Free legal consultation by phone:

8

A payment order is considered one of the types of payment documents. The owner of a bank account can thus issue instructions to the institution so that its employees carry out a certain transfer. Today, many people pay for the purchase of goods this way, transfer money to funds and budgets, as well as to banking, credit and microfinance organizations.

For such a procedure in Russia there is a special form on which the institution’s mark is affixed. The rules on how this documentation is drawn up are specified in the corresponding regulations on non-cash payments.

Payment order to the bank

A bank payment order is an order to the bank to transfer funds to an individual or legal entity. As confirmation that the bank has processed the payment document, a mark is placed on it indicating that the order was executed or its execution was refused for one reason or another.

The mark on the payment card looks like a blue stamp. The original payment slip with this stamp can be obtained directly from the bank. The company can also print the executed document using the software installed on it to communicate with the bank.

Position of the tax authority

The inspection confirmed that the disputed amounts of money were not received in the relevant Treasury account and that in this case the taxpayer’s obligation will be considered fulfilled only if he was conscientious in transferring funds to the budget. But the taxpayer, knowing in advance that the bank’s license would soon be revoked, did not assess his risks and took responsibility for the possible consequences.

The taxpayer showed imprudence, because long before the events that happened, information about the revocation of the bank’s license was published in the press.

The inspectorate also has information that the amount of tax paid does not correspond to the actual amounts payable to the budget at the end of tax periods.

Bank mark on the payment order

When making payments by payment orders, the bank puts marks on them about all the steps that the document goes through, and not just after it is completely processed. O means that the financial institution has received the document but has not yet executed it. If there is a “processing” stamp, this means that the bank is checking the received document and executing it.

These marks cannot serve as confirmation that the money has been transferred; they only inform about what stage of processing the payment is at.

Bank's note on execution of payment order

If the payment order is executed by the bank in full, then after the funds are debited from the organization’s account in favor of the required counterparty, a corresponding mark is placed on the payment order.

Typically, the mark includes:

- information that the funds have been successfully transferred (“Completed”, “Passed”, etc.);

- date of payment.

The mark also indicates the bank division that carried out the financial transaction, its BIC and the details of the bank employee who directly performed it.

Failure of the bank to execute a payment order

If the bank cannot execute the client’s order for any reason (insufficient funds in the account, errors in details, overdue payment, etc.), the corresponding “Rejected” mark is placed on the payment order.

In this case, the payer needs to clarify the reason and draw up a new document.

Blue stamp for state duty (Ermolinskaya t.)

According to Art.

333.18 of the Tax Code of the Russian Federation, the fact of payment of the state duty by the payer in non-cash form is confirmed by a payment order with a note from the bank or the relevant territorial body of the Federal Treasury (another body that opens and maintains accounts), including one that makes payments in electronic form, about its execution. In fact, having paid the state fee, but not being able to pay for the service for receiving a printout of the payment order with a blue seal from the bank, the legal entity will be deprived of the right to judicial protection. After all, a statement of claim or complaint will not be accepted for processing until a payment order with the bank’s blue seal is submitted.

Based on these rules of law, arbitration courts accept statements of claim and complaints if the fact of payment of the state duty is confirmed by printing an electronic payment document containing all the details (the date of debiting the funds, the type of payment - “electronic”, a note about the payment).

For example, in the Resolutions of the FAS SZO dated 02.13.2014 in case No. A26-5598/2013, FAS VSO dated 08.20.2012 in case No. A19-9761/2012, judicial acts on the return of statements of claim were canceled, since they were based on the explanations of the information letter Presidium of the Supreme Arbitration Court of the Russian Federation dated May 25, 2005 N 91 (currently inactive), according to which, in confirmation of payment of the state duty, a payment order must be submitted with a bank stamp and with the signature of the responsible executor.

The cassation court explained that such requirements apply to the execution of a payment order on paper. When transferring funds electronically, the payment order must indicate: type of payment - “electronic”, date of debiting the funds, bank mark confirming the payment. The electronic version of the payment order executed in this way was recognized by the court as complying with paragraph. 2 p. 3 art. 333.18 Tax Code of the Russian Federation.

When filing a statement of claim or complaint in court, you must provide proof of payment of the state fee. For an organization, this is usually a payment order with a bank mark. Payments are mainly made electronically. However, is it enough to attach a printout of an electronic payment document to confirm that the state duty has been paid? As practice shows, a court of general jurisdiction and an arbitration court have different approaches.

A court of general jurisdiction, when resolving the issue of submitting a document confirming payment of the state duty, proceeds from the fact that the applicant must submit a duly certified payment order. In other words, a payment order with the bank’s blue seal, certified by a bank employee, is required.

does not contain the signature of a bank employee on the bank’s mark on acceptance of the payment order, the bank’s seal and the mark on the transfer of state duty to the budget revenue, duly certified. Similar requirements for a payment order when transferring state fees electronically were presented, for example, in case No. 33-2119 (Appeal ruling of the Kirov Regional Court dated June 17, 2014).

Based on these rules of law, arbitration courts accept statements of claim and complaints if the fact of payment of the state duty is confirmed by printing an electronic payment document containing all the details (the date of debiting the funds, the type of payment - “electronic”, a note about the payment).

For example, in the Resolutions of the FAS SZO dated 02.13.2014 in case No. A26-5598/2013, FAS VSO dated 08.20.2012 in case No. A19-9761/2012, judicial acts on the return of statements of claim were canceled, since they were based on the explanations of the information letter Presidium of the Supreme Arbitration Court of the Russian Federation dated May 25, 2005 No. 91 (currently inactive), according to which, in confirmation of payment of the state duty, a payment order must be submitted with a bank stamp and with the signature of the responsible executor.

The cassation court explained that such requirements apply to the execution of a payment order on paper. When transferring funds electronically, the payment order must indicate: type of payment - “electronic”, date of debiting the funds, bank mark confirming the payment. The electronic version of the payment order executed in this way was recognized by the court as complying with paragraph. 2 p. 3 art. 333.18 Tax Code of the Russian Federation.

Based on paragraph 2 of paragraph 3 of Article 333.18 of the Tax Code of the Russian Federation, the fact of payment of the state duty by the payer in non-cash form is confirmed by a payment order marked by the bank or the relevant territorial body of the Federal Treasury (another body that opens and maintains accounts), including one that makes payments electronically form, about its execution.

A payment order submitted to the court through the file cabinet of arbitration courts, as well as other materials related to court proceedings, are not considered by arbitration courts as procedural documents, since they do not have legal force, but are of an informational nature (clause 14.3 of the Instructions for paperwork in arbitration courts of the Russian Federation (together with the “Instructions for office work in the arbitration courts of the Russian Federation (first, appellate and cassation instances)”, approved by Order of the Supreme Arbitration Court of the Russian Federation dated March 25, 2004 N 27).

We invite you to read: Why the bank does not issue money

It is clear that this is regulated by an agreement between the bank and the client. However, if this service is paid, then you cannot argue with the bank, and you will have to pay for issuing a payment card certified by the bank. In accordance with Art. 46 of the Constitution of the Russian Federation, everyone is guaranteed judicial protection of their rights and freedoms.

Based on the said agreement, the parties entered into a share purchase and sale agreement No. 403, under which the bank purchased shares. The contract has been completed. At the same time, the parties entered into agreement No. 404, according to which the same shares and in the same quantity were subject to repurchase by the company from the bank after repayment of the loan.

1. Contact your Russian language teacher to review your high school course. 2. What does the housing office (passport offices are divisions of housing offices) have to do with issuing foreign passports? 3. What is a “state duty receipt”? 4. Sberbank has long moved away from receipts; they work on check orders. 5.

Go to the Sberbank terminal, select in the menu to pay the state fee for obtaining a foreign passport, enter the necessary data, pay, receive a check order, which is attached to the set of documents. 6. If step 5 did not work out, then go to the operator, give him the money and tell him what service you want to pay for, get a check order.

Fill out the application form 11001, the founder’s decision or protocol, charter, state duty 4t. R. , to the notary and to the tax office, in five days you will receive an INN, OGRN, charter - if you pay the state fee of 200 rubles. and order it in parallel with submitting documents for registration, after that a stamp and a bank account

You need to write a tax application addressed to the head of the Federal Tax Service, we write on the company’s letterhead. APPLICATION Please provide an extract from the Unified State Register of Legal Entities (USRLE) OGRN. Please hand it over to the chief accountant. by proxy. The application is signed by the head. accountant and director, stamped.

Clerk.Ru gt Legal department gt Legal assistance gt State duty in Arbitration. PDA. View the full version of the State Duty in Arbitrage.dak and I’m talking about the same thing. but if they persistently tell you, yes, we will print such payment slips ourselves, we will draw a bank stamp on an eraser.

Info

It is clear that this is regulated by an agreement between the bank and the client. However, if this service is paid, then you cannot argue with the bank, and you will have to pay for issuing a payment card certified by the bank. In accordance with Art. Registration of a payment order when paying for government payments. duties in the Russian Federation The electronic version of the payment order drawn up in this way was recognized by the court as corresponding to paragraph.

2 p. 3 art. 333.18

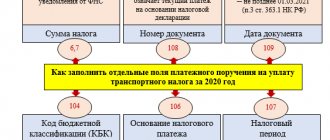

- will indicate the payer status - 01;

- recipient - the Federal Tax Service for Moscow, indicating the Federal Tax Service Inspectorate at the location of the court (in this case, Federal Tax Service Inspectorate No. 26);

- KBK - 182 1 0800 110;

- OKTMO - at the location of the court;

- basis of payment (field 106) - TP;

- in fields 107 “Tax period”, 108 “Document number” and 109 “Document date” will enter 0;

Do I need to print bank statements and payments?

A printed payment order with the bank's execution mark may be required in various situations, for example, as confirmation of payment of a state duty or tax.

In accounting, payments are usually printed as an appendix to a bank statement. If an organization makes a large number of payments every day, this can be quite inconvenient.

The legislation does not precisely regulate whether it is mandatory to print electronic payment orders or whether a bank statement is sufficient. Primary documents signed with an enhanced digital signature can be accepted by the tax authorities as confirmation of expenses, and accordingly it is not necessary to print them out - the Ministry of Finance has repeatedly pointed this out in its clarifications (for example, letter of the Ministry of Finance of the Russian Federation dated January 13, 2016 No. 03-03-06/1/259 ). An exception is a request for a document on paper, a discrepancy between electronic formats, when an electronic document cannot be submitted to the Federal Tax Service, etc. situations.

Payment to the bank: sample

“Regulations on the rules for transferring funds” No. 383-P dated June 19, 2012 approved the form of payment to the bank. This document also specifies a list of details that must be present in this document and an explanation of the procedure for entering them.

Basic information indicated in the payment order:

- Date and order number.

- Payer details and bank details.

- Recipient's details and bank details.

- The amount that the bank must transfer.

- Purpose of payment.

In order to confirm the fact of payment and debiting of funds, the bank puts an execution mark on the payment order. If the payment is rejected, this is also reflected in the bank's note.

The court decided

According to Article 45 of the Tax Code, the taxpayer is obliged to independently fulfill the obligation to pay taxes within the period established by the legislation on taxes and fees. At the same time, it is not prohibited to repay debts on taxes and fees in an amount greater than that required by settlement documents.

The obligation of each taxpayer to pay taxes is considered fulfilled at the moment when the seizure of part of his property, intended for payment to the budget as a tax, actually occurred (Resolution of the Constitutional Court of the Russian Federation of October 12, 1998 No. 24-P).

Withdrawal of funds occurs at the moment the bank writes off the appropriate funds from the taxpayer's current account to pay the tax, which indicates payment of the tax. At the same time, the taxpayer is not responsible for the actions of credit institutions participating in the multi-stage process of paying and transferring taxes to the budget.

The judges indicated that if the payer has the appropriate evidence, the obligation to pay the relevant tax must be recognized as fulfilled, regardless of the actual entry of the payment into the budget system of the Russian Federation.

A bank statement from the company's account confirms the presence of a sufficient cash balance in the current account to pay taxes in full.

During the proceedings, it was confirmed that the payment order was submitted by the applicant to the bank before the date of revocation of his license, which is certified by the bank’s mark on the document accepting it for execution.

Thus, the court came to the conclusion that the company’s obligation to pay the disputed amount of tax is fulfilled regardless of the actual entry of the payment into the budget system of the Russian Federation.

Professional press for accountants

For those who cannot deny themselves the pleasure of leafing through the latest magazine and reading well-written articles verified by experts. Select a magazine >>