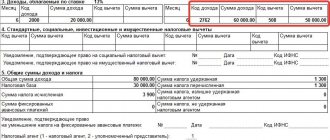

The editors of the magazine received questions from readers - budgetary institutions - about how to reflect in accounting the amounts of insurance premiums that were not accepted for offset according to the FSS inspection report. The refusal to accept the amount of insurance contributions for credit was due to the incorrect calculation of temporary disability benefits (when calculating the benefit, the maximum value of the base for calculating insurance contributions to the Social Insurance Fund was not taken into account; the certificate of incapacity for work was issued with violations). In this article, we will look at some situations that are identified by auditors and give recommendations on how an accountant should act in such situations.

FSS is a control body that checks the correctness of calculation, completeness and timeliness of payment (transfer) of insurance premiums in relation to insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity paid to the FSS. In addition, the FSS and its territorial bodies exercise control over the correct payment of compulsory insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity in accordance with the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity" (hereinafter referred to as Federal Law No. 255-FZ).

What can the employer's Pension Fund fine you for?

Each employer is required to provide reports to the Pension Fund with information about its employees:

- SZV-M - monthly until the 15th day of the next month;

- SZV-STAZH - annually until March 1 of the following year.

For failure to provide information about at least one employee, the organization may be fined 500 rubles. If the number of employees is large, the fine can reach significant amounts. If you disagree with the requirements of the Pension Fund, it is important to competently draw up objections to the act of the Pension Fund.

When should you file objections to a desk inspection report?

If a taxpayer has doubts about the legality of the tax authority’s position based on the results of a desk audit, he should file an objection. Moreover, the document must be drawn up in writing, because:

- this is how you demonstrate the seriousness of your intentions;

- the inspection or department of the Federal Tax Service will not consider it in any other form;

- it may be needed in court.

Naturally, you should select very convincing arguments that can sway the opinion of a higher authority or court in your direction.

At the same time, the taxpayer must keep in mind that filing objections is fraught with additional checks - the tax inspectorate, according to clause 6 of Art. 101 of the Tax Code of the Russian Federation, is obliged to respond to the signal. A similar situation is reflected in several court decisions, in particular in decisions of the FAS East Siberian District dated July 15, 2009 No. A58-4792/08, FAS Moscow District dated September 9, 2009 No. KA-A40/8644-09 and the FAS Northwestern District dated 06/01/2009 No. A56-26710/2008.

It may happen that tax inspectors, during an additional audit, will find even more serious violations. Therefore, when filing objections to the cameral’s act, you should once again carefully make sure that you are right and all the documents are in order.

You will learn about the timing of a desk audit from the article “With a desk audit, the inspection should be completed within 3 months .

What to do if objections were submitted, but the tax authority did not consider them and made a decision without taking into account the taxpayer’s opinion? Find out the answer to the question in the Tax Guide from the ConsultantPlus system, getting trial access for free.

Objection to the FSS on-site inspection report

An objection to the FSS on-site inspection report is a document with the help of which a company or individual insurer will be able to defend its case in pre-trial proceedings and will have the opportunity to avoid penalties from the regulatory agency. A unified form of objection has not been approved; policyholders will be able to draw it up in free form. But the document must be in writing.

An objection can be made to the entire FSS on-site inspection report or a specific part of it. The document is drawn up and submitted to the Social Insurance Fund after receiving the act with the results of the inspection. FSS employees must draw up a report within two months after completion of the inspection (Clause 2, Article 26.19 of Law No. 125-FZ). The Fund is obliged to consider the objection received; based on the results of the consideration, a commission protocol is drawn up. This procedure must take place in the presence of the policyholder, so he should be notified in advance of the date of consideration of the inspection materials.

The FSS on-site inspection report can be sent to the taxpayer in one of the following ways:

- handed over against signature to a representative of the organization or individual entrepreneur;

- sent by registered mail (the act is considered received by the policyholder on the sixth business day after the date of dispatch);

- sent via telecommunication channels in electronic form.

Which companies are checked first?

The Pension Fund has the right to carry out inspections in any companies together with the Social Insurance Fund. At the same time, Pension Fund employees can study issues of compulsory insurance, and employees can study issues of insurance for temporary disability and in connection with maternity. The Pension Fund of Russia, the Social Insurance Fund, and now the Federal Tax Service are attracting special attention to:

- expenses financed by the Social Insurance Fund;

- untimely submission of reports;

- non-taxable payments;

- application of reduced tariffs;

- inconsistency of calculations based on the results of a desk audit;

- arrears of contributions;

- frequent adjustments to reports;

- other violations.

Important! A company can avoid claims from regulatory authorities if all reports are submitted in a timely manner and the authorities’ demands are not left unanswered. In addition, when calculating contributions, you should carefully check all amounts, and also keep documents that allow you to justify the company’s actions.

When can you avoid a fine?

According to Pension Fund experts, the fine can be avoided. If:

- Errors were discovered by Pension Fund specialists, but the organization eliminated them within five days after receiving notification of them.

- The organization itself found the error and sent corrections before the deadline for submitting the form. For example, the primary SZV-M was commissioned on April 5. On April 10, the organization discovered that it had not submitted the form for a new employee and immediately provided a supplementary SZV-M.

- After the 15th, the error is corrected for those employees for whom information has already been submitted.

In 2021, the Supreme Court twice expressed the opinion that it is unlawful to apply penalties to an insured who independently discovered that he did not submit a SZV-M for an employee and submitted an adjustment report with correction (clause 38 of the Review of the Presidium of the Armed Forces of the Russian Federation dated December 26, 2018 and the Determination RF Armed Forces dated September 5, 2018 No. 303-KG18-5702).

But local inspectors still fine organizations that correct errors on their own. If you are faced with such a situation, an objection to the act in the Pension Fund of the Russian Federation SZV-M with reference to the position of the Supreme Court will help to cancel or significantly reduce the fine.

How to file an objection to the Pension Fund regarding fines

The company has 15 days after receiving the inspection report to file an objection to the fine under SZV-M. After the end of this period, the Pension Fund has 10 days to make a decision on the inspection. When making a decision, the regulatory body must consider the organization's point of view. The policyholder has the right to be present at the hearing.

As practice shows, when making a decision, the Pension Fund of the Russian Federation rarely waives a fine or reduces its amount. But if the organization can clearly defend its point of view and the Fund’s management sees the hopelessness of the trial, the fine may be canceled.

If this does not happen, the organization can always challenge the unlawful decision in court.

Making a decision based on the results of the inspection

The control body must notify the person in respect of whom such an inspection was carried out of the time and place. If desired, the party being inspected can directly participate in the verification procedure. However, the payer’s failure to appear is not an obstacle to carrying out the procedure as usual. Particular attention is paid to studying the following issues:

- Whether the party being inspected committed actions that are interpreted as a violation of the legislation of the Russian Federation.

- Do the identified offenses constitute a crime?

- Are there grounds for holding him accountable?

- Circumstances are identified that exclude the guilt of the party being inspected.

Based on the studied documentation, a decision is made whether to hold the person accountable for the offenses committed or to refuse to do so. In the first case, the inspecting party must document the violations committed, indicate the amount of arrears and the amount of the fine to be paid. In case of refusal to hold the payer liable, all circumstances confirming this fact must be additionally stated. The decision comes into force upon expiration of a ten-day period from the moment it is delivered to the verifying party.

Objection to the Pension Fund inspection report: sample

Objections are submitted to the SZV-M Pension Fund in any form. There is no regulated form. But in order for the Pension Fund to consider the company’s written opinion, some rules must be followed:

- The preparation of the document must begin by indicating the details of the policyholder and the Pension Fund of the Russian Federation branch that conducted the inspection. Be sure to indicate the registration number of the organization and TIN. It is by these details that the company is identified by the regulatory authority.

- In the text, make reference to the number and date of the inspection report to which the response is being drawn up. You should also indicate your full name. the specialist who carried out the inspection.

- State why penalties were assessed.

- Express your opinion about your disagreement with the accrual of fines and indicate the reasons why you think they are wrong. Be sure to make references to legal acts, court decisions and opinions of the Armed Forces of the Russian Federation.

- The document must be signed by the head of the organization and submitted to the territorial body of the Pension Fund.

Sample objection to the PFR inspection report

Download

Events

Tags: Workshop for company managers, accountants, lawyers October 29-30, 2021

Objections are submitted to the SZV-M Pension Fund in any form. There is no regulated form.

Moscow, hotel "Gamma-Delta", TGC "Izmailovo" 71 All-Russian seminar-workshop for company managers, accountants, lawyers October 28-29, 2021 Krasnodar, hotel "Congress hotel Krasnodar" 4* 12 All-Russian seminar-workshop for managers companies, accountants, lawyers October 17-18, 2021

Kazan, hotel “Crystal” 3*, st. Rustema Yakhina, 8 18 All-Russian workshop for company managers, accountants, lawyers October 07-08, 2021

St. Petersburg, hotel "Rus" 4* 15 Workshop for company managers, accountants, lawyers September 30 - October 1, 2021 Moscow, hotel "Gamma-Delta", TGC "Izmailovo" 427 Workshop for company managers , accountants, lawyers September 09-10, 2021 Moscow, Hotel Beta, TGK Izmailovo The contract through the eyes of the chief accountant.

Practical recommendations. Risks and tax control.

The most important legislative changes for commercial organizations in 2021 322 Optimization of company taxation, business division schemes. Current methods for reducing payments for organizations and individuals. A guide to safe tax minimization and tax planning.

Inspections by regulatory authorities Workshop for company managers, accountants, lawyers September 05-06, 2021 Moscow, Gamma-Delta Hotel, TGC Izmailovo 594 August 26-27, 2021

Moscow, st. Kuznetsky Most, 21/5, ASM-holding Interregional practical seminar on the topic:

“Complex issues of maintaining accounting and tax accounting of R&D expenses in accordance with changes in 2021-2020, including: calculation, recognition and accounting of intangible assets, determination and rules for rationing the composition of expenses, cost accounting, FSB Inventories”

:, new FSBU “Intangible assets”. Receiving subsidies PP 1312. Carrying out R&D under a government contract and within the framework of government assignments.

Pricing and separate accounting for R&D.

Methods of maintaining custom accounting. Organization of document flow. Strengthening tax control measures" 162 International contracts and transactions.

Legal and tax aspects.

Pricing methods and penalties Workshop for managers, accountants, financial directors and lawyers August 08-09, 2021

Moscow, Izmailovskoe sh., 71, building 2B, Hotel Beta, Izmailovo 175 Workshop Contract through the eyes of an accountant: identifying tax risks August 02, 2021

Moscow, Izmailovskoe sh., 71, building 2B, Beta Hotel, Izmailovo 444 1