useful life exceeding 12 months or a normal operating cycle if it exceeds 12 months;

c) the organization does not intend to subsequently resell these assets;

d) the ability to bring economic benefits (income) to the organization in the future.

According to paragraph 4 of Art. 346.13 Tax Code of the Russian Federation

if at the end of the tax (reporting) period the residual value of fixed assets and intangible assets, determined in accordance with the legislation of the Russian Federation on accounting, exceeds 100 million rubles, such a taxpayer is considered to have switched to the general taxation regime from the beginning of the quarter in which the this is an excess.

Essentially, this provision obliges taxpayers using the simplified taxation system

(including individual entrepreneurs),

keep records of fixed assets in accordance with the legislation of the Russian Federation on accounting

.

In particular, the rules for the formation of information about fixed assets in accounting are established by PBU 6/01

.

The sign is usually used for a long period of time (more than 12 months), so it satisfies the conditions of clause 4 of PBU 6/01

and, therefore,

should be accounted for as part of fixed assets

.

Regarding the duty plate, you need to determine for what period of time you will use it.

If the useful life of the plate is more than 12 months

, then it can be taken into account as part of fixed assets.

If the useful life of the regime plate does not exceed 12 months

, then the costs of its production can be taken into account as material costs.

Thus, the costs of producing signs and regime plates (with a useful life of more than 12 months) reduce the tax base for the single tax

, but not as expenses for advertising manufactured (purchased) and (or) sold goods (works, services), trademarks and service marks (clause

20, paragraph 1, article 346.16 of the Tax Code of the Russian Federation

), but as expenses for the acquisition of basic funds (

clause 1, clause 1, article 346.16 of the Tax Code of the Russian Federation

).

According to paragraphs 1 clause 3 art. 346.16 Tax Code of the Russian Federation expenses for the acquisition of fixed assets

in relation to fixed assets acquired during the period of application of the simplified taxation system,

are accepted at the time of putting these fixed assets into operation

.

In accordance with paragraph 2 of Art. 346.17 Tax Code of the Russian Federation

Taxpayer expenses are recognized as expenses after they are actually paid.

Expenses for the acquisition of fixed assets, taken into account in the manner provided for in paragraph 3 of Art. 346.16 Tax Code of the Russian Federation

, are reflected on the last day of the reporting (tax) period.

If the initial cost of fixed assets does not exceed 10,000 rubles

, then you can take into account the costs of their acquisition as material expenses (according to

clause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation

).

According to paragraph 2 of Art. 346.16 Tax Code of the Russian Federation

expenses specified in

paragraphs.

5 p. 1 art. 346.16 of the Tax Code of the Russian Federation , are adopted in relation to the procedure provided for calculating corporate income tax,

Art.

254 Tax Code of the Russian Federation .

In accordance with Art. 254 of the Tax Code of the Russian Federation to material costs

,

in particular, include

the taxpayer’s expenses for the acquisition of property that is not depreciable property.

The cost of such property is included in material costs in full as it is put into operation

.

Depreciable property is recognized as

property with a useful life of more than 12 months and an initial cost of more than 10,000 rubles (

clause 1 of Article 256 of the Tax Code of the Russian Federation

).

Therefore, fixed assets whose initial cost does not exceed 10,000 rubles can also be taken into account according to pp.

5 p. 1 art. 346.16 of the Tax Code of the Russian Federation as material expenses

.

Determine whether expenses are

on the production of signs with advertising costs,

it is important for tax purposes with the advertising tax

.

The sign may be advertising or informational in nature.

According to Art. 2 of the Federal Law of the Russian Federation of July 18, 1995 No. 108-FZ “On Advertising”,

advertising is information

distributed in any form, by any means about an individual or legal entity, goods, ideas and initiatives (advertising information), which is intended for an indefinite audience. circle of persons and is intended to generate or maintain interest in these individuals, legal entities, goods, ideas and initiatives and to facilitate the sale of goods, ideas and initiatives.

That is, the placement of a sign that meets these requirements is recognized as advertising.

In accordance with paragraph 1 of Art. 9 of the Law of the Russian Federation dated 02/07/1992 No. 2300-1 “On the protection of consumer rights”

The manufacturer (performer, seller) is obliged to bring to the attention of the consumer the brand name (name) of his organization, its location (legal address) and its mode of operation.

The seller (performer) places the specified information on the sign

.

The manufacturer (performer, seller) - an individual entrepreneur - must provide the consumer with information about state registration and the name of the body that registered it.

If a sign contains such information, then it is informational.

Its placement in this case is not intended to disseminate advertising information and therefore cannot be considered an object of taxation under the advertising tax.

Non-standard advertising expenses

Non-standardized expenses include:

- advertising expenses for events through the media and telecommunications networks, as well as for video and film services (including advertisements in print media, broadcast on radio and television);

- expenses for outdoor advertising, advertising stands, billboards, including illuminated advertising;

- expenses for participation in exhibitions, expositions and fairs, window dressing, sales exhibitions, image rooms, showrooms, production of advertising brochures, catalogs for products and services, including exhibited products, markdowns of goods, products that have lost their original qualities, commodity sign and service mark, and information about the company itself.

The list of non-standardized advertising expenses is closed.

Example

In the 4th quarter, Hermes LLC incurred expenses for the production of a leaflet in the amount of 8,000 rubles. The production of leaflets, like other printed advertising products, is considered a non-standardized expense (letter of the Ministry of Finance of Russia dated March 16, 2011 No. 03-03-06/1/142). Expenses will be fully taken into account when calculating the single tax on the basis of clause 4 of Art. 264 of the Tax Code of the Russian Federation as non-standardized advertising expenses.

Costs of maintaining exposures during sleep

Good afternoon, The list of advertising expenses is established in clause 4 of Art. 264 of the Tax Code of the Russian Federation, according to which, advertising expenses in full include the following expenses: for participation in exhibitions, fairs, expositions, for the design of shop windows, sales exhibitions, sample rooms and showrooms, production of advertising brochures and catalogs containing information about goods sold, work performed, services provided, trademarks and service marks, and (or) about the organization itself, for the discounting of goods that have completely or partially lost their original qualities during exposure. Based on paragraphs. 20 clause 1 art. 346.16 of the Tax Code of the Russian Federation, organizations that apply the simplified tax system with the object of taxation “income minus expenses” can take into account the costs of advertising manufactured (purchased) and (or) sold goods (work, services), trademark and service mark.

In the Letter of the Federal Tax Service of the Russian Federation for Moscow dated September 14, 2006 N 18-11/3/ [email protected] , it is said: In paragraphs. 20 clause 1 art. 346.16 of the Tax Code of the Russian Federation provides for the costs of advertising manufactured (purchased) and (or) sold goods (work, services), trademark and service mark. Moreover, in accordance with paragraph 2 of Art. 346.16 of the Tax Code of the Russian Federation, such expenses are accepted in relation to the procedure provided for calculating corporate income tax, art. 264 Tax Code of the Russian Federation. Based on paragraphs. 28 clause 1 art. 264 of the Tax Code of the Russian Federation, advertising costs should be taken into account taking into account the provisions of paragraph 4 of Art. 264 of the Tax Code of the Russian Federation, which establishes the following. The expenses of organizations on advertising include, in particular, the costs of participation in exhibitions, fairs, expositions, the design of shop windows, sales exhibitions, sample rooms and showrooms, the production of advertising brochures and catalogs containing information about goods sold, work performed, services provided. services, trademarks and service marks and (or) about the organization itself, for the discounting of goods that have completely or partially lost their original qualities during exhibition. Thus, expenses that correspond to the above definition of the Tax Code of the Russian Federation can be taken into account when determining the tax base for the tax paid in connection with the application of the simplified tax system as advertising expenses.

Consequently, organizations that apply the simplified tax system with the object of taxation “income minus expenses” have the right to reduce the income received by the amount of material expenses and expenses for advertising manufactured (purchased) and (or) sold goods in the presence of supporting documents, in particular, expenses for window dressing and expositions of goods sold. These expenses are accepted when calculating the single tax according to the simplified tax system in full, after their actual payment and the availability of documents confirming the expenses (Letter of the Ministry of Finance of the Russian Federation dated October 2, 2019 N 03-11-11/75556).

Sincerely, A. Greshkina

Standardized advertising expenses

Standardized advertising expenses include:

- expenses for the purchase of prizes for drawings during mass advertising campaigns;

- other expenses not related to non-standardized advertising expenses.

Other expenses may include any advertising expenses not specified in clause 4 of Art. 264 Tax Code of the Russian Federation. At the same time, they will be taken into account as part of the normalized advertising costs in an amount not exceeding 1% of revenue calculated in the manner provided for in Art. 249 of the Tax Code of the Russian Federation.

Example

Expenses for carrying out a promotional campaign for tasting advertising products are included in the normalized advertising expenses, classifying them as other advertising expenses (clause 4 of Article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 16, 2005 No. 03-04-11/205).

Check whether you have correctly taken into account advertising costs under the simplified tax system using a ready-made solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

Rules for recording advertising expenses under the simplified tax system

The procedure for accounting for advertising expenses for organizations on the OSN and the simplified tax system is the same (paragraph 2, paragraph 2, article 346.16, article 264 of the Tax Code of the Russian Federation). However, with one amendment: advertising expenses under the simplified tax system are recognized after their actual payment (clause 2 of article 346.17 of the Tax Code of the Russian Federation).

Advertising expenses for accounting purposes are recognized as expenses for ordinary activities as commercial expenses (clauses 5, 7 of the Accounting Regulations “Expenses of Organizations” PBU 10/99).

Advertising costs are reflected as part of sales expenses in the debit of account 44 (instructions for using the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

For accounting purposes, there is no need to normalize advertising costs. They can be fully included in the costs of the reporting period in which they were incurred, if this is fixed by the accounting policy (clause 9, clause 20 of PBU 10/99).

Can an organization include expenses for marketing services as expenses under the simplified tax system?

G.P. Kholodnykh, author of the answer, Ascon consultant on accounting and taxation

QUESTION

The organization provides catering services (restaurant). Applies the simplified tax system “Income minus expenses”.

In the course of business activities, an agreement was concluded to conduct marketing research to collect information necessary to formulate the emotional positioning of the restaurant. In-depth interviews of visitors were conducted: preparing tools, conducting interviews, analyzing interviews, and reporting.

Please provide an answer with reference to the regulatory framework. Is it possible to accept these services for tax accounting under the simplified tax system?

ANSWER

There is no clear answer to your question. Acceptance of costs for marketing services for tax accounting under the simplified tax system may cause claims from the tax authorities. The organization must be prepared to defend its position in court.

JUSTIFICATION

In accordance with sub. 5 p. 1 art. 346.16 of the Tax Code of the Russian Federation, organizations using the simplified tax system have the right to write off material expenses.

Organizations using the simplified tax system take into account material expenses in accordance with the procedure provided for taxation of profits (Article 254 of the Tax Code of the Russian Federation). Subclause 6 of clause 1 of this article classifies as material expenses the costs of purchasing production services performed by third-party organizations or individual entrepreneurs.

The list of material costs is not exhaustive. They may also include other documented costs that are directly related to the production and sales process.

Neither accounting nor tax legislation defines the list of documents that must be drawn up by the customer and the performing organization when accepting and transmitting the results of marketing research.

Courts accept claims from tax authorities for expenses on marketing services if the documents contain only the names of work performed or services provided (Resolution of the Arbitration Court of the Volga District of May 4, 2017 N F06-19919/2017 in case No. A65-29333/201, Resolution of the Arbitration Court Court of the West Siberian District dated December 27, 2017 No. F04-5263/2017 in case No. A27-3537/2017, Resolution of the Central District Court dated October 8, 2019 No. F10-4814/2019 in case No. A35-3954/2018).

Therefore, in order to avoid disputes with the tax office, it is advisable to prepare documents confirming the need for such research.

There is also judicial practice confirming that the list of expenses provided for in paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation, this type of expense such as marketing services is not included, therefore, its inclusion in expenses when calculating tax according to the simplified tax system is unlawful (Resolution of the Arbitration Court of the West Siberian District dated October 26, 2015 N F04-25496/2015).

The Ministry of Finance in its letter dated May 20, 2019 N 03-11-11/36060 indicated that the costs of purchasing production services performed by third-party organizations or individual entrepreneurs when determining the object of taxation for the tax paid in connection with the application of the simplified taxation system , are taken into account as expenses on the date of payment to their suppliers or offset of mutual claims. Moreover, these services must already be provided by third-party organizations and individual entrepreneurs.

Previously, the Ministry of Finance took the following position: “The list of expenses given in Article 346.16 of the Code does not include expenses for payment for accounting and marketing services provided by third-party organizations. Based on the foregoing, the taxpayer does not have the right to reduce the income received by the specified costs when determining the object of taxation for a single tax" (Letter of the Ministry of Finance of the Russian Federation dated October 22, 2004 N 03-03-02-04/1/31).

So there is no clear answer to your question. Acceptance of costs for marketing services for tax accounting under the simplified tax system may cause claims from the tax authorities. The organization must be prepared to defend its position in court.

Calculation of the maximum amount of standardized advertising expenses

As mentioned, standardized advertising expenses can be included in costs in the amount of no more than 1% of sales revenue calculated according to Art. 249 of the Tax Code of the Russian Federation (subparagraph 20, paragraph 1, article 346.16, paragraph 5, paragraph 4, article 264 of the Tax Code of the Russian Federation).

IMPORTANT! When calculating the standard within which certain types of advertising expenses can be taken into account, taxpayers using the simplified tax system take into account the proceeds received from sales (clause 1 of Article 346.17 of the Tax Code of the Russian Federation) and the amount of advances received from buyers (letter of the Ministry of Finance of Russia dated 11.02) as part of income .2015 No. 03-11-06/2/5832).

Example

Vyuga LLC placed advertising posters in public transport in the 1st quarter. The cost of the service was 32,200 rubles. The company's sales revenue for the 1st quarter is 578,000 rubles.

Let's calculate the maximum amount of standardized advertising costs:

578,000 × 1% = 5,780 rub.

Consequently, normalized advertising expenses in the amount of 5,780 rubles can be included in the actually incurred expenses based on the results of the 1st quarter.

Thus, only a small part of the expenses incurred was included in expenses for tax purposes under the simplified tax system. The tax base under the simplified tax system is formed on an accrual basis from the beginning of the year (clause 5 of article 346.18 of the Tax Code of the Russian Federation). Consequently, with an increase in the volume of accumulated revenue, the size of the maximum amount of normalized advertising expenses to be included in the costs of the “simplified” tax will also increase.

During the reporting period, you can gradually include excess advertising expenses in the organization’s expenses for tax accounting. The remaining expenses cannot be carried over to the next year.

Example

Aphrodite LLC conducted an advertising campaign in the 1st quarter of 2021 to attract new clients through free cosmetic procedures. Information about the promotion was posted on the Internet, the cost of placement was 9,870 rubles. The cost of free cosmetic procedures was 86,400 rubles. Amounts are shown excluding VAT. There were no other advertising expenses in the current period. Expenses for advertising on the Internet are included in the expenses for holding an event through telecommunication networks, since the Internet is recognized as a public telecommunications network (letter of the Ministry of Finance of Russia dated 04/05/2010 No. 03-11-06/2/48, dated 07/15/2009 No. 03-11 -09/248, dated January 29, 2007 No. 03-03-06/1/41). Consequently, such expenses are not standardized and are recognized in full in the 1st quarter of 2020 (clause 4 of article 264 of the Tax Code of the Russian Federation).

Standardized expenses include expenses for free cosmetic procedures (clause 4 of Article 264 of the Tax Code of the Russian Federation). Consequently, the amount of expenses accepted for tax accounting should not exceed 1% of revenue.

- Calculation for the 1st quarter of 2021:

Volume of proceeds received from sales: RUB 427,580.

Limit value of standardized expenses: 427,500 × 1% = 4,275 rubles.

Amount of recognized standardized expenses: RUB 4,275.

Amount of recognized non-standardized expenses: RUB 9,780.

The amount of the carryover balance of normalized advertising expenses: 86,400 – 4,275 = 82,125 rubles.

- Calculation for the first half of 2021:

Volume of proceeds received from sales: RUB 947,300.

Limit value of standardized expenses: 947,300 × 1% = 9,473 rubles.

The amount of recognized standardized advertising expenses: RUB 9,473.

The amount of the carryover balance of normalized advertising expenses: 86,400 – 9,473 = 76,927 rubles.

- Calculation for 9 months of 2021:

Volume of proceeds received from sales: RUB 1,458,700.

Limit value of standardized expenses: 1,458,700 × 1% = 14,587 rubles.

The amount of recognized standardized advertising expenses: RUB 14,587.

The amount of the carryover balance of normalized advertising expenses is 86,400 – 14,587 = 71,813 rubles.

- Calculation for 2021:

Volume of proceeds received from sales: RUB 2,248,500.

Limit value of standardized expenses: 2,248,500 × 1% = 22,485 rubles.

The amount of recognized standardized advertising expenses: RUB 22,485.

Remaining normalized advertising expenses: 86,400 – 22,485 = 63,915 rubles.

Aphrodite LLC will be able to take into account expenses for tax purposes under the simplified tax system for 2021 22,485 rubles. expenses for free cosmetic procedures and 9,870 rubles. expenses for holding an event via the Internet. The amount of advertising expenses is 63,915 rubles. will remain not included in expenses, and it cannot be transferred to the next tax period.

In the book of accounting for income and expenses, advertising costs are reflected in column 5 “Expenses taken into account when calculating the tax base”, section I “Income and expenses”.

For information on the procedure for filling out the book of income and expenses, read the article “The procedure for filling out the KUDiR under the simplified tax system “income minus expenses”.”

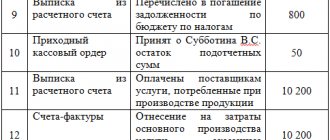

The following entries will be made in accounting:

- Dt 44 Kt 10 - cosmetics were written off for advertising procedures.

- Dt 44 Kt 70 - wages were accrued to employees for carrying out advertising procedures. Document - payroll.

- Dt 44 Kt 60 - reflects the cost of the service for placing a promotion on the Internet. Document-basis: act of acceptance and delivery of services provided.

- Dt 90.2 Kt 44 - the cost of the advertising campaign has been written off. Document: accounting statement-calculation.

Results

Only single tax payers with the object of taxation “income and expenses” can recognize advertising expenses when calculating the single tax. Non-standardized expenses can be taken into account when calculating the single tax in the full amount of paid advertising costs, and normalized expenses can be taken into account only within 1% of the revenue received and advances received in the reporting period.

About the nuances of reflecting expenses and the requirements for expenses, read the article “Accounting for expenses under the simplified tax system with the object “income minus expenses” " .

Sources:

- Tax Code of the Russian Federation

- Law “On Advertising” dated March 13, 2006 No. 38-FZ

- PBU 10/99, approved. by order of the Ministry of Finance of Russia dated May 6, 1999 N 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.