Entertainment expenses include (paragraph 1, clause 2, article 264 of the Tax Code of the Russian Federation):

- expenses for an official reception (breakfasts, lunches or other similar event) for representatives of other organizations participating in negotiations in order to establish and (or) maintain mutual cooperation, as well as officials of the taxpayer organization participating in negotiations;

- costs of transportation for the delivery of these persons to the venue of the representative event and (or) meeting of the governing body and back;

- expenses for buffet service during negotiations;

- payment for the services of translators who are not on the taxpayer’s staff to provide translation during entertainment events.

During the reporting (tax) period, entertainment expenses are included in other expenses in an amount not exceeding 4% of the company’s labor costs for this reporting (tax) period (paragraph 3, clause 2, article 264 of the Tax Code of the Russian Federation).

How are tax deductions applied to such expenses?

By virtue of clause 7 of Art. 171 of the Tax Code of the Russian Federation, tax amounts paid on entertainment expenses accepted for deduction when calculating corporate income tax are subject to deductions. Since entertainment expenses are taken into account in tax expenses according to the norms, the deduction of “input” VAT is also normalized.

Legislatively defined signs of advertising

The advertising activities of entrepreneurs are regulated by federal legislation - the Federal Law “On Advertising” dated March 13, 2006 No. 38. It defines advertising as a type of information aimed at creating and maintaining attention and interest in an object, and indicates its legal characteristics:

- the method, form and means of distribution do not matter - they can be anything;

- the circle of recipients of the information is not determined, that is, it is intended for everyone.

IMPORTANT! The last criterion is decisive. For example, souvenirs with a company logo that are given to partners and clients cannot be classified as advertising, as well as expenses for them, since it is known in advance for whom they are intended.

Advertising expenses: to ration or not to ration ?

The legislation also defines objects that are not classified as advertising:

- data required to be made public by law;

- signs with the name, address, operating hours of the company;

- information about the composition of the goods, manufacturer, exporter (importer) printed on the packaging;

- design elements for product packaging.

Question: Is the sale of fixed assets previously used to carry out the main activity of the organization taken into account when determining the proceeds from sales for the purpose of normalizing advertising costs when calculating income tax (namely, the costs of purchasing prizes that will be awarded based on the results of the drawing during the advertising campaign)? View answer

Why do we need a standard for advertising expenses?

An organization can spend significant amounts on advertising; management decides which ones, taking into account the effectiveness of management decisions made in this regard and the financial capabilities of the organization. Since advertising is not only information, but also a business activity, it is reflected in appropriate accounting and is subject to taxation.

advertising expenses recognized in tax accounting ?

For this purpose, spending on advertising is usually divided into two types:

- normalized – those that are recognized as such only in accordance with certain criteria;

- non-standardized - unconditionally taken into account as advertising expenses, without limitation for tax purposes.

This division determines what amount of costs a company can take into account when determining the base for income tax: within limited limits or in full.

REFERENCE! Expenses intended for advertising are usually taken into account as part of “Other expenses” among expenses for the production or sale of goods.

How to reflect advertising expenses in accounting?

Advertising expenses are reflected in selling expenses as expenses for ordinary activities. In the chart of accounts, they are reflected in the debit of account 44 “Sales expenses” and for accounting purposes do not have a standardized nature.

As for income tax, the amount of advertising expenses in the tax return is always reflected in one place, regardless of the method used to determine income and expenses. This amount forms the data indicated in line 040 of Appendix 2 to sheet 02 of the declaration.

VAT on advertising expenses is deductible in accordance with the generally established procedure.

If advertising expenses are due to payment for the services of third-party companies, then they can be taken into account in 2 different ways: on the last day of the reporting or tax period and at the time of presentation of documents on the basis of which calculations should be made (invoice and certificate of work performed).

Advertising expenses that are not standardized

Non-standardized advertising expenses are those that relate to advertising in all cases and cannot be regarded as otherwise. The Law “On Advertising” and the Tax Code of the Russian Federation (paragraphs 2–4, clause 4, article 264) provide a closed list of such expenses.

- Costs of advertising activities for which the media are used:

- advertisements in print media;

- radio broadcasts;

- TV shows;

- Internet;

- other communication means.

Media advertising costs can be interpreted quite broadly; they include such indicators as:

- cost of airtime;

- payment for the creation and placement of an advertising video;

- advertising agent salary, etc.

NOTE! The created advertising product, if it exists and operates for a certain time, becomes an intangible asset, which means it will have an initial book value and be subject to depreciation during its entire period of use.

- Costs for outdoor advertising , which include: advertising stands;

- shields;

- banners;

- stretch marks;

- light panels and displays;

- balloons, aerostats, etc.

ATTENTION! These expenses fully include not only expenses on the advertising information itself, but also on its media. If the media belongs to the company, then it is its asset, the value of which is depreciated.

- trade fairs;

IMPORTANT INFORMATION! As part of these events, expenses for entry fees, issuance of permits, production of brochures and catalogs, design of shop windows and demonstration rooms are not standardized, while costs associated with participation, but optional, for example, distribution of souvenirs, tastings, distribution of advertising publications, etc. ., are subject to rationing.

For advertising expenses to be recognized as normal

The tax office closely monitors the inclusion or exclusion of expenses in the income tax base. To avoid tax disputes, the requirements for justifying non-standardized advertising expenses should be strictly observed:

- expenses should be made specifically for advertising, that is, the activity should be strictly informational and not have specific addressees;

- You must have primary documents confirming the advertising use of information.

FOR EXAMPLE. Here are a few controversial points regarding the classification of expenses as non-standardized:

- The company has created its own website and advertises its products on it. The costs of creating a website are considered advertising in full. But the costs of creating and operating an online store, even if it contains advertising information, are classified as “other sales-related.”

- A furniture company is taking part in a sales exhibition and has equipped a demonstration bedroom for this purpose. In addition to furniture owned by the company, the design also included other items to create coziness (tablecloth, bed linen, vase, etc.). The costs of their purchase and delivery can be classified as non-standardized advertising expenses.

- A confectionery manufacturer organizes a tasting. Girls in branded suits with the company logo treat visitors to cookies and hand out advertising leaflets. The costs of printing leaflets are not standardized, but the costs of branded clothing and tasting samples are not.

- The company conducted training on competent advertising of its products, rules for presenting samples to the client, etc. The costs of the training are not advertising expenses.

Standardized advertising costs

All other advertising expenses not specified in the Tax Code of the Russian Federation are subject to rationing. They can be written off from the income tax base if they do not exceed 1% of revenue for products sold during the reporting period.

Calculation of advertising expenditure rates

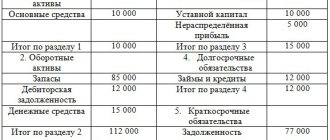

To find the required 1%, you need to know from what amount you need to calculate it. Revenue is calculated taking into account all receipts on the balance sheet for a given period, both financial and natural:

- own products sold;

- sale of previously purchased goods;

- acquired property rights.

From the amount received, VAT, excise taxes and proceeds on loans issued by the company should be subtracted (they are classified as non-operating, and revenue includes only income from sales).

Transfer of VAT to later periods

According to the general rule, in force since 2015, the company has the right to claim tax deductions specified in paragraph 2 of Art.

171 of the Tax Code of the Russian Federation, within three years after registration of goods (work, services), property rights or goods imported by it into the territory of the Russian Federation and other territories under its jurisdiction. Thus, starting from 2015, companies have the right to independently choose the period in which they can claim a deduction. Is it possible to defer VAT to a later period on travel and entertainment expenses? After all, these deductions are named in clause 7 of Art. 171 of the Tax Code of the Russian Federation, and not in paragraph 2 of Art. 171 Tax Code of the Russian Federation.

As you can see, the last of those presented (clause 2 of Article 171 of the Tax Code of the Russian Federation) is a general rule, and the first (clause 7 of Article 171 of the Tax Code of the Russian Federation) establishes specifics for certain types of deductions. Therefore, deductions can be used within three years from the date of acceptance of travel and entertainment expenses.

However, tax officials, answering the question about the possible transfer of deductions for travel expenses, noted that the company does not have the right to claim deductions for three years. In this regard, such deductions should be made in the period in which the company became entitled to them. Tax officials emphasized that in such a situation, the company can file an updated declaration within three years after the end of the tax period in which the right to deduction arose (Letter of the Federal Tax Service of Russia dated January 9, 2017 No. SD-4-3 / [email protected] ).

Despite the fact that the letter refers to travel expenses, the tax authorities’ conclusion can be extended to other deductions not listed in paragraph 2 of Art. 171 Tax Code of the Russian Federation.

But we cannot agree with such a formal approach of the tax authorities. If we are talking about other types of deductions that are not subject to clause 2 of Art. 171 of the Tax Code of the Russian Federation, the procedure that was applied before the entry into force of clause 1.1 of Art. 172 of the Tax Code of the Russian Federation, taking into account clause 2 of Art. 173 of the Tax Code of the Russian Federation and clause 27 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33. As noted in the Plenum of the Supreme Arbitration Court, VAT deductions for which all conditions are met can be reflected by the company in the declaration for any tax period within three years from the end the period in which the right to reduce VAT arose.

Documentary evidence of advertising expenses for tax accounting

So, the income tax base is reduced by the amount spent on non-standardized expenses in full, and on standard expenses - in the amount of 1% of revenue for a given period. To recognize such expenses as advertising, they must be documented. Such confirmations may be:

- annual or quarterly plans for advertising campaigns;

- cost estimate for a particular advertising campaign;

- documents for the acquisition and/or write-off of tangible assets related to advertising activities;

- on-air certificates (when advertising on air).

Working with foreign companies

In order to avoid double taxation on the part of two countries, there are special principles based on treaty provisions. In the case of each individual country, it is necessary to consider them separately, because Rules for writing off advertising expenses may vary significantly.

As an example, we can cite the agreement between the Russian Federation and Germany: advertising expenses incurred by a Russian company with the participation of an enterprise from Germany are taken into account when calculating profit tax in full.

Accounting for advertising expenses

Unlike tax accounting, in accounting there is no division of expenses into standardized and non-standardized. They are fully reflected in the amount indicated in the supporting documentation.

For postings, account 44 “Sales expenses” or 26 “General business expenses” is used. Depending on the type of advertising, the type of wiring may be different:

- for the services of an advertising agency, advertising in the media - credit 60 “Settlements with suppliers and contractors”;

- write-off of brochures, catalogs and other products not related to fixed assets - credit 10 “Materials”;

- write-off of depreciation on advertising structures recognized as fixed assets - loan 02 “Depreciation of fixed assets”;

- write-off of depreciation on used advertising videos recognized as intangible assets - loan 05 “Amortization of intangible assets.”