How to check whether the employer is transferring insurance contributions or not

Another way is to send the request and certified copies of the specified documents by mail.

Notification about the status of an individual personal account will be sent by registered mail no later than 10 days from the date of application. You can also find out the necessary information on the portal of state and municipal services (www.gosuslugi.ru). To do this, you need to register and in the subsection “Pension Fund of the Russian Federation” receive information about the status of your individual personal account online.

Results

For contributions accrued to extra-budgetary funds, the same calculation and payment rules apply in 2021 as in 2021.

However, the magnitude of a number of components of the calculations changes. Moreover, these changes apply both to payments accrued by employers (the maximum value of the taxable bases is changing, the value of some rates, regarded as lower, is increasing), and to amounts calculated by self-employed persons (the minimum wage used in calculations has increased). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deadlines for payment of insurance premiums in 2018

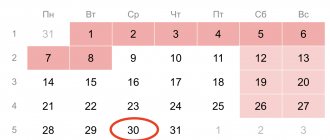

The procedure and deadlines for paying insurance premiums are established by Chapter 34 of the Tax Code of the Russian Federation. If in 2021 the deadline for paying insurance premiums falls on a weekend or non-working holiday, then the contributions must be transferred on the next working day. Such an indication is in paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation. You can find out which day falls on a weekend or holiday in Articles 111 and 112 of the Labor Code of the Russian Federation. If holidays coincide with weekends, as a rule, they are moved to other dates.

- April 28. At the same time, Monday April 30 will become a non-working day, and we will rest from April 29 to May 2 inclusive;

- the 9th of June. Due to this, the June holidays will last three days: from June 10 to June 12 inclusive;

- December 29th. Such a postponement will lead to the fact that the New Year holidays 2019 will begin on December 30, 2018.

Who must pay insurance premiums in 2021 and when?

The responsibility for calculating and transferring contributions is assigned to organizations and individual entrepreneurs if they have hired employees, as well as to individual entrepreneurs for themselves. In addition, notaries, patent attorneys, lawyers and appraisers must pay insurance premiums. A specific list of such payers is contained in Art. 419 of the Tax Code of the Russian Federation.

Insurance premiums must be transferred no later than the 15th day of the month following the month in which contributions were calculated. If the transfer deadline falls on a holiday or weekend, then contributions must be paid no later than the next business day.

How to pay insurance premiums to a budget organization

- control the timeliness and completeness of insurance transfers;

- accept and verify reports on insurance premiums for employees in 2021;

- collect arrears and penalties, issue fines.

Insurance against accidents and occupational diseases should be paid according to the old rules (Law No. 125-FZ of July 24, 1998), that is, funds should be transferred to the Social Insurance Fund. Moreover, payments must be transferred to the Social Insurance Fund in pennies. Rounding to whole numbers is not required.

The procedure for calculating and paying contributions from the salaries of employees

Contributions from the income of employees are calculated by employers monthly when calculating salaries for the next month and are also paid monthly (but in the month following the billing month). The last day of payment for all types of contributions is the same - the 15th day (clause 3 of Article 431 of the Tax Code of the Russian Federation, clause 4 of Article 22 of Law No. 125-FZ of July 24, 1998).

The accrual base is formed on an accrual basis from the beginning of the year, and the amount that is actually accrued for the last month of the period is actually subject to monthly payment. The base is reduced due to payments that are not subject to taxation (Article 422 of the Tax Code of the Russian Federation, Article 20.2 of Law No. 125-FZ of July 24, 1998).

In 2021, for contributions accrued to the Pension Fund, employers continue to use basic tariffs that are lower than the basic ones (Article 426 of the Tax Code of the Russian Federation). At the same time, some payers have the right to apply even lower rates on payments both to the Pension Fund and to other funds (Articles 427–429 of the Tax Code of the Russian Federation). The values of a number of these rates are increasing from 2021, and some of them reach generally established values.

For the bases calculated for the Pension Fund of Russia and the Social Insurance Fund, there is a concept of their limit values, upon reaching which contributions to the Social Insurance Fund for sick leave and maternity leave cease to be accrued, and contributions to the Pension Fund of the Russian Federation begin to be calculated at a different rate. The value of these limits increases every year, and 2021 in this sense was no exception.

To learn about the amounts to which the income limits for employees are expected to increase in 2021, read the material “The government has decided on the size of the maximum contribution bases for 2018.”

To which funds are insurance premiums transferred?

· receiving from individuals who are not individual entrepreneurs income in cash and in kind by way of gift, except in cases where such income is not subject to taxation.

Professional tax deductions

are provided to taxpayers in the amount of expenses actually incurred by them and documented, directly related to the extraction of income, performance of work, provision of services in accordance with Art. 221 NKRF.

From 2021, insurance premiums are transferred to the tax office.

Payment orders for insurance premiums from 2021 must be filled out according to the rules established for tax payments. You should indicate the Federal Tax Service as the recipient, and also fill out fields 106-109, in which you previously entered 0. In field 106 for the current payment for December, indicate TP, and in field 107 - MS.12.2016.

We recommend reading: How to fill out 3 personal income taxes for a tax deduction for an apartment with a mortgage

All rights reserved. Full or partial copying of any site materials is possible only with the written permission of the editors of the journal “Accounting. Taxes. Right". Violation of copyright entails liability in accordance with the legislation of the Russian Federation. This site is not a mass media outlet.

As a print media outlet, the newspaper

"Accounting.Nalogies.Pravo"

is registered by the Federal Service for Supervision of Communications, Information Technologies and Mass Communications (Roskomnadzor). Certificate of registration PI No. FS77-62334 dated 07/03/2015;

Reduced contribution rates for the Kaliningrad SEZ

Based on the Law of November 27, 2021 No. 353-FZ, reduced insurance premium rates from 2021 are valid for residents of the special economic zone in Kaliningrad (for compulsory health insurance - 6%, for social insurance - 1.5%, for compulsory medical insurance - 0.1%). This is a new paragraph 11 of Article 427 of the Tax Code of the Russian Federation.

They can be used for 7 years from the month following the month of inclusion in the register of SEZ residents. This benefit will be valid until 2025 inclusive.

It is important that at reduced tariffs, Kaliningrad SEZ residents can tax payments only to those employees who are employed in new jobs. At the same time, clause 11 of Art. 427 of the Tax Code of the Russian Federation explains that a new workplace is one that is created for the first time by a resident organization during the implementation of an investment project.

Also see “What will change in 2021: taxes, insurance premiums, reporting, accounting and a new fee.”

Where and how to transfer insurance premiums in 2019

After the repeal of Law No. 212-FZ dated July 24, 2009, most policyholders have questions about how to transfer insurance premiums in 2019. Now the procedure for calculation, payment, terms and rates is regulated by the new 34th chapter of the Tax Code. The changes affected compulsory pension and medical coverage (CPS, compulsory medical insurance), as well as contributions in case of temporary disability and in connection with maternity (VNiM).

So, based on Art. 431 of the Tax Code of the Russian Federation, we can affirmatively state that disputes about how insurance premiums are paid (with or without kopecks in 2021) are absolutely groundless. Paragraph 5 of this article gives a comprehensive answer: we pay in rubles if the amount is “round”, and in rubles and kopecks if the amount is a fraction.

The range of payments within the framework of the World Cup, which are exempt from contributions, has been reduced

From 2021, payments to foreign citizens and stateless persons who took part in the preparation and holding of the FIFA World Cup are exempt from insurance premiums. But this is a general rule.

Law of October 30, 2021 No. 303-FZ shortened the wording of paragraph 7 of Art. 420 Tax Code of the Russian Federation. From January 1, 2021, there will be no contributions if these persons signed an employment or civil contract directly with FIFA.

And so payments to them are still subject to contributions if they go through:

- FIFA subsidiaries;

- organizing committee "Russia-2018";

- subsidiaries of this organizing committee.

What contributions should I pay to the Federal Tax Service in 2019?

Separate divisions are required to inform the tax authority that they have the authority to pay remuneration in favor of individuals (or are deprived of such authority) within one month from the date of such a decision (clause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation).

If an organization has separate divisions located outside the territory of the Russian Federation, payment of payments and submission of settlements occur at the location of the parent organization (clause 14 of Article 431 of the Tax Code of the Russian Federation).

Postponement of the deadline for payment of individual entrepreneur contributions to compulsory pension insurance from large incomes

New edition of clause 2 of Art. 432 of the Tax Code of the Russian Federation (Law No. 335-FZ) establishes a new deadline for the transfer of pension contributions to individual entrepreneurs without staff and private practice specialists with incomes of 300,000 rubles.

Previously, this deadline was no later than April 1 of the following year. But it was postponed from reporting for 2021 to July 01.

Thus, contributions from the excess amount for 2021 must be paid no later than July 2, 2021. The fact is that 07/01/2018 is Sunday, so the transfer rule applies:

For more information, see “Deadline for payment of individual entrepreneur insurance premiums for 2021.”

Insurance premium rates for 2019

As you remember, the Tax Code previously stipulated that the aggregate tariff of 30%, at which the majority of insurers calculate premiums, would be in effect temporarily - from 2021 to 2020. (Article 426 of the Tax Code of the Russian Federation). And after the specified period, the tariff of contributions for compulsory health insurance should have increased by 4% to 26%, and the total tariff - from 30% to 34% (clause 1, clause 2, article 425 of the Tax Code of the Russian Federation, as amended, valid until 01/01/2019 ). However, legislators changed their minds. And the indicated basic contribution rates from 2019 move from temporary to permanent. In this regard, in 2019 the previous tariffs apply (clause 2 of Article 425 of the Tax Code of the Russian Federation):

Rates do not change for policyholders who have received a status entitling them to apply reduced rates. For example, the status of a resident of a territory of rapid socio-economic development, the status of a resident of the free port of Vladivostok, etc. (clauses 10-14 clause 1, clauses 4.5 clause 2 of article 427 of the Tax Code of the Russian Federation).

Increasing the marginal base

Decree of the Government of the Russian Federation of November 15, 2021 No. 1378 increased the maximum bases of insurance premiums for 2021.

For sick leave and maternity, the limit for calculating contributions has increased from 01/01/2018 from 755 to 815 thousand rubles. And for contributions to compulsory health insurance – from 876 thousand to 1 million 21 thousand rubles.

Three main rules for limit bases:

1. Contributions for illness and maternity are not accrued if the base limit has been reached.

2. Contributions to compulsory pension insurance when the limit is reached are charged at a reduced rate - 10 instead of 22%.

3. There has been no base limit for contributions to compulsory medical insurance since 2015. They are accrued regardless of the size of payments from the beginning of the year.

For more information about this, see “The maximum value of the base for calculating insurance premiums for 2018.”

Deadlines for payment of insurance premiums for December 2018 and KBK

Contributions for December 2021 will need to be paid in 2019. The deadline for making insurance payments is January 15. This deadline for payment of insurance premiums is established by the Tax Code of the Russian Federation (clause 3, article 431) and Law No. 125-FZ (clause 4, article 22).

In accordance with the norms of current Russian legislation, insurance premiums for December 2021 are not prohibited from being paid before the due date. Let us remind you that the taxpayer is liable only in case of refusal to pay contributions, their payment in incomplete amount and for late payment of insurance premiums.

Individual entrepreneurs’ contributions were “untied” from the minimum wage

Starting from 2021, the amounts of insurance premiums for individual entrepreneurs are not related to the minimum wage and tariff rate. Now, in the new version of Article 430 of the Tax Code of the Russian Federation, specific ruble amounts of contributions to compulsory health insurance are given (amendments were made by Law No. 335-FZ):

- if the income of an individual entrepreneur without staff does not exceed 300,000 rubles, contributions to compulsory pension insurance will amount to 26,545 rubles, and to compulsory medical insurance – 5,840 rubles;

- if the businessman’s annual income is from 300,000 rubles, as before, additional pension contributions must be made at a rate of 1%.

The amount of fixed contributions for peasant farms is similar and, since 2018, also does not depend on the minimum wage and tariff rate. Only the number of participants in the farm, including the head, matters.

Also see “Insurance premiums of individual entrepreneurs for themselves in 2021: how to calculate and pay.”

Deadlines for payment of insurance premiums in 2017

In 2021, for the first time, we will have to transfer insurance premiums not to funds, but to tax inspectorates and submit reports on them there. Instead of the Pension Fund and the Social Insurance Fund, the responsibilities of the contribution administrator are transferred to the tax service; for this purpose, a new chapter of the Tax Code was adopted, which will come into force very soon, on January 1, 2021.

We recommend reading: Fixed payment to the insurance pension in 2019 for northerners

The main innovation for policyholders in 2021 is the transition to the Federal Tax Service of control over insurance premiums. The Tax Code has been supplemented with a new chapter 34, which regulates the calculation and payment of all insurance premiums, except for “injury”. The previously existing Law No. 212-FZ on insurance premiums will cease to be in force on January 1, 2017, but almost all of its provisions have been transferred to new articles of the Tax Code of the Russian Federation.

Changes in personal income tax from 2021

1. From January 1, 2021, a progressive personal income tax scale will be introduced. This means that the amount of tax will depend on your income level: the more you earn, the more you pay. The personal income tax rate will increase from 13 to 15 percent for those who earn more than 5 million rubles a year. But 15% will have to be paid not on all income, but only from the moment the amount exceeds 5 million rubles. For example, if you earn 6 million rubles, 5 million will be taxed at a rate of 13%, and another 1 million at a rate of 15%.

The increased rate applies to residents and non-residents. But the increased rate will not apply to the income of Russian residents from the sale of personal property or receiving property as a gift, unless we are talking about securities. Also, 15% does not apply to income in the form of insurance payments.

For increased personal income tax, a special KBK has been approved: 182 1 0100 110. According to the instructions of the president, these amounts will be used for the treatment of children, the purchase of expensive medicines, medical equipment, etc.

Draft Law of September 17, 2020 No. 1022669-7

2. Individuals, including individual entrepreneurs, will pay personal income tax on interest on their deposits and account balances. The standard tax rate is 13%.

Please note that tax is not calculated on the deposit amount, but on the accrued interest. Moreover, only in the case when they exceed the amount calculated as 1,000,000 rubles × Central Bank of the Russian Federation rate. The rate is taken at the beginning of the year for which the tax is calculated. Since the amendments will come into force in 2021, the Federal Tax Service will take the rate for calculation as of January 1, 2021. This tax will need to be paid for the first time before December 1, 2022, and the tax office will send a notification with the calculated amount.

Example. Let's assume that the rate of the Central Bank of the Russian Federation as of January 1, 2021 is 4.25%. Victor has two bank deposits. One deposit is for 1.5 million rubles with a rate of 4.3%, another deposit is for 1 million rubles with a rate of 3.5%. Interest for the year was:

- for the first deposit 64,500 rubles (1,500,000 × 4.3%);

- for the second deposit 35,000 rubles (1,000,000 × 3.5%).

The total amount of interest for the year is 99,500 rubles. Let's calculate personal income tax from interest payable:

- Personal income tax payable - 7,410 rubles ((99,500 rubles - 1,000,000 × 4.25%) × 13%).

Federal Law dated April 1, 2020 No. 102-FZ

3. New lists of services for social deductions for personal income tax have been approved. The list has been clarified and expanded. Medical services have been added

medical evacuation and palliative care. Expensive services include orthopedic treatment of congenital and acquired dental defects and palliative care. The list of expensive reproductive technology services has also been expanded.

Government Decree No. 458 dated 04/08/2020

4. New rules for determining tax residence have been approved. Now a resident of the Russian Federation can be recognized as an employee who was in the Russian Federation from 90 to 182 calendar days during 2020. Previously, to obtain this status, you had to stay in Russia for at least 183 days.

Instead of the 30% personal income tax rate, the standard rate of 13% will be applied to former non-residents. To become a resident under the new conditions, you need to submit an application to the Federal Tax Service by April 30, 2021.

Federal Law of July 31, 2020 No. 265-FZ

5. Material benefits from savings on interest during the grace period are not recognized as subject to personal income tax. Now banks will not withhold and pay tax themselves or report to the Federal Tax Service about the impossibility of withholding.

Federal Law of May 21, 2020 N 150-FZ

6. When selling property (except for securities) received free of charge, as a gift or for partial payment, proceeds from the sale can be reduced by the amount of documented expenses in the form of amounts on which tax was calculated and paid upon acquisition (receipt) of such property.

No. 325-FZ

Are insurance premiums calculated from vacation pay - important rules, payment deadlines, examples

If there was a gross error when calculating insurance premiums, then the court will hold the director and chief accountant administratively liable and issue them a fine of 5,000 to 10,000 rubles. When a crime is committed, those responsible may be subject to criminal penalties.

Vacation pay is a type of employee income that is the basis for insurance contributions. Contributions are calculated from the calculated amount at current rates and transferred in various payments according to their intended purpose.

Where to pay insurance premiums in 2017-2018

Where should insurance premiums be paid in 2017-2018 if they fall into the “accident” category? Still in social security, indicating its details in the fields of the payment document intended for the recipient’s data. The BCC used for such payment will also remain the same (39310202050071000160).

At the same time, there are contributions that were not affected by the 2017 changes. These are the so-called “accident” premiums associated with occupational injury insurance. They are still subject to the provisions of the Law “On Compulsory Social Insurance” dated July 24, 1998 No. 125-FZ, and the FSS remains their curator. Where should those paying insurance premiums in 2017-2018 transfer such payments? The answer is obvious: as before - in social insurance at the place of registration of the policyholder, which may also be its separate division.

New reasons to reject RSV

From January 1, 2021, the reasons for refusal are the following: errors in the amount of payments and other remunerations, errors in the base for calculating “pension” contributions within the limit, errors in the base for calculating “pension” contributions for additional tariffs, as well as errors in the amount of the “pension” contributions themselves. pension" contributions ("regular" and at additional tariffs). The condition for data discrepancy looks like this: a discrepancy between the amounts of the same indicators for all individuals and the same indicators for the payer as a whole. As for inaccurate personal data, they will also remain on the list of reasons for non-acceptance of payment of contributions.

As before, tax authorities are required to notify the policyholder of an unsubmitted calculation. The notification period will remain: no later than the day following the day of receipt of the calculation in electronic form (or 10 days following the day of receipt of the calculation in paper form). The policyholder, in turn, must correct the violations and submit a new calculation within five days from the date of sending the notice in electronic form (or within 10 days from the date of sending the “paper” notice). If these deadlines are met, the date of submission will be considered the day the initial calculation is submitted.

Payment of insurance premiums to the Pension Fund in 2019

To group items of the state budget, special digital codes consisting of 20 digits are used, which are established by the Ministry of Finance. Each such code encrypts certain information. The budget classification code is divided into four parts :

Our organization is engaged in the dissemination of information technologies. Can we take advantage of a reduced tariff rate on compulsory health or pension insurance premiums? And if so, in what size?

What are the changes when transferring insurance premiums in 2021?

It is worth knowing that the government of the country carries out a procedure for determining the maximum size of the base for calculating insurance premiums annually, in accordance with changes in the value of the average salary in Russia. The documents attached to the bill indicate that its adoption will make it possible to change for the better the volume of annual revenues to the Pension Fund.

According to the bill, those who pay contributions, with the exception of people paying according to reduced tariffs, are required to make a transfer to pension insurance in the amount of 22 percent of their entire salary. But the rate for social insurance due to the inability to work for a certain time due to motherhood is 2.9 percent. And finally, the rate for the same type of insurance will look the same in the event of disability for a short period due to payments to foreign citizens or persons without citizenship. In all these cases, you also need to know the details for transferring insurance premiums in 2018. If the bill is passed, then most likely it will come into force as soon as the coming year begins.

Features of filling out the ERSV

The calculation of insurance premiums in 2021, the form of which consists of a title page and several sections, is a voluminous document. Accountants do not fill out all the sheets, since section 2 is intended only for peasant farm managers.

Entering personal data

In the third section of the calculation of insurance premiums in 2021, it is necessary to enter information about employees working under an employment or civil agreement. Indicated:

- SNILS and TIN;

- All details of the identity document.

The type of insurance is noted, but information about working conditions and length of service is not provided.

General requirements for registration of ERSV

The website provides an example of calculation of insurance premiums - it is submitted in paper or electronic form. Registration on paper is allowed for companies with a staff of no more than 25 people per year. Data is entered into the reporting only in printed font.

When filling out the form you must:

- Enter numbers and letters from left to right.

- Reflect monetary indicators in rubles and kopecks without rounding.

- Enter information only with blue, black or purple paste.

- Use capital letters for text.

- Do not correct entries with putty.

- Print the form only on one side of the sheet and staple it.

The procedure for filling out the calculation of insurance premiums for 2018 provides for zero values for the quantity and amount if this indicator does not exist. In other cases, a dash is allowed.

You can find zero calculations for insurance premiums here (link)

Algorithm for filling out new insurance documentation

The calculation form for insurance premiums is a unified form introduced by Order MMV-7-11/551. Compilation is done as follows:

- The title page contains information from the registration documents.

- Personalized data on insured citizens is entered into section 3, including on maternity leave and employees on maternity leave without pay.

- Subsections on insurance premiums are filled in – 1.1. and 1.2. in section 1.

- Appendix 2 is compiled with information about VNiM contributions - charges, insurance costs and compensation for it are prescribed. Information on social benefits is entered in line 070 and Appendix 3.

- At the end, OKTMO codes are given, the amount of contributions for the entire period and the last 3 months is indicated.

It is necessary to indicate the federal codes of the organization, the tariffs of the tax payer, the option of sending the form, documents (internal passport of a citizen of the Russian Federation, passport of a foreign citizen, military ID). The pages of the document are numbered in chronological order, their number is entered in the title field. The reporting is certified by the head of the enterprise with his signature and seal.

Before completing the 2021 calculation, calculate your total SV amounts. On line 030 payments are entered for the entire period, in lines 031 - 033 - broken down by month, in lines 040 and 020 the BCC is entered, and in line 090 - additional insurance coverage from the employer.

The calculation is submitted before January 30, April, July and October 2021. According to clause 7 of Art. 6.1 of the Tax Code, if the last reporting day coincides with a weekend, the deadline is postponed to the next working day.

According to the new form and amended rules, reporting documentation is submitted to the Federal Tax Service for 2021. Information on payments and accruals for insurance is provided quarterly. If an error is made in the TIN, SNILS or personalized data of employees, the document will not be accepted by the tax service. The representative of the insurance agent sends a report to government agencies on the basis of a notarized power of attorney.

Similar articles

- Sample zero calculation for insurance premiums (2018)

- Calculation of insurance premiums 2021 form

- Procedure for filling out calculations for insurance premiums (2018)

- Unified calculation of insurance premiums in 2021 (example)

- Calculation of insurance premiums in 2021