Who is considered an accountable person?

Very often, in the course of business activities, expenses for the needs of the enterprise have to be made by employees on the instructions of the head of the organization.

In this case, the employee is given money on account, i.e. this is followed by his obligation to submit a report for the amounts received and spent. Such an employee is an accountable person for the accounting department. Money can be issued to accountants:

- for business and administrative expenses - in the amount determined by production needs, and for periods determined by production needs;

- for travel expenses - for the period established by the manager’s order to send the employee on a business trip, and in the amount that should include travel expenses, living expenses and daily allowances.

Accounting for accountable amounts (their receipt, write-off, reflection of the balance or overexpenditure) is carried out on the active-passive accounting account 71 “Settlements with accountable persons”.

IMPORTANT! The accountant must maintain analytical accounting for each amount issued for reporting.

How many accountables can there be in an organization?

The legislation does not specifically indicate how many accountable employees an organization can have, and therefore the manager independently makes a decision on this issue. As a rule, companies select several accountable persons who are directly related to the purchase of inventory items, as well as employees who, due to their job responsibilities, may be sent on a business trip.

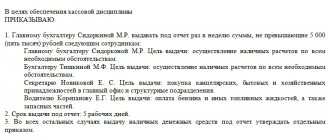

A specific list of employees who are allowed to receive money on account is compiled on the basis of the feasibility of their inclusion in this list. In this case, the head of the organization issues a corresponding order.

Read about the procedure for issuing such an order in the article “Drafting an order on accountable persons - sample 2020-2021.”

Organization of accounting of settlements with accountable persons

Funds are issued for reporting in accordance with clause 6.3 of the Bank of the Russian Federation Directive No. 3210-U dated March 11, 2014 on the basis of an employee’s application endorsed by the manager (or individual entrepreneur) with the amount and period for which the money is taken stated in it. From 08/19/2017 (directive of the Bank of Russia dated 06/19/2017 No. 4416-U), such an application is not mandatory, and issuance can be carried out without an application on the basis of an order from the manager (or individual entrepreneur). Cash is issued from the cash register using a cash receipt order.

Read about the rules for preparing this document in the article “How to fill out an expense cash order (RKO)?”

The employee must account for the accountable money. For this purpose, there is a document such as an advance report, which reflects the amount of funds received and what it was spent on. Documents confirming the expenses incurred must also be attached to the report. From November 30, 2020, the organization can independently set the deadline for the accountable person to submit the advance report; the requirement that the JSC must be submitted no later than 3 working days after the expiration date for which the reports were issued, or from the date of return to work, has been cancelled.

What should I do if the employee has not returned the accountable amount or provided an advance expense report? How to reflect the non-return of the accountable amount in accounting and tax accounting? Answers to these and other questions are in ConsultantPlus. If you don't have access yet, get a free trial online.

See also “Deadline for submitting an advance report by an accountable person.”

Reflection of accounts receivable on the balance sheet

The state of the company's assets and liabilities is reflected in the main document - the balance sheet.

Each of the assets is important. It is necessary to analyze the sources of funds and the availability of loans

Based on mobile and liquid working capital, it is possible to assess the efficiency and solvency of the enterprise

It is necessary to analyze the sources of funds and the availability of loans. Based on mobile and liquid working capital, the efficiency and solvency of the enterprise can be assessed.

Particularly important in this matter is accounts receivable on the balance sheet.

The registration of this type of asset must be correct. It can be used to determine the company's debt obligations. Therefore, the work is carried out by experienced accountants. To compose correctly, you need to study the various intricacies of the process. Debt obligations are formed from the issuance of loans by a company.

The nuances of travel expenses

A business trip is an employee’s departure to an area remote from his main place of work to perform official functions. The preparation of documents on the basis of which it is necessary to keep accounting records of settlements with accountable persons in this case must be carried out in accordance with the Decree of the Government of the Russian Federation “On the peculiarities of sending employees on business trips” dated October 13, 2008 No. 749.

The issuance of money for a business trip is calculated based on the cost of round trip travel, housing costs and daily allowance.

It should be taken into account that:

- the day of departure and the day of arrival are considered to be the dates recorded in the transport tickets;

- living expenses will have to be taken into account based on the documents provided by the accountable;

- daily allowances can be established and issued in accordance with internal documents regulating their amount, for example, regulations on business trips (Article 168 of the Labor Code of the Russian Federation).

To correctly calculate the tax base for personal income tax, daily allowances are taken into account within the limits established by law: 700 rubles. in Russia and 2500 rub. - on a business trip abroad (paragraph 12, clause 3, article 217 of the Tax Code of the Russian Federation), to calculate income tax, expenses include the amount within the amount stipulated by the employer’s internal documents (employment contract, order, business trip regulations).

IMPORTANT! That part of the daily allowance that is paid in excess of the norm established by law is considered the employee’s income and is subject to personal income tax and insurance contributions.

You can learn about the nuances of reflecting daily allowances in tax reporting from the article “How to correctly reflect daily allowances in excess of the norm in 6-NDFL?” .

Accounts receivable is an asset or liability

All About Stock Trading You Here is a way of grouping a company's assets. Sections of the balance sheet How accounts receivable differ from accounts payable To understand how accounts receivable differ from accounts payable, you need to take a closer look at each of these phenomena. If we speak in a language understandable to every person, then: Accounting - its types and methods Goals and principles of accounting Accounts receivable are a mandatory part of the working capital of a commercial organization.

Cheat sheet: Characteristics of liabilities and assets balance sheet is the main form of accounting reporting.

Postings for accounting on account 71

According to Section VI of the instructions for using the chart of accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), account 71 “Settlements with accountable persons”:

- debited to cash accounts 50 “Cash” (if cash is given to the accountant) or 51 (when funds are given in non-cash form);

- is credited to accounts that record expenses related to the employer’s business activities, and to cash accounts in the event of the return of unspent amounts.

Amounts for which the employee did not report must be returned to the employer - such an operation will be recorded as a credit to account 71 and a debit to cash accounts 50, 51.

If the balance of money is in debt to the employee, then it should be taken into account in the debit of account 94 “Shortages and losses from damage to valuables” in correspondence with account 71. Such debt can be deducted from the employee’s salary, in this case a posting will be made Dt 70 Kt 94 When the employer does not have the opportunity to withhold the debt from the salary, account 73 “Settlements with personnel for other operations” is used, and the posting will look like this: Dt 73 Kt 94.

Note! If an employee has lost (or forgotten to take) documents confirming expenses, then the decision to reimburse the employee for expenses is made by the head of the company. The supporting document will be an explanatory note from the employee attached to the advance report, and the basis for accepting the advance report will be an order from the director of the company.

Let us summarize the information about which accounts account 71 can correspond with.

| Account 71 “Settlements with accountable persons” corresponds to: | |||

| by debit with accounts | on a loan with accounts | ||

| the name of the operation | Corr. check | the name of the operation | Corr. check |

| Funds were issued for accounting or to compensate for overexpenditure of accountable amounts | 50, 51, 52 | Acquisition of material assets, goods | 07, 08, 10, 41 |

| Funds spent on expenses and household needs | 20, 23, 25, 26, 44 | ||

| VAT on purchased goods and materials | 19 | ||

| Return of the balance of accountable money | 50, 51 | ||

| There was a delay in the return of accountable amounts | 94 | ||

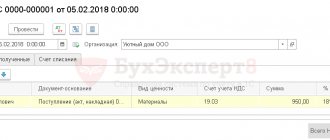

The expense report submitted to the accounting department is checked by the accountant, and its approval (by signing) is carried out by the manager (or individual entrepreneur). After this, the accountant can make all the necessary entries for expenses in accounting.

ConsultantPlus experts explained how to take into account the expenses of an advance report when calculating income tax. Get trial access to the system for free and move on to the Ready-made solution.

GLAVBUKH-INFO

When carrying out business activities, organizations can issue cash to their employees for travel expenses, operating and business expenses.The specified funds are issued from the cash desk for reporting to the organization’s employees, i.e., the employees must subsequently submit a report on the amounts spent with supporting documents attached.

Employees who receive funds on account are called accountable persons.

The issuance of accountable amounts and the submission of reports on their use are carried out in accordance with the Procedure for conducting cash transactions in the Russian Federation, approved by decision of the Board of Directors of the Central Bank of Russia dated September 22, 1993 No. 40.

The basis for issuing accountable amounts is orders from the head of the organization or travel certificates.

Accountable amounts are issued to employees in amounts and for periods determined by the head of the organization.

Persons who have received cash on account are obliged, no later than three working days after the expiration of the period for which they were issued, or from the date of their return from a business trip, to submit to the organization’s accounting department a report on the amounts spent and make a final settlement on them.

The issuance of cash on account is subject to the full report of the specific accountable person on the advance previously issued to him.

The transfer of cash issued on account by one person to another person is prohibited.

The issuance of accountable amounts from the organization's cash desk is carried out using cash receipts, which must indicate the intended purpose of the accountable amount.

Spending accountable amounts for other, not specified purposes is not permitted.

After the expiration of the period for which the accountable amounts were issued, the accountable persons are required to submit to the accounting department an advance report with the attachment of all supporting documents confirming the fact of expenditure and intended use of funds.

The advance report is submitted according to the established unified form No. AO-1 “Advance report”, checked by the accounting department and approved by the head of the organization.

Based on the data reflected in the advance report, the accounting department writes off the actual spent funds from the accountable person.

Amounts issued but not spent by the accountable person are subject to return to the organization's cash desk, which is documented by a cash receipt order.

In case of overexpenditure (when the employee has spent an amount greater than the advance received), the employee is paid the difference between the amount actually spent and the amount of the advance, which is documented in an expense cash order.

Accounting for expenses with accountable persons is carried out on active-passive account 71 “Settlements with accountable persons”.

The issuance of accountable amounts to employees is reflected in the debit of account 71 “Settlements with accountable persons” in correspondence with the credit of cash accounts.

For the amounts spent by accountable persons, account 71 “Settlements with accountable persons” is credited in correspondence with the accounts for cost accounting and accounting for acquired valuables or other accounts depending on the nature of the expenses incurred.

Example 9. Let’s say that an employee of an organization is given 1000 rubles for a period of three days. for purchasing office supplies.

When submitting the advance report, the employee presented sales and cash receipts confirming the purchase of office supplies in the amount of 950 rubles.

The balance is 50 rubles. returned to the organization's cash desk. No.

| Contents of business transactions | Corresponding accounts | Amount, rub. | ||

| Debit | Credit | |||

| 1 | An advance was issued to the employee for the purchase of office supplies. | 71 | 50 | 1 000 |

| 2 | Office supplies purchased through an accountable entity were accepted for accounting on the basis of an advance report | 10-9 | 71 | 950 |

| 3 | The unspent balance of the accountable amount was returned to the organization's cash desk | 50 | 71 | 50 |

Accountable amounts not returned by employees on time are transferred from the credit of account 71 “Settlements with accountable persons” to the debit of account 94 “Shortages and losses from damage to valuables.”

If an employee refuses to promptly return the balance of the unspent accountable amount, the organization’s administration may deduct it from the employee’s remuneration amounts.

Accountable amounts not returned on time are written off from account 94 “Shortages and losses from damage to valuables” to the debit of account 70 “Settlements with personnel for wages” in the case where they can be immediately withheld from the employee’s wages.

In the event that accountable amounts not returned within the prescribed period cannot be immediately withheld from the employee’s wages, they are first written off from account 94 “Shortages and losses from damage to valuables” to the debit of account 73 “Settlements with personnel for other operations” (subaccount 73 –2 “Calculations for compensation for material damage”). Then these amounts are withheld from the employee’s wages, which is reflected by an entry in the debit of account 70 “Settlements with personnel for wages” and the credit of account 73.

When a vehicle is sent before 24 o'clock inclusive, the day of departure, and a business trip is considered the current day, and from 00 o'clock later - the next day.

The issue of an employee’s attendance at work on the day of departure on a business trip and on the day of arrival from a business trip is resolved by agreement with the employer.

The purpose of the employee’s business trip is determined by the head of the sending organization and is indicated in the job description.

To prepare and record a work assignment for sending on a business trip, as well as a report on its implementation, the unified form No. T-10a “Office task for sending on a business trip and a report on its implementation” is used.

The official assignment is signed by the head of the structural unit where the posted worker works. Then it is approved by the head of the organization or a person authorized by him and submitted to the personnel service for issuing an order (instruction) on sending on a business trip in form No. T-9. When sending a group of workers, an order (instruction) is issued according to form No. T-9a.

Sending an employee on a business trip to the territory of the Russian Federation is documented with a travel certificate. The travel certificate is drawn up in form No. T-9 and serves as a document certifying the time spent on a business trip (date of arrival at the destination and date of departure from it). The travel certificate is issued in one copy and signed by the employer, handed to the employee and kept by him for the entire duration of the business trip.

The actual period of stay at the place of assignment is determined by the marks on the date of arrival at the place of assignment and the date of departure from it, which are made on the travel certificate and certified by the signature of an authorized official and the seal that is used in the economic activities of the organization to which the employee is posted to certify such a signature. .

If an employee is sent to organizations located in different localities, notes on the travel certificate regarding the date of arrival and date of departure are made in each of the organizations to which he is sent.

When an employee is sent on a business trip, he is given a cash advance to pay for travel expenses and rental accommodation and additional expenses associated with living outside his place of permanent residence (per diems).

The issuance of cash on account for expenses associated with business trips is carried out within the limits of the amounts due to business travelers for these purposes. The issuance of accountable amounts from the organization's cash desk is carried out according to expenditure cash orders, which must indicate the intended purpose of the accountable amount.

Average earnings for the period the employee is on a business trip, as well as for days on the road, including during a forced stopover, are retained for all days of work according to the schedule established by the sending organization

An employee working part-time during a business trip retains the average salary from the employer who sent him on a business trip. If such an employee is sent on a business trip simultaneously for his main job and part-time work, the average earnings are retained by both employers, and reimbursable expenses for the business trip are distributed between the sending employers by agreement between them.

After returning from a business trip to the organization, the employee (accountable person) draws up an advance report in form No. A01 with the attachment of documents confirming the expenses incurred. The advance report is drawn up no later than 3 working days from the date the employee returns from the business trip

In accordance with Art. 168 of the Labor Code of the Russian Federation, in case of being sent on a business trip, the employer is obliged to compensate the employee

- travel expenses;

- living expenses,

- additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission of the employer.

In accordance with Art. 168 of the Labor Code of the Russian Federation and the Regulations, the procedure and amount of reimbursement of expenses associated with business trips are determined by a collective agreement or a local regulatory act of the organization.

Additional expenses associated with living outside the place of residence (per diems) are reimbursed to the employee for each day he is on a business trip, including weekends and non-working holidays, as well as for days en route, including during forced stops along the way.

Expenses for travel to the place of business trip in the territory of the Russian Federation and back to the place of permanent work and for travel from one locality to another, if the employee is sent to several organizations located in different localities, include expenses for travel by public transport, respectively, to the station, pier, airport and from the station, pier, airport, if they are located outside the populated area, with documents (tickets) confirming these expenses. These expenses also include an insurance premium for compulsory personal insurance of passengers on transport, expenses for payment for services for issuing travel documents and providing bedding on trains.

In the event of a forced stopover, the employee is reimbursed for the costs of renting accommodation, confirmed by relevant documents, in the manner and amount determined by the collective agreement or local regulations.

Expenses for booking and hiring residential premises on the territory of the Russian Federation are reimbursed to employees (except for those cases when they are provided with free residential premises) in the manner and amount determined by collective agreements or local regulations.

An employee is sent on a business trip outside the territory of the Russian Federation by order (order) of the employer without issuing a travel certificate, except for cases of business trips to member states of the Commonwealth of Independent States with which intergovernmental agreements have been concluded, on the basis of which the border authorities do not make notes on entry and exit documents. crossing the state border..

The procedure for leaving the Russian Federation and entering the Russian Federation is determined by Federal Law No. 114-FZ of August 15, 1996 (taking into account subsequent amendments and additions).

Citizens of the Russian Federation leave the Russian Federation and enter the Russian Federation using valid documents certifying the identity of a citizen of the Russian Federation outside the territory of the Russian Federation.

The procedure for registration, issuance and withdrawal of these documents is determined by Federal Law No. 114-FZ.

The main identification documents of a citizen of the Russian Federation, by which citizens of the Russian Federation exit the Russian Federation and enter the Russian Federation, are recognized as:

- passport;

- diplomatic passport;

- service passport;

- seaman's passport (sailor's identity card).

As a rule, the time of the employee’s actual stay on a business trip abroad is confirmed by marks in the international passport about crossing the state border of the Russian Federation.

When sending an employee on a business trip to the territory of member states of the Commonwealth of Independent States, with which intergovernmental agreements have been concluded, on the basis of which border authorities do not make notes on crossing the state border in documents for entry and exit, the date of crossing the state border of the Russian Federation when traveling from the territory of the Russian Federation and to the territory of the Russian Federation are determined by the marks in the travel certificate, issued as for a business trip within the territory of the Russian Federation.

Payment and/or reimbursement of employee expenses in foreign currency related to a business trip outside the territory of the Russian Federation, including payment of an advance in foreign currency, as well as repayment of unspent advance in foreign currency issued to an employee in connection with a business trip, are carried out in accordance with the Federal Law “On currency regulation and foreign exchange control."

Payment of daily allowance to an employee in foreign currency when the employee is sent on a business trip outside the territory of the Russian Federation is carried out in the amounts determined by the collective agreement or local regulations.

During the travel time of an employee sent on a business trip outside the territory of the Russian Federation, daily allowances are paid:

a) when traveling through the territory of the Russian Federation - in the manner and amount determined by the collective agreement or local regulations for business trips within the territory of the Russian Federation;

b) when traveling through the territory of a foreign state - in the manner and amount determined by a collective agreement or local regulations for business trips on the territory of foreign states.

When an employee travels from the territory of the Russian Federation, the date of crossing the state border of the Russian Federation is included in the days for which daily allowances are paid in foreign currency, and when traveling to the territory of the Russian Federation, the date of crossing the state border of the Russian Federation is included in the days for which daily allowances are paid in rubles.

The dates of crossing the state border of the Russian Federation when traveling from the territory of the Russian Federation and to the territory of the Russian Federation are determined by the marks of the border authorities in the international passport.

When an employee is sent on a business trip to the territory of two or more foreign states, daily allowances for the day of crossing the border between states are paid in foreign currency according to the standards established for the state to which the employee is sent.

An employee who went on a business trip to the territory of a foreign state and returned to the territory of the Russian Federation on the same day is paid daily allowances in foreign currency in the amount of 50 percent of the rate of expenses for the payment of daily allowances, determined by a collective agreement or local regulations, for business trips to the territory of foreign states.

Expenses for hiring residential premises when sending employees on business trips to foreign countries, confirmed by relevant documents, are reimbursed in the manner and amount determined by the collective agreement or local regulations. Travel expenses when sending an employee on a business trip to the territory of foreign states are reimbursed to him in the manner prescribed when sending him on a business trip within the territory of the Russian Federation.

An employee who is sent on a business trip to the territory of a foreign state is additionally reimbursed for:

- expenses for obtaining a foreign passport, visa and other travel documents;

- mandatory consular and airport fees;

- fees for the right of entry or transit of motor vehicles;

- expenses for obtaining compulsory health insurance;

- other mandatory payments and fees.

Reimbursement of other expenses related to business trips in the cases, procedure and amounts determined by the collective agreement or local regulations is carried out upon presentation of documents confirming these expenses.

For accounting purposes, all types of travel expenses for employees of commercial organizations are compensated to the employee in full in the amount of actual expenses in the presence of supporting documents (travel tickets, receipts for payment for the use of bedding on the train, invoices for hotel accommodation, etc.).

Tax aspects. For profit tax purposes, expenses for business trips are taken into account as part of other expenses associated with the production and/or sale of finished products (work, services).

Thus, for profit tax purposes the following expenses can be taken into account:

- for the employee’s travel to the place of business trip and back to the place of permanent work;

- for renting residential premises;

- daily allowance or field allowance;

- for registration and issuance of visas, passports, vouchers, invitations and other similar documents;

- consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees.

Field allowance is paid to employees of geological exploration and topographic and geodetic organizations performing geological exploration and topographic and geodetic work on the territory of the Russian Federation, employees of forest management organizations, as well as employees of prospecting cooperatives and other commercial organizations engaged in the development of alluvial and small ore deposits of precious metals and precious stones.

For tax accounting purposes, travel expenses to the destination and back are reimbursed to the employee in full in the amount of actual expenses, provided there are supporting documents (travel tickets, receipts for payment for the use of bedding on the train, etc.).

In accordance with the Decree of the Government of the Russian Federation dated March 2, 2005 No. 111, the cost of a set of bed linen can be included in the cost of travel issued with a travel document (ticket). If the cost of a set of bed linen is not included in the fare on a long-distance train, then the passenger is provided with a set of bed linen at his own request and for an additional fee.

In this case, according to letter No. 30 of the Ministry of Finance of the Russian Federation dated May 12, 1992, costs for the use of bedding on trains are reimbursed based on actual costs confirmed by relevant documents.

Expenses paid to an employee for travel to and from a business trip that are not documented are not taken into account for profit tax purposes.

Under the item “renting residential premises”, expenses for hotel accommodation are subject to reimbursement, as well as employee expenses for payment of additional services provided in hotels (with the exception of expenses for service in bars and restaurants, expenses for room service, expenses for the use of recreational and health facilities ).

For tax accounting purposes, expenses for renting residential premises, confirmed by documents, are accepted in the amount of actual expenses incurred.

From January 1, 2009, for commercial organizations the amounts of daily allowance and field allowance are no longer standardized for profit tax purposes.

According to paragraph 38 of Art. 270 of the Tax Code of the Russian Federation, the amounts of excess daily allowance and field allowance are excluded from the list of expenses not taken into account when taxing profits.

This rule also applies to business trips outside the territory of the Russian Federation.

From January 1, 2009, the procedure and amount of reimbursement of daily allowances and field allowances will be determined independently by the organization and reflected in collective agreements or local regulations of the organization.

Until 2009, by Decree of the Government of the Russian Federation dated 02/08/2002 No. 93, it was established that the daily allowance for each day on a business trip in the Russian Federation should not exceed 100 rubles.

Similarly, the amounts of daily allowance payments for business trips abroad were established in the annex to the Decree of the Government of the Russian Federation dated 02/08/2002 No. 93.

However, it should be borne in mind that from January 1, 2008, certain types of travel expenses are standardized for personal income tax purposes.

According to paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, when an employee pays expenses for business trips both within the country and abroad, the income subject to taxation does not include daily allowances paid in accordance with the legislation of the Russian Federation, but no more than:

- 700 rub. for each day you are on a business trip in the Russian Federation;

- 2500 rub. for each day you are on a business trip abroad.

In the second case, in order to determine the taxable amount of daily allowance paid in foreign currency, it is necessary to convert its value into rubles at the rate in effect on the date the daily allowance was issued.

When traveling on business in the Russian Federation and the daily allowance exceeds 700 rubles. per day from an amount exceeding 700 rubles. per day, it is necessary to accrue and pay personal income tax to the budget.

On a business trip abroad with a daily allowance exceeding 2,500 rubles. per day from an amount exceeding 2500 rubles. per day, it is necessary to accrue and pay personal income tax to the budget.

Not subject to tax on the income of individuals, actually incurred and documented targeted expenses for travel to the destination and back, fees for airport services, commission fees, expenses for travel to the airport or train station at the places of departure, destination or transfers, for baggage transportation, expenses for renting accommodation, paying for communication services, obtaining and registering an official foreign passport, obtaining visas, costs associated with exchanging cash or a bank check for cash foreign currency.

If the employee fails to provide documents confirming payment of expenses for renting residential premises, the amounts of such opiates are exempt from personal income tax in accordance with the legislation of the Russian Federation, but no more than:

- 700 rub. for each day you are on a business trip in the Russian Federation;

- 2500 rub. for each day you are on a business trip abroad.

In the second case, in order to determine the taxable amount of expenses for renting residential premises paid in foreign currency, it is also necessary to convert their value into rubles.

In such cases, it is necessary to accrue and pay personal income tax on the amount exceeding the above-mentioned limits on expenses for renting residential premises.

VAT amounts paid on travel expenses to and from the place of business travel (including costs for the use of bedding on trains), as well as on expenses for renting residential premises, are subject to deduction when settling with the budget, subject to certain conditions.

When paying in cash for services for renting living quarters, for transporting employees to and from the place of business travel, including services for providing bedding for use on trains, the basis for registration in the purchase book and deduction of VAT amounts paid for such services are the completed in accordance with the established procedure, strict reporting forms with VAT amounts highlighted in them as a separate line.

Strict reporting forms filled out in the prescribed manner (or copies thereof) with the VAT amount highlighted as a separate line are stored by the purchasing organization in the journal of received invoices.

In the absence of strict reporting forms, the basis for deducting VAT amounts is an invoice and documents confirming the actual payment of the tax amount (including cash receipts with a separate line for the VAT amount).

Travel expenses associated with business trips on the territory of the Russian Federation are reflected in accounting in the following order.

The issuance of accountable amounts for travel expenses is reflected in the debit of account 71 “Settlements with accountable persons” in correspondence with the cash accounts. Depending on the category of personnel and the purpose of the trip, the spent accountable amounts are written off to the debit of accounts 20 “Main production”, 25 “General production expenses”, 26 “General business settlements” (44 “Sales expenses” in trade organizations) in correspondence with the credit of account 71 “ Calculations with accountable persons".

Amounts of VAT paid on travel expenses to and from the place of business travel, as well as on expenses for renting residential premises, are accounted for in account 19 “Value added tax on acquired assets” in correspondence with the credit of account 71 “Settlements with accountable persons”.

The deduction of these VAT amounts is reflected in the credit of account 19 “Value added tax on acquired values” in correspondence with the debit of account 68 “Calculations for taxes and fees” (subaccount 68–1 “Calculations for value added tax”).

In general, expenses for accounting for travel expenses on the territory of the Russian Federation (if the daily allowance amount does not exceed 700 rubles per day) are reflected in the following entries:

| No. | Contents of business transactions | Corresponding accounts | |

| Debit | Credit | ||

| 1 | An advance was issued to the employee for travel purposes | 71 | 50 |

| 2 | Based on the advance report, actual and documented travel expenses are included in the cost of production (selling expenses) excluding VAT | 20, 25, 26. (44) | 71 |

| 3 | The amount of VAT is reflected on the cost of accommodation and travel expenses incurred | 19 | 71 |

| 4 | VAT amounts paid on travel and accommodation expenses are claimed for deduction. | 19-1 | 10 |

| 5 | The return of the balance of the unspent accountable amount is reflected | 50 | 71 |

Travel expenses associated with business trips on the territory of foreign countries are reflected in accounting in the following order

If there are foreign currency funds in a current foreign currency account, the organization, in accordance with the established procedure, can receive cash foreign currency from an authorized bank to pay travel expenses.

In the absence of foreign currency funds in a foreign currency account at a bank, organizations can, without special permission from the Central Bank of the Russian Federation, purchase foreign currency non-cash for rubles through authorized banks to pay travel expenses.

Purchasing foreign currency in cash to pay for travel expenses is prohibited.

Accounting for transactions involving the purchase of foreign currency is described in detail in clause 3. The purchased foreign currency is credited in full to the organization’s current currency account and can only be used to pay travel expenses in foreign currency through the organization’s cash desk

The receipt of foreign currency at the organization's cash desk is reflected in the debit of account 50 “Cash office separately (for example, in subaccount 50–4 “Cash in foreign currency”) and the credit of account 52 “Currency accounts (subaccount 52–2 “Current foreign currency accounts*”).

The issuance of foreign currency to an employee for travel expenses is reflected in the credit of account 50 “Cash” (subaccount 50–4 “Cash in foreign currency”) in correspondence with account 71 “Settlements with accountable persons” (for example, subaccount 71–2 “Settlements with accountable persons in foreign currency").

In this case, the issuance of accountable amounts in rubles can be accounted for in subaccount 71–1 “Settlements with accountable persons in rubles.”

Accounting and tax accounting of expenses for business trips abroad is carried out in the same manner as for business trips within the Russian Federation. Only transactions with foreign currency and accounting for exchange rate differences require special attention.

Exchange differences arising when currency exchange rates change during a business trip are reflected in the debit/(credit) of account 91 “Other income and expenses” in correspondence with accounts 50 “Cash” (subaccount 50–4 “Cash in foreign currency”) and 71 “Settlements with non-flying persons" (subaccount 71–2 "Settlements with accountable persons in foreign currency"?

Accounting for the organization's foreign currency accounts and transactions in foreign currency is carried out in rubles based on the conversion of foreign currency at the official exchange rate of the Russian Federation on the date of the transaction.

Operations for accounting for expenses on foreign business trips (with a daily allowance of no more than 700 rubles per day when traveling through the territory of the Russian Federation and with a daily allowance of no more than 2,500 rubles per day when staying in foreign countries) can be reflected in accounting using the following entries:

| No. | Contents of business transactions | Corresponding accounts | |

| Debit | Credit | ||

| 1 | Money was received by check to issue an advance to an employee for a business trip in rubles | 50-1 | 51 |

| 2 | Money was received from a current foreign currency account to issue an advance to an employee for a business trip in foreign currency | 50-4 | 52-2 |

| 3 | An advance payment for a business trip abroad was issued to the employee in rubles. | 71-1 | 50-1 |

| 4 | An advance payment for a business trip abroad was issued to the employee in foreign currency. | 71-2 | 50-4 |

| 5 | The positive exchange rate difference is reflected on the date of issue of foreign currency funds from the cash register to the report | 50-4 | 91-1 |

| 6 | The return of the unspent accountable amount in foreign currency is reflected | 50-4 | 71-2 |

| 7 | The return of the unspent accountable amount in rubles is reflected | 50-1 | 71-1 |

| 8 | The negative exchange rate difference that arose on the returned unspent accountable amount in foreign currency on the date of its return to the cash desk is reflected | 91-2 | 71-2 |

| 9 | Based on the advance report, actual and documented travel expenses in foreign currency are included in the cost of production | 20 | 71-2 |

| 10 | The negative exchange rate difference arising on travel expenses in foreign currency is reflected on the date of their write-off to the cost of production | 91-2 | 71-2 |

| 11 | Based on the advance report, actual and documented travel expenses in rubles are included in the cost of production (excluding VAT) | 20 | 71-1 |

| 12 | The amount of VAT on travel expenses incurred in rubles within the Russian Federation is reflected | 19 | 71-1 |

| 13 | VAT amounts related to travel expenses in rubles within the Russian Federation are presented for deduction | 68-1 | 19 |

The organization must conduct an inventory of accountable amounts, during which reports of accountable persons on advances issued are checked, taking into account their intended use, as well as the amount of advances issued for each accountable person (dates of issue, intended purpose).

| < Previous | Next > |

Results

Accounting for settlements of funds issued to an accountable person is based primarily on the correct and timely documentation of all transactions. Such operations include issuing money for expenses, reporting by the accountable person, returning unspent amounts, and recording expenses incurred.

Sources:

- Tax Code of the Russian Federation

- Labor Code

- Directive of the Bank of Russia dated March 11, 2014 N 3210-U

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for approving job descriptions

The procedure by which job descriptions are approved must be enshrined in one of the company’s local acts. However, this is not a requirement. Approval of job descriptions occurs in the following order:

- First of all, a draft specific instruction is developed;

- Issue an order approving the new instructions;

- The order and instructions are agreed upon with the legal department or the company’s lawyer, if there is one, and submitted for approval to the head of the organization;

- Instructions are assigned a specific number.

Important! If necessary, the job description can be registered in a special journal, if the company maintains such a journal.

A job description becomes mandatory only after the employee has read it. Confirmation that the employee has read the instructions is his signature (