Legislation on the procedure for processing cash transactions

Everything related to the scheme for conducting cash transactions is spelled out in Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014. For the current year 2021, the information remains relevant, therefore, for any questions that arise when conducting such actions, you should look for the answer in the mentioned law .

It is important to remember that cash transactions are carried out through unified interdepartmental forms of primary accounting documents used by enterprises and organizations. They must also be approved by the State Statistics Committee of the Russian Federation and approved by the Central Bank of the Russian Federation, as well as the Ministry of Finance.

Who has concessions in cash management?

Individual entrepreneurs have the right to conduct cash transactions in a simplified manner:

- do not set a limit on the balance of money in the cash register (clause 2 of Directive N 3210-U);

- use the proceeds for personal purposes without restrictions (clause 1 of Directive N 5348-U);

- if they keep a book of income and expenses, they can (clauses 4.1, 4.6 of Directive N 3210-U): not keep a cash register,

- do not draw up cash documents.

Individual entrepreneurs and small enterprises may not set a cash balance limit (clause 2 of Directive of the Central Bank of the Russian Federation N 3210-U). To do this, it is necessary to stipulate in the local regulatory act (LNA) that the organization or individual entrepreneur does not set a limit on the balance of money in the cash register. If this is not done, the limit at the cash register will be zero.

For the purpose of applying Directive of the Central Bank of the Russian Federation N 3210-U, small enterprises include legal entities classified as small enterprises and micro-enterprises in accordance with the criteria established by Federal Law of July 24, 2007 N 209-FZ. The tax authorities maintain a Unified Register of Small and Medium Enterprises, where you can see the category of your enterprise:

- microenterprise;

- small;

- average.

Learn more about small businesses

To access the section, log in to the site.

See also:

- Cash payment procedure has been updated

- Primary documents for the cash register

- Monetary documents: legislation

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Accounting accounts and analytical accounting of cash transactions: legislation and 1C This publication describes the main accounts of cash transactions and...

- Changes in reporting and cash transactions from November 30, 2020 The Central Bank changed the rules for reporting and cash transactions from November 30...

- The procedure for accounting for operations to change the cadastral valuation of land plots has been clarified. The Ministry of Finance in Letter dated 05.29.2020 N 02-06-10/45902 explained that the change...

- The procedure for conducting an inventory: legislation The article discusses: the procedure for preparing for an inventory; cases; its timing...

Package of documents and rules for filling out papers

The State Committee of Russia has approved a list of documentation through which employees of the organization carry out the specifics of cash procedures. All legal documents listed below are included in the All-Russian Classifier of Management Documents OK 011-93.

The list consists of six types of primary cash accounting documentation:

- book of cash transactions;

- receipt transactions order;

- order of expenditure transactions;

- book of receipt and issue of cash by the cashier;

- settlement and payment (settlement for enterprises that transfer salaries to employees on a card) statement.

Separate rules are prescribed for individual entrepreneurs (individuals engaged in entrepreneurial activities). The law allows them to waive the mandatory registration of receipts and expenditure orders; a cash book is also optional. The conditions are specified in the Tax Code of the Russian Federation. However, if the individual entrepreneur expresses a desire, he can draw up the listed documents for his own convenience, because this will help to better control the movement of funds within the organization. When deciding to maintain the designated documents, individual entrepreneurs should be guided by the standards established by the Central Bank of Russia.

Cash book

The main and only function of the cash register (CC) book is to display the movement of finances received by the organization's cash desk. The number of this document according to the General Classifier (OK) is 0310004. Two design options are allowed, let’s consider them in more detail.

Paper cash book

The chief accountant is required to number each sheet of the document before he begins to fill out the book. The paper securing the pages of the document must be signed by the director of the enterprise and the chief accountant. In the case of an individual entrepreneur, it is advisable to affix a company seal.

Electronic book of cash transactions

The basic task when designing an e-book is to reflect the safety of the data entered in it and the reliable protection of the document to avoid falsification of information. That is why each record is certified by personal electronic digital signatures of employees (authorized persons).

The decision about how often to print sheets is made by the head of the company. It is possible to set any interval, but the most common options are to print once a day, week, month or quarter. The accountant files the printed papers in a folder prepared for this purpose. According to the law, the annual book must be collected in full.

Individual entrepreneurs do not have to print out electronic cash book data. But the manager must ensure that all employees with financial responsibility have issued and confirmed digital signatures (abbreviated as EDS).

Registration of the cash book

Both a paper book and its virtual counterpart are numbered. Pages are counted by the program while maintaining chronological order.

The preparation of the cash book is entrusted to the chief accountant. If he is absent (sick leave, vacation, etc.), responsibilities are transferred to the head of the company. If initially the company does not have a full-time chief accountant, then the manager is in charge of the books. Procedure for registration of CC:

- The cashier enters the data into the cash register. It is based on information from their receipt and expenditure documentation. Only those finances that were deposited into the organization’s accounts are taken into account. When funds transferred by an agent or subagent from the bank are received, the information is reflected in another book of cash transactions. It is processed and conducted by the agents involved.

- At the end of each completed banking day, the cashier checks the entries in the cash register and correlates them with the information contained in the receipts and expenditures.

- Then the employee puts a signature or digital signature, thereby confirming the amount of cash balance in the company’s cash register.

- The final reconciliation is carried out by the chief accountant or the director himself. They also need to sign.

It happens that for the whole day not a single financial transaction has been received. In this situation, no additional actions are necessary. The balance is considered to be the amount withdrawn on the previous banking day.

Postings for foreign currency transactions

Accounting for cash transactions with currency involves the following typical entries:

- D50-1 - K52-22 - the organization received foreign currency cash from the bank for the expenses of employees on a business trip. The primary document will be the receipt order.

- D71 - K50-1 - the company issued foreign currency cash to the reporting employee for his expenses on a business trip. The operation is accompanied by the execution of an expense order.

- D50-1 - K71 - the reporting employee returned money in foreign currency that was not used on a business trip to the cash desk. The primary documentation will be advance reporting, as well as a receipt order.

- D91-2 – K50-1 – a negative exchange rate difference was received. Documentation – certificate from an accountant.

- D50-1 – K91-1 – a positive difference in rates was obtained. The documentation is the same as in the previous case.

- D52-22 - K50-1 - the company deposited foreign currency cash into its account with a credit institution. For this operation, an order for the expense and a statement for the foreign currency account must be issued.

Receipt order

The cash receipt order is abbreviated as PKO. According to the General Classifier, it is assigned the number 0310001. The function of the PKO is to record the receipt of cash by the cashier. The purpose of registration of PKO will be to document the execution of debit processes.

Mandatory elements of the PKO structure:

- registration number;

- full name of the company, branch or subsidiary indicating OKPO codes (this is optional);

- compilation number;

- a corresponding account or sub-account (if the company maintains accounting).

Similar to the case with the book of cash transactions, it is permissible to fill out the PKO in both written and electronic versions. It is prohibited to submit a receipt transaction order with corrections, blots, or typos.

Transactions with foreign currency

Organizations can carry out cash transactions both in national currency and in foreign currency. Basically, accounting for transactions with foreign money is associated with payment for business trips abroad.

To receive currency for this purpose, you must have the following documents:

- Order for the purchase of currency;

- An order that sets out the rate of expenses per day;

- An order stating that the employee was sent on a business trip;

- Application for receiving currency.

The credit institution issues currency along with a certificate confirming the purchase, drawn up in a special form. It must be issued in the name of the employee sent on a business trip.

If an organization carries out cash transactions in foreign currency, the accountant must take into account these transactions in rubles in the amounts received when converting the currency at the official exchange rate of the Bank of Russia. Recalculation must be carried out on the day of the transaction.

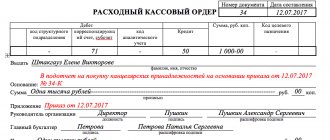

Withdrawal slip

An expense cash transaction order is abbreviated as RKO. According to the General Classifier, it is assigned the number 0310002. The purpose of maintaining cash and register management is to document the expenditure of money on the company’s balance sheet and record this procedure.

Transferring cash requires the cashier to ask and verify a receipt from the person receiving the funds and proof of their identity. Wherein:

- the receipt is filled out by hand by the recipient;

- the amount of rubles to be issued is indicated in words, and if it includes kopecks, then kopecks are written in numbers;

- if the issuance of funds is carried out by power of attorney, then the cashier must indicate the full name of the authorized person in the cash register.

The cashier writes down the details of the expense order. The chief accountant certifies the document, and the manager signs the document. The required elements of the cash settlement structure completely coincide with the details of the order for incoming transactions.

Cash book

Document number according to the General Classifier is 0310005. The cash book is kept by the senior cashier of the enterprise. This documentation records cash transactions carried out between the senior cashier and his junior colleagues during one working day. But if the company is small, then you can completely refuse to maintain such a book.

Procedure for using the cash ledger:

- Before the start of the working day, the senior cashier or other person authorized by the order of the manager issues cash to the junior cashiers. Money is issued strictly against signature.

- After a working day, all the money remaining in the cash register is also given away against signature in the accounting book. If it is necessary to give part of the funds as salaries to employees, then the authorized person must report for them before the deadline specified in the statement expires.

The senior cashier transfers all funds remaining at the end of the day into a special envelope. On it, the employee writes the exact amount of the balance, and then hands it over against signature. In cases where, at the end of the period specified in the payroll, any balance remains, it is returned in full to the central cash office. In this case, it is necessary to make an entry in the accounting book about the completed transaction.

As a rule, the responsibility for registration and control of the accounting book is entrusted to the chief accountant. But often in companies, responsibilities are transferred to other employees. Individual entrepreneurs are allowed to entrust the maintenance of the accounting book to themselves or to another employee who enjoys special confidence from the manager.

Typical transactions for monetary securities

The main entries made when accounting for monetary documents are:

- D50-3 - K71 - monetary documents purchased for cash are credited to the company's cash desk. To carry out the operation, advance reporting and an invoice are prepared.

- D50-3 – K60 (76) – monetary securities purchased by bank transfer were entered into the cash register. The primary documentation is the invoice.

- D73-1 – K50-3 – a company employee received a tourist voucher in part of the money he contributed. In this case, documents such as an order from the manager of the company, a statement on the issuance of vouchers, and a certificate from an accountant must be drawn up.

- D91-2 - K50-3 - the employee received a voucher, which was fully paid for by his employer. The primary documentation is the same as in the previous case.

- D71 - K50-3 - an employee going on a business trip received travel tickets. This operation is recorded in the cash register.

- D71 – K50-3 – the employee received various stamps from the company’s cash register for their intended use. The operation is recorded in a special journal.

- D94 - K50-3 - an inventory was carried out, during which a shortage was discovered. An accountant's certificate and an inventory list must be prepared.

- D99 - K50-3 - during emergency incidents, some of the monetary documents were lost. The same documents are drawn up as in the previous case.

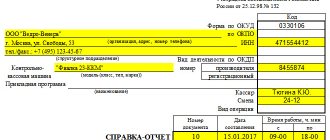

Payroll

The form of settlement and payment or, in other words, salary slip according to the General Classifier corresponds to code 0301009. This documentation is intended to record the following indicators of each employee of the enterprise:

- amount of time worked;

- amount of charges;

- number of transfers and deductions made.

The payroll is prepared by the main financially responsible person - the chief accountant. A single copy is sufficient, since this is a document for internal use.

The text of the document must include all amounts allocated to each employee:

- salary;

- social payments;

- bonuses, additional payments and allowances;

- possible fines and deductions.

If a company's employees' salaries are transferred to debit cards, then the accounting department prepares a statement only with calculations, and a payment statement is not needed.

Procedure for filling out the document:

- On the title of the statement, the accountant writes the total amount of payments.

- If there are employees to whom the employer did not manage to pay wages within the allotted time, you need to write the word “deposited” next to the names of these employees.

- In the final column, the specialist writes the total amount of payments. An expense cash order is then drawn up for this amount. The date of the order is recorded in the document.

- A separate item indicates the amount of funds that have been deposited.

If the employer issues wages in cash, the accountant always draws up this type of paperwork.

Accounting for expenses using cash

In business, not everything can be bought with paper money. A complete list of expenses for which cash can be used is available in Directives of the Central Bank of the Russian Federation No. 3073-U dated October 7, 2013. Some spending has a limit, others do not. For example, without restrictions, a company or individual entrepreneur can spend cash for the following purposes:

- issuing salaries, benefits, bonuses and any rewards to employees;

- travel expenses;

- payments to the individual entrepreneur himself.

Other expenses are limited:

- refund to the buyer when returning the goods;

- expenses for the needs of the store (stationery, soap, cash register supplies);

- payment for supplies of goods;

- payment for cleaning, utilities, rent, etc.

Let's take a closer look at the types of expenses using cash.

Payment for supplies to the store . When making payments to suppliers in 2021 under one contract, the amount of cash should not exceed 100,000 rubles. Payments above this amount are made in cashless form. And if the limit is exceeded, fines of up to 5 thousand rubles are possible for officials and individual entrepreneurs and up to 50 thousand rubles for a legal entity.

When paying for goods received in cash, expenses are recorded using a cash receipt order (RKO). It is signed by the director and accountant. Information on cash settlements is entered into the cash book.

Issuance of salaries and benefits . There are no limits on cash payments to employees. To record such expenses, pay slips are filled out.

Refund to the buyer . The law requires that money be returned in the same way that the product or service was paid for: for example, if the buyer paid in cash, he cannot have the amount returned to his bank card. The cashier makes a return at the request of the buyer and creates a return receipt, after which the accountant draws up a cash order and payment order.

Issuance of money on account . Upon reporting, employees are given cash for business trips or for the store’s business needs; there are no restrictions here. There is one spending scheme: the employee receives money from the cash register, spends it on agreed purposes and reports to the company. All such operations are carried out upon the application of an accountable person or an order from the organization signed by the director. The document states:

- Full name of the accountable person;

- the purpose of issuing money (business trip, economic necessity);

- the period for which the employee receives the amount;

- size of the amount;

- date and signatures of responsible persons.

Having such a document in hand, the accountant draws up cash settlements, makes an entry in the cash book, and after that can give the employee money from the cash register.

When an employee spends money for the specified purposes, he draws up an advance report and attaches documents to it to confirm expenses: tickets, cash and sales receipts, etc. After this, the expense can be recognized. If the employee does not confirm the expenses with documents, he will have to accept the expenses as income of the individual and pay personal income tax and insurance premiums on them.

If an employee had to spend personal money to complete a task, he writes an application for compensation of expenses and also confirms it with documents on expenses.

Issuing money to an individual entrepreneur to himself . There are no restrictions on these expenses. An individual entrepreneur can take money from the cash register for personal needs by drawing up an expense cash order. The law requires only one thing: not to spend these amounts on business.

Payment statement

It is compiled to comply with the procedure regarding the transfer of wages and other monetary payments to the company’s personnel. The document number according to OK is 0301011. The filling scheme and requirements for the document are identical to the rules for maintaining payroll records for employees.

Experts note that it is permissible to issue salaries based on the details of the expense receipt. But it is still more correct to draw up accounting statements.

The documentation is entrusted to the chief accountant, and in his absence, the head of the company handles the paperwork. It is prohibited to submit documents with errors or incorrect information.

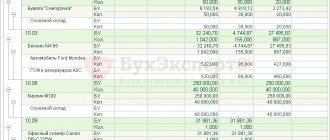

Postings for cash accounting

Cash is accounted for in account 50 “Cashier”; subaccounts can be opened to it. Here are examples of the most common transactions when working with cash.

- Dt 50 “Cashier” Kt 90 “Sales” - the buyer paid for the goods in cash.

- Dt 50 “Cash” Kt 71 “Settlements with accountable persons” - the employee returned the balance of funds after completing an order or business trip.

- Dt 57 “Transfers on the way” Kt 50 “Cash desk” - cash was collected at the bank.

- Dt 70 “Settlements with personnel for wages” Kt 50 “Cash desk” - paid wages from the cash register.

- Dt 60 “Settlements with suppliers” Kt 50 “Cash desk” - paid for the supply of goods.

Keep cash records using the Kontur.Accounting web service. The system will help you prepare all the necessary documents, offer the correct entries and correctly account for expenses and income. All beginners can test Accounting for free for two weeks.

Current cash discipline rules for 2019

All organizations must follow a clear structure for conducting financial transactions, but this depends on the scale of the business in which they operate. The organizational and legal framework and the chosen tax deduction scheme also do not play a role. All companies that carry out transactions with cash are required to comply with the requirements for registration and execution of cash register procedures. To familiarize yourself with the rules, see the Tax Code (clause 4 of article 346.11, clause 5 of article 346.26).

The requirements of the Tax Code apply to:

- state budget structures;

- private sector enterprises;

- individuals running a business (individual entrepreneurs);

- enterprises and individual entrepreneurs using cash registers in their activities;

- firms and individual entrepreneurs who use strict accountability in their documentation.

As mentioned above, individual entrepreneurs are exempt from posting certain papers: cash books, income and expense documents.

Tax service employees regularly inspect the correctness of compliance with cash procedures and financial discipline. Their tasks include:

- reconciliation of information in the cash transactions book with information in primary securities;

- checking whether cash is processed and used;

- whether records of the money deposited were made in a timely manner.

If violations of the discipline of financial transactions are detected, tax authorities issue a fine to the company.

Become an author

Become an expert

Postings according to reporting forms

- D006 - K - the organization received reporting forms from the printing house. An invoice from the printing house and a receipt order must be issued.

- D – K006 – forms used to sell tickets were written off. An accountant's statement and a cashier's report on tickets sold are prepared.

Similar articles

- Maintaining and recording cash transactions in foreign currency

- The procedure for conducting cash transactions in 2016-2017

- Accounting of cash transactions

- Cash discipline in 2016-2017

- Cash transactions in 2021