The concept of “insurance” covers many areas of financial relations arising in the relationship between the insurer, the policyholder and third parties.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The insurance procedure provides for social protection of the life and health of Russian citizens, their personal property, and civil liability in relation to persons who did not participate in the conclusion of the contract, but their interests are affected by it.

It is divided into several types, which have significant differences in subject and conditions, the nuances and subtleties of which are adjusted by the civil code of the Russian Federation.

Legislative regulation of the issue

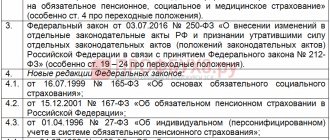

Legislative regulation of the issue is carried out by such legal acts as:

- Federal Law of April 24, 1995, number 81, regulating state benefits for citizens with a child;

- Federal Law of December 29, 2006 with number 255, which describes the procedures for social insurance of citizens;

- Government Resolution No. 375 dated June 15, 2007, which approved the regulations on the procedure for calculating benefits and other regulations of the Russian Federation.

How much to receive

According to paragraph 2.1 of Article 14 of Law No. 255-FZ, for persons who voluntarily entered into legal relations, the average earnings

, on the basis of which benefits are calculated, is taken to be equal to the minimum wage established on the day the insured event occurred.

According to paragraph 15(4) of the Regulations approved by Government Decree No. 375 of June 15, 2007, the average daily wage

for calculating benefits, it is determined by dividing the minimum wage established on the day the insured event occurred by the number of calendar days of each calendar month on which the insured event occurred.

Let's calculate what maternity benefit a woman individual entrepreneur who entered into a voluntary legal relationship will receive from the Social Insurance Fund in 2021.

Let’s assume that a woman was issued sick leave for the period from 02/04/2019 to 06/23/2019 for 140 days, and the minimum wage as of 02/04/2019 is 11,163.00 rubles.

| Calendar days of the month | Days due for payment | Average daily earnings | Benefit amount |

| February 2019 | |||

| April 2019 |

Thus, having paid 3,302.17 rubles in December 2021, a pregnant businesswoman will receive 52,014.50 rubles from the Social Insurance Fund in February 2021. The benefits are obvious!

Please note that in the case of temporary disability benefits, the length of service of the insured person will also be taken into account.

Those individual entrepreneurs who have already entered into voluntary legal relations and paid a contribution in 2021 can calculate the amount of their benefit in 2018 using

All economic entities, except taxes, are required to pay contributions to the Social Insurance Fund

(Social Insurance Fund), pension fund (hereinafter referred to as the Pension Fund) and for compulsory health insurance (hereinafter referred to as the FFOMS) for oneself and for employees, if any. Today we will talk about tariffs for 2021 and find out if there are any changes in the new reporting period.

Individual entrepreneurs pay insurance fees consisting of two parts:

- In 2021, fixed contributions to the Pension Fund

are 26,545 rubles, and to the Compulsory Medical Insurance Fund - 5,840 rubles. - Additional contributions to the Pension Fund

and the Federal Compulsory Medical Insurance Fund are charged if the entrepreneur’s annual income exceeds 300 thousand rubles and, as last year, amounts to 1% of the amount of annual income reduced by the limit.

For example, if the income for the year was 500 thousand rubles, then the additional fee = (500,000 - 300,000)/100, that is, another 2 thousand rubles will need to be added to the fixed amount.

When calculating the additional part of the fee, all income of the individual entrepreneur is taken into account, regardless of the applied taxation regime.

The total amount of contributions to the pension fund and health insurance cannot exceed 212,360 rubles.

Transfers of funds can be made from a current account, payment card or cash. Payment is accepted both at bank branches and through online services.

When drawing up a payment order, you must correctly indicate the budget classification code (hereinafter referred to as BCC):

- 182 102 021 400 611 101 60 - fixed and additional fees to the Pension Fund;

- 182 102 021 030 810 131 60 - contributions to the Compulsory Medical Insurance Fund.

If the codes are entered incorrectly, the money will be credited to other payments, which will lead to arrears in fees and the accrual of penalties. The codes are entered in the appropriate field; if there is no such column, in the “Recipient” field.

How to submit an application to the FSS

In order to submit an application to the Social Insurance Fund for voluntary insurance, you need to prepare the following documents:

- The applicant's passport and its copy;

- The insurance application itself;

- Documents confirming registration as an individual entrepreneur.

You can submit documents in two ways:

- The first and easiest way is to submit an application through the State Services portal. If you are registered on this portal, then submitting an application will not take you more than 10 minutes. You just need to fill out the application form and attach scanned copies of your passport and tax registration certificate. Based on the results of consideration of the application, the fund will generate a Notice of Registration; at the request of the applicant, this notice can be sent to the home address according to registration, or the applicant can receive it during a personal visit to the FSS.

- The second way is to submit an application during a personal visit to the FSS. You need to have the same documents with you as when filing an application electronically.

Important! The fund is obliged to register an entrepreneur within three days from the date of receipt of the application.

What it is

In countries with a social policy focused on the development of a market economy, a functioning social insurance system has been formed that provides protection for workers from social risks in the field related to professional activities.

In the Russian Federation, it has become one of the forms of social security that the state has provided for the purpose of providing material support to citizens upon the onset of old age, loss of temporary or permanent disability, and protecting their health from insurance risks.

The professional risks of a worker include illness, disability, old age, unemployment, loss of a breadwinner as a result of industrial accidents, when the family is left without a livelihood.

Social risks include:

- intractable diseases;

- accidents;

- traffic accidents;

- vehicle theft;

- sudden fires;

- robbery of property, funds;

- flooding, in cases of emergency;

- making payments to the injured party if damage to the health of third parties is caused.

Social insurance is divided into voluntary and compulsory.

Voluntary social insurance is carried out at the insured’s own request, that is, thanks to free will, consciously choosing a method of protection against unforeseen expenses in situations with negative consequences, for example, concluding an insurance contract in case of job loss, providing for specific conditions with the insurer.

Its conditions and implementation procedure are established solely by the insurer in accordance with the instructions of the current legislation on the organization of insurance business, the civil code separately for each policyholder.

The insurer offers services as special insurance programs approved for specific types of property.

When and where to pay contributions

The entrepreneur must pay insurance premiums by December 31 of the current year. Moreover, it does not matter in what order the contributions are paid, the main thing is that they are paid in full by December 31. They are paid according to the following BCC.

| Budget code. classifications | Category |

| 182 1 0 2 02090071010 160 | Contributions for temporary net work and maternity |

| 182 1 0 2 02090072110 160 | Penalty on contributions |

| 182 1 0 2 02090073010 160 | Penalty on contributions |

We draw your attention to the fact that the amounts of contributions must be paid not to the social insurance fund, but to the tax office, in which the entrepreneur is registered at his place of residence (that is, at his place of registration).

Results

Voluntary payments under insurance programs can be transferred by individual entrepreneurs for themselves to the Social Insurance Fund, and by citizens and their employers - to the Pension Fund of the Russian Federation in the order of paying voluntary contributions to a funded pension. The relevant state funds are responsible for collecting both types of payments - in contrast to mandatory payments, the bulk of which is now administered by the Federal Tax Service.

You can learn more about the relationship between insurance premium payers and government agencies that administer these premiums in the articles:

- “Where should I pay insurance premiums in 2020?”;

- “Insurance premiums accrued (accounting entry)”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Contribution rate

The rate of insurance premiums is the same throughout Russia and is equal to 5.1%. Contributions for the year that an entrepreneur must pay are calculated based on the minimum wage. From January 1, the federal minimum wage was set at 9,489 rubles. Thus, the amount of contributions payable is equal to:

9489*12*5.1%=3302.17 rubles.

This amount must be paid by December 31, 2021 in order to be eligible to receive benefits from the budget next year.

Important! The date of registration of an individual as an individual entrepreneur does not affect the amount of the contribution. It is a constant value throughout the year and does not depend on whether you worked as an individual entrepreneur all year or registered on December 30.

Is the activity of an individual entrepreneur counted towards seniority?

When forming an entrepreneur’s pension, both his work experience and the amount of contributions to the Pension Fund, including those made by him for himself during the period of entrepreneurial activity, will be taken into account.

All this will contribute to the calculation of the pension points due to him and the individual pension coefficient, which will determine the size of his future pension.

As for the length of service, all the time during which the future pensioner had the status of an individual entrepreneur and made contributions for himself is definitely counted.

In the current pension legislation, the term “length of service” is no longer used in relation to the current work of an individual entrepreneur; instead, the concept of “insurance period” is used.

Video: a few words about the experience of an entrepreneur

What benefits is an individual entrepreneur entitled to?

An individual entrepreneur with voluntary insurance has the right to receive the following types of benefits from the fund:

- For temporary disability;

- For maternity - one-time at birth and for early registration and also monthly for child care until he is 18 months old.

Important! All benefits due to the insured individual entrepreneur are calculated based on the minimum wage.

Child care benefits are paid based on 100% of the minimum wage, but for disability they are differentiated depending on the length of service of the entrepreneur and amount to 100% for more than eight years of experience, 80% for five to eight years of experience and 60% for less than five years of experience.

Kinds

The main types of voluntary insurance include insurance:

- personal, its objects include property interests relating to a person’s life, damage caused to him: harm to his health, loss of ability to work of the insured person from industrial accidents;

- movable and immovable property that a person has as property, material assets, securities;

- animals, mainly agricultural, including thoroughbred horses, exotics, pets;

- mortgages associated with funds borrowed to purchase residential real estate;

- medical, allows you to cover expenses spent on outpatient and inpatient treatment, implementation of rehabilitation measures in the postoperative period, dental services, prenatal care for women;

- personal vehicles from risks that make it possible to reimburse the full or some part of its cost;

- personal liability of the policyholder to third parties.

What documents are needed to confirm the occurrence of an insured event?

The list of documents confirming the entrepreneur’s right to receive payments from the fund is established by the fund. Mandatory documents may be:

- Application for payment to an entrepreneur;

- Certificate of incapacity for work;

- Child's birth certificate;

- A certificate from the other parent’s place of employment stating that the other parent did not receive payments from his employer;

- Certificate from a medical institution confirming the deadline for registration;

- Birth certificate of the child and/or previous child.

How is it different from mandatory

The main difference between voluntary and compulsory social insurance, which is financed through targeted taxation and payments from budget funds, is that it is a type of non-commercial insurance activity and is carried out by non-state insurance institutions, the so-called mutual insurance societies.

Distinctive characteristics:

- public sector personal insurance;

- the main legislative act is the Federal Law “On Insurance of Non-Profit Organizations”;

- the rules for the implementation of the insurance procedure are established by the insurance organization or an association created from them;

- the activity is carried out by an insurance non-profit organization;

- policyholders are individuals and legal entities who have entered into an agreement;

- The fund consists of the personal income of the population and the profits of enterprises.

The fundamental rule in the management of insurance funds is democracy at the same time as self-government; social partnership between the employer and the employee is also provided for. The amount of insurance payments is proportional to the income of the policyholders, from which insurance premiums are deducted.