Explanatory note for refund

While at their workplace in retail outlets, cashiers may mistakenly enter a cash receipt. In such cases, domestic legislation requires a written explanation from this employee, however, a sample of the cashier’s explanatory note regarding an incorrectly stamped check is not provided. Therefore the question arises:

The cash receipt was entered incorrectly: why do you need an explanatory note?

An explanatory note is a document originating from the field of labor law. In accordance with Art. 192 of the Labor Code of the Russian Federation, for improper performance of labor duties, the employer has the right to apply disciplinary sanctions to employees. But before making such decisions, he must request written explanations from the employee regarding the actions taken (Article 193 of the Labor Code of the Russian Federation). A cashier's mistake when punching a cash receipt may just be an example of improper performance of duties.

The use of cash registers is closely related to tax legal relations. The cashier's explanatory note is a valuable source of data during a tax audit of a store (and a possible legal dispute), since it allows the Federal Tax Service inspector (or the court) to establish the circumstances of the non-use of cash registers in the manner prescribed by law.

Failure to use cash registers is a reason to believe that the taxpayer has underestimated the tax base by failing to correctly fiscalize revenue. In addition, the non-use of cash registers is in itself a serious violation of the laws governing settlements between business entities and individuals (primarily the Law “On Cash Registers” dated May 22, 2003 No. 54-FZ). There are serious fines for such a violation.

The contents of the note may become an argument against sanctions being applied to the store.

If you have access to ConsultantPlus, find out what to do if you find an error in your cash register receipt. If you don't have access, get a free trial of online legal access.

Let us next consider the structure and sample of an explanatory note about an erroneously punched check.

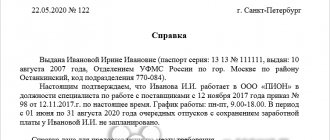

Sample of a cashier's explanatory note on an erroneously punched check

Law of the Russian Federation Federal Law No. 54 of May 22, 203 “On the use of cash registers... urgently requests that organizations that receive cash from customers for selling products or for offering offers must install cash registers. The direct responsibilities of the cashier include issuing a unique cash receipt to the buyer. However, the provided Law does not contain information on how to cancel a check issued by mistake. In paragraph 4.3 of the message of the Ministry of Finance No. 104 dated August 30, 1993, it is said that if the cashier makes a mistake in relation to a knocked out check, he is obliged to do the proper thing: An explanatory note is a document originating from the field of labor law. In accordance with Art.

192 of the Labor Code of Russia, for improper fulfillment of labor obligations, the employer has the right to use disciplinary sanctions against employees. But before that, before taking these conclusions upon himself, he is obliged to request written comments from the employee on the pretext of ideal actions (Article 193 of the Labor Code of Russia). An oversight by a cashier when punching a cash receipt can be a case of improper fulfillment of obligations. No one is immune from mistakes, and cash desk employees are no exception.

In practice, stories often happen when they punch checks with incorrect amounts. The mistake is detected immediately, if the customer in the store points out the wrong price, or after a specific time, based on the results of reconciliations. The choice of method for correcting it depends on the moment at which the error is detected.

Failure to use the cash register is an excuse to assume, in fact, that the taxpayer has underestimated the tax basis by not carrying out the correct fiscalization of the rescue. Apart from this, the non-use of cash registers is in itself a significant non-compliance with the generally accepted standards of legislation regulating settlements between business entities and individuals (primarily the Law “On Cash Registers dated May 22, 2003 No. 54-FZ”). Serious fines are taken into account for this non-compliance.

What to write in an explanatory note

The explanatory note reflects:

1. Information about the addressee of the explanatory note (as a rule, this is the name of the employing company, full name of the immediate supervisor of the cashier or director of the company).

2. The name of the document is “Explanatory note about an incorrectly punched cash receipt.”

3. First-person explanations containing:

- information about the action taken, indicating the date and time;

- information about the cash register on which erroneous actions were performed (model, serial number, information about the fiscal drive);

- statements about the reasons that prompted the cashier to make mistakes when punching a cash receipt.

The document is marked with a date and the cashier's signature. It would also be useful to include a column indicating receipt of the document by the addressee.

You can download a sample explanatory note about an incorrectly punched check in the structure we considered from the link below:

Explanatory note for refund

First person explanations having:

- information about the action taken, indicating the date and time;

- information about the cash register on which incorrect manipulations were made (model, serial number, information about the fiscal drive);

- formulations about the reasons that prompted the cashier to make mistakes when punching a cash receipt.

The document is marked with a date and the cashier's signature. It would also be useful to predict the receipt of the document by the addressee.

Results

An explanatory note is a tool from labor law. But in practice, it plays a significant role in clarifying the circumstances of tax offenses and violations of legislation on the use of cash register systems and can even save you from fines.

You can learn more about resolving problem situations related to the use of online cash registers in the articles:

- “The check was entered incorrectly at the online cash register - what should I do?”;

- “Forgot to punch a receipt when paying by card - what to do?”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

For all received tax returns and calculations, the Federal Tax Service Inspectorate conducts a desk audit, during which it may request from the taxpayer the necessary explanations on the reports provided (clause 3 of Article 88 of the Tax Code of the Russian Federation). We will talk about the reasons for such tax requests, how an explanatory note is drawn up to the tax office upon request, and we will also provide a sample of the explanations in this article.

What is explanatory

How often have we heard this word since school age?

If you are late, write an explanatory note, if you behaved badly, write an explanatory note, and so on. After leaving the school doors, approximately the same thing happens at the institute, and after graduating, having received a higher education, we get a job. However, the same thing awaits us here, in case of incorrectly completed work, being late or violating any rules. Let's figure out what explanatory is. An explanatory note is a document obliging a person to explain a number of interconnected reasons, the last of which will most likely be a negative outcome. The reasons why a person may submit such a document to an employer can be completely different, ranging from the fact that the employee was late for work, ending with the failure of a huge project.

In fact, an employee may have a lot of reasons why he might be late for work, ranging from extenuating family circumstances to the fact that “a black cat crossed the road, I stood and waited for someone to cross the street before me.” However, there is a case when the explanatory text is just an accompanying text to a more main document, being a kind of introduction to the main document.

Of course, the employer has the right to demand an explanation from the employee in case of non-compliance with the work rules established by him (according to the Labor Code).

When the tax office asks for clarification

The reasons why tax officials may have questions for a taxpayer during a desk audit are listed in clause 3 of Art. 88 of the Tax Code of the Russian Federation:

- Reason 1 - the camera revealed errors in the reporting or contradictions between the reporting data and the information available to the tax authorities.

What the Federal Tax Service will require is to provide clarifications or make corrections to the reporting.

- Reason 2 – the taxpayer submitted a “clarification” in which the amount of tax payable, compared to the previously submitted report, became less.

What the Federal Tax Service will require is to provide explanations justifying the change in indicators and the reduction in the amount of tax payable.

- Reason 3 – unprofitable indicators are stated in the reporting.

What the Federal Tax Service will require is to provide explanations justifying the amount of the loss received.

Having received a similar request from tax authorities to provide an explanation to the tax office (a sample can be seen below), it should be answered within 5 business days. There are no penalties for failure to submit, but you should not ignore the tax authorities’ requirements, since, without receiving a response, the Federal Tax Service may assess additional taxes and penalties.

Please note: if the taxpayer belongs to the category of those who are required to submit a tax return electronically in accordance with clause 3 of Art. 80 of the Tax Code of the Russian Federation (for example, on VAT), then he must ensure the receipt from the Federal Tax Service of electronic documents sent during the desk audit. This also applies to requests for explanations - within 6 days from the date of sending by the tax authorities, the taxpayer sends an electronic receipt to the Federal Tax Service Inspectorate confirming receipt of such a request (clause 5.1 of Article 23 of the Tax Code of the Russian Federation). If receipt of the electronic request is not confirmed, this threatens to block the taxpayer’s bank accounts (Clause 3 of Article 76 of the Tax Code of the Russian Federation).

An erroneously punched check at an online cash register, how to issue an explanatory note

The cashier responsible for the return can be indicated by full name or personnel number.

The clarification “including on erroneously punched checks” should be understood as follows: the basis for filling out KM-3 is an error made by the cashier when the amount is greater than the actual cost of the goods and the company returns the “difference” that arose as a result of this.

Using an example: let’s say that the cashier Svetlova, when making a purchase of a book, did not take into account the promotion for which the new price is 159 rubles. As a result, a check for 1,749 rubles was punched. The buyer discovered the error and pointed it out, as a result of which 1,590 rubles were returned to him. According to the regulations, the buyer submitted an application for a refund. Senior cashier Efremov O.A. requested an explanatory note from the cashier, which was also attached to KM-3 dated August 26. 2021.

If several checks have been knocked out incorrectly, the form provides details for each of them. However, the report on the return of funds in KM-4 will only show the final figure.

The KM-3 act, as a rule, is filled out by hand, but there is no reference to the fact that it cannot be completed using a computer. In any case, the document must be certified by the signatures of the commission, otherwise the audit may determine it as incorrectly drawn up.

Data can be reduced - this is especially true for positions in column 6.

Since this document is completed only in certain cases, the form does not need to be submitted daily. However, if several returns occurred during the day, then only one KM-3 is issued.

This happens at the end of the shift after the Z-report is taken. Data from KM-3 is used for forms KM-4 and KM-7.

The limitation period for a document is 2 calendar months .

After this time, the inspection cannot make a claim against the incorrectly executed act. KM-3 is stored in the accounting archive .

Posted on November 30, 2017by. This entry was posted in Category name. Bookmark the permalink.

Subtract the amount that was issued for reporting from the employee’s salary. If the employee did not provide documentation or did not indirectly confirm the purposeful use of funds, the company has the right to demand the return of accountable amounts. By choosing this method, the employer eliminates the need to pay taxes. The judges came to a similar opinion in order No. 13510/12 dated 03/05/2013 of the Supreme Arbitration Court of the Russian Federation. Example No. 4 The head of Meriada LLC was given sums of money to account for the purchase of fuel and lubricants throughout 2015. However, when the time came to provide the advance report, he did not provide any documentation and did not return the accountable funds. During the audit, the tax service redirected the entire amount to the employee’s income and calculated personal income tax.

How to write explanations to the tax office

There is no officially approved sample explanatory letter sent in response to the Federal Tax Service's request for clarification. Explanations can be made in any form, indicating the following information:

- name of the tax authority and taxpayer, his INN/KPP, OGRN, address, telephone;

- heading "Explanations";

- mandatory reference to the originating number and date of request from the tax office,

- direct explanations on the requested issue with their justification,

- if necessary, list attachments to the letter confirming the correctness of the reporting indicators,

- manager's signature.

If an error made in reporting did not lead to an understatement of tax, the explanatory note to the tax office must contain this information. Write about this, indicating the nature of the error (for example, a typo or technical error) and the correct value, or provide an updated declaration or calculation. An error due to which the tax amount was underestimated can be corrected only by submitting a “clarification” - mere explanations for the tax authorities in this case will not be enough.

When, in the taxpayer’s opinion, there are no errors in the reporting, and therefore there is no need to submit an “adjustment”, it is still necessary to provide explanations to the tax authorities, indicating the absence of errors in the declaration or calculation.

Letter of explanation to the tax office: sample for losses

Taxpayers may be interested in the company's unprofitable activities, in which case the taxpayer's explanations must fully disclose the reason for the loss in the requested reporting period. To do this, the letter deciphers income and expenses for a certain period of time.

Also, explanations to the tax office (see sample below) must contain instructions on why expenses exceeded income. For example, a company has just been established, operations have just begun and revenue is still small, but current expenses are already significant (rent, employee salaries, advertising, etc.), or the company has incurred urgent large expenses for repairs, purchase of equipment, etc. The more detailed the reasons for the loss are, the fewer new questions the tax authorities will have.

All information provided must be documented by attaching copies of accounting documents, contracts, invoices, bank statements, tax registers, etc. to a written explanation for the tax office.

Similarly, explanations can be given in response to a request for reasons for reducing the tax burden, in comparison with the industry average.

Sample letter to the tax office to provide explanations in connection with a loss:

Explanatory note to the tax office: sample for VAT

Since January 24, 2017, the Federal Tax Service order dated December 16, 2016 No. ММВ-7-15/682 on approval of the format of explanations to the VAT return in electronic form has been in force. This format is used by all VAT payers who submit electronic reports. The procedure for a taxpayer's actions upon receipt of a request to provide explanations on the VAT return is described in detail in the letter of the Federal Tax Service of the Russian Federation dated November 6, 2015 No. ED-4-15/19395.

How to write an explanatory note to the tax office regarding VAT? Only electronically. Explanations on VAT presented in “paper” form are not considered submitted, and in this case this may be regarded by tax authorities as an unlawful failure to provide the requested information, which threatens with a fine of 5,000 rubles (Clause 1 of Article 129.1 of the Tax Code of the Russian Federation).

Whatever the request from the tax inspectorate: about detected errors, contradictions between reporting forms, about a reduction in the amount of tax in an updated declaration, or about the reasons for the loss, in any case it is necessary to respond to the request. For reporting submitted exclusively via telecommunication channels, an electronic format for submitting explanations is provided at the request of tax authorities.

Correction check and supporting documents to avoid a fine for non-use of cash registers

We have already written in our article what needs to be done in order to avoid administrative liability for non-use of cash registers.

How exactly to run a correction check is described in sufficient detail in the Letter of the Federal Tax Service of Russia dated 08/06/2018 N ED-4-20/ [email protected] “On the features of generating a cash correction check.”

In our article today, we would like to focus on the documents that must be sent to the Federal Tax Service along with the correction check.

Indeed, according to the Note to Article 14.5 of the Code of Administrative Offenses of the Russian Federation, a legal entity or individual entrepreneur will be exempt from liability for non-use of cash register equipment if:

- firstly, they will contact the tax authority before the tax authority itself discovers the offense and,

- secondly, from the documents presented it will be possible to accurately establish the event of the offense.

So, if, when receiving funds from the buyer in cash or by bank transfer, the cashier’s check was not punched in a timely manner, then we generate a correction check and draw up the following documents for it:

- An act or memo in which the cashier explains in detail the reason for the check not clearing. An example of a memo is shown below;

- A statement in which an organization or individual entrepreneur voluntarily reports the non-use of cash registers. Such a statement, according to Order of the Federal Tax Service of Russia dated May 29, 2017 N ММВ-7-20 / [email protected] must be provided no later than three working days from the moment the correction check is drawn up until the decision on an administrative offense is issued by the tax inspectorate. An example statement is also given below.

Erroneously punched checks and errors

Table “When a receipt return check is issued”:

An important point: issuing a return receipt for a new sample cash register is possible only on the day of purchase of the goods.

Table “How does the process of processing a return at the online checkout work?”:

That is, there is a special button that allows you to programmatically perform a refund either as a “cashier” or as an “administrator” (by entering a certain password).

Such BSO (strict reporting forms) when using previous cash registers (before January 1, 2021) were a mandatory document; now this is not a mandatory procedure for returns.

An important point: however, it is better to do this act, it is important to fully justify the reason for the return.

– a complete package of documents for the Z-report.

Next, all documents are sent to the accounting department of this organization or individual entrepreneur

– issues money from the main cash register,

Table “How to make a return if the buyer paid with a bank card”:

– funds are returned to the card, in accordance with Central Bank Directives No. 3073-U dated October 7, 2013.

Other publications: Benefits after 18 years of age

– a complete package of documents for the Z-report.

Next, all documents are sent to the accounting department of this organization or individual entrepreneur.

An example of a memo on the non-use of cash registers

To the General Director of Vasilek LLC Grechishny P.G. from the cashier Natalia Andreevna Volodina

SERVICE NOTE No. 1

On July 02, 2021, the bank account of the organization Vasilek LLC received funds from the buyer (client) by bank transfer: Full name of the buyer: Rassomakhin Nikolay Andreevich Amount: 5,000.00 rubles. Purpose of payment: FOR CONSULTING SERVICES; Full name: Rassomakhin Nikolay Andreevich; ADDRESS: Perm, st. Sadovaya, 5, apt. 30; ADDITIONAL_INF: Payment on invoice 34 dated 07/02/2018; Document number: 744124 Document date: 07/02/2018

On November 7, 2021, a correction check (with the sign “receipt”) in the amount of RUB 5,000.00 was generated on the specified cash register.

At the same time, a cash receipt was sent to the buyer’s email address: email.

I am attaching a copy of the printed correction check to this memo.

11/07/2018 __________________ Natalia Andreevna Volodina

Example of an Application to the Federal Tax Service regarding the non-use of cash registers

Company letterhead

To the Federal Tax Service No. 7 for Moscow From Vasilek LLC TIN 77000000 KPP 770000

Ref. No. 7 dated November 6, 2018

STATEMENT

about a violation of the use of cash registers and its correction

In order to be exempt from administrative liability for an administrative offense provided for in parts 2, 4 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation, we voluntarily declare that we do not use cash register equipment when funds are received from a buyer by bank transfer to the organization's bank account and that we do not send a cash receipt to this buyer in electronic form. or on paper.

On July 2, 2021, there were receipts from the buyer to the organization’s current account in the amount of 5,000 rubles.

When funds were received from the buyer by bank transfer to the organization's current account, a cash receipt was not generated and issued to this buyer due to the technical impossibility of the cash register and ignorance of the changes made to the legislation of the Russian Federation on the use of cash register equipment.

When an error was discovered by the cashier on November 7, 2018, a corresponding memo was drawn up and a correction cash receipt was generated (with the sign “receipt”).

At the same time, a cash receipt was sent to the buyer's email address.

If necessary, we are ready to provide additional explanations.

General Director _____________ /Grechishny P.G./

Call us, we will calculate the cost of accounting services for your company, we will provide accounting services.

Antonova Alena

Explanatory note on the cash register for an erroneously punched check

Compensation for unused vacation: ten and a half months count for a year When dismissing an employee who has worked in the organization for 11 months, compensation for unused vacation must be paid to him as for a full working year (clause 28 of the Rules, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169) . But sometimes these 11 months are not so spent. <... Income tax: the list of expenses has been expanded. A law has been signed that has amended the list of expenses related to wages. Thus, employers will be able to take into account in the “profitable” base the costs of paying for services for organizing tourism, sanatorium-resort treatment and recreation in Russia for employees and members of their families (parents, spouses and children). <... Check employee salaries with the new minimum wage From 05/01/2018, the federal minimum wage will be 11,163 rubles, which is 1,674 rubles more than now.

This form is accompanied by an erroneously punched check containing a note about its cancellation, as well as an explanatory note from the cashier who made the error, with a mandatory indication of the reason for the error. Erroneous cash receipts are pasted onto a blank piece of paper.

All listed documents are transferred to the accounting department of the enterprise. This procedure is reflected in the letter of the Department of Tax Administration of the Russian Federation for Moscow dated April 2, 2003 No. 29-12/17931.

Form N KM-3 was approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132 and is located in the corresponding album. It should be borne in mind that Form N KM-3 is mandatory and can only be drawn up according to the approved form. Money return act The provisions of domestic legislation do not contain any special rules or procedures for filling out money return acts in the approved form.

How to write an explanatory note?

A written explanation for an incorrectly stamped check is the same document as other official letters, therefore, filling out such a document must be taken with full responsibility.

- You need to start filling out such a letter from the upper right corner, where you want to display information about the addressee to whom the note is being written. The cashier must write here the position, the name of the institution, and the name of the boss. Everything is written in the dative case. After this, information about the author of the note is filled in in the genitive case.

- Below, in the middle of the line, the name of the document is displayed. “Explanatory note” It is better to highlight the title in bold and make the font size 1-2 points larger.

- Then the circumstances that caused the erroneous actions are described in detail.

- At the end of the letter there is a date and signature of the cashier who made the mistake.

(Video: “How to write an explanatory note correctly”)

Explanatory note about the loss of documents

First of all, it is worth understanding that the situation should be described briefly, at the same time as completely as possible. It is necessary to indicate what the mistakes were, why they were made, and what consequences this entailed. Mandatory details for the document:

- Last name, initials and title of the manager's position;

- Company name;

- Title;

- Direct explanation;

- Date of;

- Signature.

The main thing: do not turn the document into an essay! In the text, indicate a valid reason why the mistakes were made, but do not shift your blame onto others; management is unlikely to like it that the employee does not want to admit shortcomings in the work that he himself made. If you admit guilt, be sure to indicate how sorry you are and explain that you will not allow this to happen in the future.

The rules are simple:

- There should be no colloquial vocabulary, the text of the explanatory note should be in an official business style;

- The information presented must be reliable;

- Always written on behalf of the employee;

- Contains signature and date of issue.

The explanatory note is written in free form. But for more correct writing, you should familiarize yourself with the samples below.

If a decision is made to apply disciplinary measures, this note will be attached to the disciplinary order as evidence.

Making a note about an erroneous check

Law of the Russian Federation Federal Law No. 54 of May 22, 203 “On the use of cash registers...” requires that institutions that receive cash from customers for the sale of goods or for the provision of services are required to install cash registers. It is the cashier's responsibility to issue the original cash receipt to the consumer. However, this Law does not provide information on how to cancel a check issued by mistake. Clause 4.3 of the letter of the Ministry of Finance No. 104 dated August 30, 1993 states that if the cashier makes a mistake regarding a knocked out check, he must do the following:

- If it is impossible to clear a check during the working day, activate it at the end of the shift.

- Draw up an act according to the unified form No. KM-3, adopted by the State Statistics Committee of the Russian Federation No. 132 of December 25, 1998.

- Display in the “Cashier Operator Journal” the money issued for returned checks.

It should be noted that in case of an erroneously issued check, the KM-3 act must be drawn up. Attached to this act is a damaged check, with a note indicating its cancellation, as well as a written explanation from the cashier who made the mistake. Damaged checks are glued to a blank sheet of paper. All named materials are sent to the institution’s accounting department. This procedure is reflected in the explanation of the Department of Tax Administration of the Russian Federation No. 29-12/17931 dated April 2, 2003.

Explanatory note for returning a check

During work, another circumstance is also possible. For example, an incorrect receipt is identified by the cashier after preparing daily reports. The cash register operator follows the same procedure as described in the previous section, but the error information is not recorded in his log. The accountant, in this case, is obliged to issue a cash settlement for the difference in the amount and certify the report with the cashier and management. The order is issued from the “accounting” cash desk, since the replacement cash receipts from the cash register have already been capitalized.

The cashier, in this case, as in the original version, is obliged to issue a written explanation of what happened. A written explanation follows the same rules.

Explanatory note for the return of funds from the cash register download

Attachments to the act As an appendix to the act, it is necessary to attach an incorrectly executed check, with the signature of the head of the enterprise, the head of the department (section), and the stamp “cancelled”. The absence of a receipt may be interpreted by a tax representative as non-receipt of the proceeds, which could result in a significant fine. In this case, certain circumstances should be taken into account in which there was a return of funds or a discrepancy between the amount of the check and the actual amount of cash in the cash register.

The letter of the law implies the ability of each buyer to return goods that do not meet the established characteristics. In order to reflect this situation in accounting and notify the Federal Tax Service inspection that the sale has been cancelled, the cashier should return the goods from customers. In the article we will tell you how to fill out form KM-3 (Act on the return of money to buyers (clients) for unused cash receipts), in what cases it is used. What is the KM-3 act and who fills it out? In cases where the buyer returns goods purchased for cash on the same day, the cashier must refer to the KM-3 act. This document is unified and approved by a decree of the State Statistics Committee in 1998. During inspections of the accounting activities of an enterprise, supervisory authorities pay special attention to their work with the money supply, conducting cash settlement operations and recording revenues. When processing returns of the cost of services or goods paid by clients or customers, a document must be drawn up - an act of form KM-3.

In this case, special attention is paid to the study of financial documents attached to it. Contents of the article Example 1 The buyer did not provide a receipt to the store when returning a product or item. This situation is stipulated by the Consumer Rights Protection Law. In this case, the buyer’s statement for the return of the funds paid must be attached to the act, with a mandatory note stating that the check was lost.

Upon application, the head of the enterprise issues a visa and makes a note that he agrees with the requirements and is ready to return the funds.

An example of an explanatory note about an incorrectly punched check

If the cashier issues a check with the incorrect price of the product, and the buyer immediately draws attention to this and demands that the money taken in excess be returned to him, it is the cashier’s responsibility to remove the damaged check and issue another one with the correct value. Accordingly, after completing the shift, the cashier draws up a KM-3 act, which reflects the amount for incorrectly stamped checks. Damaged checks are glued to a sheet of paper and attached to the statements. The offending employee attaches a written explanation to the listed materials, showing the reason for the incident.

The explanation is compiled in any form, it is required to display:

- At the top right, the “header” of the note is filled in, which displays the name of the institution, position, surname and initials of the head, then the information of the author of the note is displayed.

- Then in the middle of the line the phrase “Explanatory note” is written.

- The date the letter was issued and the entry number of its registration in the chief’s reception area.

- Next, the title is written - in this example, “about a check issued by mistake” or “an explanatory note on the return of a sum of money.”

- In the text of the letter, the cashier briefly describes the circumstances of the incident in a business style:

- The date of what happened.

- Name of the cash register device.

- Serial model number.

- Incorrectly issued check number.

- Amount of the damaged check

- Reasons for what happened.

- Then he signs a note indicating his position and full name.

- The damaged check is attached to the explanation. There is no need to issue a check for the difference in price, since this circumstance does not affect the amount of taxes. However, if the check was drawn up for a lower price, then this difference needs to be broken through.

Example of a written explanation

Example of a written explanation of a note about a check being punched incorrectly

How to issue an erroneously punched check?

How to correct the error depends on when it was discovered.

The cashier drew up a check for an amount greater than the required amount, the buyer noticed the difference and immediately pointed it out to the responsible employee.

In this case, you need to take the incorrect document from the buyer and give him the correct one. At the end of the day, the employee will draw up a report in the KM-3 form, which will reflect the amount of refund for unused and erroneous checks.

The incorrect document must be attached to the report, indicating o. If it is printed on thermal paper, it is recommended that you make a copy of it. Text printed on such paper quickly fades, and additional measures will help avoid problems with regulatory authorities.

Regarding the mistake made, the cashier is obliged to write an explanatory note at the end of the day addressed to the head of the company. This paper indicates the reasons for the mistake: inattention, problems with the cash register, etc.

There is no need to make a check for the delta: this operation will not affect the amount of tax calculated by the cash register. It may be necessary only to simplify the maintenance of accounting records within the organization. The amount of erroneously entered checks is reflected in the cash register in column 15. There is no need to make cash settlements.

The basis for reducing daily revenue is KM-3. An erroneously punched check will be deducted from the amount received. The report is printed in one copy and signed by the director of the company, the head of the department and the cashier.

If the check was punched for an amount less than the required amount, you should issue a document for the difference. The cashier has no right not to perform this operation: his actions will be regarded by the tax authorities as non-use of the cash register, which entails serious fines for the organization. According to current practice, a check for an incomplete amount is treated as a non-issued check.

If an error is discovered after preparing the daily cancellation report, it must be corrected. The procedure for the responsible employee is similar to Situation No. 1, with the exception of the point about entering data into the cashier’s journal.

Canceling an erroneous transaction is done by creating a cash settlement for the difference. The order is issued from the “head office”, because by this time the daily proceeds have already been capitalized.

It is impossible to leave a defect uncorrected. The actions of companies related to the use of cash registers are strictly controlled by tax authorities. Violations are punishable by fines amounting to 40-50 thousand rubles for one mistake. Therefore, the cashier should know the instructions for correcting errors and apply them in practice.

Money back certificate

A statement on the return of funds is drawn up at retail outlets to return amounts to consumers for incorrectly typed receipts by cash registers. The act must list the numbers and amounts of damaged checks. The act is drawn up in 1 copy by the commission members and, together with the damaged checks glued to a paper sheet, is transferred to the accounting department. Cash receipts are reduced by the amount shown in the act and the data is recorded in the cashier’s book (form No. KM-4). The document is signed by the commission members, the department head, the senior cashier, the cashier-operator and the boss.

Sample of a money return certificate

Form KM-3.

Form KM-3 is an act “On the return of funds to buyers (clients) for unused cash receipts.”

Act KM-3 is a form of return. It is issued when:

- the client returns the goods to the seller, and the seller returns the money for the goods to the client

- The cashier mistakenly punched the cash receipt

Download form KM-3 in formats: Excel, Word.

Detailed article about returning goods here.

After filling out, the KM-3 form is certified by the director of the enterprise (or other authorized person), stamped and stored in the accounting department for 5 years. The completed form must be provided to the tax office only upon request.