Account type: Active Calculation, inventory. Procedure and accounting of results Your Mail Password Register. Here you can add your version of the Accounting transaction and after verification we will add it to the site. Thank you for your cooperation Dt - Leased fixed assets - Inventory assets accepted for safekeeping - Materials accepted for processing - Goods accepted for commission - Equipment accepted for installation - Strict reporting forms - Debt written off at a loss from insolvent debtors - Collateral obligations and payments received - Security for obligations and payments issued 01 - Fixed assets - Disposal of fixed assets - Depreciation of fixed assets - Fixed assets leased - Intangible assets received for use - Inventory and business.

Payment for electricity wiring

VIDEO ON THE TOPIC: Save up to 8% on electricity!

Generalization of information on the costs of production, which are auxiliary and servicing for the main production or main activity of the enterprise, is carried out on the account “Auxiliary production”. This account is used to account for the costs of production that provide: a service with various types of energy, electricity, steam, etc. In addition, these accounts can reflect the costs of research and development departments on the balance sheet of the enterprise.

The debit of the “Auxiliary production” accounts reflects direct costs associated directly with the production of products, performance of work, provision of services, as well as indirect costs associated with the management and maintenance of auxiliary production, and losses from defects.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free! Are you already registered? Please log in by filling out the fields below. Or register. Forgot your password? Remember data.

Do you have any suggestions, comments or requests? Contact the editors! We will definitely answer. Fundamentals of Accounting Continued. See the beginning.

They say that only those who don’t look back have their whole life ahead of them. Sometimes everything changes very dramatically, you just need to change your point of view, perspective. What does this have to do with accounting, you ask? Take, for example, the costs that we will talk about today. You can also look at them from different angles in different ways and then the picture will become three-dimensional.

This can be not only interesting, but also useful. That is why in the Chart of Accounts there are two classes of accounts that reflect the same costs, only from different “angles of view.” In the last “lesson” we finished our introduction to abacus for 7th grade. Thus, we have come to a certain line that separates accounts from 0 to 7 class 1 from accounts 8 - “Expenses by elements” and 9 - “Expenses of activities” classes.

What is this feature, for what reason did it appear, and what is the fundamental difference between the accounts included in the first eight classes and the accounts included in the last two? Without answers to these questions we cannot go further. In previous publications, we have already used some accounts of this class in examples. But this was just a short mention of their existence.

We still have to get to know them in more detail. So, first, only accounts included in classes 0 to 7 are, in accordance with the Chart of Accounts, mandatory for use by all enterprises 2. But accounts of classes 8 and 9 are not always used to reflect business transactions in the accounting records, more precisely say not all enterprises.

In this regard, the developers of the instructions identified two groups of enterprises that use accounts of classes 8 and 9 in a special order: Enterprises belonging to these two groups can choose the following options for using accounts included in grades 8 and 9:. It is necessary to understand that in this case the Chart of Accounts does not prohibit, but recommends the choice of such options. Therefore, it will not be a violation of the instructions if, for example, any small enterprise decides to use accounts of class 9 or classes 8 and 9 simultaneously in accounting.

Second, accounts of grades 8 and 9 are not reflected in balance sheet 4. No, no, this does not mean at all that the accounts of these classes are analogous to off-balance sheet accounts of grade 0. The point is completely different - the accounts of these classes do not have balances at the end of the accounting or reporting period, if you like. Accounting-speaking, the sums of the debit and credit turnovers of all class 8 and 9 accounts must always be equal to each other, and accordingly the balance must be equal to zero.

And since the balance sheet reflects account balances, it is quite natural that accounts of the indicated classes will not be included in it. What are the 8th and 9th grade accounts intended for?

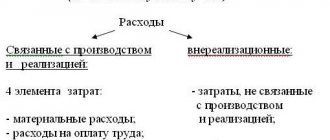

First of all, to reflect in the accounting of the enterprise's expenses for operating, financial, investment activities and others carried out during the reporting period and write them off in the order of closing accounts for production costs or financial results of operations. It is necessary to note one very important detail that will help you understand the mechanism for reflecting costs in accounts of classes 8 and 9 - those costs that are reflected in accounts of class 8 accounts are reflected directly or indirectly in accounts of class 9, only they are grouped differently.

The costs reflected in the 8th class accounts are grouped by the elements material, wages, etc. Later, after studying all the accounts, we will return to this issue and show schematically the mechanism for reflecting costs and their write-off in the order of closing the 8th and 9th class accounts. Now let's move on to studying 8th grade accounts. There is probably no need to talk separately about what expenses are reflected in each individual subaccount. Everything is clear.

With the exception, probably, of a subaccount, which, in accordance with the chart of accounts, is intended to reflect the cost of: robots and services of a production and non-production nature performed for the enterprise, carrying out individual operations for the production of products, processing of raw materials and supplies; conducting tests to test raw materials and materials used in production; transport services, which are an integral part of the technological production process, etc.

All material expenses incurred by the enterprise in the course of its activities are reflected in the debit of the specified sub-accounts, and in the credit - they are written off:. If the company does not use class 9 accounts, then instead of option “B” the company acts according to option “C”;. Option 1. The small enterprise “Consol”, which carries out production, construction and trading activities, uses accounts of classes 8 and 9 to reflect its business transactions in accounting.

Let’s assume that in November of the year, MP “Consol” carried out the following operations related to material costs, see Option 2. Let’s leave all the conditions of the first option unchanged, except for one.

Let’s assume that MP “Consol” does not use class 9 accounts to reflect its business transactions. In this case, the following postings will change, see the following account of class 8 accounts 81 “Labor expenses” reflects all the company’s expenses related to labor compensation. The debit of the account, and, accordingly, of all its subaccounts, reflects the costs associated with various types of remuneration.

Which types of payment for which subaccount are reflected already from the name of the subaccount, and probably does not require additional explanation. Such costs are reflected, as a rule, in correspondence with the account credit of 66 cm.

And since “as a rule,” there must be an exception. Such an exception is the situation when an enterprise, in accordance with the requirements of its accounting policies, creates a vacation reserve. The vacation reserve is accrued throughout the year in equal parts in order to remove the “peak load” of vacation pay during the summer period.

If a vacation reserve is not created at the enterprise, then the accrual of vacation pay is reflected “traditionally” for this account, that is, in the credit of account 66 D K. In the credit of the specified subaccounts, the write-off of labor costs is reflected.

What is the mechanism for such a write-off? It is similar to the mechanism for reflecting write-off transactions of material costs, which we outlined in detail in example 1, see above. Everything is exactly the same, and the possible write-off options are the same, only instead of the subaccounts of account 80, it is necessary to put subaccounts of 81 accounts and for the loan in transactions 1 to 7 inclusive, see example 1, there will not be subaccounts reflecting inventory accounting, but 66 or 47 accounts.

We emphasize that in this case we are talking about similar write-off mechanisms, which does not at all mean the presence of similar accounts and transactions.

And one more difference needs to be noted. It concerns tax accounting. The fact is that when inventories are written off, the enterprise does not have gross expenses, since they arise, in accordance with tax accounting requirements, upon the first event, that is, when they are paid by the enterprise or when they are received by the enterprise. When calculating wages or vacation reserves, such accrual is the first event.

Consequently, at the time of accrual of wages, bonuses, vacation pay, etc., the next account is 82 “Deductions for social events.” Transactions that are reflected in this account, with the exception of individual insurance, are directly related to wages. The debit of account 82 reflects expenses associated with contributions for social events in correspondence with the credit of account 65 cm.

And again we have to talk about analogy. That the mechanism for writing off expenses related to social insurance contributions is similar to the mechanism for writing off material expenses account 80 and labor costs account All expenses for social activities directly related to the production of products, works or services are written off to the debit of 23 accounts associated with overhead, administrative expenses and sales expenses - to the debit of accounts of class 9, and if this class of accounts is not used by the enterprise, then to the debit of the account Argo LLC, which carries out production activities, uses accounts 8 and 9 classes.

Let’s assume that in November of the year, Argo LLC made the following payroll and deductions for social events, see. Let’s leave all the conditions of the first option unchanged, except for one. Let’s assume that Argo LLC does not use class 9 accounts to reflect its business transactions. Chart of Accounts - Order of the Ministry of Finance “On approval of the Chart of Accounts and Instructions for its use” from Try for free Subscription.

Write to us Profile My newsletters My subscription Log out. Login Are you already registered? Or register E-Mail Password Wrong user. The State Registration Service approved a comprehensive inspection plan for the year. Sick leave and maternity benefits have been restored.

From January 1 of the year, new accounts for paying taxes can be opened. Change in the cost of living from December 1: what indicators will this affect?

IFRS - the most pressing problems of application November 25 Management of internal debt of a company and group of companies November 25 Legal framework for running the tourism business. Changes in national accounting standards on December 4. The State Registration Service has approved a comprehensive inspection plan for the year. Attention! Sick leave and maternity benefits have been restored Let's get acquainted with the amounts of the Unified Social Tax and the single tax for groups I and II for the year From January 1 of the year, new accounts for paying taxes can be opened. Changes in the cost of living from December 1: what indicators will this affect?

Upcoming seminars, trainings, webinars IFRS - the most pressing problems of application on November 25.

Interesting point. The date of the act is usually considered the last calendar day of the reporting month, even if such a day is a non-working day.

Proskurina, certified accountant-practitioner, SAR. Is it legal from a legal point of view to attribute these expenses, despite the documents, to production expenses as services? If not, what is the right thing to do in this situation? The attribution of utility expenses to the account or depends on the intended purpose of such expenses. For example, if cold water was used to manufacture products or provide services such as concrete preparation, cooking in a canteen, etc. In other cases, utilities are included in general and administrative expenses, which are reflected in the account

How to keep accounting records in SNT of land, electricity and property

Members of the partnership have the right to dispose of property on a general basis. In the case of use of SNT property by third parties, an agreement is concluded with them for the right to use for a fee, the amount of which corresponds to the cost established for members.

Receipt of membership fees is carried out according to a cash receipt order. SNT organizations are required to comply with the rules for conducting cash transactions. If the day of receipt of funds at the cash desk coincides with a number of persons, reception can be carried out according to a statement indicating the data of the area, the person and if there is a signature. A PKO (receipt cash order) must be issued for the document and subsequently reflected in the cash book.

Received electricity bill wiring

Generalization of information on the costs of production, which are auxiliary and servicing for the main production or main activity of the enterprise, is carried out on the account “Auxiliary production”. This account is used to account for the costs of production that provide: a service with various types of energy, electricity, steam, etc. In addition, these accounts can reflect the costs of research and development departments on the balance sheet of the enterprise. The debit of the “Auxiliary production” accounts reflects direct costs associated directly with the production of products, performance of work, provision of services, as well as indirect costs associated with the management and maintenance of auxiliary production, and losses from defects. Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website.

Utility Accounting and Taxation

If there are no meters or they are out of order for some reason, then resource supply organizations will calculate the volume of services according to the rules established by law. For example, Federal Law dated July 27, 2021 N 190-FZ “On Heat Supply”.

When a consumer does not agree with the set volumes of utility services, he can contact the resource supply organization. If the resource supplying organization agrees with the consumer’s data, then it will draw up a document on changes in volumes, which the consumer must sign.

Electrical wiring

News Tools Training Forum.

Login Register. Login for registered:. Forgot your password? Login via:. Previously, you entered through. Password recovery. WATCH THE VIDEO ON THE TOPIC: Electricity production as a business idea - Solar power plant for home and business

To log in, you can use an account created on any of the Normative sites.

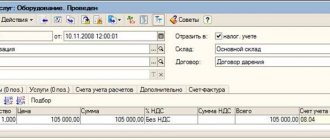

Somehow I got entangled in three pine trees. We rent out the entire premises. D 26 K 60 - billed for consumed electricity for your needs D 76 K 60 - billed for consumed electricity to the extent reimbursed by the tenant. VAT 88 paid. And it turns out that the thermal power plant was closed, and on Help: wow:: wow: Get wiser and wiser. D 76 tenant K 60 - when re-invoicing the tenant! The amount that the tenant owes you.

conclusions

If an enterprise has subsubscribers and they are connected to the supply substation, from which the enterprise itself is powered, then the substation can be leased to a network organization. This is the most profitable way, since the enterprise will not only forget about the existence of subsubscribers, but will also receive a reduction in its consumption in terms of losses in the substation, will stop servicing the substation - this will be done by the staff of the network organization, and will also receive rent for the leased substation.

If subsubscribers are connected to the enterprise’s networks “downstream,” you can either create an energy sales organization, but this is associated with certain risks, or terminate contractual relations with subsubscribers and transfer them to the status of transit consumers.

If the technological connection of the sub-subscriber is not properly formalized, it is possible to enter into an agreement on the redistribution of maximum power, under which the enterprise will transfer part of its maximum power to the sub-subscriber.

In the case where an enterprise does not have subsubscribers and has received an offer for technological connection to its networks, I advise you to think carefully. After all, having connected a subsubscriber or transit consumer, it will no longer be possible to disconnect it from your networks.

So kindness or immediate gain may later turn into problems that cannot be fully resolved by the current rules. You can only minimize the negative effect from them.

Task: make transactions

Proskurina, certified accountant-practitioner, SAR. Is it legal from a legal point of view to attribute these expenses, despite the documents, to production expenses as services? If not, what is the right thing to do in this situation? The attribution of utility expenses to the account or depends on the intended purpose of such expenses.

.

.

Please tell me the entries for the operation. True, according to the terms of the course work, there is auxiliary production.

How can a landlord reflect reimbursement of utility expenses in accounting?

Debit 76 subaccount “Settlements with the customer for purchased goods (works, services) Credit 76 subaccount “Settlements with the customer for remuneration” - the amount of remuneration is withheld from the funds received from the customer (if the intermediary independently withholds the remuneration);

If leasing property is a separate type of activity of the organization, then take into account the cost of utilities as part of expenses for ordinary activities (clause 5 of PBU 10/99). At the same time, make the following entry in accounting: