I. General provisions

1. This Regulation establishes the rules for the formation in accounting of information on the costs associated with fulfilling obligations under received loans and credits (including commodity and commercial credit), including raising borrowed funds by issuing bills, issuing and selling bonds for organizations that are legal entities persons under the legislation of the Russian Federation (with the exception of credit organizations and budgetary institutions).

2. This Regulation does not apply to interest-free loan agreements and government loan agreements.

Tax accounting under an interest-free loan agreement

TAX ACCOUNTING FOR THE BORROWER ORGANIZATION

income tax

Despite the fact that the use of interest-free loans is permitted by law, organizations that enter into such agreements may encounter certain problems related to the calculation of income tax. This applies to organizations acting as borrowers under an interest-free loan agreement, to whom the tax authorities make claims regarding savings on interest for the use of borrowed funds.

The amount of the interest-free loan itself is not subject to taxation, since on the basis of subparagraph 10 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), the following income is not taken into account for tax purposes:

“In the form of funds or other property received under credit or loan agreements (other similar funds or other property, regardless of the form of registration of borrowings, including securities under debt obligations), as well as funds or other property received to repay such borrowings "

But with regard to non-accrued interest, the position of the tax authorities was as follows: an organization receiving an interest-free loan has a tax base for income tax in the form of the amount saved on interest. Employees of the Ministry of Taxation justified their position by saying that an organization's receipt of a loan should be considered as the provision of a financial service to it, and in this case, this service is considered free of charge, since no interest is charged when providing an interest-free loan. And then, turning to paragraph 8 of Article 250 of the Tax Code of the Russian Federation, according to which the following income is recognized as non-operating income of a taxpayer:

“In the form of gratuitously received property (work, services) or property rights, except for the cases specified in Article 251 of this Code. When receiving property (work, services) free of charge, income is assessed based on market prices determined taking into account the provisions of Article 40 of this Code, but not lower than the residual value determined in accordance with this chapter - for depreciable property and not lower than production (acquisition) costs. - for other property (work performed, services provided). Information on prices must be confirmed by the taxpayer - the recipient of the property (work, services) with documents or by conducting an independent assessment.”

Thus, when receiving an interest-free loan, the borrowing organization receives non-operating income in the form of a service received free of charge.

The tax authorities also consider the provisions of subparagraph 15 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation to be indirect confirmation of their position, which states that for VAT purposes, the provision of a loan is considered a financial service.

Some tax officials even try to prove that when using an interest-free loan, the organization receives a material benefit, citing the provisions of Article 212 of the Tax Code of the Russian Federation.

Based on all this, the tax authorities insist that the borrower organization must calculate the amount of unpaid interest at the refinancing rate of the Central Bank of the Russian Federation, and bring it under income tax.

It must be said that this position of the Ministry of Taxation workers is more than controversial. Let us present the arguments on the basis of which a taxpayer can prove that when receiving an interest-free loan, he does not have an obligation to include the amount of unaccrued interest in the income tax base.

First, we will present the reasons why the provision of a loan cannot be considered a financial service for profit tax purposes. Let us turn to the concept “A service for tax purposes is an activity whose results do not have material expression and are sold and consumed in the process of carrying out this activity.”

As we can see, this definition contains one of the mandatory features of a service: the implementation of performance results. In relation to interest-free loans, this criterion is not observed, since the activity of the lender ends at the moment when the loan is transferred, and the borrower consumes the results of the activity only after its completion. Therefore, an interest-free loan cannot be considered a financial service for tax purposes.

An interest-free loan cannot be classified as property received free of charge. In accordance with paragraph 2 of Article 248 of the Tax Code of the Russian Federation:

“For the purposes of this chapter, property (work, services) or property rights are considered received free of charge if the receipt of this property (work, services) or property rights is not associated with the occurrence of an obligation on the recipient to transfer the property (property rights) to the transferor (perform for the transferor work, to provide to the transferor Under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal amount of other things received by him of the same kind and quality

. The loan agreement is considered concluded from the moment of transfer of money or other things.”

That is, in relation to the loan agreement, the provisions of Article 248 of the Tax Code of the Russian Federation are not fulfilled, therefore, the provision of an interest-free loan cannot be recognized as property received free of charge.

The assertion of the tax authorities that receiving an interest-free loan presupposes the receipt of material benefits by a business entity is also unfounded.

The fact is that the concept of “material benefit” is defined only in relation to individuals. Chapter 23 of the Tax Code of the Russian Federation contains a direct reference to material benefit, but this concept is used when determining personal income tax. In Chapter 25, “Organizational Income Tax,” there is no mention of material benefits in the form of savings on interest. But to draw an analogy between completely two different taxes, namely, personal income tax and income tax, is at least inappropriate. Therefore, if for profit tax purposes there is no concept of material benefit, then this concept and calculation procedure cannot be transferred from the chapter regulating another tax.

This conclusion, in particular, is formulated in the Resolution of the Federal Antimonopoly Service of the North-Western District dated November 24, 2003 in case No. A56-15631/03, in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 3, 2004 No. 3009/04 “On the validity of invalidating the decision of the Inspectorate Ministry of the Russian Federation for Taxes and Duties in the Leninsky District of the City of Samara, since the borrower, after receiving a loan, always has the obligation to return the property to the lender” and in other documents. The tax authorities also agreed with the conclusions of the Presidium of the Supreme Arbitration Court of the Russian Federation. On the pages of the magazine “Glavbukh” (No. 19, 2004), the head of the Department of Profit Taxation (Income) of the Federal Tax Service of the Russian Federation, Karen Ohanyan, reported that tax inspectorates should not require that material benefits from interest-free loans be included in income. Later, the position of the tax authorities was expressed in the Letter of the Federal Tax Service of the Russian Federation dated January 13, 2005 No. 02-1-08 / [email protected] “On the issue of accounting for tax purposes of an interest-free loan,” which states:

“The Federal Tax Service reports the following. Letter No. 04-02-03/91 of the Ministry of Finance of the Russian Federation dated May 20, 2004 clarified that Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) does not contain provisions that establish the procedure for determining income for tax purposes. in cases where the taxpayer receives an interest-free loan. According to Article 41 of the Tax Code of the Russian Federation, income is recognized as an economic benefit in monetary or in-kind form, taken into account if it is possible to assess it and to the extent that such benefit can be assessed, and determined in accordance with the chapters “Tax on personal income”, “Tax on profit (income) of organizations”, “Tax on capital income” of the specified Tax Code of the Russian Federation. Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation does not provide an assessment of the “economic benefit” for using an interest-free loan.

Thus, the unpaid amount of interest for income tax purposes is not considered as income for the borrower.”

.

VALUE ADDED TAX

Paragraph 2 of Article 171 of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation provides the taxpayer with the right to deduct the “input” tax paid by him when purchasing goods (work, services) on the territory of the Russian Federation for carrying out taxable transactions, except for cases where the amount “ input tax is taken into account in the cost of goods (work, services) established by paragraph 2 of Article 170 of the Tax Code of the Russian Federation.

In addition, tax amounts paid by the taxpayer when importing goods into the customs territory of Russia under the customs regimes of release for free circulation, temporary import and processing outside the customs territory are accepted for deduction.

Note!

In relation to goods (work, services) purchased by a taxpayer on the territory of Russia, tax legislation links the provision of a deduction with the condition of payment of the cost of goods (work, services) to the supplier who presented this tax for payment. In relation to import transactions, the deduction is provided regardless of whether the taxpayer has settled with the counterparty or not. When importing, VAT is paid not to the supplier of imported goods, but to the customs authorities during customs clearance and relates to customs payments. In this regard, VAT paid to customs authorities when importing goods into the territory of the Russian Federation is accepted for deduction as goods are accepted for accounting according to primary accounting documents, regardless of the fact of its sale and payment to the supplier.

Article 172 of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation establishes general and special rules for the application of tax deductions.

The general rules are established by paragraph 1 of Article 172 of the Tax Code of the Russian Federation, these include:

- goods (work, services), including fixed assets and intangible assets, which must be accepted by the taxpayer for accounting;

- the VAT charged on them must be paid by the taxpayer;

- The taxpayer must have an invoice and payment documents in his hands. Moreover, the amount of tax in the invoice, settlement documents, and primary accounting documents must be highlighted on a separate line.

If the taxpayer meets all of the above conditions, he is entitled to a deduction. Note!

The main document serving as the basis for receiving a deduction is, of course, an invoice received from the supplier of goods (works, services), duly executed. However, this is not the only document on which a taxpayer can receive a deduction. The Tax Code of the Russian Federation allows you to receive a deduction on other documents in the cases provided for in subparagraphs 3, 6-8 of Article 171 of the Tax Code of the Russian Federation. Article 172 of the Tax Code of the Russian Federation also contains special rules for the application of tax deductions.

Paragraph 2 explains the amount of deduction provided if the taxpayer pays his counterparty for purchased goods (work, services) with his own property (including a third party’s bill of exchange). When using his own property as payment, the taxpayer has the right to deduct not the amount of tax that the counterparty indicated in his invoice, but the amount of tax calculated on the basis of the book value of the transferred property, taking into account its revaluations and depreciation, which are carried out in in accordance with the legislation of the Russian Federation.

When considering the procedure for applying tax deductions, one cannot ignore one more document. We are talking about the Determination of the Constitutional Court of the Russian Federation of April 8, 2004 No. 169-O “On the refusal to accept for consideration the complaint of the limited liability company Prom Line about the violation of constitutional rights and freedoms by the provision of paragraph 2 of Article 171 of the Tax Code of the Russian Federation.” Let us recall that this Determination was made by the Constitutional Court in relation to a taxpayer who was denied by the tax authority to reimburse the amount of tax paid to the supplier by offsetting counterclaims.

Moreover, by refusing to accept a specific complaint from a taxpayer, the Constitutional Court formulated and expressed its position regarding the procedure for applying tax deductions for VAT. The conclusions of the Constitutional Court with this Definition can, without exaggeration, be called a “new reading” of tax legislation, in particular, Article 171 of the Tax Code of the Russian Federation.

It follows directly from the text of paragraph 2 of Article 171 of the Tax Code of the Russian Federation that the basis for deducting VAT from the taxpayer is the fact of payment to the supplier. When payment is made in money, the tax authorities do not make any special claims, but if the calculation is carried out in a different way, then controversial issues often arise, for example, regarding offsets.

The Constitutional Court of the Russian Federation has already touched upon the topic of applying deductions using non-monetary forms of payment in its Resolution No. 3-P dated February 20, 2001 “On the case of checking the constitutionality of paragraphs of the second and third paragraph 2 of Article 7 of the Federal Law “On Value Added Tax” in connection with the complaint of the closed joint stock company "Vostoknefteresurs". Considering this problem then, the Constitutional Court of the Russian Federation confirmed the right of taxpayers to deduction when using non-monetary forms of payment, pointing out that the amounts of tax actually paid to suppliers mean the costs actually incurred by the taxpayer (in the form of alienation of part of the property in favor of the supplier) to pay accrued by the supplier tax amounts.

It would seem that everything is clear and understandable. Payment to the supplier can be made not only in cash, but also with any other property owned by the taxpayer.

However, continuing the discussion regarding the amounts of tax actually paid to suppliers, in its April Ruling the Constitutional Court went further and noted that in order to accept the tax for deduction, in addition to establishing the fact of payment, it is necessary to analyze the costs incurred by the taxpayer in order to answer the question of what they represent represent the funds with which the taxpayer settled with the counterparty. As a result of “logical” reasoning, the Constitutional Court came to the following conclusions:

- if payment for goods (work, services) to the supplier is made with his own property (including securities, bills, property rights), then the taxpayer’s right to deduction arises only if the transferred property was previously received by him or under a compensated transaction and at the time accepting for deduction tax amounts that have been fully paid, or as payment for goods sold (work performed, services rendered). If the transferred property is not paid in full, then the amount of tax accepted for deduction from the taxpayer must be calculated according to the share in which the property is paid;

- if property previously received by the taxpayer free of charge is transferred as payment, then the taxpayer does not have the right to a tax deduction at all, since the latter does not incur any real costs;

- if payment to the supplier is made in cash, then the right to deduction arises only when these funds are received by the taxpayer as payment for goods (work, services) sold by him. If borrowed funds are used for payment, then the taxpayer’s right to deduction arises only when the latter has paid off the creditor.

After the appearance of the Ruling of the Constitutional Court of the Russian Federation of April 8, 2004 No. 169-O “On the refusal to accept for consideration the complaint of the limited liability company Prom Line about the violation of constitutional rights and freedoms by the provision of paragraph 2 of Article 171 of the Tax Code of the Russian Federation,” opinions Tax officials were divided, and the leadership of the tax department - the Federal Tax Service and the Ministry of Finance of Russia - generally refrained from making official comments.

However, on the ground, regulatory agencies immediately adopted the arguments of the Constitutional Court. Naturally, today a huge number of organizations are in the dark about whether they can or cannot receive a tax deduction if the company paid for goods (work, services) with borrowed funds.

It should be noted that the Constitutional Court itself realized that, while protecting the interests of the budget, it “overdid it” somewhat. First, the secretariat of the Constitutional Court explained that the mere fact of purchasing a product with an outstanding loan cannot prevent a tax refund, and the Ruling of the Constitutional Court of the Russian Federation of April 8, 2004 No. 169-O “On the refusal to accept for consideration a complaint from a limited liability company” Prom Line" for violation of constitutional rights and freedoms by the provisions of paragraph 2 of Article 171 of the Tax Code of the Russian Federation" should be taken into account only in non-monetary settlements, or when the purchase and sale transaction appears initially doubtful. And then the Ruling of the Constitutional Court of the Russian Federation of November 4, 2004 No. 324-O appeared “At the request of the Russian Union of Industrialists and Entrepreneurs (employers) for an official clarification of the Ruling of the Constitutional Court of the Russian Federation of April 8, 2004 No. 169-O on the refusal to accept to the consideration of the complaint of the limited liability company "Prom Line" about the violation of constitutional rights and freedoms by the provisions of paragraph 2 of Article 171 of the Tax Code of the Russian Federation", in which the Constitutional Court once again emphasized (already officially) that any taxpayer who has applied for payment for goods or . True, both of these statements, which inspire optimism, were made by the high court with a very significant caveat: the buyer can receive a deduction only if the supplier paid VAT to the budget in cash. It turns out that the tax authorities have an extra argument for refusing the deduction - a reference to the supplier’s dishonesty. However, it will be somewhat more difficult for the tax authorities to convince arbitration that the seller has not paid VAT than to prove that the buyer has an outstanding loan.

As we can see, clarifications can serve taxpayers well. Firstly, the court made it clear that the Decree of the Constitutional Court of the Russian Federation of April 8, 2004 No. 169-O “On the refusal to accept for consideration the complaint of the limited liability company Prom Line about the violation of constitutional rights and freedoms by the provision of paragraph 2 of the article 171 of the Tax Code of the Russian Federation” still concerns a specific case (Prom Line LLC) and cannot be referred to when considering other cases. Secondly, the reality of costs principle does not apply to firms whose transactions are economically justified. Until this point, a credit for VAT paid with borrowed funds can be applied. In the event that the supplier’s “bad faith” is proven, it is unlikely that it will be possible to obtain a deduction, despite the fact that such a right is granted by the Tax Code of the Russian Federation.

Thus, if the taxpayer has no signs of dishonesty, and payment for purchased goods, works, services is made from the organization’s current account with funds generated, including from borrowed funds, then the loan debt cannot serve as a basis for refusal to apply tax VAT deductions. This is indicated in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 14, 2004 No. 4149/04 “On invalidating the decision of the inspection of the Ministry of Taxes of the Russian Federation for the Chkalovsky district of the city of Yekaterinburg dated August 11, 2003 No. 12-8/557 on the recovery from Eurofurniture Factory LLC” fine under paragraph 1 of Article 122 of the Tax Code of the Russian Federation.”

And in conclusion of the issue under consideration, we note that the financial department regarding the offset of tax amounts paid with borrowed funds gave a positive answer in its Letter dated June 28, 2004 No. 03-03-11/109. Therefore, taxpayers can be advised to use this document in their practice, because compliance with official explanations of the Ministry of Finance is a circumstance that excludes the company’s guilt (Article 111 of the Tax Code of the Russian Federation). So, the use of this Letter will help to avoid tax sanctions, even if the VAT tax deduction is recognized as unlawful.

Note!

Often, an accountant has questions about the refund of “input” VAT on purchased goods (work, services) used by the taxpayer to carry out activities subject to taxation, provided that a third party paid for these goods (work, services). The point of view of the tax authorities on this issue is as follows: if a third party has paid for goods (work, services), then the taxpayer does not have the right to a deduction. Apparently this position is based on a literal reading of paragraph 2 of Article 171 of the Tax Code of the Russian Federation:

“Amounts of tax presented to the taxpayer and paid by him

when purchasing goods (works, services) on the territory of the Russian Federation.”

It seems that this interpretation of the text of the Tax Code of the Russian Federation is not entirely legal. The text of the Tax Code of the Russian Federation itself does not contain a requirement that the taxpayer must

pay for the specified goods (work, services). If an organization does not have enough funds to pay suppliers for purchased products, materials or goods, it can turn to other organizations to make payments for it.

An organization enters into a loan agreement with another organization and indicates in the agreement that the funds must be transferred to a third organization (supplier). In this case, the agreement must contain the information listed above.

The organization must notify its supplier that funds will be transferred by another organization. In addition, you need to obtain a copy of the payment order from the paying organization as confirmation that the goods have actually been paid for.

In the case when payment is made and the goods are received and accepted for accounting, the organization can present the amount of VAT paid for deduction on the basis of paragraph 2 of Article 171 of the Tax Code of the Russian Federation. In accordance with the provisions of paragraph 1 of Article 172 of the Tax Code of the Russian Federation, in order to obtain the right to deduction, the following conditions must be met:

- purchased goods are accepted for accounting;

- goods have been paid for;

- there is a properly executed invoice;

- There are documents confirming the actual payment of tax amounts.

This article of the Tax Code of the Russian Federation does not contain a provision regulating the payment procedure, that is, it does not directly say that an organization can claim VAT for deduction only if it pays for goods independently, transferring money from its current account.

In the case when a loan agreement is concluded under which the lender transfers funds to the supplier, it should be borne in mind that according to Article 807 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the loan agreement is considered concluded from the moment when the money was transferred, and Article 224 of the Civil Code of the Russian Federation establishes that money is considered transferred when it actually comes into the possession of the acquirer or the person indicated by him

. Thus, if the loan agreement states that money must be transferred to the current account of a third party, then after receiving it by the supplier, it is considered that the money has been received by the borrower and, therefore, payment for the purchased goods is made at the expense of the borrower.

Today, there is a positive arbitration practice that proves that even if material and production resources are paid for by a third party, the taxpayer has the right to a deduction. See Resolution of the Federal Antimonopoly Service of the Central District dated January 15, 2002 in case No. A23-2248/01A-5-152. This Resolution states that as a result of an audit for the period from April 1, 1998 to April 31, 2001, the Inspectorate of Taxation made a decision to hold the LLC liable for taxation for committing a tax offense, which, in the opinion of the tax authority, was an unjustified offset of the amount of VAT on acquired assets , payment for which was made by third parties.

The Tax Inspectorate believed that the moment when such a VAT offset can be made is not the date of payment by third parties for valuables acquired and registered by the LLC, but the date of repayment by the company of its debt to third parties.

The LLC filed a lawsuit to invalidate the decision of the tax inspectorate regarding the additional assessment of VAT, penalties for late payment of VAT, the application of a fine on the basis of Article 122 of the Tax Code of the Russian Federation, as well as regarding the requirement to reduce the amounts of VAT calculated in excess.

The arbitration court's decision satisfied the claims. The decision of the appellate court upheld the decision.

The cassation instance, considering this case based on the complaint of the Inspectorate of Taxes, did not find any grounds for canceling or changing the appealed decision and resolution. The court rightfully determined that amounts of “input” VAT on acquired values paid for by third parties are accepted for offset.

Analyzing the norms of tax legislation and the circumstances of the case in the aggregate, the court came to a reasonable conclusion that the right to offset the value added tax on purchased inventory assets arises with the payer - the buyer, provided that he receives the goods in accordance with the established rules, and also payment of the cost of delivery, regardless of who made such payment and due to what civil law relations.

TAX ACCOUNTING FOR THE ORGANIZATION - LENDER

VALUE ADDED TAX

Subparagraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation, the object of VAT taxation, recognizes transactions for the sale of goods (work, services) on the territory of the Russian Federation, including collateral and the transfer of goods (results of work performed, services rendered) under an agreement on the provision of compensation or innovations, as well as transfer of property rights.

According to subparagraph 15 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation, the issuance of an interest-free loan in cash is not subject to VAT (exempt from taxation).

In paragraph 3 of Article 149 of the Tax Code of the Russian Federation, operations for the provision of funds on a loan are referred to as a financial service only for the purpose of exemption from value added tax.

In addition, paragraph 28 of the Methodological Recommendations for the application of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation, approved by Order of the Ministry of Taxes and Taxes of the Russian Federation dated December 20, 2000 No. BG-3-03/447 “On approval of the Methodological Recommendations for the application of Chapter 21 “Value Added Tax” added value" of the Tax Code of the Russian Federation", an explanation was given that when applying subparagraph 15 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation, the fee for lending funds is not subject to VAT.

The provision of services for providing a loan in another form is subject to VAT, since the transfer of ownership takes place, albeit on a repayable basis.

INCOME TAX

According to paragraph 12 of Article 270 of the Tax Code of the Russian Federation, when determining the tax base, the following expenses are not taken into account:

“In the form of funds or other property that are transferred under credit or loan agreements (other similar funds or other property, regardless of the form of registration of borrowings, including debt securities), as well as in the form of funds or other property that are used to repay such borrowings” .

Paragraph 6 of Article 250 of the Tax Code of the Russian Federation establishes that non-operating income of a taxpayer is recognized as income in the form of interest received under loan agreements, credit agreements, bank accounts, bank deposits, as well as on securities and other debt obligations.

Non-operating expenses include expenses in the form of interest on debt obligations of any type, including interest accrued on securities and other obligations issued (issued) by the taxpayer, taking into account the features provided for in Article 269 of the Tax Code of the Russian Federation (subparagraph 2 of paragraph 1 of Article 265 Tax Code of the Russian Federation). In this case, interest on debt obligations of any type is recognized as an expense, regardless of the nature of the credit or loan provided (current and (or) investment). Expenses are recognized only as the amount of interest accrued for the actual time of use of borrowed funds (the actual time the said securities were held by third parties) and the yield established by the issuer (lender).

Thus, operations involving the transfer of funds under an interest-free loan agreement are not taken into account when calculating the tax base for profits for both the borrower organization and the lender organization. Since, based on the above, when calculating the tax base for profit, only interest received and paid under concluded loan agreements are recognized as income and expenses, respectively. Negative amount and exchange rate differences for the borrower's organization under interest-free agreements do not reduce taxable profit.

II. The procedure for accounting for debt on received loans, credits, issued borrowed obligations

3. The principal amount of debt (hereinafter referred to as the debt) for a loan and (or) credit received from the lender is taken into account by the borrower organization in accordance with the terms of the loan agreement or credit agreement in the amount of funds actually received or in the valuation of other things provided for by the agreement.

4. The borrower organization accepts for accounting the debt specified in paragraph 3 of these Regulations at the time of the actual transfer of money or other things and reflects it as accounts payable. In case of non-fulfillment or incomplete fulfillment by the lender of the loan agreement and (or) credit agreement, the borrower organization provides information about the shortfalls in the explanatory note to the annual financial statements.

5. The debt of the borrower's organization to the lender for received loans and credits in accounting is divided into short-term and long-term. The specified short-term and (or) long-term debt may be urgent and (or) overdue. For the purposes of this Regulation:

- short-term debt is considered to be debt on received loans and credits, the repayment period of which, according to the terms of the agreement, does not exceed 12 months;

- long-term debt is considered to be debt on received loans and credits, the repayment period of which, according to the terms of the agreement, exceeds 12 months;

- urgent debt is considered to be debt on received loans and credits, the repayment period of which, according to the terms of the agreement, has not come or has been extended (prolonged) in the prescribed manner;

- Overdue debt is considered to be debt on received loans and credits whose repayment period has expired according to the terms of the agreement.

6. In accordance with the accounting policy established in the borrower’s organization, the borrower may transfer long-term debt into short-term debt or account for borrowed funds at its disposal, the repayment period of which under a loan or credit agreement exceeds 12 months, before the expiration of the specified period as part of long-term debt. When choosing the first option, the transfer of long-term debt on received loans and credits to a short-term debt organization is carried out by the borrower at the moment when, according to the terms of the loan and (or) credit agreement, there are 365 days left before the repayment of the principal amount of the debt. The borrower organization, upon expiration of the payment period, is obliged to ensure the transfer of urgent debt to overdue. The transfer of urgent short-term and (or) long-term debt on received loans and credits into overdue is carried out by the borrower organization on the day following the day when, under the terms of the loan and (or) credit agreement, the borrower was supposed to repay the principal amount of the debt.

7. In cases provided for by law, an organization can raise borrowed funds by issuing bills, issuing and selling bonds (hereinafter referred to as issued loan obligations).

8. Analytical accounting of debt on loans and credits received, including issued borrowed obligations, is carried out by type of loans and credits, credit institutions and other lenders who provided them, individual loans and credits (types of borrowed obligations).

9. The debt on a loan provided to the borrower and (or) credit received or denominated in foreign currency or conventional monetary units is taken into account by the borrower in ruble valuation at the exchange rate of the Central Bank of the Russian Federation in effect on the date of the actual transaction (provision of credit, loan, including placement borrowed obligations), and in the absence of the exchange rate of the Central Bank of the Russian Federation - at the rate determined by agreement of the parties.

10. The return by the borrower organization of the loan received from the lender, including placed loan obligations (principal amount of the debt), is reflected in the borrower’s accounting records as a reduction (repayment) of the specified accounts payable.

GLAVBUKH-INFO

The organization received an interest-bearing loan in the amount of 600,000 rubles. According to the agreement, interest on the loan is accrued at a rate of 25% per annum on a monthly basis based on the number of days the agreement is valid in the current month from the day following the day the loan was issued until the day the loan is repaid inclusive. The loan was received on January 12, 2015 and returned on May 12, 2015. Borrowed funds were used to purchase goods.Interim financial statements are prepared by the organization on a monthly basis.

Account correspondence:

Civil relations

In accordance with paragraph 1 of Art. 807 of the Civil Code of the Russian Federation, under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him same kind and quality. The loan agreement is considered concluded from the moment the money or other things are transferred.

According to paragraph 1 of Art. 809 of the Civil Code of the Russian Federation, unless otherwise provided by law or the loan agreement, the lender has the right to receive interest from the borrower on the loan amount in the amount and in the manner specified in the agreement. In the absence of another agreement, interest is paid monthly until the day the loan amount is repaid (clause 2 of Article 809 of the Civil Code of the Russian Federation).

The borrower is obliged to return the received loan amount to the lender on time and in the manner provided for in the loan agreement (Clause 1 of Article 810 of the Civil Code of the Russian Federation).

Accounting

For accounting purposes, the amounts of loans received are not recognized as income of the borrowing organization, since they do not meet the conditions for recognizing income established by clause 2 of the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n (receipt borrowed funds is not a receipt of assets leading to an increase in the organization’s capital).

When returning (repaying) the loan amount, no expenses arise in the accounting of the borrower organization due to clause 3 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n.

In accordance with paragraphs 2, 5 of the Accounting Regulations “Accounting for expenses on loans and credits” (PBU 15/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n, funds received (returned) under the loan agreement , are reflected in accounting as the occurrence and repayment of the corresponding accounts payable.

Interest payable to the lender according to the terms of the agreement is taken into account as part of other expenses evenly (monthly) during the term of the loan agreement in the amount accrued for the current month. This follows from paragraph. 2 clause 3, clauses 6, 7, 8 PBU 15/2008, clauses 11, 14.1, 16, 18 PBU 10/99.

Accrued interest amounts are reflected in accounting separately from the principal amount of the obligation for the loan received (clause 4 of PBU 15/2008).

Accounting records reflecting the transactions under consideration are made in the manner established by the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, and are shown below in the table of entries.

Value added tax (VAT)

Operations for the provision of loans in cash, as well as interest on them, are not subject to VAT on the basis of paragraphs. 1 item 2 art. 146, paragraphs. 1 clause 3 art. 39, pp. 15 clause 3 art. 149 of the Tax Code of the Russian Federation.

Consequently, the borrowing organization does not have any tax consequences for VAT either when receiving or returning the loan amount, or when paying interest.

Corporate income tax

In tax accounting, funds received under a loan agreement and returned to the lender are not taken into account when determining the tax base for income tax, either as income or as expenses (clause 10, clause 1, article 251, clause 12, article 270 of the Tax Code RF).

As a general rule, interest on debt obligations of any type is taken into account as part of non-operating expenses based on paragraphs. 2 p. 1 art. 265 of the Tax Code of the Russian Federation, taking into account the features provided for in Art. 269 of the Tax Code of the Russian Federation.

In general, in accordance with paragraph 1 of Art. 269 of the Tax Code of the Russian Federation, interest on loans is recognized as an expense based on the actual rate stipulated by the agreement. This procedure is valid from 01/01/2015. However, there are a number of exceptions to this rule. For detailed information on changes in the accounting procedure for interest on debt obligations, see the Practical Guide to Income Tax, as well as the Practical Commentary on the main changes to tax legislation since 2015.

When applying the accrual method, expenses in the form of interest under a loan agreement are recognized monthly (at the end of each month during the term of the loan agreement and on the date of repayment of the loan) based on the interest rate established by the loan agreement and the number of days of use of borrowed funds in the reporting period. This follows from the totality of the norms in paragraph. 2, 3 p. 4 art. 328, para. 1, 3 p. 8 art. 272, para. 2 pp. 2 p. 1 art. 265 Tax Code of the Russian Federation.

In the case of accounting for income and expenses on a cash basis, interest expenses are recognized on the date of actual repayment of the debt for their payment (clause 1, clause 3, article 273 of the Tax Code of the Russian Federation).

Application of PBU 18/02

When using the cash method in tax accounting, if the accrual and payment of interest will be made in different reporting periods (months), in accounting in the month of accrual of interest, deductible temporary differences will arise (in the amount of accrued interest) and corresponding deferred tax assets, which will be repaid on the date of payment of interest (clauses 11, 14, 17 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n).

In this consultation, accounting entries are shown in the table of entries based on the assumption that interest is paid in the month of accrual, i.e. the above differences do not arise.

Analytical account symbols used in the posting table

To balance sheet account 66 “Settlements for short-term loans and borrowings”:

66-o “Calculation of the principal amount of the loan”;

66-p “Calculations of interest on loans.”

| Credit | Amount, rub. | Primary document | ||

| Received funds under a loan agreement | 51 | 66-o | 600 000 | Loan agreement, Bank account statement |

| Interest accrued on the loan for January (600,000 x 25% / 365 x 19) | 91-2 | 66-p | 7808,22 | Loan agreement, Accounting statement |

| Interest amount transferred to the lender | 66-p | 51 | 7808,22 | Bank account statement |

| Interest accrued on the loan for February (600,000 x 25% / 365 x 28) | 91-2 | 66-p | 11 506,85 | Loan agreement, Accounting statement |

| Interest amount transferred to the lender | 66-p | 51 | 11 506,85 | Bank account statement |

| Interest accrued on the loan for March (600,000 x 25% / 365 x 31) | 91-2 | 66-p | 12 739,73 | Loan agreement, Accounting statement |

| Interest amount transferred to the lender | 66-p | 51 | 12 739,73 | Bank account statement |

| Interest accrued on the loan for April (600,000 x 25% / 365 x 30) | 91-2 | 66-p | 12 328,77 | Loan agreement, Accounting statement |

| Interest amount transferred to the lender | 66-p | 51 | 12 328,77 | Bank account statement |

| Interest accrued on the loan for May (600,000 x 25% / 365 x 12) | 91-2 | 66-p | 4931,51 | Loan agreement, Accounting statement |

| Interest for May and funds to repay the principal amount of the loan were transferred to the lender (4931.51 + 600,000) | 66-p,66-o | 51 | 604 931,51 | Bank account statement |

M. S. Radkova Consulting and Analytical Center for Accounting and Taxation

| < Previous | Next > |

III. Composition and procedure for recognizing costs for loans and credits

11. Costs associated with obtaining and using loans and credits include:

- interest payable to lenders and creditors on loans and credits received from them;

- interest, discount <*> on bills and bonds due for payment; ——————————— <*> In relation to the circulation of bills of exchange in these Regulations, discount means the difference between the amount specified in the bill of exchange and the amount of funds actually received or their equivalents when placing this bill.

- additional costs incurred in connection with obtaining loans and credits, issuing and placing debt obligations;

- exchange rate and amount differences related to interest payable on loans and credits received and denominated in foreign currency or conventional monetary units, arising from the moment interest is accrued under the terms of the agreement until their actual repayment (transfer).

12. Costs for loans and credits received must be recognized as expenses for the period in which they were incurred (hereinafter referred to as current expenses), with the exception of that part of them that is subject to inclusion in the cost of the investment asset. For the purposes of these Regulations, an investment asset is understood as an object of property, the preparation of which for its intended use requires significant time.

13. Investment assets include fixed assets, property complexes and other similar assets that require a lot of time and costs for acquisition and (or) construction. The specified objects purchased directly for resale are accounted for as goods and are not classified as investment assets.

14. Inclusion in current expenses of costs for loans and credits is carried out in the amount of payments due in accordance with loan and credit agreements concluded by the organization, regardless of the form in which and when these payments are actually made. The costs of loans and credits received, included in the current expenses of the organization, are its operating expenses and are subject to inclusion in the financial result of the organization, except for the cases provided for in paragraph 15 of these Regulations.

15. If an organization uses funds from received loans and credits to make advance payments for inventories, other valuables, works, services, or to issue advances and deposits to pay for them, then the costs of servicing these loans and credits are charged by the borrowing organization to increase in accounts receivable arising in connection with prepayment and (or) issuance of advances and deposits for the above purposes. When the borrower’s organization receives inventory and other valuables, performs work and provides services, further accrual of interest and other expenses associated with servicing received loans and credits are reflected in accounting in the general manner - with these costs being allocated to the operating expenses of the organization — the borrower.

16. The organization accrues interest on received loans and credits in accordance with the procedure established in the loan agreement and (or) credit agreement.

17. Debt on loans and credits received is shown taking into account the interest due at the end of the reporting period in accordance with the terms of the agreements.

18. Interest, discount on bills of exchange, bonds and other issued loan obligations are taken into account by the borrower organization in the following order:

- a) for bills issued - the drawer reflects the amount specified in the bill (hereinafter referred to as the bill amount) as accounts payable. In the case of accrual of interest on the bill amount on issued bills, the debt on such a bill is shown by the drawer, taking into account the interest due at the end of the reporting period under the terms of the bill of exchange. When issuing a bill of exchange to obtain a loan in cash, the amount of interest or discount due to the holder of the bill of exchange is included by the drawer in operating expenses. For the purpose of uniform (monthly) inclusion of the amounts of interest or discount due as income on issued bills of exchange, the drawer organization can preliminarily take them into account as deferred expenses;

- b) for placed bonds, the issuing organization reflects the nominal value of issued and sold bonds as accounts payable. When calculating income on bonds in the form of interest, the issuing organization indicates the accounts payable on the bonds sold, taking into account the interest due on them at the end of the reporting period. The accrual of income due (interest or discount) on placed bonds is reflected by the issuing organization as part of operating expenses in the reporting periods to which these accruals relate. For the purpose of uniform (monthly) inclusion of the amounts due to the lender of income on sold bonds, the issuer organization can preliminarily take into account the specified amounts as deferred expenses. The accrual of income due to the lender on other borrowed obligations is made by the borrower evenly (monthly) and is recognized as its operating expenses in those reporting periods to which these accruals relate.

19. Additional costs incurred by the borrower in connection with obtaining loans and credits, issuing and placing debt obligations may include costs associated with:

- providing the borrower with legal and consulting services;

- carrying out copying and duplicating work;

- payment of taxes and fees (in cases provided for by current legislation);

- carrying out examinations;

- consumption of communication services;

- other costs directly related to obtaining loans and credits, placing borrowed obligations.

20. The inclusion by the borrower of additional costs associated with obtaining loans and credits, placement of borrowed obligations is carried out in the reporting period in which these costs were incurred. Additional costs may be previously accounted for as accounts receivable and subsequently included in operating expenses during the repayment period of the above borrowed obligations.

21. Accrued interest on loans and credits due for payment listed in paragraph 9 of these Regulations are taken into account in ruble valuation at the rate of the Central Bank of the Russian Federation in effect on the date of actual accrual of interest under the terms of the agreement, and in the absence of an official rate - at the rate determined by agreement of the parties.

22. To prepare financial statements, the value of the obligations listed in paragraph 21 of these Regulations is recalculated into rubles at the exchange rate of the Central Bank of the Russian Federation in effect on the reporting date.

23. Costs of received loans and credits directly related to the acquisition and (or) construction of an investment asset must be included in the cost of this asset and repaid through depreciation, except in cases where the accounting rules do not provide for depreciation of the asset. Costs for received loans and credits associated with the formation of an investment asset, for which, according to accounting rules, depreciation is not charged, are not included in the cost of such an asset, but are charged to the current expenses of the organization in the manner set out in paragraph 14 of these Regulations.

24. Depreciation on a property related to an investment asset is calculated by the organization in accordance with the procedure established in the accounting regulations “Accounting for fixed assets” (PBU 6/01), approved by the Order of the Ministry of Finance of the Russian Federation dated March 30, 2001. N 26n (registered with the Ministry of Justice of the Russian Federation on April 28, 2001, registration number 2689).

25. Costs of received loans and credits directly related to the acquisition and (or) construction of an investment asset are included in the initial cost of this asset, subject to the possibility of the organization receiving economic benefits in the future or in the case where the presence of an investment asset is necessary for the management needs of the organization.

26. The costs of loans and credits received associated with the acquisition of an investment asset are reduced by the amount of income from the temporary use of borrowed funds as long-term and short-term financial investments. These investments of borrowed funds can be made only in the event of a direct reduction in costs associated with financing the investment asset, for example, a decrease in prices for construction materials and equipment, a delay in the implementation of certain types (stages) of work by subcontractors, and other similar reasons. A reduction in borrowing costs by the amount of income must be confirmed by an appropriate calculation of the actual availability of the specified income. The organization must provide confirmation of such calculation.

27. The inclusion of costs for received loans and credits in the initial cost of an investment asset is carried out if the following conditions are met:

- a) the occurrence of expenses for the acquisition and (or) construction of an investment asset;

- b) the actual start of work related to the formation of an investment asset;

- c) the presence of actual costs of loans and credits or obligations for their implementation.

28. When work related to the construction of an investment asset is stopped for a period exceeding three months, the inclusion of costs for loans received and credits used to form the specified asset is suspended. In this case, borrowing costs are included in the organization's current expenses in the manner set out in paragraph 14 of these Regulations. The period during which additional approval of technical and (or) organizational issues that arose during the construction of the asset is not considered a termination of work on the formation of an investment asset.

29. If borrowed funds received for purposes unrelated to its acquisition are used to purchase an investment asset, interest is charged for the use of these borrowed funds at a weighted average rate. The weighted average rate is determined by the amount of all loans and credits remaining outstanding during the reporting period (according to the appendix). When calculating the weighted average rate, amounts received specifically to finance an investment asset are excluded from the total amount of outstanding loans and credits.

30. The inclusion of costs for received loans and credits in the initial cost of an investment asset ceases from the first day of the month following the month the asset was accepted for accounting as an object of fixed assets or a property complex (for the corresponding types of assets forming the property of the complex).

31. If an investment asset is not accepted for accounting as an object of fixed assets or a property complex (according to the relevant asset items), but actual production of products, performance of work, and provision of services have begun on it, then the inclusion of costs for loans and credits provided in the initial cost investment asset is terminated on the first day of the month following the month of actual start of operation.

Debt obligations (loans, credits)

Accounting for debt obligations

Regulations:

Accounting regulations “Accounting for expenses on loans and credits” PBU 15/2008 (approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n).

Loans and credits form the organization's liabilities (borrowed capital). Types of loans and credits, as well as the relationship between the borrower and the lender, are determined by civil law.

There are the following types of borrowing:

1) loan agreement (Article 807 of the Civil Code of the Russian Federation): one party (the lender) transfers into the ownership of the other party (borrower) money or other things defined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal amount other things he received of the same kind and quality;

2) loan agreement (Article 819 of the Civil Code of the Russian Federation): a bank or other credit organization (lender) undertakes to provide funds (loan) to the borrower in the amount and on the terms stipulated by the agreement, and the borrower undertakes to return the amount of money received and pay interest on it;

3) commodity loan (Article 822 of the Civil Code of the Russian Federation): under a commodity loan agreement, one party provides the other party with things defined by generic characteristics. Conditions on the quantity, assortment, completeness, quality, container (packaging) of things must be fulfilled in accordance with the rules on the contract for the sale of goods. The rules of the loan agreement apply to the trade credit agreement;

4) commercial loan (Article 823 of the Civil Code of the Russian Federation): contracts, the execution of which is associated with the transfer into the ownership of another party of amounts of money or other things determined by generic characteristics, may provide for the provision of a loan, including in the form of an advance, prepayment, deferment or installment payment for goods, works or services.

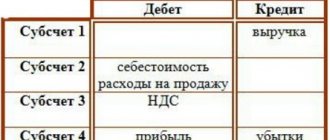

The principal amount of the loan/credit (principal debt) is reflected in accounting as accounts payable:

— on balance sheet account 66 “Settlements for short-term loans and borrowings” (by type of loans and borrowings);

— on balance sheet account 67 “Settlements for long-term loans and borrowings” (by type of loans and borrowings).

The following expenses on loans and borrowings are reflected in accounting separately from the amount of the principal debt:

1) interest due to the lender (creditor);

2) additional costs:

— payment for information and consulting services;

— examination of the loan agreement (credit agreement);

— other expenses associated with obtaining loans (credits).

The following rules have been established for reflecting expenses on loans/credits:

1) interest is reflected evenly in the reporting periods to which they relate, that is, on the last date of the month (regardless of the terms of the agreement);

2) if the terms of the agreement provide for equal monthly payment of interest on dates other than the last day of the month, then the interest amounts can be recognized in accounting as expenses on these dates, that is, according to the terms of the agreement;

3) additional expenses can be included in expenses at a time, or evenly during the validity of the loan/credit agreement (established in the accounting policy);

4) are recognized as other expenses (debited to subaccount 91-2);

5) for investment assets are included in the cost of this asset (debited to balance sheet account 08) until the completion of work to create the asset. From the 1st day of the month following the month of completion of work, interest is included in other expenses. Please note that small businesses have the right to immediately charge all interest (including on investment assets) to other expenses. A small enterprise should enshrine this procedure for recording interest in its accounting policies.

For reference. The definition of an investment asset is given in paragraph 7 of PBU 15/2008. An investment asset is understood as an object of property, the preparation of which for its intended use requires a long time and significant expenses for acquisition, construction and (or) production. Investment assets include objects of work in progress and construction in progress , which will subsequently be accepted for accounting by the borrower and (or) customer (investor, buyer) as fixed assets (including land), intangible assets or other non-current assets;

6) interest on a bill is accrued separately from the bill amount in those reporting periods to which they relate (according to the terms of the bill of exchange) or evenly throughout the circulation period of the bill;

7) interest on bonds is accrued separately from the nominal value of the bond in those reporting periods to which they relate (according to the terms of the bond issue) or evenly throughout the circulation period of the bonds.

In the Profit and Loss Statement, accrued interest on loans and credits is reflected in the line “Interest payable”. If interest is included in the cost of an investment asset, then such interest is not reflected in the Profit and Loss Statement.

Tax accounting of debt obligations

In the income tax return, interest on debt obligations is reflected on line 201 of Appendix No. 2 to sheet 02.

For tax purposes, interest on debt obligations is included in non-operating expenses (clause 2, clause 1, article 265 of the Tax Code of the Russian Federation). In this case, interest on debt obligations of any type is recognized as an expense, regardless of the nature of the credit or loan provided (current and (or) investment).

Debt obligations include loans, credits, debt securities (promissory notes, bonds).

Expenses are recognized as:

1) the amount of interest accrued for the actual time of use of borrowed funds;

2) the amount of interest accrued for the actual time that debt securities were held by third parties and the initial yield established by the issuer (lender) in the terms of the issue (issue, agreement), but not higher than the actual one;

3) the amount of interest within the limit established by Article 269 of the Tax Code of the Russian Federation (for any types of debt obligations).

The procedure for recognizing expenses in the form of interest on debt obligations is established by clause 8 of Article 272 of the Tax Code of the Russian Federation:

1) for debt obligations that are valid for more than one reporting period, the expense is recognized at the end of the month of the corresponding reporting period;

2) in the event of termination of the agreement (repayment of the debt obligation) before the expiration of the reporting period, the expense is recognized on the date of termination of the agreement (repayment of the debt obligation).

Tax accounting of interest on debt obligations is regulated by Article 328 of the Tax Code of the Russian Federation:

1) in the tax register, expenses are reflected in the amount of interest due in accordance with the terms of the agreements (terms of issue of bonds, terms of issue or transfer/sale of bills) separately for each type of debt obligation;

2) in the tax register, as part of expenses , only the amount not exceeding the maximum interest rate calculated taking into account the norms of paragraph 1 and paragraph 1.1 of Article 269 of the Tax Code of the Russian Federation is reflected;

3) expenses in the form of interest are reflected in tax accounting on the last date of each month and on the date of repayment (repayment) of the debt obligation in an amount corresponding to the actual time of use of borrowed funds in that month (accrual method);

4) in case of early repayment of a debt obligation, interest is determined based on the interest rate stipulated by the terms of the agreement (taking into account the provisions of Article 269) and the actual time of use of borrowed funds;

5) under the cash method, interest is recognized as an expense on the date of actual payment in an amount not exceeding the maximum amount established by clauses 1 and 1.1 of Article 269 of the Tax Code of the Russian Federation.

The procedure for calculating the maximum amount of interest on debt obligations for tax purposes is established by Article 269 of the Tax Code of the Russian Federation.

An organization may determine the limit based on the average level of interest on comparable obligations .

Liabilities that are issued in the same quarter ( month - for taxpayers who have switched to calculating monthly advance payments based on actually received profits) on comparable terms , namely: in the same currency, for the same terms, in comparable volumes, for similar provision.

This method must be enshrined in the tax accounting policy. In addition, the accounting policy provides criteria for the comparability of obligations in terms of terms, volumes and collateral (see letter of the Ministry of Finance dated August 16, 2010 No. 03-03-06/1/547).

Formulas for determining the maximum interest rate:

SU = (Z1 x C1 + Z2 x C2 + ... + Zn x Cn) / (Z1 + Z2 + ... + Zn), where

SU – average percentage level,

Зn is the amount of the nth debt obligation,

Сn – interest rate on the nth debt obligation;

O = SU x 20%, where

О – permissible deviations from the average percentage level;

P = SU + O, where

P – the maximum amount of interest on a debt obligation recognized as an expense for tax purposes.

If there were no comparable obligations in the quarter (month), as well as by default (if the taxpayer has not decided on the tax accounting policy), the maximum interest level is calculated in the following order:

-at the refinancing rate of the Central Bank of the Russian Federation, increased by 1.1 times - for ruble debt obligations;

-at a rate of 15% - on foreign currency debt obligations.

Federal laws and clause 1.1 of Article 269 of the Tax Code of the Russian Federation have introduced a special procedure for determining the maximum amount of interest using the refinancing rate of the Central Bank of the Russian Federation:

1) from September 1, 2008 to July 31, 2009, in the absence of debt obligations to Russian organizations issued in the same quarter on comparable terms, and also at the choice of the taxpayer:

the maximum amount of interest recognized as an expense is assumed to be equal to the refinancing rate of the Central Bank of the Russian Federation, increased by 1.5 times (for ruble obligations), and 22% (for foreign currency obligations) (Article 4 of the Federal Law of July 19, 2009 No. 202-FZ) ;

2) from August 1, 2009 to December 31, 2009, in the absence of debt obligations to Russian organizations issued in the same quarter on comparable terms, or at the taxpayer’s choice:

the maximum amount of interest recognized as an expense is assumed to be equal to the refinancing rate of the Central Bank of the Russian Federation, increased by 2 times (for ruble obligations), and 22% (for foreign currency obligations) (Article 5 of the Federal Law of July 19, 2009 No. 202-FZ);

3) from January 1, 2010 to June 30, 2010 for obligations arising before November 1, 2009, in the absence of debt obligations to Russian organizations issued in the same quarter on comparable terms, or at the choice of the taxpayer, the maximum amount of interest recognized as an expense, is taken to be equal to the refinancing rate of the Central Bank of the Russian Federation, increased by 2 times (for ruble obligations), and 15% (for foreign currency obligations) (Article 4 of the Federal Law of December 27, 2009 No. 368-FZ, clause 23 of Article 2 of the Federal Law dated July 27, 2010 No. 229-FZ);

4) in the absence of debt obligations to Russian organizations issued in the same quarter on comparable terms, or at the choice of the taxpayer:

— from January 1, 2010 to December 31, 2010 inclusive, the maximum amount of interest recognized as an expense is assumed to be equal to the refinancing rate of the Central Bank of the Russian Federation, increased by 1.8 times (for ruble obligations), and 15% (for foreign currency obligations);

— from January 1, 2011 to December 31, 2012 inclusive, the maximum amount of interest recognized as an expense is taken equal to the refinancing rate of the Central Bank of the Russian Federation, increased by 1.8 times (for ruble obligations), and equal to the product of the refinancing rate of the Central Bank of the Russian Federation and a coefficient of 0.8 (for foreign currency obligations) (clause 23 of article 2 of the Federal Law of July 27, 2010 No. 229-FZ).

Please note, on what date to take the refinancing rate of the Central Bank of the Russian Federation depends on the terms of the debt obligation:

1) in relation to debt obligations that do not contain a condition on changing the interest rate during the entire term of the debt obligation, the refinancing rate of the Central Bank of the Russian Federation, which was in effect on the date of raising funds, is applied;

2) in relation to other debt obligations - the refinancing rate of the Central Bank of the Russian Federation, effective on the date of recognition of expenses in the form of interest.

Example: securing a loan with your own bill of exchange

Organization on March 10, 2011 received a loan from her partner in the amount of 150,000 rubles. and to ensure the repayment of the loan, she issued her own promissory note to the lender, the face value of which is equal to 180,000 rubles. In accordance with the terms of the agreement, the bill must be paid after 92 days - June 10, 2011.

| date | Business transactions | Wiring | Sum | |

| debit | credit | |||

| 10.03.2011 | Received a loan from a partner | 51 | 66, subaccount "Loan/principal" | 150 000 |

| 10.03.2011 | A bill of exchange was issued to secure the loan | 66, subaccount "Loan/principal" | 66, subaccount “Loan/principal/secured by a bill of exchange” | 150 000 |

| 31.03.2011 | The discount on the bill (interest) for March is reflected: RUB 30,000. x 22 days/92 days | 91-2 | 66, subaccount “Loan/interest/ secured by a bill of exchange” | 7 174 |

| 30.04.2011 | The discount on the bill (interest) for March is reflected: RUB 30,000. x 30 days/92 days | 91-2 | 66, subaccount “Loan/interest/ secured by a bill of exchange” | 9 783 |

| 31.05.2011 | The discount on the bill (interest) for March is reflected: RUB 30,000. x 31day/92days | 91-2 | 66, subaccount “Loan/interest/ secured by a bill of exchange” | 10 108 |

| 09.06.2011 | The discount on the bill (interest) for March is reflected: RUB 30,000. x 9days/92days | 91-2 | 66, subaccount “Loan/interest/ secured by a bill of exchange” | 2 935 |

| 10.06.2011 | Funds were transferred to the lender to repay the bill and interest | 66, subaccount “Loan/principal/secured by a bill of exchange” | 51 | 150 000 |

| 66, subaccount “Loan/interest/ secured by a bill of exchange” | 51 | 30 000 | ||

Let's make a calculation of interest recognized as an expense for profit tax purposes. Since a discount bill was issued to secure the loan, the specified debt obligation should be considered as an obligation that does not contain a condition for changing the interest rate. Therefore, to calculate the maximum interest rate for tax purposes, one should take the refinancing rate of the Central Bank of the Russian Federation established on the date of borrowing - March 10, 2011. On this day the refinancing rate was 8%. Accordingly, the rate adjusted by the coefficient of 1.8 used for calculation is 14.4% per annum.

| Calculation date | Loan amount | Interest under the agreement | Interest limit | Interest to be included in the tax base | ||

| bid, % | number of days | sum | ||||

| 31.03.11 | 150 000 | 7 174 | 14,4 | 22 | 1 302 (150,000 x 14.4% x 22/365) | 1 302 |

| 30.04.11 | 150 000 | 9 783 | 14,4 | 30 | 1 775 (150,000 x 14.4% x 30/365) | 1 775 |

| 31.05.11 | 150 000 | 10 108 | 14,4 | 31 | 1 835 (150,000 x 14.4% x 31/365) | 1 835 |

| 09.06.11 | 150 000 | 2 935 | 14,4 | 9 | 533 (150,000 x 14.4% x 9/365) | 533 |

Due to the fact that interest on debt obligations for tax purposes is recognized in an amount less than actually accrued and paid, permanent differences are reflected in accounting (in special registers) and permanent tax liabilities are accrued (Debit 99, subaccount “Permanent tax liabilities” Credit 68, subaccount “Calculation of income tax”):

| date | Interest | Constant differences | Ongoing tax obligations | |

| in accounting | in tax accounting | |||

| 1 | 2 | 3 | 4 | 5 |

| 31.03.11 | 7 174 | 1 302 | 5 872 | 1 174 |

| 30.04.11 | 9 783 | 1 775 | 8 008 | 1 602 |

| 31.05.11 | 10 108 | 1 835 | 8 273 | 1 655 |

| 09.06.11 | 2 935 | 533 | 2 402 | 480 |

In the table: gr.4 = gr.2 – gr.3; gr.5 = gr.4 x 20%

Example: reflecting bond discount

An organization (OJSC) placed by public subscription 2,000 interest-free bonds with a nominal value of 1,000 rubles.

Placement price 972 rub. for the bond. Bond circulation period is 100 days (01.08.2010 – 08.11.2010).

| Debit | Credit | Sum | Posting Contents |

| 51 | 66 | 1 944 000 | Funds received from bond placement (2,000 pcs. x 972 rub.) |

| 91-2 | 66 | 17 360 | 08/31/10 the part of the discount attributable to August was included in other expenses (RUB 56,000/100 days x 31 days) |

| 91.2 | 66 | 16 800 | 09.30.10 included in other expenses is the part of the discount attributable to September (RUB 56,000/100 days x 30 days) |

| 91.2 | 66 | 17 360 | 10.31.10 included in other expenses is the part of the discount attributable to October (RUB 56,000/100 days x 31 days) |

| 91.2 | 66 | 4 480 | 08.11.10 included in other expenses is the part of the discount attributable to November (RUB 56,000/100 days x 8 days) |

| 66.3 | 51 | 2 000 000 | The redemption of bonds is reflected at par value |

For profit tax purposes, a discount on placed bonds is expenses on debt obligations that are recognized within the limit established by Article 269 of the Tax Code of the Russian Federation. The OJSC calculates the limit at the refinancing rate of the Central Bank of the Russian Federation, adjusted by the increasing coefficient.

The discount when placing bonds was received at a time and cannot change during the circulation period of the bonds. Therefore, to determine the maximum interest rate, the refinancing rate of the Central Bank of the Russian Federation on the date of borrowing is taken. In our example, this is 08/01/2010. The refinancing rate of the Central Bank of the Russian Federation was 7.75% on this date. Therefore, the interest cap is calculated at an annual rate of 13.95% (7.75% x 1.8).

Let's determine the maximum interest rate for tax purposes as of August 31, 2010:

RUB 1,944,000 x 13.95% x 31 days/365 days. = 23,032 rub. The amount received is greater than the discount amount included in expenses (RUB 17,360). Consequently, the entire amount of the discount is recognized for income tax purposes in August.

Comparison of actually accrued interest with the maximum interest amount is carried out in tax accounting on a monthly basis on the last date of each month. Let's compare the discount for September with the maximum interest rate (as of September 30, 2010):

RUB 1,944,000 x 13.95% x 30 days/365 days. = 22,289 rub. (RUB 16,800 < RUB 22,289). Etc. until the bonds are redeemed.

IV. Disclosure of information in financial statements

32. Information on the organization’s accounting policies must include at least the following data:

- on the transfer of long-term debt to short-term debt;

- on the composition and procedure for writing off additional borrowing costs;

- on the choice of methods for calculating and distributing income due on borrowed obligations;

- on the procedure for accounting for income from the temporary investment of borrowed funds.

The organization's financial statements must reflect the following information:

- on the presence and changes in the amount of debt for the main types of loans and credits;

- on the amount, types, repayment terms of issued bills of exchange and placed bonds;

- on the repayment terms of the main types of loans, credits, and other borrowed obligations;

- on the amounts of borrowing costs included in operating expenses and the cost of investment assets;

- on the value of the weighted average rate of loans and credits (if applied).

Accounting

Accounting for loans and borrowings is regulated by the Accounting Regulations “Accounting for expenses on loans and credits” (PBU 15/2008).

The main features of accounting for the transactions under consideration include the following:

- The amount of the liability for the loan (credit) received must be reflected as accounts payable (from the borrower) in the amount specified in the agreement;

- Accrued interest and other expenses under loan agreements should be reflected as part of the organization’s other expenses. However, there is an exception to this rule: these expenses must be included in the value of the investment asset, i.e. property, the preparation of which for its intended use requires a long time and significant expenses for acquisition, construction and (or) production. If the organization has the right to use simplified methods of accounting and reporting, then all expenses on loans and borrowings can be classified as other;

- Interest on loans and borrowings is included in other expenses or included in the cost of the investment asset evenly, regardless of the terms of the relevant agreement. A common mistake is to include the entire amount of interest under the contract as an expense at the time of actual payment, rather than monthly accrual;

- If the loan or loan is received in foreign currency, then do not forget that it is necessary at the end of each month and on the date of the transaction to revaluate the debt at the official exchange rate of the Central Bank of the Russian Federation in accordance with paragraphs 1, 5, 7, 8 of PBU 3/2006;

- The loan received, unlike a loan, can be interest-free. The accounting procedure for such loans is no different from the accounting for interest-bearing borrowings;

- In the financial statements, debt on loans and credits, as well as interest due for payment, are reflected depending on the date of repayment of the corresponding obligation.

In general, there are usually no difficulties with accounting for loans and credits, but tax accounting does present certain difficulties.