Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

Trade tax (TC) is a local tax established for organizations and individual entrepreneurs that trade using movable and immovable property. To pay it, you need to fill out a payment order, the important details of which are KBK. In this article we will tell you who pays the trading fee, in what time frame and which BCCs to use when paying the trading fee in 2021.

Who is released

You are exempt from the fee if:

— You are applying a patent. But if you combine special regimes, the exemption will not work for activities on the simplified tax system.

— You work in an online store, at markets or fairs. But you will have to register with the tax office.

— You sell from a warehouse.

— You provide services. The fee is not paid if the goods are necessary for the provision of services, as is the case with car services and beauty salons. The exemption applies even if you sell products separately, but the storefronts occupy less than 10% of the premises.

Who needs to pay trade tax in Russia

Authorities can establish a trade tax in any municipality and federal cities. At the beginning of 2021, the fee is valid only in Moscow on the basis of Moscow City Law No. 62 adopted in the summer of 2016.

At the moment, payers of the fee are Moscow organizations and entrepreneurs using the simplified and general system, trading through movable and immovable property. Individual entrepreneurs on a patent and taxpayers on the Unified Agricultural Tax are completely exempt from the fee.

TC objects include stationary and non-stationary retail chains, warehouses, stalls, kiosks and retail markets. The obligation to pay the fee will appear even after one use of the facility during the quarter. Ownership does not affect payment. Even if the trade object is leased, you must pay the fee, not the owner. Gas stations without a sales area and those who sell through online stores are exempt from the fee.

When you have an object subject to taxation, you need to submit a notification to the tax authority yourself. Provide information about the object and all its characteristics. The tax service verifies the submitted information. Do not forget to submit notification of changes in the characteristics of the object in a timely manner. If the retail space has increased during the quarter, the levy will have to be paid at a higher rate.

How much to pay

The amount of the fee is calculated in advance; it depends on the type of outlet and its location.

The amount of the fee depends on the area and the retail facility:

- kiosks and tents in the center of Moscow pay 81,000 rubles, in other areas of the city - from 28,350 rubles to 40,500 rubles;

- trays, auto benches and carts - 40,500 ₽;

- shops and pavilions with a retail area of up to 50 sq.m in the center - 54,000 ₽, within the Moscow Ring Road - 27,000 ₽; outside the Moscow Ring Road - 18,900 ₽;

- shops and pavilions with a retail area from 50 sq.m to 150 sq.m - 54,000 rubles for the first 50 meters and plus 60 rubles for each meter above; within the Moscow Ring Road - 27,000 ₽ and plus 55 ₽ for each meter over; outside the Moscow Ring Road - 18,900 ₽ and plus 50 ₽ for each meter over;

- vending machines - 4900 ₽ for each machine.

In Elba, the sales tax is calculated automatically; you only need to indicate the details of the retail outlet.

How to calculate trading fee

To pay the vehicle, you need to calculate its amount for the quarter yourself. Fee rates are established by district and territory; for Moscow, the rates are contained in Article 2 of Law No. 62. The amount of the fee depends on the number of retail facilities and their area. This is a physical indicator.

Vehicle amount = Rate (Article 2 of Moscow Law No. 62) × FP

Income from trading does not affect the amount of the fee. Let us note once again: even if you traded at the facility at least one day per quarter, you will have to pay the fee in full. Therefore, it is not at all profitable to start an activity at the end of the tax quarter, as well as to finish it at the beginning.

Calculation example. IP Demidov sells farm products in Moscow. It has a shopping pavilion with an area of 60 sq.m. in the Tverskoy district, two kiosks in Cheryomushki and one van.

The vehicle rate in the Tver region for an object over 50 sq.m. is 1080 rubles for each sq.m. within 50 sq.m. and 60 rubles for each full and incomplete sq.m. over 50 sq.m. In Cheryomushki, the cost of one kiosk will be 40.5 thousand rubles. The fee for the van is 40.5 thousand rubles. Let's calculate the total trading fee:

50 × 1080 + (60 − 50) × 60 = 54,600 rubles - fee for a trade pavilion 40,500 × 2 = 81,000 rubles - fee for two kiosks 54,600 + 81,000 + 40,500 = 176,100 rubles - total trade fee

Demidov will pay a trading fee of 176,100 rubles per quarter.

Do not forget that the amount of the fee depends on the area of the sales floor; when calculating it, do not take into account warehouses and utility rooms. We recommend that you separately highlight retail space in the plan or lease agreement so that inspectors do not impose fines.

How to register

Go to the tax office at the place of registration or address of movable property and submit a notification in the TS-1 form. In it, indicate the type of activity and information about the object of trade. Do this within 5 days of starting trading. After the same number of days, the tax office will send a certificate of registration. There is an easier option: send a notification from Elba. We have provided detailed instructions in the article: it is from 2015, but relevant. If you change a retail location, notify the tax office. The period is the same - 5 days from the date of change. If you decide to stop trading activities, submit a notification to the Federal Tax Service in the TS-2 form. The date of deregistration will be the same as indicated in the notification. It is better not to forget to submit it, otherwise you will have to pay a fee for the entire quarter, even if you did not trade.

Payment of trade tax in the Russian Federation in 2021

Individual entrepreneurs and legal entities pay the fee to the tax office at the place of registration of the payer of the fee. To pay for the vehicle, issue a payment order. Create a separate payment order for each collection item. When creating a payment order, indicate the details of the Federal Tax Service, your checkpoint and OKTMO code. When paying the real estate fee, indicate OKTMO of the municipality at the location of the pavilion. When paying the fee at the location of the company, look at the OKTMO code in the notification of registration.

To ensure that the trading fee is credited to the correct account, indicate the budget classification code correctly in the order. A special field 104 is provided for the code. Determine the purpose of the payment and enter the appropriate BCC - the main payment, penalty or fine. In 2021, the BCC for the trade tax has not changed; they are the same for individual entrepreneurs and legal entities:

- Payment of trade tax - 182 1 0500 110

- Payment of penalties - 182 1 0500 110

- Interest payment - 182 1 0500 110

- Transfer of fines - 182 1 0500 110

The trade fee does not increase the tax burden. By its amount, you can reduce mandatory tax payments: personal income tax, single tax for simplification and corporate income tax.

What if you don't register?

The tax office learns about individual entrepreneurs who are engaged in trade, since it controls objects subject to trade tax. Therefore, over time, she will register them herself. But for such trading, the entrepreneur will be fined - 10% of the income he managed to earn during this period, but not less than 40,000 rubles. In addition, the individual entrepreneur will no longer be able to reduce taxes by the amount collected.

Simple online accounting for entrepreneurs

The service will replace your accountant and help you save money. Elba will prepare the reports herself and send them via the Internet. It will calculate taxes, help prepare documents for transactions and will not require special knowledge.

Try 30 days free Gift for new entrepreneurs The promotion is valid for individual entrepreneurs under 3 months old

Offsetting the amount of overpayment against underpayment

An individual entrepreneur has an overpayment for trade fees in one Federal Tax Service Inspectorate, and an underpayment in another.

Question: is it possible to offset the amount of overpayment against the underpayment from one Federal Tax Service Inspectorate to another?

In accordance with paragraph 1 of Art. 411 of the Tax Code of the Russian Federation, payers of the trade tax are organizations and individual entrepreneurs carrying out types of business activities on the territory of a municipal entity (federal cities of Moscow, St. Petersburg and Sevastopol), in respect of which the regulatory legal act of this municipal entity (laws of the federal cities of Moscow, St. -Petersburg and Sevastopol) a fee has been established using movable and immovable property on the territory of this municipality.

In accordance with the Letter of the Federal Tax Service of Russia dated June 26, 2015 No. GD-4–3/ [email protected] (as amended by the Letter of the Federal Tax Service of Russia dated September 15, 2015 No. GD-4–3/16205), payment of trade tax amounts is carried out by organizations or individual entrepreneurs registered as a trade tax payer with the tax authority at the location of the real estate property - indicating the details of the payee and the OKTMO code at the place of trade activity.

If several objects of carrying out types of entrepreneurial activities in respect of which a fee is established are located in territories under the jurisdiction of different tax authorities, registration of the fee payer is carried out by the tax authority at the location of the object, information about which was received from the fee payer earlier than about other objects.

Thus, the trade tax is paid to the tax office where the first object is registered.

This means that it is necessary to deregister the erroneously registered object and register with the tax office where the first object is registered. In this case, the refund of the overpayment is made only after it is offset against the repayment of debt for taxes, penalties or fines of the same type. The Federal Tax Service will carry out this offset itself, without the taxpayer’s application. The amount remaining after the offset will be returned to the current account.

The legislation does not provide for a procedure for offsetting overpayments of trade fees from one inspection to another. Therefore, you will have to pay the arrears to one inspection and write an application for a refund of the overpayment to another.

Trade tax fines

Sanctions in the form of fines are applied not only to registered tax defaulters, but also to entrepreneurs who do not register on time.

- Late registration may result in a fine of 10 thousand rubles.

- For trading without registration, the fine will be 10% of the income received during this time, but not less than 40 thousand rubles. The director is charged a separate fine of up to 3,000 rubles in accordance with the Code of Administrative Offenses of the Russian Federation.

- For untimely notification of changes in the characteristics of a taxable object - a fine of 200 rubles for each document submitted late.

- In case of non-payment of the fee or part thereof, the fine will be 20% of the unpaid amount, if the non-payment is intentional - 40%.

When paying a fine, generate a payment order and indicate the appropriate budget classification code in line 104. Do not forget about the need to pay penalties for late payment of the fee.

Author of the article: Elizaveta Kobrina

The cloud service Kontur.Accounting will help you generate a payment order without errors. Keep records, send reports online and consult with our experts. The first month of using the service is available to new users for free.

Trade fee reporting

So far, they have not submitted a declaration for the trade tax. However, merchants have obligations to record retail facilities. In addition, organizations that pay the trade tax, like all legal entities, are required to keep accounting records.

article will tell you what entries to make when calculating the trading fee .

The trade tax is compatible with taxation systems such as the OSN and the simplified tax system.

Is it possible for a simplifier to take into account the collection amount in expenses, read our article .

For Moscow payers of the trade tax on special taxation tax, the law allows them to reduce their income tax by the amount of the fee.

But what about entrepreneurs, since they calculate personal income tax from business activities according to rules similar to the calculation of income tax for organizations?

The trade tax can be taken into account in the personal income tax return. This is provided for in the declaration form - read about it in the material “The new 3-NDFL is ready .

Despite the fact that there is no trade tax declaration yet, you will still have to report to the INFS.

In what cases - read our article .

Trade tax is a new payment for businessmen, so it raises many questions. Officials will still finalize the rules for calculating and paying this tax. The main thing that taxpayers across the country are now interested in is: will a trade tax be introduced in their region? Trade Tax section - we will keep you up to date with the latest changes in trade tax legislation

Showroom and sales fee

The organization has a showroom in Moscow in Gostiny Dvor.

Will she need to pay a trading fee if a merchant acquiring is installed on the premises? By Moscow Law No. 62 of December 17, 2014 “On Trade Fee” (hereinafter referred to as Law No. 62), exemption from payment of trade fee applies to trade carried out through stationary retail chain facilities that do not have a sales floor, non-stationary retail chain facilities or facilities stationary retail chain with hall(s) of less than 100 sq.m. m, subject to the following conditions:

- the main type of activity specified during state registration of a legal entity or individual entrepreneur relates to the provision of services by hairdressing salons and beauty salons, washing services, dry cleaning and dyeing of textiles and fur products, repair of clothing and textile products for household use, repair of shoes and other products leather, watch and jewelry repair, manufacturing and repair of metal haberdashery and keys;

- the area occupied by equipment intended for display and display of goods is no more than 10% of the total area of the facility used to carry out the activities specified above.

In turn, the Ministry of Finance of the Russian Federation in Letter No. 03–11–06/3/3381 dated 02/11/2013 indicated that the exhibition hall (showroom) belongs to the facilities of a stationary retail chain. The courts adhere to the same opinion (Resolutions of the Federal Antimonopoly Service of the North Caucasus District dated October 24, 2013 No. A25-347/2013 and Volgo-Vyatka District dated July 15, 2013 No. A79-8172/2012).

Acquiring is a method of paying for goods and services using payment cards. At the same time, merchant acquiring is when the client selects a product and provides a card to the seller for payment. The seller reads the card using the necessary equipment, after which the buyer confirms the transaction by entering the PIN code from the card.

Since in the premises where the provided demonstration samples of goods are displayed (show room), trade acquiring will be installed, and payment will also be made through it (purchase and sale agreements will be concluded with buyers), then in this case it is necessary to pay a trade fee.

Should an individual entrepreneur pay a trade tax if he carries out trading activities, but at the same time applies the patent taxation system (PTS) and pays the unified agricultural tax (UST)?

Individual entrepreneurs using the PSN, as well as individual entrepreneurs and organizations using the Unified Agricultural Tax, are not payers of the trade tax and do not have to submit appropriate notifications to the tax authorities.

PSN is used by individual entrepreneurs along with other taxation regimes provided for by the legislation of the Russian Federation on taxes and fees.

Individual entrepreneurs using the PSN and taxpayers using the taxation system for agricultural producers (UST) are exempt from paying a trade tax on types of business activities in respect of which a fee has been established by the regulatory legal act of the municipality (the laws of the federal cities of Moscow, St. Petersburg and Sevastopol). ), in relation to these types of business activities using the corresponding objects of movable or immovable property.

What is KBK and why is it needed?

The budget classification code is a special twenty-digit code. It helps recipients of budget payments understand what payment was received for this payment. The KBK is divided into groups of numbers, each of them carries certain information:

The lists of codes are approved by the Ministry of Finance. And the taxpayer needs the KBK for the sole purpose of correctly transferring the payment to the budget. Field 104 is allocated for KBK in the payment order. An error in this field will result in the money being credited to another tax or remaining an outstanding payment. The company will have to pay a penalty and write a letter to clarify the payment.

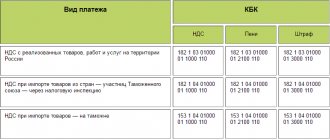

KBK for trade fee 2021 for legal entities

In 2021, organizations and entrepreneurs in Moscow use the following BCCs to pay the trade tax:

Payment type

KBK

182 1 05 05010 02 1000 110

182 1 05 05010 02 2100 110

180 1 05 05010 02 3000 110

At the moment, no changes to the BCC on trade fees for legal entities have been introduced. The codes listed in the table remain valid for 2021.

KBK for payment of trade tax: sample payment form

Companies and entrepreneurs remit the trading fee at the end of each quarter. The accountant will have to issue payments four times a year. Above we told you what an error in the KBK is fraught with. In order not to make a mistake and not pay penalties, look at the example of the KBK on payment of trade fees and download the ready-made sample:

If you nevertheless made a mistake when filling out the details, and you received a request to pay a penalty, write a letter to clarify the payment. First, find out how the tax authorities handled your payment. If you indicated the BCC of another tax or fee on the payment slip, then the money was credited towards the payment of that tax. If inspectors are unable to identify the payment, it is listed as unknown.

Compose a letter in any form. Please indicate the number, date and amount of the erroneous payment. Then indicate which BCC should be considered correct. Here, in the body of the letter, ask to cancel the accrued penalties. After all, the money arrived in the budget on time. Attach a copy of the erroneous payment to the letter.

To secure transactions, you will need new documents, such as your contractor's employee regulations. It is now dangerous to limit yourself to only checking the counterparty. This follows from judicial practice in 2021 and new explanations from officials. The recommendations in the Russian Tax Courier article will help you promptly and fully remove all claims from inspectors and successfully pass the audit. The article contains a “secret” presentation from tax officials. It was a miracle that we received the document. From it you will learn how inspectors build their accusations, what they will pay attention to first, and most importantly, what documents they will require during the inspection.

Trade tax: legislative framework

On July 1, 2015, a new chapter came into force. 33 of the Tax Code of the Russian Federation, dedicated to trade tax. This is a local payment established for such federal cities as Moscow, St. Petersburg and Sevastopol. So far, in the last 2 cities, a special law on trade tax has not been adopted, which means that you do not need to pay it. In other regions of Russia, the trade tax has not yet been introduced.

You can find out why the authorities of the northern capital are delaying the implementation of the new fee from the governor’s commentary given in this article .

What is the essence of the emerging transfer to the budget? A trade fee is a payment for the right to trade using real estate (stationary store) or movable property (distribution trade). Used property is subject to trade tax.