Home › Finance

02.01.2018

Let's figure out what changes affect financial assistance to employees in 2021. Let's consider taxation with insurance premiums and personal income tax, as well as the impact on the income tax base and the simplified tax system.

The definition of material assistance is given in GOST R 52495-2005 “Social services to the population. Terms and definitions" (Approved by Order of Rostechregulirovanie dated December 30, 2005 No. 532-st).

At a practical, everyday level, this is a payment that is not related to the recipient’s performance of a labor function. Such payments are conditioned by the occurrence of a difficult life situation, for example, due to a natural disaster or other emergency, the death of a family member, the birth or adoption of a child, a wedding, a serious illness, etc.

Let us dwell in detail on the taxation of financial assistance to an employee in 2021.

What is financial assistance to an employee?

Financial assistance to an employee is a one-time financial payment, which is provided in a number of exceptional cases, such as:

- assistance with the treatment of an employee’s relative;

- assistance at the birth of a child;

- funeral assistance.

Belongs to the category of SOT (labor remuneration system), paid at the discretion of the employer. Before applying for financial assistance, an employee should inquire whether such a payment is included in the list of SOT of the organization in which he works.

Definition

There is no clear definition of the term material assistance in Russian legislation. But the procedure for providing funds is described in detail in regulations. All cash payments are divided into:

- state and municipal (from the Social Insurance Fund, Pension Fund, etc.);

- local (from the employer).

Legal regulation of the payment of funds to citizens who find themselves in an unusual situation is carried out on the basis of local federal laws and collective labor agreements. Material assistance can be one-time or regular, paid in cash or in the form of valuables. Salary is subject to personal income tax. The lump sum payment is also part of the employee's income. Is financial assistance subject to personal income tax? Yes, but not always.

Financial assistance is a one-time payment, which is carried out on the basis of the order of the manager. If several orders are issued on the same basis, then only the first amount will be recognized as a lump sum, and for the rest you will have to pay personal income tax.

Payment nuances. What documents are needed and how are they prepared?

How to write an application for financial assistance?

If an employee applies for financial assistance from an employer, then he must draw up a corresponding application addressed to the director of his company. It is imperative to justify the reason why financial assistance is required. It is also necessary to attach documents that are evidence of a particular event (for example, a copy of a birth certificate).

Application for financial assistance

How to draw up an order for financial assistance?

In this order, which is personally drawn up by the director of the company or another responsible person, it is necessary to indicate the reason for this payment and instruct a specific employee from the accounting department to pay financial assistance within a certain period. Give the order to be signed by the employee receiving assistance and the accounting employee responsible for the payment.

Order for financial assistance

What types of financial assistance are there?

For the second half of 2021, the procedure for the existence of several types of financial assistance has been determined:

- limited – not subject to taxes if it does not exceed the amount prescribed by law. Anything over the limit is taxed;

- unlimited – not subject to taxes, if the need is confirmed by relevant documents, issued after the company has paid all taxes.

The amount of unlimited financial assistance is determined by the management itself and has no limits. But the decision to issue such an amount occurs after the organization has paid all taxes and insurance premiums. According to the Federal Tax Service, after paying taxes, companies have funds left for such procedures.

In addition to exceptions, financial assistance without tax should not exceed 4,000 rubles for 1 year to one employee, provided they provide documents confirming the need. This order has existed for many years. It will not be subject to review or adjustment in the near future.

In addition to the organization's employees, former employees of the company can also receive financial assistance. In this case, there are no tax contributions at all, since the company does not have any labor or civil law relations with the person.

When is material assistance a reward for work?

When can an employee receive financial assistance partially subject to personal income tax?

The limit applies to financial assistance in situations such as:

- Marriage – the amount less than 4 thousand rubles is not taxed. at one time. The employee must provide a marriage certificate (this can be done within a month after the order is issued and the funds are received).

- The birth of one child or more – the limit amount is 50 thousand rubles. from July 2021 can be issued in the form of financial assistance to each parent for each child.

- A working student can receive an amount of 4 thousand rubles to help pay for their studies, for example. Typically, serious companies interested in improving the skills and professionalism of their employees pay in full for the entire training time at a time, if the company has issued a decree to send the employee for training (advanced training). This provision does not apply to financial assistance. Financial assistance can be considered a situation when the employee himself pays for training and writes an application asking for help with a financial problem that has arisen, and the management goes to a meeting and allocates the necessary amount or the state-provided limit of 4 thousand rubles.

Sample application for financial assistance.

In an employee’s application for the need for financial assistance, you can specify that the amount be divided and paid monthly or in another time period.

In this case, the manager will indicate in the order the full amount of financial assistance and the dates on which it will be issued in installments over a certain period. If the employee does not immediately indicate such a need, all payments except the first will be taxed.

The amount exceeding the limit is partially subject to taxes and insurance payments. For example, if an employee Ivanov I.I. wrote an application for financial assistance in connection with marriage, indicating the required amount.

The manager issues an order, which is drawn up in any form. The essence of the order is to issue Ivanov the declared amount of 25 thousand rubles. tax will be charged on 21 thousand rubles, since 4 thousand rubles. – this is the maximum tax-free amount of financial assistance.

Another example: Employee A.N. Sviridov wrote a statement about the need for financial assistance in connection with the birth of twins. Documents confirming this fact were attached to the application (birth certificate or certificate from the maternity hospital, marriage certificate).

According to the procedure in force since July 2021, Sviridov was paid 30 thousand rubles for each child. Which does not exceed the limit.

At the same time, Sviridov’s wife received 20 thousand rubles from her place of work. Both payments are free of taxes and contributions. If Sviridov received 51 thousand for each child, then 2 thousand of this amount would be subject to taxes and contributions. In the first half of 2021, such a law was not yet in force.

The amount required for treatment is subject to contributions and taxes if it exceeds 4 thousand rubles. Assistance for the treatment of an employee is not taxed if it is allocated from the net profit of the company.

Sample application for financial assistance.

What kind of assistance is not subject to taxes?

There are situations when material assistance in the amount established by the management of the organization is not subject to taxes and contributions at all:

- Death of a close relative. Until now, a close relative was considered to be a spouse, children, and parents. Since mid-summer 2017, siblings and other relatives who have lived with the employee for a long time and (or) are dependent on him are considered close relatives. Documents confirming this fact must be attached to the application.

- Elimination of the consequences of a natural disaster. For the application to be valid, it is necessary to obtain a certificate from the Russian Ministry of Emergency Situations locally. The fact that the employee and his family and property were damaged as a result of the vagaries of nature must be confirmed by the competent authorities.

- Treatment of a serious illness of an employee or members of his family living with him is tax-free financial assistance, in this case it comes only from the profit of the organization, after paying all taxes (net profit). The amount is determined by management. How to make an application for financial assistance in connection with treatment - read here.

For example, Gazprombank employee Mamikonova K.S. got sick with cancer. For treatment, she needed an amount of 600 thousand rubles. for each visit to the clinic during the year 2 times.

The head of the bank, based on Mamikonova’s application, with attached extracts from the clinic, invoices and dates of treatment procedures, issued an order for one-time financial assistance in the amount of 1 million 200 thousand rubles. and transferring this amount in two installments of 600 thousand rubles. to the clinic's bank account.

After completing each stage of treatment, Mamikonova had the right to leave after treatment, which she was granted. If there were 2 orders according to which 600 thousand rubles were issued, then the second amount would be subject to all taxes.

In what order will insurance premiums and taxes be paid?

Are personal income taxes or insurance premiums charged for financial assistance? What financial assistance is not subject to taxes?

In accordance with Article 270 of the Tax Code of Russia, paragraph 23, material assistance cannot be taxed, since it is not classified as profit. Insurance premiums are also not charged.

However, this rule will only be true if the situation falls into the following list:

- natural disasters affecting the employee;

- death of a relative;

- urgent need for renovation of living space;

- treatment of a serious illness;

- the need for additional funds when having children;

- various social needs or any other emergency unforeseen circumstances entailing additional costs.

Reasons

Companies that value their employees introduce additional incentive measures. For example, this is the payment of financial aid. An organization can allocate part of the funds from its budget to an employee so that he can overcome force majeure situations. The basis for receiving a payment may be:

- birth (adoption) of a child;

- death of a close family member;

- wedding;

- the emergence of serious health problems;

- fire and other disasters.

Material assistance differs from wages: it does not depend on the employee’s performance indicators and results, does not compensate for his production costs, and does not reward him for his achievements. This is not part of the incentive; it is paid one-time when an emergency occurs.

Are financial assistance amounts subject to personal income tax? Yes, but not always. Therefore, the accountant needs to be careful when preparing related documentation. Funds are allocated from the organization's net profit. If the recipients are full-time students of the university, then a special fund is used as a source, constituting 1/4 of the scholarship fund.

How to reflect financial assistance to employees in accounting and tax accounting

Financial assistance in accounting and tax reporting is calculated as follows:

| Basis of financial assistance | Revenue code | Deduction code |

| due to the death of a family member | The 2-NDFL certificate is not reflected | |

| due to a natural disaster or other emergency | ||

| in connection with the birth of a child during the first year of his life, if the amount of financial assistance does not exceed 50,000 rubles. based on both parents | ||

| on other grounds, if the total amount of financial assistance does not exceed 4,000 rubles. in a year | ||

| in connection with the birth of a child during the first year of his life, if the amount of financial assistance exceeds 50,000 rubles. based on both parents | 2762 | 508 |

| on other grounds, if the total amount of such financial assistance exceeds 4,000 rubles. in a year | 2760 | 503 |

Financial assistance to an employee is a one-time financial payment, which is provided in a number of exceptional cases. If an employee applies for financial assistance from an employer, then he must draw up a corresponding application addressed to the director of his company. It is imperative to justify the reason why financial assistance is required. In accordance with Article 270 of the Tax Code of Russia, paragraph 23, material assistance cannot be taxed, since it is not classified as profit.

Financial assistance, taxation 2017

Personal income tax accrual

Is financial assistance subject to personal income tax? 2021 introduced many amendments and innovations to the legislation. But tax-free financial assistance (2017) remained unchanged.

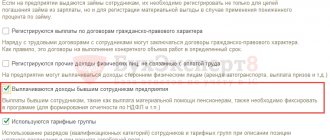

Financial assistance up to 4000 - taxation 2021 does not provide for inclusion in income to determine the tax base for personal income tax in case of payment on the following grounds:

Please note that payment for medicines is made upon provision of documents confirming the actual costs of purchasing these medicines for medical use. Medicines are prescribed by the attending physician. However, it should be borne in mind that medical aid is paid for for medications prescribed to employees and their relatives (spouses, parents, children, wards under 18 years of age), as well as former employees (age pensioners) and disabled people (clause 28 of article 217 of the Tax Code RF).

Material assistance is subject to personal income tax, but there are cases of payments that are not subject to personal income tax (clause 8 of article 217 of the Tax Code of the Russian Federation):

Accounting for income tax and simplified taxation purposes

As a general rule, amounts of paid financial assistance are not taken into account in expenses for tax accounting purposes, when taxed with income tax and the simplified tax system (clause 23 of article 270, clause 1 of article 346.16 of the Tax Code of the Russian Federation).

At the same time, in Letters of the Ministry of Finance of Russia dated 09/02/2014 No. 03-03-06/1/43912, dated 10/22/2013 No. 03-03-06/4/44144, explanations are given that financial assistance paid for annual leave is taken into account as part of labor costs.

Important! Labor costs include payments provided for in employment contracts or collective agreements (Article 255 of the Tax Code of the Russian Federation).

Conclusion

An organization may pay its employees a one-time cash payment that is not related to the performance of their job duties. Is financial assistance subject to personal income tax? Yes, provided that the payment amount exceeds 4 thousand rubles. The legislation also stipulates certain cases when financial assistance is not subject to taxes. The existence of conditions for payment of financial assistance must be documented. In the absence of a certificate, statement or order from the director, the tax office may consider the payment unlawful and charge additional personal income tax.

When is tax not withheld?

Is financial assistance always subject to personal income tax? Funeral, birth of a child, retirement - upon the occurrence of this or any other event in a person’s life, the employer can provide a lump sum payment to the employee. If you adhere to certain rules, you will not have to pay additional taxes.

According to Art. 217 of the Tax Code of the Russian Federation, not all social payments are subject to taxation. One-time transfers of funds to officially registered charitable companies are not subject to taxation. As well as financial support for victims of natural disasters and terrorist attacks. Is financial assistance for funeral subject to personal income tax? No, provided that we are talking about a former employee of the company, a member of the workforce or a former retired employee whose close relative has died. However, the maximum payout amount is not limited in any way.

Is material assistance subject to personal income tax if the funds are paid from the budget? No, if we are talking about transferring money to low-income people. This category also includes payment of maternity capital, which comes from the budget.

Is financial assistance to an employee or former employee subject to personal income tax if the amount of payment for the tax period does not exceed 4 thousand rubles? No. Personal income tax is collected from the excess of this amount at a rate of 13%. Also included in the list of exceptions is compensation for expenses for medical services, including payment for vouchers for sanitary-resort treatment.

Payment selection criteria

- Size. The amount of payments per employee for the entire reporting period must be less than 4,000 rubles. It does not matter whether the person continues to work or was fired due to disability or reaching retirement age.

- Confirmation. In order not to pay tax, the organization must prove that the situation for which the funds were allocated actually occurred:

- If an employee received payment due to the loss of a relative, he must provide a death certificate.

- If an employee has a child born (adopted), he must provide a birth (adoption) certificate.

- If a person was injured during a terrorist attack on the territory of the Russian Federation, he must provide a certificate from the police confirming this fact.

- If damage to an employee’s health was caused by a natural disaster, then documents from the competent authorities are needed.

- Special circumstances. Events such as the death of a family member or an emergency are grounds for not charging personal income tax. But you must provide documents as confirmation. If the tax office considers the documents provided to be insufficient, it may impose a tax on the payment.

BOO

Let's take a closer look at how personal income tax is applied to material assistance in accounting. The amounts issued relate to other expenses for the current period. But they are not taken into account when calculating income tax or simplified tax system. Let's look at typical wiring:

- DT91 KT73 - attribution of financial assistance to other expenses.

- DT91 KT69 - reflection of contributions under the ESSS in amounts exceeding the limits of financial assistance.

- DT73 KT68 - withholding personal income tax from amounts exceeding the limits for financial assistance.

- DT73 KT50 - issuing financial assistance to an employee “in hand.”

In the 6-NDFL report on pages 020 and 030, you need to indicate only those payments that are subject to taxation in full or in part.