We have until April 30 to submit a new 6-NDFL report. It is rented out by all organizations and individual entrepreneurs that are employers or make other payments to individuals. The form was slightly changed in 2021; in the accountant’s opinion, filling it out was even simplified (it seems that this is rare for reports). Let's figure out what has changed in the new calculation and how to reflect some atypical payments in it.

The calculation consists of a title page, two sections and an appendix (certificate 2-NDFL). We will submit the application only at the end of the year, as before; you do not need to fill out and submit it during the year, even if the employee was fired.

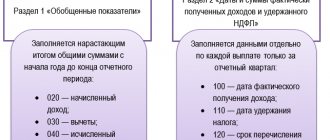

What is somewhat confusing is that previously Section 1 reflected general figures, and Section 2 contained details - dates, amounts of income received, deadline for paying personal income tax, etc. Now the sections have swapped places - in section 1 terms and amounts, in section 2 - generalized information.

Another important change is that now at the beginning of each section you need to indicate the KBK , this means that if personal income tax is paid to different codes, then a separate sheet will need to be filled out for each code. First of all, this is due to the fact that in 2021 we begin to pay personal income tax using a progressive rate - income exceeding 5 million is subject to not 13%, but 15% tax and it is transferred to another KBK.

BCC for “standard” personal income tax:

Tax 18210102010011000110

Peni 18210102010012100110

Fines 18210102010013000110

BCC for personal income tax over 650,000 rubles (i.e. from income over 5 million rubles):

Tax 18210102080011000110

Peni 18210102080012100110

Fines 18210102080013000110

The best thing for an accountant is that in the new section 1 there are no details such as dates of receipt of income and tax withholding, and there is no need to indicate the amount of income actually received. All you need to fill out is the deadline for paying the tax and its amount .

Also in section 1, new lines have appeared - the amount of personal income tax returned in the last 3 months of the reporting period. This refers to the amounts of tax that were excessively withheld by the tax agent (Article 231 of the Tax Code of the Russian Federation). By the way, please note that tax refunds can only be made by non-cash transfer (paragraph 4 of the same article 231).

Another important change is that now in the calculation it is necessary to give analytics in section 2 and separate out the amounts of income:

- on dividends (p. 111);

- under employment contracts (p. 112);

- under GPC agreements (p. 113).

Above-limit travel allowances, personal income tax and general mandatory contributions for 2017

The employer has the right to send an employee on a business trip in Russia or abroad. The business traveler is compensated daily for travel expenses. The date of payment of daily allowances is the day they are accrued. The day of approval of the business trip report is the date of receipt of income (in the form of daily allowance).

In 2021, a fixed limit on daily expenses has been determined, from which general mandatory insurance and personal income tax contributions are not calculated (Read also the article: → “Deadlines for submitting reports on 6-personal income tax in 2021”).

| Type of business trip | Legal limit on travel expenses for one day |

| Business trip to Russia | 700 rub. |

| Business trip abroad, outside the Russian Federation | 2,500 rub. |

The tax-free limit on contributions is established at a time; it cannot be determined on a cumulative basis. An organization has the right to prescribe in local regulations its daily allowance for business trips within the Russian Federation and beyond its borders. Moreover, it can exceed a fixed limit. Such daily allowances are called excess (i.e., above the established norm, limit). The amount exceeded by law will be subject to personal income tax and contributions for compulsory insurance (in addition to the injury tax) in the generally accepted manner.

This innovation has been in effect since 2021. Previously, travel expenses were not subject to general mandatory contributions if the limits were specified in the organization’s local acts.

So, from 2021, excess travel expenses are subject to personal income tax and mandatory insurance contributions, regardless of whether the excess amounts are fixed in the internal regulations of the organization or not.

Personal income tax is calculated on the final day of the month in which the business trip report was agreed upon. The tax is withheld after this date on the first payment, mainly from salary. It can be transferred to the budget on the day the income is paid or the day after that, but not later.

Special scenarios: reporting per diem upon dismissal of an employee

For clarity, let's consider another example.

Ivanov A.A. submitted a report on the business trip on July 5, 2021, then, after working in the company until the 16th, he wrote a letter of resignation. The parties agreed to terminate labor relations on July 19 and make all payments.

The question arises - how to withhold personal income tax (and reflect it in reporting) if the day on which the excess daily allowance is recognized as income - July 31, 2021 - comes later than the day the employee is dismissed?

In this case, personal income tax is subject to withholding simultaneously with calculations upon dismissal. In form 6-NDFL the following are recorded (in section 1):

- in column 022 - 07/20/2021 (date of transfer of tax to the budget).

When should business travel allowances be displayed in 6-NDFL?

Since only excess travel expenses are subject to tax, they should be displayed in the reporting - Section 2 6-NDFL. Amounts within the norm (limit) are not subject to personal income tax or general mandatory contributions. Consequently, they are not carried out according to the calculation form.

All above-limit amounts for daily and other payments (for example, severance pay for a dismissed person) are carried out under item “130” of section 2, item “020” of section 1 of 6-NDFL. This rule does not apply to amounts within the limit.

The average earnings that are due for the days of travel are part of the salary. Consequently, it is recognized as income on the final day of the month for which it was accrued. This day is displayed at position “100” in section 2 (

Taxation of travel expenses: general rules

For an employee sent on a business trip, the employer is obliged to:

1. Pay the average salary for the period of the trip. You can find out how it is calculated in the article “How the average monthly salary is calculated.” Personal income tax on an average travel salary is calculated in the same way as on a regular salary while a person is at work. In general, according to the same principles, travel and regular salaries are reflected in tax reporting (but there are nuances here - we will look at them later in the article).

2. Pay for travel and accommodation where the person is sent. Such expenses are not subject to tax, since they are not the employee’s income (Clause 3, Article 217 of the Tax Code of the Russian Federation). Information about them after a business trip is not reflected in 6-NDFL.

3. Issue daily allowances. These are amounts that an employee can use for personal purposes - usually associated with paying for food, public transport and taxis within the locality to which he left. You can find out more about the amount of daily allowance that an employee is entitled to receive on a business trip in the article “What is the amount of daily allowance for business trips.” In the manner prescribed by law, daily allowances are subject to personal income tax and are subject to reflection in tax reporting. Let's take a closer look at the features of calculating and reflecting in form 6-NDFL those components of travel payments that are subject to personal income tax - the average salary and partially daily allowances.

For reporting for the 1st quarter of 2021, the calculation of 6-NDFL must be submitted using a new form. How to fill out the updated form is described in the ready-made solution “ConsultantPlus”. You will receive even more relevant materials if you sign up for a free trial access to K+.

Uniform requirements for registration of 6-NDFL

This is a standard reporting form according to which a tax agent (individual entrepreneur, organization) reports for the income of its personnel. The document has been introduced and applied since 2021. Its structure consists of a title page and 2 sections. This type of reporting is generated on an accrual basis for the first quarter, six months, 9 and 12 months.

Form 6-NDFL

Entries are made based on available information on income, deductions, and personal income tax. The tax agent must enter the information. He also submits the completed document to the Federal Tax Service.

The rules for filling out this form are determined and formalized by the Federal Tax Service of the Russian Federation. Amounts and details are required to be filled out. If there are not enough pages for the information that needs to be entered, then the required number of pages is taken to fill out. In familiar places that are not filled in, dashes are added.

The form can be filled out on a computer and printed. Then dashes are not placed in empty positions. The font used is Courier New 1 (6-18 points).

The date is written on each completed page and the signature of the head of the organization (individual entrepreneur, notary, lawyer, representative of the tax agent) is affixed.

The procedure for displaying above-limit travel expenses in 6-NDFL

In order to display excess amounts, Section 2 of 6-NDFL is drawn up. Here the dates and amounts of income and personal income tax are specified. The section includes 5 lines.

| Key points of section 2 line by line | Section 2 details (what does it include?) |

| Page “100” (Date of actual receipt of income) | This refers to income, the size of which is displayed at position “130”; the last day of the month is written (Article 223 of the Tax Code of the Russian Federation); sickness benefits and vacation pay are recorded on the actual date of receipt |

| Page “110” (Dating of withheld personal income tax) | Income tax is withheld on the day the actual income is received (displayed in position “130”), and it is from this that the tax is calculated |

| Page “120” (Date of income transfer) | The duration is influenced by the type of income: sickness benefits and vacation pay are issued before the end of the month; in some cases, the information is reflected the next day after receiving the money. Usually the date is recorded here, no later than which personal income tax is deducted |

| Page “130” (Amount of income received) | This includes: the exact amount of total actual income without deduction of withholding tax; amount of excess travel allowances |

| Page “140” (Value of withheld personal income tax) | The summed personal income tax that was withheld on the date recorded in position “110” |

If the beginning of an operation belongs to one reporting period, and the end to another, then section 2 of this form records information on the final period.

Example 1. Display and calculation of excess travel expenses, income tax, income in 6-NDFL

An employee of Proekt LLC, Tsarev N.M., was on a three-day business trip (July 2021) around the Russian Federation. His daily allowance for 3 days amounted to 3,000 rubles. (1,000 rubles for each business trip day). The advance report that the traveler submitted to the director was approved on July 28, 2017.

The accrued July salary of N. M. Tsarev amounted to 70,000 rubles. So, for July 2021 he was paid:

- 07.2017 - advance payment towards pay 35,000 rubles;

- 08.2017 - the balance of July earnings, taking into account the withheld income tax on it and on travel expenses.

The calculated tax was received by the budget on August 4, 2017. Daily travel allowances issued to an employee (1,000 rubles) exceed the fixed limit, i.e. 700 rubles. This means that personal income tax must be withheld from the difference, i.e., the amount exceeding the limit. Accordingly, this fact should be reflected in 6-NDFL (section 2, for 9 months).

| Calculation of amounts for pay, personal income tax and travel allowances | Line-by-line display of above-limit travel allowances issued to Tsarev N.M. (6-NDFL, section 2) |

| The total amount of travel allowances issued to N.M. Tsarev for 3 days of the business trip: 1,000 * 3 = 3,000 rubles. Amount of daily allowance for 3 days of a business trip, from which, by law, personal income tax does not need to be calculated: 700 rubles. per day * 3 days = 2,100 rub. The amount of daily allowance exceeding the limit is withheld from personal income tax (13%): 3,000 – 2,100 = 900 rubles. Personal income tax withheld from the excess amount of daily allowance: 900 rubles. * 13% = 117 Personal income tax on earnings: 70,000 * 13% = 9,100 rubles. Actual earnings received by N. M. Tsarev for July: 70,000 rubles. + 900 rub. = 70,900 rub. The summed personal income tax from pay and the excess amount of daily allowance: 117 + 9,100 = 9,217 rubles. | Page “100” (Date of receipt of income) - 07/31/2017 Page “110” (Dating of personal income tax withholding) - 08/3/2017 Page “120” (Dating of personal income tax enrollment) - 08/04/2017 Page “130” (Amount of actual salary of Tsarev N.M.) - 70,900 rubles. Page “140” (Total amount of personal income tax withheld) - 9,217 rubles. |

Salary on a business trip: payment terms

Having information about the timing of transferring taxable payments to an individual is the most important condition for correctly filling out Form 6-NDFL.

The travel salary (which is calculated, as we noted above, on the basis of average earnings) is paid to the employee in the same time frame as the main salary, since it is one of the options for remuneration, part of the salary as such (Articles 167, 139 of the Labor Code of the Russian Federation) .

If the salary is transferred to the employee’s card, then, as a rule, there are no practical difficulties in meeting the deadlines for its payment (an exception is if, for example, in the locality where the business traveler went, there are no ATMs and acquiring services due to the fact that it is remote from communication networks).

If salaries are traditionally issued through the organization’s cash desk (or there are noted technical difficulties in using the card), then the employer should use available alternatives so that the employee on a business trip receives his salary on time. In this case, federal legislation proposes making a money transfer at the expense of the employer (clause 11 of the Regulations according to Decree of the Government of Russia dated October 13, 2008 No. 749).

In practice, the travel portion of the salary can be included in the calculation:

- advance payment (salaries for the first half month);

- basic salary (for the second half of the month).

Depending on which part of the salary includes its “travel” component, the procedure for reflecting this component in 6-NDFL is determined. Let's look at the options here.

Example 2. An example of the design of section 2 of 6-NDFL for above-limit business trips

An employee of Proekt LLC, Tsarev N.M., was on a business trip across Russia from August 1 to August 5, 2021. He was given an advance with daily allowance (5,000 rubles) on August 28. The amount of excess travel allowances was 5 * (1,000 – 700) = 1,500 rubles. The advance report was submitted to the director of Proekt LLC on August 8, 2017.

Thus, Tsarev N.M. was given: 08/15/2917 an advance on pay, the balance on pay - 09/06/2017 and vacation pay on 09/1/2017. Section 2 6-NDFL (for 9 months) is drawn up line by line as follows:

- «100»: 31.08.2017.

- «110»: 01.09.2017.

- «120»: 04.09.2017

- “130”: 1,500 rub.

- “140”: 195 rub.

Sample of filling out section 2 of form 6-NDFL