According to Article 169 of the Tax Code of the Russian Federation, VAT payer organizations must issue invoices for each advance received from the buyer and charge VAT. If the company has received an advance payment from the buyer for the upcoming delivery of products, it is necessary to issue an invoice for the advance payment and give one copy to the buyer.

1C 8.3 provides functionality for creating, registering and accounting for such accounts for all of the above options. Let's see what ways there are to receive an advance and create invoices for advances, using the example of the 1C: Enterprise Accounting configuration, edition 3.0.

Creation of sales invoice (issued)

Figure 1 shows the implementation document. To write and post an invoice in 1C, you need to click the button at the bottom left.

Fig.1

In Fig. 2 we see the invoice itself, generated according to the data of the implementation document. The number, date, as well as all other details are filled in automatically. The user only needs to specify the storage method (it is automatically set to “hard copy”). You can print the document in 1C by clicking the “Print” button and give it to the counterparty.

Fig.2

Our video about issuing an invoice and creating an implementation in 1C 8.3:

Verification of documents

To analyze and find documents for which there are no invoices, you can use a special processing in the program called “Express check”. It is located under the “Reports” menu.

The figure below shows an example of displaying errors for a problem of interest to us, as well as recommendations proposed by the program.

Invoices issued for advance payment

Advance invoices are registered by special processing, which is called that. They are usually issued once at the end of the reporting period.

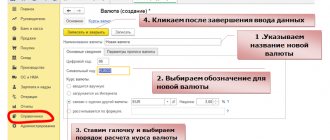

Before moving on to the processing itself, let’s set up the accounting policy in the “VAT” section (Fig. 3).

Fig.3

To reduce the number of invoices issued, you can select the registration order, highlighted with a red outline (Fig. 3). In this case, invoices will be issued only for advances for which goods have not been shipped at the end of the quarter.

Processing is called from the “VAT Accounting Assistant” section (Fig. 4).

There is also a point for registering tax agent invoices. Let us remind you that in order to conduct transactions as a tax agent, you must set the appropriate attribute in the agreement.

Fig.4

Receipt of advance payment

To make this example clear, we will first register the receipt of the advance in the program. Let’s assume that we receive funds from our counterparties in two ways: through a cash register and through a bank account.

We will not consider filling out these documents in detail. You can read about this in another article.

The receipt of cash is documented by a cash receipt order. You can find it in the “Bank and Cash Office” section, “Cash Documents” item. Make a new document by clicking on the “Receipt” button in the list that opens.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

The document generated a posting in the amount of 10,000 rubles from account 62.02 to account 50.01. Now this DS amount is listed in our cash register.

Non-cash payment is registered by the document “Receipt to the current account”. You can also find and do it in the “Bank and Cash Office” section in the “Bank Statements” item.

The document generated a similar posting, only the DS arrived at Dt 51.

Posting adjustment invoices

To generate adjustment invoices, special documents have been developed:

- Implementation adjustments

- Adjustment of receipts

Let's look at an example of adjusting a receipt invoice (Fig. 7). The document can be created either on the basis of receipt or on the basis of the primary invoice.

Fig.7

Let's assume that the parties have agreed to change the purchase price. The old and new prices are indicated in two adjacent lines of the tabular part of the adjustment document. Everything else is calculated automatically. This includes automatically registering a correction invoice; you will only have to manually enter the number of the correction or adjustment.

Adjustments for sales are made in the same way.

Invoices “For advance payment by the principal” are issued only for contracts with the type “With the principal (principal)…”

Video instruction on adjustment invoices:

Implementation of legal requirements in 1C products

When carrying out accounting using the 1C program, companies can be confident in the correctness and validity of issuing invoices, filling out all the necessary details and complying with the value added tax rates. Any changes in current legislation are promptly reflected in updated versions of the program. In addition, there is a system for notifying the accountant about introduced innovations; in automatic mode, the program will calculate the amount of advance tax payments, and will also remind you in advance about the deadlines for its payment, therefore the process of automating accounting based on 1C programs has long occurred in most enterprises of the Russian Federation.

How to insert a stamp and signature

This procedure will eliminate the need to scan a document with stamps and signatures, and it is carried out as simply as the previous one. It is especially convenient to use this function for sending completed invoices electronically. Therefore, for the convenience of work, it is also worth studying the sequence of its implementation.

On the same page on which you entered all the information for invoicing, you need to select the required organization and open its card.

Next, you will need to find files with ready-made fiscal images (they can be scanned) in the “Logo and Printing” section.

It is necessary that the images are displayed on the correct background - transparent or white.

Next, you need to return to the document and select the “Invoice for payment (with stamps and signatures)” item there. As a result, all selected images will be displayed in the document.

The next thing to do is to save the compiled version of the invoice. To do this, you need to click on the floppy disk icon and in the window that appears, indicate in what format the document will be saved and where on the disk it should be placed.

As a result, the finished invoice with all the necessary fiscal images can be sent via email or instant messengers, which is much more convenient than using and scanning printed versions.

Issuing an invoice after shipment of goods

To create such a document, you need to go to the “Sales” menu item and select “Sales (acts/invoices).”

On the next page, a journal will open in which invoices with the names of already shipped goods are recorded.

After this, you need to select the unpaid invoice and click the “Create based on” button. Next, in the drop-down menu, click “Invoice to buyer”.

As a result, an invoice for payment will be automatically generated, into which all the data from the invoice will be transferred.

We recommend reading the article: “1C Cloud - what is it? In simple words"

Data editing

The cost of product items or a specific service is billed automatically, so they need to be checked. If necessary, the numbers can be changed manually.

You can indicate in the appropriate field that the packaging provided is subject to return. This button is located to the right of “Products”.

It is worth paying attention to the fact that the first detail “Counterparty” can be filled in automatically. To do this, you will need a directory of counterparties. It can be created, for example, when downloading bank statements. To view the entire list, click on the “Show all” link.

From the available customer register, you can select the desired company and its data will appear in the field.

When a contract has been concluded with a client for the constant supply of goods, you need to open the “Repeat?” link. in the upper right part of the document and indicate the desired date and frequency.

Next, a reminder about the scheduled shipment will be displayed in the list of documents.