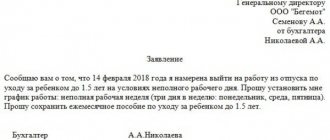

Child care leave is provided upon application; it can be used in full or in parts: by the mother, father of the child, grandmother, grandfather, or other relative who actually cares for the baby.

Specific and to the point, always relevant: in the berator “Practical Encyclopedia of Accountants”

Holiday to care for the child

Leave is provided until the child reaches 3 years of age, and child care benefits are paid only up to 1.5 years.

There is nothing more permanent than temporary

Let us recall that in recent years, namely in 2021, 2021, a temporary procedure for indexing child benefits was in effect. However, from 2018 these recalculation rules will be applied on an ongoing basis. The economic crisis is dragging on, so the temporary indexing algorithm has been approved as permanent.

In accordance with the new procedure, child benefits, in particular, child care payments in 2021, will be indexed based on the consumer price growth index for the previous year according to the indexation coefficient approved by the Government of the Russian Federation. These changes are recorded in Federal Law No. 444-FZ dated December 19, 2016 “On introducing changes to the procedure for indexing payments, benefits and compensation.”

Please note that payments for child care up to 1.5 years in 2021 are not the only benefit whose indexation procedure has changed. These changes will also affect other payments:

- maternity benefits paid to women from among the civilian personnel of military formations of the Russian Federation located in the territories of foreign states, as well as to women dismissed due to the liquidation of organizations or termination of activities by individuals as individual entrepreneurs (with the exception of maternity benefits, paid to women subject to compulsory social insurance in case of temporary disability and in connection with maternity);

- lump sum benefit for the birth of a child;

- benefits for women registered in the early stages of pregnancy;

- a one-time benefit when placing a child in a family;

- a one-time benefit to the pregnant wife of a military serviceman undergoing military service;

- monthly allowance for the child of a military serviceman undergoing military service.

Thus, starting next year, all listed payments, including monthly payments for child care up to 1.5 years in 2021, will be reviewed from February 1 of each subsequent year. That is, the new indexation of the benefit will be carried out starting from February 1, 2021 until February 1, 2021. It is during this time interval that the benefit will be paid in the new established amount. Then, after the next indexation at the beginning of 2021, the benefit amount will be increased once again and will continue to be valid until February 1, 2021.

New payment amount

Now let's talk in detail about the payment amount. The minimum amount of childcare benefits for children up to 1.5 years in 2021 will be for those workers who had no earnings in the billing period, or whose earnings were below the minimum wage. In this case, the amount of the benefit will be calculated from the minimum wage established at the start of care leave.

Let us remind you that from January 1, 2021, the minimum wage has been increased to 85% of the subsistence level and is equal to 9,489 rubles.

For more information about the minimum wage starting from the New Year, see “Minimum wage from January 1, 2018.”

Thus, from January 1, 2021, the amount of child care benefits will be 3,795.60 rubles. (RUB 9,489 × 40%).

As for the payment for child care up to 1.5 years in 2018 for the second child and all subsequent children, its amount from February 1, 2021 will be 6,327.57 rubles. (RUB 6,131.37 ×1.032).

Note that 1.032 is the indexation coefficient effective from February 1, 2021. It is clear that for benefits assigned before this date, the previous coefficient applies, and the amount of the benefit for caring for a second child will be 6,131.37 rubles.

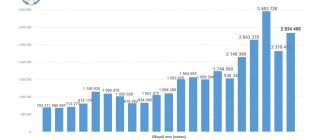

Benefit for the first child from January 1, 2021 – what is offered

From January 1, 2021, parents will be able to apply for an increased monthly benefit for their first child. that the national average amount of this benefit will be 10,523 rubles.

The most important nuance of the proposal is that not all parents with one child will receive the increased child benefit.

The increased payment will be targeted. Only needy parents will be able to apply for it. The criterion for this need is the average income for each family member in the amount of no more than 1.5 times the subsistence level in the region where the family lives. The cost of living in the second quarter of the previous year will be taken as the basis. That is, in 2021 they will rely on the cost of living of the second quarter of 2021, in 2021 - on the second quarter of 2018, etc.

What does this mean in practice? The TASS agency provides its calculations for a family of three (parents and their firstborn). Thus, to receive an increased child benefit in Moscow, the total family income must be no higher than 84,339 rubles. The amount of the benefit will be 14,252 rubles - the Moscow subsistence minimum per child.

More detailed infographics for other regions of the country from TASS:

It is easy to see that although the benefit will not be given to everyone automatically, it will still be available to many.

Perhaps the most interesting conclusion that can be drawn is that thanks to the new monthly payment for their first children, those mothers who received a “gray” salary before going on maternity leave will be able to receive a normal child benefit. Let us remind you that in Russia, maternity payments for a mother looking after a baby up to one and a half years old are equal to 40 percent of her income before going on maternity leave. In order to receive the same average for Russia 10,523 rubles, the mother had to officially earn about 26,300 rubles. In practice, very often people working in the private sector have a minimum salary, from which they then receive meager child benefits. The new payment will help these parents somewhat.

Where do the new numbers come from: details

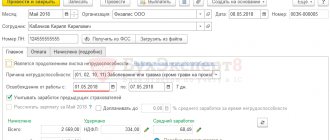

In 2021, the monthly child care benefit for children under 1.5 years of age is 40 percent of the employee’s average monthly earnings. That is, it must be calculated using the formula:

| Child care benefit up to 1.5 years per month = average monthly earnings x 40% |

If the employee’s average earnings per each full month of the billing period are less than the minimum wage (Part 1.1, Article 14 of Federal Law No. 255-FZ of December 29, 2006), then the child care benefit is calculated based on the minimum wage:

| Childcare benefit for a child up to 1.5 years old for a full calendar month = minimum wage as of the start date of leave x 40% |

At the same time, the amount of child care benefits in 2021 cannot be less than the minimum established value (Article 11.2 of the Federal Law of December 29, 2006 No. 255-FZ, Article 15 of the Federal Law of May 19, 1995 No. 81-FZ). This will be discussed further - less than what amount cannot be paid as a benefit.

Minimum benefits in 2021

To begin with, the table shows the minimum amount of benefits for child care up to 1.5 years old, applied in 2021. We will need them to calculate the “minimum wage” for 2021:

How to calculate benefits in 2021?

The calculation of childcare benefits for children under 15 years of age for employed citizens consists of the following main indicators:

- total earnings for the two years preceding maternity leave;

- number of days for 24 months (2 years), equal to 730 days;

- the average number of days in a month equal to 30.4 days;

- payment amount equal to forty percent of the employee’s average daily earnings

Therefore, the calculation formula is:

Monthly Payment = Amount Earnings * 30.4 * 0.4

In general, the benefit formula in 2021 is the average monthly income earned by an employee for the two-year period preceding the maternity leave, limited by the maximum - the maximum contribution to the Social Insurance Fund (set annually) and the minimum - the minimum wage.

You can calculate the amount of the payment using the online calculator provided on the FSS website.

Attention! For non-working persons, the amount is not calculated, but is set at a fixed amount and indexed annually.

Indexation of benefits from February 1, 2021: what does this affect?

There is such a thing as a “minimum basic child care benefit.” This is a fixed value that legislators determined quite a long time ago - in 1995 (Part 1 of Article 15 of the Law of May 19, 1995 No. 81-FZ). So, this minimum basic benefit amount for all recipients is:

- when caring for the first child – 1,500 rubles. per month;

- when caring for the second and subsequent children - 3,000 rubles. per month.

These values are indexed every year by a set factor. After multiplying the “minimum wages” by all coefficients, from February 1, 2021, the following benefit amounts were in effect:

- allowance for the first child - 3065.69 rubles. (RUR 2,902.62 x 1,054)

- allowance for the second and subsequent children - 6131.37 rubles. (RUB 5,817.24 x 1,054)

From July 1, 2021, the minimum allowance for caring for the first child increased to 3,120 rubles, since it began to be paid based on the new minimum wage, namely: 7,800 rubles. x 40% = 3120 rub. It was no longer possible to continue paying 3065.69 from July 1, 2021.

From February 1, 2021, the benefit indexation coefficient was approved at 1.032. This means that from February 1, if benefits are indexed, their amounts will be:

- allowance for the first child - 3163.79 rubles. (RUR 3,065.69 x 1,032)

- allowance for the second and subsequent children - 6327.57 rubles. (RUB 6,131.37 x 1,032).

Look, it turns out that after indexation from February 1, 2018, the amount of the benefit for the first child turned out to be less than the amount calculated from the minimum wage as of January 1, 2021: 3,795.60 rubles. > 3163.79 rub.

In this case, the amount of the benefit cannot be less than the amount calculated from the minimum wage. Therefore, even after February 1, 2021, the minimum amount of benefit for caring for the first child remains at 3,795.60 rubles. However, the minimum amount of benefit for the second and subsequent children has increased from February 1, 2021 - to 6327.57 rubles.

Table with totals

So, here is a table with the final minimum amounts of child care benefits for 2021. It applies to those who received benefits from January 1, 2021 and later:

| Benefit | From January 1, 2021 | From February 1, 2021 |

| First child care benefit | RUB 3,795.60 | RUB 3,795.60 |

| Allowance for caring for second and subsequent children | 6131.37 rub. | 6327.57 rub. |

Benefit for the unemployed

Now a few words need to be said about child care payments in 2021 for the unemployed. This category of citizens has the right to receive this benefit through the department of social protection of the population, provided that the unemployed does not receive unemployment benefits (Article 13 of the Federal Law of May 19, 1995 No. 81-FZ, subparagraph “b”, “c” paragraph. 45, paragraphs 39, 40 of the Procedure, approved by order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012n). The amount of benefit for the second child in this case is 6,131.37 rubles. It is according to these rules that maternity payments for child care up to 1.5 years will be made in 2021.

What is child care benefit for children under 15 years of age?

The sick leave certificate for the BiR is closed at the end of 70 days (in general) after the birth of the baby.

Maternity benefits are paid before the baby is born. Theoretically, a young mother should begin to fulfill her work duties.

However, the state provides leave to care for a child until his third birthday.

For the first year and a half of leave, child care benefits up to 15 years of age are paid.

The next 18 months - only payment of compensation of 50 rubles.

For working mothers (caregivers), monthly social assistance is assigned and issued at the place of official employment.

Moreover, if a woman combines work in several organizations, then in any of them (by choice) she will receive the required benefit as a percentage of the salary.

To correctly calculate the subsidy, the applicant must submit to the accounting department of the selected organization certificates of income received for the last two years from other employers.

The source of funding for paying for “children’s” is the budget of the Social Insurance Fund.

After the interested party submits an application, the state subsidy is paid by the employer, then he is compensated for expenses from the Social Insurance Fund.

Full-time students and unemployed parents/caregivers can apply for state assistance for child care at the territorial division of the social security authority (or at the Social Insurance Fund).

If the mother is divorced from the child’s father, in order to receive benefits, a child support certificate will need to be added to the package of documents.