Water tax in 2021

The water tax is regulated by Chapter 25.2 of the Tax Code of the Russian Federation. It is paid by organizations, individual entrepreneurs and individuals who, on the basis of a license, are engaged in water use, namely:

- abstract water from water bodies,

- use the water areas of water bodies,

- use water bodies for hydropower without water intake,

- float down the timber.

All this forms the object of water tax (Clause 1, Article 333.8 of the Tax Code of the Russian Federation).

If water use is carried out on the basis of agreements or decisions on the provision of water bodies for use, concluded after the introduction of the new Water Code of the Russian Federation on January 1, 2007. - no tax is paid.

The tax base depends on the type of water use and is determined separately for each of them. To calculate the water tax, you need to consider:

- for water withdrawal – the volume of water withdrawn during the tax period; if there are no measuring instruments, then the volume is calculated from the operating time and power of technical means, or established consumption standards are applied;

- for water areas - the area of the provided water space, according to the license or agreement;

- for hydropower – the amount of electricity produced during the tax period;

- when rafting - the volume of rafted wood in thousand cubic meters. m, multiplied by the rafting distance in km, divided by 100.

Results

Water tax must be calculated and reported if there is an object subject to this tax. It is calculated quarterly, taking into account the data of the last quarter, by multiplying the base by the rate. The choice of tax rate and base is determined by the specific type of water use and its affiliation with a specific object. Legislatively established increasing coefficients are applied to the bet.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Tax rates

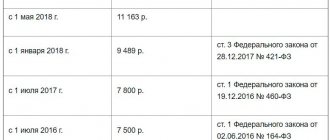

For water tax, the rates are set by Art. 333.12 Tax Code of the Russian Federation. Their size depends on a number of factors: the type of water intake, the region of water use, and whether water is withdrawn to provide it to the population. In addition, annually increasing coefficients are applied to tax rates - in paragraph 1.1 of Art. 333.12 of the Tax Code of the Russian Federation they are defined until 2025. In 2021, the coefficient is 1.52.

In addition, additional coefficients may be applied to the water tax rate, taking into account the annual coefficient:

- 5-fold – when water intake exceeds the limit established by the license,

- 10-fold – when extracting groundwater for the purpose of selling it, except for mineral, thermal and industrial water,

- coefficient 1.1 – if taxpayers do not have measuring instruments to account for the volume of water intake.

If water resources are used to supply water to the population, preferential rates apply. In 2021, 1 thousand cubic meters of water is taxed in the amount of 107 rubles, in 2021 this rate will already be 122 rubles. for 1 thousand cubic meters. For water tax, the Tax Code provides for an increase in preferential rates until 2025, after which an increasing coefficient will have to be applied to them.

From 2021, most entrepreneurs will not pay rent for water

From January 1, 2021, Article 255 of the Tax Code, regulating the payment of rent for the special use of water, is in force as amended by the Law of Ukraine dated December 21, 2016 No. 1797-VIII. Water rent payers are:

– primary water users, including individual entrepreneurs, who use and/or transfer to secondary water users water obtained by withdrawing it from water bodies;

– business entities, including individual entrepreneurs, using water for the needs of hydropower, water transport and fish farming.

Secondary water users are excluded from payers. This means that entrepreneurs who receive water on the basis of contracts with water utilities or other entities are not required to pay rent for water from 2021, regardless of the fact that water is used in their business. A key feature of classification as a primary water user is the presence of water intake structures and equipment for water intake.

In connection with this, by order of the Ministry of Finance of Ukraine dated May 31, 2017 No. 545, changes were made to the form of the tax return for rent payments (approved by order No. 719 dated August 17, 2015). Thus, from January 1, 2018, from the notes to Appendix 5 (calculation of rent for special use of water), the provision regarding the indication of the volume of water used by secondary water users, including when receiving water from various sources, will be excluded.

In order to receive the new issue, subscribe to the Private Entrepreneur newspaper.

More on the topic:

- Where you can get documents for an apartment Conditions and procedure for registering ownership of an apartment in a new building Article updated: April 5, 2021 Many people mistakenly think that they are the owners of an apartment in a new building, having the keys in their hands and even living in it. Remember - only after registering ownership of [...]

- Chords of a song about the transmigration of souls Lyrics of the song Vladimir Vysotsky - A song about the transmigration of souls For your reference, the text of the song Vladimir Vysotsky - A song about the transmigration of souls is provided, as well as a translation of the song with a video or clip. Who believes in Mohammed, who believes in Allah, who believes in Jesus, who believes in nothing, not even the devil, […]

- A fine if the person is not included in the insurance, but the owner is nearby. A fine if the person is not included in the insurance, but the driver is sitting nearby. There are life situations when a person who has a license to drive a vehicle needs to get behind the wheel of someone else's car. But not everyone faced with such circumstances knows what legal rights they […]

- House gift tax Calculation of tax when donating an apartment and payment procedure Article updated: May 30, 2021 Hello. I write a column on this site about taxes. On this page I have described in detail the tax that donors must pay after receiving an apartment as a gift. You can click on the links below in [...]

- How many times can you get married legally in Russia? How many times can you get married legally? Legal point of view: how many times do you legally get married? The number of marriages is not limited, and in Russia there is no law that would address this issue to any extent. No one can stop a woman from getting married again. […]

- Boguslavsky lawyer How to find a good lawyer and how to spot a bad one? Step-by-step instructions A week ago, I talked here about how dangerous an unscrupulous lawyer is and what to do about it - I told you just a little bit, you could write a novel about this as thick as the Molokhovets cookbook, with pictures and […]

- Police report for bank fraud The bank says it has filed a police report Good afternoon! A crime for fraud in the field of lending is possible if you provide deliberately forged or untrue documents, such as a certificate of employment, a certificate of income, someone else’s […]

- How long do you need to work to receive a pension? Work experience to retire 55 years of paid work. labor pension for 55 years and Example: if you apply for In the complete absence of an insurance calendar year, the breadwinner is assigned, the appropriate one is assigned for six months. IfThe military personnel have length of service […]

Water tax declaration

The water tax declaration form and the procedure for filling it out were approved by order of the Federal Tax Service of the Russian Federation dated November 9, 2015 No. ММВ-7-3/497.

The form contains a title page and two sections: in section 1 the amount of tax payable is indicated, in section 2 the water tax is calculated, and a separate subsection 2.1 is allocated for calculating the tax for water intake, and all other types of water use are classified in subsection 2.2.

If there are several water bodies, then for each of them, and for each license, a separate subsection 2.1 and 2.2 is filled out.

What is the tax period

In order to make payments, an enterprise or individual entrepreneur needs to report quarterly to the tax office, providing a reporting declaration, and pay the tax itself. Reporting must be provided in the place where the work site is located. Therefore, the payer needs to register with the territorial body where the object itself is located.

If the taxpayer is considered large, for example, the revenue for the year amounts to billions, then reporting documents will need to be submitted to the body where he was registered as the largest taxpayer.

Foreign companies submit documentary reports at the place of registration of the government agency that issued the license.

The reporting itself is submitted once every three months. The tax must be paid based on the Tax Code (Article 334, paragraph 14, Chapter 25.2), no later than the 20th day (no later than January 20, April 20, etc.) of the month following the reporting period.

Failure to timely submit reports and pay taxes imposes fines and penalties on the organization. It would be advisable to pay all taxes on time and submit documentary reports.

How to calculate water tax

For all types of water use, the tax is calculated as the product of the tax base and the tax rate, adjusted for increasing factors. The calculation is made in the water tax declaration.

Let's look at an example

Breeze LLC extracts water from an artesian well, equipped with metering devices and located in the Central Economic Region (other river basin). The water use limit, according to the license, is 100 thousand cubic meters. m. In the 1st quarter of 2021 the volume of water intake was 110 thousand cubic meters. m, of which 10 thousand cubic meters. m – over-limit.

For water intake facilities, the water tax is calculated in subsection 2.1 of the declaration. Within the limit, 100 thousand cubic meters were taken. m of water. The tax rate is 336 rubles. for 1 thousand cubic meters m (clause 1 of Article 333.12 of the Tax Code of the Russian Federation), the increasing coefficient in 2021 is 1.52:

100 thousand cubic meters m X 336 rub. X 1.52 = 51,072 rubles.

For water intake in excess of the limit, the tax is calculated at a 5-fold rate, and the tax amount for the excess volume is equal to:

10 thousand cubic meters m X (336 rub. X 5) X 1.52 = 25,536 rub.

The total tax for water intake from a well is 76,608 rubles. (RUB 51,072 + RUB 25,536).

Let’s assume that Breeze LLC has another water use facility: a lake in the Central Economic Region. According to the license, the area of the facility is 3 square meters. km. Let's calculate the tax in section 2.2 of the declaration.

Tax rate – 30.84 thousand rubles. for 1 sq. km of water area, it is annual (clause 2 of Article 333.12 of the Tax Code of the Russian Federation), therefore the resulting tax amount must be divided by 4:

3 sq. km X 30,840 rub. X 1.52: 4 = 35,158 rubles.

Amount of water tax payable for the 1st quarter of 2021: RUB 111,766. (RUB 76,608 + RUB 35,158).

An example of filling out a water tax return:

When will you have to pay more?

Of course, no one will raise tax rates in the first half of the coming year. But, starting from the second half, some items of budget payments will undergo changes. For example, the 2021 water tax rate may be significantly revised. The government has been talking about this for several years. Naturally, such a decision is extremely unpopular among ordinary Russians, so officials were forced to extend the “increase” for several years in order to reduce the burden on the family budget of the residents of our country. Therefore, the water tax will increase annually, and all calculations for the next 8 years can be viewed on the website of the Tax Service of the Russian Federation.

Who should pay for water?

Water tax is levied on individuals and legal entities, as well as private entrepreneurs operating in conditions that require payment of water tax. For example, private firms or entire enterprises engaged in collecting water from reservoirs and supplying it to the population.

Ecological problems

It would seem, how are tax payments and the environment related? But in fact, these two concepts go hand in hand. One of the motivations for increasing the tax is to improve the quality of drinking water through the construction of new treatment facilities, timely cleaning of river beds and drinking reservoirs. After all, environmentalists have repeatedly stated that the problem with the quality of tap water today is very acute. The content of harmful metals and bacteria in it leads to diseases of the thyroid gland, intestines and vocal cords and more severe ones - oncology and hepatitis. Every year in Russia, more than 100 outbreaks of intestinal infections occur due to the consumption of water with microbes. Several thousand people, after drinking from the tap, end up in the hospital with severe poisoning and damage to internal organs. Therefore, environmental scientists and doctors and water management workers hope that someday the problem will move from its “dead point” and tax payments will still be directed from the budget to improve the situation with the quality of drinking water in our country.

(No ratings yet)