Another tax period has ended. Organizations are preparing to submit their annual income tax return. Let us remind you that according to clause 4 of Art. 289 of the Tax Code of the Russian Federation, its submission to the tax office must be carried out no later than March 28.

When calculating the taxable base for the tax period, the following must be taken into account.

Taxpayers who during the year formed certain reserves provided for in Chapter. 25 of the Tax Code of the Russian Federation are required to carry out their inventory as of December 31. The purpose of such an inventory is to identify the amount of underutilization of the reserve or its overexpenditure and adjust the taxable base.

The article will discuss the reserve for upcoming expenses for vacation pay, the procedure for the formation and use of which is established by Art. 324.1 Tax Code of the Russian Federation.

Vacation reserve in accounting policy

According to paragraph 1 of Art. 324.1 of the Tax Code of the Russian Federation , a taxpayer who has decided to uniformly account for upcoming expenses for paying employees’ vacations for tax purposes is obliged to reflect in the accounting policy for tax purposes, firstly, the method of reservation adopted by him, and secondly, the maximum amount of deductions and the monthly percentage of deductions to the specified reserve.

For these purposes, the taxpayer is required to draw up a special calculation (estimate), which reflects the calculation of the amount of monthly contributions to the reserve, based on information about the estimated annual amount of expenses for vacations, including the amount of insurance premiums for such expenses. In this case, the percentage of contributions to the reserve is determined as the ratio of the estimated annual amount of expenses for vacation pay to the estimated annual amount of labor costs.

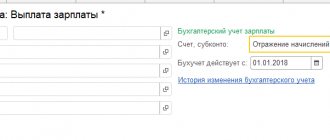

Settings

These are made in the organization’s settings ( Accounting policies and other settings – link Vacation reserves ):

There are two options for calculating estimated liabilities in accounting:

- The standard method is calculation as a percentage of the payroll, indicate the percentage in the Amount of deductions . Also indicate the Limit Value - the maximum amount of the reserve, more than which the reserve will not be accrued for the year. In tax accounting (TA), calculations are always made using the Normative method .

- Liability method (IFRS) – liabilities are calculated based on actual vacation balances and average earnings of employees at the end of the month.

Read more - Estimated vacation obligations in ZUP 3.1

What else needs to be taken into account when drawing up accounting policies?

In accordance with paragraph 2 of Art. 324.1 of the Tax Code of the Russian Federation, expenses for the formation of a reserve for upcoming expenses for vacation pay are included in the accounts for accounting expenses for remuneration of the relevant categories of employees.

Guided by this norm, as well as the provisions of paragraph 1 of Art. 318 of the Tax Code of the Russian Federation , the Ministry of Finance came to the conclusion that the taxpayer has the right to independently determine what type of expenses (direct or indirect) include the costs of forming a reserve for upcoming expenses for vacation pay, both in relation to workers involved in the production process and in relation to other employees of the organization not directly related to the production process ( Letter dated September 16, 2013 No. 03-03-06/1/38134 ). Naturally, the taxpayer must consolidate his choice in the accounting policy for tax purposes.

Officials also do not object to the calculation of the percentage of contributions to the reserve for future expenses for vacation pay being carried out separately for each division of the organization. In this case, the reserve is formed for the organization as a whole ( Letter dated December 7, 2012 No. 03-03-06/1/632 ).

So, the organization has provided in its accounting policy for tax purposes that for the current tax period it will form the specified reserve. Now you need to determine the percentage of monthly contributions to the reserve.

Following the provisions of paragraph. 2 p. 1 art. 324.1 of the Tax Code of the Russian Federation , you can present the calculation of monthly interest in the form of a formula:

% = (VacationPlan + SVVacation) / (OTPlan + SVOT) × 100% , where:

OTplan – estimated annual amount of labor costs;

Vacation plan - the estimated annual amount of expenses for vacation pay;

SVOT , SVotpusk – insurance premiums accrued for the corresponding amounts.

Using a specific example

The percentage of contributions to the reserve is determined. Now you need to multiply this percentage monthly by the amount of actual monthly wage expenses (including insurance premiums). The result obtained will be taken into account for tax purposes in accordance with clause 24 of Art. 255 Tax Code of the Russian Federation .

In this case, it is necessary to ensure that the amount of the reserve accumulated on an accrual basis since the beginning of the year does not exceed the maximum amount established in the accounting policy.

Example1

The organization operates in the production of jewelry from non-precious materials.

In December 2012, it was decided to create a reserve for upcoming vacation expenses in 2013. The accounting policy for tax purposes established a provision for the creation of such a reserve, established a maximum amount of deductions and a monthly percentage of deductions to the reserve.

For 2013, the organization planned that labor costs (excluding vacation pay) would amount to 3,000,000 rubles, and vacation costs would amount to 264,000 rubles.

In 2013, the rates of insurance contributions from the wage fund were: in the Pension Fund of the Russian Federation - 22%, in the Social Insurance Fund - 2.9%, in the Federal Compulsory Medical Insurance Fund - 5.1% (Part 1 of Article 58.2 of Federal Law No. 212-FZ).

The activity of producing jewelry from non-precious materials (OKVED code 36.61) belongs to the ninth class of professional risk (Classification of types of economic activities by professional risk classes, approved by Order of the Ministry of Labor of Russia dated December 25, 2012 No. 625n). Consequently, the rate of contributions for compulsory insurance against accidents at work and occupational diseases is 1% (Article 1 of Federal Law No. 179-FZ).

In total, the total insurance premium rate is 31% (22 + 2.9 + 5.1 + 1).

Let's calculate the monthly percentage of contributions to the reserve.

The estimated annual amount for vacation pay, taking into account insurance premiums, will be 345,840 rubles. (RUB 264,000 + RUB 264,000 × 31%). The accounting policy for 2013 reflects that the maximum amount of deductions to the reserve for future expenses for vacation pay is 345,840 rubles.

The estimated annual wage fund, taking into account insurance contributions, is RUB 3,930,000. (RUB 3,000,000 + RUB 3,000,000 × 31%).

The monthly percentage of contributions for 2013 is 8.8% (RUB 345,840 /

RUB 3,930,000 × 100%).

Based on these calculations, the taxpayer drew up an estimate.

The amount of monthly contributions to the reserve in 2013 is reflected in the table.

| Month | Actual labor costs, rub. | Insurance premiums, rub. (gr. 2 × 31%) | Amount of contributions to the reserve, rub. ((group 2 + group 3) × 8.8%) | Reserve amount at the end of the month, rub. |

| 1 | 2 | 3 | 4 | 5 |

| January | 290 000 | 89 900 | 33 431 | 33 431 |

| February | 280 000 | 86 800 | 32 278 | 65 709 |

| March | 290 000 | 89 900 | 33 431 | 99 140 |

| April | 310 000 | 96 100 | 35 737 | 134 877 |

| May | 280 000 | 86 800 | 32 278 | 167 155 |

| June | 190 000 | 58 900 | 21 903 | 189 058 |

| July | 220 000 | 68 200 | 25 362 | 214 420 |

| August | 210 000 | 65 100 | 24 209 | 238 629 |

| September | 260 000 | 80 600 | 29 973 | 268 602 |

| October | 320 000 | 99 200 | 36 890 | 305 492 |

| November | 360 000 | 111 600 | 40 348* | 345 840 |

| December | 290 000 | 89 900 | – | 345 840 |

| Total | 3 300 000 | 1 023 000 | 345 840 |

The amount of the reserve accumulated on an accrual basis since the beginning of the year should not exceed RUB 345,840. (limit amount established in the accounting policy). Contributions to the reserve from January to October amounted to 305,492 rubles, so in November their value was 40,348 rubles. (345,840 - 305,492). Accordingly, no contributions to the reserve were made in December.

Other ways to calculate reserves

As already noted, the algorithm for calculating the amount of the reserve is prescribed in the accounting policy, this is due to the fact that PBU 8/2010 does not contain formulas and methods that allow obtaining the value of the reserve.

In addition to the above method, in practice, you can also use one of the following amounts to calculate the reserve:

- wage fund (hereinafter referred to as OT);

- vacation pay paid for the calendar year preceding the year for which the reserve is created (standard method).

The procedure for calculating the reserve amount is carried out in the following steps:

- determination of the average daily wage fund or vacation pay;

- formation of a reserve.

Let's look at examples of using each of these methods.

Example 1

Molniya LLC's accounting policy reflects the creation of a reserve for vacation pay for the year 20XX based on labor costs. The organization uses the following formula to calculate the reserve:

(OT + insurance premiums) / 28 × 2.33,

where 28 is the number of vacation days per year for each employee;

2.33 - number of vacation days for 1 month worked.

The reserve is formed at the end of each month. The reserve does not include payments to employees who have not worked for a full month. The reserve amount at the end of 2021 is 0 rubles. The OT values for 2021 are presented in column 2 of Table 1. Insurance premiums - 30.2% (including contributions for injuries).

Table 1. Reserve calculation

| Month | FROM | Insurance premiums (OT × 30.2%) | Reserve (OT + insurance premiums) / 28 × 2.33 |

| 1 | 2 | 3 | 4 |

| January 20XX | 100 000 | 30 200 | 10 835 |

| February 20XX | 110 000 | 33 220 | 11 918 |

| March 20XX | 120 000 | 36 240 | 13 001 |

| April 20XX | 100 000 | 30 200 | 10 835 |

| May 20XX | 130 000 | 39 260 | 14 085 |

| June 20XX | 90 000 | 27 180 | 9 751 |

| July 20XX | 108 000 | 32 616 | 11 701 |

| August 20XX | 111 000 | 33 522 | 12 026 |

| September 20XX | 120 000 | 36 240 | 13 001 |

| October 20XX | 100 000 | 30 200 | 10 835 |

| November 20XX | 101 000 | 30 502 | 10 943 |

| December 20XX | 100 000 | 30 200 | 10 835 |

| Total | 1 290 000 | 389 580 | 139 765 |

At the end of each month, Molniya LLC will reflect in the accounting the accrual of the reserve for the year 20XX: Dt 26 (44.20) Kt 96 in the amount from column 4, i.e. as of 01/31/20XX - 10,835, as of 02/28/20XX - 11,918 , as of 03/31/20XX - 13,001, etc.

IMPORTANT! The reserve amounts are reflected in the balance sheet as part of the indicators in line 1540 “Reserves for future expenses.” Read about changes in the balance sheet from 2021 here.

Example 2

LLC "Molniya" in its accounting policy recorded the creation of a reserve once a year, based on the payment of vacations of the previous year. According to accounting data, these expenses are 960,000 rubles.

Reserve calculation:

Insurance premiums = 960,000 × 30.2% = 289,920 rubles.

Reserve = 960,000 + 289,920 = 1,249,920 rubles.

For what, with what frequency and how is inventory of reserves in accounting carried out, find out from the Ready-made solution from ConsultantPlus. You can get a trial full access to K+ for free.

Using the vacation reserve

In accordance with paragraph 24 of Art. 255 of the Tax Code of the Russian Federation, the composition of labor costs will include deductions to the reserve of upcoming expenses for vacation pay, while the amount of actually accrued vacation pay does not matter.

Expenses for vacation pay (including those provided for unused vacations of previous years) are taken into account from the funds of the created reserve ( Letter of the Ministry of Finance of Russia dated September 24, 2010 No. 03-03-06/1/617 ).

In addition, when forming the reserve, insurance premiums related to vacation pay are taken into account. Consequently, they also need to be written off against the reserve (see Letter of the Ministry of Finance of Russia dated November 29, 2010 No. 03-03-06/4/116 ). Thus, “holiday” insurance premiums will not be included in other expenses, such as contributions accrued on wages.

Keep in mind that the reserve is used only to pay for the main and additional leave used by employees. Compensation for unused vacation must be immediately charged to labor costs in accordance with clause 8 of Art. 255 Tax Code of the Russian Federation . This was indicated by the Ministry of Finance in Letter dated 05/03/2012 No. 03-03-06/4/29 .

Please note that this letter deals with compensation upon dismissal. However, in paragraph 8 of Art. 255 of the Tax Code of the Russian Federation talks about monetary compensation for unused vacation in accordance with the labor legislation of the Russian Federation. We believe that these may also be those provided for in Art. 126 of the Labor Code of the Russian Federation, compensation in exchange for part of the vacation exceeding 28 days.

Reflection of reserve inventory results

Due to the fact that during the year, at the expense of the reserve, the taxpayer takes into account the estimated, and not the actual costs of paying for vacations, at the end of the year the following may result:

– the amount actually transferred to employees for annual leave exceeds the amount of the reserve;

– the amount of the reserve allocated to expenses is greater than the actual expenses of the organization.

Therefore, it is quite natural that the taxpayer is charged with the obligation to take an inventory of the reserve of upcoming expenses for paying for vacations ( paragraph 1, clause 3, article 324.1 of the Tax Code of the Russian Federation ).

The results of the inventory must be formalized properly: draw up an act or an accounting certificate (in any form).

The reflection of inventory results for tax accounting purposes depends on whether the organization will continue to accrue a reserve for upcoming expenses for vacation pay in the next tax period.

Vacation reserve as an estimated liability

According to PBU 8/2010 “Estimated Liabilities”, organizations must create certain amount-weighted liabilities in their accounting accounts.

That is, financial statements must contain not only data on the company’s documented obligations to contractors and third parties, but also information on planned expenses that are inevitable. For example:

- future employee holidays;

- planned tax assessments;

- costs for suppliers in terms of expenses that we know for sure that they will be (for example, if a work completion certificate already exists, but has not yet been signed, so it cannot yet be recorded, although it is known for sure that the director will sign the document will be held next month).

With the advent of this information, the balance sheet becomes the most reliable, since it reflects the most realistic picture of the financial position of the enterprise. Let's take a closer look at what a reserve for vacation pay is.

Each employee, in accordance with labor legislation, is entitled to at least 28 calendar vacation days, and in a number of legally established cases this figure may be higher. Thus, for each reporting date we have vacation days that have not yet been used by employees (it is difficult to imagine an organization in which all employees took 28 vacation days at once). Accordingly, for each reporting date, there are estimated obligations of the company to employees to pay for these days and, as a result, certain obligations to funds to pay insurance premiums.

Who is responsible for reporting this information? In accordance with paragraph 3 of PBU 8/2010, all companies are required to reflect these accruals, with the exception of small enterprises (issuers of securities are not included in such exceptions), which can use a simplified method of accounting. The characteristics of such companies are specified in the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Thus, if a company does not fit the definition of a small business entity, the accrual of valuation reserves becomes mandatory, and the absence of this information on the accounting accounts may be regarded as a violation of the rules for accounting for income and expenses. Responsibility for this comes on two grounds:

- for gross violation of accounting for income and expenses under Art. 120 of the Tax Code of the Russian Federation in the amount of 10,000−30,000 rubles;

- administrative liability applied to officials under Art. 15.11 Code of Administrative Offences.

IMPORTANT! If a company creates a reserve for vacation pay, it is necessary to stipulate this in the accounting policy, as well as the procedure for calculating this reserve.

The reserve is not created in the next tax period

According to para. 3 p. 3 art. 324.1 of the Tax Code of the Russian Federation, if the funds of the actually accrued reserve, confirmed by the inventory on the last day of the tax period, are insufficient, the taxpayer is obliged, as of December 31 of the year in which the reserve was accrued, to include in expenses the amount of actual expenses for paying for vacations and, accordingly, the amount of insurance contributions, for which the specified reserve was not previously created.

If, when clarifying the accounting policy for the next tax period, the taxpayer considers it inappropriate to form a reserve for upcoming expenses to pay for vacations, then the amount of the balance of the specified reserve, identified as a result of the inventory as of December 31 of the year in which it was accrued, is included for tax purposes in non-operating expenses. income of the current tax period ( clause 5 of Article 324.1 of the Tax Code of the Russian Federation ).

In other words, if the taxpayer decides not to create a reserve for the next tax period, the entire actual balance of the reserve is included in income (expenses)

as of December 31 of the current year (see letters of the Ministry of Finance of Russia dated October 29, 2012 No. 03-03-10/121 , dated June 6, 2012 No. 03-03-10/62 , dated March 20, 2012 No. 03-03-06/1/ 131 ).

Example 2

The amount of deductions to the reserve for future expenses for vacation pay is 345,840 rubles. (see example 1).

During 2013, employees of the organization were accrued vacation pay in the amount of 310,000 rubles. Insurance premiums amounted to 96,100 rubles. (RUB 310,000 × 31%).

At the end of the year, when taking inventory of the reserve, it was discovered that the amount of actually accrued vacation pay (together with insurance premiums) exceeds the amount of the reserve by 60,260 rubles. (310,000 + 96,100 – 345,840). Thus, the accrued reserve funds are insufficient. Therefore, the excess amount must be included in labor costs.

Example 3

The amount of deductions to the reserve for future expenses for vacation pay is 345,840 rubles.

During 2013, employees of the organization were accrued vacation pay in the amount of 250,000 rubles. Insurance premiums amounted to 77,500 rubles. (RUB 250,000 × 31%).

At the end of the year, when taking inventory of the reserve, it was discovered that the amount of the accrued reserve was greater than the amount of actually accrued vacation pay (together with insurance contributions) by 18,340 rubles. (345 840 0).

The excess amount is subject to inclusion in non-operating income.

An example of calculating and reflecting the vacation reserve in the accounting accounts

This is an example of the above method of calculating the reserve - based on average earnings. Below you will see examples for other reservation options.

Example

reflected in the accounting policy that the reserve for vacation pay is formed quarterly. To calculate wages and insurance premiums, account 44 “Distribution costs” is used; in total, the company employs 20 people. The company has no grounds for applying reduced or increased insurance premiums (the total rate of insurance premiums is 30.2%). As of March 31, the data for the quarter is as follows:

- number of days of unused vacation - 134;

- for the 1st quarter, the amount of accrued wages amounted to 678,000 rubles;

- there are 91 days in the quarter.

- Let's calculate the reserve as of 03/31/20XX:

SDZ = 678,000 / 91 / 20 = 372.53 rubles.

The reserve amount is 372.53 × 134 × 20 + 372.53 × 134 × 20 × 30.2% = 998,380.40 + 301,510.88 = RUB 1,299,891.28.

Postings:

Dt 44 “Sales expenses” Kt 96.01 “Vacation reserve” - RUB 998,380.40.

Dt 44 “Sales expenses” Kt 96.01 “Vacation reserve” - RUB 301,510.88.

- Let’s add a few more data to this example to understand how the vacation reserve is adjusted:

- as of 03/31/20XX, a reserve for vacation and insurance premiums was accrued in the amount of RUB 1,299,891.28;

- in the 2nd quarter, the amount of accrued vacation pay and insurance contributions from them amounted to 140,900 rubles;

- the number of unused vacation days at the end of the 2nd quarter is 120 days;

- wages for the 2nd quarter and the number of employees remained the same as in the previous period.

Thus, as of 06/30/20XX, the amount of the unused reserve amount is equal to 1,299,891.28 – 140,900 = 1,158,991.28 rubles.

Reserve amount as of 06/30/20XX:

SDZ = 678,000 /91 / 20 = 372.53 rubles.

The reserve amount is 372.53 × 120 × 20 + 372.53 × 120 × 20 × 30.2% = 894,072 +270,009.74 = 1,164,081.74 rubles.

Amount for contributions to the reserve as of the end of the 2nd quarter:

1,164,081.74 (calculated reserve) – 1,158,991.28 (reserve balance, balance on account 96) = 5,090.46 rubles.

If the amount of the reserve on the account. 96 exceeded the calculated amount at the end of the quarter, the reserve should have been reduced. In our case, it is necessary to make an additional accrual posting.

Postings:

Dt 44 Kt 96.01 - 5,090.46 rub.

The reserve continues to be created in the next tax period

If the organization does not change its accounting policy regarding the creation of a reserve for vacation pay for the next tax period, at the end of the reporting tax period the organization may have the balance of the underutilized reserve determined during the inventory ( Letter of the Ministry of Finance of Russia dated January 11, 2013 No. 03-03-06/1 /4 ).

Based on clause 4 of Art. 324.1 of the Tax Code of the Russian Federation, the reserve for future expenses for paying vacations to employees must be clarified based on the following:

– number of days of unused vacation;

– the average daily amount of expenses for remuneration of employees (taking into account the established methodology for calculating average earnings);

– mandatory deductions of insurance premiums.

If, based on the results of the inventory, the amount of the calculated reserve in terms of unused vacation (determined based on the average daily amount of labor costs and the number of days of unused vacation at the end of the year) ( BUT ) exceeds the actual balance of the unused reserve at the end of the year ( ONR ), then the excess amount must be included included in labor costs. That is, if BUT > OHP , the difference = labor costs.

If, based on the results of the inventory of the reserve for upcoming expenses for vacation pay, the amount of the calculated reserve in terms of unused vacation is less than the actual balance of the unused reserve at the end of the year, then the negative difference must be included in non-operating income. That is, if NO < ONR , the difference = non-operating income.

Example 4

Let's use the data from example 3, according to which the amount of the underutilized reserve amounted to 18,340 rubles.

One of the organization’s employees did not take a full vacation: instead of 28 calendar days, only 10. The average daily earnings of this employee to pay for vacation is 1,000 rubles.

The amount of the calculated reserve for unused vacation is 18,000 rubles. (RUB 1,000 × (28 days - 10 days)). Together with insurance premiums, it will be 23,580 rubles. (RUB 18,000 + RUB 18,000 × 31%).

Thus, BUT (RUB 23,580) > OHP (RUB 18,340). The difference is RUB 5,240. (24,300 - 18,340) will be taken into account in labor costs.

Example 5

Let’s use the data from example 4. An employee took 18 days off out of 28 calendar days.

The amount of the calculated reserve for unused vacation is 10,000 rubles. (RUB 1,000 × (28 days - 18 days)). Together with insurance premiums, it will be 13,100 rubles. (RUB 10,000 + RUB 10,000 × 31%).

Thus, BUT (RUB 13,100) < RUB (RUB 18,340). The difference is RUB 5,240. (18,340 - 13,100) will be taken into account in non-operating income.

Unused vacation days for a specific calendar year can only be determined as of the last day of the calendar year ( Letter of the Ministry of Finance of Russia dated January 11, 2013 No. 03-03-06/1/4 ). The reserve for future expenses for vacation pay during the tax period (at the end of each reporting period) is not updated ( Letter of the Ministry of Taxes and Taxes of Russia dated August 18, 2004 No. 02-5-11/ [email protected] ).

When conducting an inventory of the reserve for vacation pay, in practice the question often arises as to how to correctly calculate unused vacation days. There are two possible approaches here. First: you should take into account the planned number of vacation days per year, which is compared with the number of actually used vacation days per year. Second: all days of unused vacation should be taken into account as of December 31 of the reporting year, including unused vacation days for previous years.

The Ministry of Finance adheres to the first approach ( 03-03-06/1/45507 dated October 28, 2013 ); there are examples of the second approach in arbitration practice.

For example, in FAS PO Resolution No. A 65-6806/2011 , the taxpayer challenged the decision of the tax inspectorate, which concluded that the reflection of expenses for creating a reserve for vacations was unjustified, and assessed additional income tax of about 1.7 million rubles.

According to the tax authorities, the taxpayer unlawfully adjusted the reserve for the upcoming payment of vacations to employees based on the number of days of unused vacation for all unused vacations of employees since the beginning of the organization’s activities.

However, the judges, having analyzed the provisions of paragraph 4 of Art. 324.1 of the Tax Code of the Russian Federation , indicated: from the content of this legislative norm it does not clearly follow that we are talking specifically about vacations to be provided for the current reporting year.

In accordance with Art. 3 of the Tax Code of the Russian Federation, all irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees are interpreted in favor of the taxpayer (payer of fees).

Articles 122 – 124 of the Labor Code of the Russian Federation establish the employer’s obligation to provide the employee with annual paid leave. At the same time, the law provides for the possibility of transferring this leave, and also establishes a ban on failure to provide annual paid leave for two years in a row.

Consequently, under unused vacations in accordance with Art. 324.1 of the Tax Code of the Russian Federation refers to unused vacations both in the reporting year and in previous years.

Methodology for calculating the amount of reserve for vacation pay

Since the formula used to calculate the amount of the reserve is not defined by law, each company determines it independently. In this case, the developed method should be fixed in the accounting policy.

IMPORTANT! Any estimated liability should be as close as possible to a reliable monetary estimate of future expenses. The reserve should be determined on the basis of existing facts of the organization's economic activity, and the calculation should be based on accumulated work experience and, possibly, some expert opinions. That is, calculations must be supported by documents and be extremely justified.

Thus, to justify the amount of the accrued reserve for vacation pay, the organization must have:

- A method for calculating a reserve established in the accounting policy that would provide a reliable estimate of expenses for this item.

- Developed primary document to reflect the calculated reserve (certificate, for example). It is worth attaching a primary document, the information on which was used in the calculation (time sheet, pay slip, etc.).

There are several ways to calculate the reserve for vacation pay. First, let's look at one of them, which is fairly accurate - it is based on the actual number of unused vacation days and the average daily earnings of employees:

- First, you should break down all employees by department to determine which cost accounts are used (20–26, 44, etc.).

- It is necessary to have information on the number of vacation days entitled to each employee. If you have automated accounting, collecting this information is not difficult. These days should be summed up for each employee group.

- We calculate the average daily earnings (ADE) of workers for each group. To do this, you must first divide all employee salaries for the past selected period (month, quarter) by the number of calendar days in this period, and then by the number of employees in the group. Visually, this formula looks like this:

Employee SDZ = Salary / DN / K,

Where

ZP - salary for the period,

DN - calendar days of the period,

K is the number of employees in the group (or the company as a whole).

IMPORTANT! Calendar and working days should not be confused, since the number of vacation days is always counted in calendar days - therefore, earnings for calculating vacation pay should also be counted in calendar days.

- The final point is to calculate the amount of the reserve itself (do not forget to calculate insurance premiums from this reserve). The final reserve amount will be calculated using the following formula:

Reserve = (employee SDZ × K × DNO) + (employee SDZ × K × DNO) × St,

Where

DNO - days of unused vacation,

Cst - the total rate of insurance premiums in%.

Read more about the rates of insurance premiums and objects of taxation in our section “Insurance premiums”.

IMPORTANT! The most accurate way to calculate the reserve is to calculate it individually for each employee. In this case, the amount of the reserve will consist of the amount of obligations to each employee. However, if the number of employees in the company is large, this process will be quite labor-intensive.

A few words about accounting

The formation of a reserve for upcoming expenses for vacation pay in tax accounting is the right of the taxpayer, in contrast to accounting: organizations must create such a reserve in it.

Please note that there is no direct indication of the creation of such a reserve in accounting regulations. However, from the analysis of the norms of PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets” it follows that the organization’s obligations in connection with the emergence of employees’ right to paid leave in accordance with the legislation of the Russian Federation are estimated liabilities. The estimated liability is recognized in accounting while simultaneously meeting the conditions established by clause 5 of PBU 8/2010 (see letters of the Ministry of Finance of Russia dated 04/19/2012 No. 07-02-06/110 , dated 04/26/2011 No. 07-02-06/64 ). According to clause 16 of PBU 8/2010, the amount of the estimated liability is determined by the organization on the basis of the existing facts of the organization’s economic life, experience in relation to the fulfillment of similar obligations, as well as (if necessary) expert opinions.

Due to the lack of clear rules in accounting for creating a reserve (only general principles for accounting for estimated liabilities are given), it would be easier for many organizations to create such a reserve according to the rules for tax accounting. This would make it possible to bring the two accounts closer together, and as a result, there would be no need to apply PBU 18/02 “Accounting for calculations of corporate income tax” .

Therefore, it is quite natural that taxpayers are concerned about the question of whether they can keep accounting records of reserves for vacation pay according to the rules of the Tax Code of the Russian Federation ( Article 324.1 of the Tax Code of the Russian Federation ), having prescribed this decision in their accounting policies. Unfortunately, officials of the Ministry of Finance, responding to it in Letter dated 05/03/2012 No. 03-03-06/1/222 , limited themselves to only references to the above norms: the procedure for reflecting estimated liabilities in the accounting and reporting of organizations is established by PBU 8/2010 , in In tax accounting, the creation of reserves for vacation pay is regulated by Art. 324.1 Tax Code of the Russian Federation .

We believe that subject to the provisions of clause 16 of PBU 8/2010 , on the basis of which the organization must provide documentary evidence of the validity of the amount of the estimated liability, a reserve for upcoming expenses for vacation pay, if necessary, can be formed in accounting under the conditions provided for in Art. 324.1 Tax Code of the Russian Federation .

- Hereinafter, we mean insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases.

- Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

- Federal Law No. 179-FZ of December 22, 2005 “On insurance tariffs for compulsory social insurance against industrial accidents and occupational diseases for 2006.” Insurance premiums in 2013 were paid in the manner and at the rates established by this document (see Federal Law No. 228-FZ dated December 3, 2012).

- Sent by Letter of the Federal Tax Service of Russia dated December 12, 2012 No. ED-4-3/ [email protected]

- Approved by Order of the Ministry of Finance of Russia dated December 13, 2010 No. 167n.

- According to clause 3 of PBU 8/2010, this provision may not be applied by small businesses.

- Approved by Order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n.

Over the past 7 years, most accountants of agricultural organizations have been trying to avoid creating reserves for vacation pay. Let me remind you that the formation of these reserves was made obligatory on January 1, 2011 (PBU 8/2010 “Estimated Liabilities”). And yet, according to the results of the first half of 2021, at the unspoken request of the Ministry of Agriculture of the Russian Federation, many accountants in agriculture had to deal with this and form these reserves. But how correctly these reserves were formed is a separate question. Let's figure out how to properly create these reserves.

The introduction of unfamiliar foreign accounting concepts frightens many, especially since the work on forming estimated liabilities requires significant labor costs, and their creation will not significantly affect the financial result of the activity. Creating a reserve will not particularly help reduce taxes: for income tax, their creation is a right, not an obligation, and for the Unified Agricultural Tax, this type of expense does not exist at all.

Auditors, of course, will write a note about the lack of a reserve for vacation pay. However, in order to include this fact in the audit report, auditors will need to independently calculate the reserve and only then determine how significant the lack of a reserve for vacation pay is and whether it will affect the reliability of the financial statements. And this may take more than one day of verification.

From the tax authorities, for not creating a reserve, you face a minor fine on the basis of Parts 1, 2 of Art. 120 Tax Code of the Russian Federation:

— for refusal of an assessment obligation for one year, the fine will be 10,000 rubles;

- for refusal for several years - 30,000 rubles.

For the absence of such an assessment obligation, which is a gross violation of the requirements for accounting and financial reporting, the head of the organization may be fined (Part 1, 2 of Article 15.11, note to Article 2.4 of the Code of Administrative Offenses of the Russian Federation):

- for a primary offense - in the amount of 5,000 to 10,000 rubles;

- in case of repeated offense - from 10,000 to 20,000 rubles. or disqualification for a period of one to two years.

At the same time, a gross violation of accounting requirements, including accounting (financial) reporting, means, in particular, a distortion of any indicator of accounting (financial) reporting expressed in monetary terms by at least 10% (note to Art. 15.11 Code of Administrative Offenses of the Russian Federation). But again, before proving that the accounting indicator is distorted, the tax authorities will have to independently calculate the amount of the estimated liability, and, of course, no one will do this.

So it turns out that many people simply ignore the estimated liability in the form of a reserve for vacation pay and accrue vacation pay “the old fashioned way.” However, they will have to be created, since the transition to international accounting standards is “just around the corner.” And in many regions, the agricultural department, as we said earlier, already refuses to accept reports without reserves.

Only small businesses that use simplified accounting methods (clause 3 of PBU 8/2010) will be able to avoid the formation of estimated liabilities.

In fact, “the devil is not as scary as he is painted.” And to create a reserve, first of all, you need to decide on the calculation method that suits you best, consolidate it in your accounting policies and calculate it correctly, so that you can then accrue it in other periods by analogy. And for those whose accounting is automated in 1C: ZUP, it’s even easier - set up the program and go ahead. What options are possible?

You can calculate the reserve for vacation pay for:

- the last day of each month. This option is the most preferable, but also more labor-intensive;

- the last date of each quarter. Based on the cost-benefit ratio, this option can be considered the most optimal;

- and at the end of the reporting year. The option is the simplest, but it is suitable only for those organizations that report at the end of the year and do not generate interim reports, therefore, agricultural enterprises are immediately excluded from this list.

It must be remembered that the amount of the vacation reserve should be equal at the reporting date to the amount of vacation pay that the organization must pay if all employees simultaneously decided to take off already earned vacation days. At the same time, remember that the number of days earned but not taken off by a specific employee (category of employees or all employees) is determined not from the beginning of the calendar year, but from the date of commencement of the labor activity of a specific employee in the organization.

Today, there are three ways to calculate reserves for vacation pay:

1) for each employee separately (personalized method);

2) by individual groups of personnel, for example, by divisions, departments;

3) for the organization as a whole, based on the results of the previous period.

When using the first method, the calculation formula will be as follows:

RO = K * Salary * x (1+ Tariff of all insurance premiums for an employee in % / 100%),

where RO is the reserve for vacation pay;

K - number of unused vacation days;

ZP – average daily earnings of an employee;

(1+ Tariff of all insurance premiums for an employee in % / 100%) – total tariff for insurance premiums.

Do not forget that the reserve for vacation pay is necessarily formed taking into account insurance contributions to extra-budgetary funds. When converting total insurance premiums from interest to share, your organization as a whole will have a single value. For example, 30% for all contributions and 0.2% for contributions for injuries, the result is 30.2%, therefore, the coefficient of insurance premiums for calculating the reserve will be equal to 1.00302 (30.2% / 100% / 100 + 1 ).

An employee’s average daily earnings are determined in the usual manner, both for calculating vacation pay and for compensation for unused vacation. The number of vacation days not taken off is calculated based on 2,333 days for each month of work.

Next, we determine the amount of vacation pay attributable to each group of employees (for each cost accrual account), and ultimately we obtain the result in the form of an accrued reserve by adding all these amounts together.

Example 1. There are two employees in the veterinary service department: Vetrov O.G. and Ponomarenok R.Yu. As of 08/31/2018 Vetrov O.G. has the right to 18.64 days of vacation, and Ponomarenok R.Yu. – 25.63 days.

Average daily earnings Vetrova O.G. as of 08/31/2018 amounted to 1023.9 rubles, Ponomarenok R.Yu. – 890 rub.

The organization pays insurance premiums at a general rate of 30%, as well as insurance premiums for injuries at a rate of 2.5%. As a result, the total tariff for insurance premiums is 32.5%.

Let's calculate the amount of the reserve for vacation pay for each employee of the veterinary department, taking into account insurance premiums:

— for Vetrov – 19,147.52 rubles. [18, 64 days * 1023.9 rub. * (1 + (32.5% / 100%)];

— for Sextons – 22,884.83 rubles. [25.63 days * 890 rub. * (1 + 32.5% / 100%)].

Total: the amount of the reserve as of 08/31/2018 for the veterinary service department is equal to 42,032.35 rubles.

The wages of the veterinary service department are accrued on account 20-2 “Livestock”, therefore, the reserve for vacation pay, calculated above, will also be reflected on this account:

Dt 20-2 - Kt 96 - 42032.35 rub.

As we said above, this method is very labor-intensive, but more accurate. It can be used by agricultural organizations with a small staff of workers. Don’t forget to indicate in your accounting policy the use of calculating the estimated liability for vacation pay “based on the average daily earnings of each employee” and prescribe the algorithm for such calculation.

The second method of calculating the reserve is based on the average daily earnings of each group of workers. In the accounting policy it will sound like “based on the average daily earnings of each group of workers.”

This technique is much simpler than the previous one and is as follows:

1) We count the number of unused vacation days, including additional days, the right to which employees have already acquired for the entire group as a whole (regardless of whether the right to additional days arises according to the law or according to local regulations of the enterprise).

2) We calculate the average daily earnings for the group as a whole using the following formula:

ZPgr = ZP tek / Ktek / Kr,

where: ZP gr - average daily earnings for a group of workers

ZPtek - The amount of wages accrued for a group of employees for the current period;

To current - Number of days in the current period;

Kr — Number of employees in the group.

3) We calculate the amount of the reserve for vacation pay for the entire group using the formula:

RO = (ZPgr + ZPgr * (1+ Tariff of all insurance contributions for an employee in % / 100%)) * K

4) Next, we determine the total amount of the reserve by adding up the data for all groups.

Example 2. The Lyubavensky agricultural production company has 5 departments: AUP (15 employees), Plant Growing (20 employees), Canteen (3 employees), RMM (5 employees). The salary amount for August 2021 by department is:

AUP (15 employees) - 375,000 rubles;

Plant growing (20 employees) - 400,000 rubles;

Canteen (3 employees) - 45,000 rubles,

RMM (5 employees) - 100,000 rub.

According to the accounting policy, the reporting date is the last day of each month. The organization pays insurance premiums at the aggregate rate, taking into account contributions for injuries - 32.5%.

As of 08/31/2018, the total number of unused vacation days by department is: AUP - 209.7; Crop production - 186.4; Dining room - 41.94, RMM - 81.55.

Let's calculate the average daily earnings of each department as of March 31, 2018:

AUP (15 employees) - 806.45 rubles. (RUB 375,000 / 31 days / 15 people);

Crop production (20 employees) - 645.16 rubles. (400,000 rub. / 31 days / 20 people);

Canteen (3 employees) - 483.87 rub. (45,000 rub. / 31 days / 3 people);

RMM (5 employees) - 645.16 rubles. (RUB 100,000 / 31 days / 5 people).

Let's determine the reserve amount for each group:

AUP (15 employees) – 224,074.14 rubles. [(RUB 806.45 + RUB 806.45 * 32.5%) * 209.7 days]

Crop production (20 employees) – RUB 159,341.16. [(RUB 645.16 + RUB 645.16 * 32.5%) * 186.4 days]

Canteen (3 employees) - RUB 26,888.89. [(RUB 483.87 + RUB 483.87 * 32.5%) * 41.94 days]

RMM (5 employees) - RUB 78,260.33. [(RUB 645.16 + RUB 645.16 * 32.5%) * 91.55 days].

The total reserve for vacation pay as of August 31, 2018 is RUB 488,564.51.

The reserve for vacation pay in the accounting of SEC “Lyubavensky” will be reflected as of 08/31/2018:

Dt 26.20-1.29.23 - Kt 96 - 488,564.51 rub.

And finally, the third method of calculating the reserve for vacation pay based on the indicators of the last reporting year using contributions to the reserve, which you also reflect in your accounting policies.

This method is the most common among accountants, but it is less informative and accurate.

If you nevertheless choose this method of creating a reserve for vacation pay, based on the results of last year, the accountant should use the standard for contributions to the reserve, which is calculated as of December 31 of the previous year using the following formula:

Nro = ∑OtPP / ∑ Zp PP,

where Nro is the standard for contributions to the reserve for a group of employees;

∑OTPP - the amount of expenses for vacation pay and compensation payments for unused vacation (excluding insurance premiums for a group of employees for the previous year);

∑ ZpPP - the amount of labor costs (excluding insurance contributions) of a group of employees for the previous year.

This estimated standard value will remain unchanged throughout the year.

Next, for each reporting date (end of month, quarter, year), which the organization itself has determined in its accounting policies, the following indicators are calculated:

1) The amount of contributions to the reserve for each group of employees is calculated using the formula:

RO gr = (ZP gr + SV gr) * Nro,

Where:

RO gr - the amount of contributions to the reserve for a group of employees;

ZP gr - the amount of the salary of a group of employees in the current period;

SV gr - the amount of insurance premiums accrued on the salary of a group of employees in the current period;

Nro is the standard for contributions to the reserve for a group of employees.

Example 3. The amount of expenses for vacation pay, including compensation for unused vacation for 2021 in the organization amounted to 3,800,000 rubles, the amount of expenses for wages for the same period was 7,000,000 rubles.

According to the accounting policy, the reporting date is the last day of each month.

Let’s say an organization has 3 departments: AUP, sales and production.

The amount of wages for August 2021 in the AUP department was 100,000 rubles, in the sales department - 120,000 rubles, in the production department - 200,000 rubles. Amount of insurance premiums based on the total tariff of 32.5%:

— AUP – 32,500 rubles;

— sales department – 39,000 rubles;

— production – 65,000 rubles.

Nro = 0.54 (RUB 380,000/RUB 700,000).

As of August 31, 2018, the amount of contributions to the reserve is:

- for the administrative department - 71,550 rubles. [(RUB 100,000 + RUB 32,500) * 0.54];

— for the sales department – 85,860 rubles. [(RUB 120,000 + RUB 39,000) * 0.54].

— for production — 143,100 rubles. [(RUB 200,000 + RUB 65,000) * 0.54].

The total amount of the reserve is RUB 300,510. It is for this amount that the reserve should be accrued based on the results of August 2021.

As mentioned above, to reflect transactions on the accrual of reserves for vacation pay, the Instructions for using the Chart of Accounts provide for account 96 “Reserves for future expenses.” The credit of this account reflects the operations for calculating the reserve; the costs of creating an estimated liability for vacation pay are taken into account in the same manner as wages accrued to employees.

The accounting entries will look like this:

Dt 20 (23, 25, 26, 44...) - Kt 96.

When checking the interim reporting for the current year, we were faced with the fact that reserves were accrued, but they forgot to reflect their use in accounting. And when employees went on vacation, accounting entries for calculating vacation pay were mistakenly taken into account in the same order: Dt 20 (23, 25, 26, 44...) - Kt 70, 69.

But by doing so, you significantly inflate your expenses: not only is the created reserve for vacation already reflected in costs by the entry: Dt 20.23 ... Kt 96, but on top of this, vacation pay is included in the cost of products, works, services (Dt 20, 23…Kt 70, 69). That is, it turns out that you “double” vacation costs.

Therefore, if you have created a vacation reserve, then do not forget to spend it. The instructions for using the Chart of Accounts stipulate that the use of the reserve is to be reflected in the debit of account 96 “Estimated liability” in correspondence with the credit of accounts 70 and 69.

Example 4. Let's use the conditions of example 1. Vetrov O.G. in September 2021 he goes on vacation for 14 days. We remind you that as of 08/31/18, a vacation reserve in the amount of RUB 19,147.52 was created for this employee. ( Dt 20-2 - Kt 96 ).

In September 2021, the accountant calculates the amount of vacation pay for this employee - 10,800 rubles, accrued insurance premiums (32.5%) - 3,510 rubles. The following entries will be made in accounting for the accrual of vacation pay from the created reserve and insurance contributions in the amount of vacation pay:

Dt 96 - Kt 70 - 10,800 rubles;

Dt 96 - Kt 69 - 3510 rub.

Sometimes situations arise when the amount of the recognized estimated liability is not enough: when the actual amount of vacation pay turns out to be higher than the created reserve. As follows from paragraph 21 of PBU 8/2010, in this case, the organization’s costs for repaying the obligation are reflected in the organization’s accounting in the general manner: Dt 20 (23, 25, 26, 44...) - Kt 70 (69).

Example 5. Let’s continue to consider example 1, with the only difference that in relation to employee O.G. Vetrov. the reserve was calculated less (RUB 19,147.52) than accrued vacation pay for 28 calendar days - RUB 18,789. and insurance premiums - 6106.42 rubles, total 24895.42 rubles. In September 2021, the accountant will reflect the following transactions for calculating vacation pay and insurance contributions:

Dt 96 - Kt 70 - 14450.9 rub.

Dt 96 - Kt 69 - 4696.56 rubles.

Dt 20-2 - Kt 70 - 4338.1 rub. (18789 – 14450.9)

Dt 20-2 - Kt 69 - 1409.86 rub. (6106.42 – 4696.56).

If the amount of the recognized estimated liability for vacation pay exceeds the actual costs incurred for the payment of vacation pay (compensations for unused vacation, one-time payments for vacation provided for by the employer’s local regulations) and the insurance premiums accrued on them, then the excess amount of the recognized estimated liability is attributed to the following time, estimated liabilities for vacation pay, without writing off previously recognized excess amounts as income (clause 22 of PBU 8/2010).

Based on example 4, according to Vetrov O.G. the amount of the reserve for vacation pay was not fully spent: 4837.52 rubles. (19,147.52 – 10800 – 3510). This reserve balance is not reversed, not restored in income, but simply transferred to the next month.

Like all assets and liabilities subject to mandatory inventory at the end of the year as of December 31, the estimated liability in the form of a reserve for vacation pay also needs to be inventoried. Involve HR employees to help with inventory, since you can’t do without their information.

Inventorying the vacation reserve consists of comparing the amount of the accrued reserve for the current year with the amount of actual expenses for vacation pay, taking into account insurance premiums and deductions for injuries (clause 23 of PBU 8/2010).

Based on the results of the inventory, the adjusted amount of the estimated liability is calculated, which must be reflected in the annual financial statements.

Based on the results of the inventory for each employee, the following is revealed:

1) the number of vacation days not used by the employee for all the years of his work in the organization on an accrual basis at the time of the inventory, or

2) the number of vacation days overspent by the employee and actually paid by the employer (this indicator is used provided that vacation pay is always accrued by reducing the corresponding estimated liability);

3) average daily earnings calculated as of the end of the reporting year in accordance with the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922;

4) the amount of one-time payments for vacation provided for by the employer’s local regulations (for example, financial assistance for vacation);

5) the amount of insurance contributions to extra-budgetary funds in terms of the calculated amount of vacation pay and one-time payments for vacation (in relation to tariffs effective from January 1 of the following reporting year).

If, as a result of the inventory, the balance of the created reserve turns out to be less than the estimated amount, taking into account the number of vacation days not used by the organization’s employees on an accrual basis since the start of work, then the reserve must be additionally accrued on the basis of clause 21 of PBU 8/2010 ( Dt 20.23.... - Kt 96 ).

If, on the contrary, it turns out that you have accrued the reserve excessively, then the amount of the excess is adjusted by assigning it to other income in accordance with clause 22 of PBU 8/2010 (Dt 96 - Kt 91).

Example 6. In SEC “Lyubavensky” during 2021, the reserve for vacation pay was:

Table 1

| Contents of operations | Total by organization, rub. |

| As of December 31 of the previous year (2016) | |

| The amount of vacation pay and insurance premiums accrued on it for employees’ vacations that were underused at the end of the year | 400 000 |

| For the reporting year (2017) | |

| The amount of vacation pay and insurance contributions actually accrued to employees | 7 350 000 |

| Amount of accrued estimated liability (including insurance premiums) | 7 650 000 |

| As of December 31 of the reporting year (2017) | |

| The amount of vacation pay and insurance premiums accrued on it for employees’ vacations that were underused at the end of the year | 500 000 |

At the end of the reporting year, an inventory of the estimated liability for vacations was carried out, as a result of which the reserve was adjusted as follows:

— as of December 31, 2021, the balance of the estimated liability in question amounted to RUB 700,000. (RUB 400,000 + RUB 7,650,000 – RUB 7,350,000).

— the actual amount of the estimated liability as of December 31, 2021 is RUB 500,000.

— the excessively accrued amount of the estimated liability for the reporting year amounted to RUB 200,000. (RUB 700,000 - RUB 500,000).

Based on clause 22 of PBU 8/2010, an entry was made in the accounting of SEC “Lyubavensky” on December 31, 2017 to adjust the reserve (Dt 96 Kt 91) in the amount of 200,000 rubles.

Reports on vacation reserves in ZUP

You can analyze the reports in the Salary – Salary Reports section:

- Help-calculation “Vacation reserves”:

- Leave reserves for employees:

- Balances and turnover of vacation reserves:

Accrual

Performed monthly using the Vacation Reserves (Salary – Vacation Reserves). Before version 3.1.10, the document was called Accrual of estimated liabilities for vacations .

This document is entered after the document Reflection of salaries in accounting (Salary - Reflection of salaries in accounting).

The document has three tabs:

- Tab Calculation of obligations and reserves for vacations contains calculation details for each employee. The composition of the tab columns depends on the selected method of calculating liabilities.

- On the tab Liabilities and provisions for employees the calculated reserve amounts are distributed according to Subdivisions And Ways to reflect salaries, in proportion to the employee’s monthly accruals.

- On the tab Liabilities and reserves of the current month results are presented consolidated by Subdivisions And Ways of reflection:

Reconciliation of data in ZUP and Accounting databases

In Accounting, we will generate a report : Account balance sheet for account 96.01, broken down by subaccounts:

And in ZUP for this purpose it is convenient to use the report Balances and turnover of vacation reserves .

To reconcile accounting data (BU), we will generate a report by clearing the Tax accounting data :

Accounting account 96.01.1 corresponds to a line for the type of liability Estimated liability (reserve) .

The column Used (vacation pay) corresponds to the account turnover for Debit, the column Accrued to the account turnover for Credit:

Accounting account 96.01.2 corresponds to the sum of the lines for the types of obligations Insurance premiums and Contributions to the Social Insurance Fund from NS and PZ .

Let's check the calculation:

Opening balance on account 96.01.2:

- 86,623.20 (beginning balance by type of obligation Insurance premiums ) + 4,842.79 (beginning balance by type of obligation Contributions to the Social Insurance Fund from NS and PZ ) = 91,465.99 rubles.

Debit turnover of account 96.01.2:

- 26,848.65 (amount used by type of obligation Insurance premiums ) + 1,456.24 (amount used by type of obligation Contributions to the Social Insurance Fund from NS and PZ ) = 28,304.89 rubles.

Credit turnover of account 96.01.2:

- 24,347.39 (amount accrued by type of obligation Insurance premiums ) + 1,363.35 (amount accrued by type of obligation Contributions to the Social Insurance Fund from NS and PZ ) = 25,710.74 rubles.

Final balance on account 96.01.2:

- 84,121.94 (beginning balance by type of obligation Insurance premiums ) + 4,749.90 (beginning balance by type of obligation Contributions to the Social Insurance Fund from NS and PZ ) = 88,871.84 rubles.

Reconciliation of tax accounting data occurs in a similar way. The report Balances and turnover of vacation reserves should be generated with the Tax accounting data :

For more details, see the online course “ZUP 3.1 personnel and payroll accounting from A to Z” - Topic 15.8: Estimated liabilities and vacation reserves