Accounting: overhead costs

During the reporting period, general production expenses are reflected in the debit of account 25 of the same name. At the same time, expenses are recorded on account 25 in the context of each production unit. In accounting, overhead costs are reflected by the following entries:

Debit 25 Credit 10 – the cost of materials, spare parts used for maintenance and repair of equipment is written off;

Debit 25 Credit 70 – salaries of general production personnel have been accrued;

Debit 25 Credit 69 – contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases are accrued from the salaries of general production personnel;

Debit 25 Credit 23 (60, 76) – expenses for maintaining premises are written off (repairs, rent for premises, equipment, payment for utilities, etc.);

Debit 25 Credit 02 (05) – depreciation has been accrued on fixed assets (intangible assets) used in the main (auxiliary) production.

This procedure follows from the provisions of paragraph 9 of PBU 10/99, Instructions for the chart of accounts, letter of the Ministry of Finance of Russia dated November 8, 2005 No. 07-05-06/294.

General running costs

Costs associated with managing an organization, organizing its economic activities, and maintaining its common property are classified as general business expenses.

For example, expenses associated with running an organization (administrative expenses) include:

- administrative and managerial;

- for the maintenance of general business personnel not related to the production process;

- depreciation charges and expenses for repairs of fixed assets for management and general economic purposes;

- rent for general business premises;

- expenses for payment of information, auditing, consulting, etc. services;

- taxes paid by the organization as a whole (property tax, transport tax, land tax, etc.);

- other expenses similar in purpose that arise in the process of managing an organization and are associated with its maintenance as a single financial and property complex.

General production personnel who include them

That is, high learning ability, stress resistance, productivity.

Motivation, creativity and the desire for development, development and implementation of innovations are not necessary for workers in this category, while such skills can be decisive for administrative and managerial personnel. Other features of the activities of production personnel Employers should take into account certain features when regulating the activities of production personnel, since they have quite significant differences from administrative and managerial personnel in many aspects of work.

In particular, employers need to carefully familiarize themselves with the following features of the work of production personnel:

- Subordination in the organization.

General production personnel definition

All this leads to the formation of costs that seem to be far from the production process, which are combined into the group of general business expenses. They may include amounts necessary for:

- covering administrative and management expenses;

- remuneration for employees employed outside production;

- depreciation and repair of general purpose fixed assets;

- payment for rent of non-production premises;

- covering other expenses of a similar nature.

General business expenses are also written off to the cost of manufactured products in accordance with the rules of the enterprise's accounting policy. Characteristics of overhead costs General production and general business expenses are combined into a group of indirect costs that arise in the course of the enterprise's activities.

Production personnel

Employers should create an effective regulatory documentation framework that clearly defines the responsibilities of production personnel and the mechanisms for their subordination to their management. At the same time, control and analysis are one of the main areas of work with production personnel that the employer should focus on.

- Employee ratio. Production personnel in any case should make up more than half of the staff of any commercial organization. However, in the absence or small proportion of administrative and managerial employees, the efficiency of production personnel as a whole will also decrease. The optimal percentage is considered to be from 60 to 90% of workers belonging to the production staff.

- Remuneration mechanisms.

personnel categories

Attention Security workers are often classified as a separate category of production personnel, but they can also be an integral part of the service and auxiliary workforce.

- Students. Since apprentices within any enterprise working on the basis of an apprenticeship contract do not have any administrative or managerial power in principle, they must be classified as production personnel.

As can be understood from the above list, production personnel do not necessarily have to participate in the production process.

However, practical participation in it or simply directly bringing profit to the enterprise with one’s labor and not belonging to management employees can clearly indicate that the employee belongs specifically to the production category of workers.

General production expenses

It is difficult to trace the ratio of their amount to types of products and production time, so they are written off by the method of allocating costs in proportion to a given indicator. General production and general business expenses are taken into account, highlighting separate cost items and departments (shops).

This allows you to control the distribution of funds and identify the most expensive objects to maintain and manufacture.

Overhead expenses in accounting data General and general production expenses in total terms are reflected in synthetic accounts 25 and 26. Important: Both accounts do not have a balance at the end of the month, because

serve to collect and distribute the costs of main production. The amounts are written off to account 20, making entries Dt 20 Kt 25/26.

Production cost Costs arising in connection with the maintenance or maintenance of production facilities can be attributed to the final result in proportion to the amount specified by the accounting policy. The distribution of overhead costs aims to calculate the cost per unit of production at the exit from the workshop, taking into account all the costs of the industrial cycle.

The distribution of general production and general business expenses when using this method occurs in different ways: from account 25 the amounts are written off to the 20th account, and from 26 to 90. Thus, administrative, managerial and other overhead expenses in terms of general business expenses are not included in the production cost, but relate directly to the financial result.

This is one of the methods that can be applied in an enterprise.

- Production. Direct participation in the production process, at any practical stage, is often the main task of the workers who represent a large part of the manufacturing class.

- Service to the organization.

Carrying out their tasks within the framework of an employment contract or other documentation in order to ensure the effective operation of the organization may be the main function of production personnel.

In most cases, production personnel are required to have the same personal qualities as performers.

Production of products is always associated with certain costs, which subsequently form the cost value. General production expenses combine the amounts necessary to maintain the main and auxiliary production workshops.

Costs not directly related to the manufacture of products are classified as general business expenses and are accounted for separately. Definition Manufacturing overhead costs are costs directly associated with production activities. The main distinguishing feature from direct costs of manufacturing products is that the amounts cannot be attributed to a specific type of product.

General production personnel who include them in 2018

Production cost indicators allow you to analyze the profitability of a particular workshop and regulate the amount of costs for the production of certain types of products. Cost and taxation In order not to create additional registers for tax accounting purposes, it is better to account for overhead costs at the full production cost.

The method involves writing off to the debit of account 20 both general production and general business expenses.

The accountant’s choice of a method for attributing indirect costs to the cost of products should be based primarily on the provisions of the enterprise’s accounting policy.

General production expenses (account 25) and expenses for general business needs, together with data from account 20, make up the bulk of the cost of manufactured products.

General production personnel who belong to them in the Republic of Kazakhstan

At the same time, it is not always the case that employees do not bring direct profit to the enterprise - in the service sector, on the contrary, the organization may not have workers among its employees at all.

- Engineering and technical or administrative and technical personnel. These employees do not bring direct profit to the enterprise with their labor, but they ensure its efficient functioning and the solution of certain technical issues that arise.

- Maintenance or support personnel. This personnel includes employees who do not participate either in production or in providing the mandatory needs of the organization, but generally influence its activities. For example, such workers include cleaners, cooks in departmental canteens and other similar employees.

- Security officers.

If the calculation exceeds the actual indicators, then the cost will include the calculated norm, that is, only part of the constant ODA. The result of the distribution is reflected in a special statement.

Distribution coefficient It is necessary in order to correctly calculate the cost of manufactured products. For it you need to know the amount of indirect costs and the selected indicator of the distribution base.

It is calculated using the following formula: Kraspr. = (∑OPR / B) x 100% where:

- Kraspr. – distribution coefficient;

- ∑OPR – the amount of indirect costs;

- B – indicator of the selected base.

So, if ODA is 100,000 rubles, and the salary is chosen as the base, which in this case is equal to 10,200 rubles, then the distribution coefficient will be 100,000 / 10,200 x 100 = 98%.

- Production personnel:

- Costs, expenses, cost

- II.

Source: https://agentstvo-prava.ru/2019/01/30/obshheproizvodstvennyj-personal-kto-k-nim-otnositsya/

Accounting: general business expenses

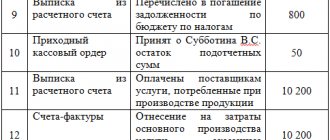

During the reporting period, general business expenses are reflected in the debit of the same name account 26:

Debit 26 Credit 10 (21) – materials (semi-finished products of own production) spent on general business needs are written off;

Debit 26 Credit 70 – salaries of administrative, managerial and general business personnel have been accrued;

Debit 26 Credit 69 – contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases are accrued from the salaries of administrative, managerial and general business personnel;

Debit 26 Credit 60, 76 – the cost of work (services) performed by third parties (for example, auditing, consulting services) is taken into account as part of general business expenses;

Debit 26 Credit 02 (05) – depreciation has been accrued on fixed assets (intangible assets) for general economic and administrative purposes.

Subscription to electronic publications

Situation: how to reflect in accounting the costs associated with subscriptions to electronic periodicals?

Accounting for expenses for periodical electronic publications depends on the type of contract.

Subscription to electronic periodicals can be issued:

- an agreement for the provision of paid information services for the provision of a copy of a periodical in electronic form (clause 2 of Article 779 of the Civil Code of the Russian Federation);

- a license agreement under which non-exclusive rights to use the electronic resources of the publishing house are transferred (Article 1367 of the Civil Code of the Russian Federation).

In the first case, pay for the subscription to the electronic publication in accounting as an advance payment (clause 3 of PBU 10/99). Reflect the advance payment using the following entries:

Debit 60 subaccount “Settlements for advances issued” Credit 51 – advance payment for subscription to an electronic magazine (newspaper) is transferred.

After receiving the issue of the magazine (newspaper) in electronic form, make the following entries:

Debit 26 (44) Credit 60 subaccount “Settlements with publishing houses” – the cost of the next issue of an electronic magazine (newspaper) is written off as expenses;

Debit 60 subaccount “Settlements with the publishing house” Credit 60 subaccount “Settlements for advances issued” - the amount of the advance is offset against repayment of accounts payable.

This procedure is based on the provisions of the Instructions for the chart of accounts (accounts 60, 44, 26), paragraphs 3, 18 and 19 of PBU 10/99.

In the second case, for accounting purposes, intangible assets received for use are accounted for on an off-balance sheet account in the valuation established by the agreement (clause 39 of PBU 14/2007). The chart of accounts does not provide for a separate off-balance sheet account for accounting for intangible assets received for use. Therefore, the organization needs to independently open an off-balance sheet account and consolidate this in its accounting policies for accounting purposes. For example, account 012 “Electronic subscription publications”.

The one-time payment for the granted right to use the electronic publication should be reflected in accounting in account 97 “Deferred expenses” and included monthly in expenses for ordinary activities during the validity period of the license agreement (paragraph 2, clause 39 of PBU 14/2007).

In accounting, reflect the prepayment by posting:

Debit 60 Credit 51 – the cost of the right to use the electronic publication has been paid.

After gaining access to the electronic publication, make notes:

Debit 012 “ Electronic subscription publications ” – the cost of the right to access an electronic publication is taken into account;

Debit 97 Credit 60 – the cost of the right to access the electronic publication is charged to deferred expenses.

Determine the mechanism for transferring future expenses to cost yourself. The following expenses can be written off:

- evenly;

- in proportion to the income received from sales;

- in other ways.

Determine the period for writing off expenses by the period for which access to the electronic subscription publication was provided. The beginning of this period (the beginning of the period of use of the subscription publication) is determined by the format of the software provided. For example, for the Internet version - from the moment the code is activated.

The period of use of the subscription publication is specified in the contract.

The established procedure for writing off future expenses should be fixed in the accounting policy for accounting purposes (clause 4, 8 of PBU 1/2008, letter of the Ministry of Finance of Russia dated January 12, 2012 No. 07-02-06/5).

Monthly during the period of access to the electronic subscription publication, make the following entries:

Debit 26 (44) Credit 97 – part of the payment for using the electronic publication has been written off.

This procedure is based on the provisions of the Instructions for the chart of accounts (accounts 97, 60, 44, 26), paragraphs 18 and 19 of PBU 10/99.

Attention: many write off deferred expenses at a time. They want to understate large profits of the current period or simply out of ignorance. Officials will be fined for this. In some cases, the organization will also suffer. However, you can avoid trouble.

In accounting, reverse the entry that was written off by the RBP at a time. Remember, this can only be done within the year in which the mistake was made.

r />

For example, the Alpha organization received a certificate of conformity for its products valid for five years. The cost of the certificate was 50,000 rubles. According to the accounting policy at Alfa, RBP is written off evenly.

Error!

Debit 20 Credit 76 – 50,000 rub. – the fee for the certificate is taken into account as part of expenses for ordinary activities.

Correctly like this:

Debit 97 Credit 76 – 50,000 rub. – the fee for the certificate is included in deferred expenses.

Monthly:

Debit 20 Credit 97 – 833 rub. (RUB 50,000: (5 years × 12 months)) – deferred expenses are written off.

Here's how to fix the error in this situation:

Debit 20 Credit 76 – 50,000 rub. – the amount previously erroneously included as expenses for ordinary activities is reversed;

Debit 97 Credit 76 – 50,000 rub. – the fee for the certificate is included in deferred expenses.

At the same time, expense the amounts written off for the past months. For example, if three months have passed since costs were accepted for accounting:

Debit 20 Credit 97 – 2500 rub. (3 months × (50,000 rubles: (5 years × 12 months))) – deferred expenses are written off.

Cost Allocation

General production and general business expenses are associated with the production of different types of products (works, services), and also ensure the operation of the organization as a whole. Therefore, unlike direct (primary) costs, these costs are considered indirect (overhead).

At the end of the reporting period, accounts 25 and 26 are closed. The expenses accumulated on them are written off to the debit of accounts: 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities” or 90 “Sales” in proportion to the indicators that must be established in the accounting policy for accounting purposes (clause 7 PBU 1/2008).

The basis for the distribution of indirect costs between main, auxiliary and service production can be, for example, the following indicators:

- wages of key production workers;

- direct costs with a workshop structure of the organization;

- the number of machine-hours worked for the equipment;

- size of production area;

- material costs;

- volume of production in natural or cost terms.

For example, in industries with a significant share of labor costs, it is advisable to distribute indirect costs in proportion to the salaries of the main production workers. Distribute indirect costs in proportion to material costs (cost of raw materials, materials, spare parts, etc.) if they constitute a significant share of the cost of manufactured products.

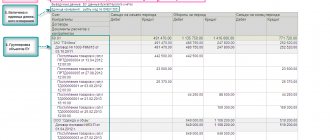

An example of the distribution of indirect costs associated with fulfilling a production order. The organization uses the custom costing method

In April, Proizvodstvennaya LLC accepted and completed two production orders (No. 1 and No. 2) for the manufacture of special transport equipment. The accounting policy of “Master” stipulates that general production and general business expenses are distributed in proportion to the salaries of production workers involved in fulfilling each order.

In April, the actual amount of expenses was:

- general production – 100,000 rubles;

- general business – 125,000 rubles.

Direct costs for order No. 1 were:

- cost of materials used – 82,300 rubles;

- salary of production workers - 68,500 rubles;

- the amount of contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases from the salaries of production workers is 20,687 rubles.

Total for order No. 1 – RUB 171,487.

Direct costs for order No. 2 were:

- cost of materials used – 151,500 rubles;

- the amount of accrued wages of production workers is 55,000 rubles;

- the amount of contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases from the salaries of production workers is 16,610 rubles.

Total for order No. 2 – RUB 223,110.

The total salary of production workers for both orders was 123,500 rubles. (RUB 68,500 + RUB 55,000).

The share of wages of production workers in the total amount of their wages is equal to:

- for order No. 1 – 55% (RUB 68,500: RUB 123,500);

- for order No. 2 – 45% (RUB 55,000: RUB 123,500).

The cost of order No. 1 includes:

- part of overhead costs in the amount of RUB 55,000. (RUB 100,000 × 55%);

- part of general business expenses in the amount of 68,750 rubles. (RUB 125,000 × 55%).

The actual cost of order No. 1 was: RUB 171,487. + 55,000 rub. + 68,750 rub. = 295,237 rub.

The cost of order No. 2 includes:

- part of overhead costs in the amount of 45,000 rubles. (RUB 100,000 – RUB 55,000);

- part of general business expenses in the amount of RUB 56,250. (RUB 125,000 – RUB 68,750).

The actual cost of order No. 2 was: 223,110 rubles. + 45,000 rub. + 56,250 rub. = 324,360 rub.

Features of the distribution of cost areas

The distribution of expenses on account 25 occurs on accounts 20, 23, 29 by product types in accordance with the established base. The basis on which indirect costs are distributed is determined according to methodological recommendations that are developed for different industry areas.

The choice of method for allocating expenses from an accounting perspective is based on reporting purposes. Traditionally, the least labor-intensive method is used, which involves the distribution of indirect costs over a common base.

Write-off of general business expenses

General business expenses can be written off in one of two ways:

- to account 20 “Main production” (23 “Auxiliary production”, 29 “Service production and facilities”);

- to account 90-2 “Cost of sales”.

Fix the chosen method of writing off general business expenses in the accounting policy for accounting purposes (clause 7 of PBU 1/2008, clause 20 of PBU 10/99).

In the first case, general business expenses form the “full” cost of finished products and are written off at the end of the month.

Record the write-off of general business expenses (after distribution) by posting:

Debit 20 (23, 29) Credit 26 – general business expenses associated with the activities of the main (auxiliary, servicing) production are written off.

In the second case, a “reduced” cost of finished products is formed, and general business expenses are completely written off for sales, regardless of how many products were sold in the reporting period.

At the moment of transfer of ownership of the shipped products (results of work or services) to the buyer, reflect the proceeds from its sale and write off the cost of the products (work, services) sold:

Debit 62 Credit 90-1 – revenue from the sale of products is reflected;

Debit 90-2 Credit 43 – the actual cost of shipped products (work performed, services rendered) is written off;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” - VAT is charged on sales proceeds.

At the end of the month, write off the amount of general business expenses:

Debit 90-2 Credit 26 – general business expenses are included in the cost of sales.

Such rules are established by paragraphs 5 and 12 of PBU 9/99 and the Instructions for the chart of accounts (accounts 20, 26). For more information about this, see How to record sales of finished products in accounting.

An example of writing off indirect costs for the main and auxiliary production of an organization. The organization accounts for costs at actual cost

LLC "Proizvodstvennaya" manufactures jewelry. In accordance with the accounting policy, for accounting purposes, cost accounting is carried out at actual cost. General production and administrative expenses are distributed in proportion to the salaries of production workers.

"Master" has two workshops:

- Workshop No. 1 – production of machine-made chains and bracelets. An auxiliary repair group has been created on the territory of the workshop, which is engaged in setting up the production equipment of workshop No. 1;

- Workshop No. 2 – production of exclusive handmade products (pendants, earrings, rings).

In addition, the organization has created a design bureau that develops sketches and models of new products for both workshops.

To reflect actual costs by workshop, additional subaccounts have been opened to account 20:

- 20 subaccount “Workshop No. 1”;

- 20 sub-account “Workshop No. 2”.

In April, actual expenses were:

For workshop No. 1:

- cost of consumed raw materials, materials - 1,200,000 rubles;

- salary of production workers - 185,323 rubles;

- contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases - 55,968 rubles;

- depreciation of fixed assets used in production - 70,000 rubles.

For workshop No. 2:

- cost of consumed raw materials, materials - 800,000 rubles;

- salary of production workers - 96,368 rubles;

- contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases - 29,103 rubles;

- depreciation of fixed assets used in production - 20,000 rubles.

The costs associated with setting up production equipment in workshop No. 1 were:

- cost of materials, parts, spare parts – 60,000 rubles;

- salary of repair group employees (including contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases) - 80,000 rubles.

The costs of maintaining the design bureau amounted to:

- designers’ salary – 124,000 rubles;

- the amount of contributions for compulsory pension (social, medical) insurance – 37,200 rubles;

- the amount of contributions for insurance against accidents and occupational diseases - 248 rubles;

- depreciation of office equipment of a design bureau - 43,000 rubles.

The amount of general business expenses for April is 248,000 rubles.

The share of wages of production workers in workshops is:

- shop No. 1 – 66% (185,323 rubles: (185,323 rubles + 96,368 rubles) × 100%);

- shop No. 2 – 34% (96,368 rubles: (185,323 rubles + 96,368 rubles) × 100%).

The amount of general production expenses (costs of maintaining a design bureau), which is distributed between workshops, is equal to: 124,000 rubles. + 37,200 rub. + 248 rub. + 43,000 rub. = 204,448 rub.

The amount of overhead costs, which is included in the cost of production, is equal to:

- for workshop No. 1 – 134,936 rubles. (RUB 204,448 × 66%);

- for workshop No. 2 – 69,512 rubles. (RUB 204,448 × 34%).

The “Master” accountant distributed the amount of general business expenses as follows:

- for workshop No. 1 – 163,680 rubles. (RUB 248,000 × 66%);

- for workshop No. 2 – 84,320 rubles. (RUB 248,000 × 34%).

The following entries were made in the “Master’s” accounting:

Debit 20 subaccount “Workshop No. 1” Credit 10 – 1,200,000 rub. – raw materials transferred to workshop No. 1 were written off;

Debit 20 subaccount “Workshop No. 1” Credit 70 (69) – 241,291 rub. (185,323 + 55,968) – wages accrued to the workers of workshop No. 1 (including insurance contributions);

Debit 20 subaccount “Workshop No. 1” Credit 02 – 70,000 rub. – depreciation was accrued on production fixed assets of workshop No. 1;

Debit 20 subaccount “Workshop No. 2” Credit 10 – 800,000 rub. – raw materials transferred to workshop No. 2 were written off;

Debit 20 subaccount “Workshop No. 2” Credit 70 (69) – 125,471 rubles. (96,368 + 29,103) – wages were accrued to the workers of workshop No. 2 (including insurance contributions);

Debit 20 subaccount “Workshop No. 2” Credit 02 – 20,000 rub. – depreciation was accrued for production fixed assets of workshop No. 2;

Debit 23 Credit 10 – 60,000 rub. – the cost of materials spent on repairing equipment in workshop No. 1 was written off;

Debit 23 Credit 70 (69) – 80,000 rub. – salaries of the repair group employees were accrued (including insurance premiums);

Debit 20 subaccount “Workshop No. 1” Credit 23 – 140,000 rubles. (60,000 rubles + 80,000 rubles) – the costs of auxiliary production of workshop No. 1 are taken into account;

Debit 25 Credit 70 (69) – 161,448 rubles. – salaries of designers were calculated (including insurance premiums);

Debit 25 Credit 02 – 43,000 rub. – depreciation has been calculated on fixed assets of the design bureau;

Debit 20 subaccount “Workshop No. 1” Credit 25 – 134,936 rubles. – general production expenses were written off as the cost of production of workshop No. 1;

Debit 20 subaccount “Workshop No. 2” Credit 25 – 69,512 rubles. – general production expenses were written off as the cost of production of workshop No. 2;

Debit 26 Credit 10 (02, 60, 69, 70) – 248,000 rub. – general business expenses are reflected;

Debit 20 subaccount “Workshop No. 1” Credit 26 – 163,680 rubles. – general business expenses were written off for the cost of production of workshop No. 1;

Debit 20 subaccount “Workshop No. 2” Credit 26 – 84,320 rub. – general business expenses were written off for the cost of production of workshop No. 2.

DESCRIPTION OF THE PROBLEM

Various regulatory legal acts on accounting provide for a wide range of approaches and methods for forming the cost of manufactured products, ranging from limiting this cost only to direct cost items and ending with the formation of the so-called full cost, which implies the inclusion in it, in addition to direct costs, of all general production and general business expenses. In practice, both of these extreme options are used, as well as various intermediate options. Such varied practices result in incomparable reporting among different organizations and thereby reduce the value of this information.

In addition, when talking about the cost of production, as a rule, it is not specified what “cost” is meant. In some cases, we may be talking about cost as a way of estimating inventories, when the question relates to the indicator of balances of finished goods (and work in progress) presented in the balance sheet. In other cases, we may be talking about the cost of products sold (goods, works, services), when the question relates to the “cost of sales” indicator presented in the balance sheet. The essence of these indicators is fundamentally different, which is why the approaches used in their formation cannot be identical.

The solution to emerging issues comes down to the formulation of acceptable approaches to accounting for general production and general business expenses, as well as the unification of these approaches by determining a uniform procedure for their accounting.

General business expenses in the absence of activity

Situation: how to reflect general business expenses in accounting if the organization does not receive income from its activities?

General business expenses (for example, salaries of management personnel, office rental costs and other expenses associated with the development and development of a business), like other expenses, must be taken into account regardless of whether they lead to income or not (clauses 16–18 of PBU 10/99). Therefore, even if the organization does not receive income from its activities, these expenses must still be fully reflected in the accounting accounts.

General business expenses, which are reflected in account 26 of the same name, should be taken into account in one of the following ways:

- write them off to account 20 “Main production”;

- take them into account in account 91 “Other income and expenses” in the subaccount “Other expenses”.

In the first case, general business expenses will be taken into account as part of the main production expenses (i.e., in the debit of account 20 (Instructions for the chart of accounts)), forming the full cost of finished products. When the organization begins to receive income, taking into account these costs, the financial result from sales will be formed (clauses 18 and 19 of PBU 10/99).

In the second case, expenses will directly form the financial result (loss) of the reporting period (i.e., taken into account as the debit of account 91-2) (Instructions for the chart of accounts).

Until January 1, 2011, general business expenses could be taken into account using account 97 “Deferred expenses”. Since January 1, 2011, organizations no longer have this opportunity. This conclusion follows from subparagraph 14 of paragraph 1 of the amendments approved by order of the Ministry of Finance of Russia dated December 24, 2010 No. 186n.

Determine the chosen procedure for distributing expenses in the accounting policy for accounting purposes (clause 4 of PBU 1/2008).

Account characteristics

The chart of accounts gives the answer which account 25 is active or passive. Since it is designed to record company expenses, it collects information about the company's assets. Therefore the account is active.

The peculiarity of this account is that it does not have balances at the beginning and end of the period, as it relates to collection and distribution accounts.

They tend to write off the accumulated turnover at the end by distributing it among other accounting accounts. That is, every month the amounts are written off, and from the beginning of the period information about the costs incurred is again accumulated.

The debit reflects expenses incurred by the company for general production purposes. The loan reflects the distribution of accumulated expenses for the month according to the methodology chosen by the enterprise.

Attention! A calculation coefficient is often used that reflects how many indirect costs are per ruble of direct costs (materials, salaries of key personnel).

Sometimes the number of workers employed in the production of a certain type of product, the area of production premises, and machine-hours of operation of capital equipment are used as the basis for distribution.

You might be interested in:

Account 03 in accounting “Profitable investments in material assets”, what is taken into account, correspondence of accounts, postings

When choosing a method for distributing cost write-offs, management must first of all be guided by the specifics of the activity being performed.

This must be approached with full responsibility, since costs written off as cost will subsequently affect the financial result of the activity.

Attention! The chosen method of distribution must be fixed in the company's accounting policy. So the account does not have beginning and ending balances, information about it is not reflected in the balance sheet.