The KBK attribute (budget classification code) is used when making payments to the state budget and is a combination of 20 digits. The structure of the BCC remains unchanged; separate codes for budget revenues and expenditures are approved by orders of the Ministry of Finance (Ministry of Finance) of the Russian Federation. From the state’s point of view, the KBK helps to group income, expenses, sources of financing of the state budget, and also track the financial flows of legal entities. From the point of view of a company accountant, the KBK is necessary for the distribution of taxes, payments to the Social Insurance Fund, the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund, and various fines for the organization and its employees.

In practice, the KBK details are used by private individuals who pay for kindergartens (parental fees), schools, property taxes, and fines for administrative offenses (for example, traffic police fines). Legal entities use the KBK details to pay income taxes and pay contributions to state budget funds. Most bank-client systems automatically download the KBK number when generating payment orders, however, due to regular changes in details, accountants and individuals check the Federal Tax Service website to transfer funds.

KBK is indicated in the Payee field of the standard form 0401-0460 (payment order), used by accountants of organizations. For individuals and organizations paying taxes on a receipt received from the Federal Tax Service (form PD-4), the KBK number is indicated on a separate line in the Recipient Details section.

How to find out the budget classification code? What is KBK

- The first subgroup determines the type and type of income: 1 – tax payment, 2 – gratuitous payments, 3 – payments from individual entrepreneurs;

- The second subgroup, showing the general and main purpose of the payment, is part of the income. Here is a list of such combinations: 01 - income tax; 02 - payment of social contributions; 03 - tax on goods sold in Russia; 04 - tax on goods manufactured and imported outside the country; 05 - income tax; 06 - property payment; 07 - payment from the resource user; 08 - state duty; 09 - penalties, penalties for canceled taxes; 10 - income from export-import activities; 11 - income from state property through its rental; 12 - payment when using natural resources; 13 - profit from paid services of government agencies; 14 - income from the sale of state property; 15 - fines and other duties; 16 - compensation for harm caused;

- The third group consists of two numbers indicating the article and three numbers indicating the subarticle;

- The last group determines one or another budget level based on the information received.

Learning to fill out a payment order: what is KBK in a payment order?

- First group (administrative) : consists of 3 digits and is the code of the main revenue administrator;

- The second group (income) , contains 10 numbers reflecting the following information: from 4th to 13th - income option, where number No. 4 indicates the group of budget revenues, No. 5 and 6 - a subgroup of revenues, No. 7 and 8 - reflect information about the article, Nos. 9, 10 and 11 indicate the subarticle, Nos. 12 and 13 indicate the revenue element;

- Third group (program) , numbers 14 to 17: encodes the group of receipts;

- The fourth group (classifying) , numbers from 18 to 20: contains analytical data.

What does it consist of?

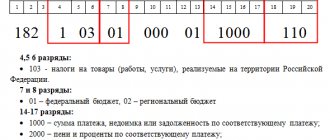

The KBK code consists of 20 digits, which are not formed arbitrarily; each group contains certain information:

- the first 3 digits are administrative, and it determines the recipient, designates the account in which funds for this type of payment are accumulated;

- the next 10 digits are the income group necessary to determine the type of income, the group where the payment is sent;

- 4 more characters are a program group, it further details the purpose of the operation (taxes, for example, this is the combination 1000);

- and the remaining 3 characters are a classifying group indicating the scope of economic activity: for example, 160 - social revenues.

What is KBC? New budget classification codes

The list of budget classification codes is in a special KBK directory - from this important document they will find out the necessary numerical combination belonging to a particular payment. Changes in it, although infrequent, still occur and are accepted through amendments and releases of a new directory. The KBK directory, current for 2015, was approved by the Ministry of Finance of the Russian Federation in 2013 (Order No. 65n dated July 1, 2013). The KBK Classifier was adopted in 2015 as amended by the Decree of September 26, 2014 (Addendum 1).

Insurance premiums

Payment order details for OPS (20%) for June 2021:

- field 104 - budget classification code, for example, insurance contribution for compulsory pension insurance;

- field 105 - OKTMO, territory code according to the all-Russian classifier of territories of municipalities at the place of registration of the taxpayer (tax agent);

- field 106 - for current payments, indicate the TP code (current year);

- field 107 - value of the tax period indicator; can take the corresponding value of the period: MC - monthly payments;

- field 108 — document number, in this case it is set to “0”;

- field 109 - date of the document, in this case it is set to “0”;

- field 110 - payment type, not filled in;

- field 24 - purpose, in this case the number of the policyholder in the Pension Fund of the Russian Federation is indicated.

What is KBK in a payment order?

The budget classification code (hereinafter referred to as BCC) is a special digital code used to designate budget income and expenses. We always come across these codes when we make a payment to the budget system. Let's look at what the KBK consists of, how important it is to correctly indicate the KBK on the payment slip, and what to do with errors.

Articles on the topic

The budget classification code is an integral requisite when transferring funds to the budget. Obviously, the sequence of 20 numbers is a kind of cipher. In this article we will look at what a KBK is, why it is needed and why it is important to avoid making mistakes when specifying the code.

KBK is .

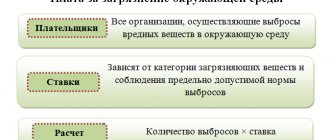

Taxpayers (organizations and individuals) replenish the budget when they pay legally established taxes. The government's fiscal policy consists of manipulating taxes and government spending. To classify financial flows for the purpose of managing them, the KBK is used.

So, KBK is a code. It encrypts the purpose of funds received by the budget and, accordingly, expenses incurred.

Budget revenues are accounted for separately in accordance with the KBK and OKATO (classifier of objects of administrative-territorial division). Using the code, you can track the path of any amount included in the budget: from which region and which organization the payment was made. On what basis and where was it redirected? In this way, state control is exercised over the receipt of taxes and fees in controlled territories, statistical information on budget flows by economic sectors is collected and processed.

Obviously, different taxes and fees, as well as penalties and fines for them, have different BCCs. But the system of budget classification codes is the same throughout the country.

Conventionally, budget classification codes can be divided into four large blocks:

- budget expenses;

- budget revenues;

- sources of financing;

- sources for reducing the budget deficit.

What is KBK in a payment order?

Tax officials warned that there are three errors in the payment slip that cannot be corrected or clarified. In this case, the tax will have to be paid twice.

Payments intended for the budget are sent to the territorial body of the Federal Treasury. If there are errors in the order, the payment may fall into the unknown. Then the taxpayer will have an arrears to the state, which may lead to penalties or fines.

We recommend regularly checking with the Federal Tax Service. This will give you the opportunity to detect the problem in time and take appropriate measures. For example, apply to the inspectorate to clarify the payment.

To fill out the payment order, use the current BCC for 2021, broken down by taxes and contributions for legal entities and individual entrepreneurs. This code liver was approved by order of the Ministry of Finance dated 06/08/18 No. 132n. We remind you that codes are approved annually. Therefore, if you are making payments for past periods in the current period, use the updated list. This is the only way to ensure their correct enrollment.

Work on mistakes

What is the KBK for employees of government agencies, where do the funds go? This is an important detail, an indicator of where to transfer the money. Thus, how quickly the funds will be transferred depends on the correctness of filling out the receipt. If the KBK is incorrectly indicated in the details, the money is most often returned to the sender’s account, but it may also end up in unclear payments or be credited to the wrong account. If you do not want to deal with government agencies and write requests for a refund, when filling out payment documents, the details must be checked especially carefully.

What is KBK on a receipt?

The payer - an individual must indicate the KBK in the receipt for the transfer of tax, payment of a traffic police fine, when paying for the education of children or the services of medical institutions.

As a rule, the payer receives a receipt in which all the key details are filled in, and all that remains is to enter the amount and basis for the payment. If for some reason the BCC is not indicated in the notice, you can find it out by calling the accounting department of the institution in favor of which you are making the payment.

If you make a payment online, through your personal bank account to which your card or other automated payment services are linked, the code, as a rule, is automatically uploaded to the receipt.

Topic: Design documentation discrepancy

By the way, Yuri. Knowing this fact, I tried to analyze it. To make a tank 3 cm wider, this difference must be taken into account on all transverse planes of the armor. This is not done from Budun, since the cutting is not done by one hard worker. That is, most likely, there was a “writing” from the technical bureau to cut it exactly this way. The question is - where? The only element that on the T-60 was initially designed to be “the width of the tank” is the torsion bar shaft. That’s why, IMHO, the chain danced from him. For some reason (unknown to me), a batch of torsion shafts was received that was longer than the standard. Since this is a high-tech product (in relation to cutting) made of heat-improved metal, it was easier to cut it locally than to throw it away. Which is what they did.

With all due respect, raising CD to an absolute level is not a very effective exercise. Because a real product, especially if it is cast, has an error noticeable even on a 35th scale. For example, the KV-1 turret, cast, had an acceptable range of wall thickness from 90 to 113 mm. Multiply by two Or another example from life - the T-60 in Kubinka is 3.5 centimeters wider than the KD. This is given its thickness. Now let’s try to imagine what’s going on with the IS-2

KBK structure

KBK consists of twenty digits, divided into categories.

| Budget income subtype code | |||||||||||||||||||

| income group | income item | income element | analytical group of budget revenue subtype | ||||||||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 |

- 1-3

manager of funds (for example, 182 - Federal Tax Service, 392 - Pension Fund, 393 - Social Insurance Fund); - 4-6

tax or contribution code (group 100 - taxes, fees, fines, sanctions; group 200 - gratuitous receipts); - 7, 8

budget level (01 - federal budget; 02 - subject budget; 03 - budgets of federal cities); - 14-17

type of payment (1000 - tax, contribution or arrears; 2100 - penalties, 3000 - fine); - 18-20

economic type of income (110 - taxes; 130 - provision of services).

- 182 - the tax office manages the money;

- 101 - according to the current classification of income, this is income tax;

- 01 - funds went to the federal budget;

- 1000 - tax fee;

- 110 - tax.

To find a decoding of a specific budget classification code, follow the link

, press F3 or Ctrl+F. After clicking, a search bar will appear below the toolbar. Enter the 20-digit KBK you are looking for, without spaces, and see its decoding in the left column of the table.

Where to get KBK

From April 14, apply the new BCC if you need to pay penalties and fines on contributions to the Pension Fund at additional rates (Order of the Ministry of Finance dated March 6, 2019 No. 36n). The new BCCs apply to companies whose employees are employed in harmful or dangerous working conditions and are entitled to receive an early pension.

Budget classification codes are approved by the Ministry of Finance. The current list of codes was approved by Order of the Ministry of Finance dated 06/08/18 No. 132n.

Current KBK directories are published on the tax office website. They contain a complete list of codes for current taxes for organizations, entrepreneurs and individuals.

«>

Reason for these changes

Previously, there were two BCCs for this tax system, and entrepreneurs under the simplified tax system paid the tax minimum once a quarter instead of advances, since they assumed that they would reach the planned minimum tax by the end of the year.

Tax authorities had difficulty sorting out the confusion of receipts to two addresses; as a result, entrepreneurs were forced to pay penalties for underpayment or fines for failure to pay the minimum tax. Now there is only one address for transfer. And the minimum tax is levied in two cases according to the simplified tax system - if at the end of the year the company was at a loss and if the minimum tax is higher than the actual one.