Why change an object under the simplified tax system and how to register it

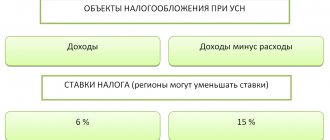

A businessman who switches to the simplified tax system, in general, can choose any of two objects of taxation: “Income” or “Income minus expenses.”

An exception is only organizations or individual entrepreneurs that operate under a simple partnership agreement, or have entered into a property trust management agreement (clause 3 of Article 346.14 of the Tax Code of the Russian Federation). Only the “Income minus expenses” object is available to them.

But most taxpayers can work on the “simplified” option that will be more profitable for them.

In order to choose the right option for using the simplified tax system, you need to take into account the relationship between income and expenses, the possibility of using deductions, as well as tax rates taking into account regional benefits. Read more about choosing a taxable object under the simplified tax system here .

But no matter how carefully a businessman chooses an object, it will still not be possible to completely avoid mistakes. The situation on the market or within the business may also change.

For example, the company will begin to develop new areas of activity. At the same time, revenue and cost structure will certainly change, which will affect the calculation of tax.

If a businessman decides that now another object of taxation will be more profitable for him, he can change the option of applying the simplified tax system from the beginning of any year. To do this, you should send Form 26.2-6 to the Federal Tax Service by December 31 of the previous year (order of the Federal Tax Service of Russia dated November 2, 2012 N ММВ-7-3 / [email protected] ).

It is impossible to change the object of taxation under the simplified tax system during the year (clause 2 of article 346.14 of the Tax Code of the Russian Federation).

How to change a taxable object

According to Art.

346.14 of the Tax Code of the Russian Federation, the object of taxation - “income” or “income minus expenses” - is chosen by the taxpayer himself, except for the case provided for in paragraph 3 of this article. Taxpayers who are parties to a simple partnership agreement (joint activity agreement) or a property trust management agreement use income reduced by the amount of expenses as an object of taxation. This is the only restriction that Chapter contains. 26.2 of the Tax Code of the Russian Federation on the choice of an object of taxation. All other “simplified” people have the right to choose, and they must submit a notification to the tax authority about the transition to this special regime. We do not set out to give recommendations on the choice of one or another object of taxation under the simplified tax system. Of course, there are general recommendations, for example, if a “simplified” person carries out production activities with high costs for raw materials, wages, rent of premises, fixed assets, then it is preferable to choose “income minus expenses,” but if business activity is related to the provision of services and the share of costs is small - “income”. But, as practice shows, only a thorough analysis of the activities of a specific business entity, taking into account the features of Ch. 26.2 of the Tax Code of the Russian Federation can help in choosing the optimal object of taxation under the simplified tax system and minimize tax payments.

Unfortunately, the calculations made to select an object of taxation under the simplified tax system do not always turn out to be correct. The reasons can be very different: from errors in calculations to changes in market conditions or the start of new types of activities.

Chapter 26.2 of the Tax Code of the Russian Federation gives “simplified” people the opportunity to change the object of taxation at will, but in accordance with certain rules. You can change the object of taxation:

- annually;

- from the beginning of the tax period. During the tax period, taxpayers do not have such a right, as the Ministry of Finance periodically reminds (Letter No. 03-11-11/47086 dated November 5, 2013);

- if the taxpayer notifies the tax authorities about this before December 31 of the year preceding the year in which he proposes to change the object of taxation.

Please note that there are no exceptions to the above rules.

The object of taxation can be changed by both existing “simplified” and those who do not actually carry out their activities or who have newly registered and have not yet started business activities (Letter of the Ministry of Finance of the Russian Federation dated 04/11/2011 No. 03-11-06/2/52). Recently, the following practice has become widespread among individual entrepreneurs who use the simplified tax system and want to change the object of taxation. They want to change the object of taxation in the current tax period, for which they terminate the status of an individual entrepreneur and register again in the same tax period, but already choose a new object of taxation.

Tax authorities spoke about the legality of such maneuvers in Letter dated 02/28/2013 No. ED-3-3 / [email protected] According to clause 2 of Art. 346.13 of the Tax Code of the Russian Federation, a newly registered individual entrepreneur has the right to notify about the transition to the simplified tax system no later than 30 calendar days from the date of registration with the tax authority indicated in the certificate issued in accordance with clause 2 of Art. 84 Tax Code of the Russian Federation. In this case, an individual entrepreneur is recognized as a taxpayer using the simplified tax system from the date of registration with the tax authority specified in this certificate.

Before re-registering as an individual entrepreneur, the individual entrepreneur is required to undergo the procedure of deregistration with the tax authority. In this case, there are certain grounds established by Art. 84 of the Tax Code of the Russian Federation, allowing the tax authority to deregister an individual entrepreneur, and changing the object of taxation is not included among them.

The Federal Tax Service draws attention to the fact that individuals are subject to tax control and prosecution for identified tax offenses, regardless of their acquisition or loss of a special legal status, engagement in certain activities, transition to certain taxes or special tax regimes. Tax control in the form of tax audits, as well as liability for tax offenses, are aimed at ensuring the fulfillment of the obligation to pay a tax or fee, which is terminated in accordance with paragraphs. 3 tbsp. 44 of the Tax Code of the Russian Federation with the death of the taxpayer or when he is declared dead.

Consequently, in the event of termination of activity as an individual entrepreneur, an individual retains the obligation to submit tax returns and pay taxes for the period in which he carried out his activities in such capacity, since the termination by an individual of activity as an individual entrepreneur is not a circumstance that entails termination of the obligation to pay tax arising from its implementation (Determination of the Constitutional Court of the Russian Federation dated January 25, 2007 No. 95-О-О).

In addition, there are separate court decisions (decrees of the Arbitration Court of the FAS Eastern Military District dated July 16, 2012 in case No. A31-5701/2011, FAS SZO dated October 20, 2005 No. A21-94/05-S1), determining that under the start of business activities refers to the date of first registration as an individual entrepreneur, which makes it possible to qualify actions related to deregistration and registration as receiving unjustified economic benefits.

If the tax authorities classify the termination of activities as an individual entrepreneur, and then a new registration in the same tax period only for the purpose of changing the object of taxation as receiving an unjustified tax benefit, then this entrepreneur will be additionally assessed taxes under the simplified tax system in accordance with the previously selected object of taxation. There is no point in hoping that the tax authorities will not notice the fact of re-registration, since they maintain the Unified State Register of Individual Entrepreneurs, and their analytical work is currently well done.

As for notifying the tax authority about a change in the object of taxation, this norm is mandatory. This means that if the simplifier completely forgets to notify the tax authority within the prescribed period, then he cannot apply the new object of taxation. The author was unable to find examples of court decisions on this issue in favor of the taxpayer. Such “simplified” persons were additionally charged taxes in accordance with the previously selected object of taxation (decrees of the Federal Antimonopoly Service of the Eastern Military District dated April 17, 2012 in case No. A31-3888/2011, FAS North-West District dated November 28, 2013 in case No. A05-16718/2012, Determination of the Primorsky Regional Court dated July 25, 2012 in case No. 33-6435).

The issue of missing deadlines for notifying the tax authority about changes in the object of taxation is irrelevant today. From October 1, 2012, the notification period was extended from December 20 to December 31 of the year preceding the year of application of the new taxation object, and the new object can only be applied from the beginning of the tax period. Accordingly, if the simplifier has not notified the tax authority by December 31, then he will not be able to apply the new object of taxation and the judges will not support him.

In fairness, we note that when the notification period was set until December 20 and the “simplifiers” missed it, notifying the tax authority before the start of the next tax period, it refused them this, and the judges supported it. For example, FAS VSO noted that Ch. 26.2 of the Tax Code of the Russian Federation does not contain rules on the consequences of a taxpayer missing the deadline established for notifying the tax authority about a change in the object of taxation, does not give the tax authority the right to refuse to consider the specified application of the taxpayer, or to prohibit or allow the taxpayer to apply the object of taxation he has chosen. According to the provisions of this chapter, the object of taxation cannot be changed by the taxpayer during the tax period, that is, only this circumstance can be the basis for refusing to change the object of taxation (Resolution of the Federal Antimonopoly Service VSO dated October 31, 2012 in case No. A19-6469/2012).

For “simplified” people who want to change the object of taxation, Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. ММВ-7-3/ [email protected] “On approval of document forms for applying the simplified taxation system” approved form 26.2-6 “Notification of changing the object taxation." It is advisory in nature, therefore such taxpayers can write a letter to the tax authority in any form, notifying them of a change in the object of taxation from January 1, 20__, indicating the new object of taxation. Sending by them to the tax authority within the period provided for by the Tax Code of the Russian Federation a notice of a change in the taxation regime under the simplified tax system, drawn up in any form, is recognized as fulfilling the obligation established by clause 2 of Art. 346.14 Tax Code of the Russian Federation.

Formats for submitting documents for the application of the simplified taxation system in electronic form are approved by Order of the Federal Tax Service of the Russian Federation dated November 16, 2012 No. ММВ-7-6/ [email protected]

Some “simplified people” believe that in response to a letter notifying the tax authority about a change in the object of taxation, the tax authority should send an information letter to them in Form 26.2-7.

Explanations on this issue are given in the Letter of the Federal Tax Service of the Russian Federation dated April 15, 2013 No. ED-2-3/261. Such a letter is sent to the taxpayer upon receipt of a written request from him with a request to confirm the fact of application of the simplified taxation system. The information letter indicates the date the taxpayer submitted an application to switch to the simplified tax system, as well as information about the submission (failure) of tax returns in connection with the application of the simplified tax system for tax periods in which he applied a special tax regime.

The form of this letter does not provide for the reflection in it of information about the object of taxation applied by the taxpayer. In this regard, sending an information letter in response to requests would not answer the question asked about changing the object of taxation.

As noted by tax authorities, if the taxpayer sent a notification to the tax authority about a change in the object of taxation as established in paragraph 2 of Art. 346.14 of the Tax Code of the Russian Federation deadline, then he has the right to apply the selected object of taxation from the beginning of the year following the year of sending the specified notification.

Principles of accounting for income and expenses when changing a simplified tax system object

There won't be any particular problems regarding income here. After all, the businessman continues to use the “simplified system”, so he must take into account income “on payment”, both before the transition and after it.

Therefore, if the money was received before the date of change of the object of taxation (i.e. before the end of the year), then this income must be taken into account according to the “old” version of the simplified tax system, and if the amount came to the account after the transition, then according to the “new” version. This applies to the transition between objects in any “direction” - both from “Revenue” to “Revenue minus expenses”, and vice versa.

Expenses are more difficult. There are various situations where expenses can be attributed to both periods of work - before and after the transition.

The Tax Code of the Russian Federation contains only the most general rules that determine the procedure for accounting for expenses when moving from the “Revenue” object to the “Revenue minus expenses” object.

- Expenses incurred during the period of application of the “Income” object do not affect the tax base (clause 4 of Article 346.17 of the Tax Code of the Russian Federation).

- If, during the application of the “Income” object, fixed assets were purchased, then their cost cannot be transferred to the “Income minus expenses” object and written off (clause 2.1 of Article 346.25 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation does not contain special rules for accounting for expenses during the “reverse” transition - from the object “Income minus expenses” to the object “Income”.

Here, a businessman needs to try to organize his work in such a way as to write off the maximum possible amount of expenses before the transition date, since then he will not be able to take the expenses into account when determining the tax base.

Let's look at how these principles are implemented in practice for the most common types of expenses.

When to submit a notice to avoid fines and additional charges

general switch to a simplified tax system from another tax system only from the beginning of the next tax period, that is, from the new year.

As we have already said, the simplified tax system can be applied from the moment of state registration of a business entity.

How to take into account expenses for fixed assets and intangible assets when changing a simplified tax system object

Often the date of purchase of a fixed asset (FPE) item and the date of its commissioning are significantly different. The equipment needs to be installed and configured, the building needs to be repaired, etc.

If a fixed asset was acquired using the “Revenue” object, but it was put into operation after the transition to the “Revenue minus expenses” object, then the costs of purchasing this fixed asset can be included in expenses.

The fact is that, in accordance with paragraphs. 1 clause 3 art. 346.16 of the Tax Code of the Russian Federation, expenses for the acquisition of fixed assets are recognized for the simplified tax system only after the facility is put into operation. This is indicated by the Ministry of Finance with a letter dated October 18, 2017 No. 03-11-11/68187.

For intangible assets (IMA), this approach cannot be applied. Expenses for the acquisition (creation) of intangible assets must be recognized at the time the object is accepted for accounting (clause 2, clause 3, article 346.16 of the Tax Code of the Russian Federation), there is no concept of “putting into operation” in this case. Therefore, if a businessman bought (created) intangible assets and paid all the costs when using the “Income” object, then after moving to another object these expenses cannot be taken into account in any case.

Fixed assets are often expensive, and businessmen buy them in installments. If the operating system was purchased using the “Income” option, but the businessman made part of the payment after switching to “Income minus expenses,” then the cost of the operating system in this part can be taken into account in expenses (letter of the Ministry of Finance of the Russian Federation dated April 3, 2012 No. 03-11-11 /115).

Tax authorities express a similar opinion for intangible assets. For example, in a situation where a businessman, while using the “Revenue” object, entered into a license agreement for the use of software, which is valid for several years. Those license fees that were paid after the transition to “Revenue minus expenses” can be taken into account in expenses (letter of the Ministry of Finance of the Russian Federation dated May 4, 2013 No. 03-11-06/2/18966).

In the opposite situation, if OS or intangible assets were received from the supplier when using the “Revenue minus expenses” object, but it was paid for or put into operation (for OS) after the transition to the “Revenue” object, it will not be possible to take into account the costs.

Therefore, if a businessman plans to switch to the “Revenue” object, then you need to try to take into account, pay for and put into operation all acquired fixed assets and intangible assets before the transition date.

How to take into account the costs of goods when changing the object of the simplified tax system

Expenses for the purchase of goods under the simplified tax system can be written off only after these goods are sold (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation).

If a taxpayer purchased and paid for goods using the “Income” object, and sold them after switching to “Income minus expenses,” then he can take into account the cost of these goods as expenses. Experts from the Ministry of Finance speak about this in the above-mentioned letter No. 03-11-11/68187.

If a businessman purchased goods at the “Income minus expenses” object, then after switching to the “Income” object he will not be able to write off the costs of purchasing these goods. Therefore, in such a situation, you need to try to sell all inventory before moving to the “Revenue” object.

How to take into account material costs when changing an object of the simplified tax system

When writing off materials during the transition period, one must be guided by the general principle of recognizing expenses during the “simplification” - as they are actually paid.

Therefore, if the materials were paid for during the period of using the simplified tax system “Revenues”, then their cost cannot be taken into account in expenses, even if the materials were written off for production after the transition to the object “Revenues minus expenses”.

Expenses can only include the cost of those materials that the businessman paid for during the period of use of the “Income minus expenses” object (letter of the Ministry of Finance of the Russian Federation dated May 26, 2014 No. 03-11-06/2/24949).

Therefore, when switching between simplified taxation system options in any “direction”, you need to try to pay for the purchased materials during the period of use of the “Income minus expenses” object.

What is the simplified tax system “income minus expenses” in 2021?

The simplified taxation system has two varieties, which differ from each other in the procedure for determining the tax base, as well as in the current rates. Let's consider, using the simplified tax system as an example, income reduced by expenses.

The use of this system is regulated by the Tax Code of the Russian Federation, as well as by regional legislation. The use of the simplified tax system assumes that the taxpayer, instead of several taxes, calculates a single tax.

The basis for calculation is the receipts that accrue to the subject’s current account or to the cash desk. The law allows you to reduce revenue received by expenses actually incurred.

At the same time, there is a closed list of them, which is enshrined in the Tax Code of the Russian Federation. There is also a requirement that establishes the need to confirm these costs with documents, and at the time the expense is recognized in the tax base, they must be paid.

Performance indicators are recorded in the ledger of expenses and income, where both income and expenses of the company must be reflected. Based on it, tax reporting is prepared once a year.

Important! During the year, the taxpayer must calculate advance tax payments and transfer these amounts to the budget within the established time frame. The system is available for both individual entrepreneurs and companies.

How to take into account labor costs and insurance premiums when changing a simplified tax system object

The specificity of wages is that this type of expense “on accrual” and “on payment” in most cases refers to different months.

When switching between simplified taxation system options, the question arises primarily regarding the salary for December, which is paid in January.

If a businessman switches from the “Income” object to the “Income minus expenses” object, then, according to the Ministry of Finance, he cannot include in expenses the amounts of wages and insurance contributions for December transferred in January (letter dated May 26, 2014 No. 03-11-06 /2/24949).

In this case, it may be beneficial for the taxpayer to transfer insurance premiums for December ahead of schedule - in December. Then he will be able to use them as a tax deduction for the simplified tax system “Income”.

However, you need to keep in mind that employers can reduce the tax under the “Income” object by no more than 50% from the contributions paid. Therefore, if the deduction amount has already been “selected” by the beginning of December, then there is no point in rushing to make payments and you can transfer contributions for December on time - in January of the next year.

When switching from the “Income minus expenses” object to “Income”, it will be profitable to pay the salary for December in December. Then the salary will be included in expenses. But in this case, it will be more profitable to transfer contributions in January. Then the entire amount of contributions can be deducted from the “simplified” tax for the “Income” object (letter of the Ministry of Finance dated June 14, 2011 No. 03-11-06/2/94).

What is taxed under the simplified tax system?

The simplified taxation system has one original feature - the taxpayer himself can choose which object he will tax. There are 2 options in total :

The business entity here has a certain freedom in choosing to pay taxes. The application of the simplified tax system, as well as the determination of the taxable object, occurs at the request of the taxpayer. The choice is declarative one. tax permission for this . , certain conditions must be met

How to transfer losses when changing a simplified tax system object

A businessman who uses the simplified tax system “Income minus expenses” has the right to transfer received losses to the future for 10 years (clause 7 of article 346.18 of the Tax Code of the Russian Federation).

If he switches to the “Income” object, he will not be able to use previously received losses, because For the “Income” object, this option for reducing the tax base is not provided.

But if a businessman, within 10 years after receiving losses, returns to the “Income minus expenses” option, then he can deduct the unused balance of the loss from the tax base ( letter of the Ministry of Finance of the Russian Federation dated March 16, 2010 No. 03-11-06/2/35 ).

The procedure for switching to the simplified tax system in 2020

The law establishes several opportunities to start using the simplified tax system “Income Expense”.

When registering a business

If a business entity submits documents for state registration of an LLC or opens an individual entrepreneur, he can, along with a package of papers, fill out an application for the transition to the simplified tax system in form 26.2-1. In this situation, when receiving papers with registration data, he also receives a notification about the transition to a simplified system.

In addition, the law makes it possible to make such a transition within 30 days from the date of registration of the business entity.

Transition from other modes

The Tax Code specifies the possibility of making a transition to a simplified tax system when a different tax system is used.

However, such a step can only be taken from January 1 of next year. To start applying the simplified tax system, you must submit an application in the established format to the tax office before December 31 of this year. At the same time, this form must contain the criteria for the right to apply the simplified tax system. They are calculated on October 1 of this year.

To start applying the simplified tax system in 2021, it is necessary that the income of a business entity for 9 months of 2021 should not exceed 112.5 million rubles.

There is no other procedure for changing the tax system in the Tax Code.

Changing the regime within the simplified tax system

The Tax Code makes it possible, at the request of a business entity, to change one system to another within the simplified tax system, i.e., switch from “Income” to “Income expenses” and back. To take this step, you must submit an application in the prescribed format before December 31 of the current year. The application of the new system will begin on January 1 of the new year.