» Business » Money for development

At the moment, some individual entrepreneurs take out this type of loan as an interest-free loan between an individual and a legal entity - for example, between an individual businessman and a legal entity - a Limited Liability Company (LLC).

Such funds are often taken by affiliates who redistribute money among themselves, as well as by various business entities - individual entrepreneurs and others.

According to the civil legislation of the Russian Federation, a loan agreement is considered an agreement under which the lender (for example, a legal entity - LLC) can give the borrower (for example, an individual - individual entrepreneur) money.

In such a situation, the individual entrepreneur must return the amount of money received to the legal entity - organization.

- 2 Taxation of a businessman

- 3 Interest-free borrowed funds - required documentation

- 4 Individual entrepreneurs and LLCs: we do without interest

- 5 Drawing up a contract - main nuances

- 6 Violation of contractual terms - penalties

Attention "simplistic people"

Chapter 26.2 “Simplified Taxation System” of the Tax Code of the Russian Federation (namely clause 3 of Article 346.11 of the Tax Code of the Russian Federation ) determines that the use of the simplified tax system by individual entrepreneurs implies their exemption from the obligation to pay personal income tax (in relation to income received from business activities), with the exception of tax , paid from income taxed at the tax rate provided, in particular, clause 2 of Art. 224 Tax Code of the Russian Federation .

Thus, according to this paragraph, in relation to the amount of savings on interest when receiving interest-free loans, the personal income tax rate is set at 35%. Based on the above, the income of a “simplified” person in the form of material benefits received from savings on interest for the use of borrowed funds should be subject to personal income tax at a rate of 35%.

However, the Ministry of Finance has its own view of the situation. Without taking into account the above-mentioned direct provisions of the Tax Code, in Letter No. 03‑11‑11/42697 , officials indicated that the amount of material benefit under interest-free loan agreements by individual entrepreneurs using the simplified tax system is not calculated and, accordingly, is not taken into account when determining the subject of personal income tax. .

They based their conclusions on the following reasoning. In accordance with paragraph 1 of Art. 346.15 of the Tax Code of the Russian Federation , entrepreneurs using the simplified tax system, when forming the object of taxation, take into account income from sales determined in accordance with Art. 249 of the Tax Code of the Russian Federation , and non-operating income determined in accordance with Art. 250 Tax Code of the Russian Federation . At the same time, Art. 250 of the Tax Code of the Russian Federation does not provide for the inclusion in non-operating income of taxpayers of amounts of material benefits under interest-free loan agreements.

The stated position in the explanations of the Ministry of Finance can be traced for many years ( letters dated July 24, 2013 No. 03-11-06/2/29384 , dated June 29, 2011 No. 03-11-11/104 , dated May 14, 2008 No. 03-11-11 05/122 , dated January 25, 2008 No. 03‑11‑05/14 , dated July 11, 2007 No. 03‑11‑05/149 , etc.). And if such an opinion was at least somehow acceptable before 01/01/2013, then today a reasonable question arises: why should an entrepreneur think this way? Let's explain the situation. Before the named date in accordance with clause 24 of Art. 217 of the Tax Code of the Russian Federation (as amended by Federal Law No. 104-FZ ) income received by individual entrepreneurs from carrying out those types of activities for which they are payers of UTII, as well as for the taxation of which the simplified tax system and the taxation system are applied, were not subject to personal income tax. for agricultural producers (single agricultural tax).

It was with reference to this (at that time in force) norm that officials gave their explanations, pointing out that the provisions of Chapter. 23 of the Tax Code of the Russian Federation , including Art. 212 of the Tax Code of the Russian Federation , do not apply to income (economic benefit) arising from an individual entrepreneur in connection with the implementation of activities, when taxing income under the simplified tax system (see Letter of the Ministry of Finance of Russia dated October 21, 2011 No. 03-11-11/260 ).

Later, in Letter No. 03‑04‑05/3-1434 , they justified their position as follows: since, by virtue of clause 3 of Art. 346.11 of the Tax Code of the Russian Federation , the use of the simplified tax system by businessmen provides, in particular, for their exemption from the obligation to pay personal income tax (in relation to income received from business activities, with the exception of tax paid on income taxed at the tax rates provided for in clauses 2 , 4 and 5 of Art. 224 of the Tax Code of the Russian Federation ), accordingly, the changes made to Art. 217 of the Tax Code of the Russian Federation, Federal Law No. 94-FZ , does not change the income taxation procedure in force before this date from January 1, 2013. That is, as before, exemption from the obligation to pay personal income tax on the income they receive from carrying out activities under the simplified tax system is applied to businessmen.

But what makes officials ignore the exceptions established in this case, which have been in force since 2009 (changes in paragraph 3 of Article 346.11 of the Tax Code of the Russian Federation were introduced by Federal Law No. 155-FZ ), which they themselves quote in their letters?

Unfortunately, for the author, the question remains unanswered today. True, one can assume that the answer lies in the very nature of material gain. So, in accordance with paragraphs. 1 clause 1 art. 212 of the Tax Code of the Russian Federation, the taxpayer’s income in the form of material benefit is the material benefit from savings on interest for the taxpayer’s of borrowed (credit) funds received from organizations or individual entrepreneurs. The taxpayer, by virtue of Art. 207 of the Tax Code of the Russian Federation , individuals who are tax residents of the Russian Federation are recognized. Accordingly, this rule is applicable only to individuals.

For your information

However, confirmation of this assumption was not found. But a refutation was found (we believe this fact will be interesting): businessmen tried to challenge the constitutionality of paragraphs. 1 clause 1 art. 212 of the Tax Code of the Russian Federation in a complaint filed with the Constitutional Court. In their opinion, the contested legal provision imposes increased tax obligations on individual entrepreneurs compared to legal entities - to pay personal income tax in the form of material benefits received from savings on interest for the use of borrowed (credit) funds. The Constitutional Court of the Russian Federation, in Determination No. 833-O , 2012, indicated that income in the form of material benefits from savings on interest for the taxpayer’s use of borrowed (credit) funds received from organizations or individual entrepreneurs is not income from entrepreneurial activity and is subject to taxation regardless depending on whether the individual who received it has the status of an individual entrepreneur.

The Federal Tax Service has not yet expressed an opinion regarding the resolution of the problem under consideration. Meanwhile, local tax authorities have a different point of view than the Ministry of Finance, so an entrepreneur should not count on their support. Inevitable disputes will have to be resolved in court. What are the prospects here?

Loan from an individual. Restrictions.

- 1. This Directive does not apply to cash payments with the participation of the Bank of Russia, as well as to:

cash payments in the currency of the Russian Federation and in foreign currency between individuals who are not individual entrepreneurs;…

- Individual entrepreneurs and legal entities (hereinafter referred to as participants in cash payments) do not have the right to spend cash received in their cash registers in the currency of the Russian Federation for goods sold by them, work performed by them and (or) services provided by them, as well as received as insurance premiums, for except for the following purposes:...

- Cash payments in the currency of the Russian Federation between participants in cash payments (subject to the maximum amount of cash payments established by paragraph 6 of this Directive), between participants in cash payments and individuals for transactions with securities, under real estate lease agreements, for the issuance (repayment) of loans (interest on loans) for activities related to organizing and conducting gambling are carried out at the expense of cash received at the cash desk of the participant in cash payments from his bank account.

- Cash payments in the currency of the Russian Federation and foreign currency between participants in cash payments and individuals are carried out without limiting the amount.

- Cash payments in the currency of the Russian Federation and foreign currency between participants in cash payments within the framework of one agreement concluded between these persons can be made in an amount not exceeding 100 thousand rubles or an amount in foreign currency equivalent to 100 thousand rubles at the official exchange rate of the Bank of Russia on the date carrying out cash payments (hereinafter referred to as the maximum amount of cash payments).

Cash payments are made in an amount not exceeding the maximum amount of cash payments in the fulfillment of civil obligations provided for in an agreement concluded between participants in cash payments and (or) arising from it and executed both during the validity period of the agreement and after its expiration. actions. {Instruction of the Bank of Russia dated October 7, 2013 N 3073-U “On cash payments” {ConsultantPlus}}

- General points

(!) If the loan agreement, the presence of which is mandatory <1>, does not stipulate the amount of interest, it means that by default it will be equal to the refinancing rate in effect on the date of payment of the debt or part thereof <2> (currently it is 8.25% < 3>).

(+) Borrowed funds can be:

(or) transferred to your current account;

(or) deposited in cash according to a cash receipt order. If the loan is given by the founder-individual, then the amount contributed can be any. But if the lender is an organization or entrepreneur, then the amount of cash should not exceed 100,000 rubles. <4>.

(!) An accepted cash loan can be immediately spent on the current needs of the company without first depositing money into the current account. But the cash that is supposed to be used to pay interest on the loan or to return it must be withdrawn from the account <5>.

———————————

<1> Clause 1 of Art. 161, paragraph 1, art. 808 of the Civil Code of the Russian Federation.

<2> Clause 1 of Art. 809 of the Civil Code of the Russian Federation.

<3> Directive of the Bank of Russia dated September 13, 2012 N 2873-U.

<4> Clauses 5, 6 of Bank of Russia Directive No. 3073-U dated 10/07/2013.

<5> Clause 4 of Bank of Russia Directive No. 3073-U dated October 7, 2013. Article: We borrow from the founder (Ostrovskaya A.Z.) (“General Book”, 2015, No. 22) {ConsultantPlus}

- It is possible to issue a loan in cash from the cash desk, but certain conditions must be met.

Firstly, to issue a loan, it is allowed to use only cash received at the cash desk from the current account (clause 4 of Directive N 3073-U). For example, if you want to use cash proceeds from the sale of goods, works, or services to issue a loan, then first hand it over to the bank and then withdraw the required amount from your current account.

Secondly, if you are issuing a loan to a legal entity or individual entrepreneur, then you must comply with the cash payment limit within the framework of one agreement - 100,000 rubles. (Clause 6 of Directive No. 3073-U). If you are giving a loan to an individual, there are no restrictions on the amount.

Failure to comply with cash handling procedures may result in a fine being imposed on your organization and its manager.

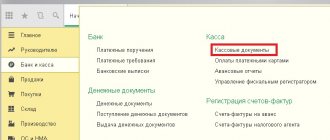

From July 3, 2021, when issuing a cash loan provided to pay for goods (works, services), in general, you need to use a cash register. CCP is used in calculations, and this operation is classified as calculations in Art. 1.1 of the Law on the application of CCP (Clause 1, Article 1.2 of the Law on the application of CCP). At the same time, until July 1, 2021, organizations and individual entrepreneurs have the right not to use cash register systems when issuing such loans.

When issuing a cash loan provided for purposes not related to payment for goods (works, services), cash register systems do not need to be used, since such an operation is not classified as settlements. {Ready solution: Is it possible to issue a loan in cash from the organization’s cash desk (ConsultantPlus, 2018) {ConsultantPlus}}

- It is possible to repay a loan in cash from the organization's cash desk, but subject to certain conditions.

Firstly, to repay the loan, use only cash received at the cash desk from the current account (clause 4 of Directive N 3073-U). For example, if you want to use cash proceeds from the sale of goods, works, or services to return, then first hand it over to the bank and then withdraw the required amount from the current account.

Secondly, observe the limit for cash payments under one agreement - 100,000 rubles, if the money is to be returned to a legal entity or individual entrepreneur (clause 6 of Directive N 3073-U). The restriction applies to all payments under the agreement - both the loan amount and interest and penalties. For example, it is impossible to return a loan in the amount of 90,000 rubles from the cash desk (including through an accountable person), if interest on this loan had already been paid in cash in the amount of 15,000 rubles. You can only return 85,000 rubles. If the lender is an individual, there are no restrictions on the amount.

Failure to comply with this procedure may result in a fine being imposed on your organization and its leader.

From July 3, 2021, when repaying in cash a loan provided to pay for goods (work, services), you must use a cash register. It is used in calculations, and this operation is classified as calculations in Art. 1.1 of the Law on the application of CCP (Clause 1, Article 1.2 of the Law on the application of CCP).

When repaying a loan provided for purposes not related to payment for goods (works, services), cash register transactions do not need to be used, since such an operation is not classified as a settlement. {Ready solution: Is it possible to return a loan in cash from the organization’s cash desk (ConsultantPlus, 2018) {ConsultantPlus}}

- ... When repaying a loan in cash, a cash receipt order is drawn up. Cash received as loan repayment does not have to be deposited into a current account - you can immediately spend it from the cash register for purposes not specified in clause 4 of the Directive, subject to the maximum amount of cash payments established by clause 6 of the Directive.

{Question: Are there any restrictions when returning a cash loan to the cash desk? (Expert consultation, Interdistrict Inspectorate of the Federal Tax Service of Russia on the largest taxpayers of the Tula region, 2018) {ConsultantPlus}} 6. The maximum amount of cash settlements between legal entities for one transaction is currently set at 100 thousand rubles. In this situation, it is necessary to note that the specified limit is set “for one transaction”. According to Article 153 of the Civil Code of the Russian Federation, transactions are the actions of citizens and legal entities aimed at establishing, changing or terminating civil rights and obligations. This means that organizations can pay each other in cash within established limits only under one specific agreement (transaction), regardless of the frequency with which payment was received for this transaction. “Accounting entries and tax accounting in public catering organizations” (6th edition, revised and expanded) (Filina F.N.) (edited by T.N. Mezhueva) (GrossMedia, ROSBUKH, 2017) { Consultant Plus}

- Question: How to extend the term of a loan agreement (concluded for one calendar year)?

Answer: The term of the loan agreement can be changed by agreement of the parties by concluding a written agreement.

Rationale: The loan agreement in the case where the lender is a legal entity is concluded in writing (clause 1 of Article 808 of the Civil Code of the Russian Federation). The borrower is obliged to return the received loan amount to the lender on time and in the manner provided for in the loan agreement (Clause 1 of Article 810 of the Civil Code of the Russian Federation).

The terms of the agreement are determined at the discretion of the parties, except in cases where the content of the relevant condition is prescribed by law or other legal acts (clause 4 of Article 421, Article 422 of the Civil Code of the Russian Federation).

Changes and termination of the contract are possible by agreement of the parties, unless otherwise provided by the Civil Code of the Russian Federation, other laws or the agreement (clause 1 of Article 450 of the Civil Code of the Russian Federation).

An agreement to amend or terminate a contract is made in the same form as the contract, unless otherwise follows from the law, other legal acts, contract or customs (Clause 1 of Article 452 of the Civil Code of the Russian Federation).

An agreement in writing can be concluded by drawing up one document signed by the parties, as well as by exchanging letters, telegrams, telexes, telefaxes and other documents, including electronic documents transmitted via communication channels, allowing one to reliably establish that the document comes from the party under the contract (clause 2 of article 434 of the Civil Code of the Russian Federation).

In the event of a change in the contract, the obligations are considered changed from the moment the parties agree on the change, unless otherwise follows from the agreement or the nature of the change in the contract (clause 3 of Article 453 of the Civil Code of the Russian Federation).

Thus, unless otherwise provided by the loan agreement, the loan agreement can be extended by concluding a written agreement. {Question: How to extend the term of a loan agreement (concluded for one calendar year)? (Expert Consultation, 2018) {ConsultantPlus}}

On the prospects for dispute resolution for an entrepreneur

Not long ago, the subject of consideration in the AS NWO was a legal dispute that arose between an entrepreneur and the tax authority on the issue of the legality of additional personal income tax assessment on the amounts of material benefits received under an interest-free loan agreement at a rate of 35% ( Resolution dated November 14, 2014 No. A 56-67702/2013 ).

An entrepreneur using the simplified tax system received funds from individual entrepreneurs under loan agreements. Under the terms of these agreements, interest payments for the use of borrowed funds are not provided. Moreover, the funds received into the taxpayer’s account were intended for his entrepreneurial activities.

According to the businessman, in relation to the types of business activities he carries out, he is not a personal income tax payer, since he is on the simplified tax system and does not apply other taxation regimes in accordance with the requirements of the legislation on taxes and fees. And since the amounts of interest-free loans are not aimed at using them for personal purposes, the inspectors have no grounds for additional assessment of personal income tax (due to the fact that the entrepreneur was not a payer of this tax) and all income from business activities carried out by him is subject to taxation exclusively according to the rules established by Ch. 26.2 Tax Code of the Russian Federation .

The tax authority, not agreeing with the position of the entrepreneur, assessed additional personal income tax on the amounts of material benefits received under the interest-free loan agreement at a rate of 35%.

The court, recognizing the position of the controllers as legitimate, indicated that the norms of Chapter. 26.2 of the Tax Code of the Russian Federation establishes an exemption from the obligation to pay personal income tax in relation to income received from business activities, with the exception of the tax paid on income taxed at the tax rates provided for, in particular, clause 2 of Art. 224 of the Tax Code of the Russian Federation ( clause 3 of Article 346.11 of the Tax Code of the Russian Federation ). Based on the foregoing, an individual entrepreneur using the simplified tax system is obliged to take into account the amount of material benefit from savings on interest when receiving an interest-free loan when determining the personal income tax base.

A similar point of view was expressed in the Resolution of the Federal Antimonopoly Service of the Eastern Military District dated April 10, 2013 in case No. A 82-882/2012 . In it, the court noted that, according to paragraph 3 of Art. 346.11 of the Tax Code of the Russian Federation ( as amended in force from 01/01/2009 ), the use of the simplified tax system by individual entrepreneurs does not relieve them of the obligation to pay personal income tax on income taxed at the tax rate provided for in paragraph 2 of Art. 224 Tax Code of the Russian Federation .

For your information

Before amendments are made to paragraph 3 of Art. 346.11 of the Tax Code of the Russian Federation, the arbitrators indicated that neither the norms of Ch. 25 “Income Tax” , nor the norms of Chapter. 26.2 “Simplified Taxation System” of the Tax Code of the Russian Federation does not establish that material benefits from the use of borrowed funds on interest-free terms are subject to appropriate taxation (see, for example, Resolution of the Federal Antimonopoly Service dated November 25, 2009 in case No. A 55-6151/2009 ).

Under the circumstances mentioned above, the taxpayer will not have to count on the favor of judges, because their position is developed, formed and, most importantly, based on the direct norms of tax legislation.

Drawing up a contract - main nuances

The interest-free loan agreement comes into force from the date of its signing. In such a situation, the lender-LLC gives money, and the borrower-individual entrepreneur receives an interest-free loan in hand - after they sign such an agreement.

Also in this situation, the LLC can take a receipt from the individual entrepreneur with an obligation to return the borrowed funds.

In the event of force majeure, both the individual - the borrower and the legal entity - the lender are guided by the provisions of the established laws of the Russian Federation, unless otherwise specified in the contract.

So, if an individual entrepreneur does not pay the monthly loan payment on time due to a fire, natural disaster, or was involved in a car accident, etc., then the period for paying the monthly payment is extended for the duration of these circumstances.

An entrepreneur or LLC may make certain adjustments to the loan agreement - in such a situation, for example, you can increase the payment period.

Such an agreement does not need to be certified by a notary. However, if the parties increase the reliability of the execution of such an agreement and receive additional guarantees, they can notarize such a document. Certification of each signature costs approximately 500 rubles.

Let's summarize...

The position of the Ministry of Finance, we believe, is not without common sense, because it, like the point of view of the tax authorities, is based on the current norms of tax legislation: the financial department is guided by clause 1 of Art. 346.15 of the Tax Code of the Russian Federation , and tax - clause 3 of Art. 346.11 Tax Code of the Russian Federation .

From the analysis of arbitration practice it follows that the judiciary places paramount importance on clause 3 of Art. 346.11 Tax Code of the Russian Federation . It is this that should be followed when bringing under personal income tax the amount of income in the form of material benefits from savings on interest when receiving an interest-free loan, and it is this exception that dominates the general rules established by Chapter. 26.2 of the Tax Code of the Russian Federation for “simplified people”.

We now propose to draw an analogy with other special regime officers - “imputers”. According to paragraph 4 of Art. 346.26 of the Tax Code of the Russian Federation, the payment of UTII by individual entrepreneurs provides for their exemption from the obligation to pay personal income tax. The Ministry of Finance in Letter No. 03‑11‑11/42697 stated that the norms of Ch. 23 of the Tax Code of the Russian Federation do not apply to them, as well as to “simplified people”. In other words, “imputers” should not determine the amount of material benefit under interest-free loan agreements and pay personal income tax. This statement was not further specified.

Interest-free loan between an individual entrepreneur and an organization - definition

According to Art. 809 of the Civil Code of the Russian Federation, a loan is considered interest-free if:

- an agreement was signed between an individual (IP) and a legal entity (LLC) for an amount equal to 50 minimum wages (minimum wage) as a maximum;

- if under the contract such an individual, the entrepreneur receives not money, but certain things.

As a result, borrowed funds are considered interest-free if the lender or borrower does not use them for commercial gain.

The individual borrower can repay the amount of debt to the lender, the organization, ahead of schedule. However, after the businessman repays the debt, obligations between the individual (IP) and the legal entity (LLC) remain to fulfill the loan agreement until specific taxes are paid.

Attention to the "imputations"

As in the case of the “simplified people,” the financial department did not take into account the following obvious fact: the norms of paragraph 4 of Art. 346.26 of the Tax Code of the Russian Federation applies only to income received from business activities subject to “imputed” tax. And besides, there is clause 7 of Art. 346.26 of the Tax Code of the Russian Federation , by virtue of paragraph. 2 of which taxpayers who, along with business activities subject to UTII, carry out other types of business activities, calculate and pay taxes in relation to these types of activities in accordance with other taxation regimes provided for by tax legislation.

In this regard, it seems that the decision on the need to tax material benefits under an interest-free loan agreement received by an individual entrepreneur applying the taxation system in the form of UTII may directly depend on what activity the loan received by the businessman is related to. If funds are received to carry out business activities subject to UTII , then income in the form of material benefits will be recognized as income received within the framework of “imputed” activities, and, as a result, will not be subject to personal income tax (by the way, the Ministry of Finance spoke about this earlier in Letter dated November 25, 2009 No. 03‑04‑05‑01/827 of Article 212 of the Tax Code of the Russian Federation to transactions concluded by a merchant as part of his business activities in respect of which UTII is paid ).

Let us give an example that confirms what has been said. An individual entrepreneur carried out retail trade through a retail outlet, subject to UTII, as well as trade through a store, subject to the simplified tax system. During the tax audit, the inspectorate found that during the audited period the businessman used borrowed funds received under interest-free loan agreements concluded with legal entities, but personal income tax was not paid on this income.

What did the tax authorities do (having later found support from the courts)? Taking into account the fact that the borrowed funds were used by the businessman to pay for goods for trade organizations both in the store and at the outlet, for the purpose of calculating personal income tax based on the established amounts of total revenue, they determined the percentage of the share of revenue under the simplified tax system and the share “imputed” revenue, and the amount of material benefit is distributed in proportion to the share of revenue by type of activity. As the court pointed out ( Resolution of the Federal Antimonopoly Service dated June 11, 2014 No. F 09-2859/14 ), since the loans were used by the entrepreneur to carry out two types of activities under different tax regimes, the tax inspectorate legally established the share of borrowed funds attributable to taxable activities UTII (and not, according to the court, subject to personal income tax). Personal income tax was charged on the remaining share.

note

The “imputed” persons are required to provide evidence of the fact that the borrowed funds received by them were used only to carry out activities subject to UTII. In this case, the judicial authorities (in the event of tax disputes) allow the possibility of not paying personal income tax on amounts of material benefit in the form of savings on interest for the use of borrowed funds (see, for example, resolutions of the Federal Antimonopoly Service of the North-West District dated June 25, 2009 No. A 05-9905/2008 ( Determination of the Supreme Arbitration Court of the Russian Federation dated August 17, 2009 No. VAS -10442 refused to transfer the case to the Presidium of the Supreme Arbitration Court for review by way of supervision), FAS PO dated November 17, 2011 No. A 65-3239/2011 ).

If the funds received under interest-free loan agreements are not used by the taxpayer in “imputed” activities, then the tax authorities have grounds for additional personal income tax assessments on material benefits. Thus, in the case considered by the Federal Antimonopoly Service of the Eastern Military District ( Resolution of June 29, 2012 in case No. A 38-3087/2011 ), the arbitrators sided with the tax authorities, recognizing their actions to additionally charge personal income tax on the amount of income in the form of material benefits received from savings on interest , legitimate. As the judges pointed out, the circumstances excluding taxation of this type of material benefit are given in Art. 212 of the Tax Code of the Russian Federation and their list is exhaustive. The use of borrowed funds in activities subject to UTII is not such. In addition, the entrepreneur did not provide evidence of the use of borrowed funds in the “imputed” activities.

What's the result?

Summarizing what has been said, we note that the statement of the Ministry of Finance in Letter No. 03‑11‑11/42697 in relation to “simplers” and “imposed”, exempting both of them from paying personal income tax in relation to income in the form of a benefit from the resulting savings on interest, is based on p. .3 tbsp. 346.11 and paragraph 4 of Art. 346.26 Tax Code of the Russian Federation .

However, this was done without taking into account the restrictions established by these same standards. Therefore, to accept the reasoning of officials as a rule means to ensure that in the future legal proceedings with controllers, who, as we were able to verify, do not agree with the Ministry of Finance. For a “simplistic” person, the probability of winning in court, we dare say, is reduced to zero. That’s why there is a direct rule in clause 3 of Art. 346.11 Tax Code of the Russian Federation .

As for the “imputed person,” it is important to provide evidence of the fact that the borrowed funds were received exclusively for the implementation of activities subject to UTII. In this case, there is a chance to win the legal dispute. For cautious taxpayers, it would be correct to pay personal income tax on income in the form of material benefits, calculating it in the declaration in Form 3-NDFL, submitted to the inspectorate at the end of the tax period.

In the analyzed situation, it would be useful to take into account that when the court makes a decision in favor of the tax authority, the entrepreneur has all the grounds ( clause 8 of Article 75 , subclause 3 of clause 1 of Article 111 of the Tax Code of the Russian Federation ) for exemption from paying penalties and from liability for committing a tax offense (or to reduce tax penalties) due to the fact that on the issue under consideration he was guided by the explanations of the Ministry of Finance (only in this case, of course, one should refer to specific letters from the financial department). Thus, the FAS UO in Resolution No. F 09-2745/12 dated May 22, 2012 in case No. A 76-11276/2011 indicated: taking into account the fact that the taxpayer complied with written explanations from authorized government bodies, and that the letters of the Ministry of Finance regarding the procedure for taxing material benefits in the form of savings on interest under interest-free loan agreements were contradictory; the tax authority had no grounds for bringing the entrepreneur to tax liability for underpayment of personal income tax to the budget.