The payment order to the bailiffs according to the writ of execution determines the procedure for repaying existing obligations, it contains information on the purpose of payment. The document is filled out by the accountant of the organization in which the citizen works, from whose salary the corresponding amounts are withheld. If the management of the organization ignores the demand of the bailiffs, it will be brought to administrative responsibility (Article 17.14 of the Code of Administrative Offenses of the Russian Federation). In case of malicious evasion of forced repayment of an individual’s debt, the management of the organization may face criminal liability in accordance with Art. 315 of the Criminal Code of the Russian Federation.

The payment is processed after receiving a special payment order from the FSSP authorities. Based on this instruction, the accountant withholds funds from the individual’s wages in favor of the recipient. The funds are first transferred to the settlement account of the bailiff service, and then sent to the address of citizens or organizations that won the lawsuit.

The document is filled out in case of withholding the amount of debt:

- on taxes;

- for non-tax payments (transfer of alimony, deduction of debt on a loan, utilities and other collections).

You can find a sample of filling out a payment order to bailiffs at the end of this article.

When is a payment made to the FSSP?

To ensure the collection of certain payments ordered by the court, the bailiffs send the payer - the obligated person - a corresponding order, which contains the appropriate requirement and indicates the necessary details.

In essence, this order is a writ of execution, which gives it the necessary legal force.

A document demanding repayment of obligations under a court decision can be sent to the payer either at the place of his employment (in this case, the debt will be officially deducted from the payer’s earnings), or to the address of his actual residence (if the obligated person is not employed).

In the practice of bailiffs, it is customary to divide writs of execution into the following types:

- collection of tax debts;

- repayment of non-tax debt (loan obligations, housing and communal services payments, penalties, alimony payments, other penalties).

If, for example, a sum of money ordered by the court for payment is withheld according to a writ of execution from the salary of the obligated person (payer), the accountant of the employing organization draws up and sends a special payment to the bailiffs to the servicing bank.

As a rule, an authorized FSSP employee who supervises (conducts) a specific enforcement proceeding officially provides the employing organization with a sample of such an order, already containing all the necessary details.

Thus, the financial institution carries out the designated payment transactions according to these orders, transferring the money directly to the FSSP authorities.

Bailiffs accept the appropriate payment, register it in the prescribed manner, and then forward it to the actual (target) recipient, who is the beneficiary of the enforcement proceedings.

The funds from this payment can be sent to a budgetary structure, an economic entity, another organization or a specific individual.

In what cases is a payment order necessary?

A payment order is a document in a prescribed form that regulates the account holder’s instructions to make non-cash transfers in favor of the recipient of funds. The instruction has been sent to the bank that maintains the payer’s account. Funds are transferred from a deposit account. If for some reason the account does not have the required amount of money, but the agreement between the bank and the payer provides for an overdraft, the transfer will be carried out. This document must be drawn up and submitted to the bank for execution in electronic or paper form.

Individuals can also process payment orders without opening a bank account. In this case, an order to the bank from an individual can be drawn up in the form of an application, in which the following information must be indicated:

- payer details;

- details of the recipient of funds;

- bank details of the payer and recipient;

- amount of money;

- purpose or purpose of payment;

- other information established by the bank.

How to fill out correctly when transferring according to a writ of execution?

Deductions directly addressed to bailiffs are transferred according to the writ of execution on the basis of the relevant payment orders, the execution of which must always be carried out properly.

For the FSSP, however, there is no special form of payment approved by any regulations.

Consequently, the payment order to the bailiffs is drawn up according to a standard template, usually used for any bank transfers.

When filling out such payments, it is important to take into account some differences between orders for tax collections and orders for non-tax withholdings.

Non-tax debts

If a payment directly addressed to the FSSP authorities is drawn up to collect non-tax debts, it does not provide for filling out the so-called tax fields.

In other words, it does not indicate the BCC, payer status, or other information related to tax specifics.

All key data characterizing a non-cash payment for the collection of non-tax debt is reflected in the payment purpose field.

The necessary information of the writ of execution, the paid period and other identifying information are indicated here.

Tax debts

If a payment order to bailiffs is issued for the purpose of collecting tax debts, it should be drawn up according to the rules provided for transfers to the budget.

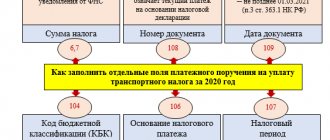

So, when filling out the payment form, the following mandatory details must be indicated:

- If the amount of tax debt is withheld from the salary of the debtor employee, field 101 (user status) in the payment order is assigned the value 19.

- In field 60, where the payer’s TIN is indicated, the TIN of the citizen (employee) against whom enforcement proceedings are applied is entered. If this individual does not have a TIN, the value 0 is entered.

- In field 102, where the payer’s checkpoint is indicated, the value 0 is reflected, since the funds are transferred for the hired employee.

- The short name of the business entity (employer) withholding and transferring funds under the writ of execution is written in field 8 of the payment order, where the name of the payer is reflected.

- Field 22 is intended to indicate the UIN code (unique accrual identifier). If such a code is not included in the bailiff’s order, 0 is entered.

- In field 105 you should enter the OKTMO code, which determines the location of the territorial body of the FSSP, which collects the debt by court decision.

- Field 108 properly reflects the number of the document that uniquely identifies the payer (debtor employee). Before the identifying information, the identification code of the corresponding document is written in the line (for example, a civil passport - 01, a military ID - 05).

- In the KBK field (104) – value 0.

- In the fields of document date (109), tax period (107) and document basis (106) the value 0 is entered.

Sample payment order when transferring to bailiffs under a writ of execution for tax debts - download.

Sample payment form to the FSSP for non-tax debts - download.

Free legal consultation

I believe that in this case you really need to know the position of the court and therefore there is no point in contacting a bank, for example. Take all payment documents to the court hearing and say that there was a mistake. The court must accept the fact of payment.

The bailiff has the address of the claimant. Ask the bailiff to make a request to the collector to confirm receipt of the amount of your monetary obligation...

After receiving such confirmation, the bailiff will terminate enforcement proceedings

The bailiff suggested that I meet personally with the plaintiff or prove it in court; he does not intend to make any requests.

And you take advantage of your rights as a citizen of the Russian Federation and write an application addressed to the bailiff. In it, clearly indicate that you voluntarily paid off the monetary obligation, that you have a payment document about this.

Write that in order to confirm the full settlement you are asking the bailiff to make a corresponding request to the claimant. Please clarify that you cannot do this yourself and are asking for assistance on the basis of Article 50 of the Federal Law “On Enforcement Proceedings.”

The amount has not been paid in full, I voluntarily transferred two payments according to the schedule, and the rest of the amount is withheld from my salary. The bailiff refuses to accept my first two payments, citing that the check does not indicate “compensation for damage”

In order not to repeat myself, I advise you to familiarize yourself with the contents of Article 50 of the Federal Law “On Enforcement Proceedings”

conclusions

The payment, through which tax/non-tax debts are collected by bailiffs, is drawn up according to the typical form of an order to transfer money from a bank account.

However, when filling it out, you should always follow certain rules. It is recommended that the details required to be reflected in such a payment order be clarified in advance with the FSSP authorities.

This will avoid problems with the correct formation and timely execution of the payment document.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 938-43-28 - Moscow - CALL

+7 - St. Petersburg - CALL

+7 — Other regions — CALL

Legal assistance

Based on the result of the payment, you will receive a payment receipt. All payments are made by the Non-Bank Credit Organization "Moneta.ru" (limited liability company) - NPO "MONETA.RU" (LLC) is registered under Federal Law No. 161-FZ "On the National Payment System" . NPO "MONETA.RU" (LLC) operates on the basis of the license of the Central Bank of the Russian Federation for banking operations No. 3508-K dated July 2, 2012.

- first and last name of the citizen who committed the offense;

- his passport details;

- the place where the violation was committed;

- date and exact time;

- a photograph from the scene of the violation, where the license plate number of the car is clearly visible;

- details of the offence;

- reference to the article and law in accordance with which the monetary penalty was imposed.

Payment to bailiffs - how to fill out?

28.10.2019, 12:33

Good afternoon The company needs to pay the debt to the bailiffs for enforcement proceedings. The bailiff issues a receipt (form No. PD-4sb (tax)), which indicates the recipient’s details and UIN - but you must pay by bank transfer from your account, and for payment you need a KBK. Who knows which BCC is indicated?

Note: the debt is specifically for the organization; there are many examples on the Internet of filling out payment slips for deductions from the salaries of individuals, but this is not the same.

28.10.2019, 13:29

28.10.2019, 13:36

28.10.2019, 15:48

28.10.2019, 19:12

It seems like a different situation there. There are many measurements in case of deduction from salary, there really is 0.

Question: How to fill out a payment order for a writ of execution to the bailiff service?

Answer: Payment orders for the transfer of collections under a writ of execution for tax and non-tax debts are filled out according to the general rules for filling out payment orders, however, for payment orders for the transfer of tax debts (insurance contributions) there are a number of features.

Rationale: After initiating enforcement proceedings, the debtor has the opportunity to independently fulfill the requirements of the executive document and transfer the required amount within five days from the date the debtor receives the decision to initiate enforcement proceedings, unless otherwise provided by law (Part 12 of Article 30 of the Federal Law of 02.10. 2007 N 229-FZ “On Enforcement Proceedings”).

General provisions for filling out instructions for a writ of execution Appendices NN 102 - 108 to the Order of the Federal Bailiff Service of Russia dated July 11, 2012 N 318 “On approval of sample forms of procedural documents used by officials of the Federal Bailiff Service in the process of enforcement proceedings” approved the forms of resolutions on filing penalties on cash. According to these forms, funds are subject to transfer to the appropriate deposit account of the structural unit of the territorial body of the FSSP of Russia or the FSSP of Russia. A standardized form of payment order to bailiffs has not been approved, therefore, a standard form of payment order is used for all payment transactions. In order to make a payment, the payer sends to the bank a payment order drawn up electronically or on paper (clause 5.4 of the Regulations on the rules for transferring funds (approved by the Bank of Russia on June 19, 2012 N 383-P) (hereinafter referred to as Regulation N 383-P)). If the payment order is drawn up on paper, then it is filled out on the form given in Appendix 2 to Regulation N 383-P. The list and description of the details of a payment order, collection order, payment request are contained in Appendix 1, the numbers of payment order details are given in Appendix 3 to Regulation N 383-P. Regarding the indication of information about the payer's bank, BIC and account number, one should take into account Letters of the Treasury of Russia dated 02/15/2017 N 07-04-05/03-170, dated 03/06/2017 N 07-04-05/03-217. It should be borne in mind that filling out a payment order to bailiffs when paying tax and non-tax debts is somewhat different.

Filling out a payment order for a writ of execution for tax payments Filling out a payment order for payment of tax payments should take into account some of the features provided for by the Rules established in Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds to payment of payments to the budget system of the Russian Federation" (hereinafter referred to as Order No. 107n). A payment order to bailiffs for tax (insurance) debts must contain instructions on a number of mandatory details, including: - payer status (field 101) - for these payments, Appendix No. 5 to Order No. 107n provides for either status “01” (taxpayer (payer) fees, insurance premiums and other payments administered by tax authorities) - legal entity), or “02” (payer - tax agent); - UIN code (field 22) - if the penalty is assigned a UIN, this numerical value should be indicated when filling out the field; if it is not specified in the resolution - “0” is indicated in field 22; — type of operation (field 18) — indicate the number “01”; — order of payment (field 21) — indicate the number “4” (clause 2 of Article 855 of the Civil Code of the Russian Federation); — KBK (field 104) — indicate “0”; - OKTMO (field 105) - determined by the location of the bailiff service executing the court decision; — basis for payment (field 106) — “AR” is indicated: repayment of debt under the writ of execution; — tax period indicator (field 107) — indicate “0”; — document number (field 108) — indicates the number of the document that is the basis for the payment (the N sign is not inserted) (in this case, the number of the writ of execution initiated on its basis); — date of the payment basis document (field 109) — indicate “0”. — purpose of payment (field 24) — an explanation of the payment is indicated (Appendix 1 to Regulation N 383-P), for example, “Payment of VAT according to the writ of execution dated December 28, 2018, series AS N 9876543.” In the event that a payment order is generated in relation to non-tax deductions, the fields required for tax payments are not filled in.

Example. Sample payment order for the transfer of non-tax payments under a writ of execution to the bailiff service

How to voluntarily pay claims based on a court decision?

The court decided to pay the Plaintiff the amount for the flooding of the apartment. Lost the appeal. Is it possible to voluntarily pay the amount to the Plaintiff by bank transfer using the details specified by him? Is it necessary to take a receipt from the Plaintiff? Do I need to notify the Court of payment?

You have the right to enter into a settlement agreement at any stage of the process if the plaintiff agrees.

Can. But be sure to get a receipt stating that you are executing the court decision. date... entered into force on the basis of the appeal ruling dated. number of transfer to the plaintiff. amount by transferring the specified amount to his account No. in such and such bank.

Exactly what is needed. Thank you!

It is not necessary to take a receipt.

In the purpose of the bank transfer, indicate: payment by decision. court from. 19 in case no.

Thank you, everything is clear now.

You make a payment, and in its basis you indicate that payment for such and such by a decision of such and such a court on such and such a date, it’s simple

So should I take the receipt or not? Should I bring it to court or not?

It is better to take it and indicate it in the message when transferring money. It is not necessary to provide this information to the court; they do not need it. The main thing is that your creditor (claimant) does not apply with a writ of execution to the SSP, and if he does, you will show the bailiff this receipt and a printout from the bank and the writ of execution will be returned to him, and the enforcement proceedings will be stopped. The enforcement fee will not be deducted from you. And if he has already applied to the SSP with a writ of execution, then pay off the debts in the first five days, voluntarily and ONLY THROUGH THE BAILIFIC SERVICE!

Thanks for the useful advice!

There’s definitely no need to bring it to court - he’s no longer interested in it. You can additionally take a receipt, but a correctly executed payment, as I wrote above, will be enough.

If I make a transfer, then it will no longer be possible to obtain a receipt from the Plaintiff; he will not need it. Only if you give it in cash in exchange for a receipt.

Both options are correct. Decide for yourself what is convenient for you.

Thanks for the clear answer!

Attention! Reply from a user who is not registered as a lawyer.

Go to court with a receipt for payment and if used. the sheet has not yet been received by the plaintiff, then the court will attach your financial document (copy) to the case materials, and apply. the sheet will not come out. I did this myself and no problems.

If the court is already underway, and you want to pay the amount required by the plaintiff in the claim, then pay according to the details indicated by him and notify him so that he withdraws the claim from the court. If the claim is not withdrawn, but under the PPA, then paying the debt after filing a claim in court will still lead to the fact that the consumer can collect a fine from you under the PPA, even if you voluntarily pay the debt before the court’s decision. If the plaintiff does not withdraw the claim, then the court must provide a receipt for payment, otherwise they will charge penalties and so on.

In general, it is not clear what type of legal dispute you have, it is difficult to give advice. But you can’t pay and quietly wait for the court to decide. Since the court will collect money from you without knowing about the payment, the plaintiff will then receive a writ of execution and recover the money through the bailiffs, and then you will have to sue the plaintiff for a year in order to recover the overpayment from him as enrichment.

What are the features of a payment order to bailiffs of the 2019–2020 model?

Let's start with the fact that the procedure for filling out payments to the bailiffs will be different for tax deductions and for non-tax payments of the employee (for example, alimony, judicial penalties).

There are no special rules regarding non-budgetary collections, as well as official instructions on the procedure for processing payments. Therefore, we believe that a regular payment order is issued for them, without filling out the “tax” fields, including payer status, BCC, etc. In this case, all information identifying the payment is provided in the “Purpose of payment” field.

So, it indicates the type of deduction (for example, alimony for such and such a period), details of the writ of execution, alimony case, you can provide information about the recipient of the amount withheld from the employee. The specific composition of the information can be clarified with the bailiffs.

For more information about the details indicated in the payment document, read the material “Basic details of a payment order” .

If, according to a writ of execution, you transfer an employee’s personal taxes to the account of the FSSP department, the payment order is issued according to the rules provided for payments to the budget.

The features of such a payment are as follows.

- Payer's TIN (field 60). The TIN of the individual whose tax obligation is being fulfilled is indicated. If he does not have a TIN, 0 is entered.

- Payer checkpoint (field 102). Set to 0.

- Payer's name (field 8). The short name of the organization that transfers the withheld amounts to the budget, i.e. yours, is given.

- Payer status (field 101). For these payments, Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n provides the status “19”.

Read about other possible payer statuses here.

- Code (field 22). If there is a unique accrual identifier, it is provided (20 or 25 characters). If there is no UIN, 0 is entered.

- KBK (field 104). Here they put 0, since BCCs are not provided for such transfers.

For information about the cases in which it is necessary to indicate the KBK in the payment order when transferring funds to bailiffs, read the Ready-made solution from ConsultantPlus.

- OKTMO is brought to the location of the bailiff service.

- Document number (field 108). For payer status with code 19, field 108 requires the identification of information about the individual. Such an identifier can be SNILS, series and number of a passport or driver’s license, series and number of a car registration certificate, etc. Before the identifier in field 108, enter its 2-digit code. For example:

- 01 — passport of a Russian citizen;

- 04 - military personnel identification card;

- 14 — SNILS;

- 22 - driver's license;

- 24 - vehicle registration certificate.

This cipher is separated from the identifier by a semicolon. The signs “No” and “–” are not indicated in field 108. If the individual’s TIN is filled in, the value 0 is allowed in this field.

- In fields 106 “Base of document”, 107 “Tax period” and 109 “Date of document” enter 0.

Results

Payments to the FSSP are a transfer there of funds withheld by the employer from the employee’s salary under a writ of execution. Non-tax and tax debts can be paid in this way. In the second case, the payment document will be drawn up according to the rules applied for budget payments, but taking into account some of the features of entering data into certain fields.

Sources: Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sample of filling out a payment order to bailiffs

For clarity, let’s look at filling out a payment slip to the FSSP using a conditional example.

Let’s say that ICS LLC, on the basis of writ of execution dated August 19, 2019 No. 1234/56789, withholds from its employee amounts to pay off his transport tax debt.

The organization will fill out the payment order as follows:

- will indicate the employee’s tax identification number, enter 0 in the checkpoint, and designate himself as the payer;

- will indicate 19 as the payer status;

- the individual’s identifier will be a passport, so in field 108 the organization will enter code 01 and, separated by a semicolon, the series and number of the employee’s passport;

- the recipient of the payment will be the department of the Federal Bailiff Service for Moscow;

- instead of UIN will put 0;

- payment order 4th;

- OKTMO - the one that is installed at the location of the FSSP management;

- fields 104, 106, 107 and 109 will contain 0.

You can view and download a completed sample payment order to bailiffs on our website.

Grounds for collection

For the payer, the basis for collection is the payment order for the enforcement fee issued by the bailiff service. Such a request can be sent by bailiffs:

- at the payer’s place of work, to pay off the debt by deducting from wages;

- at the payer’s place of residence (for unemployed persons).

The bailiff issues a financial claim as part of enforcement proceedings, on the basis of a court decision on the repayment of tax or non-tax (alimony, fines, utility bills, loans, etc.) debts. Such an order has the force of a writ of execution.

When deducting the claim amount from the payer's salary, the accountant fills out a payment slip to the bailiffs, a sample of which, indicating the recipient's details, must be provided to the employer by the responsible representative of the FSSP in charge of the proceedings. A transfer is made in favor of the bailiffs, who, in turn, having registered the payment, send it to the address of the individual, government agency or organization in whose favor the enforcement proceedings have been opened.

How to transfer insurance premiums

After the entry into force of Chapter 34 of the Tax Code of the Russian Federation, insurance premiums directed to:

- compulsory pension insurance,

- compulsory health insurance,

- social insurance in case of temporary disability and in connection with maternity,

are paid to the tax authorities. Previously, they were transferred directly to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund, respectively.

The rules for processing payment orders for tax payments are established by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

All employers who hire employees pay contributions from the amount of wages paid. The transfer deadline is until the 15th day of the month following the billing month.

Features of filling out a payment order for payment of insurance premiums

SS in case of VNiM: 18210202090071010160.

TP - transfers of the current year.

ZD - voluntary repayment of debt.

TR - repayment of debt on demand.

AP - repayment of debt according to the inspection report.

In MS.month.year format.

For example, when paying for May 2021, you should indicate: MS.05.2018.

For current payments, “0” is entered.

If payment is made on demand, then the request number.

For current payments, “0” is entered.

If payment is made on demand, then the date of demand.

| On the forum since: 11/06/2014 Messages: 1,032 | On the forum since: 11/06/2014 Messages: 1,032 | On the forum since: 11/06/2014 Messages: 1,032 | On the forum since: 09.13.2017 Posts: 5 | On the forum since: December 14, 2006 Posts: 17,704 |

| Field | Field name | Specified value | ||

| 101 | Payer status | 01 | ||

| 104 | KBK | |||

| 105 | OKTMO | 8-digit code according to the classifier | ||

| 106 | Basis of payment | |||

| 107 | Taxable period | |||

| 108 | Document Number | |||

| 109 | Document date | |||

| 24 | Purpose of payment | Information about the type of payment and payment period. |

Samples of filling out payment orders for payment of insurance premiums:

How to find a resolution by UIN number

This number can be determined as follows: when a motorist pays fines from the traffic police, he visualizes a twenty-digit digital combination repeated in: In paragraph 120 of the administrative regulations of the state traffic safety inspection, the following grounds are indicated for establishing an administrative offense: When a traffic police officer has established an offense on the spot, and issued a warning or issued an administrative fine.

After its introduction, the share of unidentified revenues—tax, customs, etc.—reduced significantly. The code must be indicated when: Payment for services provided by federal, regional, and local authorities.

Contributions for injuries

The Social Insurance Fund continues to administer mandatory payments for industrial accidents and occupational diseases. They are paid directly to the Fund by all organizations that employ hired workers in accordance with Federal Law No. 125-FZ.

The fee rate is set annually depending on the level of professional risk of the company from 0.2 to 8.5%. Its size is established by the Social Insurance Fund and indicated in the Notification sent in response to the application for confirmation of the main type of activity.

The deadline for paying the fee is similar to the deadline for transferring insurance premiums: until the 15th day of the month following the reporting month.

The differences between issuing a payment order are that:

- the recipient of the payment is indicated by the territorial body of the Social Insurance Fund;

- the payer status is set to code 08;

- Zeros are entered in fields 106-109.

How to find out the UIN is the decree number

Information is provided from the state payment system GIS GMP. If you find a fine on our service, it means it has not been paid according to the GIS GMP data. To check the traffic police from cameras, you need to enter the vehicle registration certificate (VRC) number in the form at the top of the page.

Payment by UIN is a simple and convenient tool for paying for any state and municipal services. Using this service, you can pay any debts and fines issued by the state, and recently you can also use it to pay fees for various government services, including: How to pay for services using UIN Payment is available regardless of the region where you receive and a service is ordered or an invoice is paid.

If you don't pay on time: consequences

For each day of delay in transferring a tax payment, the company will be charged penalties in accordance with Article 75 of the Tax Code of the Russian Federation. In case of non-payment, the Federal Tax Service has the right to collect them. The collection procedure is as follows:

- A demand is issued to the defaulter indicating the deadline for payment.

- In case of non-receipt of funds to the budget, a collection order is issued to the company's current account. According to it, the debt is written off (Article 46 of the Tax Code of the Russian Federation).

- If there is a shortage of funds in the current account or if there is no information about current accounts, the debt is collected from other property of the company by sending a collection order to the bailiff (Article 47 of the Tax Code of the Russian Federation).

Data Bank of Enforcement Proceedings

The service “Data Bank of Enforcement Proceedings” is provided only on the official website of the FSSP of Russia at https://fssprus.ru/iss/ip/ and sections of the territorial bodies of the FSSP of Russia located in third-level domains r**.fssprus.ru/iss/ ip/.

*If the fact of the existence of initiated enforcement proceedings is established when checking the debt through the service "Data Bank of Enforcement Proceedings" or through the unified portal of public services (EPGU) in relation to a debtor with identical full name, date of birth, in order to avoid erroneous identification of an individual as a debtor in enforcement proceedings and application of enforcement measures against him (seizure of accounts, restrictions on the right to register a vehicle, etc.), citizens can contact the bailiff who initiated the enforcement proceedings and provide documents that allow them to uniquely identify the citizen (copy of passport, SNILS, TIN).

Transfer by writ of execution: payment order for an employee

It often happens that your employee was previously registered as an individual entrepreneur and did not pay insurance premiums in a timely manner in a fixed amount. In this case, a writ of execution may be issued to collect debts from his wages.

In this case, the organization is obliged to fulfill the request of the bailiffs, retain the debt and transfer it to the budget. When withholding, it is worth remembering the restrictions established by Article 138 of the Labor Code of the Russian Federation.

Details for the transfer are indicated in the decision on collection. In this case, the recipient of the payment is the Office of the Federal Bailiff Service that issued the writ of execution. In this case, the funds are transferred to a special account of the Department and then distributed according to payment types. Therefore, the KBK will not be present in the details.

When transferring a payment for an employee, indicate the payer status in field 101 as “19”, and the order of payment as “4”.

What you shouldn't forget

The executor of the bailiff's claim, regardless of whether he is directly the debtor or the entity holding the debt and transferring it to the FSSP, should remember two important aspects of liability for failure to comply with the bailiff's decision.

The debtor, or a business entity that ignored the request of the bailiff service for forced repayment of the debt, bears liability, the limits of which are established by Article 17.14 of the Code of Administrative Offenses of the Russian Federation.

If the employer maliciously evades the execution of the order, his actions may be interpreted as a criminal offense under Art. 315 of the Criminal Code of the Russian Federation.

Enforcement fee: payment order to bailiffs

In addition to the tax payments themselves, an enforcement fee is collected from the debtor in accordance with Article 112 of Federal Law No. 229-FZ of October 2, 2007. It is collected if the debtor refused to voluntarily fulfill the requirements of the writ of execution.

The fee is 7% of the amount to be collected, but not less than 1000 rubles. from an individual (citizen or individual entrepreneur). The executive fee goes to the federal budget.

Sometimes the payment details indicate a UIN (unique accrual identifier). It contains from 20 to 25 digits and is found only for payments in favor of government agencies. It must be indicated in field 22 of the payment order. If the UIN is unknown, then “0” is indicated in field 22.

Payments and methods of accepting them

The first three characters of the identifier contain the code of the main manager of budgetary funds (GRBS) for the FSSP of Russia. For the FSSP, the code “322” was selected. The fourth and fifth characters are the UFSSP code for the subject of the Russian Federation. The sixth character contains the constant "0". The seventh and eighth characters contain the OSP code in the region. The ninth and tenth characters contain the last 2 digits of the year. Characters from the eleventh to the seventeenth contain the serial number of the Enforcement Proceedings (IP) in the department, supplemented on the left with zeros up to 7 digits. The eighteenth and nineteenth characters contain the constant "0". The twentieth character is a check digit calculated using a specific algorithm.

The unique accrual identifier of the Federal Bailiff Service (UIN FSSP) is a twenty-digit key. All positions in the key must be completed. The UIN FSSP is compiled by the budgetary authority. In this case, only numbers from 0 to 9 are used. UIN payers themselves do not invent it; it is assigned by the FSSP.