Origin of the term “quarter”

The word is of Latin origin and has become part of the German language. It is literally translated as “quarter”. The very meaning of the term seems to carry the answer to the question of how many quarters there are in a year. There are four of them, because we are talking about the fourth part.

In the Russian Federation, this period is usually denoted by Roman numerals: IV, III, II, I. And in English-speaking countries (including the USA) - by Arabic numerals, preceded by the Latin letter Q. For example, Q4. This unit of measurement is used in economic statistics and accounting to summarize the interim results of the year.

How long is a quarter?

There are also four seasons, and each lasts 3 months. Does this mean that the concepts of “season” and “quarter” are identical? And under what circumstances is this possible? Indeed, a quarter also lasts 3 months. But he counts from the beginning of the year and further - in order, regardless of the season. We would observe a complete coincidence when celebrating the New Year, for example, on the first of March.

This could also have been the case among the ancient Slavs, who celebrated the transition of the calendar in the fall. For them, the New Year began on the first of September.

So how many quarters are there in a year? There are four of them, let's call them by month (there are three of them) and compare them with the seasons.

| I (Q1) | January March | December – February (winter) |

| II (Q2) | April June | March-May (spring) |

| III (Q3) | July – September | June – August (summer) |

| IV (Q4) | October December | September – November (autumn) |

Long weekend in 2020

| Start / End | Days | Name |

| January 1 / January 8 | 8 | New Year holidays 2020 |

| February 22 / February 24 | 3 | Defender of the Fatherland Day |

| March 7 / March 9 | 3 | International Women's Day |

| May 1 / May 4 | 4 | Labor Day (first May) |

| May 9 / May 12 | 4 | Victory Day (second May) |

| June 12 / June 14 | 3 | Russia Day (June) |

What is a quarter? How many months are there in each quarter?

Translated from Latin, this word means “quarter”. Accordingly, a quarter is ¼ of a year. Thus, it becomes clear that we have only four quarters in a year. Knowing that a year consists of twelve months, you can calculate the number of months in one quarter. How many months are there in each quarter of the year? Through simple mathematical calculations we arrive at the following: 12 / 4 = 3. In total, we have 4 quarters in a year, each of which has three months. Quarters are numbered with Latin numerals. In English-speaking countries, this time period is indicated by Arabic numerals. Each of them is preceded by the letter Q.

Interesting Facts

In the word "quarter" the stress falls on the second syllable. However, many people pronounce this word incorrectly, emphasizing the first syllable. You need to remember how to pronounce it correctly so as not to look illiterate.

Previously, in Soviet times, the quarterly year began in October. This fact caused confusion in the documentation, so this practice was soon abandoned.

Since at the end of each quarter, as a rule, employees of accounting, statistics and other organizations have to make a report, this period of time is also called the reporting period, as well as the tax period.

The word "block" can refer not only to a period of time, but also to a row of houses between two intersections on a street.

In this article, we found out what a quarter is, how many months are in each quarter, etc. This knowledge will be useful primarily to employees of those organizations where quarterly reporting is prepared. It would also do well for people not involved in reporting periods to know this information to broaden their horizons. Division into quarters is a worldwide practice. It allows you to intelligently plan time for performing various tasks in order to achieve your goals. Only those who schedule their time minute by minute, set specific tasks for themselves and control their implementation are able to achieve something.

Dividing the year into quarters is very convenient, as it allows you to track overall results in a timely manner, and if something happens, timely adjust your activities.

What are the months in each quarter?

The year has a similar division into seasons. There are also four of them, each lasting three months. However, there are differences between quarters and seasons. Seasons represent the seasons of the year. There are four seasons in total: winter, spring, summer and autumn.

However, the winter season does not begin with the beginning of the year. The first month of winter is the last month of the year – December. The quarter is characterized by division from the beginning of the year. That is, the first quarter begins on January 1. Further, both in seasons and in quarters, the months are counted in order.

This way we can find out which months are in the first quarter. These are January, February and March. The total is 31 + 28 (29) + 31 = 90 (91) days in the first quarter of the year. The number of days can only change in the first quarter, because February does not have 28 days in a leap year, but once every 4 years it consists of 29 days.

Q2 – what months are these? The second quarter of the year includes the next three months - April, May and June. Total number of days: 30 + 31 + 30 = 91. This number of days is constant from year to year.

Q3 – what months are these? July, August, September - these are the three months that make up the third quarter of the year. Total number of days: 31 + 31 + 30 = 92.

And finally, the last quarter of the year consists of the following months: October, November and December. Total days: 31 + 30 + 31 = 92.

Calendar 3rd quarter 2021 quarterly, production, third

Today we can hardly find out in one minute about the information we need, and on almost any topic, for which we turn to the World Wide Web for help, where we very quickly find answers to our questions. So the production calendar for the 3rd (third) quarter of 2021 will probably not be difficult to find for someone who needs it for work, and we ensure that upon direct request we can definitely find it on the Internet and prepare it.

Quarterly calendar 3, third quarter 2021, production

In the quarterly production calendar for the 3rd (third) quarter of 2019, specialists, and these are accountants, economists and personnel officers, will find all the necessary information that they need for the high-quality performance of their job duties, that is, they need it directly for their work. It contains all the information that will help them, tell them about all the issues that they need for work.

The production calendar based on the results of the 3rd (third) quarter of 2021 contains all the information important for professionals; it contains working time standards for a 24, 36 and 40 hour work week, weekends, holidays and working days, their number by month and the quarter as a whole, as well as long weekends, postponements and shortened days, all that is important for specialists to know about.

Why is it necessary to divide the year into quarters?

Having dealt with the question: how many months are there in a quarter, it is worth paying attention to why it is generally necessary to divide the year into quarters, because there are months and half-years. Dividing the year into quarters is most often used for reporting in various institutions. This allows you to systematize the recording of documentation, especially in the field of accounting and statistics, as well as track the implementation of certain work plans.

The year is evenly divided into quarters of months, but they are not all the same length and usually last 90, 91 or 92 days. It all depends on the number of days in a month, because a quarter is 3 months of the year, which means its duration is equal to the sum of all the days of the three months of which it consists. For example, the first quarter in a normal (non-leap) year consists of 90 days (31+28+31), the second quarter consists of 91, and the last two are 92 days each. The difference in the length of quarters causes inconvenience when preparing quarterly reports. To cope with this problem, the project of creating a new, more stable and convenient calendar than the current one has been discussed for more than 100 years. However, the strongest minds on the planet have not yet been able to solve this problem, since the Gregorian calendar, which we use now, despite all the disadvantages, is the most accurate in the entire known history of mankind and was created on the basis of astronomical data, taking into account all the features of the Earth’s movement around the Sun.

What should an accountant's report to the director look like?

Vyacheslav, good afternoon. There is a Profit and Loss Statement. But not everything is as simple and unambiguous as any leader would like. In general, in “standard” accounting, in my opinion, everything is done in such a way as to confuse the manager as much as possible, so that he cannot manage without an accountant! )))) It’s probably more important for you to understand for yourself what exactly you want to see in the report. If I were you, I would include the following in it: 1. How much money was earned and from what items of income (revenue). 2. How much money was spent and on what expense items (what exactly) was spent. 3. Cost of fixed assets (Buildings, structures, equipment) at the beginning of the month and at the end, taking into account monthly depreciation. 4. The cost of working capital (the cost of goods that your organization sells) + the amount of money available for the purchase of goods (you need to allocate a special fund and set aside a percentage of the sale of each product, covering its cost). Again at the beginning of the month and at the end. 5. Accounts receivable (Who owes us and how much?) 6. Accounts payable (To whom and how much do we owe?) 7. How much money is on the organization’s balance sheet, that is, how much cash should it have, taking into account the balance of the last month, income received and funds spent. 8. How much money does the organization actually have (live) and where exactly is it located (we do an audit of the funds and indicate in which current accounts, how much cash and in which cash registers, safes, exchanges, etc. this money is located.) At the same time real money must match the money on the balance sheet (clause 7). In general, it is best to undergo training at company A. This will allow you to: * clearly understand all the nuances of accounting * set up your work so that no accountant can fool you by asking you not to pay attention to the notes in your reports * receive any information about the state of the accounting department at any time without contacting an accountant * receive standard and understandable reports IN GRAPHICS on the activities of the accounting department on a weekly basis * understand what your accountant can actually do and see whether he brings you results And also: * earn more than you spend * put your finances in complete order * make sure that income is needed not only for you, but also for your employees

Types of quarterly tax reporting

Limited liability companies (hereinafter referred to as LLC) on the general taxation system (hereinafter referred to as OSNO) are required to submit quarterly tax reports to the Federal Tax Service at the place of registration of the company.

Let us remind you that the tax reporting quarters are as follows:

- 1st quarter (January, February, March);

- 2nd quarter – also called half-year (April, May, June);

- 3rd quarter – also called 9 months (July, August, September);

- 4th quarter – also called the year (October, November, December).

| Preparation and submission of reports for individual entrepreneurs and LLCs Cost of reporting

|

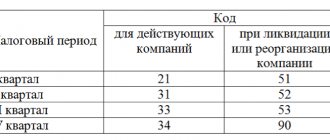

The VAT declaration is submitted by the 25th day of the month following the reporting month (reporting period quarter). The declaration is prepared quarterly. Compiled on the basis of books of purchases and sales, a journal of issued and received invoices.

The Profit Declaration is submitted by the 28th day of the month following the reporting month (reporting period quarter). The declaration is drawn up on an accrual basis for the quarter. Those. When preparing a declaration for the quarter, it is necessary to take into account the indicators of the previous quarter. Compiled on the basis of the balance sheet.

Payments for insurance premiums are due by the 30th day of the month following the reporting month (reporting period quarter). Such a declaration is drawn up on an accrual basis for the quarter. Those. When preparing a declaration for the quarter, it is necessary to take into account the indicators of the previous quarter. Compiled on the basis of accrued insurance premiums from the payroll.

Quarterly report of an individual entrepreneur

Obviously, the composition of quarterly reporting primarily depends on the tax system chosen by the entrepreneur for application. Therefore, for OSN, simplified tax system, PSN and UTII, the number of reporting forms and the timing of their submission differ significantly.

General taxation system

Individual entrepreneurs do not have to prepare financial statements, and their main report is the 3-NDFL declaration, which is submitted once a year. The only quarterly declaration that an individual entrepreneur is required to submit to the OSN is the VAT tax return.

It is provided only in electronic form, even if the individual entrepreneur had no revenue in the reporting period. This is determined by Article 145 of the Tax Code of the Russian Federation. If an entrepreneur ignores this obligation, he will face a fine under Article 119 of the Tax Code of the Russian Federation in the amount of 1 thousand rubles. If the declaration is submitted with data, then all the necessary sections must be completed, including copies of the purchase book and sales book, which taxpayers are required to send to the Federal Tax Service along with the declaration. The deadline for submitting the report for the 3rd quarter is November 20, 2019. The declaration must be certified by a qualified electronic signature and sent to the tax authority through an operator via telecommunications channels.

If an individual entrepreneur has employees, then he is required to submit quarterly reports on insurance premiums. Starting from 2021, it is necessary to report to the Federal Tax Service and the Social Insurance Fund. The tax service must provide a calculation of insurance premiums on paper or electronically. If an individual entrepreneur employs less than 25 people, he can submit the calculation on paper. The DAM form includes individual information on all payments made in the reporting period in favor of employees. Data in the report is entered on an accrual basis from the beginning of the year. Moreover, if an individual entrepreneur had employees who later quit, and until the end of the year he works alone, he still must submit reports to the DAM throughout the year. A similar rule applies to form 6-NDFL, which such entrepreneurs are also required to submit every quarter. If an individual entrepreneur does not and has not had employees, he does not report quarterly on insurance contributions to the Federal Tax Service and Social Insurance Fund, unlike organizations that in such a situation are required to provide “zero” calculations.

The 4-FSS calculation for the 3rd quarter of 2021 must be sent to the regional office of the Social Insurance Fund by October 25 in electronic form and by October 20 in paper form. The restrictions on the possibility of submitting a paper version are the same as in the case of calculating the DAM: up to 25 people of the average number. Information is entered into the calculation on an accrual basis from the beginning of the year.

If it is necessary to correct an error in the report and submit a corrective calculation or declaration, then this must be done only in the form of the report that was in force at the time of its initial submission to the regulatory authority. If the report is submitted late or with errors, the entrepreneur will face a fine of 1 thousand rubles per report, or in proportion to the unpaid contributions, if any.

Simplified taxation system

If an individual entrepreneur uses “simplified taxation” as the main taxation system, then he is relieved of the obligation to submit VAT returns. However, if in the reporting quarter the taxpayer issued invoices to his counterparties with an allocated amount of value added tax, he must pay VAT and submit a declaration on the same basis as VAT payers. Also, you do not need to report income and property taxes using the simplified tax system.

In addition, the taxpayer of the simplified tax system is obliged to make quarterly payment of advance tax payments. To do this, the individual entrepreneur must generate calculations based on the data in the book of income and expenses. These calculations are for reference only. Understating the amount of advance payments is not punishable by fines; the Federal Tax Service can only impose a penalty on the entrepreneur. However, this is a revenue control measure. After all, after reaching its maximum value, the individual entrepreneur loses the right to use the simplified tax system. In this case, he is automatically transferred to the general taxation system and must submit reports in accordance with its requirements.

In this regard, when preparing quarterly reports, the individual entrepreneur must monitor all contracts with counterparties. This measure is necessary to prevent the occurrence of excess revenue and to promptly transfer part of the income to another taxation system, if such a need arises. In particular, he can always switch to UTII for certain types of activities. Indeed, in this case, the amount of revenue is taken into account separately, whereas when applying the patent system it is summed up.

A single tax on imputed income

UTII is a preferential tax regime in which individual entrepreneurs are required to submit a quarterly report on a single tax to the Federal Tax Service. The UTII declaration is usually submitted to the tax office before the 20th day of the month following the reporting quarter. To generate reporting indicators, the entrepreneur, first of all, uses physical parameters that serve to calculate the tax: the number of vehicles, seats, number of employees, square footage of the sales floor.

With UTII, an individual entrepreneur does not have to keep records. All his calculations are analytical and intended only for his own needs. However, it is necessary to create accounting registers for control and to ensure receipt of operational accounting data in the event of loss of the right to UTII.

Patent tax system

An individual entrepreneur using a patent tax system does not have to submit any reports on it. He pays a fixed cost for the patent, and is obliged to annually provide data on the number of his employees to the tax office. Their maximum number for maintaining the right to use PSN cannot exceed 15 people. Accounting for income and expenses, as well as other reports on the PSN, are carried out by individual entrepreneurs by analogy with the simplified taxation system.

Division into quarters

Dividing the year into quarters is a division into four equal periods of time. Thus, each quarter represents three months. The first quarter begins on January 1 and continues until March 31. The second quarter is the period from April 1 to June 30, the third from August 1 to October 31, and the last quarter from November 1 to December 31. Roman numerals are used to designate the quarters of the year: I, II, III and IV quarters. The length of the quarters varies and varies from 90 to 92 days. Today we use the Gregorian calendar, which is quite accurate from an astronomical point of view. However, its reform has been talked about for decades in order to regroup the days of the year. In this case, it would be possible to equalize the length of months, quarters and half-years and correct the fact that the week begins in one month and ends in another. In 1923, a special committee on reform issues was created at the League of Nations, and after World War II, this problem began to be discussed in the UN Economic and Social Council. With all the number of calendar projects, the main attention is paid to the option proposed by Gustave Armelin in 1888. According to his project, the calendar year has 12 months, as now, the year is divided into 4 quarters of 91 days. The first month has 31 days, the other two have 30. The first day of the year and quarter is Sunday, each quarter ends on Saturday and contains 13 weeks. The calendar project was approved in the USSR, France, India, Yugoslavia and several other countries. However, the UN General Assembly postponed its consideration and approval, currently ceasing activities on this issue.

How are the blocks numbered?

Quarters are usually designated by Latin numerals (IIIIIIIV). In countries where English is used as the official language, quarters of the year are usually designated in Arabic numerals. The numbers are preceded by the letter Q.

September

Monday18152229512192629162330Tuesday2916233061320273101724Wednesday31017243171421284111825Thursday4111825181522295121926Friday5121926291623306132 027Saturday61320273101724317142128Sunday7142128411182518152229| July | August | September | III quarter | |

| Calendar days | 31 | 31 | 30 | 92 |

| Working days | 23 | 22 | 21 | 66 |

| With a 40 hour work week | 184 | 176 | 168 | 528 |

| With a 36 hour work week | 165.6 | 158.4 | 151.2 | 475.2 |

| With a 24-hour work week | 110.4 | 105.6 | 100.8 | 316.8 |

Property tax

Company property tax is a regional tax, so you will not find deadlines for its payment in the Tax Code. But the legislation states that the reporting periods for this tax are quarters. This means that it is also quarterly. Exact data on its payment and reporting should be looked at in the regulations of a particular region. The declaration form is unified and is mandatory for use.

I would also like to note that previously property tax was paid only by organizations on special tax purposes. Starting from the third quarter of 2014, the government of the Russian Federation obliged organizations that are on UTII to calculate and pay it.

Production calendar - 2021, print in A4 format

From the options below, select a suitable production calendar for 2021; you can print it in A4 format.

Additionally, you can download and print on a separate A4 sheet:

• full list of holidays 2021;

• calendar for a specific month of 2021 (including holidays);

• .

Each of the 2018 annual calendar options below contains public holidays and weekend transfers.

Next year:

Print a weekly planner for your plans 30 options:

Popular:

Diary with calendar - 2021 for any month >>>

Download the fitness calendar + exercises:

This is what the production calendar 2021 looks like (you can also print it on the page of a specific month - click on the name of the month below):

| January 2021 >>> | ||||||

| Holidays in January 2018 | ||||||

| February 2021 >>> | ||||||

| Holidays in February 2018 | ||||||

| March 2021 >>> | ||||||

| Holidays in March 2018 | ||||||

| April 2021 >>> | ||||||

| Holidays in April 2018 | ||||||

| May 2021 >>> | ||||||

| Holidays in May 2018 | ||||||

| June 2021 >>> | ||||||

| Holidays in June 2018 | ||||||

| July 2021 >>> |

| 23 |

| 30 |

| 24 |

| 31 |

| 25 |

| 26 |

| 27 |

| 28 |

| August 2021 >>> | ||||||

| Holidays in August 2018 | ||||||

| September 2021 >>> | ||||||

| Holidays in September 2018 | ||||||

| October 2021 >>> | ||||||

| Holidays in October 2018 | ||||||

| November 2021 >>> | ||||||

| Holidays in November 2018 | ||||||

You can print the production calendar for 2021 by downloading one of the PDF files.

Other pages on the topic Production calendar - 2021, print:

- < Previous:

- Next: 2021 Calendar - Printable Version >

| December 2021 >>> | ||||||

| Holidays in December 2018 | ||||||

Tax paid depending on the tax regime

In Russia, all commercial organizations pay their tax depending on the tax regime they choose. However, only OSN and UTII are paid by organizations once a quarter. There are four payments and four reporting dates in a year. Also, the income tax of an organization located on the OSN can be paid once a month.

Thus, reporting on UTII is submitted on the twentieth day of the month following the reporting period according to the tax return form approved by order of the Federal Tax Service of the Russian Federation. This form is filled out in accordance with the regulations and submitted to the tax authority to which the organization is attached. Failure to submit or late submission entails an administrative penalty in the form of a fine.

The tax for OSN is paid once a quarter. There are three months in a quarter, therefore, an enterprise can also submit three tax returns per quarter, since the reporting period for this tax is not precisely specified. Organizations determine it independently. This declaration is mandatory for use; Order of the Ministry of Finance No. 55n approved its form.

Other special regimes submit tax reports only once a year, although they pay advance payments every 3 months.

Quarterly report of the organization

Organizations that apply the general taxation system are required to report to the Federal Tax Service on income tax and VAT every quarter. The income tax return for the quarter is practically no different from the return that taxpayers submit at the end of the year. For the 3rd quarter it must be submitted by October 28, 2019.

VAT reporting is completely similar to reporting for individual entrepreneurs. If an organization on OSNO does not operate and does not have property, there are no transactions on the account and cash register, then it has the right to report quarterly in the form of a Unified Simplified Declaration on paper for all taxes (VAT, profit) at once.

As in the case of an individual entrepreneur, an organization using the simplified tax system does not submit declarations quarterly, this happens once a year. At the same time, the deadline for submitting a declaration under the simplified tax system for legal entities is 1 month earlier than for individual entrepreneurs. They must be submitted by March 31 of the year following the reporting year.

Similar to individual entrepreneurs in “simplified” terms, an organization is obliged to report VAT, even if it is not a payer, if it issued invoices to its counterparties during the reporting period with the allocated amount of tax. Failure to report in this case will lead to a fine under Article 122 of the Tax Code of the Russian Federation for failure to pay VAT on time and under Article 119 of the Tax Code of the Russian Federation for failure to submit a report.

Patent and UTII

The quarterly reporting of legal entities under these special tax regimes is not fundamentally different from the quarterly reporting of individual entrepreneurs. Everything that has been said about them applies equally to organizations.

Thus, in order to avoid fines for late submission of quarterly reports, it is enough to compile and send to the regulatory authorities all the reporting forms presented in this article on time.

>Quarterly reporting

Quarterly reporting is tax reporting and reporting to extra-budgetary funds, which is submitted quarterly.