Containers are a material asset of an enterprise used for storing, moving and packaging goods. Depending on the purpose and nature of use, containers can be disposable or reusable.

Disposable containers are the packaging we are used to (paper, polyethylene, boxes, bags, etc.). Some categories of goods are placed in it after manufacturing or during the packaging process to preserve their physical and chemical characteristics. In such cases, the packaging remains on the product immediately until it is consumed.

In any trade ]packaging materials[/anchor] are a mandatory expense item, despite the fact that the concept of “packaging” itself is absent in accounting legislation. This is due to the fact that the costs of materials used for packaging are already included in the cost of goods and the buyer does not pay for it separately. Such packaging is positioned in accounting as disposable containers.

As already noted, the costs of preparing goods for sale form their cost (paid by the end consumer). In some cases, reimbursement of costs is borne by the trading organization, and sometimes packaging is not related to trading activities at all.

The packaging process often involves performing a number of complex technological operations using automatic lines, special equipment, materials, etc. In order to simplify tax and accounting, many enterprises consider packaging as an integral element of trade (since when placing a product in consumer packaging, its main characteristics remain the same).

Thus, the purpose of consumer packaging is to ensure the convenience of selling a product to the end consumer. Its price is included in the price of the product.

There are two types of consumer packaging:

- Production - goods are placed in it at a plant, factory, etc. (aerosol cans, cans, tubes, ampoules, etc.);

- Pre-sale, packaging - it is most often used by trading companies selling food products.

Accounting entries for business expenses

Commercial expenses - when accounting for such expenses, entries are made in correspondence with account 44. From the article you will learn which company expenses are classified as commercial expenses and how they should be reflected correctly in accounting.

What are business expenses?

Postings for accounting business expenses

Example of accounting for business expenses

Results

What are business expenses?

The term “commercial expenses” is absent in the Tax Code of the Russian Federation and other legal acts. In practice, accountants take into account as business expenses the amounts collected in account 44 “Sales expenses” of the chart of accounts (approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n).

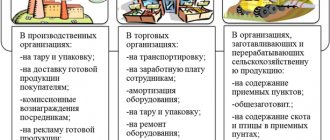

For manufacturing companies, business expenses include:

- for packaging of manufactured products;

- delivering them to customers;

- services of sales and intermediary companies;

- maintenance of premises for storing products at points of sale and salaries of sellers;

- advertising;

- entertainment and other similar expenses.

Some business expenses when calculating income tax can be taken into account only within the limits of the norms - read more about this in the article “Features of accounting for advertising expenses.”

In trading companies, expenses are collected on account 44:

- for the transportation of goods;

- remuneration of sellers;

- maintenance of retail premises and equipment;

- rental of buildings or other structures for trade;

- storage of goods;

- advertising;

- entertainment needs and other similar expenses.

For companies whose main activity is the procurement and processing of agricultural products, commercial expenses will be:

- general procurement costs;

- expenses for maintaining animals in reception centers and the reception centers themselves.

In accounting, the company indicates commercial expenses in line 2210 of Form 2. For more information on how to fill out Form 2, read the article “Profit and Loss Statement - Form No. 2 (form and sample).”

Postings for accounting business expenses

The company collects all commercial expenses in the debit of account 44. Let's look at the main entries that record commercial expenses in accounting.

| Account by debit | Loan account | Operation description |

| 44 | 02 | Depreciation has been accrued on fixed assets used in trade or for the sale of finished products |

| 44 | 05 | Depreciation has been accrued on intangible assets used in trade or for the sale of finished products |

| 44 | 10 | Costs for the purchase of materials necessary for the sale of goods or products are reflected. |

| 44 | 41 | The cost of goods that the trading company spent for its own needs is included in selling expenses |

| 44 | 43 | The use of finished products for the sale of other items or products is reflected |

| 44 | 60 (76) | Reflects the costs of services of intermediary companies, advertising agencies and other companies that contribute to the growth of sales of goods or products |

| 44 | 70 | Reflects the costs of remunerating sales managers, sellers and other employees associated with the sale of goods or products |

| 44 | 71 | Reflected expenses on advance reports on expenses associated with sales of finished products |

| 44 | 69 for the corresponding subaccount | Insurance premiums have been calculated for the salaries of employees engaged in the sale of goods or products |

| 44 | 94 | Shortages or losses of valuables are included in business expenses |

The accumulated amounts on account 44 are subsequently subject to debiting to account 90. There are 2 ways to do this:

- debiting all amounts accumulated on account 44 in full every month;

- distribution of business expenses for goods sold or products sold.

The chosen method should be indicated in the accounting policy.

https://www.youtube.com/watch?v=n1rkL-mJPys

If a company completely writes off business expenses on a monthly basis, then an entry should be made in accounting as the debit of account 90 and the credit of account 44. In this case, the final balance of account 44 at the end of the month will be zero.

If the company has chosen the second method of writing off business expenses, then the specific algorithm depends on the type of activity of the enterprise. Trading companies distribute only transportation costs, manufacturing companies - for transportation and packaging. The formula for calculating expenses to be written off is as follows:

KRmes = DTs44 + KRtek – TiURkon

TiURkon = Skon × (TiURtek + DTs44) / (S / Mix + Skon),

Where

KRmes - commercial expenses to be written off for the month;

DTS44 - debit balance of account 44 at the beginning of the month (that is, unwritten off sales expenses for the previous month);

KRTek - business expenses for the reporting month;

TiURkon - transportation costs (and packaging - for manufacturing firms) attributable to the balance of goods at the end of the reporting period;

TiURtek - transportation costs (and packaging - for manufacturing companies) for the current month;

Skon - the cost of goods or products at the end of the month;

C / Mix - the cost of goods or products sold in the current month.

The wiring will be the same:

Dt 90 Kt 44 - commercial expenses are reflected in expenses to be written off for the reporting period.

To understand the difference between the two methods, let's look at an illustrative example.

Example of accounting for business expenses

Fantasia LLC (works at OSN) bakes bread and sweet buns. In May 2021, the company decided to hire an employee to distribute baked goods. His salary is 30,000 rubles.

In addition, the enterprise has two delivery drivers who deliver bread and buns; Fantasia LLC pays them 20,000 rubles. At the end of May, the company decided to conduct an advertising campaign with the help of individual entrepreneur A. I. Ledovsky (he uses UTII) - a banner was ordered at a cost of 30,000 rubles.

and radio advertising. In total, Fantasia LLC spent 53,450 rubles for these purposes.

In the accounting of Fantasia LLC, the entries for accounting for business expenses are as follows:

Dt 44 Kt 70 for 30,000 rub. — the marketer’s salary is reflected in expenses;

Dt 44 Kt 70 for 40,000 rub. — the salaries of two drivers are reflected in expenses;

Dt 44 Kt 69 for 21,000 rubles. — contributions to extra-budgetary funds from the payroll of employees involved in the sale of bread and buns are reflected in expenses;

Dt 70 Kt 68 for 9,100 rub. — personal income tax is withheld from the salaries of employees involved in the sale of bread and buns;

Dt 10 Kt 60 for 30,000 rub. — the advertising structure (banner) was taken into account as materials;

Dt 44 Kt 10 for 30,000 rub. — expenses for the banner are written off;

Dt 44 Kt 60 for RUB 23,450. — expenses for radio advertising are reflected, the supplier is IP Ledovsky A.I.;

The total debit turnover on account 44 as of May 31, 2016 amounted to RUB 144,450.

Next, the accountant of Fantasia LLC acts in accordance with the accounting policy. If, according to it, sales expenses are not distributed, then the accounting entry will be made Dt 90 Kt 44 for 144,450 rubles. (commercial expenses written off at the end of the month).

If Fantasia LLC distributes commercial expenses, then transportation costs and packaging costs should be separated and distributed between sold bakery products and balances in warehouses, and the remaining sales costs should be written off to account 90 in full.

Procedure for maintaining tax accounting of packaging

Income tax

To determine income tax, expenses associated with placing goods in disposable packaging are recorded according to the same principle as in financial statements. Enterprises specializing in the manufacture of products include these costs in the cost of goods or are classified as trading costs. The majority of trading organizations prefer to take them into account in the form of trade costs, while some still reflect these costs in the cost of goods.

As an illustrative example, consider the following situation:

“Our dry cleaning shop purchases special bags made of thick polyethylene from the supplier. We use them to pack clean items when handing them out to clients. The bags protect products from re-contamination and also improve the quality of service - it is convenient for customers to carry bulky items. However, the tax service considered the use of thick bags to be inappropriate. To pack clean items, experts recommended purchasing less expensive materials (paper, thin bags).”

In many manufacturing plants, packaging is an integral part of the product. In such cases, the costs of it (whether purchasing or manufacturing) are considered direct. Everything else is indirect costs of the reporting period, the correct display of which allows you to reduce income tax.

Packaging, as the final production stage (transformation of a product into a commodity), involves the type of expense that is accepted without question by the tax authorities. Everything is very clear here: packaging makes the product suitable for sale. Claims arise if packaging is not necessary in a particular case or if cheaper solutions can be used.

Tax authorities always carefully check the costs of an enterprise, since the amount of income tax depends on this. They pay close attention to expensive packaging: they determine the feasibility and justification of the costs for it, find out whether it is possible to do without it in a particular case. That is why the costs of purchasing packages given to clients free of charge often fall into the “unreasonable” category.

It should be understood that tax authorities do not have the authority to assess costs for their rationality, validity, and feasibility. However, no one wants to have fruitless arguments. It is much more reliable and safer to ask an opinion on this matter directly from a representative of the Russian Ministry of Finance.

“When determining income tax, all expenses that are related to the activities of the enterprise, are economically justified and documented are recognized as appropriate. For example, if a company can prove that additional packaging is necessary to preserve some characteristics of the product, then tax authorities have no right to doubt the advisability of these expenses. Such expenses are quite capable of reducing income taxes. Documentary evidence means: the manager’s order to introduce additional packaging, invoices or sales receipts into the production or sales cycle.”

Value added tax

The company will not have problems deducting VAT from packaging costs if it is a payer of this tax. In this case, the procedure is carried out in the standard manner.

However, many people at this stage have misunderstandings in packaging accounting. For example, packaging costs are included in the cost of production and are not indicated separately in the reporting documentation. The buyer pays only for the product, but at the same time receives both the product itself and the packaging. It turns out that he gets the latter for free. Free transfer of goods is a sale, which means that VAT should also be charged on the cost of packaging. As for the calculation of income tax, it does not take into account the costs of packaging sold free of charge.

This is a fairly common mistake. If the buyer pays for the goods and receives the goods and packaging, then in 100% of cases the costs of purchasing this packaging are already included in the cost of the goods. It does not go to the consumer free of charge; VAT on it is paid along with the general VAT on the product. Thus, no gratuitous sale occurs and no additional tax deductions need to be made.

To obtain an authoritative opinion on this issue, we decided to contact an employee of the Ministry of Finance of the Russian Federation.

“In tax legislation, VAT for a specific enterprise is considered as the total cost of goods sold/transferred to customers at base market prices before taxes are included in them. The contract price of a product may include various company costs (including packaging costs), for which tax is not calculated. Thus, VAT is not charged separately on the cost of packaging.”

Postings for expenses for the sale of goods

Operations to reflect additional costs for the sale of goods occupy an important place in the accounting of enterprises in the trading industry. We will talk about the composition of such expenses and the features of their accounting in our article.

The concept of selling expenses and their composition

Selling costs include the costs incurred by the organization directly for the purchase of goods, as well as costs associated with the procedure for its sale (the so-called distribution costs). According to PBU and the Tax Code of the Russian Federation, additional sales costs may include:

- expenses for renting premises (shop, warehouse, outlet);

- wages for employees who sell goods (sellers, loaders);

- transportation costs (delivery of goods from the supplier and to the buyer);

- costs of maintaining retail inventory and equipment;

- costs of storing goods;

- representation, management and other expenses associated with the sale of goods.

It should be noted that transportation costs for delivering goods from the supplier can be included in the cost of goods and reflected on account 41.

Accounting for additional costs for selling goods

To reflect generalized information on additional costs associated with the sale of goods, account 44 is used.

Let's look at the postings to reflect standard postings on account 44:

| Dt | CT | Description | Document |

| 44 | 02 | Calculation of depreciation on fixed assets (equipment necessary for the sale of goods) | Depreciation statement |

| 44 | 05 | Depreciation on intangible assets | Depreciation statement |

| 44 | 10 | Write-off of materials | Sales Invoice |

| 44 | 60 | Reflection of expenses for security, rent, etc. | Certificate of completion |

| 44 | 70 | Payroll for salespeople | Payroll |

Costs for packaging and packaging of goods

Kupets LLC is engaged in the sale of food products. On November 2, 2015, Kupets LLC purchased a batch of flour at a price of 484,500 rubles.

Flour was received at the warehouse of Kupets LLC in 50 kg bags, after which it was packaged in 1 kg packages for further retail sale.

The cost of packaging, which was previously purchased by Kupets LLC, amounted to 7,480 rubles. Other expenses for packaging and packaging of flour amounted to 12,300 rubles.

The following entries were made in the accounting of Kupets LLC:

| Dt | CT | Description | Sum | Document |

| 41 Products in stock | 60 | A batch of flour has been received at the warehouse | RUB 484,500 | Packing list |

| 41 Container under goods and empty | 60 | Packing packaging has been received at the warehouse | RUB 7,480 | Packing list |

| 44 | 41 Container under goods and empty | The cost of packaging used for packaging flour has been written off | RUB 7,480 | Expense report |

| 44 | 70 | Other expenses for packaging and packaging of flour were written off | 12,300 rub. | Expense report |

Delivery costs

Farmer LLC is engaged in the wholesale sale of dairy products. At the end of November 2015, sales revenue amounted to RUB 1,314,500. without VAT. As of November 30, 2015, unsold goods in the amount of RUB 543,000 were registered.

https://www.youtube.com/watch?v=7F4AOdR9oVA

The balance of costs for delivery of goods at the beginning of the month was 24,000 rubles; during November 2015, 53,000 rubles were spent.

To determine the amount of expenses incurred for delivery in November 2015, the accountant of Farmer LLC made the following calculations:

- The average percentage of delivery costs was 5.86% (RUB 24,000 + RUB 53,000) / (RUB 1,314,500 + RUB 543,000) * 100%.

- The amount of delivery costs that account for unsold goods is RUB 31,820. (RUB 543,000 * 5.86%).

- The amount of transportation costs included in the cost of products sold is 45,180 rubles. (RUB 24,000 + RUB 53,000 – RUB 31,820)

The accountant of Farmer LLC wrote off the amount of transportation costs using the following posting:

| Dt | CT | Description | Sum | Document |

| 90.2 | 44 Costs for delivery of goods | The costs of selling goods - delivery incurred in November 2015 were written off | RUB 45,180 | Accounting certificate-calculation |

Write-off of expenses when selling goods

At the end of December 2015, Tekstil Plus LLC sold products in the amount of 1,412,000 rubles, VAT 215,390 rubles. Cost of goods sold—RUB 945,000. When selling goods, Tekstil Plus LLC incurred additional sales costs (storage of fabrics, salaries to sellers) in the amount of 51,500 rubles.

The accountant of Tekstil Plus LLC reflected the sale and write-off of sales expenses in accounting:

| Dt | CT | Description | Sum | Document |

| 62 | 90.1 | Reflection of revenue from the sale of finished products (fabrics) | RUB 1,412,000 | Implementation report |

| 90.3 | 68 VAT | VAT accrual on revenue amount | RUB 215,390 | Implementation report |

| 90.2 | 43 | Write-off of the cost of goods sold in December 2015 | 945,000 rub. | Costing |

| 90.2 | 44 | Posting for writing off additional sales expenses | RUB 51,500 | Expense report |

| 90.9 | 99 | Reflection of profit from sales of products (fabrics) | 200 110 rub. | Profit and Loss Statement |

Source: https://saldovka.com/provodki/tovary/rashodam-na-prodazhu-tovara.html

Account 44 in accounting:

Account 44 in accounting is a collective account; it reflects all current expenses for the sale of goods or services, which include many items of relevant costs. The account is used primarily by trade organizations, but is often used to reflect expenses for the sale of goods by manufacturing and other enterprises.

Account characteristics

In order to correctly make entries, you need to know exactly: is account 44 in accounting active or passive? The account is active, synthetic and collective. The latter means that the balance at the end of the period is written off to another account. For the entire month, the debit of account 44 records the enterprise's expenses for the sale of goods, which are reflected in the financial result accounts.

The debit balance in the balance sheet (item “Work in progress”) is indicated only if goods were not fully sold during the reporting period.

Analytical accounts

Many expenses associated with the sale of goods are written off to account 44 in accounting. Subaccounts used for detailed reflection of information:

- 44.1 – opens to collect information on business expenses that are directly related to the process of selling goods or services;

- 44.2 - created to account for the costs of the implementation process, i.e. for the deduction of wages, social benefits, depreciation costs and other expenses;

- 44.3 – takes into account the amounts written off to the cost of sales (when using the partial write-off method).

Features of accounting for advertising packaging

When packaging goods, an enterprise can put on the packaging any information about the product itself or about the company, print a logo or details, or publish an announcement about upcoming promotions. In all these cases, costs are recorded and accounted for as advertising. And if the cost of a unit of such packaging exceeds 100 rubles, VAT will have to be charged separately on it.

To print advertising on packaging, a retail enterprise needs:

- Provide documentary evidence of the appropriateness of using this packaging;

- The costs of creating/purchasing this packaging will be recognized as indirect, thereby reducing the base income tax rate.

Accounting for sales expenses

Sales expenses are written off in accordance with the norms of PBU, Chart of Accounts and Tax Code of the Russian Federation. In accounting, costs are shown by the date they were incurred without reference to the day the payment was actually made. For this type of expense, a separate synthetic account is provided with the ability to conduct analytics on it.

Accounting for sales expenses: highlights

For enterprises not related to wholesale or retail trade, the commercial cost structure is represented by a limited set of expense transactions. Trading companies have a wider list of payments that are reflected in accounting as sales. Selling expenses include:

- expenses of a representative nature;

- management type of costs;

- expenses incurred in connection with the payment of hired personnel;

- payment of bills for the transportation of consignments of goods;

- funds spent on rent and maintenance of operated real estate, household and work equipment;

- costs of storing products intended for further sale to the consumer.

In industrial and agricultural enterprises, sales expenses can be written off, consisting of:

- purchase cost of containers and packaging prices of finished products;

- funds allocated for delivery to points of departure;

- amounts of money allocated for loading products for transportation to customers;

- commission payments and transfers on accounts of intermediary structures;

- funds spent on advertising campaigns and entertainment expenses.

Write-off of selling expenses may be associated with the formation of the actual cost of goods. The cost of expenses incurred should be recorded in account 41 or 44. The choice of the preferred option is recorded in the company's accounting policy.

Postings for writing off sales expenses

Every business has to deal with selling costs because no finished product sells itself. Let's consider how to reflect in accounting additional expenses for the sale of goods, entries for advertising costs and entries when writing off sales expenses.

Accounting for sales expenses and its features

To form the cost of goods or products sold, account 44 is used, which makes it possible to understand the composition and structure of costs incurred.

Account 44 is intended to account for commercial expenses that were incurred in the sale of certain products. The accumulation of these costs occurs in the debit of 44 accounts, which are only closed at the end of the month to the debit of account 90 “Sales”.

Accounting for commercial costs at trade and manufacturing enterprises has some differences, which are based on the use of production materials for the repair of sales equipment, packaging of finished products, and others.

Selling costs may include:

- Depreciation charges accrued on equipment that ensures the sale of finished products.

- Salaries of sales employees (marketers, forwarders);

- Taxes on wages of sales employees;

- Transportation of goods;

- Costs associated with storing products (for example, renting a warehouse);

- Cargo handling;

- Advertising expenses;

- For medical examination and overalls for marketers and forwarders;

- Entertainment expenses;

- Travel expenses.

List of costs that are not included in sales expenses:

- Services of credit institutions (repayment of accrued interest);

- Costs of issuing securities;

- Legal costs;

These types of costs are non-operating, therefore they are accounted for separately in account 91.2.

To effectively solve commercial problems, it is necessary to form an appropriate organization for accounting for sales expenses based on the principles below:

Get 267 video lessons on 1C for free:

List of possible entries for writing off sales expenses

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 44 | 02 (05) | 17 500 | Depreciation was calculated on fixed assets and intangible assets involved in trading activities | Depreciation statement |

| 44 | 10 | 22 500 | Materials were written off to ensure sales of finished products. For trade organizations: materials that are included in sales expenses are written off | Write-off act |

| 44 | 16 | 23 500 | Deviations were identified in the cost of inventories that were used to support trading activities | Accounting information |

| 44 | 19 | 17 820 | Sales expenses include VAT on works and services used in the sale of finished products | Check |

| 44 | 23 (29) | 22 780 | Sales costs increased by the amount of costs incurred by auxiliary (service) production | Certificate of completion |

| 44 | 41 | 15 000 | The cost of goods used for commercial purposes has been written off | Write-off act |

| 44 | 42 | 7 500 | For goods spent for own needs, the trade margin was reversed | Accounting information |

| 44 | 43 | 13 200 | Finished products are used for commercial purposes | Write-off act |

| 44 | 60 | 75 000 | The cost of contractor services is included in sales expenses | Invoice, invoice, certificate of completion of work |

| 44 | 68 | 18 390 | Accrued taxes and fees included in sales costs | Accounting information |

| 44 | 69 | 96 800 | Insurance contributions were accrued for the salaries of sales employees | Payroll |

| 44 | 70 | 10 800 | Salaries of sales employees accrued | Payroll |

| 44 | 71 | 23 900 | Travel and hospitality expenses incurred in the sale of products | Advance report and documents confirming costs incurred |

| 44 | 76 | 12 500 | The amount of insurance payments is included in sales expenses | Insurance contract |

| 44 | 94 | 2 500 | The amount of shortages and damage is included in sales costs | Inventory report |

| 10 | 44 | 22 500 | Materials included in sales costs are capitalized | Purchase Invoice |

| 15 | 44 | 2 963 | The cost of inventories includes costs that were associated with sales | Accounting information |

| 45 | 44 | 9 500 | The cost of finished products includes transportation costs | TTN |

| 76 | 44 | 7 800 | Sales costs reduced by receiving insurance compensation | Insurance contract |

| 90 | 44 | 75 200 | Write-off of costs incurred when selling goods | Accounting information |

| 91 | 44 | 14 800 | Write-off of other (indirect) costs incurred during the sale of goods | Accounting information |

| 94 | 44 | 8 900 | A shortage was identified during the sales process. | Inventory report |

Source: https://BuhSpravka46.ru/buhgalterskie-provodki/provodki-po-spisaniyu-rashodov-na-prodazhu.html

- FINISHED PRODUCTS AND ITS EVALUATION

- DOCUMENTATION OF SHIPMENT AND SALES OF PRODUCTS

- SYNTHETIC ACCOUNTING OF FINISHED PRODUCTS

- ACCOUNTING FOR PRODUCTS SALES

- ACCOUNTING FOR COMMERCIAL EXPENSES

Chapter 7

ACCOUNTING FOR FINISHED PRODUCTS, ITS SHIPMENT AND SALES

FINISHED PRODUCTS AND ITS EVALUATION

Finished products are a product of the production activities of an enterprise, products and products, the processing of which at this enterprise is completed, they meet established standards and technical conditions, and are delivered to the warehouse (accepted by the customer).

Finished products are included in working capital and are shown on the balance sheet at actual production costs (manufacturing costs).

Finished products are accounted for in active account 40 “Finished Products”: the debit shows the receipt of finished products from production to the warehouse, and the credit shows the shipment (issue) of finished products. The balance on account 40 reflects the balance of finished goods at the end of the month.

Accounting for finished products is carried out in natural, conditionally natural and cost indicators. Conditional natural ones are used to obtain generalized data about homogeneous products.

Finished products received from production are documented with invoices, specifications, acceptance certificates, and other primary and summary documents. As with material inventories, a nomenclature-price tag is drawn up for finished products. In addition to the price tag, directories of products subject to and exempt from various types of taxes, payers and consignees, average quarterly and average annual costs, etc. are being developed.

The following types of evaluation of finished products are used:

– at actual production cost – used relatively rarely, mainly at enterprises producing large equipment and vehicles; also used in organizations with a narrow range of products;

- based on partial production costs of products, calculated based on actual costs without general business expenses - used in the same industries where the first method of assessment is practiced;

– at wholesale selling prices, which are used as accounting prices. Deviations in the actual cost of products are taken into account in a separate analytical account;

– according to planned or standard production costs, serving as a fixed accounting price;

– at free selling prices and tariffs increased by the amount of value added tax – used when executing single orders;

– at free market prices – used when accounting for goods sold through the retail network.

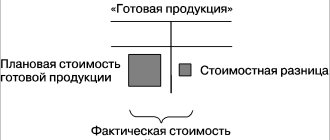

When using wholesale prices, planned cost and market prices at the end of the month in accounting, it is necessary to calculate the deviation of the actual production cost of products from its cost at accounting prices in order to distribute this deviation to shipped (sold) products and their balances in warehouses. To calculate deviations of the actual production cost of products from their cost at accounting prices, a special calculation is made using the weighted average percentage of deviations of the actual production cost of products from their cost at accounting prices.

DOCUMENTATION OF SHIPMENT AND SALES OF PRODUCTS

The sales service, in accordance with supply contracts concluded by the enterprise with customers, issues orders for the release of finished products to customers. An invoice is issued for selected and packaged products at the warehouse, which must contain the following details:

– date and number of the supply agreement;

– name of the customer enterprise, its address, current account number indicating the bank;

– name of the product, its product number;

– quantity of products;

– selling price of the product;

– total amount of vacation;

– signatures of the head of the sales service, chief accountant, storekeeper and the person who received the products.

Additional requirements for the availability of documents other than the invoice depend on what free place conditions are stipulated in the product supply agreement.

Franco-place

- this is the name of the point up to which the supplier bears responsibility for the safety of the product and the costs of its movement. When transporting by rail, the following types of free place conditions are distinguished:

1. Ex-warehouse of the supplier - all costs, starting from loading the products at the manufacturer's warehouse, are borne by the buyer of the products.

2. Free station of departure - the supplier bears the costs up to and including the unloading of the products at the station, and the buyer is responsible for delivery, starting from loading into the railway car.

3. Ex-wagon departure station - the supplier is responsible for the products until they are loaded onto the wagon.

4. Ex-wagon destination station - the buyer of the product pays for unloading from the wagon and subsequent movements, and the supplier pays for all previous ones.

5. Free station of destination - the supplier’s responsibilities for delivering products are completed at the destination station by unloading the goods.

6. Ex-warehouse of the buyer - all costs for delivery of products are borne by the supplier.

The costs of delivering products to the free location are included by the supplier in the full cost of production, so they are ultimately paid by the buyer.

Subject to delivery ex-warehouse of the supplier, the buyer's representative, having presented a power of attorney (certifying that this person acts in the interests of the buyer company), receives the products at the warehouse. In other delivery options, the products in the warehouse are received by the supplier's forwarder - the person entrusted with delivering the products to the free location.

The forwarder formalizes the export of products with a number of documents (in addition to the warehouse invoice): a waybill when transporting products to the departure station, a railway invoice when sending cargo by rail, and others. All documents are issued in several copies, one of which is issued to the forwarder (the forwarder can receive a document receipt). The remaining copies remain in the documents of transport organizations and the buyer.

When the forwarder submits all the documents to the sales service, an invoice is issued. The purpose of an invoice is to inform the buyer of the assortment, quantity, selling price and cost of the products shipped and the method of dispatch. The invoice must be registered in the statement of shipment, release and sale of products and material assets. This statement keeps analytical records of shipped products (what, to whom, when and at what price it was sold). After transferring money for shipped products and receiving a statement from the current account certifying payment, a note is made in the statement about the date and amount of payment.

SYNTHETIC ACCOUNTING OF FINISHED PRODUCTS

Finished products are accounted for on active account 40 “Finished Products” at actual production costs (registration prices can also be used).

Account 40 “Finished products” is used by material production enterprises. Products purchased for assembly or as goods for sale are accounted for in account 41 “Goods”. The cost of work performed and services provided to third parties is also not reflected in account 40; actual costs for them are written off from the production cost accounts to the debit of account 46 “Sales of products (works, services).” Products that are subject to delivery on site and are not formalized with an acceptance certificate are considered work in progress and are not taken into account on account 40.

Synthetic accounting of finished products can be maintained using account 37 “Output of products (works, services)” and without using it.

If account 37 is not used, finished products are accounted for on synthetic account 40 at actual production costs. But analytical accounting of certain types of finished products is carried out, as a rule, at accounting prices (planned cost, wholesale prices, etc.), highlighting deviations of the actual cost of finished products from the cost at accounting prices of individual products accounted for in a separate account. Accounting for finished products at discount prices is recorded as an accounting entry to the debit of account 40 “Finished products” and the credit of account 20 “Main production”. At the end of the month, the actual cost of finished products is calculated, the deviation of the actual cost of products from its cost at accounting prices is determined, and this deviation is written off from the credit of account 20 “Main production” to the debit of account 40 “Finished products” using an additional accounting entry or the “red reversal” method.

If finished products are used at the enterprise itself, then they can be debited from account 10 “Materials” and other similar accounts from the credit of account 20 “Main production”.

During the year, agricultural enterprises take into account the movement of agricultural products at the planned cost, and at the end of the year they bring the cost to the actual cost.

Shipped finished products are written off at accounting prices from the credit of account 40 “Finished products” to the debit of account 46 “Sales of products (works, services)”. At the end of the month, the deviation of the actual cost of shipped (sold) products from their cost at accounting prices is determined and written off to the debit of account 46 from the credit of account 40 using an additional posting or the “red reversal” method.

Products that were transferred to other organizations for sale on a commission basis are written off from the credit of account 40 to the debit of account 45 “Goods shipped”.

When using account 37 “Output of products (works, services)” to account for production costs, synthetic accounting of finished products is carried out on account 40 at standard or planned cost. The debit of account 37 reflects the actual cost of production, and the credit reflects the standard (planned) cost. The actual cost of production is written off to the debit of account 37 from the credit of accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”. The standard or planned cost of production is written off from the credit of account 37 to the debit of accounts 40 “Finished products”, 46 “Sales of products (works, services)” and other accounts (10, 11,21,28,41, 79).

On the 1st day of the month, comparing debit and credit turnovers on account 37, determine the deviation of the actual cost of production from the standard or planned one and write off from the credit of account 37 to the debit of account 46 “Sales of products (works, services)”. The excess of the actual cost of production over the standard (planned) is written off by additional posting, and the savings are written off using the “red reversal” method.

Account 37 is closed monthly and there is no balance at the reporting date. When using account 37, there is no need for separate calculations of deviations of the actual cost of products from their cost at accounting prices for finished, shipped and sold products, since the identified deviation for finished products is immediately written off to account 46 “Sales of products (works, services)”.

In the balance sheet, finished products are reflected: at the full actual production cost (if account 37 is not used and general business expenses are written off to accounts 20, 23, 29); at the full standard (planned) cost (if account 37 is used and general business expenses are written off to accounts 20, 23, 29); at incomplete standard cost (if account 37 is used and general business expenses are written off to account 46); at a reduced actual cost (for direct expense items), if indirect expenses are written off from account 26 “General business expenses” to the debit of account 46 “Sales of products (works, services)” and account 37 is not used.

ACCOUNTING FOR PRODUCTS SALES

The sale of finished products allows the enterprise to fulfill its obligations to the state budget for taxes, to the bank for loans, to workers and employees, suppliers and other creditors and to reimburse the costs of production - all this explains the importance of accounting for product sales.

When products (works or services) are released to the buyer, but not paid for by him, they are considered shipped. The moment of sale of the shipped products is the date of crediting the payment from the buyer to the current account or the date of shipment (delivery) of the products to the buyer.

Products are sold in accordance with concluded contracts or through free sale through retail trade. Products (works, services) are sold at the following prices:

– free selling prices and tariffs increased by the amount of VAT;

– state regulated wholesale prices and tariffs, increased by the amount of VAT (products of the fuel and energy complex and services for industrial and technical purposes);

- for the sale of goods to the population and the provision of services to them - at state regulated retail prices (minus, in appropriate cases, trade discounts, as well as discounts for sales and wholesale) and tariffs, including VAT.

Settlements for inter-republican supplies of goods (works, services) with states that have signed the Agreement on the Economic Community are carried out at prices and tariffs increased by the amount of VAT.

Until the moment of sale, shipped products are recorded on active account 45 “Goods shipped”, which reflects:

– actual production cost of shipped products;

– list price of the container paid by the buyer;

– transport costs reimbursed by the buyer.

The debit of account 45 reflects the amounts payable by customers, and the credit reflects the amounts paid. The account balance reflects the debt of buyers to pay for products, packaging and reimbursement of supplier expenses.

Sold products, work, services are accounted for in account 46 “Sales of products (work, services)”. Its peculiarity is the reflection on debit and credit of the same volume of products sold in different estimates. The debit shows the costs of the enterprise for the production and sale of products: the actual production cost of products sold and commercial expenses, which in total amount to the total actual cost of products sold; the amount of value added tax and excise taxes; list price of the container.

The credit of account 46 reflects revenue from sales of products. Excess of debit turnover is a loss, excess of credit turnover is profit. Account 46 has no balance and is closed monthly in correspondence with account 80.

The procedure for accounting for product sales depends on whether the buyer makes advance payment for the products.

If products are sold without prepayment, then accounting transactions are recorded in the following sequence:

– finished products are capitalized at actual cost;

– products were shipped to the buyer at actual cost;

– reflects the list price of the container, paid by the buyer in addition to the cost of the product;

– transport costs reimbursed by the buyer are reflected;

– revenue received from sales;

– sold products are written off at actual cost;

– the cost of the packaging is written off;

– the buyer reimbursed transportation costs;

– the amounts of excise taxes and VAT on products sold are reflected;

– business expenses are written off;

– the result of the implementation is written off.

So, the procedure for synthetic accounting of product sales depends on the method of accounting for product sales for taxation. Enterprises can determine revenue from the sale of products for taxation at the moment of payment for shipped products, work performed and services rendered, or at the moment the products are shipped and payment documents are presented to the buyer. As noted, in accounting, products are considered sold at the time of their shipment - ownership of the products passes to the buyer. Therefore, with both methods of selling products for taxation, finished products shipped or presented to customers at sales prices (including VAT and excise taxes) are reflected in the debit of account 62 “Settlements with buyers and customers” and the credit of account 46 “Sales of products (works, services)”. At the same time, the cost of products shipped or presented to the buyer is written off to the debit of account 46 “Sales of products (works, services)” from the credit of account 40 “Finished products”. From the amount of revenue of organizations, value added tax and excise tax are calculated (according to the established list of goods).

If the sale is “by shipment”, the amount of accrued VAT is reflected in the debit of account 46 and the credit of account 68 “Calculations with the budget”. This posting reflects the organization's debt to the budget for VAT, which is then repaid by transferring funds to the budget (debit account 68, credit cash accounts).

When selling “on payment”, the organization’s debt to the budget for VAT arises after the buyer pays for the product. Therefore, after shipment of products, enterprises reflect the amount of VAT on sold products in the debit of account 46 and the credit of account 76 “Settlements with various debtors and creditors.” Received payments for sold products are reflected in the debit of account 51 “Current account” and other accounts from the credit of account 62 “Settlements with buyers and customers”. When payments are received, organizations using the “on payment” sales method reflect the VAT debt to the budget:

D-account 76 “Settlements with various debtors and creditors”;

Set of accounts 68 “Calculations with the budget.”

Repayment of debt to the budget for VAT is formalized by the following posting:

D-t account 68 “Calculations with the budget”;

Set of accounts 51 “Current account”, 52 “Currency account”, etc.

In cases where the supply agreement stipulates a different moment of transfer of the right of ownership, use and disposal of shipped products and the risk of accidental death from the organization to the buyer, account 45 “Goods shipped” is used to account for such shipped products. When shipping products in such cases, they are written off from the credit of account 40 “Finished products” to the debit of account 45 “Goods shipped”. After receiving notice of the transfer of ownership and disposal of the shipped products to the buyer, the supplier writes them off from the credit of account 45 “Goods shipped” to the debit of account 46 “Sales of products (works, services)”. At the same time, the cost of products at the selling price (including VAT and excise taxes) is reflected in the credit of account 46 and the debit of account 62 “Settlements with buyers and customers”. The amount of VAT calculated on the products sold is reflected in the debit of account 46, depending on the sales method used by the organization on the credit of accounts 68 or 76. When using account 76, after payment for the sold products, the accrued amount of VAT is written off from the debit of account 76 to the credit of account 68.

Finished products and goods transferred to other enterprises for sale on commission and other similar basis are also reflected in account 45 “Goods shipped”. When released, they are written off from the credit of accounts 40 “Finished Products” and 41 “Goods” to the debit of account 45 “Goods Shipped”. When notification of the sale of transferred products and goods is received, they are written off from the credit of account 45 “Goods shipped” to the debit of account 46 “Sales of products (works, services)” with reflection in the debit of account 62 “Settlements with buyers and customers” and the credit of account 46 “ Sales of products (works, services).”

The cost of work and services provided is written off at actual or standard (planned) cost from the credit of account 20 “Main production” or 37 “Release of products (work, services)” to the debit of account 46 “Sales of products (work, services)” as invoices are presented for work and services performed.

At the same time, the amount of revenue is reflected in the credit of account 46 “Sales of products (works, services)” and the debit of account 62 “Settlements with buyers and customers”.

Recently, advance payment of finished products has been widely used, in which the supplier issues an invoice and sends it to the buyer. Having received this document, the buyer transfers the payment amount for the products to the supplier using a payment order. When paying in advance, the amount of received payments is reflected in accounting until the moment of shipment of the products as accounts payable and is recorded as an accounting entry:

D-account 51 “Current account”;

Set of accounts 62 “Settlements with buyers and customers.”

After the product has been shipped, it is considered sold and is written off to the debit of account 62 from the credit of account 46 “Sales of products (works, services).”

In accounting, transactions are recorded in the following sequence:

– finished products are capitalized at actual cost;

– an advance (prepayment) has been received from the buyer;

– products were shipped to the buyer at actual cost;

– reflects the list price of the container, paid by the buyer in addition to the cost of the product;

– transport costs reimbursed by the buyer are reflected;

– the advance payment previously received from the buyer is offset;

– sold products are written off at actual cost;

– the list price of the container is written off;

– transportation costs are reimbursed by the buyer;

– the amounts of excise taxes and VAT on products sold are reflected;

– business expenses are written off;

– the result of the implementation is written off.

In cases where the prepayment is in the form of an advance payment and is not directly related to a specific invoice, received payments are reflected in the credit of account 64 “Settlements for advances received.”

The buyer may refuse to pay for products shipped to him if the goods were sent incorrectly, with a delay in delivery, low quality products, or for other reasons. Then the supplier’s accounting department makes reverse entries for the shipment of products;

D-t account 40 “Finished products”;

Set of accounts 46 “Sales of products (works, services)”;

D-t account 46 “Sales of products (works, services)”;

Set of accounts 62 “Settlements with buyers and customers.”

With any method of accounting for sales of products, enterprises pay VAT and excise taxes. Objects of VAT taxation are turnover from the sale of goods (works, services) and goods imported into the territory of the Russian Federation.

The calculated amount of VAT on products sold is recorded using the following accounting entry:

D-t account 46 “Sales of products (works, services)”;

Account set 68 “Calculations with the budget”, subaccount “Calculations for value added tax”.

Excise taxes are levied on sales of excisable goods of own production, including their sales to CIS member states. To determine taxable turnover, the cost of excisable goods is taken, calculated on the basis of:

free selling prices including the amount of excise tax;

regulated prices (less trade discounts), reduced by VAT at an estimated rate of 16.67%.

Settlements with the budget for excise taxes are taken into account on account 68 “Settlements with the budget”, subaccount “Settlements for excise taxes”. For the amount of the excise tax in the revenue, account 46 “Sales of products (works, services)” is debited and account 68, subaccount “Calculations for excise taxes” is credited. The transfer of excise tax is reflected in the debit of account 68, subaccount “Calculations for excise duties”, and the credit of account 51 “Current account”.

When using account 36 “Completed stages of work in progress,” accounting has some features. Organizations that perform long-term work (construction, scientific, design, etc.) can recognize the implementation of work and services as a whole for work completed and delivered to the customer or for individual stages of work performed.

In the first option, accounting for product sales is carried out using one of the above methods for accounting for sales of products (works, services). In the second, calculations are made for completed stages or complexes that have independent significance, or the organization is advanced by the customer until the work is completed in the amount of the contract price.

In the second option, account 36 “Completed stages for work in progress” is used. The debit of this account takes into account the cost of work completed by the organization, accepted in the prescribed manner and reflected on the credit of account 46. At the same time, the costs of completed and accepted stages of work are written off from the credit of account 20 to the debit of account 46. The amounts of received payment are reflected in the debit of cash accounts with credit account 64 “Settlements on advances received.”

After completion of all the work, the cost of the stages paid by the customer is written off from account 36 to the debit of account 62 “Settlements with buyers and customers”. The cost of fully completed work, recorded on account 62, is written off to the amount of advances received in the debit of account 64 and to the amount received in the final settlement in the debit of cash accounting accounts.

ACCOUNTING FOR COMMERCIAL EXPENSES

The cost of production is determined during the sales process. In addition to the production cost of the product (manufacturing costs), it is necessary to include costs associated with the sale of products. These expenses are called commercial, or non-productive expenses.

Business expenses include:

– costs of containers and packaging of finished products in warehouses (packaging in workshops refers to workshop costs);

– costs for delivery of products to the free location;

– commission fees paid to sales organizations and intermediaries;

– advertising costs, including the cost of product samples provided to buyers or intermediaries free of charge, and other similar costs;

– other sales expenses.

Non-production expenses are recorded on active account 43 “Business expenses”. The debit turnover of this account reflects the costs of the reporting month associated with the shipment of products, the credit turnover represents the amounts written off for products sold that month, and the account balance is equal to the amount of expenses incurred attributable to products shipped but not paid for at the beginning of the month.

Advertising expenses are written off to account 43 “Business expenses” according to actual amounts, but for tax purposes they are accepted within the established standards. (It must be borne in mind that organizations operating in the field of tourism services increase the maximum amount of advertising expenses by 3 times.)

In the debit of account 43 “Business expenses”, business expenses are taken into account from the credit of the following material, settlement and cash accounts:

– 10 “Materials” – for the cost of consumed containers;

– 23 “Auxiliary production” – for the cost of services for sending products from the warehouse to the departure station (pier, airport) or to the buyer’s warehouse using the organization’s vehicles;

– 60 “Settlements with suppliers and contractors” – for the cost of services for sending products to the buyer, provided by third parties;

– 70 “Settlements with personnel for wages” – for the payment of workers accompanying the products and other accounts.

Analytical accounting of the account is kept in the statement f. No. 15 accounting for general business expenses, deferred expenses and non-production expenses for the specified expense items.

At the end of the month, these expenses are written off to the cost of goods sold. For certain types of products, these costs are charged directly, and if it is impossible to determine, they are distributed in proportion to their production costs and the volume of products sold at the organization’s wholesale prices or in another way.

Non-production expenses are written off using the following entries:

D-t account 46 “Sales of products (works, services)”;

Account set 43 “Business expenses”.

In cases where only part of the manufactured products is sold in the reporting month, the amount of commercial expenses is distributed between sold and unsold products in proportion to their production costs or in another way.

In the balance sheet, commercial expenses do not have a separate item - when drawing up the balance sheet, the balance on account 43 is added to the balance on account 45 “Goods shipped”.

Table of contents