How to calculate in accounting?

Depreciation of a building is the transfer of the value of a property into expenses.

The amount of depreciation depends on the useful life established for the premises. Important! In accounting, when determining SPI, you must be guided by clause 20 of PBU 6/01.

There are no strict requirements or restrictions on the duration of the useful life, therefore, in each case, the enterprise can independently analyze the condition of the structure or premises, the degree of its wear and tear, the rate of obsolescence, factors influencing this, and existing restrictions.

Based on a combination of factors, a period is determined during which the initial cost of the premises is completely transferred to expenses, and the property can be written off as a depreciated fixed asset.

When determining SPI, you can be guided by the Classification of fixed assets by depreciation groups for tax accounting purposes.

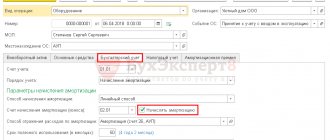

After the period during which it is planned to use the building with the required return has been determined, a depreciation method is selected that will be used throughout the entire period of operation of the building.

Depreciation must be calculated for the building; this is required by PBU 6/01. Therefore, even in the case where the property has been owned for more than 30 years, you still need to calculate deductions every month.

Methods for calculating depreciation charges:

- Linear – the cost is written off in equal parts over the entire period of investment.

- The declining balance method is an accelerated non-linear method in which depreciation is calculated from the residual value and the acceleration factor.

- Based on the sum of the number of years of SPI - the calculation is carried out at the initial cost when summing up the number of years of service life.

- Proportional to the products produced.

In the vast majority of cases, for buildings, non-residential and residential premises, and structures, the linear method of calculating depreciation is chosen.

It is the uniform write-off of value throughout the entire period of use that is appropriate for real estate objects.

Postings

Calculation of depreciation charges must begin in the month following the month the building was taken into account.

Once a month, a depreciation entry is made for the amount of the monthly deductions.

Postings:

- Dt 20 Kt 02 - depreciation was accrued on the building occupied in the main production;

- Dt 23 Kt 02 – the amount of deductions was accrued for the property used in auxiliary production;

- Dt 25 Kt 02 – depreciation charges for general production premises;

- Dt 26 Kt 02 – deductions for a general purpose facility.

- Dt 29 Kt 02 - depreciation of an asset used in service production.

Linear method

This method is the most convenient and expedient for writing off the cost of the building as expenses.

The determining factor in depreciation is time, and therefore the easiest way is to divide the entire cost by the number of months of self-employment, attributing the monthly depreciation received to expenses.

For a room, building, apartment, the issue of obsolescence, as well as production factors, is not relevant, therefore nonlinear methods are almost never used in practice.

Calculation method using the linear method:

- The depreciation rate is calculated - the monthly percentage of deductions.

Formula:

Annual depreciation rate = 1/SPI in months * 100%.

- The amount of annual depreciation is calculated.

Formula:

Annual A. = Initial cost of the building * Norm.

- The amount of monthly contributions is determined.

Formula:

Monthly A. = Annual A. / 12 months.

General accrual rules

The general rules for calculating depreciation are established by Instruction No. 157n of the Ministry of Finance. These include:

- Accrual during the financial year is monthly in the amount of 1/12 of the annual amount.

- Depreciation is not suspended over its useful life.

- Accrual from the first day of the month following the month the building/premises was taken into account.

- Accrual stops on the first day of the month following the month of repayment of the cost of the building/premises.

- Accrual occurs in accordance with the calculated depreciation rate.

- The accrual cannot exceed 100% of the cost of the building/premises.

Calculation method in tax accounting

For tax purposes, the methodology for determining the useful life of real estate is different.

There are strict requirements - it is necessary to select a depreciation group for the building in accordance with the Classification approved by Decree of the Government of the Russian Federation No. 1 of 01.01.2002.

In accordance with the established group, the useful period is determined.

For real estate objects, it is possible to be assigned to groups from 4 to 10 depending on the type of building, premises, its purpose, design features, and the material from which the structure is made.

The longest SPI is determined for buildings falling into depreciation group 10.

These are permanent buildings, non-residential and residential buildings, apartment buildings.

The owner of a property has the right to set any period from the proposed range of years for a specific group. If this is group 10, then the useful service life can be any duration over 30 years.

In tax accounting, there are only 2 ways to calculate depreciation:

- Linear - linear calculation calculator;

- Nonlinear accelerated.

For buildings and structures, you can only choose the linear calculation method, in which depreciation charges are calculated evenly.

The procedure for calculating the linear method is described above; it is similar to that established for accounting.

Examples of depreciation deductions for real estate

Below are two examples: in the first, depreciation is calculated on non-residential premises located in a brick building, in the second, an apartment is considered that the company rents to its employee.

The useful life in both cases is more than 30 years.

For non-residential premises with a service life of over 30 years

Initial data:

The organization bought non-residential premises, which are located in a permanent brick building.

The premises are assigned to depreciation group 10, and the SPI is set for it = 31 years (372 months).

The property was registered as a fixed asset at a cost of 5 million rubles.

It was decided to calculate depreciation using the straight-line method.

Calculation:

Norm A. = 1 / 372 * 100% = 2.67%

Annual A. = 5,000,000 * 2.67% = 133,500.

Monthly A. = 133,500 / 12 = 11125.

Every month for 31 years, the organization will write off the cost of non-residential premises in the amount of 11,125 rubles. using wiring Dt 20 Kt 02.

For an apartment when renting out

A residential apartment on the balance sheet of an enterprise can be used to rent to employees of the organization for a fee. In this case, such a fixed asset item will be accounted for in account 03.

Despite the fact that the employee will actually use the apartment, the residential property will continue to be listed on the enterprise’s balance sheet, and the organization is obliged to charge monthly depreciation on it.

For accrual purposes for accounting purposes, you can choose linear or one of three non-linear methods of writing off value. For tax accounting, you can choose either linear or nonlinear.

The most convenient way is to calculate depreciation using the straight-line method both for accounting and tax purposes. In this case, the discrepancies will be minimal or absent.

When transferring an apartment for rent, internal wiring is done Dt 03. Property transferred for rent Kt 03. Property for rent.

For the amount of accrued depreciation at the time of renting out the apartment, posting Dt 02. Depreciation on fixed assets Kt 02. Depreciation on fixed assets in the lease is made.

Accrued depreciation charges are written off as other expenses by posting Dt 91.2 Kt 02. Depreciation on fixed assets in lease.

When the apartment is returned to the company, reverse postings are made.

Initial data:

The company purchased an apartment for payment and put it on its balance sheet at a cost of 3 million rubles.

The apartment is located in an apartment building and is assigned to depreciation group 10; its useful life is set at 35 years (420 months) both in tax and accounting.

From April 2021, the apartment is leased to an employee of the organization, the term of the rental agreement is 11 months. Accommodation fee 10,000 rub. The employee is paid monthly at the cash desk.

As of April 2021, accumulated depreciation is 150,000.

Calculation and postings:

Dt 03. Transferred property Kt 03. Property for rent in the amount of 3 million rubles.

Dt 02. Depreciation on fixed assets Kt 02. Depreciation on fixed assets in a lease in the amount of 150 thousand rubles.

Norm A. = 1 / 420 * 100% = 2.38%.

Annual A. = 3,000,000 * 2.38% = 71,400.

Monthly A. = 71,400 / 12 = 5,950.

The posting of Dt 91.2 Kt 02 is carried out monthly. Depreciation on fixed assets in the lease in the amount of 5950.

“Vremyanka”: The Ministry of Finance has set priorities Depreciation of temporary structures

Despite their fragility, temporary structures are classified as depreciable property. We will talk about the features of calculating depreciation on such objects in accounting and tax accounting in this article.

The essence of the problem

Temporary structures are widely used in construction activities. These include production, warehouse, auxiliary, residential and public buildings and structures specially erected or adapted for the construction period, necessary for construction and installation work and servicing construction workers (clause 4.83 of the Methodology for determining the cost of construction products on the territory of the Russian Federation (approved by resolution Gosstroy of Russia dated 03/05/2004 No. 15/1), clause 1.2 "GSN-2001. Collection of estimated cost standards for the construction of temporary buildings and structures. GSN 81-05-01-2001" (approved by Decree of the Gosstroy of Russia dated 05/07/2001 No. 45)).

These buildings are divided into title and non-title. Lists of title and non-title objects are given in Appendices 2 and 3 to GSN 81-05-01-2001.

They are erected during the construction period, and upon completion they are dismantled and disposed of. Thus, their real useful life is two to three years.

Despite their fragility, such structures are fixed assets for accounting and tax accounting purposes, since they meet all the requirements of clause 4 of PBU 6/01 “Accounting for fixed assets,” as well as Art. 256 and 257 of the Tax Code of the Russian Federation, which means they are subject to depreciation in both accounting and tax accounting. Let us note that earlier, clause 50 of the Regulations on Accounting and Financial Reporting in the Russian Federation (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n) provided for the accounting of temporary non-title structures as part of funds in circulation. However, by order of the Ministry of Finance of Russia dated December 24, 2010 No. 186n, this paragraph was declared invalid.

In accounting - no problem

In accounting, the initial cost of temporary buildings and structures is formed in subaccount 08-3 “Construction of fixed assets”. When they are put into operation, temporary buildings and structures are included in fixed assets in the debit of account 01.

The commissioning of a title temporary structure is formalized by an act of acceptance and transfer of a building (structure) in form No. OS-1a (approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7). For the commissioning of temporary non-title structures, a special unified form No. KS-8 “Act on the commissioning of a temporary (non-title) structure” is provided (approved by Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100).

After putting a fixed asset into operation, depreciation begins to accrue on it both in accounting and tax accounting (clause 21 of PBU 6/01 and clause 4 of Article 259 of the Tax Code of the Russian Federation).

There are no problems with calculating depreciation for temporary structures in accounting. After all, accounting depreciation depends on the useful life of the fixed asset. This period is determined based on: the expected period of use of this object in accordance with the expected productivity or capacity; expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, the repair system; regulatory and other restrictions on the use of this object (for example, the lease term) (clause 20 of PBU 6/01 “Accounting for fixed assets”). Thus, in accounting, the useful life of a temporary structure erected during the construction period will be equal to the period of this construction. As a result, by the end of construction this structure will be completely depreciated.

Tax accounting problems

But in tax accounting, not everything is so simple. First of all, the question arises: over what period should temporary structures be depreciated? The fact is that depreciable property is distributed among depreciation groups in accordance with its useful life. The classification of fixed assets (hereinafter referred to as the Classification), approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1, establishes long useful lives for buildings and structures. At the same time, the useful life is recognized as the period during which an object of fixed assets is used in the activities of the organization (clause 1 of Article 258 of the Tax Code of the Russian Federation).

What period is the priority when determining the useful life of temporary structures - during which fixed assets are used in the activities of the taxpayer or which is established taking into account the Classification?

In a letter dated January 13, 2012 No. 03-03-06/1/12, specialists from the financial department explained that when determining the useful life of temporary structures, one should be guided by the Classification. That is, if a temporary structure will be used by the taxpayer only for two years, and according to the Classification it belongs to the tenth depreciation group with a useful life of 30 years, depreciation charges for two years will amount to only 2/30 of its original cost.

The financial department justifies its position by the fact that, according to paragraph 1 of Art. 258 of the Tax Code, the taxpayer determines the useful life independently on the date of commissioning of this depreciable property in accordance with Art. 258 of the Tax Code of the Russian Federation and taking into account the Classification.

It must be admitted that the position of the Russian Ministry of Finance corresponds to current legislation. It follows from the provisions of the Tax Code that the taxpayer can set the useful life of a fixed asset independently, but only within the boundaries indicated by the Classification for a given category of fixed assets. The Tax Code does not provide any special rules for temporary structures. And since such structures, as noted above, are recognized as depreciable property, they are subject to the rules for calculating depreciation provided for fixed assets.

But it is not all that bad. The Russian Ministry of Finance is not against a one-time write-off of the remaining under-depreciated part at the time of liquidation of a temporary structure as part of non-operating expenses. The letter noted that upon completion of construction work and after the liquidation of temporary (non-title) structures related to fixed assets recognized as depreciable property on the basis of Art. 256 of the Tax Code of the Russian Federation, the taxpayer has the right to take into account expenses in the form of amounts not accrued in accordance with the established useful life of depreciation, taking into account the provisions of sub-clause. 8 clause 1 art. 265 Tax Code of the Russian Federation.

Let us recall that, according to this norm, non-operating expenses include the costs of liquidation of fixed assets being taken out of service, the write-off of intangible assets, including the amount of depreciation underaccrued in accordance with the established useful life, as well as the costs of liquidation of unfinished construction projects and other property, the installation of which was not completed. completed (expenses for dismantling, dismantling, removal of disassembled property), subsoil protection and other similar work.

If we take into account the insignificant amount of depreciation charges, it turns out that for income tax purposes almost the entire cost of a temporary structure will be taken into account as expenses only after its liquidation.

There will be differences in accounting

Due to differences in the procedure for calculating depreciation in tax and accounting accounting, temporary differences will arise in the latter according to PBU 18/02 “Accounting for corporate income tax calculations.”

Example

The cost of erecting a temporary structure was 100,000 rubles. The period during which this structure will be used is 24 months. The structure belongs to the tenth depreciation group. Useful life for tax purposes is 31 years (372 months).

In tax accounting, the depreciation rate will be equal to 0.27% (1: 372 x 100%).

In this case, the amount of monthly depreciation charges will be 270 rubles. (RUB 100,000 x 0.27%).

In accounting, the monthly amount of depreciation charges will be 4167 rubles. (RUB 100,00: 24 months).

Thus, during the construction period, a deductible temporary difference in the amount of RUB 3,897 arises monthly. (RUB 4,167 - - RUB 270), leading to the formation of a deferred tax asset in the amount of RUB 779.4. (RUB 3,897 x 20%).

This is reflected monthly by posting:

Debit 09 Credit 68

— 779.4 rub. — formation of a deferred tax asset

By the time construction is completed, the amount of the tax asset recorded in the debit of account 09 will be 18,705.6 rubles. (RUB 779.4 x x 24 months).

After completion of construction and liquidation of the temporary structure, this amount will be written off as follows:

Debit 99 Credit 09

— 18705.6 rub. The deferred tax asset is written off.

Before the construction of the main permanent buildings, during the construction period for construction and installation work and servicing workers, builders erect or adapt temporary buildings and structures from existing ones. These can be industrial, warehouse, auxiliary, residential, public buildings. After all the work has been completed and construction is completed, there is no longer a need for them, and they are eliminated or the original appearance of the used object is restored.

conclusions

Real estate owned by the company is depreciable property, so the company must calculate deductions monthly.

For accounting and tax accounting, it is convenient to use the linear calculation method, in which the cost of the premises is written off evenly over the entire period established for it.

Discrepancies for taxation and accounting will be minimal if you establish the same SPI, based on the depreciation group from the OS Classification, as well as the same method of depreciation.

The article describes typical situations. To solve your problem, write to our consultant or call for free:

Moscow - CALL

+7 St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

If buildings and structures are listed on the organization’s balance sheet, depreciation on them is accrued from the month following the period of commissioning. Depreciation amounts are calculated depending on the type of object, based on a certain useful life of the building (SPI) in accordance with the Classification according to Resolution No. 1 of 01/01/02. Let's consider how depreciation of a building is carried out using a typical example.

Useful life of the building

2. DECREE OF THE GOVERNMENT OF THE RF DATED 01/01/2002 No. 1

On the Classification of fixed assets included in depreciation groups (as amended as of December 10, 2010)

Application

APPROVED by Decree of the Government of the Russian Federation dated January 1, 2002 N 1

Classification of fixed assets included in depreciation groups

(as amended as of December 10, 2010)

| Code OKOF | Name | Note | |

| Group ten (property with a useful life of over 30 years)* | |||

| Building | |||

| 11 0000000 | Buildings (except residential) | buildings, except those included in other groups (with reinforced concrete and metal frames, with walls made of stone materials, large blocks and panels, with reinforced concrete, metal and other durable coatings) | |

3. ORDER OF THE MINISTRY OF FINANCE OF THE USSR, GOSPLAN OF THE USSR, GOSKOMSTAT OF THE USSR, GOSSTROI OF THE USSR, CSB OF THE USSR DATED 06/28/1974

Annual depreciation rates for fixed assets of institutions and organizations financed by the state budget of the USSR

APPROVED by the State Planning Committee of the USSR, the Ministry of Finance of the USSR, the State Construction Committee of the USSR and the Central Statistical Office of the USSR on June 28, 1974 in accordance with Resolution of the Council of Ministers of the USSR of November 11, 1973 N 824

ANNUAL DEPRECIATION RATES for fixed assets of institutions and organizations included in the state budget of the USSR *

| (in % of book value) | ||

| Types and groups of fixed assets | Cipher | Annual wear rate |

| BUILDING | ||

| Industrial and non-industrial buildings | ||

| Multi-storey buildings (more than two floors), with the exception of multi-storey buildings such as shelves for special technological purposes; one-story buildings with reinforced concrete and metal frames, with walls made of stone materials, large blocks and panels, with reinforced concrete, metal and other durable coatings, with a floor area of over 5000 sq.m. | 1,0 | |

| Two-story buildings for all purposes, except wooden ones of all types; one-story buildings with reinforced concrete and metal frames, with walls made of stone materials, large blocks and panels, with reinforced concrete, metal and other durable coatings, with a floor area of up to 5000 sq.m. | 1,2 * | |

| Multi-storey buildings such as shelves for special technological purposes; one-story frameless buildings with walls made of stone materials, large blocks and panels, with reinforced concrete, metal and brick columns and pillars, with reinforced concrete, metal, wood and other floors and coverings | 1,7 | |

| Single-story, frameless buildings with lightweight masonry walls, reinforced concrete, brick and wooden columns and pillars, reinforced concrete, wooden and other floors and coverings; wooden buildings with cobblestones or chopped log walls, one-, two-, or more storeys | 2,5 | |

4. Recommendation: How to calculate depreciation of fixed assets in accounting

The cost of property that meets the criteria of a fixed asset must be transferred to expenses gradually, through depreciation (clause 84 of the Instructions to the Unified Chart of Accounts No. 157n). The exception is movable property (with the exception of library collection objects) worth up to 3,000 rubles. inclusive, as well as the library collection, which is periodicals, regardless of cost. Do not charge depreciation on these objects. This follows from the provisions of paragraphs 38, 50, 92 of the Instructions to the Unified Chart of Accounts No. 157n.

Start and end of depreciation

In accounting, depreciation must be calculated starting from the month following the month in which the property was accepted for accounting as a fixed asset. In the future, depreciation should be calculated monthly, regardless of the institution’s performance.

It is necessary to stop accruing depreciation starting from the month following the one in which the fixed asset was retired (was written off from the register) or completely paid off its cost.

This is stated in paragraphs 86–87 of the Instructions to the Unified Chart of Accounts No. 157n.*

Suspension of depreciation

Sometimes depreciation may be suspended. In particular, depreciation is not charged:

for a period of conservation of a fixed asset lasting more than three months;

for a period of restoration (reconstruction, repair or modernization) of a fixed asset lasting more than 12 months.

This procedure is provided for in paragraph 85 of the Instructions to the Unified Chart of Accounts No. 157n.

A complete list of cases in which depreciation is suspended is presented in the table.

Accounting

Reflect the amounts of accrued depreciation on analytical accounts opened for account 0.104.00.000 “Depreciation” (clause 84 of the Instructions to the Unified Chart of Accounts No. 157n).

Depreciation is calculated:

for real estate worth up to 40,000 rubles. inclusive – in the amount of 100 percent upon acceptance for accounting;

for movable property (except for library collection objects) worth over 3,000 to 40,000 rubles. inclusive – in the amount of 100 percent upon commissioning of the facility;

for objects of the library collection (except for periodicals) worth up to 40,000 rubles. inclusive - in the amount of 100 percent upon commissioning;

for movable and immovable property worth over 40,000 rubles. - according to established standards.

This procedure is established by paragraph 92 of the Instructions to the Unified Chart of Accounts No. 157n.

When receiving fixed assets free of charge from institutions, state (municipal) organizations, their useful life is determined based on the actual service life and the previously accrued depreciation amount (clause 44 of the Instructions to the Unified Chart of Accounts No. 157n). In this case, the previously accrued depreciation is indicated in the act in form No. OS-1 (0306001) (No. OS-1a (0306030), No. OS-1b (0306031)).

Documenting

Keep analytical accounting of accrued depreciation in the turnover sheet for non-financial assets (f. 0504035). This procedure is established by paragraph 90 of the Instructions to the Unified Chart of Accounts No. 157n, Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n.

Record the results of calculating depreciation charges in the primary document (Part 1, Article 9 of Law No. 402-FZ of December 6, 2011, Clause 7 of the Instructions for the Unified Chart of Accounts No. 157n).

Accrual method

In accounting, depreciation can only be calculated using the linear method (clause 85 of the Instructions to the Unified Chart of Accounts No. 157n).

To calculate depreciation using the straight-line method, you need to know the useful life of a fixed asset and its original cost (replacement value if the object was revalued) or residual value if the object was previously in operation. The list of expenses that form the initial cost of a fixed asset is given in the table.

When calculating depreciation, first determine the annual depreciation rate. To do this, use the formula:

– for fixed assets taken into account at historical cost:

| Annual depreciation rate, % | = | Useful life of a fixed asset item, years | × |

– for fixed assets that were previously in operation:

| Annual depreciation rate, % | = | Remaining useful life of a fixed asset item (as of the date of its acceptance for accounting), years | × |

Then calculate the annual depreciation amount:

| Annual depreciation amount | = | Annual depreciation rate, % | × | Initial (replacement) cost of an item of fixed assets (residual value if the item was previously in operation) |

The amount of depreciation to be calculated monthly is 1/12 of the annual amount.

This procedure is provided for in paragraph 85 of the Instructions to the Unified Chart of Accounts No. 157n.*

Situation: how to reflect in accounting the depreciation charge on a fixed asset that has been registered but not put into operation (a fixed asset in inventory)

In accounting, the answer to this question depends on the value of fixed assets.

The institution may not put the fixed asset into operation immediately. In this case, for convenience, additional subaccounts can be maintained to account 0.101.00.000 “Fixed assets”, for example, “Fixed assets in warehouse (in stock)” and “Fixed assets in operation”.

Depreciation in accounting must be calculated starting from the month following the month in which the property was accepted for accounting as a fixed asset (clause 86 of the Instructions to the Unified Chart of Accounts No. 157n). Thus, after reflecting the received property on account 0.101.00.000, the institution must begin to depreciate it. This must be done regardless of whether the facility is put into operation or not.

An exception to this rule is movable property (with the exception of library collection objects) worth more than 3,000 rubles. up to 40,000 rubles, as well as library collections (except for periodicals) worth up to 40,000 rubles. For these fixed assets, accrue depreciation not at the time they are accepted for accounting (i.e., reflected in the account 0.101.00.000), but when the object is put into operation. In this case, depreciation is charged at the rate of 100 percent of the book value. This procedure is established in paragraph 92 of the Instructions to the Unified Chart of Accounts No. 157n.

In tax accounting, the calculation of depreciation on fixed assets located in a warehouse (in reserve) depends on the reason for the delay in their actual operation.

If the delay in the actual operation of a fixed asset is due to technological reasons, it is possible to charge depreciation and write it off as expenses in tax accounting. For example, in the case of purchasing equipment as a reserve to ensure the alternate use of two or more fixed assets (letter of the Ministry of Finance of Russia dated July 3, 2006 No. 03-03-04/4/114).

If fixed assets were initially acquired for use with a deferred commissioning, it is impossible to depreciate such objects when calculating income tax (clause 4 of Article 259 of the Tax Code of the Russian Federation). In this case, there will be a difference between tax and accounting.

S.S. Bychkov

Head of the Department of Budget Control and Audit Methodology of the Department of Budget Policy and Methodology of the Ministry of Finance of Russia

5. Recommendation: How to correct errors in accounting and reporting

Reason for correction

Fill out corrections with a primary accounting document - a certificate (f. 0504833) based on documents that were not posted in the required reporting period (for example, an act of provision of services, an additional agreement, etc.). Please indicate in the certificate:

Rationale

If buildings and structures are listed on the organization’s balance sheet, depreciation on them is accrued from the month following the period of commissioning. Depreciation amounts are calculated depending on the type of object, based on a certain useful life of the building (SPI) in accordance with the Classification according to Resolution No. 1 of 01/01/02. Let's consider how depreciation of a building is carried out using a typical example.

Depreciation rate for buildings

Chemist's Handbook 21

To economically compensate for the physical and moral wear and tear of OPF, part of their cost is included in the costs of production throughout the entire life of fixed assets in the form of depreciation rates. The average depreciation rate is calculated using the formula

Average depreciation rate, %: Leasing payment = principal debt + (loan interest + property tax + other additional costs) * 1.18 (VAT) If we take a 5-year calculation as of November 2011, where the initial cost of the property is 1 million rubles, an advance of 30% and an increase in price of 10.40%, then the components will look as follows: amount of the contract = body of the debt [700 thousand.

Calculation of depreciation using the linear method and its features

Its salvage value is subtracted from the original cost of the depreciable object, and then the resulting amount of depreciation charges is multiplied by a fraction, the numerator of which will be the remaining useful life, and the denominator will be the sum of the numbers of years.

How to calculate depreciation

The leased asset transferred for temporary possession and use to the lessee is the property of the lessor.

The leased asset transferred to the lessee under a financial leasing agreement is recorded on the balance sheet of the lessor or lessee by agreement of the parties.

Leasing items are classified into one or another profile group. Depending on membership in the profile group, the risk indicator of the leasing transaction is calculated.

In conditions of economic instability, the risks of recovering the residual value in the car leasing sector are minimal.

Depending on the useful life of the leased object and the economic essence of the leasing agreement, the following are distinguished:

- Financial leasing (financial lease). The term of the leasing agreement is comparable to the useful life of the leased object.

What are depreciation deductions and why are they needed?

Depreciation charges for non-residential properties represent a monthly transfer of the cost of a fixed asset in parts (in this case, non-residential premises) in cash equivalent to account 02 (depreciation).

According to federal legislation (Article No. 259 of the Tax Code of the Russian Federation), it is carried out by all organizations in accordance with established standards and taking into account the book value of fixed assets. An exception may be those objects that are under conservation.

As the premises are used, their value gradually decreases due to physical and moral wear and tear. Based on this fact, depreciation may have the purpose of :

- direct cash flows to restore and repair the premises in the future;

- gradually distribute large expenses (for writing off premises that have fallen into disrepair) over several periods on an accrual basis;

- create the appearance of the absence of large losses for shareholders (if you do not depreciate a fixed asset, but simply write it off at the end of its useful life, a large loss for the organization will be reflected in the reporting period, which may alienate potential shareholders or frighten existing ones);

- payment of less income tax (the amount of depreciation does not always exactly match the actual depreciation; if it is greater, then the income tax will be significantly less).

Depreciation in accounting: basics

The starting element in the methodology for calculating depreciation is the useful life (LPI) of real estate assets. It is installed following the data of the “Classification of fixed assets included in depreciation groups.” It operates in accordance with government decree in 2002. It is also necessary to take into account the changes made on 07/07/2016. Their action began in January of this year.

The SPI is the period during which the building is able to serve productively as an asset and contribute to the accomplishment of the taxpayer's objectives.

The enterprise determines it itself, based on the date the building was put into operation and information about the OS classification: (click to expand)

| OS groups (buildings incl.) | SPI (years) | |

| over | up to (inclusive) | |

| 4th | 5 | 7 |

| 5th | 7 | 10 |

| 7th | 15 | 20 |

| 8th | 20 | 25 |

| 9th | 25 | 30 |

| 10th | 30 | |

The buildings belong to the 4th and 5th, as well as to 7-10 groups. The enterprise independently determines which of them its real estate should be classified as. The characteristics of each set of buildings provide a clue.

How to determine which depreciation group real estate belongs to?

In order to determine which depreciation group an object belongs to, it is necessary to know its useful life (USI). The organization itself determines the SPI and confirms it with a separate act with the date the premises are put into operation.

According to the OS Classifier (RF Government Decree No. 526 dated April 28, 2018), non-residential buildings and premises belong to:

Group seven (from 15 to 20 years inclusive):

- wooden;

- container;

- wood-metal;

- panel;

- frame;

- adobe;

- adobe;

- other non-residential buildings.

- Eighth group (from 20 to 25 years inclusive) . Buildings with:

- lightweight masonry;

- with cobblestone, chopped or log walls;

- with reinforced concrete, brick and wooden pillars.

- with walls made of stone;

- brick and reinforced concrete columns;

- and reinforced concrete coverings.

Calculation of depreciation of buildings in tax accounting

Tax legislation provides two ways to calculate depreciation of buildings:

- Linear – depreciation is calculated evenly and separately for each object. Regardless of the accounting policy of the organization, it must be applied to buildings. The basis for the calculation is their initial cost.

- Nonlinear.

The linear method is described above (example No. 1).

When applying the nonlinear method:

- The amount of depreciation should be calculated for the complex of buildings, and not for each one separately.

- The basis is taken as the residual value of the OS, not the original one. Their total assessment is reduced monthly by the accrued amount of depreciation.

Depreciation charges (A) are determined as follows:

A = Co Na, where:

Co – residual value of the building complex;

Na is the depreciation rate.

The size of the latter is:

| Depreciation group | Norm, % |

| 4 | 3,80 |

| 5 | 2,70 |

| 7 | 1,30 |

| 8 | 1,00 |

| 9 | 0,80 |

| 10 | 0,70 |

Example No. 2. The total residual value of buildings of the seventh group is 15 million rubles on the first day of the year. For the 7th group of fixed assets, the depreciation rate is 1.3%.

Let's calculate the amount of depreciation:

- January 15,000,000 · 1.3/100 = 195 thousand rubles.

- February (15,000,000 – 195,0000) 1.3/100 = 14,805,000 1.3/100 = 192,465

- March (14,805 – 192,465) 1.3/100 = 14,612,535 1.3/100 = 189,963

The residual value of the group of buildings at the beginning of the second quarter will be:

14,612,535 – 189,963 = 14,422,572 rubles.

Further calculations are carried out in exactly the same way.

In a non-linear way, the cost of buildings is written off much faster than in a linear way. The amount will be 35-40% in the first year of asset operation.

Important! The method is convenient to use in organizations that prefer accelerated depreciation.

Top 5 Frequently Asked Questions

Question No. 1. The building has been under renovation for 10 months. Is it necessary to calculate depreciation?

Answer. Depreciation should be suspended if the repair period exceeds one year. Until this period, it is calculated in accordance with the procedure established by the enterprise.

Question No. 2. The individual entrepreneur owns a building with a mortgage. Is it subject to depreciation? IP on OSNO.

Answer. Depreciation is charged. But it can only be taken into account for tax purposes if the building is used for business.

Question No. 3. An organization bought non-residential premises in order to place an office in it. It occupies the first floor of a multi-storey residential building. Is there a depreciation group to which it should be classified?

Answer. Residential buildings last more than 30 years, so the premises that are part of them should be classified as group ten.

Question No. 4. How to determine the depreciation period of a building in tax accounting?

Answer. It is necessary to establish its SPI using the official OS Classification (Government Decree 31 of 2002 plus amendments).

Question No. 5. SPI should be defined as:

- Any provided for by the corresponding depreciation group.

- Maximum for the same group?

Answer. Any useful life of buildings is selected, corresponding to the time interval provided for the group of fixed assets to which they need to be classified.

Buildings belong to the passive part of the OS. For their timely restoration and continuation of SPI, it is important that the enterprise, by analyzing its benefits, independently determines which depreciation methods are appropriate for it to use.