03/05/2020 Category: Money transfers

- Account 20 in NU closes on 90.08

Error closing account 20 in NU

The amounts for 43 and 10 accounts in NU are reversed at the end of the month

Error closing the month: no postings to NU for finished products

Adjustment of write-off value in accounting and tax accounting in 1C 8.2

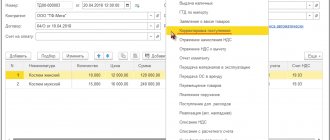

When closing the month with the routine operation Adjustment of write-off value, negative entries are made for the non-written-off item, entry 90.02.1dt - 41.01kt, the amount in red is negative.

These are the frequently asked questions about the problems of closing a month when using 20 accounts in accounting.

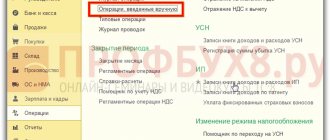

To eliminate such errors, it will often be enough to refer to the accounting policy settings. If everything is closed correctly in accounting, but errors occur in tax accounting, then the first thing that needs to be done is to check the setting in the “Income Tax” section in the current accounting and tax accounting policies. In this section, you can specify a list of cost items that should be considered direct in tax accounting. See below for more details and screenshots:

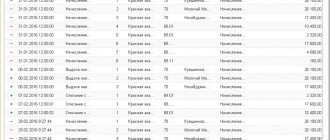

The most convenient way to analyze errors of this kind is to use the account analysis report, in the settings we select account 20.01 and in the indicators we display the amount (BU), amount (NU), amount (PR) and amount (BP). In our case, there are erroneous amounts of VR (time differences) and of course the period of interest, choose the smallest possible period for ease of analysis, in order to avoid analyzing a large amount of data.

It’s worth looking at the breakdown of amounts (NU), the transaction report. In it you can immediately see the incorrect amounts generated by routine operations.

Having restored the chronology of the formation of operations in the 1C program, we find the root cause of the error. In our case, this is an obvious incorrect closing of expenses from account 20.01 to account 90.08 using the “direct costing” method.

To eliminate this kind of error, let us turn our attention to the current accounting policy of the organization:

Open the “Income Tax” section and in this section look at the “List of direct expenses” settings. You can create a single entry specifying invoice 20.01, or you can create entries specifying specific cost items.

Then we repeat the operations of closing the month and get the result that is correct for us.

I hope that this article will help you avoid wasting a lot of time searching for and correcting errors that arise in your work.

With the end of the month, the reporting period also comes to an end, that is, the accountant will have to summarize interim results, evaluate the results of the work and analyze them. And to do this, it is necessary to close the month, i.e., adjust the indicators on balance sheet accounts, achieving the necessary accounting reliability. One of the important operations when closing the month is adjusting the cost of the item. Let us consider the main aspects of this operation, illustrating them with examples.

Write-off of main production costs

The amount of costs to be written off in the current month is determined as the difference between the debit balance of account 20 “Main production” and the balance of work in progress at the end of the month. The balances of work in progress at the end of the month are determined based on inventory data and are entered by the user into the document “Work in Process” (menu “Documents - Regular”). This document does not create any entries (entries) in accounting, but its data is used in the future by the “Month Closing” document.

After this, the costs to be written off (the positive difference between the debit balance of account 20 “Main production” and the balance of work in progress) for a specific type of item and division include:

- to the debit of account 40 “Product Output” for the corresponding type of item, if we are talking about the costs of producing finished products or semi-finished products (which, like finished products, are accepted for accounting within a month by the documents “Transfer of finished products to the warehouse”);

- to the debit of account 90 “Sales”, subaccount 90.2 “Cost of sales”, also according to the corresponding type of item - for work performed and services rendered.

The algorithm for writing off costs from account 20 “Main production” in the part attributable to the production of finished products and semi-finished products depends on setting the constant “Method of accounting for finished products and semi-finished products” (menu “Operations - Constants”), which can take one of two values:

- at planned cost;

- at actual cost.

By default, the value is set to “At actual cost”, since this is the method of accounting for finished products and semi-finished products that corresponds to the norm of paragraph 5 of PBU 5/01 “Accounting for inventories”, approved by Order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n.

Another value (“At planned cost”) is left as a reserve for cases if the configuration will be used to restore accounting records for 2001 (when PBU 5/01 was not yet in effect, and according to clause 59 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, finished products were allowed to be reflected in the balance sheet either at actual or at planned production costs.At the same time, in 2001, the new Chart of Accounts approved by the order could already be used Ministry of Finance of Russia dated October 31, 2000 No. 94n).

If an organization for certain types of activities is a payer of the single tax on imputed income (UTII), then when writing off the cost of work (services), a distribution occurs between the subaccounts of account 90.2 “Cost of sales” - 90.2.1 “Cost of sales not subject to UTII” and 90.2. 2 “Cost of sales subject to UTII.” The distribution criterion is the share of revenue from activities subject to a single tax on imputed income in the total revenue.

Let's consider closing account 20 “Main production” if finished products and semi-finished products are reflected at actual cost.

Example

Pandora LLC is engaged in the production of building materials and at the same time provides household services to the population. Activities providing household services are subject to UTII. In May 2003, finished products were produced - 610 sq.m. floor coverings (production costs amounted to 58,629 rubles) and 50 sets of double-glazed windows (costs amounted to 171,456.25 rubles). Expenses for the provision of household services to the population were incurred in the amount of RUB 25,654. Let's consider closing account 20 “Main production” in Pandora LLC for May 2003:

As a result, taking into account the calculation, the following entries will be made:

Debit 40/Floor coverings Credit 20 - RUB 58,629; Debit 40/Glass units Credit 20 - RUB 171,456.25; Debit 90.2.2/Household services Credit 20 - 25,654 rubles;

If you look directly at the debit entries of account 43 generated by the document, then for finished products and semi-finished products they are formed by the difference between the actual and planned cost of the corresponding products, since during the month it is not possible to keep records other than at the planned cost.

That is, if in the above example the planned cost of flooring was 61,000 rubles. (100 rubles per 1 sq. m.), and double-glazed windows - 170,000 rubles. (3,400 rubles per set), then when calculating the actual cost of products, the following records will be generated:

Debit 43/Floor coverings (item) Credit 40/Floor coverings (item type) - 2,371.00 (reversing entry); Debit 43/Glazed windows Credit 40/Glass windows - 1,456.25 rubles;

Thus, when writing off the costs of main production, several points can be highlighted:

1. For complex production, where the results of some stages (processes, redistributions) are used as semi-finished products for others, the calculation of the cost of finished products and semi-finished products is carried out sequentially: first, the cost of semi-finished products is calculated at the first stage of production, then at the next, etc. Calculation order determined automatically.

2. If production has a closed cycle (that is, for example, the results of the first process are used as a semi-finished product in the second, and by-products of the second, on the contrary, in the first), then the cost calculation is not automatically performed, and a corresponding warning is issued.

3. If several product items belong to one type of product, then the actual production costs are distributed in proportion to the planned cost of these products. The planned cost of finished products and semi-finished products is reflected in the credit of account 40 in the subaccount “Accounting (planned) cost”.

4. To obtain correct data, it is not recommended to change the planned cost of products and semi-finished products more than once a year, although technically it is possible to change the planned cost of a specific product or semi-finished product at any time. For more information about the method of accounting for finished products at actual cost, see paragraphs 199 - 207 of the Guidelines for accounting of material and industrial inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

5. Although the use of account 40 when accounting for finished products (and especially semi-finished products) at actual cost is not necessary, it is technically convenient, since during the month the accounting price (planned cost) is still used to reflect operations on the movement of manufactured products.

Closing of the year

Balance reform.

In order to perform this operation, you must use documents that close December; in all other cases, this operation is not available. When it is carried out, all balances of subaccounts of accounts 90 and 91 / 99 / 99.01.1 are written off to the corresponding subaccounts 90.09 and 91.09 / 99.01.1 / 84.

Closing tax accounts.

In order to perform this operation in the same way as for the previous one, it is necessary to use documents that close December; in all other cases this operation is not available. When it is carried out, all balances of NU accounts that are not intended to reflect the value of assets are written off.

Do you need proofreading or review of academic work? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Cost adjustment

Actually, this function is performed together with the write-off of the costs of the main production described above, due to the need to calculate the cost of multi-stage production.

Thus, in fact, the cost price is calculated by type of product range and subsequent adjustment of all turnover in the accounting accounts for this type of item:

- for finished products - turnover on accounts 40 “Product Output”, 43 “Finished Products” and 45 “Goods Shipped”;

- for semi-finished products - turnover on accounts 40 “Product output”, 21 “Semi-finished products of own production” and 45 “Shipped goods”.

Example (continued)

The balance of double-glazed windows in the finished product warehouse as of May 1, 2003 is 23 sets worth RUB 74,980.23. During the month, the debit turnover on the account is 43 - 50 sets in the amount of 170,000 rubles. (at planned cost - 3,400 rubles per set), credit turnover - 65 sets in the amount of 217,174.25 rubles. (moving average estimate taking into account the planned cost), including 55 sets written off for sale (RUB 184,574.15), and 10 sets shipped to customers without transfer of ownership (Debit 45 Credit 43 - RUB 32,600.10). After calculating and adjusting the cost of finished products, in addition to the entry for adjusting the debit turnover of account 43 (the previously given entry in the amount of 1,456.25 rubles), all turnover on the credit of account 43 is also adjusted, taking into account the weighted average actual cost of production. The weighted average cost of 1 set of double-glazed windows for May 2003 will be: (74,980.23 + 171,456.25) / (23 + 50) = 3,375.842 rubles. Actual cost of sold double-glazed windows: 55 x 3,375.842 = 185,671.32. Consequently, the entry is formed: Debit 90.2.1 Credit 43

- RUB 1,097.17.

Actual cost of double-glazed windows shipped without transfer of ownership: 10 x 3,375.842 = 33,758.42 rubles.

When adjusting, an entry is generated: Debit 45 Credit 43 - 1,158.32 rubles.

A similar algorithm is used to adjust turnover for account 45, only there the weighted average actual cost is determined for each counterparty and agreement separately.

It should be taken into account that the rolling estimate of the average cost, at which finished products and semi-finished products are written off during the month using the relevant documents, is “sensitive” to the order in which these documents are processed, if the actual cost of the balance on account 43 (or 21) differs from the planned cost. However, the procedure for calculating and adjusting the cost of products and semi-finished products smoothes out all differences, so there is no need to retransmit documents on the movement of products within a month.

Closing 44 accounts

Write-off of transportation expenses.

RO with the same name includes transportation costs as expenses. To determine the amount of write-off of transportation costs that relate to the balance of goods in the warehouse, the program uses the average percentage for the current month, while taking into account the carryover balance at the beginning of the month.

When posting a document, the program generates transactions for writing off from Kt account 44.01 to Dt account 90.07 the amount of direct expenses that relate to the volume of goods sold.

Write-off of other expenses (except for transport).

All balances of account 44.01 (44.02) for cost items with any other types except transport are closed to account 90.07 (90.08).

Write-off of permanent differences

The write-off of permanent differences recorded in account NPR.20 is carried out almost simultaneously with the calculation of the actual cost of finished products, semi-finished products, works and services.

The amount of permanent differences subject to write-off to the accounts of NPR.43 (in terms of differences attributable to released finished products), NPR.21 (in terms of differences attributable to released semi-finished products), NPR.99 (in terms of differences attributable to work performed and services provided, except for services within the framework of activities subject to UTII - such differences are simply written off from the NPR.20 account without indicating a correspondent account), determined by the “weighted average” formula for each type of product range, work and services. That is, the amount of permanent differences to be written off (the final balance on the debit of account NPR.20) is written off from the credit of this account in proportion to how account 20 was written off according to the corresponding analytics.

Error 3: duplicate items

Let's move on to the third line. Here the situation will be different; when entering the nomenclature, we display two lines with the same name, but a different code. This indicates that there has been a duplication of nomenclature positions in the database.

If we generate the “Subconto Analysis” report, we will see that we are trying to write off the wrong item. This can be solved very simply. In the “Request-invoice” document, select the correct item, forward and open the transactions in order to make sure that the write-off was successful.

And one more important point that will help you avoid some mistakes when writing off materials: when writing off materials, I advise you to use the “Selection” button instead of the “Add” button. In the form that opens, you can set the switch to the “Only balances” position, and only those item items for which there are balances will be visible on the screen.

Calculation of the average price in the 1C program

Let's look at how the average price for the “Apple jam” position is calculated. For example, before it was written off, there were only two receipts of apple jam in your store.

100 kilograms of apples x 1000 rubles = 100,000 rubles;

80 kilograms of apples x 1200 rubles = 96,000 rubles;

The average write-off amount will be equal to (100,000 + 96,000)/(100+80) = 108.89 rubles.

We multiply the resulting amount by 120 kilograms of apples and get 130,666.67.

At the moment, during the write-off, we used the moving average.

After the write-off, another receipt occurred. We received 50 kilograms of apples for 1,100 rubles.

Based on this, the average weighted amount for the month will be equal to:

(100,000+55,000 + 96,000)/(100+50+80) = 1091.30 rubles. If we multiply this by 120, we get a sum equal to 130,956.52.

The difference that we get by subtracting one value from another will be written off in 1C when closing the month and after performing the “Adjustment of item cost” operation. It is important to remember that 1C rounds the amount, so there may be a difference of 1 kopeck.