In the commercial activities of many manufacturing enterprises, there is such a thing as material costs. It is no secret that manufactured products do not appear out of nowhere. For its production, various materials, raw materials and energy resources are used. Such expenses are included in the balance sheet of the enterprise, and the final cost of manufactured products depends on material costs. Let's try to figure out what material costs are and how such resources are accounted for.

What are material costs

This definition refers to costs that are directly or indirectly involved in the production of goods or the provision of services. These types of material costs include the cost of electricity, the purchase of raw materials, value added tax, and amounts transferred to counterparties.

There can be quite a lot of material costs, but such amounts are invariably reflected in the financial statements of the enterprise. Enterprises determine the list of such expenses independently, depending on the specifics of their professional activities. In accounting, these amounts are reflected in accounts 20 and 29.

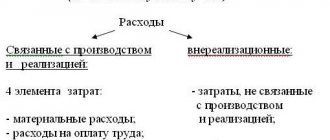

Costs for determining cost and financial results

According to this classification, costs are divided into:

- Direct and indirect;

- Basic and invoices;

- Included in the cost of production and not included.

In other words, this classification is determined by:

- Based on the economic derivative:

Basic – involved in the manufacture and release of a product item. An example is any expenses incurred during the production process, both material, labor, and others.Invoices – arising during the auxiliary production process in connection with its management. These can be any expenses of service and auxiliary production, expenses of the management staff and other examples.

- Regarding cost:

Direct – refer to the products manufactured, goods sold or services provided. These are expenses attributed to a specific product.Indirect - they cannot be immediately included in the cost of the product. They are collected separately, and subsequently divided between nomenclature positions according to the rule prescribed in the accounting policy of the organization. Example – salaries of support staff, vacation pay, equipment maintenance, components, etc.

Fig.3 Classification scheme

The division of expenses by type determines their distribution among accounting accounts.

Linking these diagrams together, you can see the parallel:

- main expenses are direct;

- invoices are indirect.

But individual examples of basic expenses (based on the first classification) may also turn out to be indirect (according to the second). For example, depreciation of equipment when producing several types of products.

Based on the example of the classification of inclusion in cost, we can distinguish included expenses :

- Material costs;

- Payroll expenses and deductions;

- Depreciation and others.

are not taken into account in the cost :

- Fines and penalties;

- Payment for land;

- Tax on vehicle owners;

- And other types of taxes and payments.

What is included in material costs

This includes money spent on the purchase of:

- Raw materials and necessary materials;

- Fuels and lubricants;

- Semi-finished products and components;

- Electricity and water resources;

- Packaging materials.

In addition, the following financial costs are included in this expense item:

- Salaries of employees, including mandatory contributions to social and pension funds;

- Control of technological processes and quality of finished products;

- Purchase of personal protective equipment, workwear and footwear;

- Transportation costs associated with the transportation of semi-finished and finished products;

- Depreciation of fixed assets;

- Maintaining equipment in technically sound condition.

Without going into details, the concept of material costs covers all types of costs associated with the production of products and delivery from the place of manufacture to points of warehouse storage and retail sales.

Material costs include

To make management decisions

This division can be represented as the following classification:

- Production and periodic costs;

- Constants and variables;

- Normative and factual;

- Operational and administrative;

- Relevant and irrelevant;

- Alternative and non-alternative.

And there are a lot of such classifications.

Depending on the resource and period:

Costs of production, production of items - the composition of the cost of the product being created, “inventory-intensive expenses”.

Periodic expenses are expenses determined by a time interval and independent of the quantity of items produced. These are articles such as:

- Commercial, organizational expenses;

- General expenses, including expenses for managing the process as a whole.

The second type of expenses according to the classification under consideration is not included directly in the cost price, but refers to the time period when they are made.

Fig. 4 Cost example diagram

Depending on the response to changes in production volumes, costs are divided into:

Constant - remain unchanged throughout time. They are not affected by changes in the quantity of output.

Variables - depend on fluctuations in quantitative production indicators and are divided into: production-related and non-production.

Fig. 5 Cost example diagram

In relation to accounting and control, there are:

Regulatory - determined by standards per unit of nomenclature.

Actual – costs incurred in the production of the item.

According to the following classification, “Operational” includes:

- materials and components;

- machines and mechanisms;

- wages of workers associated with the production process;

- fare;

- Commission remuneration;

- rent;

- communal payments;

- advertising and others.

Those. These are expenses that are involved in the operating activities of the enterprise.

And “Additional administrative costs” include:

- credits and loans;

- taxes;

- other unforeseen expenses.

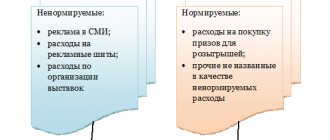

For another example of cost classification:

- irrelevant – do not depend on management decision making;

- relevant – depend on management decisions.

Opportunity costs - depending on the choice or adoption of some decision in favor of another or the rejection of some possible variant of the task in favor of an alternative solution. This may result in lost profits.

As you can see, costs can be classified according to different parameters.

Types of material costs

Such expenses are classified according to several criteria. Let's look at each of the groups in more detail.

Direct

This category includes all material costs directly involved in the production of finished products. For example, this includes the purchase of materials and payment of employees.

Variables

This is a type of cost, the value of which directly depends on the volume of products produced. This item of material costs can be considered direct costs, but there is one feature. Variable costs disappear when production is suspended.

This may include:

- Energy consumption;

- Bonus payments to workers for fulfilling the plan;

- Costs for transportation of raw materials and finished products.

Indirect

These are costs that are not directly involved in the production of products, but contribute to the production process or sales of products. For example, here you can include the costs of advertising, rent of office space, and salaries of business personnel.

Refundable

This includes the remains of resources that participated in the production process, but are unsuitable for further use for their intended purpose. Essentially, this is industrial waste that can be used after recycling. Return expenses do not include inventories transferred to branches of the enterprise for further use and by-products obtained as a result of main production.

Read also: How to make SNILS for a child?

The concept of costs, their classification

The costs of living and embodied labor for the production and sale of products (works, services) are called production costs.

In domestic practice, the term “production costs” is used to characterize all production costs for a certain period. Of great importance for the correct organization of cost accounting is their scientifically based classification. Production costs are grouped according to their place of origin, cost carriers and types of expenses.

According to the place of origin, costs are grouped by production, workshop, site and other structural divisions of the enterprise. This grouping of costs is necessary to organize accounting by responsibility centers and determine the production cost of products (works, services).

Cost carriers are the types of products (works, services) of an enterprise intended for sale. This grouping is necessary to determine the cost of production.

By type, costs are grouped by economically homogeneous elements and by costing items.

In management accounting, the classification of costs is very diverse and depends on what management problem needs to be solved.

The main objectives of management accounting include the following:

- calculating the cost of manufactured products and determining the amount of profit received;

- management decision making and planning;

- control and regulation of production activities of responsibility centers.

The solution to each of these problems has its own classification of costs.

1) To calculate the cost of manufactured products, estimate the value of inventories and determine the amount of profit received, costs are distinguished:

Incoming and expired

Incoming costs

- these are those funds, resources that have been acquired, are available and are expected to generate income in the future. They are shown as assets on the balance sheet. If these funds (resources) were spent during the reporting period to generate income and lost their ability to generate income in the future, then they become expired. As an example of the incoming costs of a trading enterprise, one asset item on the balance sheet can be cited - goods. If these goods are not sold and are stored in a warehouse, then they are recorded in the balance sheet as incoming. If these goods are sold, then the purchase costs incurred in connection with them should be considered expired.

Direct and indirect

Direct costs include direct material costs and direct labor costs. They are accounted for in the debit of account 20 “Main production”, and they can be attributed directly to a specific product. Direct material costs.

Each industrial product consists of some materials. Basic materials are materials that become part of the finished product and whose cost can be directly and inexpensively attributed to a specific product.

In some cases, it is not economically profitable to take into account the consumption of materials for each type of product. For example, nails in furniture, bolts in cars, etc. Such materials are considered auxiliary, and the costs for them are considered indirect general production costs, which are taken into account as a whole for the reporting period, and then distributed using special methods between individual types of products.

Direct labor costs include all labor costs that can be directly and economically attributed to a particular type of finished product. Labor costs for work that do not meet these characteristics are called indirect labor costs. This is, for example, remuneration for mechanics and supervisors. Such labor costs are classified as indirect overhead costs.

Indirect costs (general production costs) are a set of costs associated with production that cannot (or are not economically feasible) be attributed directly to specific types of products. They are accounted for in the debit of account 25 “General production expenses” and distributed among individual products according to the methodology chosen by the enterprise (in proportion to the basic wages of production workers, the number of hours worked, etc.). This technique is described in the accounting policy of the enterprise.

Basic and overhead costs

The main ones include all types of resources (labor items in the form of raw materials, basic materials, semi-finished products; depreciation of fixed production assets; wages of main production workers with accruals for it, etc.), the consumption of which is associated with the production of products (rendering services).

Overhead costs are the costs of running a business (Table 2).

Table 2

Composition of overhead costs of a manufacturing enterprise

| Overheads | ||

| General production | General economic | |

| Expenses for maintenance and operation of equipment | General shop management costs | |

|

|

|

Production and recurring costs

Production costs are materialized costs included in the cost of production, consisting of three elements:

- direct material costs;

- direct labor costs;

- general production costs.

Production costs are embodied in inventories of materials, in the volume of work in progress and in the balance of finished products in the warehouse. In management accounting they are often called inventory-intensive.

Periodic costs are costs that cannot be inventoried. These costs are called costs of a certain period, since their size depends not on production volumes, but on the duration of the period. These expenses are generally associated with services received during the reporting period.

Periodic expenses are represented by non-production costs that are not directly related to the production process. They consist of selling and administrative expenses. The former involve costs associated with sales and deliveries of products, the latter represent the costs of managing the enterprise.

Single element and complex costs

Single-element costs are those that at a given enterprise cannot be decomposed into components.

Complex costs consist of several economic elements.

2) For decision making and planning, there are:

Fixed, variable, conditionally fixed (conditionally variable) costs

Variable costs increase or decrease in proportion to the volume of production (provision of services, turnover), i.e. depend on the business activity of the organization. Both production costs (direct material costs, direct labor costs, costs of auxiliary materials and semi-finished products) and non-production costs (product packaging costs, transportation costs, commission to an intermediary for the sale of goods) can be variable in nature.

A type of variable costs are proportional costs. They increase at the same pace as the business activity of the enterprise.

Production costs that remain virtually unchanged during the reporting period and do not depend on the business activity of the enterprise are called fixed production costs (advertising costs, rent, depreciation of fixed assets and intangible assets).

In real life, it is extremely rare to encounter costs that are purely fixed or variable in nature. Economic phenomena and the costs associated with them are much more complex in their content, and therefore, in most cases, costs are conditionally variable (or conditionally constant). In this case, a change in the organization's business activity is also accompanied by a change in costs, but unlike variable costs, the relationship is not direct. Conditionally variable (conditionally fixed) costs contain both variable and constant components. For example, telephone fees consist of a fixed subscription fee (fixed part) and long-distance calls (variable part).

Costs taken into account and not taken into account in assessments

The process of making a management decision involves comparing several alternative options with each other in order to select the best one, and the indicators can be divided into two groups. The former remain unchanged under all alternative options, the latter vary depending on the decision made. When a large number of alternatives are considered, differing from each other in many respects, the decision-making process becomes more complicated. It is advisable to compare the indicators of the second group, i.e. those that change from variant to variant. Indicators of the first group, on the contrary, are not taken into account in the assessments.

Sunk costs

These are expired costs that no alternative option can correct, i.e. these previously incurred costs cannot be changed by any management decisions.

Opportunity costs (lost profits)

In management accounting, sometimes in order to make a decision it is necessary to accrue costs that may not actually occur in the future. Such costs are called imputed. This is the lost profit of the enterprise - an opportunity that is lost or sacrificed for the sake of choosing an alternative management decision.

Marginal and incremental costs

Marginal costs and revenues represent additional costs and revenues per unit of output (good).

Incremental costs arise as a result of manufacturing or selling an additional batch of products.

Planned and unplanned costs

Planned costs are costs calculated for a certain volume of production. In accordance with norms, regulations, and estimates, they are included in the planned cost of production.

Unplanned - costs that are reflected only in the actual cost of production.

3) To carry out the functions of control and regulation in management accounting, there are:

Regulated and unregulated costs (controllable and uncontrollable)

Regulated costs are subject to the influence of the responsibility center manager; he cannot influence unregulated costs.

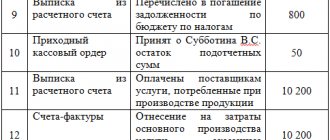

Accounting for material costs in the balance sheet

If you look at the reporting form, the material costs line is missing here. However, other accounts are used to calculate such expenses.

| Account number | Expense item |

| 20 | Main production costs |

| 21 | Semi-finished products accounting line |

| 23 | Auxiliary production costs |

| 25 (26) | Costs for general production and business processes |

| 29 | Service accounts |

Here it is necessary to clarify that according to accounting rules, accounts with indexes 25 and 26 cannot create a balance, therefore they are closed according to the financial result of each reporting period. Therefore, formulas for calculating material costs are built on the basis of the remaining accounts indicated in the table. In the assets section, inventories for material costs are reflected in line 1210.

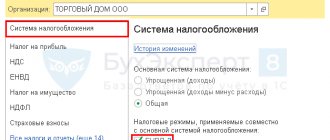

The concept of reflecting costs in 1C:ERP

Reference data for cost accounting in the ERP

Correct setup of regulatory and reference information allows you to correctly record and “collect” the cost of manufactured products. Let's look at reference books related to cost reflection.

Directory "Calculation Articles" . It reflects the list of elements in the context of which the cost is collected. It allows you to detail costs. The information in the directory is filled out at the initial stage of setting up the program; it can be supplemented in the future, but it is recommended to fill it out at the beginning of working with the ERP program. The directory is available in the "Production" section.

Fig.6 Section “Production”

The list of articles is generated using the “Create” button.

Fig.7 Creating a new costing item

When creating a new type of costing item, the “Cost Type” is limited to the names listed on the “screen”.

Fig.8 Selecting a cost type

The next reference book is “Expense Items” (CP), available in the “Financial Performance and Controlling” section.

Fig. 9 Go to the directory “Items of expenses”

The directory contains predefined articles - marked with a yellow circle. The user can supplement the directory with his own cost items, while combining them into groups.

Fig. 10 Creating a new expense item

When creating a new element and describing its characteristics, one of the important parameters is “Expense Type”, which specifies the classification of expenses according to the selected characteristics.

Fig. 11 Selection-classification for a created article from the list

Depending on the selected type of expenses, their reflection in regulated accounting is specified. The example below - “Expense type - Sales expenses”, specifies the following options for reflection in regulated accounting:

Fig. 12 Filling out the accounting regulation settings

For the next setting, the list is supplemented with the line “Reflect to production costs”.

Fig. 13 Filling out the accounting regulation settings

Each distribution option changes the fields and order of filling out the card. For example, the costing item is additionally indicated.

Fig. 14 Selecting a costing item

A rule is set to distribute the costs.

Fig. 15 Securing rule settings

The user has the opportunity to create his own expense distribution rule by right-clicking in the directory and selecting the “Create” command. For each “rule element”, a distribution method and a distribution base are specified, which determines what to distribute in proportion to:

- cost, quantity or weight of materials;

- actual or standard wage amount;

- quantity, volume or weight of products and other indicators.

Fig.16 Rule settings

The nature of the element is determined and the expense analytics type is specified.

Fig. 17 Example of creating “CP”

For the “Division” analytics, using the “Set up distribution rules for organizations and divisions” hyperlink, the user creates and sets the cost item distribution setting.

Fig.18 Creating a new setting

When describing an expense item, the costs of which are included in the cost of goods, an additional distribution rule is specified - see the list on the screenshot.

Fig. 19 Example of setting up an expense item

When writing off expenses incurred to the financial results, a distribution rule is set in 1C ERP - see the list of options on the screenshot.

Fig.20 Filling example

When assigning costs to deferred expenses, a distribution rule is also set for each element.

Fig. 21 Example of filling when classified as RBP

On the “Regulated accounting and MFP” tab, accounting settings for the “item element” are set, incl. the account for accounting for the assignment of customized “elements-articles” of the directory is set.

Fig. 22 Settings for regulating cost item accounting

On the “Restrictions of Use” tab you can see in which documents this reference book is used. Those. When filling out the listed documents, it is indicated which cost item to assign certain expenses to.

When the restriction checkbox is checked, the user can specify (limit) the list of documents in which this cost item can be used.

Fig.23 Tab “Restriction of use”

Thus, the created directory elements specify the settings for their reflection in regulated accounting and indicate the order of distribution of each type of cost in 1C:ERP.

Cost Reflection Process

Let's look at how costs are collected, where they are indicated and involved in 1C: ERP using the example of Winter Garden LLC.

Go to the “Production” - “Resource Specification” section.

Fig. 24 Transition to resource specifications

A resource specification is created for each manufactured product - product.

Fig. 25 Directory “Resource Specifications”

The “Materials and Works” tab reflects the direct costs of raw materials and materials, indicating costing items. In our example, Zimniy Sad LLC is engaged in the production and sale of furniture. For the manufacture of the product “Bedside Table” for shoes, the specification reflects the range of materials used, which relates to the costing item “Basic materials”.

Fig. 26 Attaching costing items to a document

The “Labour Costs” tab displays the types of work also indicating the costing item – in our example, “Salary”.

Fig. 27 Attaching costing items to a document

When registering production output in a document that reflects production costs, the column “Calculation Item” is highlighted. In our example, for Zimniy Sad LLC, a document “Production without an order” was generated, reflecting the production of the “Shoe Cabinets” products.

Fig. 28 Directory elements when filling out

On the “Labor Costs” tab, you can also see the calculation item for the labor costs of workers involved in the manufacture of this product - “Salary”, indicating in the “Type of work” field, in our example - “Carpentry work, 3rd category”.

Fig. 29 Costing items

The following example reflects the electricity costs for Zimniy Sad LLC, for auxiliary production, counterparty Mosenergo. On the “Expenses and Other Assets” tab of the “Purchase of Services and Other Assets” document, in the “Item of Expenses/Assets” column, the cost analytics of the reference book discussed above is indicated.

Fig. 30 Example of articles when filled out by the user

As you can see, any costs incurred are attributed to user-specified costing items or distributed among specified expense items.

Let's look at examples of reports on cost and expense analysis in 1C:ERP.

Reports on product cost analysis in 1C:ERP

Go to the "Production" - "Production Reports" section.

Fig.31 Go to production reports

The section contains a reporting block “Cost Analysis”.

Fig.32 Cost analysis reports

The report allows the user to analyze the cost by type of product with details of costing items and cost items for a given period of time in general and separately by product.

Fig. 33 Analysis report for Winter Garden LLC

For cost analysis, a group of “form reports” is provided in the “Intra-shop accounting” subsection.

Fig.34 Production reports

Using the example of the report “Movement of itemized expenses of an organization”, you can see that the expenses in the report are grouped by departments with the user highlighting the cost items specified in the document. The report shows which items are not allocated to production batches. For example, the received electricity costs of the organization Winter Garden LLC, attributed to auxiliary production, remained undistributed in the amount of 75,356.94 rubles. Those. For this amount, the month closing operation was not performed and their distribution was not completed.

Fig. 35 Item-item expenses of organizations in the Unified Plan

The report “Movement of Inventory and Materials and Costs in Production by Organization” provides the user with information on costs, grouped into sections:

- “Movement of itemized expenses”;

- “Movement of costs by production batches”;

- “Grouping costs by production batches” and others.

Fig. 36 Cost analysis report for Winter Garden LLC

In addition to specialized reports, 1C:ERP can analyze other expenses by generating a “report form” “Income and Expenses”, in the “Reports on Financial Result” group, section “Financial Result and Controlling”.

Fig. 37 Go to the report for cost analysis

The report generates information by itemizing other expenses, both in general and by area of activity, and by month of a given period.

Fig. 38 Analysis of expenses of Winter Garden LLC

Reports in 1C:ERP allow the user to see a general picture of costs and expenses for the enterprise, broken down by item-elements determined during program setup. Therefore, before starting work, it is necessary to think through their structure and correctly configure the master data.

System of linear equations in 1C:ERP

The 1C:EPP program implements a method for calculating the cost of batches using a system of linear equations. It lies in the fact that the cost is calculated in terms of accounting analytics:

- Organizations;

- Warehouses;

- Nomenclatures;

- Divisions, etc.

As a result of this calculation, the cost of one product (item) differs from its cost in another warehouse or division. Also, items with different characteristics (for example, color) may have different costs.

For additional setup of “separate accounting” of cost calculation, go to the section “Master data and administration” - “Financial result and controlling”.

Fig. 39 Go to the subsection “Financial accounting and controlling”

Here you can enable separate accounting for:

- appointments;

- transactions;

- departments or managers.

Fig.40 Setting up separate cost accounting

To calculate the cost for each analytics, the program specifies a linear equation for the correct calculation of the cost and balances in terms of details.

Analytics of enterprise performance efficiency

The following criteria are taken into account here:

- The ratio of costs and profit received - here the income from the sale of finished products is taken into account based on each ruble spent on its production;

- Material intensity - the ratio of material costs for each unit of production;

- Material productivity - calculated by dividing the cost by the materials and resources spent for production;

- Cost ratio - demonstrates the dynamics or decrease in production volumes and the profitability of the use of material costs.

Costs and their properties

The cost sharing in question is used in management and accounting. Product costs are costs that form the cost of production products. They are directly determined by the technological nuances of production and sales of products, are material, and are subject to inventory.

Periodic costs of a non-production nature; their inventory is impossible. They are “tied” not to the manufacture of products, but to the period during which they took place, and directly affect the amount of profit, bypassing the inventory stage.

From the above, the properties of two types of costs follow:

- product costs exist in the presence of production activities, but are practically absent if production is suspended or curtailed;

- costs for the period are present, even if there is no production and there are no costs for the product; they can be considered as losses of the reporting period.

Ways to reduce material costs

Such expenses usually amount to 50-60% of the cost of finished products.

Therefore, all manufacturing companies are interested in reducing such costs. During the operation of such enterprises in market conditions, a certain strategy was developed aimed at reducing production costs. These include the following decisions:

- Introduction of modern technologies aimed at waste-free production;

- Use of innovative materials;

- Optimization of production processes;

- Encouraging employees to use enterprise resources more carefully;

- Do not neglect scientific research in the manufacturing industry;

- Effective use of production waste.

The assessment of the efficiency of using material costs is determined by the method of substituting economic indicators. Let's assume that a company is engaged in the production of woodworking machines. Component parts are also produced by the structural division of this company. However, among competitors, such parts are 30% cheaper. In such a situation, it is more profitable to liquidate an unprofitable structural division and buy components from other manufacturers. Transport costs are also taken into account according to a similar scheme.

In addition, material costs for production can be reduced by reducing the number of defects and increasing the volume of products.

General principles of cost formation in agriculture

The production and sale of any product, including services and work, allows us to talk about a single list of economically homogeneous costs: material costs, labor costs, social contributions, depreciation charges, and other costs. They make it possible to evaluate production as a whole according to a number of indicators, for example, an increase (decrease) in the share of wages, depreciation and a number of others.

For an agricultural company, such consolidated categories are insufficient. As a rule, we are talking here about several types of production, and within one production - about several types of activities.

How is the cost of training for a peasant farm member ?

The structure of agricultural costs primarily takes into account the types of production and farms:

- basic;

- auxiliary;

- serving.

Each category contains the general structure mentioned above.

How to keep track of the expenses of agricultural enterprises for transporting workers to their place of work ?

The main ones, depending on the chosen areas of the company’s work, may be:

- crop production;

- livestock farming;

- industrial production, processing.

Auxiliary facilities traditionally include repair shops, transport shops, packaging shops, boiler houses, and other facilities that meet production needs. Service industries are structures related to the everyday needs of workers, for example, a canteen, a bathhouse, if they are allocated to a separate unit.

Next, costs are grouped by the place where they arose: for each team, farm, site. Large objects are accounted for in dedicated accounts and subaccounts. It is advisable to use a chart of accounts adapted for agriculture (Order of the Ministry of Agriculture No. 654 of 06/13/01).

These accounting objects are further divided into simple ones, consisting of one element. The most important grouping is by type of product (one crop, one type of animal, one type of work). Its main goal is to calculate costs and identify reserves for cost reduction. For example, in seed farming, the cost of seeds of a certain variety can be calculated, in fish farming - the cultivation of a species of fish until the moment of sale. These are objects of analytical accounting. The corresponding accounting accounts must be recorded in the working chart of accounts.

Cost is the sum of all types of resources: labor, material, energy, which are distributed among cost items. The unit of calculation is determined by the type of product (1 quintal of grain, 1 head of offspring, etc.).

When calculating the cost, products are divided into main, associated and by-products. The basis is the products for which this production was launched. The by-product is produced simultaneously with the main one, while having secondary importance. If during production two or more main products are obtained, they are considered conjugate. Example: in dairy farming, the main product is milk, the associated product is offspring, and the by-product is animal skins after slaughter, manure.

By the way! Manure can be used only if the company complies with the technology for handling such waste and has technical conditions and regulations developed in accordance with the law.