Absolutely all income of individuals that may be subject to income tax must be indicated in 6-NDFL, and for them there is a special line number 020. The declaration form itself with all the relevant rules has been applied from the very beginning of the year before last, however, tax agents have -There are still many questions related to filling it out.

- 3.1 Table: control ratios for section 1

What are the general rules for forming line 110 (formerly page 020)

Starting from the report for the 1st quarter of 2021, 6-NDFL is submitted using a new form.

It is radically different from the previous one. Read more about the changes in the Review from ConsultantPlus. You can get trial access to K+ for free.

Line 110 (formerly line 020) is located in section 2 of form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

Section 2 itself, in turn, consists of a number of lines:

Line 110 (formerly line 020) is generated separately for each personal income tax rate involved in the reporting period.

What are the differences between the lines in sections 1 and 2 of the 6-NDFL report

According to the algorithm for compiling 6-NDFL:

- Section 2 is formed on a cumulative basis from the beginning of the reporting year.

Read more here.

- Section 1 shows information only for the last quarter. They are presented in terms of deadlines for sending withheld personal income tax to the budget.

Read more here.

Conclusion: line 110 (previously line 020) is formed as a cumulative total, separately for each tax rate applied in the period.

ConsultantPlus experts have prepared step-by-step instructions with explanations for filling out each line of the new 6-NDFL form. Get trial access to the system and move on to the Ready-made solution.

How line 110 (formerly line 020) should relate to other report lines

Benchmark ratios for the new report have not yet been published at the time of writing. But in terms of filling out page 110, you can use the Constitutional Court, which was in force for filling out page 020 of the form, which was valid until the end of 2021. They are given in the Appendix “Internal Documentary Codes” to the letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] In accordance with the letter, the information in line 020 (in our case, page 110) must satisfy the following parameters:

- The amount on line 110 (formerly line 020) should not be less than in line 130 (formerly line 030) “Tax deductions”.

- The equality must be observed: (line 110 (formerly page 020) – line 130 (formerly page 030)) / 100 × line 100 (formerly page 010) (rate) = line 140 (formerly page 040). There is a margin of error for rounding. The error is calculated as 1 rub. for each individual included in the report, multiplied by the number of lines 021-022 of section 1 of the report.

Find out more about the KS in 6-NDFL, which was in force until the end of 2021, from the article “Control ratios for checking form 6-NDFL” .

Line 020 and its features

Federal Tax Service Order No. ММВ-7–11/450 contains only brief and superficial instructions, which can be indirectly referenced in the process of filling out the declaration, but which, however, does not give any idea about the rules for filling out each specific line. Taking this problem into account, the Federal Tax Service has issued a number of explanatory letters, including those related to line 020, so it is now known which income should be included in it and which should not.

Line 020 includes all income of individuals that by law must be subject to income tax. This line refers to the first section of the 6-NDFL declaration and has its own very important features. Unlike the lines located between numbers 060 and 090, which contain general (i.e., aggregate) data on absolutely all applied tax rates, lines 010–050 include indicators for each rate separately.

How do changes in the Tax Code of the Russian Federation for 2016-2021 affect the algorithm for generating section 2 of the 6-NDFL report?

The Tax Code of the Russian Federation has also found room for significant changes in the procedure for calculating the tax specified in Art. 226 Tax Code of the Russian Federation.

Thus, the previous version of Art. 226 of the Tax Code of the Russian Federation directly required that personal income tax be calculated by tax agents based on the results of each past month (clause 3 of Article 226 in previous editions of the Tax Code of the Russian Federation). Thus, information in the personal income tax registers had to be entered monthly, and there was a separate concept of “calculated tax,” i.e., personal income tax calculated from the amounts accrued according to accounting for individuals, but not necessarily already withheld and transferred to the budget.

In the new edition of Art. 226 of the Tax Code of the Russian Federation, the moment of tax calculation is clearly tied to the moment of receipt of income. In turn, this moment is the day when an individual receives money (or valuables in kind) in his hands in all cases, except those specifically mentioned in paragraphs. 2–5 tbsp. 223 Tax Code of the Russian Federation.

Thus, in the version of the Tax Code of the Russian Federation, effective in 2016–2021, the concepts of “tax calculated” and “tax withheld” have practically merged. From here there are 2 important consequences that help to reason correctly when generating lines 110 (formerly line 020) and 140 (formerly line 040) of the 6-NDFL report in complex cases (for example, with carryover income accrued in accounting in one quarter (year) , and paid in another):

- In accordance with the edited requirements of Art. 226 of the Tax Code of the Russian Federation to the calculation of personal income tax, the fact of the end of the month (or other reporting/contractual period) in itself is not a basis for calculating personal income tax for this month (period). The starting point for the calculation, deduction and transfer of personal income tax is the actual payment of income to an individual. The only exceptions are the calculations listed in paragraphs. 2–5 tbsp. 223 of the Tax Code of the Russian Federation (primarily wages).

- Amounts of income of an individual (except for exceptions under Article 223 of the Tax Code of the Russian Federation), reflected in tax registers according to the norms of Art. 226 of the Tax Code of the Russian Federation, now fall into these registers strictly on the date of actual receipt of income by an individual. And since the data for inclusion in the 6-NDFL report must be taken from the personal income tax registers (clause 1 of article 230 of the Tax Code of the Russian Federation), then only that income that is reflected in the tax registers will appear in line 110 (formerly line 020) for the period , namely: calculated on the date the individual received actual income.

If you doubt whether you filled out the report correctly, look at the ready-made sample 6-NDFL according to the new form, which was prepared by ConsultantPlus experts. Trial access to the system can be obtained for free.

The most common mistakes in 6-NDFL: what to check before submitting

Despite the fact that we have been presenting calculations using Form 6-NDFL for almost three years, there are still many blank spots in filling out this form, which leads to errors. The Federal Tax Service of Russia (Letter dated November 1, 2017 N ГД-4-11/ [email protected] ) identifies three main reasons for possible errors:

- violation of calculation rules (when control ratios are not met);

- non-compliance with the clarifications of the Federal Tax Service of Russia;

- the procedure for submitting calculations to the tax authorities was violated.

The correctness of the calculation in form 6-NDFL can be checked according to the Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected] , as well as by checking the explanations of the Federal Tax Service of Russia.

1) Errors in filling out section I of the calculation.

1.1) section I of the calculation in form 6-NDFL is filled out not on an accrual basis, but on a quarterly basis;

1.2) Payments that are only partially exempt from personal income tax must be reflected in the calculation. Although line 020 of Section I indicates income that is completely exempt from personal income tax. Such income should not be reflected there (Letter of the Federal Tax Service of Russia dated 01.08.2016 N BS-4-11 / [email protected] ).

For example, financial assistance is exempt from tax in an amount that does not exceed 4,000 rubles. for the tax period (clause 28 of article 217 of the Tax Code of the Russian Federation).

But, according to the position of the Federal Tax Service of Russia and the Federal Tax Service of Russia (Letters of the Federal Tax Service of Russia for Moscow dated March 14, 2018 N 20-14 / [email protected] , Federal Tax Service of Russia dated July 21, 2017 N BS-4-11 / [email protected] , income , exempt from taxation in full or partial amount in accordance with Article 217 of the Tax Code of the Russian Federation, are not subject to reflection in information on Form 2-NDFL and in calculations on Form 6-NDFL. In this regard, the organization has the right not to reflect in information on Form 2- Personal income tax and when calculated in form 6-NDFL, tax-free income in the amounts established by the Tax Code of the Russian Federation.If the amount of such income exceeds the established amount, then they are reflected in the specified forms in full.

1.3) wages for December paid in January are reflected in line 070 of section I “the amount of tax that will be withheld only in the next reporting period” Since the organization will withhold the amount of personal income tax from income in the form of wages accrued for December but paid in January when paying wages in January, line 070 of section I in the fourth quarter of 2021 is not filled in (Letter of the Federal Tax Service of Russia dated 01.08.2016 N BS-4-11 / [email protected] );

1.4) line 080 of section I indicates the amount of payroll tax that will be paid in the next reporting period (submission period), that is, when the deadline for fulfilling the obligation to withhold and transfer personal income tax has not yet arrived, or line 080 of section I indicates the amount of the difference between calculated and withheld tax. This line reflects only the amount of tax that the organization could not withhold due to the lack of income in cash, namely personal income tax on income received by individuals in kind and in the form of material benefits (Letter of the Federal Tax Service of Russia dated 01.08.2016 N BS-4 -11/ [email protected] ).

1.5) income in the form of temporary disability benefits is reflected in section I of the calculation in Form 6-NDFL in the period for which the benefit was accrued. Such income is reflected in Section I in the period in which it was paid (Letter of the Federal Tax Service of Russia dated 01.08.2016 N BS-4-11 / [email protected] ).

2) Errors made when filling out section II:

2.1) filling out section II with a cumulative total. (Letters of the Federal Tax Service of Russia dated 02/25/2016 N BS-4-11/ [email protected] and dated 07/21/2017 N BS-4-11/ [email protected] );

2.2) on lines 100, 110, 120 of section II of the calculation in form 6-NDFL, periods outside the reporting period are indicated - this error is consistent with the previous one. If a tax agent performs an operation in one reporting period and completes it in another period, then this operation is reflected in the period in which it was completed. (Letters of the Federal Tax Service of Russia dated 02/25/2016 N BS-4-11/ [email protected] and dated 07/21/2017 N BS-4-11/ [email protected] );

2.3) line 120 of Section II incorrectly reflects the deadlines for the transfer of personal income tax (for example, the date of the actual transfer of the tax is indicated). The terms of transfer are indicated strictly in accordance with clause 6 of Art. 226 and paragraph 9 of Art. 226.1 Tax Code of the Russian Federation. In this case, it is necessary to take into account the rules for rescheduling defined in paragraph 7 of Art. 6.1 Tax Code of the Russian Federation;

2.4) on line 100 of section II, when paying wages, the date of transfer of funds to the employee is indicated. The date of actual receipt of income in the form of wages is recognized as the last day of the month for which the taxpayer was accrued income for the performance of labor duties in accordance with the employment agreement (contract), regardless of whether the specified date falls on a weekend or a non-working holiday (clause 2 Article 223 of the Tax Code of the Russian Federation) (Letters of the Federal Tax Service of Russia dated 02/25/2016 N BS-4-11/ [email protected] and dated 05/16/2016 N BS-3-11/ [email protected] );

2.5) on line 100 of Section II, when paying a bonus based on the results of work for the year, the last day of the month on which the bonus order is dated is indicated. The date of actual receipt of income in the form of a bonus based on the results of work for the year is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation) ( Letter of the Federal Tax Service of Russia dated October 6, 2017 N GD-4-11/20217). Such payments include bonuses for production results, paid at the end of the month (Letters of the Federal Tax Service of Russia dated September 14, 2017 N BS-4-11/18391, dated August 9, 2017 N ГД-4-11 / [email protected] ).

The date of actual receipt of income in the form of other bonuses (paid for anniversaries, holidays), not related to wages in accordance with the Labor Code of the Russian Federation, is defined as the day of payment of the specified income to the taxpayer (Letter of the Federal Tax Service of Russia dated April 11, 2017 N BS-4-11/ [email protected] );

2.6) interpayments (salaries, vacation pay, sick leave, etc.) are not included in a separate group. Blocks from lines 100 - 140 are filled out separately for each tax remittance period, including in cases where different types of income have the same date of actual receipt, but different tax remittance deadlines. For example, if the date of actual receipt of various incomes (vacation pay and salary) on the basis of Art. 223 of the Tax Code of the Russian Federation recognizes one day, then in Section II data on these incomes are included in separate blocks, since the deadlines for transferring taxes on these incomes are different. This is indicated in Letters of the Federal Tax Service of Russia dated 03/18/2016 N BS-4-11/ [email protected] , dated 05/11/2016 N BS-4-11/8312.

3) Failure to comply with the control ratios of calculation indicators according to forms 6-NDFL and 2-NDFL:

3.1) the amount of accrued income on line 020 of section I of the calculation in Form 6-NDFL does not coincide with the amount of the lines “Total amount of income” of certificates in Form 2-NDFL;

3.2) the amount of calculated tax on line 040 of Section I of the calculation in Form 6-NDFL is less than the sum of the lines “Calculated tax amount” of certificates in Form 2-NDFL;

3.3) line 025 of section I at the corresponding rate (line 010) does not correspond to the amount of income in the form of dividends (according to income code 1010) of certificates of form 2-NDFL with attribute 1, submitted for all taxpayers;

3.4) the number of individuals (line 060 of section I of the calculation in form 6-NDFL) who received income is overestimated (underestimated) (inconsistency with the number of 2-NDFL certificates).

4) Errors in the presentation of the calculation:

4.1) late submission of calculations in form 6-NDFL. In accordance with paragraph 2 of Art. 230 Tax Code of the Russian Federation;

4.2) submission by tax agents of calculations on paper if the number of employees is 25 or more people;

4.3) errors when filling out the checkpoint and OKTMO, which leads to unreasonable overpayments and arrears.

How to show in line 110 (formerly line 020) payments not subject to personal income tax

Amounts of payments to individuals that are completely exempt from personal income tax are not included in the calculation of tax. Taking into account the above explanations about the procedure for reflecting taxable income in 6-NDFL, as well as the requirements for control ratios, we can conclude that amounts not subject to personal income tax do not fall into the 6-NDFL report - neither in line 140 (formerly line 040), nor to line 110 (formerly page 020).

NOTE! If the income is not taxed only partially (for example, a limit of 4 thousand rubles for a gift to an employee from an enterprise), and the remaining amount in excess of the preferential amount is subject to personal income tax, such income should be included in line 110 (previously 020). In this case, the non-taxable part is indicated in line 130 (formerly line 030) “Deductions”. This is the position of the Federal Tax Service of Russia, set out in letter No. BS-4-11/13984 dated 08/01/2016.

For more information on the nuances of forming 6-NDFL in this case, read the material “Procedure for filling out line 130 in the 6-NDFL form.”

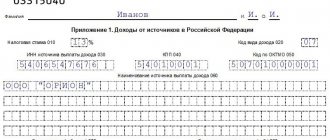

Example of filling line 020

Let's look at an illustrative example. Let's imagine a company that once (for example, 06/05/2017) spent 5,000 rubles on an anniversary souvenir for its best employee. And, of course, it also needs to be reflected in the 6-NDFL declaration, since only those gifts that cost less than 4,000 rubles are not taxed.

According to Article 217 of the Russian Tax Code, mandatory tax must be calculated on any amount exceeding this limit.

Line 020 should reflect the true value of the gift, i.e. 5,000 rubles. The same part that is not taxed is indicated on line 030, and this is 4,000 rubles. In line number 040 we get this simple calculation: (5000 rubles - 4000 rubles * 13% = 130 rubles.

An example of filling out line 020 of the 6-NDFL declaration

If the price of this gift were even a little less than the notorious 4,000 rubles, then, as you might guess, it would not have to be reflected in the declaration at all.

In line number 020, only those data are entered that reflect the income actually received by individuals. These are exactly the amounts that, if you follow Article 223 of the Tax Code, fall during the reporting period. If the date of receipt of income does not coincide with the reporting period (if, for example, it has not yet arrived), then it is not entered in line 020.

In no case should the line include payments that are not subject to taxation in the Russian Federation, for example, payments to non-residents located abroad.

Video: what income does not need to be included in line 020

A foreign employee works under a patent: what will fall into line 110 (formerly line 020)

An employee who has a patent pays fixed payments on it for himself, which are taken into account when calculating personal income tax for such an employee (clause 6 of Article 227.1 of the Tax Code of the Russian Federation). At the same time, it is not uncommon for the patent payment to exceed the amount of personal income tax calculated from the salary. Let's look at how this is reflected on line 110 (formerly p. 020) with an example.

Example

A foreign employee on a patent worked in February 2021 for a salary of 25 thousand rubles. The amount of personal income tax from 25 thousand rubles. will be 3,250 rubles. The February payment for a patent, transferred in advance, is 4,200 rubles.

That is, there will be no tax payable to the budget by the tax agent - the employer. But what should be shown in section 2 of the 6-NDFL report?

Taking into account the provisions of Art. 226 and 223 of the Tax Code of the Russian Federation, the amount of income in respect of which the employer acts as a tax agent should be reflected in the tax registers as of February 28, 2021 (clause 2 of Article 223 of the Tax Code of the Russian Federation). Consequently, when filling out the 6-NDFL for the 1st quarter of 2021, this salary is 25 thousand rubles. should be included as part of line 110 (formerly line 020) of section 2.

In accordance with the control ratios and the same tax registers, the tax amount is 3,250 rubles. should be shown as part of line 140 (formerly line 040) in the same section.

And to show in 6-NDFL the fact that the tax has already been paid, there is line 150 (previously page 050) “Fixed payment amount”. You need to indicate 3,250 rubles in it. (the amount accepted to reduce the tax calculated by the tax agent).

(The example was prepared using the explanations of the Federal Tax Service in letter dated May 17, 2016 No. BS-4-11/ [email protected] )

Read more about the procedure for filling out line 150 (formerly 050) of 6-NDFL here.

What amounts should I include?

Field 020 shows accrued income.

It is important to pay attention to the following points:

- It is the accrued income that is indicated, not the paid one.

- The amount includes personal income tax, that is, income is shown before taxation with income tax.

- The value must be calculated as a cumulative total for all individuals who have accrued income taxed at the rate from line 010 for the period from the beginning of the year;

- Only payments that are subject to personal income tax are included.

The last point is very important for filling out line 020 6-NDFL. Those amounts that are exempt from income tax are not included in the accrued income for calculation.

This includes only those incomes that are subject to personal income tax. The list of such amounts is given in clause 1 of Article 207 of the Tax Code of the Russian Federation. It is important that the list is open, that is, any income accrued in favor of individuals that is not included in the number of non-taxable amounts can be subject to personal income tax.

The list of payments that are not subject to personal income tax and are not included in field 020 of the 6-personal income tax calculation is given in Article 217 of the Tax Code of the Russian Federation.

Not included in line 020 of the 6-NDFL report:

- maternity benefits;

- amounts of compensation for personal injury;

- severance pay up to three monthly earnings (six for northern regions);

- financial assistance to family members of a deceased employee, as well as to victims of natural disasters;

- payment for vouchers to sanatoriums and dispensaries for the purpose of health improvement;

- payment for professional training and retraining;

- material gifts and financial assistance from the employer up to 4,000 rubles.

- others from Article 217 of the Tax Code of the Russian Federation.

What is included in field 020 of form 6-NDFL:

- wage;

- vacation pay;

- sick leave;

- vacation compensation;

- severance pay in excess of three average earnings (six for RKS);

- financial assistance over 4,000 rubles, except for the types of assistance listed above;

- dividends and other payments not included in the list of Article 217 of the Tax Code of the Russian Federation.

How to fill it out correctly?

To fill out line 020 in form 6-NDFL, you need to calculate the total amount of accrued income for all individuals for whom an organization or individual entrepreneur is a tax agent. This includes persons with whom employment and civil law contracts have been concluded.

The amount is considered a cumulative total from the beginning of the year.

For example:

- When submitting the report for the 1st quarter of 2021, amounts are given for the period from the beginning of January to the end of March 2021.

- When submitting calculations for half a year 2021 - from January to the end of June 2018.

- For the 3rd quarter of 2021 – from January to the end of September 2018;

- For 2021 – for the entire calendar year;

- For the 1st quarter of 2021 - for the period from the beginning of January to the end of March 2019, etc.

When filling out 6-NDFL at the end of each subsequent period, the amount to be reflected in line 020 will be equal to the indicator from line 020 of 6-NDFL for the previous period plus accrued income for the last quarter.

Important! Accrued income is indicated, not paid. That is, line 020 will include accruals that include personal income tax.

Thus, in order to correctly fill out line 020 in 6-NDFL, you must follow the following rules:

- Consider only taxable amounts.

- Sum up your income on a cumulative basis from the beginning of the year.

- Take into account income that was accrued in the reporting period before tax (and not paid).

Read about filling out line 040 here.

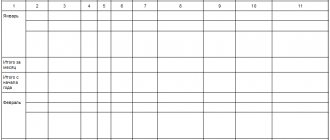

Sample filling

The organization employs 5 employees who are paid monthly salaries.

Monthly accruals for all personnel in 2021 are as follows:

| January | February | March | April | May | June | July | August | September |

| 125000 | 130000 | 130000 | 130000 | 120000 | 145000 | 130000 | 130000 | 130000 |

The organization fills out the 6-NDFL calculation for 9 months of 2021.

To fill out line 020, the total amount of accruals for the period from January to September is calculated as a cumulative total = 1,170,000.

Deductions are given to only one employee per child in the amount of 1,400 rubles.

Personal income tax on this amount = (1,170,000 – 1400*9) * 13% = 150,462.

With such initial data, a sample for filling out section 1 and line 020 in 6-NDFL will be as follows:

Results

The algorithm for generating line 110 (previously line 020) in 6-NDFL is determined by order No. ED-7-11/ [email protected] and the requirements of the Tax Code of the Russian Federation. All other explanations by authorized persons and bodies must comply with the principles established by these regulations.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.