Kontur.Accounting - 14 days free!

Personnel records and employee reports, salaries, benefits, travel allowances and deductions in a convenient accounting web service

Try it

Each organization carries out settlements with staff related to wages, providing loans to employees, issuing money on account, etc. For accounting, correct accounting of these transactions is a labor-intensive process. Let us tell you in more detail how and on what basis you should pay your employees.

Payments to employees regarding wages

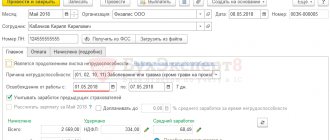

The accounting department records settlements with employees for wages on account 70 “Settlements with personnel for wages”. Payroll is reflected in debit, deductions and loan payments. The source for calculating wages are cost and distribution cost accounts. The employee is accrued for time worked - in accordance with the remuneration system - and time not worked.

Remuneration for hours worked includes:

- remuneration for work;

- compensation and incentive payments.

Salary for unworked time is calculated based on average earnings, which are paid:

- for annual and educational leaves;

- during downtime due to the fault of the organization;

- during a business trip, etc.

When calculating wages, an entry is made: Dt 20 (23, 44 ...), Kt 70.

Overpayment of wages

Most often, overpayment of wages is caused by:

- vacation overexpenditure;

- unpaid advances.

In the first case, the employee was granted leave for the unworked period. At the time of dismissal, the period for which vacation pay was paid remained unworked, and vacation pay became an excessively issued salary.

The second case is when an employee received money in the middle of the month, after which he quit, and the actual accrued salary for a given month turned out to be less than the advance received.

There are three ways to get out of the situation with overpayment of wages:

- ask the employee to voluntarily repay the debt;

- if you refuse to voluntarily repay the debt, file a lawsuit;

- forgive the debt.

Salary deductions

The task of accounting is to calculate salaries, accrual and deductions from it. The law does not limit the list of deductions from an employee’s salary, but the main ones include:

- personal income tax;

- according to executive documents;

- compensation for damage caused to the organization;

- union dues;

- on loans received;

- to repay advances;

- on transfers of insurance premiums to personal insurance, etc.

The total amount of deductions should be no more than 20% of the salary, and in the case of deductions based on executive documents, no more than 50%. However, when collecting alimony for minor children, when compensating for damage to health caused by a crime, as well as associated with the death of the breadwinner, the amount of deductions should be no more than 70%.

Deductions from wages are reflected by posting: Dt 70, Kt 68 (76, 73...)

Income tax on salary

The organization acts as a tax agent. It is obligated to pay personal income tax for its employees (13% and 30% for residents and non-residents, respectively). When determining the amount of tax, you need to remember that employees have the right to apply tax deductions:

- standard (for children, as well as various categories of persons defined in Article 218 of the Tax Code of the Russian Federation);

- social (for treatment, training, charity and voluntary pension provision);

- property (related to the sale and acquisition of property);

- professional.

Example. The employee received a salary of 35,000 rubles. He is a widower and has two school-aged children. The standard deduction for children is 1400 + 1400 = 2800, and since the employee is a widower, these deductions are doubled and will amount to 5600. The tax base will be calculated as 35,000 - 5600 = 29,400 rubles, the tax amount will be 29,400 * 13% = 3822 rubles.

Payment of salaries to employees

After all deductions, the organization must pay the remaining wages to employees. Salaries are paid at least once every half month (Article 136 of the Labor Code of the Russian Federation). The specific payment day is determined by internal regulations, labor or collective agreements. Both advance and non-advance payment methods can be used.

Most enterprises transfer salaries to employees to their bank card accounts. If the company pays wages from the cash register, it may be necessary to deposit it if the employee for some reason was unable to receive the money on time. The deposited salary is issued to the employee upon his written application.

When paying wages, the enterprise is obliged to notify the employee in writing about its components, amounts and grounds for deductions.

Payment of salary is reflected by the posting: Dt 70, Kt 50 (51).

Voluntary debt repayment

If the advance payment is returned, there will be no need to make adjustments to insurance premiums, since insurance premiums are not charged from the advance amounts. The same applies to personal income tax, if the employer does not withhold tax from advances paid. If it is withheld, then the transferred tax will have to be returned to the current account or counted against future payments to the budget, and an updated 2-NDFL certificate will be issued for the employee if the tax period in which the overpayment occurred has expired.

note

If you voluntarily return the overpayment, there is no need to make any mutual settlements with the personal income tax officer, since he returns the money from which personal income tax has already been withheld, that is, minus tax.

When returning vacation pay, the accountant must reverse the accrual entry and cancel expenses in the form of accrued vacation pay in tax accounting.

There is an overpayment of insurance premiums. For the current period, it is necessary to take into account the adjustments for their accrual, and the overpayment should be adjusted with further payments.

If, in connection with the deletion of accrual of vacation pay, negative values are formed in the personalized accounting in the Pension Fund of the Russian Federation for an employee, the company’s report will not be accepted. Therefore, you will have to adjust not the current period, but the previous period.

An overpayment of personal income tax is formed, withheld from the amount of vacation pay and transferred to the budget. If Certificate 2-NDFL for the corresponding year has been submitted, you need to make an updated certificate - the current date with the old number.

The posting for accrual of personal income tax on vacation pay is reversed.

The resulting tax overpayment can be returned to your current account or offset against future payments to the budget. EXAMPLE 1. HOW TO REFLECT OVEREXPENDITURE OF HOLIDAY PAY AND THEIR VOLUNTARY REFUND

At the beginning of the reporting year, employee Belov was granted early leave for the unworked period.

The amount of accrued vacation pay is 20,000 rubles, personal income tax is 2,600 rubles. (RUB 20,000 × 13%) was withheld and transferred to the budget. Belov received 17,400 rubles. (RUB 20,000 – RUB 2,600). The accountant made the following entries: DEBIT 20 CREDIT 70

- 20,000 rubles.

– vacation pay was accrued to Belov; DEBIT 70 CREDIT 68

- 2600 rub.

– personal income tax accrued; DEBIT 68 CREDIT 51

- 2600 rub.

– personal income tax is transferred; DEBIT 70 CREDIT 50

- 17,400 rub.

- vacation pay was issued to Belov. Returning from vacation, Belov resigned. The vacation pay was returned to the cash register. The accountant made the following entries: DEBIT 20 CREDIT 70

- 20,000 rubles.

– Belov’s vacation pay was reversed; DEBIT 70 CREDIT 68

- 2600 rub.

– personal income tax accrual was reversed; DEBIT 50 CREDIT 70

- 17,400 rub. - Belov returned overpaid vacation pay. In tax accounting, wage expenses in the amount of 20,000 rubles. cancelled. Overpayment of personal income tax in the amount of 2600 rubles. will be counted against upcoming payments to the budget after the tax inspectorate makes an appropriate decision based on an application from the tax agent.

Settlements with employees upon dismissal

The organization is obliged to make final payments to employees upon dismissal, that is, to issue the due salary, as well as compensation for unused vacation. The employee's salary is calculated for all days he worked. The amount of compensation for vacation that he did not use is determined based on their average salary for the 12 months that preceded his departure (Resolution of the Government of the Russian Federation No. 922).

All payments are made on the day of dismissal, which is considered the last day worked. If for some reason the employee did not work on that day, then the payment must be made no later than the day following the employee’s request for payment of all amounts (Article 140 of the Labor Code of the Russian Federation). If there is a delay in paying the required amounts to a dismissed employee, the organization is obliged to pay him compensation for each day of delay in the amount of at least 1/150 of the key rate of the Central Bank of the Russian Federation (Article 236 of the Labor Code of the Russian Federation).

Personal income tax (NDFL)

As a general rule, all types of compensation payments established by the current legislation of the Russian Federation, including those related to the dismissal of employees, are not subject to personal income tax (exempt from taxation), with the exception, in particular, of the amount of payments in the form of severance pay and average monthly earnings for the period of employment in a portion that generally exceeds three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent areas (clause 3 of Article 217 of the Tax Code of the Russian Federation).

According to the official position, additional compensation paid in accordance with Art. 180 of the Labor Code of the Russian Federation, refers to payments upon dismissal of an employee, exempt from personal income tax, in a total amount not exceeding in general three times (six times) the average monthly salary. Amounts exceeding three times the amount (six times the amount) of average monthly earnings are subject to personal income tax in accordance with the generally established procedure (see, for example, Letter of the Ministry of Finance of Russia dated March 21, 2016 N 03-04-06/15453).

At the same time, we note that the additional compensation paid in the event of termination of an employment contract with an employee before the expiration of the notice period for dismissal is not directly mentioned in clause 3 of Art. 217 of the Tax Code of the Russian Federation as part of restrictions (payments related to dismissal, which are not fully or partially exempt from personal income tax). In this regard, there is a different approach to resolving the issue of determining the amount of additional compensation for personal income tax purposes, according to which such compensation is not subject to personal income tax in full.

For details on the existing positions on the issue of taxation of the amount of additional compensation upon dismissal paid in connection with a reduction in the number of employees (including law enforcement practice), see the Practical Guide on Personal Income Tax, as well as the Encyclopedia of Disputed Situations on Personal Income Tax and Contributions to Extra-Budgetary Funds.

Note that if an organization, in order to avoid tax risks, decides to attribute the amount of additional compensation to general payments associated with dismissal, then if there is a further excess of total payments over three times the employee’s average monthly earnings, the excess amount received will be recognized as an object of taxation and included in tax base for personal income tax (clause 1 of article 209, clause 1 of article 210 of the Tax Code of the Russian Federation). As a rule, such a situation may arise when paying the average monthly salary for the period of employment, which is summed up with the total payments made earlier for the purpose of determining the tax-exempt amount <***>.

Payment of severance pay

According to Art. 178 of the Labor Code of the Russian Federation, upon dismissal, severance pay is paid in the amount of average earnings for 2 weeks, if:

- the employee was called up for service (military or alternative);

- the employee is not suitable for the position due to health conditions;

- the employee who previously held the position has been reinstated;

- the employee refuses the transfer due to the relocation of the enterprise.

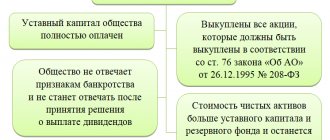

Also, benefits in the amount of average monthly earnings are paid when an enterprise is liquidated and when staff are reduced. Under the same circumstances, the dismissed employee must be paid the average monthly salary for the period of employment, but no more than 2 months from the day the employment contract was terminated.

Insurance premiums

As a general rule, all types of compensation payments established by the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the limits of the norms provided for by the legislation of the Russian Federation) related to the dismissal of employees are not subject to insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, for compulsory medical insurance, for compulsory social insurance against industrial accidents and occupational diseases. The exception is, in particular, the amounts of payments in the form of severance pay and average monthly earnings for the period of employment in the part exceeding in general three times the average monthly earnings (six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent to their localities) (paragraph “d” paragraph 2

Part 1 Art. 9 of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund,” paragraphs. 2 p. 1 art. 20.2 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”).

Additional compensation paid in the event of termination of an employment contract with an employee before the expiration of the notice period for dismissal is paid in accordance with labor legislation and is not listed in the list of exceptions that are not subject to exemption from insurance contributions. In this regard, we can conclude that there is no basis for imposing insurance premiums on this compensation.

A similar opinion is shared by the Russian Ministry of Labor, according to which additional compensation paid in the event of termination of an employment contract with an employee before the expiration of the notice period for dismissal does not apply to the amounts of severance pay and average monthly earnings for the period of employment, not subject to insurance contributions in a part not exceeding in general, three times (six times) the average monthly salary. In this regard, additional compensation is completely exempt from insurance premiums (i.e., the limit of three (six times) average monthly earnings does not apply in this case) (Letter of the Ministry of Labor of Russia dated February 11, 2016 N 17-3/B-56, consultation specialist of the Ministry of Labor of Russia E.B. Balandina) <*>.

Accounting for transactions with accountable persons

An accountable person is an employee who receives funds on account for travel and business expenses. For accounting purposes of transactions with these employees, account 71 “Settlements with accountable persons” is used. Amounts issued for reporting are reflected in debit, written off - in credit.

The head of the enterprise approves the lists of persons to whom money is given on account, and sets a deadline for the return of excess funds. Accountable persons undertake to draw up an advance report (no later than 3 days upon return from a business trip). The unspent balance is returned to the organization, overspending is paid to the employee. If the accountable person has not provided an advance report, or the excess funds have not been returned, then these amounts are withheld from his salary.

Basic wiring:

- The accountable amount was issued: Dt 71, Kt 50 (51).

- Write-off of accountable funds (for corresponding expenses or surplus): Dt 44 (10, 50, 51 ...), Kt 71.

Accounting

The amount of additional compensation paid to an employee in the event of termination of an employment contract with an employee before the expiration of the notice period for dismissal is recognized as an expense for ordinary activities in the reporting period for calculating compensation, regardless of the time of actual payment of funds (clauses 5, 16, 18 of the Regulations on accounting “Expenses of the organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated 05/06/1999 N 33n) <**>.

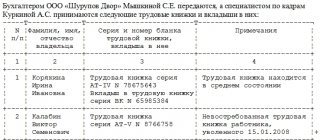

[B=63]

Accounting records for reflecting the transactions under consideration are made in the manner established by the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, and are shown below in the table of entries.