When to transfer personal income tax

Most often, personal income tax is transferred by a tax agent. As for the payment deadline, currently it must be made no later than the 1st working day following the day the income is issued (clause 6 of Article 226 of the Tax Code of the Russian Federation). For example, income was paid and personal income tax was withheld on 11/18/20XX, the deadline for tax payment is 11/19/20XX. An exception is made for vacation pay and sick leave: tax on them must be paid no later than the last day of the month in which the employee was given the appropriate funds. For example, the payment of benefits and the withholding of personal income tax from it is 11/18/20XX, the deadline for transferring tax to the budget is from 11/18/20XX to 11/30/20XX.

How to correctly display the timing of tax transfers in Form 6-NDFL, see here.

If personal income tax is calculated and transferred directly by the individual taxpayer or individual entrepreneur, then the deadline for paying the tax is July 15 of the year following the tax period (clause 6 of article 227, clause 4 of article 228 of the Tax Code of the Russian Federation). IP on OSNO also transfers advance payments. From 2021 the deadlines are as follows:

- for the 1st quarter - no later than April 25;

- for half a year - no later than July 25;

- for nine months - no later than October 25.

Deadlines for transferring personal income tax for yourself

Labor activity is not the only possible source of income for individuals. There are other types of transactions leading to the formation of material benefits:

- lottery winnings;

- sale of real estate owned for less than three years;

- rental of property;

- receiving prizes worth more than 4 thousand rubles, etc.

In all of the above cases, an individual must independently calculate and remit income tax. The deadline for payment is 15.07 next year.

Individual entrepreneurs and persons engaged in private practice (notaries, lawyers) pay personal income tax for themselves based on written notifications from the Federal Tax Service. The tax is transferred in three tranches: for the first half of the year - until July 15 of the current year, for nine months - until October 15, for the whole year - until January 15.

What changed

From June 1, 2021, everyone who pays individuals will have two new responsibilities when transferring and completing payments.

The amount of collection in the purpose of payment. If your employee is a debtor, and you, as an employer, have received a writ of execution for deduction from his wages, you must make a note about this on the payment slip. In the “Purpose of payment” field, indicate the amount of the collected amount in the following format: symbol “//”, “VZS” (amount collected), symbol “//”, amount in numbers, symbol “//” .

Information letter of the Bank of Russia dated February 27, 2020 N IN-05−45/10

When indicating the amount, rubles are separated from kopecks by a dash. If the amount is a whole amount, without kopecks, then “00” is indicated after the dash sign. For example, if you withheld 500 rubles from an employee according to a writ of execution, write in the payment slip: //VZS//500−00//.

New field 20. If you pay wages to employees, pay remuneration under a contract, or make any other transfer to an individual, you must indicate the type of income code in the payment order. The payment order itself has not changed, so the code is indicated in field 20 “Payment purpose code”.

Other formalities

In Letter No. ЗН-4-1/12498, tax authorities report that under Art.

45 of the Tax Code, payers must prepare a tax payment in accordance with the Rules of the Ministry of Finance. In particular, they say that the tax period of payment must be entered in cell 107. The personal income tax payer is required to generate a separate payment slip for each value in cell 107 if the law provides for different payment deadlines and tax transfer deadlines for each deadline.

Source of payments in 3-NDFL

- an individual or legal entity from whom the taxpayer receives income.

Now financial assistance is subject to personal income tax - details at the link.

The tax authorities' letter did not establish new rules. It comments on the existing procedure for filling out tax payments. The Tax Code of the Russian Federation has established different deadlines for paying personal income tax, for each of which there is a deadline for transfer.

Tax on wages, financial assistance and bonuses must be transferred maximum the next day after payment. Personal income tax on vacation and sick leave is allowed to be paid until the end of the month.

In the payment slip, you can indicate the deadline for payment of income or the interval for which tax is withheld. The second option is simpler. In this case, it is enough to know in what period the income arose.

| Revenue for April 2019 | When is it recognized as income (Article 223 of the Tax Code) | Field value 107 |

| Earnings | Last date of the month of accrual | MS.04.2017 |

| Vacation and sick leave | Last day of the payment month | |

| Material benefit | Last day of the month in which it occurred |

In some cases, the payer pays off the personal income tax debt. If he does this voluntarily and does not have a requirement from the tax authorities, then in cell 107 indicate the month for which the tax is paid. In field 106 the code “ZD” is entered, indicating the debt.

How to fill out a personal income tax payment order

All details of the payment order must be specified correctly - only this will exclude claims from the tax authorities.

If you are a tax agent for personal income tax, then a ready-made solution from ConsultantPlus will help you when filling out a payment form. If you are an individual entrepreneur and you need to issue a personal income tax payment from your income, this is a ready-made solution for you. Follow the links and get trial access to K+ for free.

For more information about what errors in payment orders lead to, read the material “Errors in payment orders for taxes.”

Any payment order indicates its number, date and amount of debit in numbers and in words.

In the “Taxpayer status” field, code 09 can be entered if an individual (individual entrepreneur) independently transfers personal income tax from his income to the budget, or 02 if the payment is made by a tax agent.

See also: “Main payer statuses in a payment order.”

The name of the payer of the payment, his tax identification number, checkpoint, current account, payer’s bank with all details (BIC and correspondent account) must also be indicated.

In the “Recipient” column, enter the name of the tax office to which the personal income tax payment must be made. Other fields indicate her TIN, KPP, and current account in the corresponding bank branch.

Note! From 01.05.2021, when paying taxes, it is necessary to fill out field No. 15 “Account number of the recipient’s bank.” From January to April 2021 is a transition period. This means that until 05/01/2021 payment orders can be filled out both according to the old rules and the new ones. See here for details.

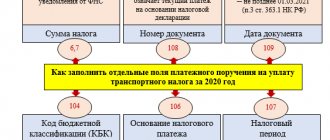

In a payment order for the transfer of personal income tax, like any other tax, it is required to indicate the KBK , OKTMO, the basis for payment (current payment or repayment of debt for expired periods, etc.), data of the tax period for which payment is made, number and date document on the basis of which the tax is transferred. If there is no information about the basis document, then the value 0 is entered in the corresponding fields of the payment order.

Read about filling out field 106 here.

The “Payment Type” field starting from January 1, 2015 in tax bills does not need to be filled in due to the changes made by Order of the Ministry of Finance of Russia dated October 30, 2014 No. 126n “On Amendments to Appendices No. 1, 2, 3 and 4 to the Order of the Ministry of Finance Russian Federation dated November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.”

In the “Payment priority” field, put 5. Currently, the third priority is intended for the transfer of wages and taxes or tax payments collected by force.

Read more about the order of payment here.

In the “Purpose of payment” field, information about the transfer of personal income tax is disclosed.

The payment order on paper is signed by the manager and chief accountant or authorized persons. It must also be stamped by the payer. If personal income tax is transferred via the Electronic Bank system, the order is signed with an electronic signature of authorized persons.

If you, as a tax agent for personal income tax, still made a mistake when transferring personal income tax, the payment can be clarified if three conditions are met. Read more about them in ConsultantPlus. Get trial access to the system for free.

In no time: how to draw up a payment order to pay penalties and fines

Rules for indicating information in the fields of settlement documents for the transfer of taxes, fees and other payments to the budget system of the Russian Federation were approved.

— Order of the Ministry of Finance of the Russian Federation dated December 21, 2012 No. 171n (taking into account the changes and additions made by Orders of the Ministry of Finance of Russia dated April 17, 2013 No. 44n and dated July 10, 2013 No. 67n) approved the Instructions on the procedure for applying the budget classification of the Russian Federation for 2013 and for the planned year the period 2014 and 2015, as well as the current budget classification codes (KBK), and a list of taxpayer statuses.

— The meaning of the administrator code (the first 3 digits of the KBK) of the Federal Tax Service 182

— In one payment document for one code of the budget classification of the Russian Federation, more than one indicator of the basis of payment and type of payment cannot be indicated.

— Field 104 indicates the indicator of the budget classification code (BCC) in accordance with the classification of budget revenues of the Russian Federation, which has 20 characters

— When filling out 14-17 categories of the BCC, you should indicate 1000 (when paying taxes), 2000 (when paying penalties and interest), 3000 (when paying fines).

— In field 105, indicate the value of the OKTMO code of the municipality in accordance with your legal address (when paying state fees for courts, the OKTMO code of the municipality at the location of the judicial authority is entered!)

ATTENTION! When filling out the “OKTMO Code” indicator, for which 11 familiar spaces are allocated, the free familiar spaces to the right of the code value if the OKTMO code has eight characters cannot be filled in with additional characters.

“TP” - payments of the current year; “AP” - repayment of debt according to the inspection report

"PE" - payment of penalties; "PC" - payment of interest

ATTENTION! When paying a tax (fee), including an advance payment, contribution, tax sanctions, administrative and other fines, as well as other payments administered by tax authorities, the value “0” is indicated in field 110.

Blank fields in the settlement document are not allowed!

A sample of filling out a payment order is attached.

If penalties are due

All of the above features of payments for penalties from 2021 also apply to the payment of penalties on insurance premiums, which have become a tax payment from this year.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance.

When paying both contributions and penalties to the Social Insurance Fund in fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document”, enter 0 (clauses 5, 6 of Appendix 4 to the order of the Ministry of Finance of Russia No. 107n).

And if penalties are paid at the request of the fund and according to the inspection report, their details are given in the purpose of payment.

What to consider when filling out

To answer the question of how to fill out a personal income tax payment order correctly in 2021 so that the funds can reach their intended destination, you need to be aware of some nuances:

- On line 101, each applicant must indicate their own status. This can be an ordinary individual (13) or a tax agent (02). If this individual entrepreneur transfers tax for himself, his status is 09.

- For line 104, it is important who exactly pays the tax and what its status is: a tax agent, an individual or a merchant for himself.

- If an organization has separate divisions, then the tax must be transferred to the location of each of them (its own checkpoint, OKTMO, another Federal Tax Service). From payments under civil law contracts, “isolated companies” also deduct personal income tax according to their details. A similar procedure is established for merchants with personnel on a patent or imputation.

Penalty of an individual taxpayer for non-payment of personal income tax

Legal entities pay income tax as a tax agent. The correct BCC for the tax itself in 2021: 182 1 0100 110.

For penalties: 182 1 0100 110.

To transfer the fine: 182 1 0100 110.

In all such cases, if the tax is late, the person may also be charged a penalty.

The amount of sanctions must be paid in the same way as the tax itself. That is, all existing methods are available:

- through a bank;

- local administration;

- at the post office;

- by contacting a non-bank credit organization licensed by the Central Bank of the Russian Federation to conduct relevant operations.

In addition, if a person has not paid personal income tax to the budget, the tax office may impose a fine under Article 122 of the Tax Code of the Russian Federation - 20% of the amount of arrears. Personal income tax penalties for individuals who received income listed in Art. 228 Tax Code of the Russian Federation, -182 1 0100 110.

Avisto LLC

Changes from 2021

From 01/01/2021, in the payment slip for the transfer of taxes and insurance contributions, you need to fill out 2 columns in a new way related to the recipient of the funds - the Federal Treasury. From October 2021, an updated list of payment grounds should be applied when repaying debts for past periods. In addition, a new BCC has been introduced for personal income tax on the income of an employee or founder, which during the year exceeded 5 million rubles.

FIELDS 17 AND 15

These are the details of the recipient of the funds. The change in filling from 01/01/2021 is due to the transition to a new procedure for treasury services and a system of treasury payments. So:

- for field 17 – the new account number of the territorial body of the Federal Treasury (TOFK);

- for field 15 - from January 2021 you need to indicate the account number of the recipient's bank (this is the number of the bank account that is part of the single treasury account - UTS).

Note that until 2021, when paying taxes and contributions, field 15 was left empty.

In January-April 2021, in field 17 of the payment slip, you can enter both a new and an old TOFK account. And from 05/01/2021 - only new.

There are other changes in filling out payment slips from January 1, 2021.

Read the full review in the article “How to fill out payment order fields in 2021.”

Regulatory regulation of filling out a payment order

The payment order form, field numbers and description of the procedure for filling them out are approved by Bank of Russia Regulation No. 383-P dated June 19, 2012. Requirements for the execution of payment documents sent to the bank for the transfer of taxes and other obligatory payments to the budget, extra-budgetary funds are established by Order of the Ministry of Finance dated November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system Russian Federation". It establishes what purpose of payment to indicate when paying personal income tax, which BCCs and to which accounts the tax should be paid.

These are the two main regulatory documents that guide tax agents when transferring taxes.

IMPORTANT!

From 07/01/2021, the rules for checking the UIN (Order of the Ministry of Finance dated 09/14/2020 No. 199n) were introduced into the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.

Budget Classification Codes (BCC)

| Payment Description | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| Income tax for individual entrepreneurs “for oneself” | 182 1 0100 110 |

| Payment by an individual (not an individual entrepreneur) | 182 1 0100 110 |

| Penalties for personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| Penalties paid by individual entrepreneurs “for themselves” | 182 1 0100 110 |

| Penalties paid by an individual (not an individual entrepreneur) | 182 1 0100 110 |

| Fines for non-payment of personal income tax by a tax agent | 182 1 0100 110 |

| Fine for personal income tax (individual entrepreneur “for oneself”) | 182 1 0100 110 |

| Personal income tax fine for an individual (not an individual entrepreneur) | 182 1 0100 110 |

By Order of the Ministry of Finance dated October 12, 2020 No. 236n, new budget classification codes were introduced from January 1, 2021. They apply to personal income tax, calculated at an increased rate of 15%, on income exceeding 5 million rubles per year. This tax must be paid separately.

| Payment | KBK |

| Personal income tax at an increased rate of 15% | 182 1 0100 110 |

| Tax penalties at an increased rate of 15% | 182 1 0100 110 |

| Tax penalties at an increased rate of 15% | 182 1 0100 110 |

Procedure for paying payments to the budget

All organizations and individual entrepreneurs that use the labor of hired workers, by virtue of the norms of the Tax Code of the Russian Federation, are recognized as tax agents for personal income tax. They act as intermediaries in the withholding and payment of personal income tax (NDFL) between individuals and the state and bear full responsibility for the correctness of its calculation and transfer.

IMPORTANT!

The deadline for paying the tax withheld from employees is established in Article 226 of the Tax Code of the Russian Federation - no later than the 1st working day following the day the income is issued.

In addition to employers who are tax agents, individual entrepreneurs who apply the general taxation system transfer personal income tax to the budget. They pay the tax in advance quarterly by the 25th day of the month following the previous quarter. And for them there are separate BCCs and requirements for processing payments.

In 2021, personal income tax payments must be filled out in a new way, and the rules for calculating tax have changed. An increased tax rate of 15% has been introduced for income exceeding the maximum limit of 5 million rubles per year. New BCCs for such payments and their designation have been established. The registration procedure has changed and new TSA accounts have been introduced in the regions of the Russian Federation.

Current BCCs for income tax

As for the BCC in the personal income tax payment order for 2021, their current values for line 104 are as follows:

| KBK for personal income tax in 2021 | |

| Type of personal income tax | KBC for 2021 |

| Personal income tax on employee income | 182 1 0100 110 |

| Penalties for personal income tax on employee income | 182 1 0100 110 |

| Personal income tax fines on employee income | 182 1 0100 110 |

| Tax paid by individual entrepreneurs on the general taxation system | 182 1 0100 110 |

| Penalties for personal income tax paid by individual entrepreneurs on the general system | 182 1 0100 110 |

| Penalties for personal income tax paid by individual entrepreneurs on the general system | 182 1 0100 110 |

For more information about this, see “KBK for personal income tax in 2021: table.”

Also see “Fill in field 107 in the payment order in 2021 to pay personal income tax.”

What does KBC represent for penalties for personal income tax in 2021?

Knowing the budget classification code for the payment itself, you can independently determine the code for the penalty for it. The fact is that the KBK for penalties and fines differs from the code for the tax itself by only four digits in 14-17 digits. They represent a code for a subtype of income. At the same time, the numbers for penalties are their own, for fines – their own.

It must be said that the BCC for personal income tax 2021, including the amount of sanctions, has not changed. And they are still prescribed in the order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n.

Filling out the payer status and TIN

Certain payment order details must be filled out very carefully. After all, if you make a mistake in them, your tax/contribution will simply be considered unpaid. Accordingly, you will have to re-transmit the amount of tax/contribution to the budget, as well as pay penalties (if you discover the error after the end of the established payment period).

Such details include (clause 4, clause 4, article 45 of the Tax Code of the Russian Federation, clause 4, clause 7, article 26.1 of the Federal Law of July 24, 1998 N 125-FZ):

- Federal Treasury account number;

- name of the recipient's bank.

Errors in other details are not critical - the money will still go to the budget. And the error can be corrected by clarifying the payment (Clause 7, Article 45 of the Tax Code of the Russian Federation).

In the payment order of the 2021 sample, you must provide the name of the documentation used to calculate personal income tax, the order number and the form.

- The order number is numbered in order from the beginning of the reporting tax period.

- The form form is most often standard, which has the number 0401060.

- Line 101 indicates the taxpayer status. We put 01 for payment of own taxes by a legal entity, 02 for payment as a tax agent, 08 for individual entrepreneurs, 09 for payment by an entrepreneur for himself, 14 for payment to individuals.

- Next, fill in the payer’s TIN and KPP. The TIN of legal entities contains 10 digits, and that of individuals – 12.

In column 8, fill in the name of the taxpayer organization.

Field 107 reflects the period or date of personal income tax payment. This is evidenced by clause 8 of the Rules, which were approved by the Ministry of Finance by order No. 107n dated November 12, 2013 (hereinafter referred to as the Rules).

The last four characters of the field are the year of listing. For example, when paying tax for April 2021, filling out a personal income tax payment order in field 107 looks like: “MS.04.2017”.

The tax interval is reflected for current payments and transfers of amounts for previous periods for which there are no requirements from tax authorities. In this case, indicate in the field the period for which the additional payment is made.

According to the letter of the Federal Tax Service No. BS-3-11/4028 dated 09/01/16, it is not necessary to enter the transfer date in field 107; it is enough to indicate the month. The exact date will not be an error, but more payments will have to be created. For example, for personal income tax from an advance for May, in field 107 you can reflect “MS.05.2017” or “05.31.2017”.

If it is impossible to reflect the tax interval in the payment slip, then “0” is indicated in the corresponding field.

If the personal income tax debt is repaid based on the request of the Federal Tax Service, then in cell 107 you need to enter the date corresponding to the deadline for payment specified in the request. If the debt is paid based on the results of the audit, then the tax period is zero.

In field 101, all companies and entrepreneurs must indicate payer status. It is a two-digit code, the meaning of which depends on the payment being made.

For example, if a company fills out a payment form to pay taxes on income from its activities, as well as contributions administered by the Federal Tax Service, code 01 is entered in field 101. In the case of paying taxes on payments to employees - 02. When performing duties:

- individual entrepreneur - “09”;

- notary engaged in private practice – “10”;

- lawyer who established a law office - “11”;

- head of a peasant (farm) enterprise – “12”;

- individual – “13”.

The full list of codes is given in Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. Read more in the article “Payer status in payment orders in 2021.”

How to pay taxes for a third party

Attention: starting from 2021, a legal or authorized representative of the taxpayer will be able to transfer money to the budget.

The company is represented by its owner or manager by proxy, for example, the chief accountant. In addition, other persons will be able to transfer payments. This could be a friendly company or an individual. face. The Federal Tax Service has provided information on its website on how to fill out payment documents in this case. Payers of tax payments, insurance premiums and other payments to the budget system of the Russian Federation indicate in the fields:

- “TIN” of the payer is the value of the TIN of the payer, whose obligation to pay tax payments, insurance premiums and other payments is fulfilled. If the payer, an individual, does not have a tax identification number (TIN), zero (“0”) is indicated in the payer’s “TIN” details. In this case, it is necessary to indicate the Unique accrual identifier (document index) in the “Code” field;

- “KPP” of the payer is the value of the checkpoint of the payer, whose obligation to pay tax payments and insurance premiums is fulfilled. When fulfilling the obligation to pay payments for individuals, the payer’s “KPP” details indicate zero (“0”);

- “Payer” - information about the payer making the payment. Including:

For legal entities - the name of the legal entity fulfilling the payer’s obligation to make payments to the budget system of the Russian Federation.

For individuals - last name, first name, patronymic of the individual fulfilling the duty of the payer to make payments to the budget system of the Russian Federation. See how a director can pay taxes for a company: a sample payment slip.

In this case, in the “Purpose of payment” field, the TIN and KPP (for individuals only TIN) of the person making the payment and the name (full name) of the payer whose obligation is being fulfilled are indicated. To highlight information about the payer, the “//” sign is used. These details are indicated in the first positions in relation to other additional information indicated in the “Purpose of payment” field.

It should be borne in mind that the Rules do not provide for a new status for this category of payers. Field “101” - “Payer Status” indicates the status of the person whose obligation to pay tax payments, insurance premiums and other payments to the budget system of the Russian Federation is fulfilled.

Below in the article you will find a sample of filling out a payment order in 2021, in field 101 of which the payer status code is entered.

Field number and name | What to indicate |

| 3 “Payment order number” | The serial number of the payment, consisting of a maximum of six digits. The countdown of payment order numbers begins at the beginning of the new year. If the number consists of four digits or more, then the last three digits must be different from 000. That is, after 999 there will be 1001, 1002, etc. |

| 4 “Date of payment order” | The date is entered in the format “DD.MM. YYYY." For example, 02/05/2017 |

| 5 “Type of payment” | The field must be filled in only if the payment order is sent to the bank through the Client-Bank system. In this case, you need to indicate “electronically” in the field. In other cases, there is no need to put any dashes in field 5 |

| 6 “Amount in words” | The payment amount is written in rubles and kopecks from the beginning of the line with a capital letter. Moreover, rubles are written in words, kopecks - in numbers. The words “rubles” and kopeks” are entered in full without abbreviations. For example, Six thousand rubles 20 kopecks. If the amount is expressed in whole rubles, kopecks may not be indicated |

| 7 "Sum" | The payment amount is reflected in numbers. In this case, rubles are separated from kopecks by a dash. For example, 1200 -15. If the payment amount is without kopecks, then an equal sign is placed after the number. For example, 247= |

| 8 "Payer" | The full or abbreviated name of the organization is recorded. For example, Korablik LLC. Entrepreneurs write down their full names and put “IP” in brackets. Then the address of the place of residence (registration) is indicated. Moreover, before and after the address information you need to put “//” |

| 9 “Current account” | Bank account number |

| 10 "Payer's bank" | Full name of the bank indicating the city in which it is located |

| 11 "BIK" | Indicate the BIC of the bank where the company or individual entrepreneur is serviced |

| 12 "Account number" | Record the number of the correspondent account in the bank in which the company or individual entrepreneur has a current account. |

| 13 "Recipient's bank" | The full name of the bank and its location are recorded |

| 14 "BIK" | The BIC of the recipient's bank is indicated |

| 15 "Account number" | The recipient's account number is indicated |

| 16 "Recipient" | When paying taxes, contributions and fees to the tax office: UFK MF RF for ___ (name of the subject of the Russian Federation where the tax, contribution, fee is paid), and in brackets - the name of the Federal Tax Service to which the reports are submitted. For example, the Federal Tax Service of the Ministry of Finance of the Russian Federation for the Lipetsk region (Inspectorate of the Federal Tax Service of Russia for the city of Lipetsk) When paying contributions to funds: UFK for ____ (name of the subject of the Russian Federation in which contributions are paid), and in brackets - the name of the fund branch to which reports are submitted. For example, UFK for the city of Moscow (GU - Branch of the Pension Fund of the Russian Federation for the city of Moscow and the Moscow region) |

| 17 "Account number" | The recipient's account number is indicated |

| 18 “Type of operation” | 01 |

| 19 "Payment due date" | — |

| 20 “Purpose of payment” | — |

| 23 "Reserve field" | — |

| 24 “Purpose of payment” | Additional information is recorded that will be useful in identifying the payment. For example, numbers, names and dates of documents that are the basis for the transaction to transfer money, payment deadlines |

| 43 "Seal" | A stamp is placed if available. |

| 44 "Signature" | The signature of an authorized person of the organization, for example, the chief accountant, is affixed. Or the signature of the entrepreneur |

| 45 "Bank Marks" | — |

| 60 “TIN of the payer” | The TIN of the organization or entrepreneur is indicated. Please note: the first and second characters cannot be zeros at the same time |

| 61 “TIN of the recipient” | Enter the TIN of the tax office or fund |

| 62 “Receipt of a payment order at the bank” | — |

| 71 “Debited from the payer’s account” | — |

| 102 “Payer checkpoint” | The company's checkpoint is entered from the certificate of registration with the tax authorities. Merchants put 0 in this field |

| 103 “Recipient checkpoint” | Enter the TIN of the tax office or fund |

| 104 "KBK" | The budget classification code consisting of 20 digits is indicated |

| 105 "OKTMO" | The OKTMO code of the municipality where the tax, contribution or fee is paid is indicated. The code may consist of 8 or 11 characters. In the 11-digit code, the last three digits indicate settlements that are part of municipalities. Therefore, for municipalities the OKTMO code consists of 8 digits, for populated areas - of 11. OKTMO codes are contained in the All-Russian Classifier of Municipal Entities OK 033-2013 (approved by order of Rosstandart dated June 14, 2013 No. 159-st). For example: 45341000 |