Procedure for paying fines

The Federal Tax Service has the right to impose monetary sanctions on taxpayers for violations listed in the Tax Code of the Russian Federation. Such offenses include failure to meet reporting deadlines, failure to pay taxes on time, refusal to provide tax authorities with requested information, errors in registration procedures, etc. The amount of the fine is indicated in the decision or demand sent to the business entity.

Transfer of taxes, penalties and fines according to the decision of the Federal Tax Service is made in separate payments. It is unacceptable to combine these amounts in one order.

The law does not oblige companies to make all transfers on one day: the taxpayer has the right to split them into different dates. It is recommended to pay off the arrears first so that no penalties are charged on them. Next, the penalties themselves are transferred for the entire period of delay. The latter can be sent a fine, the main thing is to meet the deadlines specified in the demand.

How to correctly fill out a payment order to transfer a fine?

A step-by-step algorithm for how to submit a payment for a fine to the tax office involves specifying the following information in the fields of the order:

Recipient details

The fine is paid to the same branch of the Federal Tax Service as the tax itself. This means that the name of the recipient, his BIC, correspondent account and current account will remain “standard”. If the transfer is made for the first time, the details can be clarified at the tax office or on its official website.

Purpose of payment

The type of transfer and a link to the base document are indicated. For example, an accountant writes: “Fine for failure to submit a VAT return in accordance with requirement No. 1 of 01/01/2019.”

It is important to take into account that different BCCs have been established for repaying arrears, paying penalties and fines. The difference lies in symbols 14-17, which show the subtype of payment. For fines, their combination is set as “3000”, for the “body” of the tax - “1000”. You can find the required code on the websites of information and legal systems; it is indicated in the request received from the Federal Tax Service.

Basis of payment

In field 106 an abbreviation is entered, depending on the document for which the fine is paid. “AP” is indicated if the basis was a decision of the tax inspectorate based on the results of an audit, or “TR” if the organization received a request.

The abbreviation “ZD” should not be indicated when listing fines. It is used in cases where the taxpayer voluntarily repays the identified debt.

Document number and date

In field 108 of the payment order, enter the number of the claim for which the fine is transferred. Field 109 indicates the date of this document.

In field 22, the UIN is written if it is indicated in the request received by the taxpayer. If this information is not in the document, “0” is entered.

OKTMO

The OKTMO corresponding to the tax office where the funds are sent is indicated. For example, if a company transfers money to the Federal Tax Service, where its separate division is registered, the code must be entered not at the registration address of the parent organization, but at the location of the branch.

The taxpayer’s responsibility is to remit the fine within the time limits specified in the request. If the funds are not received by the inspectorate in a timely manner, it will foreclose on the bank accounts of the business entity and its electronic wallets.

General rules for filling out payment slips

To figure out how to fill out a payment order for penalties, let’s remember the rules for filling out documents for the transfer of non-cash funds; you need to provide information in the following fields:

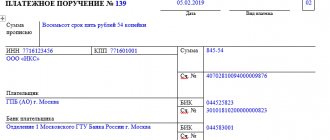

- Number and date. The program assigns the number automatically, and the date is indicated in the format DD.MM.YYYY.

- Payment type. Most often, this field is left blank, since most companies use electronic systems. For paper documents, the values “By Mail”, “Telegraph” or “Urgent” are used.

- Payer status. For transfers to the budget, codes 01 (taxpayer), 02 (tax agent) or 08 (payer of insurance premiums) are used.

- Sum. Indicated in numbers and words.

- The payer's details include TIN, KPP and name of the organization.

- The recipient's details include TIN, KPP and name. For tax authorities, indicate the name of the Federal Inspectorate for the region and the inspection number. For example: UFC for St. Petersburg (Interdistrict Inspectorate of the Federal Tax Service of Russia No. 1 for St. Petersburg).

- Type of operation. The value "01" is indicated.

- Sequence of payment. For settlements with counterparties, payment of taxes, fines and penalties, the value “5” is indicated.

- Purpose of payment. The name of the tax for which the fine or penalty is assessed should be indicated. For example: “Payment of a fine for transport tax for 2021 according to request No. 1 dated November 20, 2020, is not subject to VAT.” VAT information is indicated regardless of the nature of the payment.

- For transfers to the budget, fill in the cells above field 24:

- BCC is determined in accordance with Order of the Ministry of Finance No. 99n dated 06/08/2020;

- OKTMO is determined in accordance with the All-Russian Classifier of Municipal Entities (approved by order of Rosstandart No. 159-ST dated June 14, 2013); check that the OKTMO code matches the tax return for which penalties or fines are assessed;

- the “Base of payment” field is filled in with the values “TP” (current period), “ZD” (voluntary repayment of debt), “TR” (repayment of debt on demand) or “AP” (payment based on an inspection report);

- the “Tax period” field is filled in in the format XX.XX.XXXX; for transfers to the budget, the quarter or year is usually indicated, for example, “KV.03.2020” or “GD.00.2019”;

- number and date - the current date is indicated, the number is usually set to “0”;

- “Payment type” - this field is not filled in.

The document is signed by authorized persons indicated in the sample signature card and certified with a seal. For electronic documents, the key of an electronic signature issued to the head or accountant of the organization is used.

Use free instructions from ConsultantPlus on working with payments. Experts discussed how to fill out, store, revoke a document and much more.

Where to pay fines on contributions starting from 2021

Starting from 2021, the administrator of insurance premiums is the tax authorities (with the exception of contributions for injuries). Therefore, to pay any types of “insurance” payments, you must follow the rules for generating orders to the tax office. This is true both for contributions, penalties and fines accrued before 2021, and for contributions, penalties and fines accrued in 2021.

But it is necessary to take into account that for contributions accrued according to the rules of the Law of July 24, 2009 N 212-FZ, and for contributions accrued according to the rules of Chapter 34 of the Tax Code of the Russian Federation, the BCC values differ.

New BCC for fines from 01/01/2020

In accordance with the order of the Ministry of Finance dated November 29, 2019 No. 207n KBK 18211603010016000140, from 2021, in particular, the following budget codes for fines will be replaced:

- 182 1 1601 140 - for violation of the procedure for registration with the tax authority (Article 116 of the Tax Code of the Russian Federation);

- 182 1 1602 140 - for failure to submit a tax return, calculation of the financial result of an investment partnership, calculation of insurance premiums (Article 119 of the Tax Code of the Russian Federation);

- 182 1 1603 140 - for violation of the established method of submitting a tax return, calculation (Article 119.1 of the Tax Code of the Russian Federation);

- 182 1 1604 140 - for submitting to the tax authority by the managing partner responsible for maintaining tax accounting, a calculation of the financial result of an investment partnership containing false information (Article 119.2 of the Tax Code of the Russian Federation);

- 182 1 1605 140 - for gross violation of the rules for accounting for income and expenses and objects of taxation, the basis for calculating insurance premiums (Article 120 of the Tax Code of the Russian Federation);

- 182 1 1606 140 - for failure to comply with the procedure for possession, use and (or) disposal of property that has been seized or in respect of which the tax authority has taken interim measures in the form of a pledge (Article 125 of the Tax Code of the Russian Federation);

- 182 1 1607 140 - for failure to provide the tax authority with information necessary to carry out tax control (Article 126 of the Tax Code of the Russian Federation);

- 182 1 1608 140 - for the submission by a tax agent to the tax authority of documents containing false information (Article 126.1 of the Tax Code of the Russian Federation);

- 182 1 1609 140 - for failure to appear or evasion of appearing without good reason as a witness, unlawful refusal of a witness to testify, as well as giving knowingly false testimony (Article 128 of the Tax Code of the Russian Federation);

- 182 1 1610 140 - for refusal of an expert, translator or specialist to participate in a tax audit, giving a knowingly false conclusion or making a knowingly false translation (Article 129 of the Tax Code of the Russian Federation);

- 182 1 1611 140 - for unlawful failure to report information to the tax authority (Article 129.1 of the Tax Code of the Russian Federation);

- 182 1 1613 140 - for unlawful failure to provide a notification of controlled transactions, provision of false information in a notification of controlled transactions (Article 129.4 of the Tax Code of the Russian Federation);

- 182 1 1614 140 - for unlawful failure to submit a notice of a CFC, a notice of participation in foreign organizations, provision of false information in a notice of a CFC, a notice of participation in foreign organizations (Article 129.6 of the Tax Code of the Russian Federation), etc.

Features of processing a payment for a fine

Starting from 2021, payers are given the right to make payments to the tax office for third parties. This is also true for penalty payments. In addition, the Tax Code of the Russian Federation has not established restrictions on such payment of accruals made before 2021. This means that a situation is possible when either the payer himself pays the fines, or another person does it for him.

Depending on the situation, the payment order for a fine to the tax office, a sample of which is given below, will indicate the corresponding status of the payer.

Also, depending on the situation, the name of the payer, his TIN and KPP, and, if necessary, also the name, TIN and KPP of the person for whom the payment is being made, will be indicated.

BCCs for penalties are established for each type of tax and contribution. When making a payment for a fine, it is important to take into account that in the KBK for fines the 14th and 15th digits will always be 30.

The inspectorate in which the “penalty” was registered will be indicated as the recipient of the “penalty” payment for taxes and contributions.

OKTMO props. From 2021, the OKTMO of the municipality in which the sanction is paid is indicated. Its length is 8 characters.

Fill out the personal income tax fine payment form according to the decision

In it, she will request documents confirming the validity of reflecting such amounts and tariffs.

for each month of delay. IMPORTANT!

Your task is to correctly answer this requirement. For income tax purposes, the date of presentation of the “primary report” is the date of its preparation. Expenses for the acquisition of work (services) performed (rendered) by third-party organizations are recognized for “profitable” purposes in the period in which the fact of completion of these works (rendering) is documented. services).

The Ministry of Finance reminded what to consider as the date of such documentary evidence.

The costs of drinking water for the office can be taken into account in the income tax base. The organization's expenses for purchasing drinking water for employees and installing coolers are included in the costs of ensuring normal working conditions, which, in turn, are taken into account as part of other expenses. This means that “water” amounts can be included in the “profitable” base without any problems. Update: April 6, 2021

Basis of payment and related details

Another detail that causes doubts among accountants is the basis for the payment.

If the transfer of the fine is made by the payer independently, not at the request of the controllers, then the PD code is indicated as the basis for the payment. If there is a requirement to pay a fine, then the TP code should be indicated.

When paying a fine to the tax office, the “Base of payment” detail is associated with the “Code” detail. If the basis is a requirement, then the UIN specified in the requirement is entered in the “Code” field. Otherwise, 0 is entered.

A similar rule when paying fines applies to the details “Tax period”, “Document date” and “Document number”.

In the case where the basis for payment is a claim, they take the following values:

- “Tax period” - the deadline for paying the fine from the demand;

- “Document date”—the date of the request;

- “Document number”—requirement number.

Otherwise, 0 is indicated.

If penalties are due

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office in 2021.

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties on them to the Social Insurance Fund, fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document” are entered as 0 (paragraphs

How to submit a payment for a fine to the tax office

The amount of the fine assessed to the taxpayer is transferred by payment order. The tax authority is indicated as the recipient of the funds, and its details are specified, which are used to pay off tax obligations. When generating a payment document, you must enter the value “5” in the field identifying the order of payment.

Payment of the tax fine is carried out based on the request of the fiscal authority. In this document, the taxpayer needs to find the UIN code (this is the unique identifier of charges). This code is indicated in the payment order in field cell 22 “Code”. If there is no UIN in the notification, then the code “0” should appear on the payment.

The basis for payment when paying a fine to the tax office can be indicated in two ways:

- in a situation where a company has received from the tax service a notice of a fine or a requirement to pay it, the abbreviation “TR” is entered;

- if an independent transfer of funds is carried out before the actual receipt of notification of an identified offense and the imposition of a penalty for it, the basis for “ZD” is indicated in the payment order.

In the first case, the payment order for a fine to the tax office must contain information about the date and number of the notification form received from the fiscal authority with a requirement to pay the debt on the fine. When pre-emptively transferring money to pay off a fine, which will definitely be accrued in the near future, the columns reserved for details of documentary reasons are filled in with zeros.

When a tax fine is paid, the sample payment slip, in the absence of a notification from the Federal Tax Service, will reflect “0” in the tax period indicator line. If there is a tax requirement for a business entity to pay a penalty, this cell must indicate the payment period allocated to the taxpayer to repay the debt obligation.

In addition, not only the taxpayer himself, but also third parties can pay off the fine.

So, how to pay a fine to the tax office:

- A request from the Federal Tax Service has been received. An enterprise or individual entrepreneur that has violated the law draws up a payment order to the bank to transfer funds to the Federal Tax Service to pay a fine upon notification or request of a government agency.

- The business entity independently discovered an error, which will certainly entail the imposition of a fine. In this case, you can instruct the bank to transfer funds to pay off the fine without documentary evidence of the existence of a debt.

- Payment is made by third parties. In the payment form, in the columns for INN and KPP, information on the debtor is indicated, and the payer is indicated as the person who made the payment from his own funds (Letter of the Federal Tax Service dated March 17, 2021 No. ZN-3-1/1850).

Individuals can pay off penalties through a bank or in the taxpayer’s personal account on the Federal Tax Service website.

Attention accountants! Check the correct payment of traffic fines in 2021

The Code of Administrative Offenses of the Russian Federation regulates fines for legal entities in Article 2.6.1.

Administrative responsibility of owners (owners) of vehicles

“Administrative liability for administrative offenses in the field of traffic and administrative offenses in the field of landscaping, provided for by the laws of the constituent entities of the Russian Federation, committed using vehicles, in the event of recording these administrative offenses by special technical means operating automatically, having photo and filming, video recording, or by means of photography, filming, video recording, the owners (owners) of vehicles are involved.”

Several years ago, fines for legal entities were rare. At that time, cameras recording traffic violations were not actively used on Russian roads. Drivers stopped by the traffic police received only small personal fines (for example, not wearing a seat belt, speeding, and not allowing a pedestrian to cross a zebra crossing).

Traffic police cameras, widely introduced in Russian cities, have automated the process of issuing fines. The camera cannot determine who is driving; the system automatically issues a fine to the owner of the car. If the owner is a legal entity, the fine is sent to the company's registered address.

It is clear from the question that fines must be paid by a legal entity. However, the company management has the right to impose a fine if it is documented that the driver operated the car for personal purposes, and not for work reasons.

In small companies, drivers and company management negotiate a fine payment scheme before hiring an employee-driver. As a rule, the driver pays fines out of his own pocket under threat of dismissal.

In large companies, cargo and passenger fleets are equipped with devices that track the route, speed and other travel parameters.

Part 3 of Article 2.1 of the Code of Administrative Offenses of the Russian Federation clearly states:

“The imposition of an administrative penalty on a legal entity does not relieve a guilty individual from administrative liability for a given offense, just as bringing an individual to administrative or criminal liability does not exempt a legal entity from administrative liability for a given offense.”

Thus, according to the law, the traffic police officer has the right to issue a fine to the direct driver of the car who violated the traffic rules and an additional fine to the individual (firm, company, organization) who owns the vehicle.

> > > Tax-tax August 27, 2021 All story materials How to fill out a payment order for fines? Every accountant faces this question from time to time.

Drawing up such a document has its own nuances. How to properly fill out a payment order to pay a fine?

What are the features of filling out payments for the transfer of sanctions for insurance premiums?

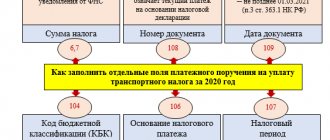

Let's look at the main points. Detail 104 indicates KBK (20-digit budget classification code)

Reading time: 5 minutes Expand Legal entities pay transport tax (TN) through a bank using a payment order.

And unlike physical For those who receive a completed receipt by mail, organizations independently calculate the amount of auto tax and advance payments and, based on this, generate payment orders. Form No. 0401060, which is used to pay road tax in 2021, is established by Bank of Russia Regulation No. 383-P dated June 19, 2012.

It looks like this: You can fill out the form:

- Online - using a special service on the official website of the Federal Tax Service.

- Manually, following the rules described in Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n.

We recommend sticking to the second option. It is much more convenient for the reason that all the details are filled in automatically.

For example, the tax office has decided that you need to pay land, transport or some other tax, then they will definitely assign the UIN and write it on their receipt (see.

If the budget administrator has accrued a debt to you. Provide the short name of the organization that transfers the withheld amounts to the budget, i.e.

sample payment slip in 2021 traffic police fine How to open your own business minutes how to pay contributions in 2021 sample payment slips for contributions December January 2021 watch the webinar by the chief specialist of the Federal Tax Service for contributions.

You can find them out directly at the branch, or on the official website of the FSS.

Firstly, it should be noted that traffic police officers have the right to draw up reports of administrative offenses not only for violation of traffic rules (traffic rules).

Violations of other rules provided for by the laws of the regions, committed with the use of vehicles, also have the right to be recorded and processed by a traffic police inspector or technical means in automatic mode. Secondly, no organization, that is, a legal entity, can, for obvious reasons, independently drive a car that belongs to it (it).

KBC on fines to the tax office

When filling out a payment order, you must correctly indicate the KBK code. It is important to use the current code that is valid in the year the fine debt is repaid. The BCC for current payments to pay off tax obligations and for transfers of penalties will be different. For example, in 2021:

- when filling out a payment slip for income tax for the billing period, enter code 18210102010011000110;

- when paying a fine for personal income tax, the BCC has the form 18210102010013000110;

- if the fine is assigned to an individual entrepreneur applying the general taxation regime, the code will be 18210102020013000110.

A complete list of current BCCs in 2021, including fines, can be found in this article.

Sample payment order fine for late submission of a declaration

To administer budget revenues, each type of payment has a special code - KBK (budget classification code).

It must be indicated in each payment order for the payment of funds to the budget, as well as in tax reporting sent to the Federal Tax Service, Social Insurance Fund and other government agencies. The full list of codes is contained in the KBK classifier (order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n).

It is in it that you need to look for the decoding of 2017-2018 KBK 18211603010016000140. According to the classifier (in the current edition) indicating KBK 18211603010016000140 - decoding for which the fine is in 2017-2018 - the taxpayer must transfer the fine for violation of tax legislation under the following articles Tax Code of the Russian Federation: 116 , 119.1, 119.2, 120 (paragraphs 1 and 2), 125, 126, 126.1, 128, 129, 129.1, 129.4, 132, 133, 134, 135, 135.1, 135.2.

We recommend reading: Sberbank Restructuring Department telephone Moscow

Ask them on our forum.

What is a requirement to pay a tax, fee, penalty or fine?

According to Article 69 of the Tax Code of the Russian Federation, the Federal Tax Service may send a demand for payment of a tax, fee, penalty, or fine if the taxpayer incorrectly calculated the amount of tax, did not pay the tax or did it later than the established deadline, as well as in other cases of tax offenses.

The requirement is drawn up in the form of a table indicating the amount of tax debt, the amount of penalties and fines. It also provides the deadline for fulfilling the requirement, as well as measures to collect the tax and ensure the fulfillment of the obligation to pay the tax if the taxpayer does not repay the debt. The form of request for payment of tax, fee, penalty, fine was approved by Order of the Federal Tax Service of the Russian Federation dated December 1, 2006 N SAE-3-19/ [email protected]

Example of a request for payment of arrears and penalties

Amounts of fines for failure to submit reports to the tax authorities

In this case, the minimum amount of the fine is 1 thousand rubles, while the maximum is limited to 30% of the unpaid amount of tax or contribution taken from the report data. IMPORTANT! In the absence of tax activities that do not involve non-submission of reports in the absence of an object of taxation, a zero tax return must be submitted.

Its absence will entail a fine of 1,000 rubles. (letter of the Ministry of Finance dated October 7, 2011 No. 03-02-08/108).

Is it necessary to submit a zero calculation for insurance premiums, read. In addition, according to paragraph 1 of Art.

126 of the Tax Code of the Russian Federation, inspectors can charge 200 rubles for failure to provide information necessary for the implementation of tax control functions (for example, 2-NDFL certificates). (for each certificate not submitted).

And for late submission of form 6-NDFL, the same article of the Tax Code of the Russian Federation provides for a fine of 1,000 rubles. Unlike other reports, which can be

How to draw up a payment order

For each line of the request, it is necessary to generate a separate payment order. This can be done manually - transfer the data from the received request to fields 24 and 104-109 of the payment order.

When filling out a payment slip, you can use this table, which will tell you what value you need to indicate in each field. Be careful when entering data - an error in even one figure will lead to the fact that the organization’s money will not go to its intended destination, and the debt will not be repaid.

You can read complete instructions on how to generate a payment order on the Accounting Online website.

The second option to prepare a payment order is to generate it automatically. This function has recently been available to Kontur.Extern users.

Having received an electronic request for payment in Externa, notify the Federal Tax Service about this by clicking on the button “Send an acceptance receipt to the Federal Tax Service.” Then proceed to create a payment order: follow the “Create payment order” link and enter the name of your bank and current account. The system itself will insert all other data from the request into the appropriate fields of the payment order. You can also choose what type of debt to make a payment for and, if necessary, change the payment amount.

You can create a ready-made payment slip either in Word format and then print it, or download a special text file to then upload to the Internet bank.

How to fill out a payment order for taxes and contributions in 2021

If there are no details, you can find them without much difficulty. And there are enough ways to do this - from searching in the protocol, contacting the department directly and ending with official online services. At Sberbank you can always get a TIN, KPP, BIC, KBK and so on. In addition, there is even an option to pay without specified payment information. But it is not advisable to take such risks.

The traditional place for paying fines for most older drivers is a bank. Not innovative, but perhaps the most reliable solution. But first you need to find out which bank you can pay the fine at. Unfortunately, not everyone accepts such payments. But there is Sberbank, which carries out these transactions. To solve the problem you need:

- Visit the branch with your passport and receipt (decree). There is no provision for paying a fine on a driver's license.

- Notify the cashier of your intention. He will fill out the receipt with the details himself.

- Deposit the amount and receive a check.

Extremely simple and clear. Moreover, any person can make payment for you, and the receipt received will always serve as confirmation of repayment of the debt. However, the presence of queues should be taken into account. Plus, the bank does not have information about all fines; their presence will still have to be checked. And, of course, Sberbank charges a commission - 3%, but not less than 30 rubles.

Making a payment through a terminal or ATM is not much more difficult. It takes less time, and cash is not always needed, but you will need the details of the payee, which we described above. But there are no queues or commissions, plus there are no days off for the machines. In addition, it is possible to pay using a barcode, which must be on the original receipt. The device will issue a receipt, but remember that cash is accepted for payment. If you deposit more money into the receiver, do not expect change.

You can also easily pay fines at the post office. The procedure at the post office is similar to banking. Queuing, contacting the operator with documents, paying in cash, processing and issuing a receipt. But the guarantee of payment completion is also one hundred percent.

Only here you will also need a full understanding of where to pay. Again, you will need details, the name of the organization, and so on. Before going to the post office, prepare as much information as possible for the operator and take your passport with you. Also consider the presence of a commission.

The Tinkoff online bank offers its own website and mobile application for paying traffic police fines. The work here also begins with the detection of fines. The search is possible in two ways - by receipt number or VU. In the mobile version, you can configure alerts about incoming collections. This feature is paid. The process itself is not much different from other services.

How to avoid paying too much

When processing a claim, it is important to know about the peculiarity of indicating amounts in the “Arrears” field. If the amount is marked with an asterisk, then you do not need to pay it - this information is for reference only.

When you create a payment order in Externa, you will never include an amount with an asterisk in it by mistake. This amount will be in the general list, but you cannot select it to generate a payment order.