As a general rule, the calculation of child care benefits for children under one and a half years old is 40% of the average earnings of a working parent (or other relative caring for the child). However, in 2021, when calculating care benefits for up to 1.5 years, several rules apply, as a result of which the payment may differ from the generally determined one.

Starting from 2021, the territorial branch of the FSS is responsible for the calculation and payment of child benefits. Information and documents for calculating benefits to the Social Insurance Fund are provided by the employer. In this article we will look at how the amount of monthly child care benefits is calculated in 2021 and in what order.

Average earnings for calculating benefits

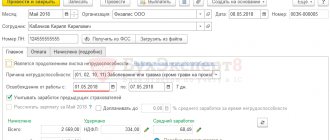

Average earnings per day for child care benefits are calculated similarly to earnings for payments associated with the birth of a baby.

Just as for maternity benefits, the period of the previous 2 years before the year of granting the benefit is taken into account. In cases where there was no income in these years or it was small (for example, payments were made only for part of the year), the years taken into account can be replaced.

From the resulting time period, expressed in days (for example, 731 days), days are excluded when the employee being calculated was released from work, and contributions for temporary disability and maternity (VNiM) were not accrued for the content he received.

The employee was on maternity leave for a child under 3 years of age for 60 days and on sick leave for 16 days. You need to take into account:

731-60-16 = 655 days.

The employee’s income should also be taken only for these days according to the principle: the payment was subject to contributions to VNiM.

Let’s say an employee, whose history we have already begun to consider, received for the estimated 2 years:

- salary - 380,000 rubles;

- sick leave benefits - 16,000 rubles;

- financial assistance from the employer - 15,000 rubles.

When calculating her average earnings, only 380,000 rubles will be used for care payments.

The final iteration is to divide the estimated income by the estimated number of days.

AVERAGE DAILY EARNING = INCOME FOR THE BILLING PERIOD / NUMBER OF DAYS IN IT

For the hypothetical employee we are considering:

380,000/655 = 580.15 rubles.

The legislative framework

The main assistance to parents in our country in the first one and a half years after birth are child care payments, which are paid every month.

According to the National Decree “On compulsory social insurance in case of temporary disability and in connection with maternity,” compensation is paid through funding from the federal social insurance resource, and everything is necessarily paid by the employer. If none of the parents is temporarily officially employed, the benefits are paid by the relevant authorities.

Not only the mother of the child can receive these payments, but also people who care for the baby and raise him up to one and a half years. The legislative framework makes it possible for parents, other relatives, and guardians who actually care for the child to purchase benefits.

Citizens who work must contact their employer to receive payments.

In this case, funds are paid, which are transferred to the enterprise by the relevant authorities.

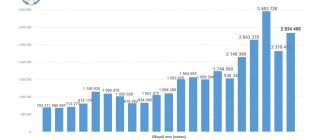

The amount of the benefit varies within forty percent of the monthly average salary for the two previous working years. When the length of service of the person receiving payments is less than six months or the income is reduced to a minimum, then the minimum amount of benefits will be paid. In 2015, these payments amount to 5,965.00 rubles, and the minimum amount ranges from 2,718.35 rubles per month for the first child and 5,436.67 rubles for subsequent newborns.

The law establishes the highest average wage from which the benefit amount is calculated. In 2015, it has no right to be higher than 670,000 rubles . Benefits for non-working persons and persons studying full-time in educational institutions are set at a minimum amount.

Child benefit is assigned from the beginning of parental leave and ends at eighteen months. An application for an appointment must be made no later than 6 months after the baby reaches 1.5 years of age. After the employer or the Department of Social Protection of the Population receives the necessary documents, the funds must be transferred no later than ten days.

Payments for the third child and subsequent children under three years of age are made in accordance with the article of the law of May 7, 2012 No. 606 “On measures to implement the demographic policy of the Russian Federation” to help low-income families.

How to calculate the amount of care allowance

As we have already noted, child care benefits for children up to one and a half years old are not paid in full amount of average earnings, but only as a percentage of it.

Moreover, it is monthly. Therefore, for a fair calculation, they do not take the actual number of days in a particular month, but the calculated one - 30.4 days.

Based on this, the formula for determining benefits looks like this:

SIZE OF CARE BENEFITS UP TO 1.5 YEARS = AVERAGE DAILY EARNING × 30.4 × 40%

Let's see how much the employee from our example will receive per month:

580.15 × 30.4 × 40% = 7054.62 rubles.

Step-by-step instruction

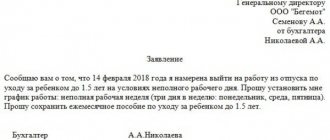

If a person is employed and directly cares for a baby, the steps listed below should be taken to purchase funds:

- Submit to the personnel department of your organization an application, written in any form, about taking leave to look after a child up to one and a half years old. The application must be written to the director of the organization.

- Purchase a photocopy of the order on leave to look after the baby from the personnel department of the organization, indicating the start and end date.

- A photocopy of this order must be submitted to the director with an application for the accrual of funds, bringing it to the personnel department.

- Assistance is provided from the moment childcare leave is granted until the child reaches the age of 1.5 years. After the owner of the enterprise or the Department of Social Protection of the Population receives the application and the necessary documents, he takes ten days to make a decision on determining the amount and start of payment.

Because of this, it is advisable to start applying for childcare benefits for a baby up to 1.5 years old early before maternity leave ends.

Maximum amount of child care payment

Unfortunately, the law does not allow paying an employee caring for an infant under one and a half years old, any amount of money. Despite the fact that the calculation is based on two years' earnings, this value is limited by the maximum limit.

The limit is approved for each year individually based on the maximum amount of contributions paid for VNIM insurance.

For example, in 2021 it is 865,000 rubles, in 2021 it is 912,000 rubles.

When an employee’s earnings for the corresponding 12 months are higher than the indicated figures, the excess is simply not taken into account. And the benefit is calculated according to the maximum possible. Let's see how this works in practice. To do this, we will calculate the maximum possible payment in 2021.

We take the maximum income (subject to insurance contributions) for 2019 and 2021 and add it up:

865 000 912 000 = 1 777 000.

Now let's calculate the maximum benefit amount:

1,777,000 / 731 days × 30.4 × 40% = 29,600.48 rubles.

That is, the maximum amount of benefits for child care up to 1.5 years in 2021 is 29,600.48 rubles per month.

Allowance for children in single-parent families

The following persons have the right to a monthly allowance for a child aged 8 to 17 years:

- the only parent of such a child (the parent who is indicated in the birth certificate is recognized, provided that there is no information about the second parent, or he died or is recognized as missing);

- parent of such a child in respect of whom the payment of alimony is provided on the basis of a court decision.

Condition: the average per capita family income does not exceed the subsistence level established in the region.

That is, both single mothers and mothers IN DIVORCE can apply for benefits, but only on the condition that they have filed for alimony!!!

Payment period:

- from the date of application for 12 months, but not earlier than the child’s 8th birthday and not earlier than July 1, 2021.

- Re-registration is annual until the age of 17.

Benefit amount:

- 50 percent of the subsistence level for children in the region of residence (or registration).

- Installed for every child from 8 to 17 years old.

- Subject to annual recalculation.

Minimum amount of care allowance up to 1.5 years

In addition to the maximum benefit amount, there is also a minimum amount. His allowance cannot be lower.

As a general principle, the minimum benefit amount should be calculated from the minimum wage. That is, the monthly benefit should not be less than 40% of the minimum wage. But in 2021 an interesting nuance has arisen.

The fact is that there are categories of citizens who are assigned a care allowance in a fixed amount (independent of earnings and the minimum wage). For example, the unemployed receive such benefits. And according to an additional condition from the law, the payment to a working caregiver should not be less than the payment to an unemployed person.

Since the care allowance for the unemployed is regularly indexed (the last time this happened on February 1, 2021), the moment has come when its size “jumped” over that obtained under the minimum wage. Therefore, when calculating, you can avoid making unnecessary calculations and immediately focus on the amount of benefits for the unemployed.

Thus, the minimum amount of care allowance for 2021 is 7082.85 rubles.

Necessary documents for obtaining monthly child benefits

To apply for child care benefits, a working person must deliver the following documents to the human resources department at the place of work:

- handwritten application for taking leave to care for a child up to 1.5 years old;

- a photocopy of the order from the organization to provide this leave;

- application for accrual of payments;

- a certificate stating that one of the parents did not formalize and receive such payments;

- a photocopy of the order from the organization on the assignment of benefits;

- original documents and a photocopy of the birth certificate;

- photocopy of the applicant's passport.

Parents who are not working due to dismissal due to layoffs during the liquidation of an organization or students who are studying full-time have the opportunity to submit documents in their region to the social security authorities of residents:

- a photocopy of an extract from the work book about the last place of work or service, certified by a notary;

- a photocopy of the order regarding dismissal from the previous job and calculations of the maternity benefits provided, if provided;

- certificate at the place of residence about family composition;

- certificate of average salary.

Comparison of benefit amount with minimum and maximum amounts

The calculated amount of child care benefit for children under 1.5 years of age is compared with the maximum and minimum amount of the monthly child care benefit.

Next, select one of the options:

- If the calculated benefit amount is less than the minimum amount, child care benefits for children up to one and a half years old are paid in the amount of 7082.85 rubles.

- If the calculated benefit amount is greater than the maximum amount, a benefit is paid in the amount of 29,600.48 rubles.

By analogy, they calculate benefits for caring for a second child.

Let’s apply the information received to our employee from the calculations above.

Based on the calculation of earnings, it turned out that the employee must be paid 7,054.62 rubles per month. This is clearly less than RUB 29,600.48. And the minimum you need to rely on is 7082.85 rubles. That is, the benefit calculated based on salary turned out to be slightly lower.

Conclusion: the employee should receive 7082.85 rubles per month.

Benefit for pregnant women

Article 9 of this law now reads as follows:

Women who register with a medical organization in the early stages of pregnancy have the right to a monthly allowance if:

- their pregnancy period is from 6 weeks;

- they registered early (up to 12 weeks);

- the average per capita family income does not exceed the subsistence minimum established in the region (at the place of residence or stay).

Article 10:

Payment duration:

- when applying for benefits within a period of up to 30 days from the date of registration, the benefit is assigned from the month of registration (but not earlier than 6 weeks) until childbirth (termination of pregnancy);

- when applying after 30 days from the date of registration, the benefit is assigned from the month of application until childbirth (termination of pregnancy).

Benefit amount:

- the benefit amount is 50 percent of the subsistence minimum for the working-age population established in the region.

- from January 1 of the year following the year of application - the amount is subject to recalculation.

Payment terms

You must submit documents to purchase childcare benefits for a child up to 1.5 years old no later than six months from the date of birth.

It is also recommended to focus on the fact that, regardless of the date of submission of the application, benefits in 2015 will be provided for the entire period of time from the date of going on parental leave until the child reaches the age of one and a half years, no older.

Compensation is assigned within ten working and weekend days of the calendar from the date of submission of the application and a copy of the birth certificate. Compensation can be transferred by the employer to the day of payment of wages. When a benefit is issued by the regional Office of the Social Insurance Fund, it can be sent by mail or paid for by a credit institution.