Table of KBK used by taxpayers of the simplified tax system in 2020

The simplified tax system with the object “income minus expenses” and the minimum tax should be calculated and paid according to the following BCC:

- 18210501021011000110 - tax;

- 18210501021012100110 - penalties;

- 18210501021012200110 - interest;

- 18210501021013000110 - fines.

The simplified tax system with the object “income” should be accrued and paid according to the following BCC:

- 18210501011011000110 - tax;

- 18210501011012100110 - penalties;

- 18210501011012200110 - interest;

- 18210501011013000110 - fines.

The sample payment system for the simplified tax system “income minus expenses” 2021 contains details that are applicable both for paying tax in connection with the simplified tax system and for paying the minimum tax calculated at a rate of 1% of annual income. The only difference will be in the purpose of payment.

When paying tax in connection with the simplified tax system, in the purpose of payment we write: “Tax in connection with the application of the simplified tax system for the 1st quarter of 2021.”

When paying the minimum payment, the following text is appropriate in the purpose of payment: “Minimum tax for 2021.”

The minimum tax is calculated at the end of the year; at the end of the quarter, advance payments are made according to the simplified tax system.

Purpose of payment - simplified tax system 6 percent 2021

There is no uniform wording for the “Purpose of payment” field for the simplified tax system. But you will need to provide the following information:

- name of the transfer and type of tax indicating the object (for example, “advance payment for a single tax levied under the simplified tax system (tax object “income”));

- the period for which funds are deposited;

- It is advisable to indicate the number and date of the collection document if the amount is paid at the request of the tax authorities.

However, the crediting of the received amount to the personal account of the taxpayer (which is maintained by the Federal Tax Service for any tax, including the simplified tax system) occurs not according to the “purpose of payment”, but according to the above details. This field is for reference only.

General procedure for processing tax payment orders

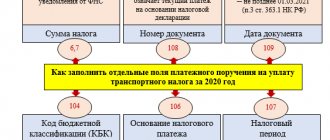

Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n determines the mandatory details for paying taxes and insurance premiums:

- 101 - status of the payer who issued the payment document;

- 104 - twenty-digit budget classification code, where the first three digits correspond to the tax administrator number;

- 105 - OKATO;

- 106 - basis of payment, consists of two letters (TP, ZD, AR);

- 107 - frequency of tax payment - month, quarter, half year, year;

- 108 — document date, filled in depending on the indicator of field 106;

- 109 - document number, if the debt is repaid on demand;

- 110 - payment type, currently not filled in.

How to correctly calculate an advance payment according to the simplified tax system

So, you’ve worked for some time, the end of the quarter has arrived, and it’s time to calculate your taxes. If you have chosen income under the simplified taxation system, then the base rate for you will be 6%. However, regions can, by their decision, reduce this figure to 1% both for the entire business as a whole and for entrepreneurs engaged in certain areas.

If you were registered no later than two years ago, then you may even be given a tax holiday if the individual entrepreneur meets all the criteria. To find out, just contact the tax office at the place of registration of the individual entrepreneur.

If we take as a basis that the tax rate is 6%, then the calculation is carried out as follows:

- The entire amount of income received by the individual entrepreneur for the quarter is taken (six months, nine months or a year - the tax period for a simplified year is yearly), and advance payments are calculated on an accrual basis. Be careful – income does not include depositing your own funds into the individual entrepreneur’s account.

- The resulting figure is multiplied by six percent. For example, revenue amounted to 140,000 rubles, then the advance payment under the simplified tax system is 140,000 x 6% = 8,400 rubles.

- If you have already paid advance payments this year, then subtract them from the resulting amount.

And now what can please you is that every entrepreneur annually pays a fixed contribution “for himself” to the Pension Fund and the Health Insurance Fund. Its value is different every year and has been approved by the government since 2019. This year the contribution is 32,385 rubles. You can pay it all at once or in installments throughout the year, the main thing is that the payment goes out before December 31st.

But usually, the fee is divided into four parts and paid quarterly. This is due to the fact that the amount of the fixed payment paid in the quarter for which you are calculating the simplified tax system reduces the advance tax payment.

If the individual entrepreneur does not have hired personnel, then up to 100% (in our example, this is 8400 - (32385: 4) = 303.75 - the amount that needs to be transferred according to the simplified tax system), if there are employees, then up to 50%.

All that remains is to transfer the money to the treasury. And this must be done before April 25 for 1 quarter, before July 25 for half a year, before October 25 for 9 months and before April 30 of the next year for a year.

Tax payment methods

If the time has come for an entrepreneur to pay taxes, then this can be done in three ways. The first of them is to use the nalog.ru portal, which has a service for creating a payment document.

You will need to fill in the required fields:

- KBK.

- Your tax code (if you don’t know, the program will insert it automatically when you fill out your address).

- Status of the person (in our case, this is “09” - individual entrepreneur).

- The basis of payment is “TP” if it is a tax for the current period.

- Tax amount.

- Last name and first name of the individual entrepreneur.

- Taxpayer Identification Number (required if you want to pay directly from the site) or address, if you just need to print out the generated receipt to pay later through the cash desk at a bank convenient for you.

The second way is to use bank terminals to pay. However, if you choose it, you should prepare in advance all the same information as when filling out a receipt through the website, since it is better not to blindly trust the data that the terminal automatically enters.

The third - and perhaps the most effective - is to open a bank account if you have not done so before.

Yes, the law does not oblige individual entrepreneurs to have a current account, but this is beneficial for a number of reasons:

- allows you to make payments anytime and anywhere;

- expands the circle of your clients at the expense of organizations that are more convenient and easier to work with non-cash transactions (and these are the majority among medium and large companies);

- allows you to accept absolutely any amount, while there is a limit on cash turnover of 100,000 rubles per agreement. Even if the payment is not made once, but in small parts, as soon as the total amount exceeds the specified threshold, the entrepreneur is obliged to switch to non-cash payments;

- if you plan to keep money in an account, then you can choose a bank that has a tariff plan that charges interest on the account balance;

Many entrepreneurs are deterred from opening a bank account by the fact that it will cause unnecessary costs. But at the moment, the tariff plans offered by various financial institutions are very flexible, and if an individual entrepreneur has a small account turnover, then you can choose a tariff without a subscription fee at all, however, the cost of the transfer for each individual payment will be higher.

If you plan to carry out only a few transactions per month on your account, this turns out to be much more profitable than the usual option with a subscription. fee and low price for money transfer. Moreover, there is no bank commission charged for paying taxes.

Instructions for filling out a payment order

If an entrepreneur has decided to pay tax from his current account, then in order to transfer funds he will need to correctly fill out a payment order.

There is nothing complicated about this, the main thing is to have a sample on hand.

Particular attention must be paid to correctly entering the name of the UFK bank and the recipient's account, otherwise your obligation to transfer the tax will not be considered fulfilled.

So, the payer fills in:

- field 101 – payer status – in our case, individual entrepreneur – 09;

- field 8 and 60 – name of the individual entrepreneur and his TIN. If you use Internet banking, then these fields are usually always automatically filled in, as well as fields 9, 10, 11, 12 containing information about your account;

- field 7 – amount of tax paid;

- fields 16,61 and 103 – the name of the tax authority where you are transferring the payment and field 14-BIK of the recipient’s bank. Cor. the account in field 17 and the bank name in field 13 are usually filled in by the program after you enter the BIC;

- field 21 – order of payment – in this case “5” or “3” if payment is already being made upon request from the tax office. In general, the correct filling of this field is critical only if there is no money in the account to make payments; if there are funds, then all debits from the account will occur in calendar sequence;

- field 104 – KBK tax, for the simplified tax system “Income” in 2021 it is 182 1 05 01011 01 1000 110. Please note, if you pay a fine or penalty for tax, they will have their own personal KBK.

- field 105 - OKATO - this is a territorial code, it can be found through specialized sites, for example, https://classinform.ru/kod-okato-po-inn.html by entering your TIN;

- field 106 will offer you a choice of several options. If you pay your tax on time, put “TP”. If you realize that you have a debt and pay it off voluntarily - “ZD”. Well, if you have already received a requirement from the Federal Tax Service - “TR”, the other six values are much less common, and you can see them all directly when filling out the column;

- field 107, select “QV” - quarter, then the number from 01 to 04 is the quarter number, respectively, the last four digits are the year for which you pay the tax;

- field 108 – document date – always equal to 0 if the current payment is transferred;

- field 109 – document number of the tax payment request. Similar to field 108 – if you have a timely transfer – always “0”

- field 24 - purpose of payment - where you write almost the same thing that you previously coded in fields 104-109, but in words.

For a person faced with filling out a tax payment order for the first time, this may seem like a rather difficult task.

In fact, the entire procedure listed above needs to be completed only once; then you will save the template in your online bank or simply copy the previous payment order for the same tax, changing only the date, payment period and editing the purpose of the payment. Drawing up a document in this order takes less than a minute.

We also recommend that you note that an individual entrepreneur’s current account and a personal account of an individual are two different things.

And although there is no direct prohibition on transferring taxes from an entrepreneur’s personal account, by making such a payment, the individual entrepreneur violates the agreement with the bank, which, according to the instructions of the Central Bank, prohibits the use of clients’ personal accounts for commercial purposes. At best, the bank can simply block such a payment; at worst, there will be troubles up to and including closing the account.

KBK 2021 IP USN "Revenue"

Budget classification codes for paying tax fees under the simplified taxation system “Income” in 2021 remained the same as they were in 2021. It must be taken into account that the main payment, penalties and fines for late or incomplete payment of tax must be transferred to different codes. Otherwise, the payment will be credited to the wrong account.

KBK USN "Income" IP 2021:

- 182 – payment administrator Federal Tax Service;

- 105 – tax system “USN”;

- 0101101 – payment is sent to the Federal budget, subgroups, code, income subitem;

- 1000 – tax (basic payment), for penalties – “2100” and fines – “3000”;

- 110 – tax revenues.

Table KBK simplified tax system “Income” 2021 IP

| Purpose of payment | KBK |

| Basic payment | 182 1 0500 110 |

| Fine | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

In the payment order, the budget classification code is indicated in field “104”. If the BCC is incorrect, the funds will be credited to the wrong account. As a result, the company will be subject to penalties. They must be paid as quickly as possible, having previously clarified the details. To do this, you must submit an application to the Tax Service.

The form of the payment order is given in Appendix 2 to Bank of Russia Regulation No. 383-P dated June 19, 2012. For ease of filling out, each field is assigned a number (a form with numbered fields is given in Appendix 3 to the specified Regulations). The payment order for tax payment must be filled out in accordance with the filling rules given in Appendices No. 1, 2, 5 to Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended on April 5, 2017).

Procedure for paying simplified tax system

The payer of this tax independently chooses from which particular object the tax will be calculated - from revenue or from revenue minus costs, the list of which is provided for by the norms of the Tax Code of the Russian Federation.

The amount of tax payable is calculated by the payer independently based on the results of three reporting periods and one tax period.

Clause 7 of Article 346.21 of the Tax Code of the Russian Federation reflects the timing of payment of the simplified tax system for the corresponding purpose of payment (i.e., advances and taxes).

Tax transfer is carried out in accordance with the budget classification codes given in Order of the Ministry of Finance dated July 1, 2013 N 65n.

Sample payment slip

From 2021, tax contributions can be clarified if the bank name and the recipient's account are correct. The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

You can calculate all contributions and prepare payment slips using this service. The first month is free.

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

From February 6, 2021, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

Taxes, unlike contributions, are calculated and paid rounded to whole rubles.

Purpose of payment: Advance payment for the simplified tax system for 2021.

Payer status: Payer status: 01 - for organizations / 09 - for individual entrepreneurs (if paying their own taxes).

TIN, KPP and OKTMO should not start from scratch.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

Fig. Sample of filling out a payment order for the payment of Income Tax in Business Pack.

Current for 2016-2017. In 2021, the BCC was not changed.