How to apply for financial assistance for an employee of an organization?

Financial assistance is payments made by the employer in favor of employees if there are grounds for this. A distinctive feature of financial assistance is that the procedure for its provision is not regulated by the Labor Code of the Russian Federation and other regulations. In this regard, employers can establish payment procedures by local acts or collective agreements.

Payments can be made according to three models, each of which will be discussed below. These include:

- A model when the procedure for paying financial assistance is not regulated by a local act or a collective agreement.

- A model where the payment procedure is regulated by a local act.

- A model where the payment procedure is regulated by a collective agreement.

Assignment of material support

First of all, you need to decide on the purpose of the payment. The employer must understand that financial assistance is not part of the wage fund. It cannot be classified as a bonus for the employee’s merits, and therefore it should not be specified in the regulations on remuneration. Material assistance falls into the category of social support for workers.

Financial assistance is a voluntary desire of the employer to support an employee who finds himself in difficult life circumstances. Its purpose may be different, but always individual. Typically, social guarantees in an organization provide for the participation of management in the event of:

- death of an employee;

- death of a close family member of the employee;

- marriage for organizing a wedding;

- birth of a child;

- emergency (theft, natural disasters);

- treatment and recovery.

Financial assistance is intended for the following purposes:

Payments related to family circumstances (death, wedding, birth) are targeted. In turn, payments arising as a result of an emergency situation are classified as non-targeted.

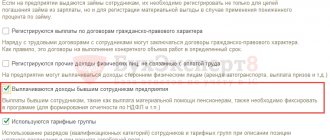

How to apply for financial assistance if the organization has adopted a local act or a collective agreement?

If the payment procedure is regulated by internal documents, the algorithm for transferring financial assistance will depend on what provisions are contained in the local act or collective agreement. In all cases, the basis for payment will be the order of the employer. Let us give an example of the procedure for paying financial assistance, if it is regulated.

- Before initiating the procedure, it is determined whether there are grounds for payment.

- The procedure is initiated. The payment may be made at the initiative of the employer; at the initiative of the employee (by submitting an application to management); on the initiative of the direct management of the employee who is entitled to financial assistance (by sending a submission to the employer). Most often, financial assistance is paid based on the employee’s application.

- The employee’s compliance with the criteria specified in internal documents is checked. This procedure can be carried out by both the employer and a person authorized by him.

- An order for payment is issued if the employee is entitled to receive financial assistance, or a written refusal is prepared.

- If an order is issued, it is signed by the employer, the employee gets acquainted with it, and the document is transferred to the accounting department for execution.

The decision on the use of net profit is made by shareholders

The founders of the organization (participants and shareholders) can use part of the net profit to pay financial assistance. Such a decision of the founders must be documented.

Please note: Financial assistance is a payment made by an organization in favor of individuals. Including employees, their relatives and strangers. Payment of financial assistance may be associated with a difficult life situation, the birth of a child, or the death of a family member. Also, financial assistance can be issued for vacation, professional holiday, etc.

If the organization has one founder, then the allocation of part of the profit for the payment of financial assistance is formalized by the decision of the sole founder (Clause 3, Article 47 of the Federal Law of December 26, 1995 No. 208-FZ, Article 39 of the Federal Law of February 8, 1998 No. 14-FZ).

If there are several founders, then you need to draw up minutes of the general meeting of participants (shareholders) (Article 63 of the Federal Law of December 26, 1995 No. 208-FZ, paragraph 6 of Article 37 of the Federal Law of February 8, 1998 No. 14-FZ).

When funds are allocated, the head of the organization can decide to pay financial assistance, guided by the circumstances (clause 2 of article 69 of the Federal Law of December 26, 1995 No. 208-FZ, subclause 4 of clause 3 of article 40 of the Federal Law of 02/08/1998 No. 14-FZ) (for more details, see “Providing financial assistance to an employee”).

Publication of a local act that regulates the procedure for paying financial aid

It is possible to issue a local act, which will clearly state the grounds, amounts, and procedure for payments. For example, this document may be taken in the form of a provision on the payment of financial assistance.

The procedure for adopting local acts is established by Art. 8 Labor Code of the Russian Federation. Their design is carried out in several stages:

- The issue that will be regulated by the document is determined. In this case, the issue of payment of financial assistance will be resolved.

- The procedure for developing the document is determined. At this stage, the employer appoints someone responsible for drawing up the draft local act (by order), or develops the draft independently. It is advisable to reflect the reasons for payments in the document; payment procedure; documents required to make payments; list of those responsible for implementing the provisions of the local act.

- The developed project is agreed upon with the employer. This stage is not necessary if the project was drawn up by the employer himself.

- An order is issued approving the local act, which is signed by the employer.

- Employees of the organization get acquainted with the text of the order and sign it.

If there is a trade union in the organization, it is necessary to coordinate the adoption of a local act with it in accordance with Art. 372 Labor Code of the Russian Federation. The project is sent to the trade union, and within 5 days it is approved or not. If it is not approved, the provisions of the local act are agreed upon and subsequently adopted (taking into account the wishes of the trade union, or without taking them into account). The trade union can appeal the local act to the State Labor Inspectorate or to the court.

Order on the provision of financial assistance and its taxation

Material support is formalized using an order signed by the manager. Before this, the employee writes a statement indicating a request for the situation that has arisen.

In relation to the reason for issuing compensation, a procedure for full or partial exemption from taxation is provided:

- the birth of a child, treatment, vacation, training - financial assistance is partially taxed if a certain amount of payment is exceeded;

- death of a relative, emergency circumstances - any amount of compensation is provided with complete exemption from tax and insurance obligations.

But according to the Tax Code, it is required to present supporting documents for the funds issued to employees.

Help for relatives in the event of the death of an employee

In the event of the death of an employee or in connection with the death of a relative, financial support is not subject to income tax. The amount of finance paid can be any. Insurance premiums from this

no amounts provided.

The following conditions of issue are possible:

- lump sum - the order specifies the deadline for payment in one amount;

- in parts - the order specifies the date for the issuance of several parts of assistance (several orders require partial payment).

Relatives are considered to be children, parents and spouse. Options for receiving financial compensation when distant family members (brothers, sisters, in-laws, in-laws) pass away are not excluded.

In case of illness

At the enterprise level, the procedure and conditions for paying financial assistance to employees of the enterprise in case of illness are determined. The benefit is issued in the event of illness of the employee or his children. The maximum amount not subject to tax calculation is 4,000 rubles. But it is possible to receive

a larger amount by order of the employer.

There are cases when medical grounds are not the reason for payment:

- non-chronic illness;

- abortion;

- gender change;

- venereal disease other than AIDS;

- addiction treatment (alcohol, drugs, tobacco).

Tax on employee income when receiving material compensation is not provided for mandatory medical treatment and transfer of funds to a licensed medical institution.

At the birth of a child

Parents can apply for financial assistance upon the birth (adoption) of a child.

The maximum tax-free amount is 50,000 rubles per year. Both parents can be paid. But it is necessary to bring to the accounting department a document from the husband’s (wife’s) work, which will indicate the fact of non-issuance of financial aid or issuance in a certain amount.

Receiving a larger amount implies payment of tax obligations and insurance premiums on the excess amount in the general manner.

Please note: The employment of parents in one organization does not affect the amount of assistance provided.

Education

In connection with the training of an employee or his children, it is possible to issue financial aid. If its amount does not exceed 4,000 rubles, then it is not subject to tax. A large amount is subject to payment of contributions to insurance organizations and the tax service.

Social assistance for pensioners

Marriage registration

When a legal relationship is formed, the amount of compensation is assigned. Its size is determined individually. If the amount exceeds 4,000 rubles, income tax and insurance contributions must be collected from the employee.

Vacation

The assignment of an additional payment for vacation implies financial support for the employee. Assistance is considered one-time and is recorded in a local document of the organization. This type belongs to the category of remuneration. Therefore, it is taxed when calculating taxes on accrued wages.

This rule is confirmed by letters from the Ministry of Finance, the Tax Service and the Resolution of the Federal Antimonopoly Service.

Other cases when financial assistance is paid

Damage caused by an emergency (flood, hurricane, explosion) can be supported by payment of financial assistance. Its size is unlimited. Tax obligations and payment of contributions to insurance authorities for this amount are not provided. The applicant is required to attach the relevant certificate of

receiving damage.

Other cases are:

- anniversary - in many organizations the anniversary date begins after 35 years;

- retirement;

- damage to property as a result of theft or fire;

- difficult financial situation (single mother, large family, disabled relative, temporary disability of the spouse).

When calculating assistance in the amount of 4,000 rubles, income tax is not paid.

Financial assistance to a former employee

A former employee can receive financial assistance in a difficult life situation if this is provided for by an adopted collective agreement or other local documents. Most often, organizations pay financial support to applied pensioners whose last

This place was the place of work before retirement.

The situation implies partial taxation of allocated funds. The fixed amount of 4,000 rubles is not subject to inclusion in the tax base. Compensation above this amount is subject to tax. Insurance premiums are excluded for any amount of assistance.

Relatives of a deceased employee of an enterprise can turn to the manager for financial assistance. Upon presentation of appropriate documents, compensation may be assigned.

Please note: When making a special contribution to the development of the enterprise, any former employee can receive financial assistance in the event of special family or social circumstances.

Conditions of receipt

The decision to pay benefits or issue food and household items is made by the head of the organization. The rules for issuing are prescribed in a general regulatory document or a separate Regulation on the payment of financial assistance.

Financial assistance to fire victims

The worker should write an application and attach certificates indicating a special situation with financial difficulties. After reviewing the application and analyzing the documentation presented, an order is issued.

What documents are needed?

Regarding the circumstances that have arisen, the following documents are required to be attached:

- death of a relative - a copy of the death certificate, the birth certificate of a child (death of a child), marriage certificate (death of a spouse);

- birth of a child - a copy of the birth certificate;

- registration of a legal marriage - a copy of the marriage certificate;

- damage as a result of an emergency - a certificate from the Ministry of Internal Affairs, the Ministry of Emergency Situations, or a medical organization about the damage caused to property or health;

- treatment – treatment agreement, referral for surgery, prescription, payment documents;

- training – a copy of the training agreement and payment documents;

- difficult financial situation - documents and certificates from relevant authorities indicating social status (certificate of a large family, documents for a single mother).

When relatives or other persons ask for help in organizing the funeral of an employee, it is required to submit a copy of the main document on death and receipts (checks) for payment of services. Close people bring copies of marriage and birth certificates. In the absence of relatives, a petition from the trade union for trust in these persons is attached.

How to write an application (samples)

The application is written on the company’s letterhead or plain paper. It is submitted to the HR department, where you can clarify all questions regarding the provision of assistance. The statement contains the following points:

- appeal to the head of the enterprise (in the right corner of the form);

- Full name, position of the applicant;

- the essence of the request;

- information on the circumstances that have arisen;

- numbers of attached documents;

- date, signature.

After reading the application, the manager makes resolutions on appointment or refusal. Approval of payment involves the formation of an order.

Sample application.

Please note: Indicating the amount of financial security in the application will not affect the amount of payment. The compensation awarded depends on the manager.

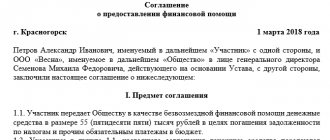

Formation of an order and its sample

The order specifies the following parameters for issuing assistance:

- size;

- payment terms;

- base;

- source of funds.

The document is signed by the manager and goes to work, namely the accounting department.

Sample order:

Adoption of a collective agreement that regulates the payment of financial assistance

It is possible to adopt a collective agreement in the organization, which will regulate the procedure for calculating amounts of financial assistance. The document is adopted during collective bargaining. The algorithm for adopting a collective agreement is as follows:

- A decision is made to develop an agreement and conduct negotiations. The initiator can be either the employer or employees represented by their representative.

- Collective negotiations are held, during which the content of the agreement is agreed upon. The procedure for conducting negotiations can be developed by its participants during the discussion, since the law does not impose strict requirements on it. The duration of negotiations is up to 3 months.

- When agreement is reached, the contract is signed by the parties - a representative of the employer (or himself) and the employees. The agreement comes into force from the moment of signing.

- The draft agreement is sent for notification registration to the authorized state. organ. For example, for Moscow - the Department of Labor and Social Services. protection of the population of Moscow.

General concepts and design

Financial support is provided to an employee who finds himself in a difficult situation. It is necessary to focus attention on this circumstance, since in practice an organization can issue financial assistance to all employees in honor of an upcoming holiday, for example, for the New Year. In fact, such support is ambiguous. There are cases when judicial authorities classified it as a one-time holiday bonus.

Material support can be considered as an additional condition for improving the financial situation of an employee. This is how financial assistance for vacations became widespread. This type of service is not targeted, since there is no certainty where the employee will spend the funds received.

The employer may, at his own discretion, come to the rescue of the employee in any situation that does not fall under the category of emergency.

If the organization does not provide for documentation in the contract or regulation on social guarantees, then the basis is the resolution of the management on the employee’s application. This type of financial assistance is paid exclusively from profits.

Upon receipt of the employee’s application and copies of evidentiary documents, the employer checks the basis and amount of the requested amount with the regulations adopted by the enterprise. If management decides to satisfy an employee’s request, the HR department writes a corresponding order.

Based on the order, the organization’s accounting department, in turn, after checking the presence of all the necessary documents, issues money to the employee through the cash register or to a bank card.

Amounts of assistance for 2021

The employer can independently determine the amount of financial assistance in regulations. However, it is recommended to take into account that amounts up to 4,000 rubles paid in one billing period are not subject to personal income tax or insurance contributions.

If financial assistance is not specified in regulations, then up to 4,000 rubles it may also be tax-free. If the established threshold is exceeded, financial assistance is subject to personal income tax and insurance contributions. The legislator believes that the following are not subject to taxation:

- payments as one-time compensation for damage from natural disasters or terrorist attacks;

- due to the death of an employee’s family member;

- upon the birth of a child to an employee, with the condition that the amount of payments does not exceed 50,000 rubles.

Financial assistance for the death of family members is separately stipulated. It is not subject to taxation if these are first-degree family members according to the Family Code of the Russian Federation, that is, parents, spouses, children.

If the deceased relative was a grandmother, grandfather, brother, sister, aunt, uncle, etc., only 4,000 rubles are exempt.

In what situations can an employee qualify for financial support?

Accrual of financial assistance is the right, but not the obligation of the employer. This payment is a one-time payment. The basis for issuing funds is an order for financial assistance signed by the employer.

The list of situations in which an employee can receive financial support must be specified in the company’s local regulations and in the employment contract. The General Regulations on Financial Assistance, which contains a list of situations when employees can be supported financially, should also contain the procedure for its allocation, information on the amount of payments, etc.

Most often, money is paid in the following cases:

death of a close relative;

birth of a child, etc.

When preparing an order for the issuance of financial assistance, the employer will be able to refer to this local regulation. Thus, it will be clear to everyone how and by what criteria such compensation is made.

Sample document

There is no legally approved sample for drawing up an order for financial assistance. The legislator gives the enterprise the right to independently develop the form of the document. The only condition is that the order meets the principles of office work. That is, the order must be issued on the company’s letterhead.

The company form requires:

- full and short name of the organization;

- addresses (legal and postal);

- contact information (phone, email);

- TIN;

- logo;

- document numbers and dates.

If the organization does not have a letterhead, the HR specialist must write down all the required details in the upper right corner.

The order must contain the number and date of preparation in accordance with the log of personnel orders. The number and date are followed by the name of the order “On providing financial assistance to an employee.”

The following describes the reason for the payment of monetary support. After the word “I order” the amount, terms of payment, personal data of the recipient, and details of the foundation document are indicated. The order is completed by a decoding of the position, the signature of the manager and the stroke itself.

Basic recommendations

When reflecting financial assistance in accounting, various entries are accepted depending on the purpose and documentary basis. If the support is enshrined in contracts and regulations and is intended for a targeted solution to a difficult life situation, then it is reflected in the credit of account 70.

In the absence of support provided in the regulatory documentation, the payment amounts are accrued in the debit of account 73 and credit of 91. If assistance is provided to former employees or relatives of a deceased employee, then it should be reflected in the debit of account 76 and credit of account 91.