The procedure for filling out payment orders in 2021

The payment order form remains the same; its form is contained in Appendix 2 to the Regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P (OKUD 0401060). But the rules for filling out payment slips, approved by order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n, were amended in 2021.

Let us recall the basic requirements for how to fill out a payment order for 2021:

- Payer status (101) indicates the person making the payment: “01” - legal entity, “02” - tax agent, “09” - individual entrepreneur, etc.

- When listing tax payments, in the fields provided for the TIN (60) and KPP (102) of the recipient, indicate the details of the Federal Tax Service, and in the field “Recipient” (16) - the region, and in brackets - the name of the specific Federal Tax Service. You should especially carefully fill out the Federal Treasury account number (17) and the name of the recipient's bank (13) - if there is an error in these details, the tax or contribution is considered unpaid and will have to be paid again, in addition, the Federal Tax Service will calculate penalties for late payment if the payment deadline has already passed. passed.

- The order of payment for taxes (21) is 5.

- BCC (104) must be valid at the time of payment and correspond to the transferred tax or contribution. Let us remind you that from January 1, 2017, insurance premiums, with the exception of contributions for “injuries,” should be transferred to the Federal Tax Service, therefore, the BCC for them has also changed.

- OKTMO code (105) is indicated at the place of residence of the individual entrepreneur, the location of the legal entity, or its property.

- Ground (106) when paying current payments is designated as “TP”, when filling out a payment order at the request of the Federal Tax Service in 2017, or FSS - “TR”, repayment of debt - “ZD”, debt under the inspection report - “AP”.

- The period for which the insurance premium/tax is paid (107): at the basis of “TP” and “ZD” the reporting (tax) period is indicated, for “TR” the date of the claim is indicated, and for “AP” - “0”.

- Payment type (110) – usually “0”.

An example of filling out the fields of a payment order in 2021.

At the request of the Federal Tax Service

The procedure for filling out a payment order at the request of the Federal Tax Service has its own peculiarities. In 2021:

| Filling out a payment based on the request from the Federal Tax Service | |

| Field | What to indicate |

| 106 “Basis of payment” | Specify "TR". That is, repayment of the debt based on the request received from the inspectorate. |

| 107 “Tax period indicator” | The payment deadline established in the request for payment of taxes and fees. In the format "DD.MM.YYYY". |

| 108 “Document number” | Number of the request for payment of tax, insurance premium, fee |

| 109 | Date of the tax authority's request for payment of tax, insurance premium, fee |

Also, the rules for filling out a payment order in 2021 state: if the transfer of taxes, fees, and insurance premiums occurs at the request of regulatory agencies, the value of the UIP (field 22 - unique payment identifier) must be indicated directly in the request issued to the payer.

Otherwise, filling out tax fields in a payment order has not undergone major changes since 2017.

Filling out a payment order from April 25, 2021

The latest changes to the Rules came into force on April 25, 2017 (Order of the Ministry of Finance dated April 5, 2017 No. 58n). Let's look at what's new in the updated Instruction 107n when filling out payment orders for 2017:

- The issue with taxpayer status in field 101 of payment slips for the transfer of insurance premiums has been resolved. The position of the Federal Tax Service has changed on this matter more than once since the beginning of 2017, and now, finally, the tax authorities have decided - from April 25, 2021, in field 101 of the payment order the following should be indicated:

- code 01 – when the organization transfers contributions for employees,

- code 09 – when an individual entrepreneur transfers contributions for employees or for himself.

When transferring insurance premiums for “injuries” to the Social Insurance Fund and other budget payments not administered by the tax authorities, organizations and individual entrepreneurs indicate code 08 in the payment field 101.

For example, for an individual entrepreneur paying insurance premiums for himself in 2017, filling out a payment order will be as follows:

What to follow

The sample payment order that is relevant for filling out in 2017 is fixed by the regulation of the Central Bank of Russia dated June 19, 2012 No. 383-P. This form has index 0401060.

The basic rules for filling out a payment order in 2021 are set out:

- In the Regulations of the Central Bank dated June 19, 2012 No. 383-P.

- Order of the Ministry of Finance of the Russian Federation of November 12, 2013 No. 107n.

Moreover, the second of these regulatory documents was amended and supplemented by order of the Ministry of Finance dated April 05, 2021 No. 58n. Thus, new rules and requirements apply to filling out a payment order from April 25, 2021.

Please note right away that filling out the fields of a payment order in 2021 varies depending on:

- who makes the payment - the obligated person or a third party;

- what payment needs to be made - tax, insurance premium, fee;

- there is a voluntary payment or a request has already been received from the Federal Tax Service for the transfer of payment within the period specified therein.

Payment order sample 3

- A new filling out of payment orders has been approved in 2021 for making payments to the budget for third parties. The opportunity to pay off debts on taxes and state duties for other taxpayers appeared from November 30, 2016, and from January 1, 2017, you can pay insurance premiums for others, except for “injuries” in the Social Insurance Fund.

From April 25, 2017, when making payments for other persons, the following rules for filling out a payment order in 2021 must be observed:

- In the fields provided for the payer's TIN and KPP, the TIN and KPP of the person for whom the tax or insurance premium is being transferred is indicated. When paying for an individual who does not have a TIN, “0” is indicated instead.

- “Payer” in the appropriate field indicates the one who transfers funds from his current account.

- “Purpose of payment” - here you must first indicate the TIN/KPP of the person who is paying, and then, after the “//” sign, enter the taxpayer for whom they are paying.

- The payer status (field 101) is indicated according to the status of the person for whom the payment is made: 01 – legal entity, 09 – individual entrepreneur, 13 – individual.

Example. Payment for another organization (Alpha LLC for Yakor LLC) of transport tax - payment order (filling sample 2017):

Insurance premiums for individual entrepreneurs

In the situation of filling out a payment order for individual entrepreneurs for insurance premiums, starting from 2021, these deductions are supervised by the Tax Service of Russia. That's why:

- recipient of payments - tax inspectorates;

- in field 101 – code 09.

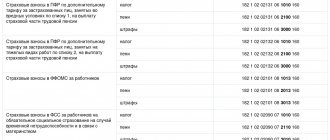

In field 104, when filling out a payment order in 2021, you must enter one of the following BCCs:

- 182 1 0210 160 – fixed pension contributions from the minimum wage, additional payment for such contributions;

- 182 1 0213 160 – entrepreneur’s contributions to compulsory medical insurance.

Also see “Insurance premiums of individual entrepreneurs “for themselves” in 2021: how much to pay to the Federal Tax Service.”

Requirements for making a payment

The payment can be generated either in electronic format (must be signed with digital signature) or in paper format.

The following requirements apply to a paper payment form:

- The payment must be drawn up on a sheet of paper no larger than A4;

- The number of copies generated is determined by the credit institution;

- The payer must put his personal signature and stamp on the first copy;

- When the bank accepts a payment for execution, it checks the compliance of the affixed signature with the available card with sample signatures.

In no case should there be corrections or erasures in the fields of the payment order. The credit institution is responsible for monitoring the integrity of the payment.

The bank will only be able to accept a payment that is drawn up in an officially approved form and in which all the necessary details are filled out.

Deadlines for payment of labor income tax

Personal income tax must be paid strictly within certain deadlines. Consider them:

- Salary Employers must pay their employees wages twice a month - in the form of an advance payment, as well as a final payment. The tax must be paid once a month - simultaneously with the final payment.

- Sick leave benefits and vacation pay. The tax on them must be paid no later than the last day of the month of their payment.

- Calculation of severance. When an employee resigns, the employer must pay him in full on his last day of employment. The tax must be paid on the same day.

What is UIN on a receipt?

To individual entrepreneurs making advance payments for personal income tax, tax authorities can send, along with the notification, ready-made receipts (Form No. PD (tax)) for the amount determined according to Form 4-NDFL. At the top of such a receipt there is a line “Document Index”, which indicates the 20-digit code of the unique accrual identifier. If an individual entrepreneur transfers an advance on personal income tax by payment order, then he must indicate this UIN index in field 22 “Code” (Explanations of the Federal Tax Service of the Russian Federation dated March 28, 2014).

By the way, as the Federal Tax Service of the Russian Federation explains in its letter dated 04/08/2016 No. ZN-4-1/6133, individual entrepreneurs, heads of peasant farms, notaries, lawyers and other individuals, when transferring payments to the budget, must indicate their INN or UIN in payment slips . Banks that require taxpayers to fill out two details at once and refuse to accept payments with one of these details violate Ministry of Finance Order No. 107n. If the payment order contains a Taxpayer Identification Number (TIN), then in field 22 “Code” the UIN should be replaced with the value “0”, and vice versa, the presence of a UIN does not require the TIN to be reflected in the payment order.

If field “Code” 22 in the payment order is filled in with an error

You should be very careful when filling out field 22, since by indicating an incorrect UIN number in a payment order, the taxpayer risks a lot.

The UIN allows a special information system to quickly and accurately identify a payment received into the budget. But if the UIN code in the PP is indicated incorrectly, the system will not be able to “identify” it, and the money will end up in the category of “unidentified” receipts. As a result:

- the taxpayer’s debt remains “unpaid”, and he continues to be charged late fees;

- a payment made with an erroneous UIN in 2021 payments will need to be clarified by indicating the correct identifier value;

- As a result, the time allotted for payment may be violated, which will entail further sanctions from the tax authorities.

What does UIN mean?

UIN is a unique accrual identifier, which is indicated when transferring to the budget at the request of tax authorities or funds. You can find the UIN in the request for payment of tax arrears, insurance premium, as well as for payment of a fine or penalty, in the part where the payment details of the inspection or fund are indicated.

How many characters are there in the UIN 2021? The code can consist of 20 or 25 digits and is unique, that is, assigning the same codes to different documents is excluded. It is also unacceptable to assign a completely “zero” UIN when all its signs are equal to “0”. For the UIN code, the decryption includes 3 blocks:

- the first three characters are the payment administrator code (IFTS - 182, FSS - 393, etc.), the fourth character is “0”,

- characters from the fifth to the nineteenth are the unique index of the document in the system,

- the twentieth digit is determined according to the algorithm established by the Federal Tax Service or the fund.

The introduction of the UIN number has speeded up the time it takes for payments to be received by the budget, since the received “budget” amount is credited immediately using this unique code, and there is no need to waste time checking other payer details (TIN/KPP).

Number of generated payments

Firms and businessmen have the right to combine tax on various incomes (salary, bonus payments, vacation pay, etc.) in one payment slip, if all these charges were made in one month.

If the income on which personal income tax is paid belongs to different months, filling out a personal income tax payment form in 2021 is required for each period. If this rule is not followed, discrepancies will arise between actual contributions to the state budget and the calculation in Form 6-NDFL. The tax office may require an explanation of the current situation in writing.

Sample

Below is a sample of filling out a payment order for transport tax 2021.

From our website, you can fill out a payment order in 2021 using the following direct link.

Other examples of filling out payment orders in 2021 are presented on our website using the following links:

- to pay insurance premiums;

- for the payment of dividends;

- according to VAT;

- according to personal income tax;

- according to the simplified tax system “income minus expenses”;

- according to UTII;

- pension contributions;

- medical fees, etc.

Also see “Payment order for the payment of taxes and insurance premiums in 2021: decoding of the fields.”

Samples of payment slips

In field 104 you indicate the BCC. See the table with the KBK for 2021 below. Check if the recipient's bank details have changed. For example, from May 5, 2021, new details must be entered in payment slips for contributions that the company transfers to inspectorates near Moscow. Check them out on your tax office website and in samples 3 and 4 below. Payments with old details will be listed as unknown.