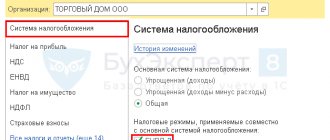

Rate of the simplified tax system “Income minus expenses”

The tax rate shows how much of the difference between income and expenses you will pay to the government. It ranges from 5 to 15%. The specific size is determined by the regions.

The simplified tax system rate in Moscow is 15% for everyone, 10% for those who do business in the field of social services, sports, livestock farming and others from the law of the city of Moscow.

The simplified taxation system rate in St. Petersburg is 7% for everyone.

The simplified taxation system rate in Yekaterinburg and the Sverdlovsk region is 7% for everyone, 5% for those doing business in the field of education, healthcare, sports and others from Article 2 of the law of the Sverdlovsk region No. 31-OZ.

Find out the rate of your region on the tax website: select your region and go to the “Features of regional legislation” section.

The rate will increase to 20% for any region if you earn more than 150 million in a year or hire more than 100 employees.

Actual expenses incurred must be proven

The office of the “Unified Protection Center” in Barnaul was visited by a citizen who had previously entered into a contract for the installation of window products with “Unified Window” LLC. According to the contract agreement, Single Window LLC undertook to purchase and install window products at our Client’s address within 70 days. The contractor's representatives verbally assured him that the windows would be installed within five days and that he should not pay attention to the terms of the contract.

As expected, the verbal promises were not fulfilled, and therefore the Client sent a unilateral refusal of the contract.

Oddly enough, the contractor granted the application, but subsequently recovered from the customer in the court of first instance the amount of actual expenses incurred in the amount of 23 thousand rubles for the purchase of window products from the supplier. The client fundamentally disagreed with this outcome, and therefore contacted our Company.

This case was handled by lawyer Sergei Sokolov, who analyzed the available documents and decided to prepare an appeal.

In the appeal, the lawyer noted that the court of first instance, satisfying the demands for recovery of actually incurred expenses, was based only on the application of the contractor Single Window LLC sent to the supplier, the invoice and the act of reconciliation of mutual settlements. The complaint sets out the argument that these documents are part of the business activities of the contractor and supplier; the Client was not present during their preparation.

Part one of Art. 55 of the Civil Procedure Code of the Russian Federation dated November 14, 2002 No. 138-FZ (hereinafter referred to as the Civil Procedure Code of the Russian Federation) establishes that evidence in the case is information about facts obtained in the manner prescribed by law, on the basis of which the court establishes the presence or absence of circumstances justifying the demands and objections parties, as well as other circumstances relevant for the proper consideration and resolution of the case.

Based on Part 2 of Art. 56 of the Code of Civil Procedure of the Russian Federation, the court determines what circumstances are important for the case, which party must prove them, and brings the circumstances up for discussion, even if the parties did not refer to any of them.

According to paragraph 11 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 24, 2008 No. (as amended on February 9, 2012) “On the preparation of civil cases for trial,” having established that the evidence presented does not sufficiently support the plaintiff’s claims or the defendant’s objections or does not contain other necessary data, the judge has the right to invite them to provide additional evidence, and in cases where the presentation of such evidence is difficult for the named persons, at their request, which meets the requirements of Part 2 of Article 57 of the Code of Civil Procedure of the Russian Federation, assists in collecting and requesting from organizations and citizens, in particular, written and material evidence (part 1 of article 57, paragraph 9 of part 1 of article 150 of the Code of Civil Procedure of the Russian Federation).

By virtue of Parts 1, 3, 4 of Art. 67 of the Code of Civil Procedure of the Russian Federation, the court evaluates evidence according to its internal conviction, based on a comprehensive, complete, objective and direct examination of the evidence available in the case. The court evaluates the relevance, admissibility, reliability of each evidence separately, as well as the sufficiency and interconnection of the evidence in its entirety. The court is obliged to reflect the results of the assessment of evidence in a decision, which provides the reasons why some evidence was accepted as a means of substantiating the court’s conclusions, other evidence was rejected by the court, as well as the reasons why some evidence was given preference over others.

Taking into account the above, it could be concluded that the case materials do not contain adequate and indisputable evidence confirming the fact of delivery of goods by the supplier to the contractor before our Client filed an application to terminate the contract. Thus, one can question the actual costs incurred for the purchase of window products.

06.02.2020

Tax calculation

From the income received, subtract the expenses of the same period and multiply by the tax rate of your region.

Ivan registered an individual entrepreneur in Moscow and opened an online store. He bought phone cases for 20 thousand rubles, and then sold them for 50 thousand rubles. Tax simplified tax system = (50 thousand rubles - 20 thousand rubles) x 15%.

For information on how to correctly account for income, read our article “STS “Income”: how to report and how much to pay.” Remember the main rule: take into account income on the day you received money from the client.

Expenses are a little more complicated. To take them into account correctly, follow three rules:

- The expense is named in Art. 346.16 of the Internal Revenue Code and is good for business.

- The expense is confirmed by documents.

- You have paid in full and received the product or service. To account for the cost of purchasing items to resell, wait until you sell the item.

We described these rules in more detail in the article “How to take into account expenses for the simplified tax system.”

Elba will calculate the tax on the simplified tax system “Income” and “Income minus expenses”. Get 30 free days when you sign up and try it yourself. If you are using the simplified tax system “Income” and all payments are sent to your current account, use our free service.

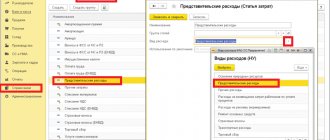

Accounting for organizational expenses

The organization of any company from its conception to the start of activity takes some time and requires financial costs. We will tell you how to take them into account in the article.

T.A. Stepanova, expert editor of AG "RADA"

Having decided to organize a company, its founders must first of all draw up constituent documents - a charter and a memorandum of association. They are approved by the minutes of the general meeting of shareholders (in the case of OJSC and CJSC) or participants of the limited liability company. However, a company can be considered established only from the moment of its state registration. This is stated in Article 51 of the Civil Code.

In order for the company to start operating, you need to make several copies of the constituent documents, have them certified by a notary,, if necessary, obtain legal advice, and pay a registration fee. For state registration of a new company, a set of documents must be submitted to the tax office in accordance with Article 12 of Federal Law No. 129-FZ of August 8, 2001 “On State Registration of Legal Entities and Individual Entrepreneurs.”

From the moment it receives a number in the Unified State Register of Enterprises (USRE), the company is obliged to keep accounting records and submit reports, regardless of whether it is operating or not. This is stated in paragraph 3 of Article 8 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”. The first reporting year is considered to be the period from the date of state registration to December 31 of the current year. For companies created after October 1, the report for the first year of operation must include the last quarter of the current year and the entire next year. These are the requirements of paragraph 36 of the Regulations on maintaining accounting and financial statements in the Russian Federation, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n.

After official registration, the company can begin preparing for statutory activities: rent or buy a building (premises), equipment, office equipment, make repairs to the premises, purchase materials or goods, issue a license, and so on.

Where should we include organizational expenses that were incurred before the state registration of the company? The answer to this question depends on whether these expenses are recognized in the memorandum of association as a contribution of participants to the authorized capital of the company or not.

If the founders agreed that organizational expenses are recognized as a contribution to the authorized capital of the company, then they are classified as intangible assets. This is stated in paragraph 4 of the Accounting Regulations “Accounting for Intangible Assets” PBU 14/2000 (hereinafter referred to as PBU 14/2000), approved by Order of the Ministry of Finance dated October 16, 2000 No. 91n. They are valued at an agreed value, that is, by agreement between the founders (clause 9 of PBU 14/2000).

Intangible assets contributed as a contribution to the authorized capital are reflected in accounting by the following entries:

Debit 08 Credit 75 subaccount “Calculations for contributions to the authorized capital”

– organizational expenses were made as a contribution to the authorized capital at an agreed cost;

Debit 04 Credit 08

– the intangible asset is accepted for accounting.

Such an entry is made on the basis of the constituent agreement, which in this case serves as the primary document.

To account for intangible assets, form card No. NMA-1 is used, approved by Decree of the State Statistics Committee of October 30, 1997 No. 71a.

According to paragraph 14 of PBU 14/2000, the cost of intangible assets is repaid during their useful life by calculating depreciation. This can be done in one of three ways: linear, proportional to production volume, or reducing balance method. The chosen method must be reflected in the company's accounting policies.

It is possible to establish a specific period of useful use of organizational expenses if the period for which the company is created is known in advance. If it is not determined, then depreciation on organizational expenses will have to be accrued for 20 years (clause 17 of PBU 14/2000).

In accounting, depreciation charges are written off as expenses. When choosing the linear method or writing off the cost in proportion to the volume of production, depreciation is usually reflected in a separate account 05 “Depreciation of intangible assets”:

Debit 26, 44 Credit 05

– amortization of intangible assets has been accrued.

If the company’s accounting policy contains the reducing balance method, then it is more convenient to write off depreciation directly from the credit of account 04:

Debit 26, 44 Credit 04

– amortization of intangible assets has been accrued.

Depreciation is accrued from the 1st day of the month following the month in which the intangible asset was accepted for accounting. Therefore, it will be the month following the month in which the company is registered. Depreciation is reflected in the reporting period to which it relates and is accrued regardless of the company's performance.

Tax accounting, unlike accounting, does not recognize organizational expenses as an intangible asset. According to paragraph 3 of Article 257 of the Tax Code, these include intellectual property acquired or created by a company and used for production and management needs. And since organizational expenses are the founders’ contribution to the authorized capital, the company did not acquire or create them. Therefore, depreciation charges on them cannot reduce taxable profit.

The Department of Tax Administration for Moscow holds the same opinion in letter dated November 27, 2002 No. 26-12/58140. Tax authorities believe that organizational expenses contributed to the authorized capital do not correspond to the characteristics of intangible assets listed in Article 257 of the Tax Code.

In this case, for profit tax purposes, such expenses are taken into account as expenses associated with production and sales.

Whether it is possible to write off organizational expenses that are not recognized as a contribution to the authorized capital in accounting and tax accounting is a controversial question. Some experts believe that it is impossible to take them into account in principle. The argument is as follows: expenses are expenses incurred by the taxpayer, that is, the company. However, organizational expenses were incurred even before the establishment of the company.

Other experts believe (and we support this point of view) that the costs of organizing a company can be taken into account as ordinary expenses: legal, consulting, notary and others. After all, they are all justified, documented, and without them it is impossible to generate income, since the activity of the company itself is impossible. Therefore, such expenses should be written off to cost accounting accounts - account 26 “General business expenses” or account 44 “Commercial expenses”.

There is also no consensus among tax specialists. The Ministry of Taxation explained its position on this matter in a letter dated September 10, 2002 No. 02-5-11/202-AD088.

According to paragraph 2 of Article 318 of the Tax Code, the costs of creating a company are classified as indirect costs of production and sales. They are written off in full as expenses of the current reporting (tax) period. And this does not depend on the company receiving income from its activities. At the same time, in accordance with Articles 252 and 270 of the Tax Code, indirect expenses do not include costs for organizing activities, income from which has not yet been received in a given reporting period. Therefore, they can be taken into account in the future.

It is interesting that the regional departments of the Ministry of Taxes interpreted the position of the main tax department in a very unique way. Thus, Moscow tax authorities believe that organizational expenses, in principle, cannot be taken into account when taxing profits (letter of the Department of Tax Administration for Moscow dated February 7, 2003 No. 26-12/8123). St. Petersburg officials allow them to be taken into account when calculating income tax only when the expenses are related to the conduct of activities directly named in the company’s charter (letter dated May 26, 2003 No. 02-5-11/137-U178).

To avoid disputes with the tax authorities, in our opinion, it is better to prepare organizational expenses with an advance report. According to subparagraph 5 of paragraph 7 of Article 272 of the Tax Code, the date of incurring other expenses, which include organizational expenses, is the date of approval of the advance report. At the same time, the code does not limit the period when the company incurred the expenses itself.

Example

When creating a trade director - one of the founders - the following expenses were incurred, which were not recognized as his contribution to the authorized capital:– 3000 rub. – payment for legal advice;

– 4000 rub. – printing of constituent documents;

– 2000 rub. – payment to the notary;

– 2000 rub. – state duty for company registration.

The accounting policy provides for a one-time write-off of organizational expenses in the month the company begins its activities.

After registering the company, the accountant reflected organizational expenses with the following entries:

Debit 44 Credit 71

– 11,000 rub. (3000 + 4000 + 2000 + 2000) – organizational expenses are reflected in deferred expenses;

Debit 71 Credit 50

– 11,000 rub. – money was given to the director for overexpenditure according to the advance report.

–end of example–

Is it possible to reduce the tax on insurance premiums?

The tax on insurance premiums is reduced only under the simplified tax system “Income”. Using the simplified tax system “Income minus expenses,” you do not deduct insurance premiums from tax, but take them into account as a regular expense.

Submit reports in three clicks

Elba will prepare a tax return according to the simplified tax system and calculate taxes. The service is used by 100,000 individual entrepreneurs and LLCs. Try it too!

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Reporting on the simplified tax system “Income minus expenses” in 2021

Tax payment deadlines

- until April 26 - for the 1st quarter,

- before July 26 - half a year,

- before October 25 - 9 months,

- until March 31, 2022 for LLCs, until April 30, 2022 for individual entrepreneurs - final calculation of the simplified tax system for 2021.

Submit your declaration once a year : for 2021, LLCs report until March 31, 2021, and individual entrepreneurs - until April 30, 2021.

Keep a book of income and expenses - abbreviated as KUDiR. Record business income and expenses there. KUDiR does not need to be submitted to the tax office until she asks.

Article “How to keep a book of income and expenses.”