Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

When a company experiences a financial crisis, it is quite difficult to find financial support. Banks refuse to issue loans to organizations with a negative balance, which could go bankrupt at any time.

In this case, help should be sought within the company, from the official founders. A transaction is considered safe if the contract is drawn up correctly and all necessary points are taken into account.

Let's look at how to apply for a loan from the founder and what needs to be taken into account when concluding a deal.

Legislative framework for such a loan

The main document that regulates the relations arising in the process of receiving and further repaying a loan (and it makes absolutely no difference who the borrower and the lender are) is the Civil Code, namely Chapter 42 of this document.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

A loan from a founder to a legal entity has every right to exist and does not contradict the legislation of the Russian Federation.

Article 807 of this document states that the loan agreement involves two parties, one of which is the lender, and the other the borrower. The loan agreement must contain complete information about the transaction being concluded.

The main aspects are:

- loan amount;

- loan term;

- the interest rate charged for the use of borrowed funds or a direct indication that the loan is interest-free;

- conditions and methods of debt repayment.

If one of the parties to the loan is a legal entity, then the agreement must be confirmed in writing (Article 16 of the Civil Code).

In addition to the loan agreement, the founder of the organization and the borrower enterprise must sign an act confirming the transfer of money or other property specified in the main document.

A loan agreement between the founder and the company, like any other type of loan agreement, is considered concluded at the moment of transfer of the property or funds specified in it to the borrower.

If the founder of the company (also the lender) and the director of the company (in this case, the borrower) are the same person, then the loan agreement is drawn up according to the same rules with one exception.

The specified person must sign the document for both the lender and the borrower, that is, twice.

Similar to other types of loans, a loan from the founder can be targeted or non-targeted (Article 814 of the Civil Code). If the loan is targeted, then the funds received can be spent exclusively for the specified purposes.

If the loan from the founder was received in foreign currency, then it is additionally necessary to rely on the law defining currency regulation and currency control in the territory of the Russian Federation.

Issues related to the taxation of loans are discussed in detail in the Tax Code of the Russian Federation.

Summing up

- The founder has every right to provide his organization with an interest-free loan.

- In the vast majority of cases, such funds are not subject to taxes.

- Accounting entries are made using accounts 66 and 67, depending on the period of provision of funds, in correspondence with the account. 50 (51).

- The loan can also be used to pay off the company’s debt to suppliers (Dt 60).

- The loan agreement must contain an indication that there is no interest on it.

Sources

- https://ppt.ru/forms/dogovor/zayma-uchreditelya

- https://www.regberry.ru/registraciya-ooo/obrazec-dogovora-zayma-mezhdu-uchreditelem-i-ooo-besprocentnyy

- https://azbuha.ru/uchet-denezhnyx-sredstv/zajm-uchreditelya-svoej-kompanii/

- https://uchet.pro/zaem-ot-uchreditelya/

- https://rusjurist.ru/dogovory/dogovory_zajma/dogovor_besprocentnogo_zajma_s_uchreditelem_skachat_obrazec/

- https://praktibuh.ru/buhuchet/kapital/ustavnyj/zaem/besprotsentniy-uchreditelyu.html

- https://creditometr.online/documents/dogovor-zayma-s-uchreditelem

- https://assistentus.ru/vedenie-biznesa/besprocentnyj-zaem-ot-uchreditelya/

- https://nalog-nalog.ru/dogovory/besprocentnyj_zaem_ot_uchreditelya_nalogovye_posledstviya/

Nuances of interest-bearing and interest-free loans from the founder

As mentioned earlier, a loan issued by the founder of his company can be interest-bearing or interest-free.

An interest-bearing loan implies that the organization that received the funds is obliged to return to its lender not only the amount of money received, but also an additional payment in the form of interest accrued on the loan amount for a certain period of time.

The interest rate is set by agreement of the parties and is in no way regulated by legislation in force in the territory of the state.

Thus, an interest-bearing loan from the founder is no different from a regular consumer loan.

An interest-free loan is one in which you do not have to pay any additional amounts when repaying it, that is, as much as the company received, it must return as much.

An indication that the loan is interest-free must be reflected in the concluded agreement (Article 809 of the Civil Code of the Russian Federation). If this aspect is missed, then by default the loan is considered interest-bearing.

Previously, it was believed that an enterprise-borrower, receiving an interest-free loan from the founder, additionally acquires material benefits with which it must pay taxes.

The financial benefit was calculated based on the company's savings on interest that it would have paid if it had received an interest-bearing loan.

The existing legislation (Tax Code of the Russian Federation) does not introduce the concept of material benefit of an enterprise, and, therefore, no additional taxes need to be paid.

How to write off an issued loan?

A loan to the founder can be written off in two cases:

- In case of full repayment.

- In case of registration of a debt forgiveness procedure.

Refund

In accordance with the concluded agreement, the founder can repay the interest-free loan either in full or in part, on time or ahead of schedule, as well as on a deferred date by agreement of the parties.

Depending on the method of return, amounts are reflected in accounting entries:

- Dt 50 Kt 66, 67 – return in cash to the cash desk of a short-term or long-term loan.

- Dt 51 Kt 66, 67 – repayment of a short-term or long-term loan through a credit institution.

Debt forgiveness

Any person can forgive a debt to another person, either completely or partially. From a legal point of view, this is an ordinary transaction. Debt forgiveness is regulated by Art. 415 of the Civil Code of the Russian Federation. The law does not impose any special requirements for the loan forgiveness procedure on the founder.

As a general rule, a debt can be forgiven if this fact does not violate the rights of other persons in relation to the lender's property.

According to the Civil Code of the Russian Federation, the debt is considered forgiven from the moment the borrower receives notice of the debt being written off. The debtor may object to the forgiveness of the debt within a reasonable time.

The fact of forgiveness from the date of receipt of the notice is reflected in paragraph 2 of Art. 415 of the Civil Code of the Russian Federation, this clause was introduced relatively recently. Before the advent of this norm, the parties formalized the forgiveness procedure in other ways.

- Drawing up a gift agreement.

- Concluding a debt forgiveness agreement. Often, participants in borrowing relationships consider unilateral notification insufficient and enter into a bilateral agreement. This is not prohibited by law, but it would be redundant. In addition, on the basis of this agreement, in any case, it will be necessary to send the debtor a notice of debt forgiveness.

Regardless of the method of writing off the debt to the founder, the latter receives a material benefit, with which it is necessary to pay personal income tax at a rate of 13%.

The forgiven debt cannot be expensed and therefore reduce the taxable base. This type of cost is not reflected in Art. 346.16 Tax Code. The amount of forgiven debt is included in profit, that is, it is a direct loss for the enterprise.

Preparation of contract

Any type of loan is formalized by an agreement. The document must contain the basic conditions for receiving and paying off the debt, which include:

- the amount of money given by the founder of his organization;

- the period during which the company is obliged to pay its creditor;

- the presence or complete absence of interest on the use of funds;

- method and timing of debt repayment (if the loan is repaid in parts, then a payment schedule must be attached to the main agreement);

- rights, duties and responsibilities of the parties entering into the document;

- the presence or absence of penalties that come into force in the event of failure of one of the parties to fulfill its obligations;

- other conditions that the parties wish to reflect in the document.

The loan agreement and accompanying documents (payment schedule, receipt of funds, etc.) are signed by both parties. However, the document acquires legal force only at the moment of transfer of the property specified in it to the borrower.

Methods of obtaining and repaying a loan on the Easy ru service. See the article: Easy ru loan. A sample interest-free loan agreement between legal entities can be found here.

Key points of the borrowing agreement

There are a number of points that are of particular importance for the tax consequences of a loan agreement with the founder. Among them is the ability to make an agreement:

- Provides for the payment of interest at a frequency convenient for its parties. The absence of reservations in this regard will require monthly interest accrual (clause 3 of Article 809 of the Civil Code of the Russian Federation).

- Interest-free (in the case of loaning things, the absence of interest becomes mandatory - clause 4 of Article 809 of the Civil Code of the Russian Federation). In order for an agreement to be considered interest-free, the condition of non-accrual of interest must be fixed in the text of the document, since the absence of such a condition will entail the need to calculate interest on the key rate of the Bank of Russia (clause 1 of Article 809 of the Civil Code of the Russian Federation).

- Targeted. For this situation, the contract will have to provide for a procedure for monitoring the use of what was loaned and a procedure for returning it if misuse is identified (Article 814 of the Civil Code of the Russian Federation). Accordingly, interest accrued on borrowed funds used for other purposes will not be taken into account to reduce the tax base for profits or the simplified tax system; It will also be impossible to take into account the negative exchange rate difference on a loan issued by a foreign founder in foreign currency.

- Does not contain an indication of the repayment period or makes it dependent on the moment of reclaiming the loan from the lender. Under such conditions, the debt must be repaid no later than the 30th day from the date of the demand from the lender, unless a different period is specified in the text of the agreement (clause 1 of Article 810 of the Civil Code of the Russian Federation). Moreover, the date of return (unless otherwise provided by the agreement) will be considered the day of actual receipt of the debt by the lender (clause 3 of Article 810 of the Civil Code of the Russian Federation).

In order to avoid undesirable consequences, it is recommended to stipulate each of the listed points in detail in the text of the loan agreement.

Sample

Samples of loan agreements from the founder can be found in large quantities on various websites on the Internet. Let's give general examples.

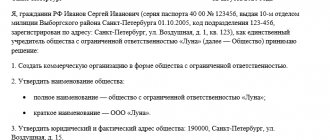

The interest-free loan agreement from the founder will look like this.

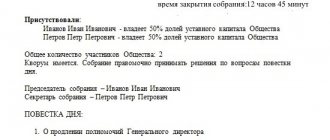

The interest-bearing loan agreement from the founder must indicate the amount of interest and the time when they must be paid.

Below is a sample of such an agreement.

An appendix to the above loan agreement is a debt repayment schedule, which is drawn up according to the following model:

How are taxes paid?

The Tax Code clearly defines the concept of income on which an enterprise is obliged to pay income tax.

This article consists of two main parameters:

- income received by the organization from the sale of property produced or services provided;

- non-operating income, which consists of other sources of profit, for example, interest received from an interest-bearing loan issued to another person.

A loan received from the founder is not a source of income. Therefore, it is not subject to income tax.

Value added tax arises exclusively on the circulation of various products and products and does not in any way affect funds. Consequently, there is also no requirement to pay VAT on a loan received in cash.

If the founder issues an interest-bearing loan to his company, he is obliged to pay income tax (if the founder is a legal entity) or personal income tax (NDFL).

This is due to the fact that interest on the loan relates to non-operating income, subject to appropriate tax.

An enterprise acting as a borrower must take into account loan interest as part of non-operating expenses, thereby reducing its own profit taken into account for tax purposes.

Loan without interest: what taxes are possible

What tax consequences does an interest-free loan from the founder have? For a loan taken without interest, the issue of taxation also turns out to be related to the presence of mutual dependence between the parties to the transaction and whether the founder is a resident or non-resident. The situations here are:

- There is no dependency. In this case, the lack of taxable income in the form of interest from the lender is completely legal (Clause 1, Article 105.3 of the Tax Code of the Russian Federation). Accordingly, the borrower has no expenses.

- There is a dependency. For her, the inclusion of the founder as a resident becomes significant. If the founder is the founder, then the transaction to provide an interest-free loan is not recognized as controlled (subclause 7, clause 4, article 105.14 of the Tax Code of the Russian Federation). If the founder turns out to be a non-resident, then the absence of interest on the loan makes the transaction not subject to control, since in this case the conditions for him, provided for in Art. 269 of the Tax Code of the Russian Federation.

Thus, an interest-free loan will not have tax consequences in any case.

Differences between a loan from the founder in foreign currency and in rubles

Due to the unstable exchange rate of the Russian ruble, some borrowers (including founders of enterprises) prefer to issue loans in foreign currency. In this case, interest under the loan agreement (when concluding an interest-bearing loan) is also accrued in foreign currency.

The interest rate under such an agreement is significantly reduced. But the risks of the enterprise increase greatly, and the risks of the lender decrease. Based on this, it is considered that it is inappropriate for the founders to issue loans in foreign currency.

However, such situations do happen. And first of all, difficulties arise when preparing financial statements, since all transactions must be presented in rubles.

Therefore, accountants have to constantly monitor the exchange rate of the currency in which the loan was issued, and instead of basic transactions, make complex calculations.

Another aspect of a loan in foreign currency is related to taking into account exchange rate differences and the additional income or expenses arising in connection with this. According to the accounting regulations, these amounts relate to the costs associated with obtaining a loan.

What it is?

In accounting, a posting is an entry in a journal or computer about transactions carried out during a certain period. Accounting entries are recorded as a credit to one account and a debit to another. Companies can charge interest on issued loans; it is based on the profit accounting method.

The loan can also be interest-free, as decided by the loan officer. The Civil Code has a special chapter that describes the issuance procedure. For example, such an action must be recorded.

The lender gives the borrower a specified amount of funds or some things, and the borrower must pay back the amount or give things back in the same condition and quality.

The signed agreement must include the following points:

- Loan rate (if any).

- Return period.

- What is the return procedure?

- If the loan percentage is not written in the agreement, or it is not written there that the agreement is interest-free, then the amount of the interest will be determined at the NPL rate.

The loan size can be any, there are no restrictions on this.

How is debt paid off?

The method of returning funds to the founder who issued the loan to the organization is provided for by the terms of the agreement.

Currently, there are two ways to repay the debt to the founder:

- transferring the specified amount to the founder’s current account;

- a product whose value is equal to the amount of funds invested.

In the first case, it is enough to simply transfer the amount specified in the agreement to the founder’s account. Moreover, this must be done several days before the loan is due to be repaid, since most banks carry out transactions within a certain time.

Otherwise, penalties may arise for late repayment of debt.

In the second case, the borrower and the lender must enter into an additional agreement to the loan agreement, according to which the funds received must be returned not in cash, but in the form of a certain product and in a certain quantity (Article 409 of the Civil Code of the Russian Federation).

The following can be used as a “product”:

- products manufactured by the enterprise;

- fixed assets of the borrower company;

- other property owned by the borrower company.

How to issue a loan

If there are several founders, then before drawing up an agreement, you need to check whether the transaction is large. These include transactions in an amount exceeding 25% of the value of assets on the balance sheet as of the last reporting date.

A major transaction can be made only after the approval of the general meeting of participants (Article 46 of Law No. 14-FZ dated 02/08/1998).

Cash loans can be issued both in cash and in non-cash form.

However, it should be remembered that if the founder is an organization or individual entrepreneur, then the “cash” part of payments under one loan agreement cannot exceed 100 thousand rubles. (Instruction of the Bank of Russia dated October 7, 2013 No. 3073-U).

If the lender is an “ordinary” individual, then any amount can be issued in cash.

If the loan amount exceeded 600 thousand rubles, then Rosfinmonitoring may be interested in the transaction. In this case, the parties to the transaction will have to justify its economic feasibility.

Payment of debt with the property of a legal entity

So, the founder provided a cash loan to the company. Upon expiration of the contract, the borrower is obliged to return the invested funds to the lender and, moreover, in cash.

There are situations when a company simply does not have money. In this case, the borrower can repay the debt with some property.

What is needed for that:

- draw up an additional agreement to change the terms of the main agreement;

- transfer the specified property to the founder;

- pay taxes.

The Tax Code of the Russian Federation states that the transfer of property is considered a sale (Chapter 39, Article 1) and is subject to taxation, namely payment of value added tax.

The taxable base will be the amount received from the transfer of ownership of a certain product or company property. Tax must be calculated at the current rate.

How is debt forgiveness from the founder processed?

There are situations when the founder, who issued a loan to the company, forgives the latter’s debt (Article 415 of the Civil Code of the Russian Federation).

In this case, you can issue (your choice) two documents:

- additional agreement on forgiveness by the founder of the loan received by the organization (signed by both parties to the loan agreement and comes into force after signing);

- notification of forgiveness of the loan received (drawed up by the founder and sent by official letter to the legal address of the borrower. Comes into force from the moment the correspondence arrives).

The loan amount that the founder can forgive is not regulated by existing legislation, therefore, it can be anything.

The taxation of a forgiven loan depends on the founder’s share in the company’s authorized capital.

If the founder’s share is more than 50% of the total authorized capital of the borrower organization, then no taxes need to be paid.

If the founder’s share is less than 50% or clearly equal to this amount, then the borrower is obliged to take into account the received loan amount as part of income and, accordingly, pay income tax (Article 250 of the Tax Code of the Russian Federation).

If a company in need of additional funds has “poor” reporting on its activities, then it is almost impossible to get a loan from a bank.

The founders can come to the rescue by investing personal funds in business development. Most often, founders issue interest-free loans.

The procedure for obtaining a bill of exchange loan for an individual is described in the article: bill of exchange loan. How an investment loan agreement is concluded is described on the page.

In what cases a claim is filed under a loan agreement, find out here.

Posting accrued interest

Under the cash method, interest is calculated on the day the loan is issued. This is reflected by posting Debit 76, Credit 91-1. When accounting for interest using the accrual method, you should pay attention to the period for which the loan was issued under the agreement.

Interest on loans is calculated according to the formula:

Principal loan amount x rate per year: 365 (366) x number of calendar days of the period (for example, month)

Interest may also be a fixed amount, which is specified in the agreement.

If the lending period exceeds a year, interest is accrued at the end of each month until the end of the period during which the agreement to provide money is valid. When issuing a loan for a period of less than a year, interest is calculated on the final day when it must be returned to the lender.

For an example of accounting entries, let's take the following data:

- One company received a loan from another in the amount of 2 million rubles.

- Period from September 30 to December 31.

- At an interest rate of 14.5% per year.

Accounting entries

| date | Action | Debit | Credit | Size | Documentation |

| September 30th | Getting a loan from a company | 51 | 66 | 2 million rubles | Agreement, bank extract |

| October 31 | Interest on loan agreement per month | 91 | 66 | RUB 24,778 | Agreement, certificate from accounting |

| November 30th | Interest on loan agreement per month | 91 | 66 | RUB 24,270 | Agreement, certificate-calculation |