Environmental fee for manufacturers and importers of packaged goods

Paragraph two of the data clarifies the procedure for calculating and paying the environmental fee for packaging and packaged goods. According to the amendments, the environmental fee must be paid by manufacturers of goods and importers of goods who do not independently dispose of waste from the use of goods.

Payment of the environmental fee is carried out according to the following rules:

- for each product group

- for each product packaging group

Who should pay the environmental fee for packaging?

It must be paid either by the packaging manufacturers themselves, or by the suppliers who import this packaging into Russia.

If we are talking about a group of packaged goods that are not themselves ready for consumption, then an environmental fee is paid only for the packaging.

For which products and packaging do I need to pay an environmental tax?

To determine these groups of goods and packaging, it is necessary to rely on the order of the Government of the Russian Federation dated December 28, 2021 N 2970-r.

Important nuance

With regard to packaging that is subject to disposal after loss of consumer properties, the obligation to comply with recycling standards rests with manufacturers and importers who use this packaging for their goods (Part 10, Article 24.2 of Law No. 89-FZ). It does not matter whether the goods themselves are included in the mentioned list of products that are subject to disposal. For example, a company imports wine in barrels. Wooden barrels are included in the list of goods subject to environmental collection. From the point of view of legislation, it does not matter whether the company imports barrels as a product or the product is wine - in both cases you will have to pay for the barrels.

Where should I pay the environmental fee?

Payment of the environmental fee is carried out by transferring funds in the currency of the Russian Federation:

- payers who are manufacturers of goods - to the account of the territorial body of the Federal Service for Supervision of Natural Resources in the Federal Treasury at the place of state registration of the payer;

- payers who are importers of goods - to the account of the Federal Service for Supervision of Natural Resources in the Federal Treasury,

- Payers who are both a manufacturer of goods and an importer of goods pay the environmental fee by transferring funds in the currency of the Russian Federation to the account of the Federal Service for Supervision of Natural Resources in the Federal Treasury.

Who is exempt from reporting and paying environmental fees?

If the List does not include goods or packaging that an enterprise produces or imports, then it is completely exempt from reporting and paying environmental fees.

In addition, the following are exempt from paying the environmental tax:

• packaging manufacturers selling it for packaging products to other manufacturers (as in the example above, when a manufacturer of cardboard boxes sells boxes to a confectionery factory);

• manufacturers and importers of packaging, which is subsequently used for its own needs (for example, when a plant buys boxes to transport parts from one workshop to another);

• exporters of goods and packaging;

• companies that independently recycle their goods and packaging in volumes not less than those provided for the reporting year. However, they are not exempt from submitting environmental tax reporting.

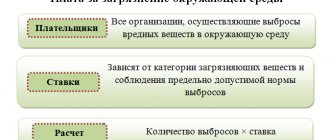

The procedure for calculating the environmental fee

To calculate the environmental fee, you need to multiply the environmental fee rate

- by the mass of goods released into circulation on the territory of the Russian Federation, which were sold for domestic consumption on the territory of the Russian Federation for the calendar year preceding the reporting period, that is, by the number of units of goods depending on the type of goods,

- or by the weight of product packaging released into circulation on the territory of the Russian Federation, sold for domestic consumption on the territory of the Russian Federation for the calendar year preceding the reporting period and by the recycling standard established for the reporting period and expressed in relative units.

Environmental fee rate*weight of goods (packaging)*recycling standard

If the standards for recycling waste from the use of goods are not achieved, then the environmental fee is calculated by payers by multiplying the rate of the environmental fee by the difference between the established and actually achieved value of the amount of recycled waste from the use of goods.

How to pay

Advance payments for NVOS must be paid by legal entities that are not classified as small or medium-sized businesses. Such payments are made three times a year, upon completion of the 1st, 2nd and 3rd quarters, no later than the 20th day of the month following the end of the corresponding quarter. SMEs do not make advance payments, but pay a lump sum in the amount for the reporting year until March 1 of the year following the reporting year.

Note! If the due date for payment for the NVOS coincides with a weekend, the payment must be transferred the day before. There is no transfer of deadlines to the next working day (as in the Tax Code of the Russian Federation) in Law No. 7-FZ. For the final payment for the year, the deadline for this period corresponds to March 1 of the year following the reporting year, that is, you will need to pay for 2021 no later than February 28, 2020 (March 1 is a day off).

The calculation of the pollution fee for the year is made in the declaration, which includes:

- title page;

- section with summary results of calculations;

- 3 special sections (according to the number of main types of pollution sources). The calculation rules in special sections are given in the order of the Ministry of Natural Resources of Russia dated 01/09/2017 No. 3 and in the Decree of the Government of the Russian Federation dated 03/03/2017 No. 255.

Who and how will monitor the correctness and timeliness of payment of the environmental fee?

The administrators of the environmental fee are:

- Federal Service for Supervision of Natural Resources

- territorial bodies of the Federal Service for Supervision of Natural Resources at the place of state registration of the payer.

The administrator of the environmental fee exercises control over the correctness of calculation of the amount of the environmental fee, the completeness and timeliness of its payment, taking into account the information available to the administrator of the environmental fee and (or) received by him in the prescribed manner when declaring goods and packaging of goods, when submitting reports on compliance with recycling standards and when monitoring compliance with established recycling standards, as well as federal state environmental supervision.

If, when monitoring the correctness of calculation of the amount of the environmental fee, the completeness and timeliness of its payment, errors or contradictions (inconsistencies) are identified in the calculation of the amount of the environmental fee, or an inconsistency in the information provided by the payer is identified, or the fact of non-payment, incomplete payment or untimely payment is established payment of an environmental fee, then the administrator of the environmental fee draws up an act of monitoring the correctness of calculation of the amount of the environmental fee, the completeness and timeliness of its payment. The form of the control act is approved by the Federal Service for Supervision of Natural Resources.

Waste disposal rates

1. Waste of hazard class I (extremely hazardous) 4643.72. Waste of hazard class II (highly hazardous) 1990.23. Waste of hazard class III (moderately hazardous) 13274. Waste of hazard class IV (low hazardous) (except for solid municipal waste of class IV hazard (low-hazard) 663.25. Hazard class V waste (virtually non-hazardous): mining industry 1.1 processing industry 40.1 other 17.3Also see “List of new fines of Rosprirodnadzor”.

What is indicated in the Control Certificate?

a) facts of errors made when performing calculations and contradictions (inconsistencies) between the information contained in the calculation of the amount of the environmental fee and the information available to the administrator of the environmental fee and (or) received by him in the prescribed manner when declaring goods and packaging of goods, when reporting on standards and when monitoring compliance with established recycling standards, as well as federal state environmental supervision;

b) facts of non-payment, incomplete payment or untimely payment of the environmental fee;

c) the fact of overestimation of the amount of calculated and (or) paid environmental fees;

d) the requirement to submit to the administrator of the environmental fee, within 10 working days from the date of receipt of such a requirement, reasonable explanations regarding the calculation of the amount of the environmental fee, and (or) making corrections to it to eliminate the facts specified in subparagraph “a” of this paragraph, by making changes in the calculation of the amount of the environmental fee, which are re-sent to the administrator of the environmental fee, and (or) repayment of debt on the environmental fee if the facts specified in subparagraph “b” of this paragraph are revealed.

The Act itself is sent via telecommunication networks or on paper with a notification (depending on the form in which the payer reports) within 3 business days after signing.

Disagreement with the Control Act

In case of disagreement with the requirement specified in the control report, the payer, within 10 working days from the date of receipt of such requirement, sends to the administrator of the environmental fee copies of documents confirming the validity of the calculation of the amount of the environmental fee, payment of the environmental fee, as well as explanations of the reasons for the discrepancy in the information provided by the payer .

Federal Law of December 28, 2017 N 422-FZ

This law amends Article 14 of the Federal Law “On Environmental Expertise” and Article 12 of the Federal Law “On Amendments to the Federal Law “On Environmental Protection”. In accordance with these changes, capital construction projects of category I and enterprises that emit pollutants into the air receive a one-year deferment to conduct an environmental assessment of project documentation and develop a justification for obtaining an environmental permit.

Before the adoption of Federal Law No. 422-FZ of December 28, 2017, all companies engaged in economic and production activities related to air pollution were required to install systems for measuring and accounting for emissions of harmful substances into the air by January 1, 2021. This law concerned primarily stationary sources of air pollution - gas production companies, oil refining complexes, enterprises producing mineral fertilizers, etc. In accordance with the adopted changes, the installation period for special equipment for emission accounting is postponed until January 1, 2021.

Another change is the abolition of the mandatory environmental assessment when carrying out major repairs of facilities located on lands of specially protected natural areas. In accordance with the new law, the requirement to submit documents for environmental assessment at the federal and regional levels when planning major repairs has been abolished.

Warnings to managers and accountants

If the enterprise generates waste of hazard classes 1-4, then it is necessary to have passports for each of them. This also applies to unsorted household waste. Otherwise, the organization faces a fine for not complying with environmental requirements. The fine reaches 100 thousand rubles.

Material expenses within the approved limits - this is the section in which environmental payments are included in order to correctly calculate income tax. But when calculating the tax, emissions that go beyond the standard should not be taken into account.

Similar rules apply for the single tax on simplified taxation system. Payments for negative environmental impacts can reduce the tax base.

We can say that environmental payments are the same as ordinary tax levies that require reflection in reporting.

But when calculating taxes, they are included only if they are paid for maximum permissible discharges and limits.

Everything else is other expenses that are simply not taken into account for tax purposes. Regulatory authorities may request information on waste if the enterprise operates transport, but no payment is made for it.

If there is no response to the request, there is a risk of a serious fine.

back to menu ↑

The procedure for calculating the environmental tax for emissions of pollutants in Belarus has been significantly simplified

Special cases of payment of environmental fees

Let us also consider several special cases to determine who is responsible for paying the environmental fee:

1. tolling scheme (implies the sale of production services): company A makes an order to company B for the production of products from the raw materials of company A. Company A, which acts as a customer, owns the received goods as property, sells these goods and is responsible for the environmental fee .

For example, an enterprise orders a printing house to print notepads with the company logo and provides paper for this. The finished notebooks belong to the enterprise, so it is responsible for the environmental fee.

2. Production of goods according to the off-take (implies the sale of finished goods made to order): company A places an order to company B for the production of products, while company B uses its own raw materials. Company B (manufacturer) sells the resulting product to company A (customer). The manufacturer is responsible for environmental collection.

For example, an enterprise orders a printing house to print notepads with the company logo, and the printing house’s raw materials are used for their production. Finished notebooks are the property of the printing house, so it is responsible for the environmental fee.

About payments for air pollution from cars

Section 2 of the reporting is completed by those organizations that have mobile sources of pollution. It doesn't matter whether they are owned or rented.

There are no separate emissions limits for vehicles. But there are technical standards for emissions of pollutants into the atmosphere.

When conducting a technical inspection, specialists check whether a particular vehicle meets the specified requirements.

It is prohibited to operate a vehicle if it emits more harmful substances than specified in current regulations. Or a ban is imposed until the violations are eliminated.

The mass of pollutant emissions does not determine the payment standards. The determining factor here is the type of fuel used and its type.

The standards must be multiplied by the amount of fuel that was actually consumed. Primary accounting documents will help to accurately calculate how much fuel was consumed in a particular case. In volumetric units, fuel is taken into account by those who maintain waybills.

But basic payment standards are set separately for a ton of fuel. Liters are converted to tons for those interested in accurate calculations. To do this, multiply the volume of the material by the density.

back to menu ↑

What taxes are environmental?

In connection with the use of certain natural objects, there is a need to pay a tax fee. Let's take a closer look at the situations in which this happens.

- Transport tax. In 2021, it must be paid if it is proven that the vehicle is harmful to the environment.

- Mineral extraction tax. For example, when extracting natural resources, including coal and oil, which are exhaustible.

- Water tax. In Russia it is paid for introducing an imbalance into the environment when using water resources.

- Fee for the exploitation of aquatic biological resources in Russia, objects of the animal world. This tax is paid if damage to nature is caused as a result of hunting or other types of catching animals.

- Land.

back to menu ↑

Fee calculation and related documents

The regulatory documents that are currently in force do not provide for an additional package of documents to the current reporting. But territorial authorities may put forward their own requirements for the provision of additional papers.

- Documents to confirm the actual use of waste.

- Acceptance acts.

- Waste transfer agreement.

- Regulatory documents, including placement limits, MAP, MPE permits and conclusions.

- Lease agreement, evidence that the premises are owned.

This information is especially important when it comes to large payers. Sometimes only one certificate about the production activities of the enterprise is enough.

Each territorial body has its own rules of cooperation. It is better to find out about this in advance by visiting the relevant office.

back to menu ↑

About some features of the calculation

For each pollutant and waste, payment amounts are calculated separately. This also applies to each type of fuel on which mobile objects operate. When calculating the payment for environmental emissions, several factors must be taken into account:

- Additional coefficients 2 and 1.2.

- Ecological significance coefficient for the region.

Emissions also require the determination of several indicators at once:

- Coefficient for suspended solids.

- Additional coefficient 2.

- Ecological significance of the region.

Finally, when the waste fee is calculated, it is based on:

- Coefficient of the location of the facility where waste is disposed.

- Additional coefficient 2.

- Ecological significance.

An inflation factor can be added to all of the above schemes. It is established in the Federal budgets for the next calendar year.

back to menu ↑

Deadlines and reporting

According to current legislation, environmental tax in 2016 is transferred until the 20th day of the month following the reporting period. And the reporting period itself is a calendar quarter.

As mentioned above, the organization carries out all calculations along with rates independently, depending on the amount of pollution arising due to its activities. The settlement declaration for such payments consists of several parts:

- Starts with the title page, according to the tax code.

- Next comes the total amount that needs to be transferred to the budget.

- Then Section 1. It is devoted to the release of harmful substances into the atmosphere by stationary objects.

- Section 2. The same thing, only for mobile objects.

- Section 3. With information on discharges of pollutants into water bodies.

- Section 4. Dedicated to the disposal of waste from production and consumption.

In the calculation of payment with rates, you should include only those sections that are really necessary for the organization. Depending on the negative impact it has on the environment. For example, there is no need to attach and fill out Section 1 if there are no stationary facilities that emit harmful substances into the environment.

There are several ways to submit a declaration along with rates:

- In electronic form, via telecommunication channels, or on magnetic media.

- On paper. By registered mail with notification, or through a representative of the organization.

In electronic form, declarations and calculations must be in XML format, as the Tax Code of the Russian Federation says.

The declaration may not be submitted electronically if the fee is less than 50 thousand rubles. Otherwise, this requirement must be met.

back to menu ↑