Counterparties may resort to obtaining a bank guarantee for the fulfillment of obligations. For example, the seller wants to reduce the risk of the buyer not paying the debt. Or the buyer is not sure that he will pay for the delivery on time.

Let's look at how to take into account a bank guarantee step by step in 1C Accounting 3.0:

- how to transfer remuneration to the guarantor;

- how to reflect the costs of obtaining a bank guarantee;

- what transactions are generated in the principal’s accounting.

How are rights and responsibilities distributed when issuing a bank guarantee?

A bank guarantee is an obligation that a bank or any other credit organization issues as insurance for the fulfillment of contractual (agreement, procurement) conditions (Article 368 of the Civil Code of the Russian Federation). It is provided in both electronic and written form. If the contractor violates a number of conditions, the bank pays the customer organization a documented amount of money.

In relations related to the provision of a guarantee, three participants are involved:

- guarantor (bank) - an entity that, for a certain fee, assumes the obligation to issue a guarantee;

- principal (executor) - a participant who initiates the issuance of a bank guarantee and is a debtor in accordance with the terms of the agreement;

- beneficiary (customer) - a person whose interests are protected by a bank guarantee.

In this case, the beneficiary and the principal are parties to the agreement, as when concluding a government contract. They act strictly in accordance with current civil legislation (Article 420 of the Civil Code of the Russian Federation). Their mutual settlements are made outside the jurisdiction of the relationship established with a third party - the bank that provided the guarantee.

The parties interact taking into account the current bank guarantee agreement - a document defining the legal relationship of all three parties: the guarantor, the beneficiary and the principal. The agreement on the provision of a bank guarantee must indicate that the guarantor bank will pay the guarantee only if the supplier-principal cannot fulfill the obligations established by the government contract to the beneficiary customer. The bank guarantee agreement necessarily stipulates the circumstances due to which situations of payment of bank collateral occur.

Securing a probable obligation

A bank guarantee is a document issued by a bank and addressed to a specific creditor of your company.

In it, the bank undertakes to repay the company’s possible debt to the creditor at his request under certain conditions. We are talking about paying the creditor a fixed, pre-agreed amount. The peculiarity of this agreement is that at the time of issuing the bank guarantee, the company’s obligation itself does not yet exist, that is, the creditor is a potential one. Moreover, in the future the debt may not arise. Example 1

Contracts for state and municipal needs are concluded on the basis of competitions and auctions. Applications of participants must be secured by the deposit of funds or a bank guarantee. If the participant violates the conditions, the customer will use the security funds to compensate for the losses caused to him. Contracts are enforced in similar ways in this area. Details are in the Federal Law of April 5, 2013 No. 44-FZ “On the contract system in the field of procurement in the field of procurement of goods, works, services to meet state and municipal needs.”

So, a bank guarantee is a transaction that involves three parties:

- bank, called “guarantor” (French garant - guarantor);

- the company that has approached the bank with a request for a guarantee, called the “principal” (from the Latin principalis - chief);

- potential creditor (from Latin beneficium - benefit).

The guarantor, at the request of the principal, gives a written obligation to pay the beneficiary a sum of money upon submission by the beneficiary of a written demand for its payment (Clause 1 of Article 368 of the Civil Code of the Russian Federation). The beneficiary must indicate what the principal’s violation of the main obligation to secure which the guarantee was issued is (clause 1 of Article 374 of the Civil Code of the Russian Federation).

A bank guarantee ensures proper fulfillment by the principal of his monetary obligation to the beneficiary. For issuing a bank guarantee, the principal pays a fee to the guarantor (Article 369 of the Civil Code of the Russian Federation). it is not subject to VAT (paragraph 9, paragraph 3, paragraph 3, article 149 of the Tax Code of the Russian Federation).

Note that the role of a bank guarantee can be played by a letter of guarantee from a bank in which a specific beneficiary is not named (clause 8 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 15, 1998 No. 27).

Documents and grounds for accounting of bank guarantees

Bank guarantee transactions are regulated by civil and banking legislation. In the same regulatory legal acts one can find the answer to the question of whether a bank guarantee is registered.

In the Civil Code, the provisions regulating such a financial obligation are spelled out in Chapter 23 (paragraph 6, Articles 168, 169, 374 - 379, Article 429 of the Civil Code of the Russian Federation). The issuance of a bank guarantee by credit institutions relates to bank operations (clause 8, part 1, article 5 of the Federal Law of December 2, 1990 No. 395-1).

When concluding a supply agreement, it is not allowed to indicate a condition on a bank guarantee if there is no reason to assume that the guarantee obligations will be received from the guarantor under certain conditions (Determination of the RF Armed Forces in case No. 305-ES16-14210 of January 30, 2017). But when it comes to public procurement in accordance with the regulations of the Federal Contract System Law, the provision of a guarantee issued as security for the performance of the contract is mandatory. This is stated in Art. 96 44-FZ. The customer is obliged to include in the procurement documentation, notice of order, invitation to participate in the selection of a supplier in a closed way a requirement to ensure the execution of the contract (Part 1 of Article 96 44-FZ). The exception is the situations defined in Part 2 of Art. 96 44-FZ.

In Part 3 of Art. 96 states that such contract performance security is provided in the form of a bank guarantee. It must meet the requirements established in Art. 45 44-FZ. The supplier has the opportunity to provide a bank guarantee as security for the execution of a government contract and in the form of funds by transferring the required amount to the settlement (personal) account specified by the customer organization. The method of guaranteeing its obligations is determined by the procurement participant himself.

IMPORTANT!

From July 1, 2019, procurement participants will be able to provide a bank guarantee as security for the application.

Warranty or insurance?

Not only a bank, but also an insurance company can act as a guarantor. But the guarantee will still be called a bank guarantee. The payment itself under a bank guarantee resembles the payment of an insurer upon the occurrence of an insured event. This similarity is confirmed by an alternative: in some cases, the company, at its choice, can either provide the counterparty with a bank guarantee or insure its liability to it. Examples:

- Article 17.1 of the Federal Law of November 24, 1996 No. 132-FZ “On the fundamentals of tourism activities in the Russian Federation”;

- Article 121 of the “Code of Inland Water Transport of the Russian Federation” dated March 7, 2001 No. 24-FZ.

What is the difference between a guarantee and insurance? The fact is that the insurer does not have any claims against the insured in connection with the payment of insurance compensation (in the absence of intent). And the guarantor, who has paid for the principal’s obligation, may make recourse claims against him when this is provided for by the agreement between them (clause 1 of Article 379 of the Civil Code of the Russian Federation).

Important

A bank guarantee is one of the ways to secure obligations (along with a pledge, surety, etc.).

How to reflect receipt and issue from the principal and beneficiary

The reflection of a bank guarantee in accounting is directly dependent on the type of financial obligation for which it was issued. There are a number of situations for which a guarantee is required:

- To ensure compliance with the terms of payment for acquired assets and property (MPS and fixed assets).

- To insure the fulfillment of loans, borrowings and other debt obligations.

- For guaranteeing the return of the advance payment, since many performers stipulate that an advance payment must be provided.

- To ensure the fulfillment of other responsibilities.

Postings for a bank guarantee in accounting are formed based on a complex system of legal relationships between the principal and the beneficiary. Postings are prepared for legal relations:

- issuance and use of a guarantee;

- entering into an agreement that is not legally binding but is secured by a guarantee.

Bank guarantee - how to take it into account in accounting?

Today, a bank guarantee is one of the most popular services. With its help, they insure financial risks that sometimes arise when a counterparty refuses to fulfill its obligations in connection with the execution of a contract. On January 1, 2014, the new 44-FZ “On the contract system” will come into force. In it, the bank guarantee will be used in a much more expanded version, which means that the accounting department will have more questions about how to take into account accounting expenses, how and in what way to reflect transactions? First of all, we need to explain what a bank guarantee is? A bank guarantee is a written (or electronic) obligation of a bank (or a credit institution or an insurance organization), which it issued at the direction of another person, called the principal, to pay the creditor (beneficiary) a sum of money in accordance with the terms of the agreement. The guarantor pays the amount fixed in the contract if the beneficiary makes a request for this in writing. The validity of the bank guarantee begins on the day of its issue, and the validity period is specified in the contract. It can be concluded for any amount and for any period with both legal entities and individual entrepreneurs. In some cases, a bank guarantee must be provided. For example, it is provided before concluding government contracts; according to the new 44-FZ, it can also be provided to ensure participation in tenders, auctions and competitions. What documents can confirm the validity of accounting for a bank guarantee? Sometimes an accountant has a question: how can all this be documented? Of course, bills and invoices are provided along with the bank guarantee itself, but sometimes the guarantee is provided in the form of an electronic message. What to do with this option of providing a bank guarantee? The fact is that in accordance with paragraph 3 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated March 23, 2012 N 14 “On certain issues of dispute resolution practice .....” a bank guarantee issued in the form of an electronic message using the SWIFT telecommunication system is identical to a bank guarantee in writing. And if, when issuing a bank guarantee, certain requirements, sometimes imposed by the beneficiary or guarantor on the form of the guarantee, were not met, then this is not a reason not to accept it for accounting. Interested parties can, quite legally, provide various evidence that can confirm this transaction. Bank guarantee - its distinctive features A bank, or a credit institution or an insurance organization always acts as a guarantor. Naturally, a bank guarantee is not issued to the principal free of charge, which means that the accountant will need to take into account the transactions carried out on the accounting accounts. A bank guarantee cannot depend on the underlying obligation. In addition, this guarantee cannot be revoked, that is, it is irrevocable. Rights under a bank guarantee cannot be transferred to another person, unless, of course, otherwise provided in the document itself. The bank guarantee must indicate the period for which it is issued. If the period is not specified, then it (bank guarantee) in accordance with Art. 432 of the Civil Code of the Russian Federation is considered not to have arisen. In this case, the guarantee period may be equal to, greater than, or less than the period for fulfillment of obligations. Typically, the guarantee specifies who the beneficiary is, but due to established dispute resolution practices, if the beneficiary is not indicated in the document, the bank guarantee is still considered valid. If a guarantor issues a bank guarantee to a beneficiary without a prior written agreement between the principal and the guarantor, the guarantee is not considered invalid. However, before issuing a bank guarantee to the beneficiary, the principal may enter into an agreement with the guarantor, which will stipulate the conditions under which the bank guarantee will be concluded. In the contract, the guarantor may stipulate, in particular, the right to demand from the principal, by way of recourse, a certain remuneration if he pays the beneficiary a certain amount of money in connection with the demands made. Neither the guarantor nor the beneficiary pays VAT when the guarantor fulfills obligations under the bank guarantee. That is, there is no need to pay VAT when performing such operations as payment under a guarantee, issuance and cancellation of a bank guarantee, and so on. Transactions that are carried out in connection with the repayment of obligations under a loan agreement are also not subject to VAT, since in accordance with current legislation all loan transactions are exempt from taxation. The exception is transactions that arise when issuing bank guarantees by insurance organizations - these services are subject to VAT. The guarantor is obliged to reflect the accounting entries when fulfilling obligations under the bank guarantee. As soon as the beneficiary receives money from the guarantor (in connection with the fulfillment of obligations), the accountant makes a corresponding entry in a special book in the debit of account 51 “Current accounts” and the credit of account 76 “Settlements with various creditors and debtors”. The principal's debt is recorded in accounting depending on the type of obligation. This may be subaccount 58-3 “Loans provided,” account 62 “Settlements with buyers and customers,” account 76 or 58 “Financial investments.” Below is an example of a table with accounts:

The letter “G” in the account indicates settlements with the guarantor, the letter “K” – settlements with counterparties. Accounting for the beneficiary's receipt of funds from the guarantor The beneficiary, upon receipt of funds from the guarantor (using the cash method), must recognize the proceeds from the sale of goods (works, or services), since the payment was secured by a guarantee. When securing obligations to pay interest under an irrevocable bank guarantee, the beneficiary reflects non-operating income in the form of interest on the loan. Methods for reflecting accounting records by the beneficiary when fulfilling obligations under a bank guarantee If the principal fails to fulfill the main obligation (or if performed improperly), the beneficiary makes a demand to the guarantor for the payment of funds in accordance with the guarantee agreement (in writing). This requirement must indicate what exactly the principal violated during the execution of the contract. The bank guarantee expires when the beneficiary receives the amount due to him under the agreement, or if the validity period of the bank guarantee expires. The guarantee itself is accounted for in off-balance sheet account 008 “Securities for obligations and payments received.” The amount in the account is equal to the figure specified in the contract. The amount is debited from the off-balance sheet account gradually as the debt is repaid. Simplified taxation system - features of accounting for a bank guarantee Under the simplified taxation system, the beneficiary who received funds from the guarantor is obliged to reflect in accounting the proceeds from the sale of goods and / or non-operating income in the event of receipt of funds from interest on the loan. As soon as the beneficiary receives funds from the guarantor (in accordance with the execution of the agreement), the accountant records entries in a special book in the debit of account 51 “Current accounts” and the credit of account 76 “Settlements with various creditors and debtors”. In this case, the principal’s debt is reflected in the debit of account 76 - in the credit of (58-3, 62, 76.78) accounts, depending on the type of obligations. This may be subaccount 58-3 “Loans provided,” account 62 “Settlements with buyers and customers,” account 76 or 58 “Financial investments.” In this case, the bank guarantee is accounted for in off-balance sheet account 008 “Securities for obligations and payments received.” The amount in the account is equal to the amount specified in the agreement. This amount is debited from the off-balance sheet account gradually as a result of debt repayment. Accounting for a bank guarantee from the principal First of all, you need to know that such a service as the provision of a bank guarantee by a bank or credit institution is a banking transaction, and in accordance with Federal Law No. 395-1, such a service is not subject to VAT taxation. But if the bank guarantee was issued by an insurance company, then such a service is subject to mandatory VAT taxation. In this case, the principal must accept VAT for deduction, having previously reflected this service in accounting. But at the same time, a bank guarantee must be provided to carry out transactions that are subject to tax. The principal cannot deduct input VAT if the transactions carried out in connection with the issuance of a guarantee do not incur VAT. If the bank guarantee is issued by a bank or credit organization, the amount of income tax is taken into account as part of non-operating expenses. When a bank guarantee is issued by an insurance organization, this operation is accepted for accounting for income tax. Accounting for remuneration to the guarantor This accounting will depend on the type of obligations. For example, if, when purchasing property, the buyer provides the seller with a bank guarantee, then this will be considered an expense that is associated with the acquisition of the property. The costs in this case will include the cost of acquiring property, interest paid on a loan provided for the purchase of property, various markups (surcharges), commissions, customs duties and payments, and so on. The amounts of remuneration to the guarantor are included in the actual cost of the acquired assets if the guarantee was issued before the assets were accepted for accounting. The postings in this case are as follows: The amount of remuneration to the guarantor, included in the actual value of the asset - debit account (01/07/08/10/41...) - credit account 76. Payment of remuneration to the guarantor: Debit account 76 - credit account 51. If a bank guarantee issued after the formation of the actual value of assets, the accountant must reflect the following entries: Debit account 91.2 - credit account 76. Borrowing expenses are recognized as other expenses if a guarantee is issued to secure debt obligations. Additional costs are included, if desired, evenly as part of other costs throughout the entire term of the contract. The accounting policy must reflect the chosen method of accounting for additional loan costs, either accounting evenly throughout the entire loan period, or at a time during the period when they arose. As a result, the following entries will appear in accounting: Debit of account 91.2 – Credit of account 76 (reflects the amount of remuneration to the guarantor). Debit of account 76 - Credit of account 51 (payment of remuneration to the guarantor is reflected) Bank guarantee issued to secure other obligations In this case, the tax amount is included either in non-operating expenses or in expenses associated with production and sales. Moreover, the organization itself decides which group of expenses to include this amount of remuneration (payment for guarantor services). Typically, in practice, other expenses include, for example, the customer’s obligation to pay for work (services), the supplier’s obligation to supply products, etc. As part of non-operating expenses, the amount of remuneration is taken into account, for example, to apply the application procedure for VAT refund, to ensure payment of customs duties, taxes, etc. Expenses under the guarantee are recognized for profit tax purposes, provided that these expenses are economically justified and confirmed, and they must also be aimed at generating income. In this case, the remuneration is taken into account for tax purposes in full.

In the current economic situation, a bank guarantee is one of the most popular financial services. It is an instrument for insuring financial risks that may arise due to the counterparty’s refusal to fulfill obligations.

Bank guarantee agreements can be concluded by credit (insurance) organizations for any required amount and for almost any period not only with legal entities, but also with individual entrepreneurs.

Based on clause 1 of Article 369 of the Civil Code of the Russian Federation, a bank guarantee ensures the proper fulfillment by the principal of his obligation to the beneficiary (the main obligation). Thus, a bank guarantee is one of the forms of securing obligations and is a guarantee of a bank *, which guarantees the fulfillment of the obligation assumed by the company that applied for such a guarantee.

*Another credit organization that has the appropriate license from the Central Bank of the Russian Federation.

In accordance with Article 368 of the Civil Code of the Russian Federation, under a bank guarantee agreement, the bank acting as a guarantor issues, at the request of the client (principal), a written obligation to pay the client’s creditor (beneficiary) a sum of money* upon submission by the beneficiary of a written demand for its payment.

*In accordance with the terms of the obligation given by the guarantor.

Providing a bank guarantee is mandatory in some cases, for example:

- for concluding government contracts,

- when fulfilling government orders,

- to participate in tenders, auctions, competitions,

- and so on.

According to clause 2 of Article 369 of the Civil Code of the Russian Federation, the principal pays a fee to the guarantor for issuing a bank guarantee.

The issuance of guarantees by banks relates to banking operations in accordance with clause 8, part 1, article 5 of the Federal Law of December 2, 1990. No. 395-1 “On banks and banking activities.”

In accordance with the provisions of paragraph 3 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation, operations for the execution of bank guarantees are not subject to taxation (exempt from taxation) of VAT on the territory of the Russian Federation:

- issuance and cancellation of a bank guarantee,

- confirmation and modification of the terms of the specified guarantee,

- payment under such guarantee,

- preparation and verification of documents under this guarantee.

Accordingly, VAT on the amount of remuneration by the bank-guarantor of the company-principal is not charged.

The situation is different with guarantees issued by insurance organizations. When the guarantor is an insurance company, the remuneration for its services is subject to VAT. The amount of “input” VAT on remuneration to the guarantor can be deducted by the principal company subject to the conditions specified in clause 1 of Article 172 of the Tax Code of the Russian Federation.

Our article will discuss the features of accounting and tax accounting of expenses for remuneration to the guarantor of the principal organization.

Accounting for the guarantee by the beneficiary

When the beneficiary has received a bank guarantee, he himself decides how to use it. The customer's choice whether to apply or write off bank collateral depends on whether the supplier principal has fulfilled its obligations.

Settlements between the customer and the supplier are regulated by the contract. The beneficiary receives a separate benefit when providing a bank guarantee, since the guarantor determines its payment obligations to the organization until mutual settlements are fully completed (clause 1 of Article 378 of the Civil Code of the Russian Federation). That is why for accounting purposes they use off-balance sheet account 008 “Securities for obligations and payments received.” The collateral is written off from the balance sheet if the parties fulfill their obligations. Analytics is carried out for each received collateral.

How to bring tax and accounting closer together

Is it possible to reflect the costs of a bank guarantee under long-term contracts in account 97 “Deferred expenses” in accounting?

Here you need to clearly understand the following.

The costs of guaranteeing an independent asset do not form (clauses 7.2 and 7.2.1 of the Concept of Accounting in the Market Economy of Russia, approved by the Methodological Council on Accounting under the Ministry of Finance of the Russian Federation and the Presidential Council of the IPB RF on December 29, 1997). But they can be taken into account as part of inventories as costs incurred in connection with upcoming work, and gradually transferred from account 97 to account 20 “Work in progress”. This is precisely the approach implied by paragraph 16 of PBU 2/2008 “Accounting for construction contracts.” Example 4

The company purchased a bank guarantee for obligations related to the execution of a construction contract.

The guarantor's remuneration is 30,000 rubles, the guarantee period is equal to the contract term and is 6 months. The accountant reflects the current costs of performing work on account 20 “Main production”. He accepted the bank guarantee as part of deferred expenses under this agreement and writes it off evenly as the work is completed: DEBIT 97 CREDIT 97

- 30,000 rubles.

– the bank guarantee has been accepted for accounting; DEBIT 20 CREDIT 97

- 5000 rub. (RUB 30,000: 6 months) – monthly warranty costs are included in the cost of construction work. In the balance sheet, the accountant will reflect the balances of accounts 20 and 97 on line 1210 “Inventories”.

What if a bank guarantee was purchased by a trading company in order to ensure settlements under a real estate lease agreement?

Regardless of the duration of the contract, the costs of the guarantee must be written off as expenses at a time (DEBIT 44 CREDIT 76). But this amount needs to be distributed in tax accounting. An example will show you how to act. Example 5

The tenant provided the landlord with a bank guarantee for the obligation to pay rent on time for a period of five months.

The bank's remuneration amounted to 15,000 rubles. Three months later, due to the tenant-principal missing the payment deadline, the bank made payment to the beneficiary landlord. Thus, the guarantee is terminated (subclause 1, clause 1, article 378 of the Civil Code of the Russian Federation). In accounting, the principal attributed rental costs on a monthly basis to account 26 “General expenses”. The remuneration for the bank guarantee should also be written off to the same account, but at a time: DEBIT 26 CREDIT 76

- 15,000 rubles. – a bank guarantee that does not form an asset is recognized. In tax accounting, expenses for the guarantee (subclause 25, clause 1, article 264 of the Tax Code of the Russian Federation) for the first three months were recognized monthly in the amount of 3,000 rubles (15,000 rubles: 5 months). The unwritten part of the remuneration in the amount of 6,000 rubles (15,000 rubles . – 3000 rubles x 3 months) the accountant will expense at the time the guarantee expires.

Example of transactions with a beneficiary: receipt and write-off of a guarantee

For commercial and non-profit organizations, it is necessary to use corresponding postings. Let’s imagine that LLC “Ideal Customer” purchased products from LLC “Ideal Supplier” in the amount of 500,000.00 rubles. The table shows how to reflect the collateral provided by the bank in the beneficiary's accounting records.

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 008 | — | 500 000,00 | Accounting for the received guarantee |

| 62 | 90 | 500 000,00 | Delivery of products to the customer |

Let's say the buyer is late in payment, and the supplier contacts the bank with a demand to pay the principal's debt in the amount specified in the guarantee. The accounting entries will be as follows:

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 51 | 76 | 500 000,00 | Receiving funds from the guarantor |

| 76 | 62 | 500 000,00 | Debt offset |

| — | 008 | 500 000,00 | Write-off of payment security from off-balance sheet |

If payment is made on time, the beneficiary does not need to contact the guarantor for debt reimbursement. Accounting records will be generated for the receipt and subsequent write-off of collateral on the 008 off-balance sheet account.

Transfer of remuneration to the guarantor

Reflect the payment of remuneration to the guarantor in the document Write-off from the current account transaction type Other settlements with the counterparty in the Main section - Bank and cash desk - Bank statements.

Please indicate:

- The recipient is the guarantor;

- Amount - the amount of remuneration to the guarantor;

- Agreement - a document according to which settlements with the guarantor are carried out, Type of agreement - Other .

- Settlement account — 76.09.

See also Receipt and debit from current account

Postings according to the document

The document generates transactions:

- Dt 76.09 Kt - transfer of remuneration to the guarantor.

Accounting for the principal

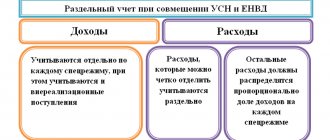

Accounting for guarantees in the principal’s accounting department is based on two positions:

- The bank guarantee should not be taken into account by the principal. The logic is this: the guarantee is intended not for the principal, but for the beneficiary, and is issued by a third party - the bank. That is, the guarantee obligations are obtained for the lender and issued by the lending institution, and not by the principal himself. Therefore, it makes no sense for the principal organization to reflect these obligations on off-balance sheet accounts 008 and 009.

- Warranty obligations must be recorded in accounting.

This is necessary in order to reflect a change in the creditor organization in the event of transfer of obligations to pay the debt to the guarantor. Reflection of collateral in accounting allows for further operations to apply penalties to the debtor.

From an analytical point of view, reflecting the guarantee collateral is necessary, as this makes financial and accounting reporting more transparent and allows you to view the resulting accounts payable of the principal in the context of analytical accounting.

How to calculate reserves for insurance premiums and vacations

The reserve for payment of insurance premiums is calculated according to the methodology for calculating the reserve for payment of vacations.

Exceptions are government agencies that find it difficult to perform calculations using the methods recommended by the Ministry of Finance. In this case, to calculate the standard, data for the previous year is taken, i.e. the entire amount of last year's vacation pay actually paid is divided by the total wage fund and the resulting result is multiplied by the payroll for a certain period. Contributions are calculated in the same way.

To evenly assign deferred expenses to the financial result in budget accounting, account 401.60 is used. Accounting for the reserve in this account allows you to obtain complete and reliable information about the institution’s obligations using the accrual method, which provides for the reflection of expenses in the period to which they relate, regardless of when the funds were paid.

At the end of each month worked, the employee has the right to the corresponding vacation days, and the employer has the obligation to provide payments for these days. Accordingly, there is a basis for recording obligations in account 401.60. If we take into account the reserve for vacation pay, then you can use a separate account 401.61, but for this it needs to be fixed in the accounting policy. Taking into account labor costs, an institution can set a convenient frequency for accrual, for example, once a month or less.

Authorization transactions for other subsequent years (outside the planning period) are accounted for in account 500.90. Account 502.99 is intended to reflect deferred liabilities.

Accounting for bank guarantees for public sector employees

Accounting for bank guarantees in a budgetary institution has its own peculiarities. When conducting competitive and auction procedures for the supply of goods, works or services, the customer organization establishes a mandatory requirement for securing applications. It can be transferred by the procurement participant either by depositing funds into the customer’s current (personal) account or by providing a bank guarantee. Based on clause 351 of Instruction No. 157n, accounting for a bank guarantee received as security for an application is carried out in off-balance sheet account 10 “Security for the fulfillment of an obligation.” The Letter of the Ministry of Finance dated July 27, 2014 No. 02-07-07/31342 states that funds received as security for participation in a competition or closed auction, as well as as security for the execution of a contract, do not need to be taken into account in off-balance sheet account 10.

In a budgetary institution, a bank guarantee is recorded in the accounting department strictly on the day the guarantee liability occurs. The amount must match the value of those obligations whose performance is guaranteed. On the day of termination of the guarantee and financial conditions, the established amount is reduced on account 10 of the off-balance sheet.

An example of reflection in the accounting of a beneficiary

Buyer LLC and Supplier JSC entered into an agreement for the supply of goods with deferred payment. JSC Supplier requested a guarantee for the full amount of delivery of goods - 800,000 rubles.

The beneficiary (JSC Supplier) will account for the bank guarantee in the accounting department as follows:

| Operation | Debit | Credit | Amount, rub. |

| A bank guarantee was received from the bank under an agreement with LLC “Buyer” | 008 | — | 800 000 |

| The goods were shipped according to the contract | 62 | 90 | 800 000 |

The principal (Buyer LLC) did not fulfill the obligation to pay for the delivery. For failure to fulfill obligations, the beneficiary filed a claim with the bank. The banking organization accepted the claim from Supplier JSC. The bank guarantee was transferred in full to the benefit of the beneficiary.

The beneficiary reflected the transactions in accounting:

| Operations | Debit | Credit | Sum |

| A bank guarantee has been received in the current account | 51 | 76 | 800 000 |

| The offset of the received guarantees from the bank in favor of the debt under the agreement is reflected | 76 | 62 | 800 000 |

| Payment security under the contract has been written off | — | 008 | 800 000 |

IMPORTANT!

When fulfilling the principal's obligations, only transactions on off-balance sheet accounts are reflected in accounting.

Postings for budgetary institutions

Funds received from a credit institution (bank) allocated for execution must be reflected in the accounting of a budgetary institution with the following entries:

| Debit | Credit | Operation description |

| 2.201.11.510 | 2.205.41.660 | Funds received into the personal account of a budgetary institution (payment to the beneficiary of the amount for which the bank guarantee was issued) |

| 2.205.41.560 | 2.401.10.140 | Accrual of income in the amount of security under a bank guarantee in the event of its receipt at the disposal of a budgetary institution |

Accounting in government institutions

A bank guarantee and accounting in the accounting departments of government institutions are carried out differently. When funds are received into a current account, they are accounted for according to KFO 3, since they are received at temporary disposal and are required to be transferred to budget revenues. Accounting entries for transactions depend on the powers delegated to a particular government institution to administer budget funds.

Postings for accounting in a government institution are reflected in the table:

| Operation | Debit | Credit | Notes |

| Funds under the bank guarantee were received in accordance with the established procedure | KIF 3,201 11,510 | GKBK 3 304 01 730 | For PBS, RBS, GRBS and budget revenue administrators |

| Guarantee funds transferred to the budget | GKBK 3 304 01 830 | KIF 3,201 11,610 | |

| Accrued profit from receipt of funds to the budget | KDB 1 209 40 560 | KDB 1 401 10 140 | For budget administrators |

| Calculations by the administrator of budget revenues are reflected | KDB 1 304 04 140 | KDB 1 209 40 660 | For limited administrators only |

| The guarantee amount is credited to the budget | KDB 1 210 02 140 | KDB 1 209 40 660 | Only for administrators with full privileges |

Tax accounting

The guarantee from the bank must be reflected in both the accounting and tax records of the organization. Tax accounting of bank guarantees is carried out in accordance with the norms of the Tax Code of the Russian Federation. The remuneration is taken into account as part of other costs associated with the production and sale of various products, and as other expenses.

The Tax Code of the Russian Federation requires the submission of reports to the Federal Tax Service, including the costs of a bank guarantee during the period of its actual provision, and not according to the timing of payment of monetary amounts under it. In tax accounting, the date of receipt of a bank guarantee is considered the day of signing the agreement (main agreement) on the issuance of guarantee obligations to the client.

Tax accounting of bank guarantees has a number of nuances. The purchase of goods, works and services under a contract is subject to VAT, with the exception of products not subject to value added tax. Operations involving the use of bank guarantees are not subject to VAT (subclause 3, clause 3, article 149 of the Tax Code of the Russian Federation).

After receiving payment of the guarantee for the obligations not fulfilled by the supplier from the guarantor bank, the beneficiary-customer includes it in income in the same way as the payment of the principal would be taken into account without the use of a bank guarantee.

The principal has the right to take into account expenses under the guarantee (commission to the guarantor) for tax accounting purposes either as other expenses or as non-operating expenses. In any of these cases, costs are recognized throughout the entire validity period of the bank guarantee in equal parts (Letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/4 dated 01/11/2011).

Accounting for the costs of obtaining a bank guarantee

The costs of remuneration to the guarantor for providing a bank guarantee are reflected in the Transaction document. Manually entered transaction type Transaction in the Transactions - Accounting - Manually entered transactions section.

In our example, costs are associated with remuneration under a bank guarantee to ensure payment of rent for 6 months, so account 97.21 is used.

Postings in the accounting of the principal in case of failure to fulfill an obligation

Situations often arise when the principal did not manage to fulfill his obligations under the contract, after which the beneficiary turns to the bank to receive the funds due to him under the contract from the guarantor. The guarantor notifies the principal about this and informs about the termination of the warranty obligations. The principal is obliged to reimburse the bank for the amount that it transferred to the beneficiary.

If the principal needs to recognize the bank’s regressive claim in accounting, then transactions in the event of failure to fulfill obligations are reflected in accounting entries:

| Debit | Credit | Operation description |

| 60 | 76 | Obtaining a guarantor's recourse claim |

| 76 | 51 | Repayment of debt to the bank |

Reflection of a bank guarantee in budget accounting

But before reflecting the BG in the accounting records of a budgetary institution, you need to make sure that the guarantee is registered in the register of bank guarantees of the Unified Information System for the procurement of goods, works and services. The said register must contain information such as the details of the guarantor bank, the validity period of the BG, as well as the amount that the guarantor will pay to the beneficiary if the principal fails to fulfill the terms of the contract.

According to special Instruction No. 157N, in a budgetary institution, bank guarantees are accounted for in off-balance sheet account number 10, which is intended to ensure the fulfillment of obligations. It is important to remember that the amount of the bank guarantee must necessarily be equal to the amount of the obligations that it secures. And if a bank guarantee has arrived, the entries in budget accounting look like this.

When crediting occurs, the BG is reflected in the off-balance sheet account “ten” as an increase in the amount of the liability with a “plus” sign. When the obligation expires, it looks like a decrease in this off-balance sheet account by the amount of the obligation with a minus sign. In this case, movement, both in debit and credit, is not expected.

Accounting for payment of commission for issuing a guarantee

For the guarantor, the issuance of security under the contract is a source of income, therefore, the principal will have to pay a certain commission for the bank to issue the guarantee. Such a commission can be fixed, or calculated as a percentage of the contract amount or by other methods.

In the bank guarantee agreement, the bank has the right to stipulate various conditions for the payment of obligations. For example, an obligation may be established for the principal to make a one-time or evenly distributed payment over the entire period of validity of the guarantee.

We determine the responsibility of the parties to the transaction

In any transaction there are several participants. The bank guarantee is issued by the bank, received by the supplier and transferred as security for the contract to the customer. A bank guarantee is a documented obligation of the bank to pay the customer a certain amount if the supplier violates or fails to fulfill obligations under the contract (Article 368 of the Civil Code of the Russian Federation). In essence, this is a guarantee that the contractor’s illegal actions (his dishonest behavior) are financially compensated.

Officially, the parties to the transaction are called as follows:

- Guarantor is the one who issues a bank guarantee. This is a bank or credit institution. Banking institutions issue a guarantee for a fee specified in the contract.

- The principal is the one who applies for warranty obligations. This is a supplier, contractor or executor of a government contract. Under the terms of the agreement with the credit institution, the supplier acts as a debtor.

- The beneficiary is the one for whom the bank guarantee is issued. This is the customer whose interests are protected by the guarantee obligations issued by the bank.

Just as in a government contract the parties are the supplier and the customer, so in a warranty agreement the parties to the agreement are the principal and the beneficiary. They are obliged to act within the framework of civil norms and rules (Article 420 of the Civil Code of the Russian Federation). The presence of a warranty agreement insures possible actions of the supplier. The parties - supplier-customer, principal-beneficiary - interact within the framework of two agreements. Under a government contract, the contractor supplies goods, performs work and provides services, and the customer pays for them in full. The guarantor bank is involved only when the supplier, for certain reasons, is unable to fulfill its obligations or deliberately avoids fulfilling them. It is the responsibility of the drafter of the guarantee agreement to clearly state all the grounds for payment of the guarantee.

The customer organization is obliged to carry out warranty obligations both in accounting and tax accounting. Postings depend on the form of obligations. Here is the account to which the bank guarantee should be attributed:

- for budgetary institutions - off-balance sheet account 10;

- for commercial and non-profit organizations - off-balance sheet account 008.

Postings to reflect the commission on a bank guarantee

The procedure for reflecting the commission depends on the moment of acquisition and registration of the acquired property.

If the commission is transferred to the bank before the purchased assets are registered and before the funds are transferred by the principal, then the credit institution’s remuneration is included in the expenses for the acquisition of property - in its cost (clause 6 of PBU 5/01, clause 8 of PBU 6/01 ).

Let's show it with an example. Zarya LLC acquires the building from Aktiv LLC. The cost of the property is 1,500,000.00 rubles. Zarya LLC provides the seller with a guarantee from the bank. The guarantor's commission is 3% of the value of the property - 45,000.00 rubles. The fee must be paid in one lump sum. The commitment is issued for a period of one month. The transaction was completed, all mutual settlements were made on time, no warranty obligations were applied.

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 76 | 51 | 45 000,00 | Transfer of commission to the guarantor |

| 08 | 76 | 45 000,00 | The commission amount is included in the cost of construction |

| 08 | 60 | 1 500 000,00 | Reflection of the cost of construction as part of non-current assets |

| 01 | 08 | 1 545 000,00 | Reflection of the cost of construction as part of the principal's fixed assets |

If the guarantee obligations were provided after the value of the property asset was formed, then it is no longer possible to change the amount of the recorded asset by including the amount of remuneration to the guarantor in the initial cost of the property.

If the bank commission, which was paid before the initial cost of the asset was formed, is included in other expenses, this may affect the calculated property tax. In 2020, property tax is calculated according to new rules. All movable property is excluded from the base. This means that when purchasing a property, writing off bank fees for other expenses may lead to a distortion of the tax base.

The accounting entries will be as follows: Dt 91.2 Kt 76 - accounting for the commission to the bank, the amount of which is not included in the initial cost of the purchased object.

Let's clarify the official position

What position do the tax authorities take? Let us turn to the letter of the Ministry of Finance of Russia dated January 16, 2008 No. 03-03-06/1/7.

Let's start with the indisputable recommendation presented in paragraph 2. If the company loses the tender (competition), then the costs of purchasing a bank guarantee can be safely included in non-operating expenses. This suits all taxpayers.

But the ministry’s approach to accounting for the costs of a bank guarantee under supply contracts, presented in paragraph 1, may seem controversial. The letter states: if, under the terms of the guarantee agreement, the amount of remuneration to the bank is set as a percentage of the amount of supplied products, then such expenses are equated to expenses in the form of interest on debt obligations. As a result, they will be normalized. The grounds are in Article 269 of the Tax Code.

This position is not difficult to challenge if the company has fulfilled its obligations to the beneficiary. After all, there was no borrowing, that is, the involvement of the guarantor’s funds in the economic activities of the principal with their subsequent return. What if the guarantor made a payment to the beneficiary and filed a recourse claim against the principal?

Just such a case is presented in example 2. The debt relationship with the bank is obvious.

According to paragraph 3 of Article 43 of the Tax Code, interest is any pre-declared (established) income received under a debt obligation of any type (regardless of the method of its execution). In such circumstances, the remuneration to the bank is “tax” interest on the debt obligations. And this is the third option for classifying expenses - subparagraph 2 of paragraph 1 of Article 265 of the Tax Code. And the point here is not at all that the remuneration is set as a percentage of the size of the principal’s main obligation. Example 3

Let's use the conditions of example 2. The company repaid the debt it incurred to the bank in two months. On the date of raising funds from the guarantor bank, the refinancing rate was eight percent. Therefore, as part of income tax expenses, the principal company has the right to take into account only 146,667 rubles (10,000,000 rubles x 8% x 1.1 x 2 months: 12 months).

It turns out that the amount of expense depends on the duration of the debt to the bank. The conclusion suggests itself: the expense can be recognized no earlier than the principal completes settlements for the amount of the obligation specified in the guarantee. The problem is that the Tax Code does not provide for such an approach to determining the date of expenditure. The incorrectness of letter No. 03-03-06/1/7 lies precisely in this...

However, in practice the situation is completely different. As a rule, the guarantee provides that from the moment the money is transferred to the beneficiary until the debt to the bank is repaid, the principal additionally (in addition to the remuneration) pays interest at the agreed rate. The absence of such a condition does not encourage the principal to return the money to the guarantor. And the procedure for accounting for such expenses does not cause disagreement. They are indeed adopted taking into account the provisions of Article 269 of the Tax Code. So example 3 is unrealistic. It should be supplemented with wiring:

DEBIT 91-2 CREDIT 76

- interest was accrued to the guarantor for the use of his funds (at the rate established by the bank guarantee).

As a result, letter No. 03-03-06/1/7 is not worth challenging. You just need to understand that the recommendation it contains is not universal. It refers to a special case, which Example 3 explains. The author did not find any arbitration practice on these issues.

note

Expenses are recognized in the reporting (tax) period in which these expenses arise based on the terms of transactions (clause 1 of Article 272 of the Tax Code of the Russian Federation).

A bank guarantee provides for two independent “stages”: before and after the guarantor repays the obligation to the beneficiary. The remuneration for the first stage is set in a fixed amount, for the second - in the form of interest for the time of use of the funds. Therefore, two types of expenses arise in tax accounting.

Features of accounting policies

The remuneration to the guarantor under the loan agreement must be reflected in the accounting policies of the organization. When concluding a loan agreement, one of the conditions of the agreement may be the mandatory execution of guarantee obligations. In such cases, the costs are borne by the borrower himself. The procedure is specified in PBU 15/2008 “Accounting for expenses and borrowings on loans.” The borrower is obliged to consolidate the chosen method in the accounting policy. Remuneration costs can be classified as other expenses (clause 7 of PBU 15/2008) or additional borrowing costs can be recognized evenly as part of other expenses (clause 8). This can only be done during the validity of the loan agreement itself. The correspondence of the accounting accounts will not change depending on the choice of cost distribution method and will be as follows:

| Posts | Operation description | |

| Debit | Credit | |

| 91.2 | 76 | Reflection of full or partial bank commission |

| 76 | 51 | Accounting for the amount of guarantor's remuneration paid |

The write-off methodology can be presented schematically:

Encyclopedia of solutions. Account 10 “Ensuring the fulfillment of obligations” (for the public sector)

Information block “Encyclopedia of solutions. Public sector: accounting, reporting, financial control" is a set of unique updated analytical materials aimed at accountants and specialists in financial and economic services of public sector organizations

The material is updated as of November 2021.

See Solutions Encyclopedia for updates

See Solution Encyclopedias

The materials in the information block will help you quickly and at a high level solve problems in the field of accounting, use of budget classification, as well as correctly apply regulatory legal acts in the context of improving the legal status of state (municipal) institutions.

Each material in the block is supported by references to regulatory legal acts, takes into account existing judicial practice and is updated as legislation changes.

Authors' team:

S. Bychkov, Deputy Director of the Department of Budget Methodology and Financial Reporting in the Public Sector of the Russian Ministry of Finance

Yu. Krokhina, Head of the Department of Legal Disciplines of the Higher School of State Audit (Faculty of M.V. Lomonosov Moscow State University), Doctor of Law, Professor

V. Pimenov, head of the “Budget Sphere” direction, expert at the Laboratory for Analysis of Information Resources of the Research Computing Center of Moscow State University. M.V. Lomonosov

A. Kulakov, head of the accounting and reporting department of the Federal State Budgetary Institution “Main Military Clinical Hospital named after Academician N.N. Burdenko" Russian Ministry of Defense, professional accountant

E. Yancharin, deputy. Head of the Department for Organization of Capital Construction of the DT Ministry of Internal Affairs of Russia from 2021 to 2021

A. Semenyuk, State Councilor of the Russian Federation 3rd class

A. Shershneva, adviser to the state civil service of the Russian Federation, 2nd class

O. Levina, adviser to the state civil service, 1st class

O. Monaco, auditor

A. Kuzmina, Candidate of Legal Sciences

N. Andreeva, professional accountant, member of the IPB of Russia

D. Zhukovsky, head of the budget accounting automation department, specialist in the implementation of software products in public sector organizations

A. Sukhoverkhova, expert of the Legal Consulting Service GARANT, member of the Union for the Development of Public Finance

I. Sapetina, expert of the Legal Consulting Service GARANT

V. Evsyukova, expert of the Legal Consulting Service GARANT

V. Suldyaykina, expert of the Legal Consulting Service GARANT, specialist in automation of budget accounting

and etc.

List of abbreviations:

Law N 402-FZ - Federal Law of December 6, 2011 N 402-FZ “On Accounting”

Instruction N 157n - Instructions for the application of the Unified Chart of Accounts for state authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved by order of the Ministry of Finance of Russia dated 12/01/2010 N 157n

Instruction N 162n - Instructions for the use of the Chart of Accounts for Budget Accounting, approved by Order of the Ministry of Finance of Russia dated December 6, 2010 N 162n

Instruction N 174n - Instructions for the use of the chart of accounts for accounting of budgetary institutions, approved by order of the Ministry of Finance of Russia dated December 16, 2010 N 174n

Instruction N 183n - Instructions for the use of the chart of accounts of accounting of autonomous institutions, approved by order of the Ministry of Finance of Russia dated December 23, 2010 N 183n

Instructions N 65n - Instructions on the procedure for applying the budget classification of the Russian Federation, approved by order of the Ministry of Finance of Russia dated 01.07.2013 N 65n

Order N 52n - Order of the Ministry of Finance of Russia dated March 30, 2015 N 52n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state (municipal) institutions, and Guidelines for their use"

Instruction N 33n - Instructions on the procedure for drawing up and submitting annual and quarterly financial statements of state (municipal) budgetary and autonomous institutions, approved by order of the Ministry of Finance of Russia dated March 25, 2011 N 33n

Instruction N 191n - Instructions on the procedure for drawing up and submitting annual, quarterly and monthly reports on the execution of budgets of the budget system of the Russian Federation, approved by order of the Ministry of Finance of Russia dated December 28, 2010 N 191n

KOSGU - Classification of operations of the general government sector

FCD Plan - Financial and economic activity plan