Types of existing penalties

Before considering the question of how to post a fine or penalty in accounting, let’s figure out what sanctions of this kind may be. They are divided into two groups:

- Accrued by counterparties to each other in connection with violation of contractual obligations.

- Arising in case of non-compliance with tax legislation.

Sanctions of the first group are provided for in the texts of agreements concluded between counterparties as mutual and can equally arise for each of the parties. For example, penalties are usually established for the buyer for late payment, and for the supplier for failure to meet the delivery deadline. More serious sanctions (in the form of a fine) are intended to ensure the fulfillment of obligations that seriously affect the very fact of the functioning of the counterparty or lead to significant losses for it (including due to failure to fulfill obligations to a third party). The amount of sanctions arising between counterparties is indicated in the contract either directly (such as the amount of interest for each day of delay in payment or delivery) or by describing the calculation algorithm.

Situations in which penalties and fines are assessed for violations of tax legislation are given in the Tax Code of the Russian Federation; there are also indications of their specific amounts, and, in necessary cases, calculation algorithms. Here, taxpayers usually become the payers of sanctions, although in a number of cases (for example, a delay in the return of overpaid tax to the budget or the amount of VAT to be refunded), the same kind of responsibility is established for the tax authorities.

Thus, a specific legal entity may turn out to be both a payer and a recipient of payments from both groups, and accounting entries for fines and penalties will arise not only when accounting for expenses on them, but also when reflecting income.

Penalties and fines for settlements with customers

If the buyer does not pay for goods, work, or services on time, penalties are also charged.

Let's look at where to set the payment deadline and how to automatically charge penalties.

Where to set the payment deadline

The payment deadline is set for the entire program, and it is also possible to set a deadline for each agreement with the buyer.

If a payment term is not specified for a contract, the default term is used.

To set the default period, go to the menu “Administration - Program Settings - Accounting Options”:

Let’s follow the link “Payment terms for buyers”:

Set the payment deadline in the appropriate field:

The payment period under the contract is specified in its card; to do this, check the “Payment period has been set” checkbox and indicate the value:

Reflection in accounting of sanctions under contracts with counterparties

How can accounting entries reflect fines or penalties that arise in relations with counterparties? Expenses or income generated by a legal entity in this case are among others (clause 7 of PBU 9/99 and clause 11 of PBU 10/99, approved by orders of the Ministry of Finance of Russia dated May 6, 1999 No. 32n and No. 33n). The chart of accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) recommends using account 91 to reflect them, the credit of which will show income, and the debit - expenses.

The corresponding account for account 91 in the entry for reflecting a fine or penalty in accounting will be settlement account 76, to which the Chart of Accounts provides for the opening of a sub-account called “Settlements for claims.” Analytics in this sub-account is organized by counterparties and each arising claim.

That is, the entries for the accrual of penalties will look like this:

- Dt 91 Kt 76 from a legal entity reflecting the claim addressed to it (i.e. its expense);

- Dt 76 Kt 91 from a legal entity that has submitted a claim to its counterparty and is counting on the receipt of funds to its address.

The amount accompanying these postings will be determined in the same way for both entries: as corresponding to the volume of accruals, either recognized by the debtor or established by the court (clause 10.2 of PBU 9/99, clause 14.2 of PBU 10/99). Accordingly, the moment of reflection in accounting will coincide with the moment of either recognition or adoption of a court decision.

Payment of sanctions will be expressed by posting Dt 76 Kt 51 (transfer to the counterparty) or Dt 51 76 (receipt from the counterparty).

Important! ConsultantPlus warns The Russian Ministry of Finance identifies cases in which penalties are subject to VAT.

These are situations when... See K+ for more details. Trial access is available for free.

If obligations under the supply contract are violated...

Let's change the conditions of example 3. The supplier transferred funds to the institution's account in the amount of 30% of the contract amount (RUB 150,000) as security for the execution of the contract. According to the terms of the contract, the penalty is withheld from the amount of security to be returned to the contractor.

We recommend reading: Is a pension a social benefit or a social guarantee?

In this case, it should be taken into account that, in accordance with the provisions of Art. 125 and 126 of the Civil Code of the Russian Federation, in the event of non-fulfillment or improper fulfillment by the executor of obligations arising from state (municipal) contracts, the creditors in such obligations are the Russian Federation, constituent entities of the Russian Federation, and municipalities.

How to reflect the accrual and payment of tax penalties and fines in accounting

The basis for making entries for penalties or fines assessed for payment to the budget are documents with the amounts of these payments issued by the tax authority:

- decisions based on the results of the audit;

- requirements for payment of taxes (contributions).

For the taxpayer, they represent an expense that must be reflected on account 99 or account 91, depending on the type of tax.

For which taxes the Ministry of Finance requires penalties and interest to be reflected on account 99, and for which on account 91, find out from the Typical Situation from ConsultantPlus by receiving a free trial access.

The corresponding account for tax sanctions will be account 68, in which both penalties and fines should be allocated for each tax (contribution) in the analytics.

The accrual of sanctions in favor of the tax authorities will thus be reflected by the entry Dt 99 (91) Kt 68, and the entry for payment of fines or penalties will look like this: Dt 68 Kt 51.

If the payer of sanctions against a legal entity turns out to be a tax authority, then the accounting entries in this case will be similar to those used when calculating similar payments arising under contractual relationships with other counterparties:

- Dt 76 Kt 91 - accrual of income under sanctions;

- Dt 51 Kt 76 - receipt of funds for their payment.

The Chart of Accounts does not provide for the attribution of such income to account 99. The use of account 91 in this posting indicates the preference for reflecting tax sanctions paid by the taxpayer through account 91, since this provides a more convenient comparison of income and expenses.

Login for clients

In this case, in accordance with paragraph 3 of Art. 298 Civil Code of the Russian Federation, clause 4, art. 9.2 of Law No. 7-FZ, it has the right to carry out other types of activities that are not the main ones, only insofar as it serves to achieve the goals for which it was created and corresponds to these goals, provided that such activities are indicated in its constituent documents.

In this case, the budgetary institution has the right to transfer funds to pay for obligations in an amount reduced by the amount of the penalty (fines, fines) recognized by the contractor, without reducing the price of the civil contract. It should be noted that similar norms are provided for autonomous healthcare institutions.

Results

Sanctions reflected in accounting in the form of penalties and fines arise:

- in relations between counterparties due to violation of contractual relationships;

- in case of non-compliance with the requirements of tax legislation.

In both cases, a specific legal entity may be both a payer and a recipient of payments under sanctions. That is, entries for fines and penalties will reflect either expenses or income in his accounting:

- for settlements with the counterparty - Dt 91 Kt 76 (expense) or Dt 76 Kt 91 (income);

- for tax payments - Dt 99 (91) Kt 68 (expense) or Dt 76 Kt 91 (income).

Accounting analytics should be organized by counterparties and claims (for account 76), types of taxes and sanctions (for account 68), and assignment of sanctions (for account 91).

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

- Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n

- Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accrual of penalties (fine)

How to correctly reflect the accrual of a penalty (fine) in a government institution for paid material assets in connection with the delay in fulfilling obligations (delivery of goods) provided for in the contract for the supply of goods

The amount of the penalty (fine, penalty) in case of violation of the terms of the state contract (agreement) relates to non-tax budget revenues and is credited in the amount of 100 percent to the income of the corresponding budget. Therefore, the supplier must transfer the penalty (fine) directly to budget revenue without reflecting it on the personal account of the customer - the recipient of budget funds.

Accounting entries of a government institution

In a government institution, a building that had become unusable as a result of a natural disaster was written off; its book value is 4,500,000 rubles; depreciation accrued at the time of destruction is 3,000,000 rubles.

The monetary obligation must be reflected in the amount of the credit turnover of the account 0 302 00 000, regardless of the form of payment made in the future, the only condition: it must be made in the current year (clause 141 of Instruction No. 162n).

Accrual of penalties for transactions with a budgetary institution in 2021

Most often, penalties are charged for non-payment of housing and communal services and taxes. For a legal entity, the second case is especially relevant. It happens that an enterprise does not have the means to pay taxes or deliberately hides them. The accrual of penalties, like an increase in any other liability, must be reflected in the accounting records. We will consider the transactions for calculating penalties in the article.

You can calculate the amount payable yourself and pay it, or wait for a notification from the inspection inspector after he has completed the inspection. In order for accruals on insurance premiums to be taken into account, it is necessary to open sub-accounts for each type of sanctions for account 69.

Penalty: how to calculate, demand and reflect in accounting

Calculate the amount of the penalty, guided by the provisions of the contract. If the agreement does not contain conditions for the application of penalties to the guilty party, then make calculations based on Decree of the Government of the Russian Federation No. 1042 of 08/30/2021.

In addition to compensation, the injured party has the right to demand compensation for losses or other expenses that were aimed at eliminating the adverse consequences. However, these expenses will also have to be proven. And in most cases through the courts.

Accounting for penalties under a contract in 1C 8.3

Penalties against the counterparty under the contract (agreement) are taken into account by the seller in:

- BU: Dt 76.02 Kt 91.01;

- in non-operating income for income tax;

To reflect contractual penalties automatically and without errors, pay attention to the Type of agreement and Type of transaction when entering the current account. Select the analytics shown in the diagram above.

Penalties recognized by the Organization under the contract (agreement) are taken into account by the buyer in:

- BU: in Dt 91.02 Kt 76.09;

- in non-operating expenses for income tax;

More details What document in 1C is used to calculate fines received from organizations and accepted claims?

How to charge a fine in 1C 8.3 transactions in the seller’s accounting

Let's look at calculation and registration in 1C using an example:

On February 13, the Organization fulfilled its obligations to supply goods.

According to the terms of the contract, payment for goods is transferred within 5 days after their delivery. The buyer violated the contract and did not pay for the goods on time.

On February 28, the Organization charged a penalty of 0.05% for each day of delay and issued penalties to the buyer.

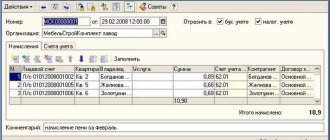

Accrue penalties to the buyer using the standard document Accrual of penalties in the Sales section.

In the document, fill in the counterparty and the agreement under which the obligations were violated.

- from – date of accrual of penalties;

Calculate penalties automatically using the Fill button or fill out the tabular part manually.

The document Accrual of penalties is used only by the seller if the buyer or principal fails to pay on time.

With this document, the buyer cannot be charged fines and penalties for failure to fulfill obligations by the supplier. For example, if goods are not delivered on time.

Posting Dt 76.02 Kt 91.01 in 1C 8.3 Accounting will be generated automatically.

Analytics for account 91.01 was specified by the developers - the item for which the Document “Calculation of penalties” is set by default in the Usage field is substituted.

If there is no such article, it will be automatically created in the database.

Learn more How to reflect a claim to a buyer?

Fine – postings in 1C 8.3 and its recognition in the buyer’s accounting

Let's look at calculation and registration in 1C using an example:

On February 13, goods arrived at the Organization’s warehouse. According to the terms of the contract, payment for goods is transferred within 5 days after their delivery.

Due to financial problems, the Organization did not make payment on time.

On February 28, the Supplier filed a claim and imposed penalties in the amount of 0.05% for each day of delay.

On the same day, the Organization recognized them and reflected them in accounting.

Create a document Transaction entered manually (Operations – Transactions entered manually).

To correctly reflect incoming penalties from the counterparty, pay attention to the article Fines, penalties and penalties for receipt (payment) and Type of agreement. Check the analytics in your accounting with the data given above.

So, we have successfully dealt with the calculation of penalties and postings in 1C 8.3 Accounting.

See also:

- How to correctly reflect the accrual of penalties for income tax under PBU 18/02?

- Reconciliation of settlements with tax authorities

- What document in 1C calculates fines received from organizations and claims accepted?

- Do you follow the controllers' instructions? There can be no penalties or fines!

- New notification form for those who cannot submit documents to tax authorities on time

- We write off the arrears that the tax authorities “wasted”

If you are a subscriber to the BukhExpert8 system, then read additional material on the topic:

- Cheat sheet for calculating and accounting for penalties

- Changes in the calculation of tax penalties 2019

- How to avoid a 20% fine when submitting an amendment

- How to reflect in 1C the accrual and payment of a fine under Art. 126 NK?

- Calculation and payment of VAT penalties

- Calculation and payment of penalties for income tax

- How to reflect a traffic police fine issued to an organization due to the fault of an employee in the 1C program?

- How to calculate penalties for taxes in 1C?

- How to correctly reflect the accrual of penalties for income tax if PBU 18 is applied?

- How to reflect a customer’s claim for failure to complete work on time?

- How to reflect a claim to a buyer?

- What document in 1C calculates fines received from organizations and claims accepted?

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C: Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

How to correctly reflect transactions for accrual or write-off of penalties

In accordance with paragraph 8 of Art. 34 of Federal Law No. 44-FZ[1] fines are assessed for non-fulfillment or improper fulfillment by the supplier (contractor, performer) of the obligations stipulated by the contract, with the exception of the delay in the fulfillment by the supplier (contractor, performer) of these obligations (including the warranty obligation). The amount of the fine is fixed in the contract in the form of a fixed amount, determined in the manner approved by Rules No. 1063.

It should be noted that from March 26, 2021, by virtue of clause 6.1 of Art. 34 of Federal Law No. 44-FZ in 2021, in cases and in the manner determined by Decree of the Government of the Russian Federation of March 14, 2021 No. 190, the customer provides a deferment in the payment of penalties (fines, penalties) and (or) writes off the accrued amounts of penalties (fines, fines). Thus, the customer provides a deferment and (or) writes off the debt if the supplier fully fulfills the obligations provided for in the contract (except for guarantees) in 2021 or 2021. An exception is contracts whose terms are changed in 2021 and (or) 2021 in accordance with clause 1.1 of Art. 95 of Federal Law No. 44‑FZ (for example, the term of execution of the contract).

Penalty under a government contract: practical recommendations

According to Part 11 of Article 9 of the Federal Law of July 21, 2005 No. 94-FZ “On placing orders for the supply of goods, performance of work, provision of services. » (hereinafter referred to as Law No. 94-FZ), in case of delay in fulfillment by the supplier (performer, contractor) of the obligation stipulated by the contract, the customer has the right to demand payment of a penalty.

We recommend reading: Procedure for Registration of a Land Plot When Buying and Selling

Therefore, the amount of the penalty must be set so that, on the one hand, its payment would be unprofitable for the supplier (performer, contractor), so that he does not violate his obligations under the contract. On the other hand, the penalty must be proportionate to the consequences of the violation.

Administrative fines

A special resolution is issued for an administrative fine for a company. In addition to standard information, it indicates

- Amount of fine;

- The article under which the company was fined;

- Required information about the payee.

To pay an administrative fine, an enterprise has 60 calendar days, which must be counted from the day the resolution came into force.

After receiving the resolution, the accountant is obliged to reflect the accrual of the fine in the accounting registers of the 1C 8.3 program.

Administrative fines are accounted for as part of other expenses. This procedure is prescribed in clause 11 of PBU 10/99.

The accounting entries will be as follows: Dt 91 subaccount Other expenses Kt 76 - the administrative fine is reflected in other expenses.

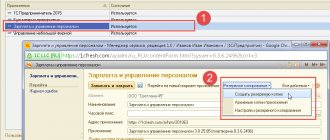

In 1C 8.3, the accrual of an administrative fine should be reflected as an Operation. Go to the Operations menu, select the type of operation Operations entered manually:

Open the selected operation:

Using the Create button, create a new operation and fill in:

- The date of the document and correspondence of accounts corresponding to the accounting entries;

- We recommend filling out the comments line;

- When filling out the analytics, you should use the previously created Miscellaneous Income and Expenses – Administrative Fines item or create a new one:

When choosing analytics for a cost item, you should take into account that the amount of the fine is accepted only for accounting purposes, so you should select the expense/income item “not accepted for accounting”, that is, with a “tick”. The cost should not be marked in the NU column in the cost directory:

Due to the fact that fines in tax accounting cannot be written off as expenses, therefore, a permanent tax liability of the PNO arises.

You should pay attention to the result of generating transactions in 1C 8.3. In the column “Dt NU” the amount of the fine is not reflected. The fine is reflected according to the rules of PBU 18/02:

After posting the document, you need to print the accounting certificate on the Accounting certificate tab. Sign and keep in the accounting documents in the original:

Small enterprises may not apply PBU 18/02 and permanent differences are not formed in accounting.

Tax penalties - postings in 1C 8.3

Regulatory regulation and scheme in 1C

The procedure for reflecting penalties must be approved in the accounting policy. The chosen method will affect the reflection of penalties in the financial statements.

Options for calculating tax penalties in accounting and their reflection in the Statement of Financial Results may be as follows:

- Dt 91.02 Kt 68 – page 2350 “Other expenses”;

- Dt 99.01 Kt 68 – page 2460 “Other”.

Accounting expert8 recommends following the Letter of the Ministry of Finance of the Russian Federation dated December 28, 2016 N 07-04-09/78875 and reflecting on:

As for tax accounting, tax penalties are not recognized as expenses. And they are not shown in the income tax return.

Fines imposed by tax authorities are taken into account in the same way as penalties, according to the same rules.

To calculate penalties for income tax in 1C 8.3 postings, use only account 99.01:

- Dt 99.01.1 Kt 68.04.1

For other taxes, apply the rules approved in the accounting policy.

Penalties are accrued from the next day after the payment deadline is violated and are calculated up to and including the day the penalties are paid. In this case, the maximum amount of penalties that can be accrued cannot exceed the amount of the tax debt.

For example, the deadline for paying the first 1/3 of VAT is 01/27/2020. The tax was paid late by the organization on 02/10/2020. Penalties will be accrued for the period from 01/28/2020 to 02/10/2020 inclusive, i.e. in 14 days.

Formulas for calculating penalties can be presented as follows:

- Penalties for late payments up to 30 days (inclusive):

- Late fees starting from 31 days:

Where:

- Kd - number of days in debt;

- SR - refinancing rate.

Study in more detail the legislative part on the calculation of penalties on taxes

Design scheme in 1C

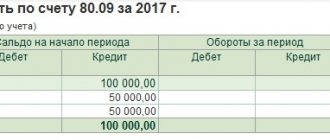

VAT penalties – postings in 1C 8.3

Let's look at the calculation of penalties for VAT in 1C using an example:

The deadline for paying VAT for the fourth quarter is 01/27/2020, 02/25/2020, 03/25/2020.

The organization did not timely pay the first VAT payment due on January 27, 2021.

On February 10, VAT debt in the amount of RUB 100,000. was repaid.

On the same day, tax penalties were accrued and paid to the budget.

According to the accounting policy of the organization, tax penalties are accrued in Dt 91.02.

First, calculate the amount of penalties that must be paid on February 10. Attention! The day of payment is included in the calculation of penalties.

Create a document Transaction entered manually (Operations – Transactions entered manually).

Pay attention to the choice of article - Fines, penalties transferred to the budget and to filling out analytics on it. Check and repeat these settings in your database.

The columns Amount NU Dt and Amount NU Kt are not filled in in this case!

Read more about the calculation of penalties for VAT and its payment to the budget

How to calculate VAT penalties and what kind of transactions to create in 1C 8.3 are the most popular questions among accountants. But such penalties can be associated not only with late payment of taxes, but also with incorrect handling of mutual settlements. How incorrect accounting of settlements with counterparties affects VAT and how to prevent such violations can be found in the articles:

- Error: incorrect settlement document with counterparty

- Error: incorrect contract with counterparty

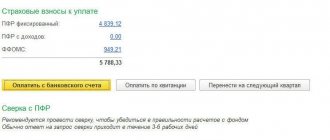

Pension Fund fines – postings in 1C 8.3

Fines in the Pension Fund of Russia in 1C 8.3 are issued similarly to other taxes - manually through Operation.

Let's look at how a Pension Fund fine is reflected in accounting using an example and create transactions in 1C 8.3.

When submitting the SZV-M, the accountant did not include data on 3 employees in the report. In this regard, the organization was assessed a fine for late submission of SZV-M in the amount of 1,500 rubles. (500 rubles for each individual).

On February 28, the Organization reflected the fine in its accounts and paid it to the budget.

According to the accounting policy of the organization, penalties for taxes, fees and contributions are accrued in Dt 91.02.

Create a document Transaction entered manually (Operations – Transactions entered manually).

Learn more about transferring fines for other taxes

Penalties for personal income tax – postings in 1C 8.3

Let's look at calculation and registration in 1C using an example:

On January 24, the Organization paid vacation pay. The deadline for paying personal income tax on vacation pay is January 31.

Due to the difficult financial situation of the organization, personal income tax on vacation pay in the amount of 5,000 rubles. listed with a delay only on February 10th.

On the same day, penalties were accrued and paid to the budget.

According to the accounting policy of the organization, tax penalties are accrued in Dt 91.02.

Calculate the amount of penalties that must be paid on February 10. Attention! The day the tax was paid is included in the calculation of penalties.

Create a document Transaction entered manually (Operations – Transactions entered manually).

Accounting for fines under contracts in the 1C program: Enterprise Accounting 8 edition 3.0

Published 07/28/2016 14:27 Administrator Views: 46391

Unfortunately, it is not always possible to pay obligations to suppliers or customers on time. It happens that an organization has financial problems and is unable to pay off its debts on time. And sometimes violations of the terms of the contract occur, for example, failure to meet delivery deadlines, damage to property, or downtime due to the fault of the counterparty. And in this case, penalties often have to be assessed. Let's figure out how to correctly accrue and pay off fines in the 1C: Enterprise Accounting 8 rev 3.0 program.

In this article we will look at two options for accounting for a fine.

First, we are suppliers of goods and our buyer made a delay in payment under the contract. We reflected the fact of the sale in the program with the document “Sale of Goods”; a buyer’s debt arose on account 62.01, which was not repaid within the period established by the contract. In order to calculate penalties, open the tab “Operations”, “Accounting”, “Operations entered manually”

Create a new document and click the “Add” button. We fill in the empty fields, on debit we indicate account 76.02 “Settlements on claims”, on credit account 91.01 “Other income”

Now, to receive payment from the buyer, we create a document “Receipt to the current account”. Open the tab “Sales”, “Sales (acts, invoices)”

Select the document “Sales (acts, invoices)”, which reflects the fact of sale, click the “Create based on” button and create the document “Receipt to the current account”

Fill in the input. number, date, agreement, DDS article, purpose of payment.

We post the document and look at the postings that repay the debt on account 62.

In the event that you automatically download bank statements into the program, just make sure that when you post the document “Receipt to the current account”, the debt is repaid correctly according to the required document (we select the debt repayment method “By document” and the required document in the table or leave the option “Automatically”, if this counterparty has a debt under only one sales document). Now we will create a document to pay off penalties. Open the tab “Bank and cash desk”, “Bank”, “Bank statements”

Click the “Receipt” button and fill out the opened document “Receipt to the current account”. Enter the date, number, amount, DDS article, select settlement accounts 76.02 “Settlements for claims”. If you download statements into the program from a client bank, make sure that invoice 76.02 and automatic debt repayment are entered in the downloaded document.

We post the document and look at the postings

The second option for accounting for fines is that we are the buyer and did not pay the debt for the delivery of goods to the supplier on time. The supplier charges us a fine, which we must pay. The fact of receipt of goods is reflected in the program by the corresponding document; account 60.01 shows the debt to the supplier. As in the first case, we first charge penalties for late payments by filling out the document “Operations entered manually”

We fill in the fields in the document that opens - date, content, amount. For debit we indicate the account 91.02, for credit the account is 76.02.

I would like to draw your attention to the subconto that we choose for accounts 91.01 and 91.02 in both situations considered. In this case, the directory element “Other income and expenses” is used, which must be configured correctly. We take into account fines under business contracts in income and expenses for the purpose of determining the tax base when calculating income tax, so the element in the directory must have a checkbox “Accepted for tax accounting.”

But if we are talking about fines to government agencies (fines for taxes, for violating traffic rules, etc.), then we cannot accept such fines in tax accounting. Therefore, it is recommended to create two different elements of the “Other income and expenses” directory, choosing the appropriate one for each fine. Next, we pay the supplier the debt and the amount of the fine. To do this, we will generate documents “Write-off from the current account”. We download documents from the bank or open the “Purchases”, “Receipts (acts, invoices)” tab, and find the purchase document.

And based on the document “Receipt of goods” we create a “Write-off from the current account”

In the document that opens, fill in the date, number, agreement, and DDS article.

We post the document and look at the postings

Now we will generate a document for payment of penalties. Go to the tab “Bank and cash desk”, “Bank”, “Bank statements”

And click the “Write-off” button to fill out the document “Write-off from the current account.” The type of operation will be “Payment to the supplier.” We indicate the date, recipient, amount of the fine, agreement, settlement account 76.02, article.

In the program “1C: Accounting 8” (rev. 3.0), accrued fines (penalties) for late submission of tax reports or payment of taxes (fees, insurance contributions) are reflected manually in the “Operation” document:

- Section: Operations – Operations entered manually (Fig. 1).

- “Create” button, document type – “Operation”.

- In the “From” field, indicate the date the fine(s) were calculated. If a fine (penalty) was assessed based on the results of the audit, indicate the date on which the tax authority’s decision entered into force. If penalties are calculated by the organization itself, indicate the date of their calculation.

- In the “Debit” field, select subaccount 99.01.1 “Profits and losses from activities with the main tax system” and the subaccount to it “Tax sanctions due”.

- In the “Credit” field, select the subaccount for tax calculations for which a fine (penalty) is calculated (for example, subaccount 68.02 “Value Added Tax”) and a subaccount for it (for example, “Penalties: additionally accrued/paid (independently)”).

- In the “Amount” field, enter the amount of penalties (fine). If an organization uses PBU 18/02 on the OSN, then in the “Amount Dt” column, reset the amount in the “NU” subline. It is not necessary to indicate the amount in the “PR” subline. You can indicate the amount in the “PR” subline so that in standard reports the checksum (the “Control” indicator) when checking the principle of compliance between accounting and tax accounting (BU = NU + PR + VR) for account 99.01.1 is equal to zero. This will not affect accounting in any way: account 99.01.1 is intended to summarize information about financial results, therefore PNO (PNA) are not recognized for permanent differences reflected on it (PNO (PNA) are recognized for permanent differences reflected in the 90th accounts). If you do not indicate the amount in the “PR” subline, then the check sum (the “Control” indicator) for account 99.01.1 in standard reports will be closed automatically after the balance sheet is reformed.

- “Save and close” button.

Rice. 1

- Reflection of additional charges for tax audits for previous years (insignificant error)

Penalties are fees for late payment. Such sanctions, like fines, are possible not only for taxes, but also for contracts. Basically, penalties are calculated manually in 1C 8.3. The accountant immediately has a question about which accounts to use when calculating penalties in 1C 8.3 postings.

But are all penalties accrued by an Operation entered manually? We hasten to please you - this is not so! For example, the accounting of penalties under a contract in 1C 8.3 to the buyer is automated. For this purpose, the program provides a special document Accrual of penalties.

Let's figure it out:

- what entries must be made in accounting and in 1C 8.3 in order to accrue penalties for taxes and fees;

- how to calculate a fine in 1C 8.3 - we will reflect the entries in the accounting of the seller and buyer in case of violation of obligations under the contract.

Reflection of the amount of the penalty in the accounting of a government institution

Good afternoon When you ask a question, please do not forget about the forum rules. Let me remind you: we strive to create a friendly atmosphere on our forum. Therefore, it is customary for us to say hello and also say “thank you” and “please.” Respectful attitude towards forum members, experts and moderators is a requirement of the forum rules.

The question has been moved. Please pay attention to the section in which you post your question. We have a special section for students, and I’m moving the topic there. But remember that, according to the rules of our forum, you will only be answered if you offer your own solution to the problem. Please read the forum rules.

Accrual of penalties under a government contract in a government institution

Answer: In our opinion, the conclusion of the regulatory body that the failure of a government institution to take liability measures against a supplier for late delivery of medical equipment is an ineffective use of budget funds is unlawful. The current legislation of the Russian Federation does not provide for liability for ineffective use of budget funds. Until 01/01/2021, the requirement to pay a penalty (fine, penalty) in the event of delay in fulfillment of an obligation by the supplier was the right of the customer. From 01/01/2021, sending a demand to the supplier to pay a penalty (fine, penalty) is the responsibility of the customer, with the exception of a number of cases established by law.

Question: At the end of 2021, a government institution entered into a state contract for the supply of medical equipment. The supplier delivered the goods in full, but in violation of the established deadline by 5 days. The government institution did not apply the penalties provided for in the state contract for late delivery of medical equipment to the supplier, which was considered by the regulatory authority as an ineffective use of budget funds. Is the conclusion of the regulatory authority legal? In this case, can the head of a government institution be held accountable for ineffective use of budget funds? Is the customer obliged, in the event of improper fulfillment by the supplier of the terms of the state contract, to apply to him the measures of liability provided for by the state contract?

We recommend reading: Benefit for major repairs for pensioners after 80 years in the Sverdlovsk region 2021